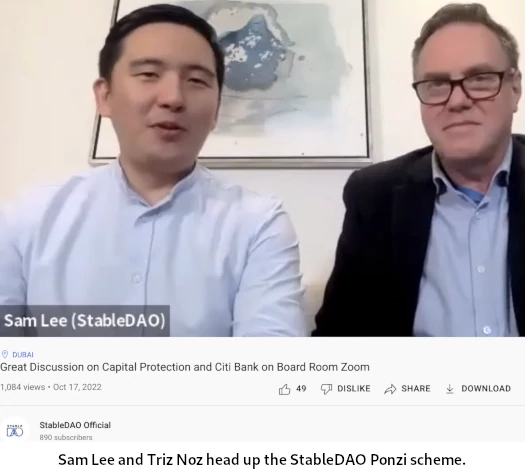

StableDAO Ponzi launched by Hyperverse scammer Sam Lee

![]() Samuel Lee (aka Xue Lee and Sam Lee), co-founder of the HyperCapital, HyperFund and Hyperverse Ponzi schemes, has launched StableDAO.

Samuel Lee (aka Xue Lee and Sam Lee), co-founder of the HyperCapital, HyperFund and Hyperverse Ponzi schemes, has launched StableDAO.

BehindMLM was able to confirm Lee’s involvement via his appearance in an October 17th StableDAO webinar.

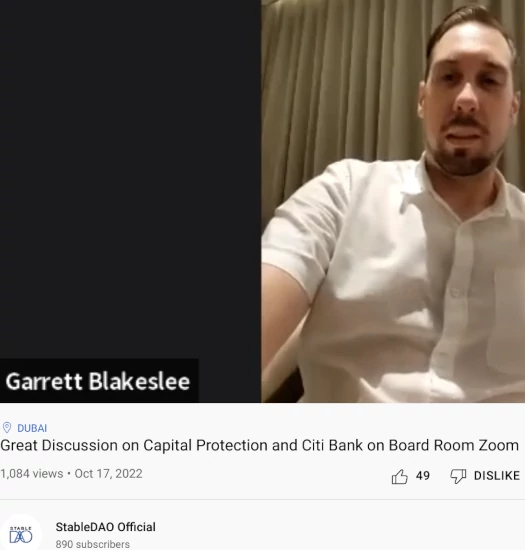

After a brief introduction, Lee fobbed off the webinar to Chief Commercial Officer Garrett Blakeslee.

In a January 2021 interview with the Crypto Revolution Telegram group, Blakeslee revealed he “got into crypto back in 2017” through BitConnect.

At the time Blakeslee was promoting his company Block Duelers, a collapsed NFT scam.

According to Blakeslee and after preloading Hyperverse scammers, StableDAO opened up registrations “a few hours” before the October 17th webinar.

We launched today, about two hours ago.

The early participation program is basically a way for you beautiful people to get in at the ground floor, and to start earning fast and to start earning now.

To drive recruitment of new victims StableDAO is paying $10 per new investor recruited. New investors also receive $100.

Residual recruitment commissions are paid out through a unilevel team.

The catch is this is all paid out in StableDAO “credits”.

StableDAO operates from the domain “stable.limited”, privately registered on September 28th, 2022.

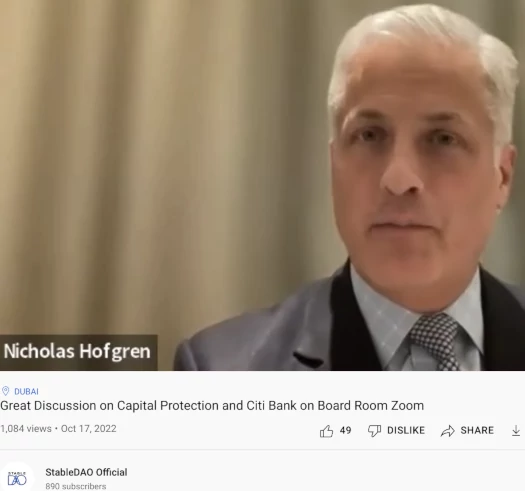

Also speaking on the StableDAO webinar was Nicholas Hofgren, who laid out StableDAO’s Ponzi offering.

