NASAA urges fed gov not to weaken state securities regulators

The North American Securities Administrators Association (NASAA), has urged the US House Committee on Financial Services not to weaken state securities regulators.

The North American Securities Administrators Association (NASAA), has urged the US House Committee on Financial Services not to weaken state securities regulators.

Several MLM related fraud cases, initiated by state regulators in the US, are cited in support.

NASAA is made up of US state regulators, as well as their equivalents in the District of Columbia, Puerto Rico, the US Virgin Islands, Guam, Canada and Mexico.

NASAA’s September 17th letter, signed off on by association President Marni Rock Gibson (right), is addressed to the U.S. House Committee on Financial Services’ Subcommittee on Oversight and Investigations.

NASAA’s September 17th letter, signed off on by association President Marni Rock Gibson (right), is addressed to the U.S. House Committee on Financial Services’ Subcommittee on Oversight and Investigations.

Specifically, Chairman Dan Meuser, Chairman Bryan Steil and ranking members Al Green and Stephen Lynch.

Writes Gibson;

On behalf of [NASAA], I write to urge Congress to preserve the critical role that state securities regulators play in our capital markets as fighters of fraud, market manipulation, and similar abuses.

As explained below, since 2017, U.S. NASAA members have taken over 330 enforcement actions that involve crypto assets and fraud.

Further, we have seen bad actors misuse evolving and emerging technologies, such as distributed ledger technologies (“DLTs”) and artificial intelligence (“AI”), to scam Americans at alarming rates spawning an epidemic of online fraud.

Failing to preserve state authority to fight fraud would have net-negative, significant consequences for investors and innovators throughout the United States.

Securities regulators routinely initiate enforcement actions to protect investors in their jurisdictions from all types of financial fraud and other misconduct.

To bring these cases, they use the legal authority provided to them through longstanding state laws enacted to protect investors and promote trust in the capital markets.

Unfortunately, bad actors in our capital markets are skilled at using new technologies to defraud or otherwise take advantage of the investing public.

In the 2010s, they began to exploit DLTs, ultimately prompting state securities regulators in 2017 to initiate a coordinated effort to investigate and bring enforcement actions against frauds associated with uses of DLTs.

When describing Operation Cryptosweep in 2018, former NASAA President and Director of the Alabama Securities Commission Joseph P. Borg stated, “The persistently expanding exploitation of the crypto ecosystem by fraudsters is a significant threat to Main Street investors in the United States and Canada, and NASAA members are committed to combating this threat.”

Since 2017, state securities regulators have taken over 330 enforcement actions involving fraud in the crypto ecosystem. Broadly, the fraud underlying these cases pertained to securities offerings, trading platforms, investment advisory services, Ponzi schemes, and crypto mining.

There were even some cases where fraudsters went after already defrauded crypto investors, claiming they could help them recover their losses.

Failing to preserve the ability of states to fight fraud involving new and emerging technology would be a decision with net-negative, significant consequences for Americans in all corners of this great country.

Respectfully, these consequences are evident.

As state securities regulators, we play a crucial role in the successful prosecution of securities offenses.

We often prosecute securities law violations, either through inherent prosecutorial authority or appointments from district attorneys or attorneys general.

We also work in parallel with local, state, and federal law enforcement agencies to investigate complex schemes, refer cases for criminal prosecution, and testify in criminal proceedings as fact and expert witnesses.

Based on the reported data, in 2023, securities regulators helped convict white collar criminals collectively sentenced or ordered to serve 5,531 months (approximately 460 years) in prison and 2,723 months (approximately 230 years) of probation and deferred adjudication.

These actions show that we are committed to the pursuit of justice for victims of financial fraud.

The fight against fraud is unrelenting and we remain vigilant in the face of increased sophistication in types of fraud and methods used by fraudsters.

Thank you for continuing to bring attention to this important issue and for allowing us to share how state securities regulators are working to protect your constituents.

Gibson’s letter is supplemented by an appendix, titled an “Overview of Selected Crypto Fraud Enforcement Actions by State Securities Regulators”.

The appendix lists three hundred and thirty-four cases of state-level regulatory cases, categorized as “crypto offering frauds”, “crypto trading platform frauds”, “crypto advisory services frauds”, “crypto Ponzi/pyramid schemes”, “crypto mining frauds”, “crypto recovery schemes” and “commodity-based frauds”.

MLM schemes feature in NASAA’s “crypto offering frauds”, “crypto trading platform frauds”, “crypto Ponzi/pyramid schemes” and “crypto mining frauds” lists:

Crypto Offering Frauds

- GSPartners (thirteen separate state enforcement actions across 2023 and 2024)

- My Trader Coin (Arizona 2022)

- Polivera (California 2024)

- Keep It 100, aka K100 (California 2024)

- We Are All Satoshi (California 2023)

- Vortic United (California 2023)

- CryptoProgram (California 2023)

- Fundsz (California 2022)

- Elevate Pass (California 2022)

- Polinur (California 2022)

- BitConnect (Colorado 2018, Georgia 2018, North Carolina 2018, North Dakota 2018, Texas 2018)

- USI-Tech reboot (Georgia 2019)

