PGI Global’s RV Palafox sentenced to 20 years

PGI Global founder Ramil Ventura Palafox has been sentenced to 20 years in prison. [Continue reading…]

PGI Global founder Ramil Ventura Palafox has been sentenced to 20 years in prison. [Continue reading…]

Win On Wealth Ponzi founders settle with SEC

Win On Wealth co-founders Trong Hoang Luu and Linh Thuy Le have settled with the SEC. [Continue reading…]

Win On Wealth co-founders Trong Hoang Luu and Linh Thuy Le have settled with the SEC. [Continue reading…]

TexitCoin securities fraud C&D from Texas

TexitCoin has received a securities fraud cease and desist from the Texas State Securities Board (TSSB).

TexitCoin has received a securities fraud cease and desist from the Texas State Securities Board (TSSB).

As per TSSB’s February 11th TexitCoin fraud order; [Continue reading…]

Herbalife promoter starves, tortures downline to death

A homicide case has shed light on how Herbalife is promoted in Singapore.

A homicide case has shed light on how Herbalife is promoted in Singapore.

On February 9th Lim Peng Tiong pled guilty to culpable homicide in relation to the death of his HerbaLife downline, Huang Baoying. [Continue reading…]

MLM Ponzi promoter Lisa Boisselle to pay $1.39M restitution

MLM crypto Ponzi promoter Lisa Anne Boisselle, aka Lisa Anne Homer and Lisa Anne Jager, has been ordered to pay $1,398,900 in restitution.

MLM crypto Ponzi promoter Lisa Anne Boisselle, aka Lisa Anne Homer and Lisa Anne Jager, has been ordered to pay $1,398,900 in restitution.

The Arizona Corporation Commission (ACC) also ordered Boiselle to pay a $75,000 fine. [Continue reading…]

IsPay Review: Fintech ruse MLM crypto Ponzi

IsPay fails to provide ownership ore executive information on its website.

IsPay fails to provide ownership ore executive information on its website.

IsPay’s website domain (“ispay.com”), was privately registered on June 9th, 2025.

If we look at the source-code of IsPay’s website, we find Chinese:

This ties into marketing material citing Wu Xiaorong as IsPay’s Chairman:

Wu doesn’t appear to exist outside of IsPay’s own marketing. Her IsPay corporate bio appears to be fictional.

Such to extent Wu makes an appearance at staged IsPay marketing events, she’s likely a puppet CEO who the actual Chinese scammers running IsPay hide behind.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Conectiv Review: Investview reboots fraud for 3rd time

![]() Conectiv is the latest reboot of Investview’s long-running fraudulent investment scheme:

Conectiv is the latest reboot of Investview’s long-running fraudulent investment scheme:

- Wealth Engineering was launched in 2005 by Mario Arthur Romano and Annette Raynor;

- Romano, Raynor and several other individuals co-founded Investview in 2013;

- Investview launched Wealth Generators sometime after its own launch, offering passive returns connected to Wealth Engineering trading signals;

- Wealth Generators was rebooted as Kuvera Global in 2018, just before a $150,000 commodities fraud fine from the CFTC was made public;

- Kuvera Global rebooted as iGenius in 2021 after Investview learned of a pending SEC investigation;

- Investview’s then CEO Joseph Cammarata was arrested on recovery scam fraud charges in December 2021;

- Cammarata was sentenced to ten years in prison for recovery scamming in June 2023;

- Investview’s former accountant was fined $400,000 for filing dodgy audits with the SEC in January 2024;

- Cammarata was sentenced to six years in prison for tax fraud in May 2024;

- the SEC filed suit against two Apex promoters in September 2024 (Apex was a fraudulent scheme launched by Investview in 2019);

- Investview settled Apex fraud charges with the SEC for $375,000 in January 2025;

- Investview settled securities fraud allegations from Ontario and Quebec in July 2025;

