Mirror Trading International Review: Forex trading daily returns

Mirror Trading International operates in the forex trading MLM niche.

Mirror Trading International operates in the forex trading MLM niche.

The company is incorporated and based out of South Africa. Heading up Mirror Trading International is CEO and founder Johann Steynberg.

Prior to founding Mirror Trading International, Steynberg (right) was promoting Syntek Global.

Prior to founding Mirror Trading International, Steynberg (right) was promoting Syntek Global.

Based on his Twitter account activity, at some point Steynberg took an interest in cryptocurrency.

Earlier this year Steynberg was advertising a “turn $25 into $75 over and over again” opportunity on Twitter:

Guess that didn’t work out.

Read on for a full review of Mirror Trading International’s MLM opportunity.

Mirror Trading International’s Products

Mirror Trading International has no retailable products or services, with affiliates only able to market Mirror Trading International affiliate membership itself.

Mirror Trading International’s Compensation Plan

Mirror Trading International affiliates invest $100 or more on the representation of perpetual trading returns.

How long is the investment period?

The investment period is continuous and you will continue to earn profits as long as you keep the minimum balance of 0.01 BTC in your trading account.

Recruitment Commissions

Mirror Trading International affiliates earn a 10% commission on funds invested by personally recruited affiliates.

Residual Commissions

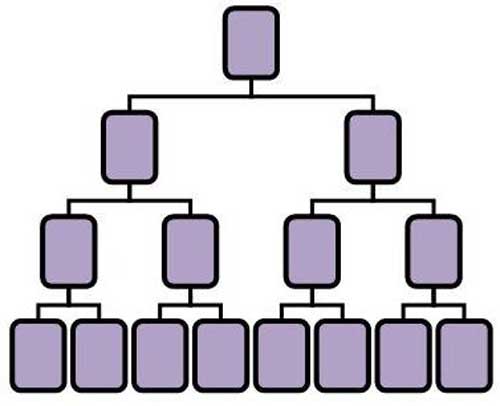

Mirror Trading International pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

How many binary team levels a Mirror Trading International affiliate earns residual commissions on is determined by how much they’ve personally invested:

- invest $200 to $999 and earn residual commissions down ten binary team levels

- invest $1000 to $4999 and earn residual commissions down twenty binary team levels

- invest $5000 to $9999 and earn residual commissions down thirty binary team levels

- invest $10,000 or more and earn on your full binary team (unlimited depth)

Residual commissions are calculated weekly, based on 20% of company-wide generated returns.

Mirror Trading International states that of the 20% set aside, affiliates earn their share based on “the total business your team structure contributes”.

Although not explicitly clarified, residual commission payouts are clearly based on binary team investment volume.

Joining Mirror Trading International

Mirror Trading International affiliate membership is tied to a minimum $100 investment.

Full participation in the attached MLM opportunity requires a minimum $200 investment.

Note that all fund transfers within Mirror Trading International (both paid and received), are made in bitcoin.

Conclusion

Mirror Trading International combines pyramid recruitment with a passive investment opportunity.

The system is fully automated and you can sit back and relax.

Johann Steynberg doesn’t appear to have a forex trading background, so it is unclear where and how Mirror Trading International is trading.

This is important because Mirror Trading International’s passive investment opportunity constitutes a securities offering.

Securities in South Africa are regulated by the Financial Sector Conduct Authority.

Although Mirror Trading International might be incorporated in South Africa, neither the company or Johann Steynberg appear to be registered with the FSCA.

This means that Mirror Trading International is operating illegally in South Africa.

Indeed if Mirror Trading International is not registered with securities regulators in every jurisdiction is solicits investment in, the company is operating illegally worldwide.

The only reason Mirror Trading International would opt to commit securities fraud is if they aren’t doing what they say they are. Namely paying returns from trading revenue.

Part of securities regulator registration is providing audited accounting demonstrating trading revenue being actually used to pay returns. Mirror Trading International would also have to make disclosures regarding what happens to investor funds to their investors and the public.

Again, this is not optional. By failing to register and providing disclosures, Mirror Trading International is committing securities fraud.

As it stands the only verifiable source of revenue entering Mirror Trading International is new investment.

Using new investment to pay existing affiliates a daily return would make Mirror Trading International a Ponzi scheme.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Joel Santiago, he of Volishon, Copy Profit Success Global plus too many other short lived recruitment driven blink and you missed them “opportunities” to recall, and his crew are pushing this hard.

Folks, if you’re following people like Joel from one program to another for any reason other than morbid curiosity you are either getting screwed or helping other people get screwed, or both.

This review is riddled with inaccurate information. Please perform your due diligence.

This review is due-diligence.

If there was anything inaccurate in it, you’d have surely pointed it out.

Hi Liz – As you identify yourself on your Facebook account as “Founder member at Mirror Trading International Pty Ltd”, perhaps you can help me refine some due diligence I am doing:

Mirror Trading’s website states,

Shouldn’t it also be mentionable that “members have a disadvantage when the value of BTC decreases?

Do you agree that it would maybe more honest to state:

“WE USE BITCOIN because once you send it, you have NO recourse for getting your money back”?

Also …

The “contact us” page lists their “Registered South African Office” as:

341 Beyers Naude Street

… but the Google map they provide identifies the location as:

341 Beyers Naudé Drive

Do you think it is MTIclub or Google that isn’t too sure about what the “registered address” is?

I would bet it’s MTI. The business occupying that building are clearly listed on the entrance in street view. Mirror Trading International isn’t there.

SD

Again a review that will not stick. Again a persoon that thinks he or she know’s it all.

You think you are the vigilante of the MLM world, meaning that you think the rest of the people are either stupid or don’t have a brain of there own.

But let’s go and see where your review don’t stick’s.

First of all, investing your bitcoin with MTI is to grow the amount of bitcoin, NOT the value! So whether the price of bitcoin decreases or increases you always win.

Second you state:

Answer.

Sinds MTI has bitcoin in bitcoin out, they don’t have to be registered with the FSCA.

For the reason that cryptocurrency is world wide not regulated! This is what the FSCA told Johan.

So maybe you should ask the FSCA, i think they are glad to answer all your questions. But as soon as crypto is regulated MTI will register at the FSCA.

Then you are stating that on the address MTI is having there office it is not on the building!

Well as we all know, google street view doesn’t make around the clock photo’s. So this is a pretty leem excuse on your part.

My free advice to you is. Do your research and try to have your facts in order.

I get it that you may not like MLM, many people are very happy with this industry in whatever business.

I my self have some questions with some of the companies in this industry.

But with MTI i feel very confident, they are transparent, they answer every question if you have one.

So if you had done your hobby the right way, you had picked up the phone or send an email to MTI and you would have got all the answers needed.

Regards,

JW

You can’t forex in bitcoin so that’s a load of BS. You give your BTC to Mirror Trading International, they use it to pay existing investors.

If people invest after you, they pay you with their money.

Bullshit again. The FSCA regulates securities offerings. Mirror Trading International’s passive investment scheme is a securities offering.

Nobody said anything about regulating cryptocurrency. The FSCA regulate securities.

A securities offering (passive investment opportunity) is a securities offering irrespective of the investment vehicle.

Mirror Trading International’s MLM opportunity is a securities offering. By not registering said investment opportunity with the FSCA Mirror Trading International is operating illegally.

Not just in South Africa but in any country securities are regulated.

Do your thing, because of your answers nobody is going to take you seriously. You are just a Wanne be know it all.

But in all cases with any program do your research your self even if it is not mlm. And i’m a pro investor and know all the rules.

