BigWhale emergency C&D filed by Texas, admins outed

A few days ago the BigWhale Ponzi scheme collapsed.

A few days ago the BigWhale Ponzi scheme collapsed.

BigWhale’s admins drained what was left in its smart-contract and, in an effort to cover up their exit-scam, concocted a “we got hacked!” ruse.

Now it has been revealed that regulators were onto the multi-million dollar Ponzi scheme.

On October 4th the Texas State Securities Board issued an emergency cease and desist against BigWhale.

TSSB cites BigWhale as a Dubai-based company. In reviewing BigWhale back in July, BehindMLM noted a Swiss shell company and potential ties to Canada.

That BigWhale has ties to Dubai, the MLM crime capital of the world, doesn’t come as a surprise.

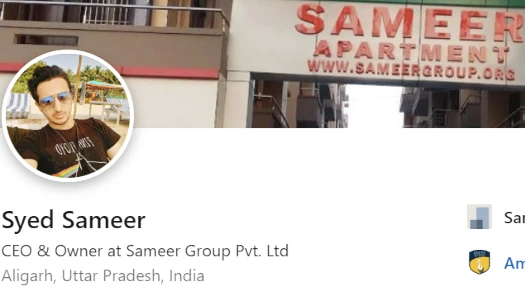

In addition to BigWhale itself, TSSB identifies Syed Sameer and Christopher Page as persons of interest.

Sayeed Sameer purportedly owns BigWhale’s website.

On LinkedIn Sayeed Sameer cites himself as a resident of Uttar Pradesh, India. He’s also the

owner of Aligarh based Sameer Group Pvt. Ltd. – The 3rd largest real estate developer in Aligarh city.

Sameer Group is a privately owned holding company involved in Real Estate & E-Commerce through its subsidiaries Sameer Real Estate Pvt. Ltd and Essencia, LLC.

Essencia LLC is a Delaware, USA based company with investments in eCommerce, Digital Marketing & Social Media Marketing.