- Poland’s Office of Competition and Consumer Protection filed civil fraud charges against six iGenius promoters in July 2025;

- Conectiv’s website domain (“conectivglobal.com”) was registered on October 9th, 2025;

- a former iGenius promoter was fined $15,000 in Quebec in December 2025;

- Conectiv was disclosed to top iGenius promoters around early December 2025;

- Poland fined iGenius $4 million for pyramid fraud in January 2026;

- iGenius wiped/deleted its social media profiles in late January 2026;

- Conectiv distributor agreements are created on February 1st, 2026; and

- Conectiv marketing/branding from Investview surfaced on or around February 3rd, 2026

No executive information is provided on Conectiv’s website. Based on publicly available Conectiv marketing material though, Chad Garner (right) is still President of Conectiv.

No executive information is provided on Conectiv’s website. Based on publicly available Conectiv marketing material though, Chad Garner (right) is still President of Conectiv.

Garner has retained this executive role dating back to Wealth Generators. Garner joined Investview in 2016.

Investview is headquartered in Pennsylvania. Conectiv and its predecessors operate from Utah.

With Investview’s history out of the way, read on for a full review of its latest Conectiv MLM opportunity reboot. [Continue reading…]

Quantro Network Review: Trading bot MLM crypto Ponzi

Quantro Network fails to provide ownership or executive details on its website.

Quantro Network fails to provide ownership or executive details on its website.

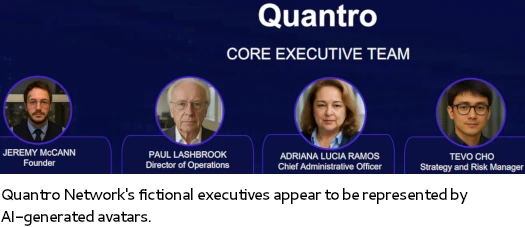

In Quantro Network’s marketing material we find a list of executives, none of which actually exist:

Quantro Network’s website domain (“quantronetwork.com”), was privately registered on September 9th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

OnyxCard Review: Vault27 Ponzi adds VISA cards

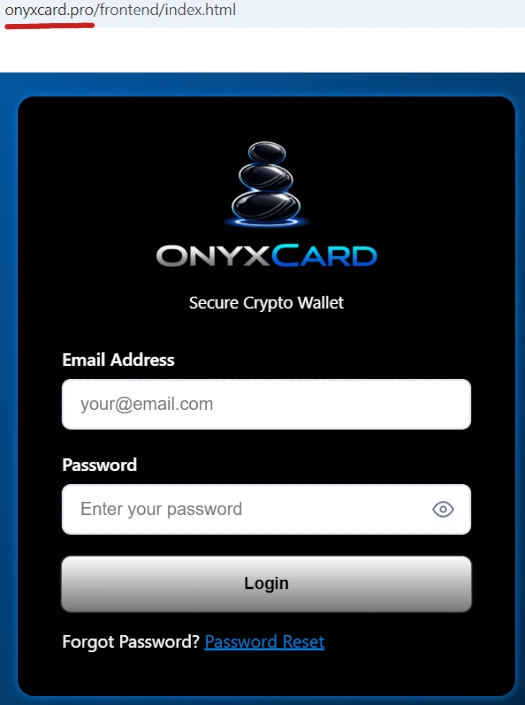

OnyxCard fails to provide ownership or executive information on its website.

OnyxCard fails to provide ownership or executive information on its website.

In fact as I write this, OnyxCard’s website is nothing more than a sign-in form:

OnyxCard’s website domain (“onyxcard.pro”), was privately registered on December 27th, 2025.