Have a nice life and don’t let people how will never have success other than telling you that life sucks for them and you should suffer the same way they do!

Listen to people how have success and ask them how they did it. Never stop believing it is there for you to.

So uh, just going to ignore the facts then?

Mirror Trading International is a securities offering and the company is committing securities fraud. Best of luck with the scamming.

What a cookie cutter, absolutely nothing to do with bitcoin apart from the in and (for a while) the out..

And the chief shill is aptly named Rich. He’s an “influencer” y’know. A disruptive one.

richsimmonds.files.wordpress.com/2018/11/cropped-screenshot-2018-11-26-at-12-08-59.png

Hey, is it funny how people will always over look the facts to support their views.

I attend numerous presentations on MTI and after heated debates I decided to open up a case against them with a number of agencies. I even contacted the FCSA which had formally open a case against MTI and is even roping in the Reserve Bank..

If what you say is true about the FCSA and Johan why was I on my request to look into MTI (I actually copied and pasted this article in my email complaint) not correct.

For some reason everyone associated with MTI thinks we are targeting bitcoin… It’s what’s being done with the bitcoin that’s the issue here..

And why is the binary payout system shaped like a pyramid on MTIs youtube training videos? What other legitimate investment firm asks for you to get them new investors with the promise of a 10% payout on everything they subsequently invest.

Another thing according to the buy in levels you can get between 10 and infinite binary returns levels depending on the amount you invest, for the simple mathematical reason thay if the top tier starts of at one and then the level has 3, then 9 if you follow this you will run out of the entire population when you get to 13th level.

So the ones at the bottom won’t see the returns of the ones higher up so why would you invest such an obscene amout to get unlimited levels when that isn’t even mathematically possible?

Some things in South Africa work wonderfully. If this was reported online at fic.gov.za, he would have his bank accounts immediately scrutinised tomorrow.

The SA Reserve bank would be told that he is accepting deposits without a license in terms of the Banks Act, Collective Investment Schemes Act or Long Term Insurance Act.

The Asset Forfeiture Unit could seize everything as early as Friday. Merry Christmas.

Someone affected in South Africa, please visit the fic.gov.za website and file an STR and this will be over.

Do you want to wait until it actually collapses first and then call it a “Ponzi scheme”? There’s a lot of people that turn 18 each year.

How much money exactly are participants losing? Why are you complaining about something that hasn’t happened yet??

Nope. A business model makes a Ponzi scheme a Ponzi scheme. All Ponzi schemes eventually collapse, whether they do so is not a prerequisite to Ponzi identification.

Thankfully not everyone who turns 18 is interested in getting scammed. One of the more stupider Ponzi excuse cliches for sure.

Math dictates the majority of Ponzi participants lose money.

Pointing out facts != complaining. The only complaints are from MTI scammers such as yourself.

You say “prior to founding Mirror Trading International, Steynberg was promoting Syntek Global.”

He was also heavily involved in the Kipi Pyramid scheme in South Africa, also known as MyDeposit247, and was one of the main promoters giving workshops and recruiting people to the scam.

I still have som pictures from a presentation, interesting to look back at them now and see him with people who are now Karatbars promoters in South Africa.

Many Famous Ponzi king pumping this right now. Joel Santiago, Marco Ricciardi, LaRon Dejoun, Derrick brewer, Belinda Jameson.

The name of Liz Malton and Scott Smith as founder member they have working together before. Previous business was also a South African ponzi scam that scammed a lot of people.

I Think it won’t take long before FSCA will close this down.

Zoom calls weekly by Joel Santiago and Scott Smith to let others recruit so they can cash out is also a funny thing.

Serial Ponzi pimp and pimpette, Wes Garner and Lisa Marie Holt, apparently now have their black thumbs into this.

Be warned, things usually collapse soon after Wes gets involved. BitClub was his latest (that I know of) until authorities shut it down.

Garner and Holt seem to be operating under the downline team name “The Faculty”. LaRon Dejoun aka Residual Ron claims he’s the CFO.

The primary business of MTI is facilitating group investment with a registered Forex trading company.

MTI does (Ozedit: snip, see below)

Oh MTI is registered now is it? Feel free to provide evidence Mirror Trading International has registered its passive investment opportunity with financial regulators.

Then of course you’ll be able to provide audited accounting verifying your “MTI does” claims.

After you’ve provided this evidence, you’re free to post your verified “MTI” does this and that” claims.

Without securities regulatory registration, all you know is invested funds go into MTI and returns are paid out.

Bitcoin is not regulated in South Africa and therefore under the current situation I do not believe it is necessary for them to be registered with any financial regulatory body.

Once Bitcoin and other digital currencies are recognized and accepted thereby requiring registration and reporting, then we can have a debate on whether they comply or not.

Bitcoin is unregulated in South Africa, yes. What Steynberg is scamming is regulated by the Collective Investment Schemes Act in South Africa.

He is not a registered provider. If he is collecting deposits, he is in breach of the Banks Act. He is also in breach of the Consumer Protection Act by selling something which is ultimately bad for the people buying it.

Additionally he is in breach of the Financial Intelligence Centre Act for being in breach of all of the others, and definitely the Prevention of Organised Crime Act.

With the current emphasis in SA on ending corruption and financial fraud, he is an easy target for the Hawks.

Nobody said anything about bitcoin being regulated.

MLM + passive investment opportunity = securities.

Securities are very much regulated the world over. Doesn’t matter if a security is offered in bitcoin or fiat or any other vehicle.

I know MTI is not registered to offer securities anywhere in the world. You do too, so how about you stop pretending it’s anything other than a Ponzi scheme.

I don’t know about MTI, I’m not interested.

What does interest me is your central premise that they are not registered to offer securities. You misunderstand something fundamental here.

Any investment company offering Bitcoin in/out does not have to comply with securities regulations since Bitcoin is NOT a security. It is a commodity.

The SEC chairman (in US), clarified this in June 2019. This decision echoes the position the rest of the world has taken.

Round and round we go.

Whether bitcoin itself is a security or not is irrelevant. The offering of a passive investment opportunity is a security.

There are no exemptions for bitcoin or any other cryptocurrency in the Securities and Exchange Act. Nor is there a crypto carveout in the Howey Test.

With respect to securities law, the SEC doesn’t give a shit what you do with your own bitcoin.

If you’re an MLM company promoting a passive investment scheme, in bitcoin or any other form of currency, you’re offering a security and need to be registered.

BitClub Network was recently targeted in the US by the DOJ. Literally bitcoin in and out, through a passive investment opportunity.

Although the DOJ are pursuing it as a criminal matter, the issue of securities came up:

US authorities don’t give a shit what you use to commit securities fraud.

As for the rest of the world, there are no cryptocurrency exemptions in securities law in any country that I’m aware of.

Honestly, do I really need to have this discussion every time some crypto dumbfuck who doesn’t know the law stumbles across BehindMLM?

I find your article interesting as I have Bitcoin in MTI. Whenever doing something like this caution is the best thing for yourself. I have been and met Johann and I felt safe in entrusting my Bitcoin with them. Also I have seen the growth and have taken money out without any hassle.

Seeing as your name is Oz I take it you are in Australia, not a fan. That said give me the names and addresses of all these different FSCA and things here in Cape Town that you will trust and I will go to their offices and get you the proof you need for your allegations, if not and they confirm all that the other people have said here you will have to give a public apology to MTI.

I prefer to speak to people face to face and that is why I went to their presentations here to see for myself. So let me go to the right authorities according to you and see if what you claim is true.

