My Trader Coin & Now Mining securities fraud fines in Arizona

My Trader Coin, Now Mining and the scammers behind it have been fined for securities fraud by Arizona’s Corporation Commission.

My Trader Coin, Now Mining and the scammers behind it have been fined for securities fraud by Arizona’s Corporation Commission.

Back in 2020 (and unbeknownst to BehindMLM until today), the ACC filed a cease and desist application seeking restitution and administrative penalties.

Named defendants in the ACC’s application are:

- My Trader Coin – a $550 a day Ponzi scheme reviewed on BehindMLM in April 2017 (collapsed late 2017);

- Now Mining – a daily returns Ponzi scheme reviewed on BehindMLM in December 2017 (collapsed mid 2018);

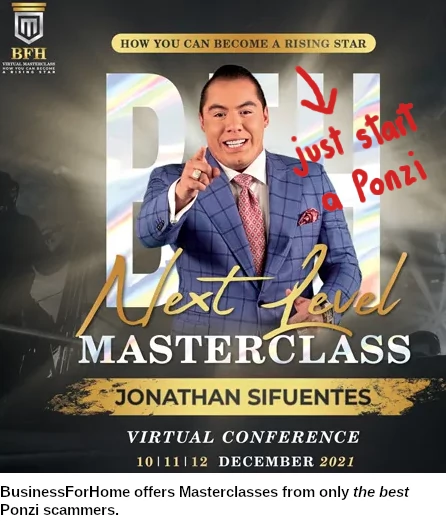

- Jonathan Yelemian Sifuentes Saucedo (aka Jonathan Sifuentes) – cited as a Brazilian national who is “domiciled primarily in Texas”, suspected of founding My Trader Coin or at the very least being part of the executive team;

- Mario Sosa – an Arizona resident, promoter of My Trader Coin and Now Mining;

- Moises Herrera – an Arizona resident, then Vice President of KASA Radio (now La Indiscreta FM), a promoter of My Trader Coin and Now Mining; and

- Carlos Parra – an Arizona resident, then Director of KASA Radio (now La Indiscreta FM), a promoter of My Trader Coin and Now Mining

The ACC’s application groups claims that My Trader Coin (MTCoin)

targeted the Hispanic community through a number of pastors at local Hispanic Christian churches and a Hispanic Christian radio station.

In total, from March 2017 and into 2018, Respondents offered and sold at least 194 investments to approximately 185 different investors for a total of at least $1,614,997, with three investments in Now Mining totaling $106,500 and the remaining $1,508,497 in MTCoin.

Sifuentes offered and sold MTCoin investments to at least 12 persons for a total investment amount of at least $126,000, these persons invested based on Sifuentes’s representations.

Sosa offered and sold MTCoin investments to at least 26 investors for a total of approximately $297,800, these persons invested based on Sosa’s representations.

Herrera offered and sold MTCoin investments to at least II people for a total of at least $221,500, these persons invested based on Herrera’s representations.

Parma offered and sold MTCoin investments to at least 17 people for a total of at least $229,000, these persons invested based on representations that Parma made.

MTCoin investors were told they would be able to withdraw cash from their earnings in their MTCoin account (with accounts serviced by a company called CoinBase) soon after they invested.

Several investors invested as early as March 20 17. The investors, however, were never able to withdraw cash from their accounts as promised.

Respondents failed to inform MTCoin investors that previous investors had not been able to withdraw cash from their accounts as promised

Four investors received returns totaling approximately $28,000. All the remaining investments were lost.

Of Now Mining, the ACC wrote;

Beginning in fall 2017, Respondents Sosa, Herrera and Parra also sold investments in another cryptocurrency investment, Now Mining.

Herrera, Parra and Sosa failed to inform Now Mining offerees and investors that they had sold MTCoin investments to several persons, an investment that turned out to be worthless.

This information would have been material to investors in assessing Herrera’s, Parra’s and Sosa’s inability to value investments that they were selling.

Now Mining offered and sold at least three investments to Arizona investors totaling approximately $106,500.

Sosa offered and sold Now Mining investments totaling approximately $80,000 to at least one person, this person invested based on Sosa’s representations.

Herrera offered and sold investments in Now Mining to at least two people for a total investment amount of at least $25,000, these persons invested based on Herrera’s representations.

Parra offered and sold investments in Now Mining to at least two couples for a total of at least $26,500, these persons invested based on Parra’s representations.