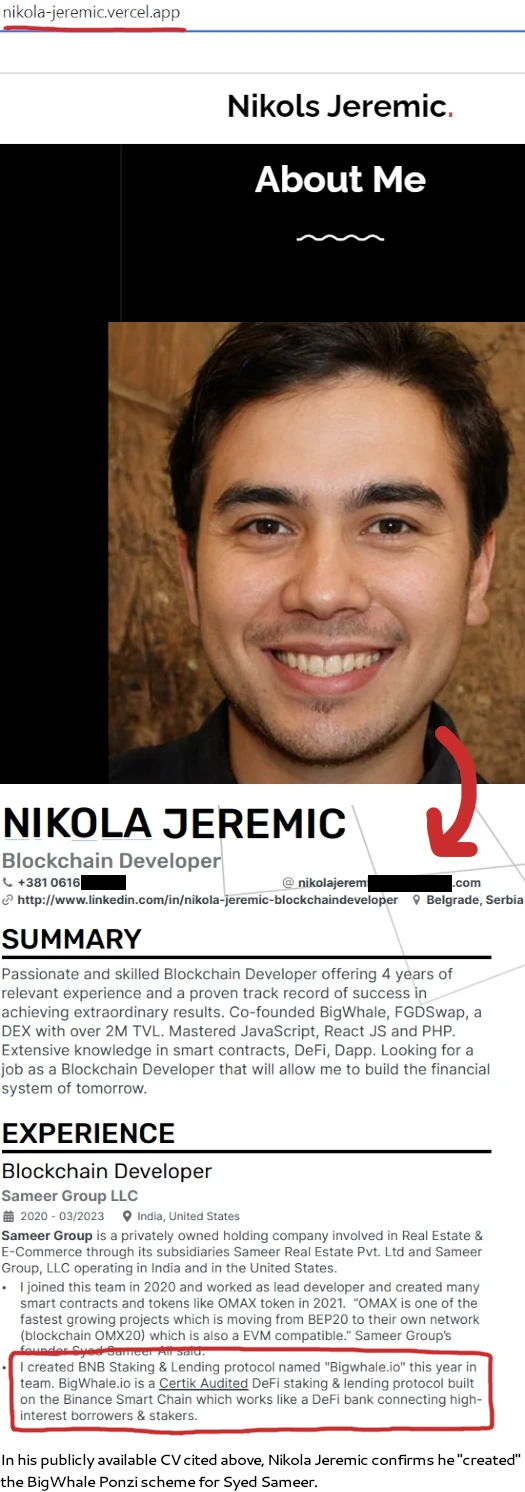

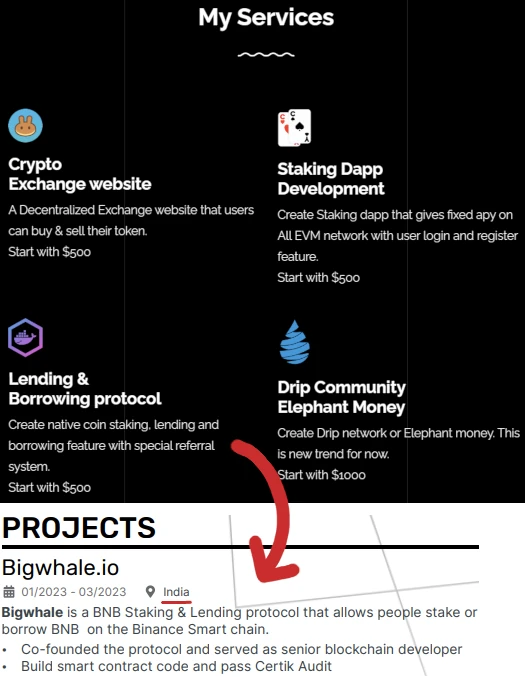

BigWhale was put together by Serbia based developer Nikols Jeremic (aka Nikola Jeremic).

Jeremic cites Ponzi scheme business models, including BigWhale, as a “service” on his website:

Sameer is one of Jeremic’s “happy clients”:

Christopher Page owns BigWhale’s website domain. I wasn’t able to find anything on Page, suggesting it might be an alias.

In addition to BigWhale’s admins, promoter shills on YouTube also get a mention;

Various users are promoting Respondent BigWhale and the BigWhale Dapp through social media and videos published in YouTube, including users acting as MoonShot Max (@moonshotmax3841), SCrypto101 (@Scrypto101), Razz Tafari (@razztafari), Crypto Goshen (@cryptogoshen3579), DeFi Strategy (@defi_strategy), Crypto Kingz (@cryptokingz9915), Scott_The_Investor (@ScottTheInvestor), Crypto Muscle Network (@cryptomusclenetwork1), Crypto Muscle OG Channel (@cryptomusclelegacy), DEFILIFE (@mydefilife), Hippo Crypto (@hippocrypto3675), Jacob Crypto (@jacobcryptoyt) and Mo Crypto 777 (@mocrypto777).

TSSB’s goes on to confirm BigWhale is an illegal Ponzi scheme, is committing securities fraud and is masquerading as a bank.

Although Respondents are using the term “bank” and “banking” when describing Respondent BigWhale and the BigWhale Dapp, Respondent BigWhale is not licensed with nor obtained a charter from the Texas Department of Banking and the National Multistate Licensing System does not show it has been conferred any state license tied to mortgages, money service businesses or consumer finance.

Respondents are representing the smart contract was audited by Certified Kernel Tech LLC, also known as CertiK (“CertiK”), and it is using this audit to tout the legitimacy of the BigWhale Dapp.

The audit also identifies a critical finding. The critical finding shows “[t]he project appears to be using user deposits as other people’s rewards…”

The investments described herein have not been registered by qualification, notification or coordination and no permit has been granted for their sale in Texas.

Respondent BigWhale has not been registered with the Securities Commissioner as a dealer or agent at any time material hereto.

Respondents Sameer and Page have not been registered with the Securities Commissioner as agents of Respondent BigWhale at any time material hereto.

The TSSB’s cites BigWhale’s marketing, in which BigWhale claims to have reinvented itself as an offshore crypto Ponzi scheme following a $258,000 fine issued by the Swiss Federal Tax Administration.

The fine and associated legal expenses purportedly drove Respondent BigWhale to incur $120,000 in costs associated with transitioning its operations offshore.

It also purportedly began partnering with offshore banks to minimize tax and risk exposure from the Swiss FTA and European Union.

TSSB labels the marketing “deceptive and misleading” due to a lack of evidence.

As described herein, the Swiss FTA purportedly assessed a $258,000 against Respondents.

Their description of the fine is materially misleading or otherwise likely to deceive the public because they are not providing a description of the facts giving rise to the fine or the violations of law that gave rise to the fine, and they are not providing sufficient information for investors to independently access the order, judgment or other action that levied the fine.

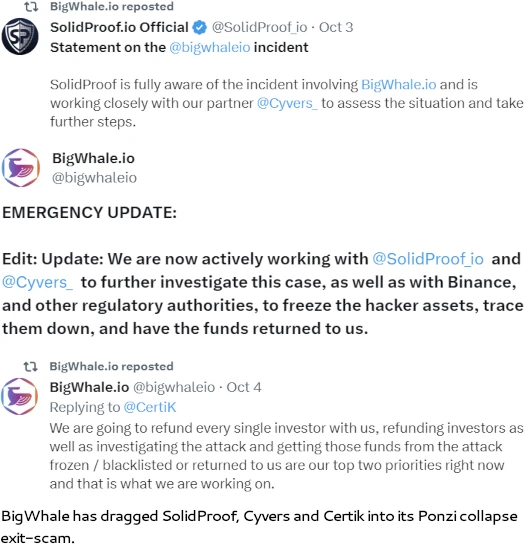

Finally, BigWhale’s exit-scam, including purported links to the Russian government, also get a mention.