No need to visit the FSCA’s office, you can verify Mirror Trading isn’t registered to offer securities in South Africa on their website:

fsca.co.za/Regulated%20Entities/Pages/List-Regulated-Entities-Persons.aspx

Bit funny crapping on about “trusting” scammers when you didn’t just them for their securities regulatory filings (they don’t exist).

Okay Oz seeing as you can’t keep your words out of the toilet bowl, keep the slinging of it.

I have been granted an appointment with the Hawks in Bellville next week. The person that I spoke to over the phone doesn’t agree with many of the statement you make and that is why I will be going to see them and getting the information on paper.

I just don’t know how I will be able to add it to this website as there isn’t an attachment option.

If I’m wrong I will withdraw my bitcoin from MTI and apologize here to you and move on.

I don’t care what you do with your bitcoin. Nor do I care about your apologies. I care about facts.

MLM + passive investment opportunity = securities.

Securities in SA are regulated by the FSCA. You can check for yourself that Mirror Trading International is not registered with the FSCA.

Conclusion: MTI is an illegal securities offering. The only reason a passive investment opportunity would opt to operate illegally is if it’s a Ponzi scheme.

Best of luck with your appointment with the hawks, it doesn’t change the facts.

Oh and inbe4 “bUt ThE hAwKs ToLd Me ThE fScA dOeSn’T rEgUlAtE bItCoIn!” /facepalm

@M I have a genuine question for you:

Can you tell me the difference between a blatant thief and a con man?

I’m not asking if you can tell the difference, but rather what is the difference. I want your comparison of the two types. Thanks.

@M I have personally opened a case against MTI with FCSA, and I have responses that the SARB is investigating MTI.

Let them do their job and we can all get clarity but the fact that after they read and saw everthing that MTI said, they still oepned a case should be telling.

I’ve been offered an opportunity to get involved with MTI. I’ve attended one of their presentations and it all seems to good for words.

What is the latest with regards to this scheme being investigated by the Hawks?

No investigation by the Hawks has been confirmed. The guy claiming he had an appointment with the Hawks disappeared.

Regardless, MTI engaging in securities fraud should be enough – with or without a Hawks investigation.

Ponzi scam.

Cheri Ward of BTC Global fame has crawled out from under her rock and is now pimping Mirror Trading International.

imgur.com/a/W3nuypR

Great. Guess this means we’re on our way to having another Crowd1 South Africa pillage sesh then.

BTC Global caused over $80 million in losses, South African authorities failed to make any arrests. Never forget.

Sir, with due respect to you and your interview… You don’t know how South African regulators go about… I live in South Africa. The FSCA does NOT except bitcoin as a currency or commodity and therefore M.T.I CAN’T register with them.

However, you didn’t know that MTI is trading through FX Choice who is in fact IFSC Regulated and full insurance on all funds invested. License Number for FX Choice: IFSC/60/191/TS/16O

The offices moved from Byers Naudee drive to Stellenboch in early Feb. I’ve seen the office, it’s looking great!!

2nd: I’ve seen with my own eyes the bot in use to do the trading, plus my cousin Johan Kruger is the Senior Admin for the company. Here follows the MTI registration number: 2019/205570/07

Hope this helps, as this IS the true facts around MTI

The issue is Mirror Trading International’s passive investment scheme, which is a securities offering. Not bitcoin.

Securities are regulated the world over. Even in South Africa, albeit poorly when it comes to MLM.

Cryptocurrency investment schemes are not exempt from securities regulation in any country on the planet.

Not a substitute for legally required audited accounting, showing actual external revenue is being used to pay affiliate returns.

Nor is having an office or a basic incorporation number. Or any other company that is not MTI having a license.

Stop making excuses for scammers.

Werner: Not true, it IS Bitcoin! you’re wrong again… are you blind? (Ozedit: derails removed)

meanwhile you’ve NEVER owned a BMW just like you’ve never been a member of MTI to know how it works… You’re biased and contridicting!

Werner: Wrong pal! We recieve FULL statements EVERYDAY and audit invoices…

In my opinion; I just hope MTI’s trading bots dont lose all the money on forex.

If they do that; we are all done. If someone steals the coin and run; we are done; i have faith in MTI’s CEO; If there was something illegal; MTI would have been closed now.

Legally, MTI is sound, theres nothing wrong; Its not a ponzi scheme; its MLM scheme and its sustainable. What exactly is wrong here? i dont understand. I want more Bitcoin.

Thats all; you people can keep arguing. Authorities dont give a shit. Honestly BTC is an asset class.

Its not a security you dumbos; Someone is paying OZ to talk against MTI; i rest my case.

Oh great Werner’s another “but muh blockchain!” hero.

I’m not disputing Mirror Trading International’s passive investment opportunity is offered in bitcoin. I’m saying with respect to securities litigation, the vehicle used to offer the security doesn’t matter.

If you reply you’ll provide evidence in South Africa’s securities legislation explicitly stating bitcoin investment opportunities are exempt from securities regulation.

No country on the planet excludes bitcoin investment opportunities from securities regulation.

Yeah, not even what I was talking about herp a derp derp.

@Maaz

Right. Just like it’s impossible the guy down the street was murdered.

I mean, if a crime had been committed the police would have caught the offender. Dumbass logic++

Yeah, except for the securities fraud part. And the fact that’s its a Ponzi scheme. Totally sound.

You mean you don’t give a shit. You’re cool with stealing from people. Awesome.

You don’t need to come up with conspiracy theories to justify your theft. Own it.

Via email:

All I read is pyramid scheme.

And to make it worse. Go to the website and watch the youtube video.

You only gain 40% back on trading profit each day. The rest goes back to the company basically split in percentages for trading system, affiliation and to MTI itself. This is not transparency, This is a load of bullshit.

Hi, are you able to provide proof of these cases? I don’t represent MTI, I’m just a recent member getting cold feet – reading all this is making them very cold indeed.

Hello everyone.

Love all the comments back and forth. And I understand both arguments. However, this debate started in Oct of 2019. It is now May of 2020. Mti seems to still be going strong. Not shut down. Know one arrested as far as I can tell. Is it possible that through some trials and error, perhaps Johan got it right?

I Like Rawbox want to get it right. Should we wait a few more months? In 5 more months this article will be a year. If they are still around, will you change your mind then. I know that if they are not, I will come back and say so.

But for now, I am sticking my foot in. Won’t be the first time I have been scammed. And probably won’t be the last.

BUT what if it really works.

I’ll keep you posted…..

Ponzi schemes pay out as long as new investment rolls in. 7 months isn’t all that long in MLM Ponzi land.

You wouldn’t have to guess if MTI registered with securities regulators and provided legally required financial disclosures.

There’s only one reason an MLM company opts to operate illegally. They aren’t doing what they say they are (paying returns with external funds).

All these coments to and fro, I am a financial planner and operate a brokerage.

1. He is accepting money ~ this constitutes a financial activity. This makes it unlawful as he needs to be registered,at worst he can be a sole prop, he can be the compliance officer and key individual but he is not registered? Why?

2. As for bitcoin/forex trading, as I understand, trades are done in the fx market and paid in bitcoin, I am registered for fx trading, the red tape is massive, so its irrelevant the bitcoin, he needs a license to make a trade, even if the trade is dollar based, which all fx trades are.

Also, they say a bot is running the show, no need to register, my business too uses a bot but I have to register, now how does that work? Also my bot is nowhere near the 10% per month return….which seems to be the average at MTI.