(In) one of the projects we’re working with we’ve received MOUs for refinancing. This allows us to secure a return in a three-month period. Which makes us very happy.

The property is being purchased at a nominal rate of about 8.5 ringgit per square foot, and we have a refinancing that allows us to make approximately 33% on our invested money.

Ringgit is the national currency of Malaysia.

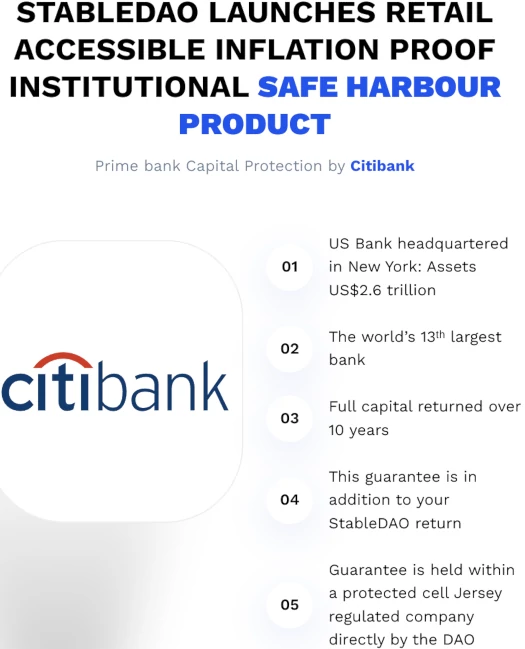

StableDAO’s scam is wrapped in finance bro jargon. Front and center on its website is the claim CitiBank is involved:

I can guarantee you now CitiBank has nothing to do with StableDAO or Sam Lee. At least not knowingly.

The gist of StableDAO’s fraudulent scheme is new suckers sign up and invest on the promise of returns, purportedly tied to real-estate (evidently in Malaysia and elsewhere).

This fails the Ponzi logic test for obvious reasons. If StableDAO has already signed MOUs that will generate 11% a month, what do they need your money for?

The answer is, like all of Sam Lee’s Hyper* scams before it, StableDAO is yet another Ponzi scheme.

Lee touts StableDAO investors will earn 4% a month on invested funds.

- invest over $500,000 and you’ll receive an extra 1% a month

- invest over $1,000,000 and you’ll receive an extra 2% a month

- invest over $5,000,000 and you’ll receive an extra 3% a month

Funds invested into StableDAO are locked up for 10 years (i.e. you’ll never see them again).

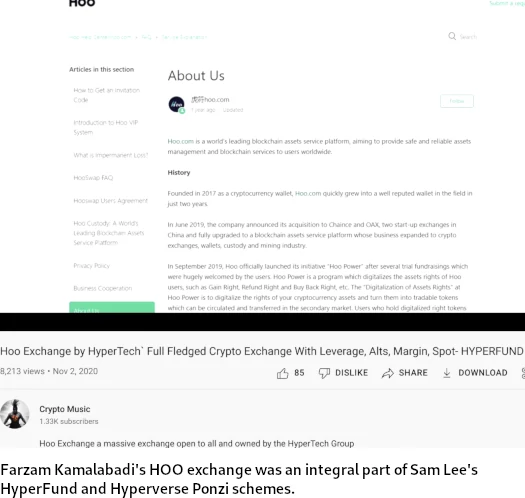

Farzam Kamalabadi, a StableDAO Non-executive Chairman, also spoke on the webinar.

Kamalabadi owns the HOO cryptocurrency exchange. HOO was heavily integrated into HyperFund and Hyperverse, dating back to at least 2020.

Kamalabadi profited off investors losing millions in Sam Lee’s various Hyper* Ponzi schemes.

Seeking to profit again with StableDAO, he had this to share:

So this hybrid system is really going to be the game of the future. And then we have real assets and real operations.