On October 3, 2023, Respondents announced Respondent BigWhale “suffered what seems to be a spoofing type or some other type of hack.”

Respondent BigWhale is offering a “bounty” of 20% to the hacker in exchange for the return of assets.

Respondents are also threatening to pursue extrajudicial relief and leverage contacts in the Russian government.

In addition to banking and securities fraud, further allegations of fraud the TSSB levels at BigWhale include failing to disclose

- “the identity and location of the borrowers, as well as their capitalization, revenue, and credit risk” (BigWhale’s Ponzi ruse revolves around fictional lenders and borrowers);

- “the criteria used for vetting borrowers and minimizing defaults on loans issued to borrowers”;

- “the methodology used to recruit borrowers and the consequences of failing to recruit new borrowers”;

- “the identity of the party or parties that developed, maintain, and update the BigWhale Dapp”;

- “the costs associated with developing, maintaining, and updating the BigWhale Dapp”;

- “any information about the safety of investor assets in light of the critical finding from the CertiK audit that shows “[t]he project appears to be using user deposits as other people’s rewards…,””;

- “any information about how a hacking incident or malicious act may negatively impact the ability to use the BigWhale Dapp or withdraw assets”;

- “the identity of the assets within the Russian government that Respondents purportedly work with”;

- “the nature of the relationship between Respondents and the assets within the Russian government that Respondents purportedly work with”; and

- “an explanation of how Respondents will work with assets within the Russian government to address the purported hack”.

As per TSSB’s October 4th C&D, BigWhale, Syed Sameer and Christopher Page have been ordered to immediately cease and desist committing further acts of securities fraud in Texas.

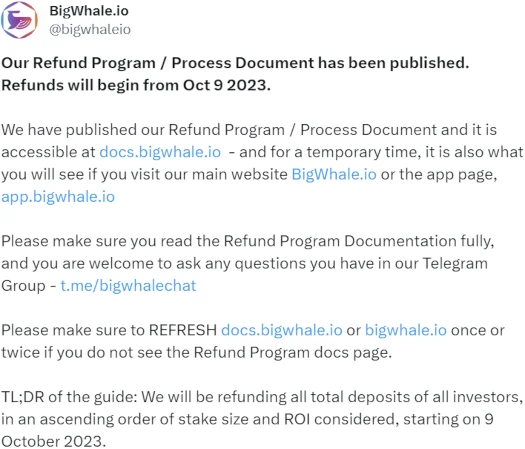

Following BigWhale’s collapse and “we got hacked!” exit-scam, the Ponzi scheme is now touting refunds for investors:

As per BigWhale’s published refund process, the Ponzi scheme

will be refunding all total deposits of all investors, in an ascending order of stake size and ROI considered, starting on 9 October 2023.

Left unsaid is the fact that BigWhale’s biggest investors are its own admins.

Left unsaid is the fact that BigWhale’s biggest investors are its own admins.

Thus by “refunding” himself the money he’s already stolen, BigWhale’s exit-scam is complete and Syed Sameer (right) rides off into the sunset.

Pending any further developments, we’ll keep you posted.

Update 7th October 2024 – BigWhale has confirmed its refunds scheme was a sham.

Additionally, within a few hours of this article being published, Syed Sameer marked his social media profiles as private.

Nikola Jeremic has also gone underground and deleted his website.

Rando Indian crypto scammer fronting connections to the Russian government. Lulz.

These C&D orders are meaningless… as we have seen with past scams like novatech and usi-tech the order actually helps the scammers to keep the ponzi going by claiming that they no longer allowing members from there and simply stealing their money…

USI-Tech is a Euro problem but I’d very surprised if there weren’t federal NovaTech FX investigations underway. A lot likely hinges on where the Petions have fled to.

In the US federal action is typically preceded by state regulators taking action.

As for cutting off states when orders are issued, the money is already gone. It also prompts additional complaints from victims, which ultimately strengthens cases being built.

With respect to BigWhale, investors now know they’ve been had by an Indian scammer. We wouldn’t have known that had the TSSB not made it public.

One thing thats really sad is the amount of people that believe a hack actually happened. I don’t feel bad for people so gullible continue to get scammed.

I don’t believe that there is any SEC action or investigation in the novatech case… if there was then they would have acted by now and Cynthia would never have been able to leave the leave the country…

As I said, these c&d orders are meaningless…

Regulatory investigations into NovaTech FX began in late 2022. By then the Petions were already gone.

https://behindmlm.com/companies/empiresx/empiresxs-nicholas-confirms-sec-novatech-fx-investigation/

You won’t get any argument from me that these cases take too long to put together in contrast to how quickly an MLM Ponzi can proliferate these days.

There is another company behind this scam called spaceddev.io.

Bigwhale was saying this is the coding company “working for them” but they are likely the people behind the scam too.

Hope all burn in hell.