My friends are convinced this is the answer, I am not so sure, I will not be investing after looking at this for sometime, good luck to those invested, maybe Johann is a philanthropist so good on him

Like others also on this site, I would like to know the truth about whether MTI is scam or not, but I am interested in facts and not opinions.

(Ozedit: snip, see below)

Fact 1: MTI offers a passive investment opportunity which is a securities offering.

Fact 2: MTI is not registered to offer securities in any jurisdiction.

Fact 3: MTI is committing securities fraud.

All of this was documented in the review. So instead of coming up with excuses for scammers how about you read it.

I was in a ponzy Pretorius and Brandt. for 6years.They were running for 16 years before colapsing. Pyramids always collapse. Even in Egipt. Good luck. Some will win but most will lose all.

The ponzy comp. where i infested was registered at the financial service board at that time. { South Africa} and they never infestigate them. So its not helping to be registered.

The head of the ponzy killed himself after murdered his partner. They both go to there graves with R2.3b. of there investors.

Rawbox.. You can contact the fcsa and ask them about MTI and I have an email from Fcsa where they confirm that resbank was being roped on.

The very fact they aren’t registered with fcsa is a concern as fcsa is there to provide security and regulate this type of investment.

Would you go to a doctor that’s not registered with the health council which holds him accountable? Would you go to a lawyer that’s not registered with the bar?

Even if MTI isnt a scam let’s think of this for a moment why are they still to this day not registered why would you not give people that extra confidence by being registered?

Obviously this stupid writer has not clue what MTI, how it works, how to verify daily MTI’s trading activities, what the MTI dashboard even looks like. He mind is full of ponzi schemes and all that shit!

MTI takes Bitcoin in and out, not Fiat currency goes in and out of MTI, therefore MTI is not obliged to register as a security company.

Does the writer know what Bitcoin is and how it works?

FREE lesson Mr stupid writer: Bitcoin is decentralised CryptoCurrency, it’s governed by any government. Bitcoin is NOT a security!!!

Feel free to provide third-party audited accounting filed with financial regulatory in any country.

I know they don’t exist, so do you. Which means you’re talking out of your ass because money.

No country on the planet exempts securities offerings in cryptocurrency from securities regulation.

Whether bitcoin is or isn’t a security in and of itself has no bearing on MTI offering a passive investment opportunity.

MLM + passive investment opportunity = securities offering. The only reason to not register your securities offering is if you’re not doing what you say you are (Ponzi).

Such a poor review on such an excellent company.

Do your homework and come back when you have the information required to do a proper review.

Such a poor comment on such an excellent review.

Do your homework and come back when you have better excuses for fraud. Herp derp.

I would never ever ever invest my money, especially Bitcoin with anyone, any company, ever. Bitcoin is unregulated, which means if the person or company decides to do a Houdini, …

you are screwed with no recourse.

Read that again. Stop. Ponder. Read it again..

I don’t care if Johann made Puss in boots eyes and brought his mother along to vouch for him, I want dealings in traceable fiat, with proper legal authorisations, a documented legal contract, I want your ID or social security number, I want a DNA sample so that if anything goes wrong, I will definitely see you in court.

So I will only deal in fiat, which I convert and store as Bitcoin myself, in my own wallet. Thank you.

Look at Johann’s history. Full stop.

Printing trading orders on a sheet and sending that out to members, is just that, anyone can do that to keep your BTC whilst waiting for you to recruit more people.

Whether you trade BTC, or whether you trade any other fiat, forex trading is still forex trading. So there is no reason this company cannot trade in fiat, IF trading is what they actually do..

There is no ACTUAL proof of trading. If FX choice confirmed MTI’s account, I would then like to see a daily trading report from FX Choice, seeing that they are allowing MTI to trade with my money and verifying their trading account.

Just because MTI has an account registered at a brokerage, does not mean they are trading your BTC, it just means they have an account, well, until they can prove that they are trading my money.

The agenda here is MLM, nothing wrong, but MLM and BTC in one sentence = a whole lot of risk to a whole little surety of reward.

The business model is risky to any investor, because MTI has no interest in providing solid proof to calm the investors mind, besides, nothing should calm anyone around BTC, unless it’s sitting in your own wallets instead of someone else’s.

Again, I would never ever part with my Bitcoin and a herpa derp derp.

I cannot find evidence of MTI having offices at 43 Plein Street in Stellenbosch.

Usual BS from OZ.

(Ozedit: derail removed) Well done OZ you convinced a member of mine not to invest their BTC here.

Nothing illegal here with mirror trading. Its BTC in and BTC out you clown. No SEC and other securities agencies permission needed. BTC is decentralized and not regulated by any government body in any country.

There’s nothing to convince. The fact of the matter is MTI is committing securities fraud and operating illegally.

Not everyone is interested in signing up and getting scammed through Ponzi schemes.

Feel free to provide relevant legislation exempting bitcoin from securities regulation in any country.

Whether BTC is or isn’t regulated is a strawman. Securities are very much regulated in practically every country.

MTI isn’t committing BTC fraud, they’re committing securities fraud using BTC.

Here’s to more of your potential victims not getting scammed, cheers.

How many times does this have to be repeated? In South Africa it is illegal to offer something which looks like an investment unless you have a particular kind of license.

It really doesn’t matter how you pay, what’s managed or how it hangs together.

This Johann clown thinks he is very clever. He really is just a scammer and part of the boeremafia white trash you find in Stellenbosch who moved there because they were concerned about crime but don’t see the irony of doing it themselves with a white collar.

Johann, Leon, etc, don’t think you’re immune from ending up in Pollsmoor.

The kind of people you are stealing from are just the sort who will use someone like Gerrie Nel to launch a private prosecution

Reading all these comments really scared me. I decided to Google about mirror trading International since I had also made an investment with them.

I had my suspicions because we all know the story of the pyramid it’s always something never right with the pyramid.

When I invest my money I don’t want the company telling me to look for other investors to put in my right leg and left leg. First and foremost I’m never good at sales. So that is where I already had my suspicions.

I have to go out there and look for people to come to join under me and I stand a chance to get more percentage of the income. Almost something like what crowd1 is doing.

I really don’t know if I made the right choice in investing. Because the whole thing is that something that goes as a pyramid is definitely not right from starters.

Why can’t I just invest in the trading process or whatever, sit back and relax waiting for my returns without stressing about getting more members because if I don’t there is a chance that my returns will not move at all I will not get any income my amount will remain the same or so or probably be the same as from the date when I invested.

I don’t want to judge after all I took the risk myself and all I’m hoping for is that it really works. But the part I don’t like is to be getting new members to join under me and many people need proof before you have them join.

They either wanna see how much money you’ve made so far and if that is not there they just laugh it off and walk away. So I really just have got no clue of how I even decided to do this.

But hopefully, it works because I will not get any members under me, I’m not selling anything I’m gonna wait and see if it works for me before I try and convince others to join.

Because Mirror Trading International is a Ponzi scheme.

Ponzi schemes “work” until they don’t. And whoever you recruit then gets sucked into your scam mess.

You joined a scheme that involves stealing money from the people who joined after you, and you’re asking why you need to convince more people to join after you?

If it’s any consolation, 99% of people who join pyramid/Ponzi schemes fail to scam enough suckers into joining after them, and therefore lose money – it is mathematically impossible for it to be any other way.

If you only lose your own money and fail to scam other people into losing their money as well, the “not scamming other people” part is nothing to be ashamed of.

Its easy to conclude : What would they sacrifice…. for a so called ponzi? Its for people to decide for themselves.