- AirBit Club (Maryland 2021)

- Bitcoiin (New Jersey 2018)

- Bitles (Texas 2021)

- Mind Capital (Texas 2020, Wisconsin 2020)

- DavorCoin (Texas 2018)

- R2B Coin (Texas 2018)

- YoCoin (Washington 2020)

Crypto Trading Platform Frauds

- Novatech FX (Alabama 2025, California 2022, New York 2024, Washington 2024, Wisconsin 2023)

- AladdinBot (California 2024)

- TLC Trading (California 2024)

- Bitcoin Trading World (California 2023)

- Pegasus (California 2022)

- USI-Tech (Ohio 2018, South Carolina 2020, Texas 2017)

- DCPTG (Washington 2024)

- ITP Corp (Washington 2024)

Crypto Ponzi/Pyramid Schemes

- My Trader Coin (Arizona 2022)

- CoinMarketBull (California 2023)

- MetaFi Yielders (California 2022)

- Maxpread Technologies (California 2023)

- StableDAO (California 2023)

- Trage Technologies, aka TrageTech (California 2024, Texas 2024)

- Forsage (Montana 2021)

- BigWhale (Texas 2023)

- Mirror Trading International (Texas 2020)

- COS, aka Coscoin (Washington 2024)

Crypto Mining Frauds

- Arkbit Capital (Arkansas 2023, Texas 2024)

- Vbit (California 2024, Montana 2024, Washington 2022)

- Bitcoin Trading World (California 2023)

- Mining Max (California 2020)

- Coince (Georgia 2020)

- Mintage Mining (Michigan 2021, Texas 2018)

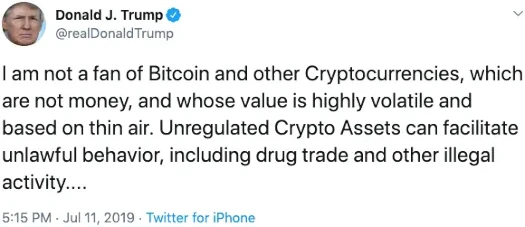

I wasn’t aware state financial regulators in the US were under threat of being weakened but apparently that’s now a thing. Such that the NASAA has to plead with the US federal government to allow states to continue their “fight against fraud”.

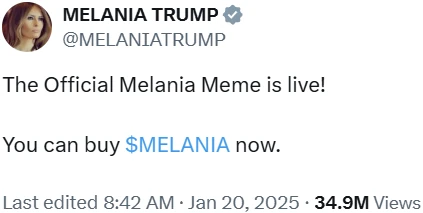

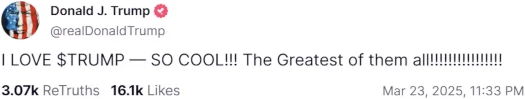

Who stands to benefit from the US government gutting crypto regulation? Beats me.

As someone who’s work at BehindMLM often sees me standing in front of what NASAA refers to as “the first, and often the last, line of defense against white-collar crime and financial misconduct”, weakening state regulators doesn’t benefit US residents in any shape, way or form.

A BehindMLM review is often the first step in consumer education and awareness of MLM related fraud (crypto or otherwise). A state-level securities fraud warning adds weight to our research and reporting.

Scroll up, it’s not a coincidence BehindMLM has a published review for every MLM fraud scheme detailed in the NASAA’s letter. Or that we’ve drawn attention to almost every state regulatory warning pertaining to the MLM fraud we report on.

There’s a lot of time and resources dedicated to this work that goes on behind the scenes.

Money saved through consumer education and awareness till the feds get involved (SEC, CFTC, DOJ, IRS etc.) is incalculable. And the reality is, for various reasons, the feds don’t get involved in the majority of cases taken up by state regulators.

Ideally the scammers behind these schemes are prosecuted, stripped off their ill-gotten gains and given lengthy prison sentences. In the absence of that, a state-level fraud warning more often than not is enough to trigger a collapse.

It’s not perfect but, given the alternative is letting the majority of MLM crypto fraudsters run rampant unchecked, there’s literally no downside to at the very least keeping the status quo.

If anything the current system is in need of improvement. The AI flavor of MLM crypto fraud is only going to grow, and I’m really not looking forward to the day I can’t pick out AI-generated slop.

The faster state regulators are able to process complaints and feed them into the system, the better. Give US state regulators and federal agencies the resources, people and tools to do their jobs more effectively.

Oh, right. Nevermind.

Update 17th October 2025 – NASAA has dropped the GSB and GSPartners fraud cases from its letter due to the pending North American settlement;

Several state actions related to Josip Heit, GSB Gold Standard Corporation AG, and related entities were removed because they

are subject to an ongoing settlement process under which, once fully performed, “[a]ny Settling Jurisdiction that previously alleged fraudulent acts or dishonest, unethical practices by Respondents, whether in a temporary or emergency cease-and-desist order, other legal process, press release, or other public statement, will withdraw, redact, or amend the prior order, process, press release, or public statement to remove any allegations of fraud or dishonest, unethical practices by Respondents to the extent permissible under the Settling Jurisdiction’s best practices, policies, rules, and laws.”