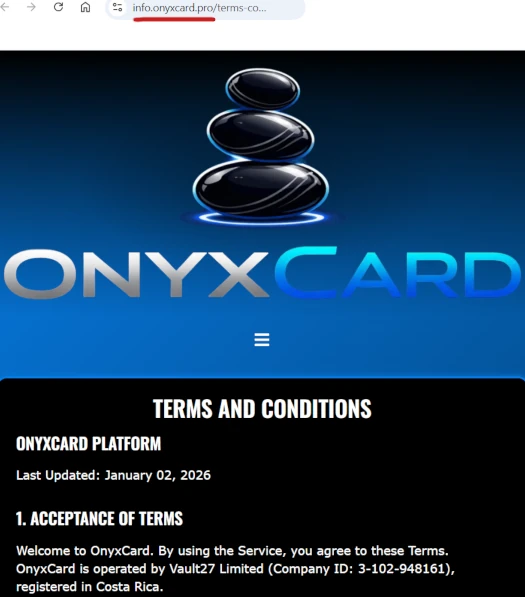

On the subdomain “info.onyxcard.pro”, OnyxCard provides a Terms and Conditions page. On this page we learn “OnyxCard is operated by Vault27 Limited”:

Vault27 is a “staking” model MLM crypto Ponzi run by Bruce John Curnick.

Why Curnick’s ownership isn’t disclosed on OnyxCard’s website is unclear.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

BitradeX Review: Olivier Giroud fronts MLM crypto Ponzi

BitradeX fails to provide ownership or executive information on its website.

BitradeX fails to provide ownership or executive information on its website.

BitradeX launched on the domain “bitradex.com” in or around February 2025.

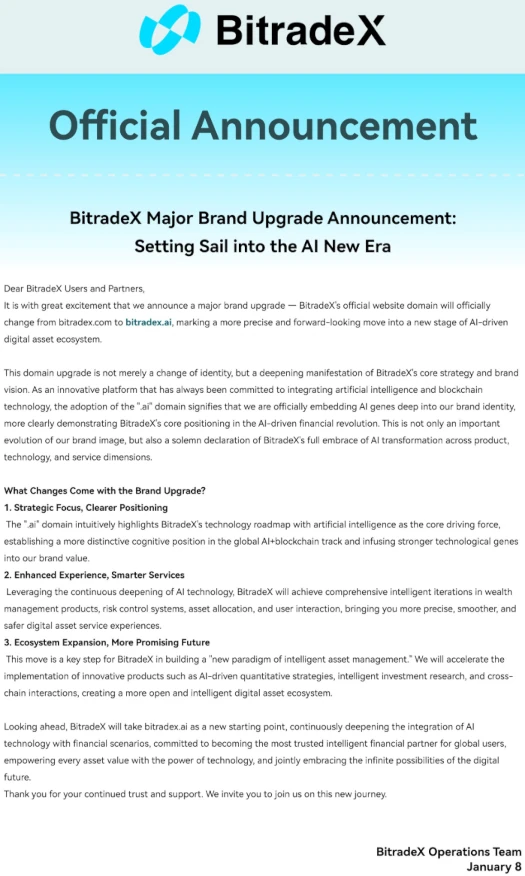

BitradeX lost its domain towards the end of 2025, prompting a switch to the domain “bitradex.ai” on January 9th;

BitradeX’s .AI domain was privately registered on March 3rd, 2025. It appears to have been dormant and suggests BitradeX has other domains on standby.

Why?

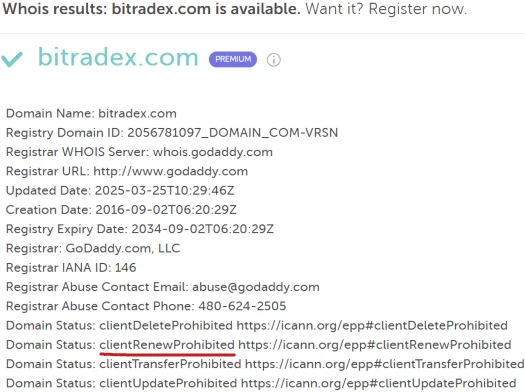

If we look at the WHOIS record for BitradeX’s original .COM domain, we see it has been frozen by the registrar:

As per ICANN, “Domain Status: clientRenewProhibited”

tells your domain’s registry to reject requests to renew your domain. It is an uncommon status that is usually enacted during legal disputes or when your domain is subject to deletion.