Everything has risk, even some daily choices you make. Dont “invest” anything more than what you could loose.

Dont have to many panicked moments on just a few comments you read…Cheers!

“They’re” not sacrificing anything. Ponzi scammers steal your money.

If you sign up anyway, hand over your money and only panic after it’s gone, it’s too late.

As for risk, math guarantees the majority of Ponzi investors lose money. Risk has nothing to do with it.

Perhaps South-Africans are severely underestimated then….I think you missing the point. Anyway the post is great and all views respected.

The information stated is not true, especially:

Using new investment to pay existing affiliates a daily return would make Mirror Trading International a Ponzi scheme.

I am a member and what is very clear from their very transparent operation is that nobody is paid from new investments – all money deposited is traded to the benefit of the member making the deposit. Income is only paid out of profits (if there are) and the model is very sustainable and definately not a Ponzi!

Furthermore, all transactions are done in Bitcoin and MTI is not an Exchange – Bitcoin is not regulated as a currency in South Africa (and globally as far as I am aware) and is viewed as an asset.

See the full legal opinion debated here: qr.ae/pNyqrG

Just because a person such as our CEO, Mr Johann Steynberg participated in other network marketing opportunities, such as Syntek etc, should not negatively impact his integrity, as we all have tries other businesses before. This was in fact the reason for him starting MTI – he was sick and tired of other programs failing.

MTI is a huge succes with more than 50 000 members in only 1 year!

Prove it with legally required audited financial reports filed with financial regulators.

Nobody said it was. MTI’s passive investment opportunity is a security and securities are very much regulated in South Africa and everywhere else in the world.

Strawman harder.

Fellow South Africans but of the gullible or criminal kind, you might be interested to know that the Hawks are looking for CEO of VaultAge Solutions (VS), Willie Breedt.

This is relevant for a number of reasons. Firstly the business model (ie modus operandi) of VS looks a lot like MTI’s. Secondly, it seems the authorities do care if you are scamming – and screaming “BTC” is as worthless as your investment.

Thirdly, you will be poorer. WTF is wrong with people in SA that you cannot see that the likes of Werner and Johan are crooks?

I have a number of friends that have been sucked in by this scam. They often publish the daily “returns” of the scheme on Facebook and other social media.

Over and above the issues that have already been mentioned, there are a couple of common sense red flags that clearly show MTI for what it is – a Scam:

1. In the year or so that the scheme has been running, they have never posted a negative day. Ever. Any investor that has traded any type of instrument will find that not only suspicious, but downright preposterous.

2. I keep seeing comments about Johann showing people actual trades as proof if their activity, yet nobody can tell me the name of this magic software package that they are subscribed to, so that I can verify its authenticity.

If it is as expensive as they claim, they could surely not be afraid of any single small investor like myself going at it for himself?

Besides, even if I did open my own account, how would it negatively impact MTI or its members? Unless off course if MTI needs to keep the investment funds flowing, to feed the fat cats at the top.

3. If MTI is legitimate and Johann has somehow found a magic software package that never loses, why on earth would he even need investors? Why not just put in his own cash, sit back and get rich?

4. If someone developed software like that, why on earth would they sell it, or sell subscriptions? Why not just use their own software, sit back and get rich?

Oh, and why is it that Johann is the only person that’s ever heard of this software? If I was the developer, and for some reason I decided to sell my magic invention, I would be marketing it everywhere!

I’m sorry, but if it walks like a duck, and it quacks like a duck, well… it’s probably a duck!

I invested a significant amount of money with MTI about 6 months ago. I have not recruited a single person to join MTI, as I an not a fan of such. I have however made very decent returns off my capital in the short timeframe it’s been with MTI.

I’ve also been able to withdraw bitcoin when I have needed to, and have been able to add additional funds with no problem when i have a bit extra to put away. So far so good.

If people want to choose an alternative investment and income stream such as MTI, then I say let them. I’m sticking with them. (Ozedit: derails and abuse removed)

You personally stealing money from people who joined MTI after you is neither here nor there. Ponzi schemes pay out until they don’t.

Ponzi schemes are illegal the world over for good reason. They only benefit owners and scammers such as yourself who get in early.

The vast majority of investors lose money (to scammers such as yourself).

I love these comments. I’m a South African and been in the Network Marketing industry for a long time. (With one solid Company) I have seen so many of these “Ideas” appear and everybody jumps on the band wagon to make a quick buck. Then they all cry once the scheme falls apart.

Do your due diligence before your depart with your hard earned cash. I have been following this website for as long as I am in Network Marketing and from all the schemes listed here 99% does not exist anymore due to being illegal.

When deciding on a Business Opportunity look past the money, look at it long term and make informed decisions.

First Bet will be to make sure they are registered with the Direct Selling Association, look at their track record, their compensation plan and the history of the owners.

Think 5 year plan, not $$$.

Dude… Here I thought I can get some new information and learn something new about the company I’m invested in (I’m a rookie) but the things I researched on my own easily beats what you wrote here… But at least you didn’t lie (kinda)

I was hoping you actually do a deep research about companies but instead this site is just some fact check but mainly opinionated….

Don’t worry im not just going to leave you hanging, but first of all you send Bitcoin yes that’s true, you recieve Bitcoin back that’s also true. But here are some extremely important details (some that you didn’t mention)

First of all the 10% is for the direct referral only. You only start receiving binary bonuses after you added 2 direct refferals (1 to each leg).

Then the weekly binary bonus is depending purely on the volume of Bitcoin that you have in your weaker leg (regardless of how many people you have there) about the exact calculation I’m not sure but I don’t need to be sure of it because the amount is Soo minimal that it’s easy to see that it’s not something inflated or fake…

For example I have a volume of 0.051 btc on my weaker leg, and my current weekly reward is 0.00018 btc…

Their trading days are same as forex

Each trading day will give you a full list of all the trades of that day that you can verify.

Now the 2 actual critical things you missed about this company:

1. MTI doesn’t hold your money, they send it to a broker (I personally reached to the broker and confirmed with them if they cooperate with MTI and the answer was yes)

2. I made about 3 withdrawals Soo far (one of them was a full withdrawal. You can withdraw anytime with any amount, there are no limits! Their guarantee is up to 48 hours you recieve your Bitcoin, personally I don’t think it even exceeded the 15 hour in all the times I request a withdrawal..

In conclusion, MTI is definitely one of the most trustful out of companies like that. Would I say it’s 100% safe? No! But that’s why you don’t put all your money in platforms like this… You only put what you can afford to lose just like in any investment, Noone can promise that Johan won’t wake up one day, and decide to wrap it up, pack all the money and keave…

So that’s what I know, please if you decide to grow a website like this, you have to do a much cleaner and deeper job, or else you just become another person with an opinion and you will misguide many people on many good opportunities. Cheers!

A few of my direct family have been investing in MTI and of course tried to convince me to do the same. They share screen shots of their success daily (always from MTI’s dashboard).

I’ve been following this site and all the comments, and there is nothing but red flags. I am no expert, and I’ve come very close in giving in to the “sales pitches”, cause it sounds so legit.

There is a few things I remind myself of:

– Any one can sell you something with the right sales pitch, even worst when they give you the “tools” to sell for them. You sell something by coloring in details and pressing on peoples desires and needs.

– I believe in second changes, but I wont be giving my bitcoin or any form of asset to someone who has a very questionable history in trading

– Even if you are not required to register with some sort of regulatory, why wouldn’t you? With so many members, would you not want to give them peace of mind that you are accountable?