The ACC’s application goes on to accuse the respondents of committing securities fraud, in violation of the Arizona Revised Statutes (A.R.S.).

The Division requests that the Commission grant the following relief:

- Order Respondents to permanently cease and desist from violating the Securities Act pursuant to A.R.S. §44-2032;

- Order Respondents to take affirmative action to correct the conditions resulting from Respondents’ acts, practices, or transactions, including a requirement to make restitution pursuant to A.R.S. §44-2032;

- Order Respondents to pay the state of Arizona administrative penalties of up to $5,000 for each violation of the Securities Act, pursuant to A.R.S. §44-2036;

- Order that Respondents and Respondent Spouses be subject to any order of restitution, rescission, administrative penalties, or other appropriate affirmative action; and

- Order any other relief that the Commission deems appropriate.

Following failed motions to dismiss, Now Mining, Sifuentes, Sosa, Herrera and Para settled with the ACC. My Trader Coin failed to respond and was issued a default order.

On August 14th 2021, Mario Sosa and his wife agreed to permanently cease and desist committing securities fraud in Arizona.

The settlement also saw the Sosas consent to $155,300 in restitution and a $20,000 administrative penalty.

On December 28th 2021, Now Mining agreed to permanently cease and desist committing securities fraud in Arizona.

The settlement also saw Now Mining consent to $45,500 in restitution and a $10,000 administrative penalty.

On April 28th 2022, My Trader Coin received a default order to cease and desist committing securities fraud in Arizona.

My Trader Coin was ordered to pay $1,162,747 in restitution, as well as a $75,000 administrative penalty.

Also on April 28th 2022, Carlos Parra and his wife agreed to permanently cease and desist committing securities fraud in Arizona.

The settlement also saw the Parras consent to $73,500 in restitution and a $20,000 administrative penalty.

Moises Herrera has filed a motion to dismiss on the grounds he is “cognitively impaired”.

As per a filing in February 2022, Herrera has booked himself in for a neuropsychological evaluation. At time of publication the outcome of Herrera’s motion to dismiss is pending.

Jonathan Sifuentes filed a motion to dismiss in March 2021. The motion was denied in April 2021.

Sifuentes filed an answer to the ACC’s application in February 2022. In his answer, Sifuentes mostly denied the allegations or claimed he didn’t know anything about them.

Sifuentes is heading towards a showdown trial with the ACC later this year. It is my opinion that he is unlikely to prevail.

Of particular note is Sifuentes founding Xifra Lifestyle in late 2019.

Xifra Lifestyle offers investors 200% returns, on the ruse revenue is generated via trading and cannabis plantations.

BehindMLM reviewed Xifra Lifestyle in late 2020, concluding it was a simple crypto Ponzi scheme. Not unlike MT Coin and Now Mining.

Based on website traffic estimates, the majority of Xifra Lifestyle investors are believed to be from Mexico and the US.

Xifra Lifestyle represents it is a Mexican company by way of a Mexican corporate address provided on its website.

Sifuentes initially hid that he was behind the company from investors. George Goodman was presented as Xifra’s President and CEO.

That Sifuentes was behind Xifra Lifestyle was made public following his arrest in Mexico earlier this year.

Mexico has begun cracking down on Xifra Lifestyle and Sifuentes.

The Ponzi scheme was issued a securities fraud cease and desist last September. This was followed up by a securities fraud fine in December.

Sifuentes has not been seen or heard from in public since his January 2022 arrest. His current status is unknown.

Of concern is Xifra Lifestyle investors reporting withdrawal delays since late April. Xifra Lifestyle also announced it was rebranding as Decentra, and there’s talk of a move to Dubai.

Dubai is the MLM scam capital of the world. A move there would put Sifuentes out of reach of US and Mexican authorities.

Stay tuned for updates on Sifuentes’ Arizona securities fraud hearing, as well as Herrera’s motion to dismiss.

Update 2nd June 2022 – As per a May 19th filing, Herrera has been assessed and found to be

not competent to participate in the two-week trial set in August of 2022.

A decision on his and his wife’s Motion to Dismiss remains pending.

Part 3 coming…

I went to a meeting in Utah. An argentinian guy name Juan Manuel Peroni promised a crazy amount of money to the latino crowd in Xifra.

People invested the money from equity up to $200k. They lost everything.

I only lost less than $10k. But it was fraud. The hispanics are vulnerable to this.