It’s likely BitradeX’s .COM domain was flagged for fraud and/or registered with bogus details that could not be verified.

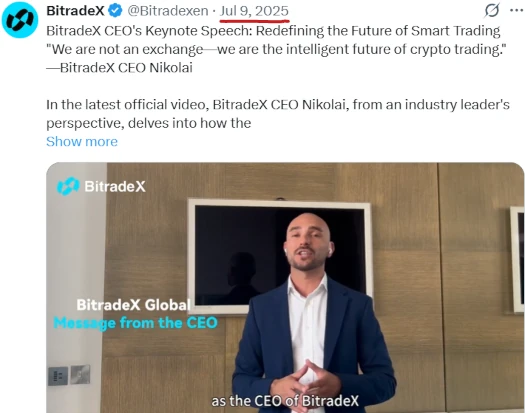

In July 2025 BitradeX rolled out CEO “Nikolai Bonello Jenkins”:

Jenkins has a European accent and, as far as I can tell, does appear to be an actual person from Malta.

It seems BitradeX has moved on from pretending Jenkins exists as he’s mostly disappeared from its marketing.

A visit to BitradeX’s website today features Olivier Giroud front and center:

Giroud is a celebrated French footballer. He is the current all-time top goalscorer of the France national team.

I originally thought BitradeX has misappropriated Giroud’s likeness but Giroud confirmed his involvement in June 2025:

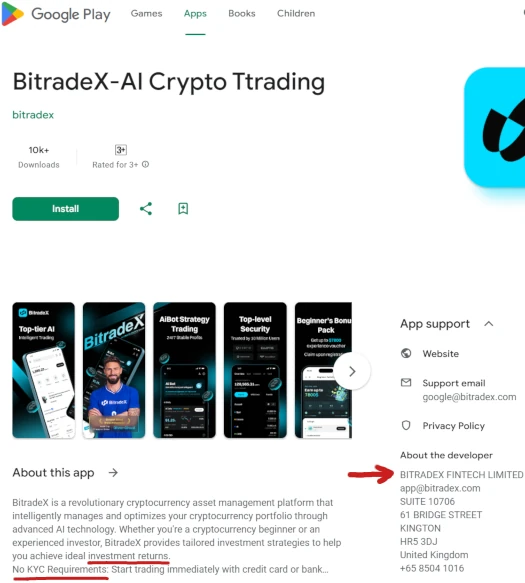

BitradeX is tied to BitradeX Fintech Limited, a UK shell company registered on March 18th, 2025.

As far as I can tell, BitradeX’s UK shell company only exists so that it was able to register its apps on Google Play Store and Apple App Store.

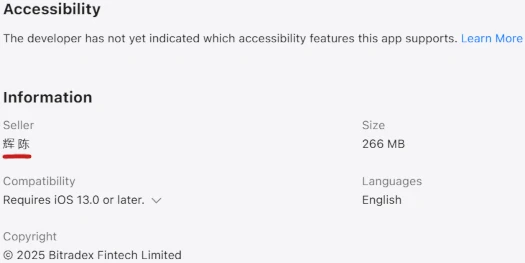

Over on the Apple App Store we can see BitradeX is using “辉 陈” for its developer:

Courtesy of the WayBack Machine we can also see BitradeX’s website was defaulting to Chinese circa November 2025:

This strongly suggests whoever is behind BitradeX has ties to China.

As of January 2026, SimilarWeb was tracking ~646,000 monthly BitradeX website visits.

Top sources of BitradeX website traffic are Japan (23%), Brazil (13%), Malaysia (6%), Saudi Arabia (5%) and Italy (5%).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]