– Trading goes, win some loose some, no losses so far? There’s just no way

– Unrealistic high returns, huge red flag!!

– Sure, you can withdraw anytime, no way to tell how long you’ll be able to do that. There is no way you can be sure you are accessing your own money. Your “dashboard” or account is all run and managed by MTI, who can feed you what ever they want you to see (and not regulated).

I’ve heard one of the sales phrases: even if everyone withdrew all their BTC at the same time, they will still be ok, cause your BTC never actually goes anywhere, it just grows in value.

Well hmmm, that just doesn’t make sense on a whole lot of levels. Raised even more questions from me…..

– It’s a pyramid because it deals exactly like a pyramid, come on, if you want an excuse, you will find one.

I feel terribly sorry for my family who will bow their heads in shame while feeling the huge financial loss one day. I just hope it happens sooner than later, and I wish a very painful future for the makers of MTI.

@Stas

As stated in the review under “recruitment commissions”.

Verify what? That some trades were made?

What you can’t verify is that external funds are being used to pay ROI withdrawals.

Why?

Because Mirror Trading International commits securities fraud by not registering its passive investment opportunity with financial regulators.

Why would a company supposedly using external revenue opt to operate illegally? You know why. I know why. Everybody promoting MTI knows why.

Feel free to provide legally required audited financial reports proving your claims. Failing which you are talking out of your ass.

You personally stealing money from people who invest after you doesn’t change the fact that MTI is committing securities fraud and operating as a Ponzi scheme.

You are clearly terrible at reviewing. Next time you decide to run around the internet and “review reviews”, use some of the money you’ve stolen to buy a clue first kthx.

I tried to politely explain to you my side, for some reason don’t see that same respect back… I know 10% is direct referral

Try it yourself, before shitting on a company, find out what broker they work with, and ask them personally…. Their broker is FX Choice

The trades you see daily, fits all data at the end, and fits all the conversion rates during those period of times it’s been check multiple times by multiple people….

The next best proof is going physically there and visit everything everywhere, see how the broker operating, see their office… By the way something that bigger investees did…

When a person invested 100K into such company, he probably doing a good check up to make sure he is not throwing away his money… So far the amount of Bitcoin MTI holds from their investors is enormous, and it’s growing from day to day.

My point stays tho, If you want to truly be the go to mlm check… You need to knock your doubters off easily but that means that the research you do is not a research that anyone can do in 10 or 15 minutes, it’s a deep research that you need to conduct!

Otherwise what you say is mainly information that anyone else could’ve found + some opinion.

(Ozedit: derails removed)

So yah conclusion, keep doing the reviews I’m sure you did save some people from many bad and unpleasant experiences, but you have to think both ways, what if one company that you shitted on, is actually a legit company? You think it’s fair?

This company could help others in the next 5 to 10 years (And no I don’t mean helped that person while screwing others, but I mean a legit company)

Anyway, good luck for now I’m staying in MTI slowly growing my Bitcoin (currently not trying to recruit anyone, just receiving my daily percentages)

I don’t completely disclude the fact that it can be fraud, or the company will fall like some many of the similar companies, and even then I will keep looking for opportunities. Suggest others to do the same (I don’t necessarily mean opportunities like this, there is Soo many other types of opportunities)

Nah. You don’t need to get scammed in a securities fraud Ponzi scheme to identify one.

MTI is legally required to disclose this information to the public and financial regulators. They don’t because it’s a Ponzi scheme.

What do you think I’m doing? If you want to ignore the facts that’s on you. We’ll be here when you come back to pretend you didn’t know MTI was a Ponzi scheme.

A “good check up” on MTI would quickly identify it as a securities fraud scheme. Plenty of people chase Ponzi dreams despite the evidence.

Here’s one who commented here in just the last 24 hours –

https://behindmlm.com/companies/onecoin/onecoin-leaks-simon-les-resignation-letter/#comment-424496

We’ll be replying to the same thing from MTI members when it inevitably goes bust. Those that aren’t too embarrassed to admit their losses anyway.

Companies who commit securities fraud by definition aren’t legit. You can’t legitimize fraud.

I stopped reading the comments about halfway down (taking almost an hour). Something became clear. There were about five “different” usernames all promoting the company and all five had the same identifiable grammar errors and many said things like “met Johann” or “seen the offices”.

A LOT of their global base of customers seems to live on the same block! Not sure which block, since we’ve seen 3 addresses since December. And they all have the same grammar faults. Lol!

I don’t know as much about this stuff as you guys. But as a reasonably intelligent person all sorts of alarms are going off when reading the comments that attempt to prop up this company.

I read almost all of their signup disclaimer. The “secret” part is the hidden forex trading (if that’s even occurring). They’ll eventually say, “we lost our ass on forex today” and hope most members accept that reasoning. “Sorry, the trades are secret, but trust us it was a bad week”

I read through this entire thread and completely agree that this is a scam for various reason, but most pro prominent being consistent returns without a negative trade in like 6 months.

Together with btc in and out, so if they dissappear you have no way of getting your money back, especially because the company is not registered with FSCA.

Someone promoted this scheme on a neighbourhood group which is why I felt something had to be done.

I contacted the member, trying to ask questions which I thought she didn’t have the answers too.

Little suprise that she had most answers which I felt was bs, but anyway. The last question I ask her is if the the company has audits which would put my mind at ease.

She stated that as a member she does not have access to it, but she would ask higher up.

She responded by saying that I have to write an email to her and she would forward it to the ceo.

Could someone perhaps assist in what to include in this email? Thanks.

“Why is MTI committing securities fraud and operating illegally?”

The audited financial reports you’re after show proof of external revenue being used to pay returns. These are legally required to be filed with financial regulators.

Thanks Oz,

This scam is currently being investigated and will collapse.

Think I’m rather gonna leave the whole ordeal, don’t really want them to know my personal information.

Oh man, there are always people who defend the get rich quick dream they have. Let them dream.

I use my own wallets and I am the only one who has control over them. I use third party bots which is still a risk in the volatile Crypto world and if I screw it up I take responsibility for my actions and don’t blame others for my own stupidity.

This company is more than fishy in this NEW digital asset world. WHAT SANE PERSON WOULD DEPOSIT HIS MONEY IN SOMEBODIES POCKET/WALLET IF HE/SHE DOESN’T KNOW HIM/HER?

Pad your shoulders if it works but don’t blame others if it doesn’t. And MAN up if you are the one who recommended something to your dearest and they loose their money eventually.

Thanks OZ for your work!

@ Strictly speaking, who is investigating mti? I tried googleing mti hawks, but nothing came up. Thanks

@Kyle – I personally opened a case with fcsa and sarb

Thanks for letting me know, hopefully this wil expose the truth. I heard a R1 billion is already involved, could have been false, but definetely possible.

The company MTI has not appointed an auditor.

According to the companies act the company must be audited. It far exceeds 350 public interest points and holds far more than R5m in fiduciary assets.Unless of course all the bitcoins it has received and invested are worth zip.

The company has one, only one director. This same director was previously a director of:

JNX Online (Pty) Ltd – now deregistered.

and a Member of Bergrowil Brokers CC – now deregisterd.

He was recently appointed a director of newly incorporated Durospan (Pty) Ltd.

His fellow director resigned last month and was previously a Member of Tzanenga Civil Contractors CC, also now deregistered.

All deregistrations were due to not submitting annual returns.

MTI has also missed submitting its annual returns ….. perhaps it will still do so.