No more only promises of a whitepaper, a feature that by its outset is doomed and will not deliver.

At the end they fizzle and they die. But not here. It’s impossible that the project will disappear.

Fearing arrest, Sam Lee and his Hyper* cohorts fled to Dubai in early 2021.

With partner in crime Ryan Xu, Lee launched HyperCash, HyperCapital, HyperFund and Hyperverse – all Ponzi schemes in which the majority of investors lost money.

Hyperverse has two spinoffs; HyperOne and HyperNation. It is unclear to what extent Lee is involved in either.

Xu hasn’t been seen in public for over a year. It is unclear whether he’s involved in StableDAO.

In any event, Dubai is the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

Neither StableDAO, Sam Lee or any of its executives are registered to offer securities in any jurisdiction.

This would see StableDAO provide regulators and potential investors with audited financial reports, providing evidence of the marketing claims.

The evidence hasn’t been audited and filed because StableDAO is a Ponzi scheme, run by a serial scammer.

Update 21st April 2024 – The cited October 17th StableDao webinar cited in this article has been removed from YouTube.

The previously accessible link now returns a message stating the “video is no longer available due to a trademark claim by a third party”.

What’s even more hilarious was one of the presenters at the first ever CeDeFi Dubai Conference *cough* (basically a StableDao sales pitch).

he was talking about the SEC and the Howey test being archaic and undermining Progress in the Crypto space ie. making it harder for Cryptobro scammers to Scam for fear of SEC enforcement.

Everybody likes this.

I am shocked at seeing him come out of hiding, to promote something else, when he has a long history of freezing people’s funds and disappearing then re-appearing.

I have lost a lot, he froze my accounts and sold worthless tokens which are now worth nothing. When is this man going to get arrested for fraud????

When Dubai freezes over?

Thanks OZ for the good work you’re doing through BehindMLM.

Everyone knows that Sam Lee (or whatever he calls himself) is a world-renowned fraudster and serial SCAMMER.

So, if anyone willingly or blindly joins any of his schemes, it’s akin to saying that the person fully accepted to be scammed. No two ways!!!

This Ponzi scheme has no class. I did actually think Sam Lee was classier than this one. This is a unprofessional attempt at starting a Ponzi Scheme.

There’s so many floors even the company offices are located at Regis which is a co-shared office space, they just updated there office address to Tokyo which is also a shared office space.

It’s like watching a bad circus act trying to fool people with fake everything. Hopefully people will see through this even though many people will think it’s real.

What were you doing 10 years ago? Now they’re saying wait 10 years in a volatile industry for your return on your investment.

Read this:

smh.com.au/business/markets/blockchain-global-millions-used-for-exotic-crypto-personal-payments-court-told-20221020-p5brbt.html

Citibank has been contacted and they have NO IDEA who StableDAO is.

And yes Zippy, read that article, wow just wow, such criminal behaviour, that explains a LOT about the career criminal.

Our only hope now is that he does get arrested!

Thank you so much for saving the world, you are the kind of persons we actually need in this world this time around.

please keep it up, don’t let down ur guard for this fruad stars, we are actually dying in there hand in my country too.

Simply terrible!! Why can’t he just be arrested.

Thank you for the updates.

Sam Lee answering questions about Hyper… and promoting StableDao, January 28, 2023, on Vimeo:

vimeo.com/793697211/2735343e2e

I’m 7:52 into this and Sam Lee keeps referring to Hyper*’s management as “corporate”, suggesting he’s not part of it.

Is it Sam Lee pretending he didn’t run the Hyper* Ponzi schemes with Ryan Xu for am hour and a half?

Some of Hyper* victim’s funds is in Sam Lee’s bank account. He’s using it to live in Dubai and try to get new Ponzi schemes off the ground.

This isn’t rocket science.

edit: Yeah I’m out. This is just Sam Lee lying for an hour and a half.

In Sam Lee’s own words, he is in the PUMP and DUMP business.