MTI is also registered with – well nobody actually, other than CIPC and SARS for income tax.

There are no fixed properties registered in either the director’s name, nor that of the company. So any claim against either party pretty much stands on its own.

Ultimately any assets invested are done so in good faith, nothing more.

Hi everyone, I came across a very informative video interview with the CEO of MTI – Johann Steynberg…. Use it, don’t use it…

Whether it is a scam or not, there is quite a bit of validity in what he has to say, and its worth watching:

(Ozedit: link removes, see below)

You want to post marketing spam you’ll first explain how it pertains to the review.

I’m not attempting to post “marketing spam”, I am trying to contribute to this discussion on the pros and cons of Mirror Trading International.

The video interview which I was trying to post discusses both pros and cons of MTI….

Cool. So you can timestamp the bit where the interview addresses MTI committing securities fraud then.

There are no pros to Ponzi schemes.

Thank you for confirming the interview doesn’t address anything in the review and is indeed just marketing spam.

@Julie please let us know how MTI goes. I was invited to a MTI presentation yesterday I’m still doing my research as I am a disappointed crowd1 member.

It’s all lies I joined in Feb 2020 on the black package and I got €0.54 C1 Rewards ( formerly called owner rights) this is because members are so desperate to recruite they will lie to potentials.

Please don’t fall prey to Crowd1 especially if you don’t recruit. I had actually recruited 4 people though.

What’s there to research? Crowd1 == Ponzi == MTI.

It’s not like one MLM Ponzi is different from the next.

Lo, who is Julie? I assume you are talking to this person?

Apparently they are looking to be audited soon (within the next 3 months). Also to register at FCSA somehow (before the end of the year). Also to show the bot trade live (very soon).

Until this happen all this seems dodge.

I’m starting to wonder if they make these claims just to keep the people quite for a bit longer.

Ya think?

@truth seeker – are there any updates regarding the investigation, or is there a way for us to check that? I’m not saying I don’t believe you.

I 100% believe that you open a case because obviously this is ponzi scheme.

I am in no way, shape or form invested in this rubbish, but I know friends that are. So is there an email or something I can show them to say “hey open your eyes, they are being investigated”? Thanks in advance

I can’t believe people actually believe this guy. He has literally been connected with 2 previous ponzi schemes, but I guess 3rd time is the charm? Monkeys

@truth seeker – are there any updates on the investigation, or is there somewhere we can look to see that there is one?

I 100% believe you that you opened one, because this is of course a ponzi scheme, but I would like to show my friends that they are actually being investigated.

Thanks in advance.

Rudi all I have is an email stating their investigation…

If I am honest with you some people will still invest with MTI regardless of what is happening, just look at crowd1 full page on rapport, moneyweb article, fsca warnings people still ignore all these warnings.

As a member of mti I’m happy about company they trade for us everyday.

I received trading statement you can continue guys with yours selfish and investigation but we will always support MTI.

Prove it with legally required audited financial reports filed with regulators then.

Until it collapses like every other Ponzi scheme.

Thank you Oz for this review. I feel you get a bit harsh in the comments, but that’s probably to be expected with feeling like you are repeating yourself over and over.

I have been invested, I have never promoted. But I felt like something was off. I’ll be withdrawing my minimum deposit and leaving this behind. I’ve been scammed before and don’t want to have it happen again and definitely don’t want to perpetrate it on someone else.

Why did I invest?

Because when looking at the printed reports there ARE losses each and every day. Having been a trader in my past, I know this is expected. The goal is to have your wins exceed your losses which MTI (on paper) has done.

Anyway, made me feel like that coupled with the lack of a requirement to recruit kept the company in a safe spot. But I bought the line about BTC in/out.

Your mantra of “MLM + Passive Investment = Securities” helped to clear the cloud over my eyes.

Thanks again! Only had $100 or so in there, but was thinking of investing a lot more. Hence me doing some better due diligence and coming across this (and other) article.

Best regards!

“Lack of requirement to recruit” is a perfect example of pseudo compliance used by illegal pyramid schemes to disguise their intent.

It makes no difference if recruiting is “required” or not. If members CAN make the majority of any “earnings” (i.e. >50%) by recruiting – then you have an illegal pyramid scheme

Mr. Oz, I have to congratulate you. In order to persist with this argument since October last year, requires a certain amount of diligence.

I have a question, but first I want to make a statement. According to Google dictionary a Ponzi Scheme is identified as follow: “a form of fraud in which belief in the success of a non-existent enterprise is fostered by the payment of quick returns to the first investors from money invested by later investors”. I think everyone can agree on this. Now my question:

If MTI is a Ponzi Scheme, how are the people on the bottom still getting payed? I mean, they did not recruit anyone below them and if it wasn’t actual profits (lets say, made by an actual trading bot), where does the money come from?

I was recruited by a friend, but not a single portion of my BTC that I invested disappeared or was used to pay anybody. I can withdraw it at any time (+ profits).

To conclude… I have not recruited anyone, but receive profits. There is no evidence that my investment is used to pay my recruiter and if I withdraw my whole portfolio, it does not affect my recruiter’s account.

It does not make sense that a company that does not require members to recruit can be sustainable, if actual profits were not made.

PS. My grandfather always told me to never believe anything you hear and only half of what you see. So if MTI is a Ponzi scheme, well done Mr. Johann for fooling me and 60 000+ others.

If you’ve actually withdrawn more than you put in, you’re not at the bottom.

If you’re equating numbers in your backoffice to getting paid, you haven’t been paid and are at the bottom – with the majority of MTI affiliate investors.

Yet if everyone did this, that is actually put in a withdrawal request equating to more than they invested, MTI would collapse. Math is math.

You haven’t seen audited proof of MTI generating external revenue and using said revenue to pay affiliates, as claimed.

Mr. Johann didn’t fool you. You turned a blind eye to fraud and invested anyway.

OZ – I agree with all of your points, but why do you say things like, “… You turned a blind eye to fraud and invested anyway…”?

Not just specific to Student, but do you believe all involved really think they’re stealing or involved in a fraudulent business? I understand attacking when attacked, but don’t agree with accusing people who invest or throw away their money as stealing?

Are they willfully stealing? I’m pretty sure stealing money is illegal in most/all countries, therefore are all who invested/throw away money breaking the law?

Once again, you make valid points (MTI needs to be independently audited or under the proper government regulating authority), but I don’t agree with you telling people that they are willfully turning a blind eye to fraud.

I’m sure there are a lot (probably most) that believe the company is legit. Stealers no, Suckers perhaps!

The ones that come up with excuses to justify fraud, yes. They know what they’re doing.

It doesn’t matter what people “think”.

Pyramid scheme regulations are very clear: It is against the law not only to promote a pyramid scheme, BUT to participate in one

Don’t make the mistake of assuming that because participation rules are not being enforced, they don’t apply

Okaaaaaay… so, this bullshit thread goes aaaaall the way back to Oct 8th 2019.

Can you please provide the name or details of at least ONE PERSON WHO LOST MONEY OR HAS BEEN SCAMMED BY MTI?

Please! Just one person.

I’m pretty sure any “ponzi scheme” would have collapsed by now or atleast would have fucked over a couple of people so where are they??

Its been nearly a year OZ, where are they?

You’ve been Biased through out your article and comments but please acknowlege this as fact too.

NOT 1 SINGLE MEMBER OUT OF 70 000+ MEMBERS HAS REPORTED BEING SCAMMED.

All the other bullshit mentioned here are from paranoid people that probably got fucked over before, and this gives them the right to be cautious but you end up leading people away from such a great opportunity by your speculation and opinions.

PROFITS COME FROM FOREX TRADING, NOT FROM NEW MEMBERS ENTERING THE SYSTEM.

Mr Werner provided you with the details further up the thread.

OZ!

Just because you cannot prove that people are getting profits from Forex Trading does NOT mean that its not true.

If you so sure its a Ponzi scheme and that new members are used to pay old members then PLEASE!

SHOW US YOUR PROOF!

SHOW US YOUR PROOF OF NEW MEMBERS BEING USED TO PAY THE OLD ONES.

If you can do that I will withdraw from MTI and report it myself.

But unless you can do that you should either invest or mind your own business because your shitty review is still scaring away new prospective members.

Some one mentioned only recieving 40% of the daily profits.

AND!?

Can you point me in the direction of another opportunity that provides 40% interest a day with no sigh up or withdrawal fees?

Stop being greedy, people like you are a part of the problem.

MTI is fully transparent about where the funds go to. Every single member of MTI receives 40% interest the remaining 60% gets split into various pools which admin fees and recruitment and Binary bonuses get paid from. This is no secret its advised this way.

(Ozedit: attempt to take discussion offsite removed)

Your ignorance of Ponzi lore reflects how little you know. And goes a long way to explaining the rest of your comment.

Bernie Madoff’s Ponzi went on for 17 years. Every Ponzi scheme runs until it’s either shut down by regulators, it runs out of money or both.

Math guarantees the majority of Ponzi investors lose money. Just because the majority of 70,000 investors don’t acknowledge they’ve been scammed doesn’t mean they haven’t been scammed.

The tragedy being that by the time they accept or realize they’ve been scammed, it’ll be too late.

I can’t prove a negative, that is MTI isn’t generating external revenue.

What I can point to is the fact that MTI has not registered its securities offering and provided legally required financial audits showing proof of external revenue generation.

The onus is on the company to prove it’s doing what it says it’s doing. That’s how regulation works.

And if you’re going to run around the internet making claims on behalf of MTI, the onus is on you to provide proof to verify your claims. All I can do is point out there is no proof and you’re full of shit.

I’ll also point out that passive investment opportunities choose to operate for one reason and one reason only: external revenue isn’t being used to pay investors.

If it was, they’d save themselves the inevitable regulatory heat and opt to operate legally from the get go.

They are most certainly not. See comments about legally required financial audits above.

jeez bro.

Oh okay so the majority of 70 000 people must have just forgotten to mention or report being scammed then. Or is your defense that they just don’t know yet…. Nearly a year later they don’t know they’ve been scammed, lets overlook the year of profits and earnings they’ve gained because the majority of 70 000 members are victims and lost their money.

And nearly a year later, even longer for some members, and they just dont know. or dont see the importance in mentioning it or reporting it.

Psshhhh. Get a life Oz, your claims of MTI being a ponzi is rediculous. (Ozedit: derail waffle removed)

Math is math. You want to speak on behalf of 70,000 people be my guest. Not interested.

Thank you for confirming you have no evidence MTI generates external revenue or uses it to pay returns.

I think we’re done here. Sorry for your loss.

@Littleroundman – Let me make this clear, most of the participants of MTI are NOT breaking the law (I don’t care what country, state, providence, etc. they’re in).

We go back and forth on pyramid vs ponzi. MTI if anything, is more of a Ponzi because participants are NOT required to bring in additional participants, unlike a pyramid scheme.

Regarding the law in my area, specific to either scheme – it’s not the “participation” that is illegal – it is the creation, operation, advertising, selling or promotion of the scheme that is illegal.

Although encouraged, MTI does not require promotion of the product. In the case of a Ponzi, participants are victims not criminals. The creators are the offenders.

I believe in the points made by OZ regarding MTI, all valid and no one has proven otherwise. I just take exception with inferring individuals are knowingly participating in fraudulent activity, or stealing.

Lastly, although MTI has not proven the money is generated by Forex trading (because it has not been independently audited), we also cannot prove the opposite.

I’m on the side of OZ, but outside of the logical points OZ makes, until they are audited no one can be certain. All that to say, we can’t tangibly prove it’s a ponzi/pyramid.

People still claim because it is in Bitcoin, they don’t need to register. You are idiots!

The names of top promoters was given in the comments, and you STILL join and recruit others? SMH.

Don’t you think if it wasn’t required, the proof of that discussion would be publically provided as well as a way for members to follow up with that discussion by the fsca? No, places should not attempt to be fully compliant long after they are in business, but straight away!

Ffs learn to trade yourself if those returns look appealing, many free online websites, or invest with fsps as they are regulated by fsca!

When it comes to cryptocurrency you either trade it yourself or hold in your personal wallets. Never send it away…you will not get it back! This should be common sense by now.

And I’m glad if this review scares people away, it means it is working, they clearly have more brains than those of you defending it so passionately.

Quick tip though, for those members checking this out when this thing collapses, report the recruiters too, it’s time they are made examples of!

Oh and don’t blame Bitcoin as being the scam, blame your lack of education around it and your greed. Oh and read the consumer protection act for SA.

@Heff

Promoting unregistered securities is illegal in every country with a financial regulator.

Legitimate companies don’t choose to operate illegally.

The line I quoted: It is against the law not only to promote a pyramid scheme, but to participate in one is from a government website.

We can go round and round the mulberry bush all day and half the night – facts are facts.

@ OZ and Littleroundman – We don’t need to go round and round, both of you know that the average PARTICIPANT that invests or throws away $100 into MTI is not breaking any laws.

To say it is a “fact”, is the opposite of a fact. That’s like saying people who invested with Bernie Madoff committed a crime (and Bernie’s firm was involved in selling some unregistered securities).

In fact, some investors (through word of mouth) encouraged others to invest w/Bernie. We know all who invested were not criminally charged.

Please don’t conflate victims with the operators. If you’re just saying it to discourage individuals from participating, then I understand.

Way to move the goalposts from “do you believe all involved really think they’re stealing or involved in a fraudulent business?”

To which I answered

I stand by that.

And obviously the majority of Ponzi investors aren’t breaking laws. Math guarantees the majority of Ponzi investors lose money.

Also @ Littleroundman – This line is from one of the states in the US, “…makes it a crime to create, prepare, advertise, sell, operate or promote a pyramid promotional scheme.” – Another state said don’t “participate” in what “appears” to be pyramid schemes.

I get the gist of what your saying, but we can’t quote law universally, its interpretations are more complex and vary from jurisdiction to jurisdiction.

Lastly, not even sure MTI is a pyramid probably a more like a ponzi.

MLM Ponzi schemes incorporate pyramid elements. They are always Ponzi/pyramid hybrids.

@OZ – Not sure how I moved any goal posts, my first comment and/or main points are simply this, all participants are not:

– willfully stealing

– knowingly involved in any fraudulent activity

– and regardless of the first two, breaking the law or involved in criminal activity.

If you want to carve out some by saying, “The ones that come up with excuses to justify fraud, yes. They know what they’re doing.” – Fine, I’m cool with that.

I hope you get my point(s) too. – It’s ok say, “I agree” or “I understand” – LOL.

Anyway, I’m done and continue to fight the good fight 🙂

Actually, it’s not.

In fact, it’s from the Australian government website.

Here’s another one, this time from the UK government

establish, operate or promote a pyramid selling scheme – it is illegal and you risk a criminal conviction, a prison sentenceand a fine

As I said: “round and round the mulberry bush”.

@OZ

Cool and understood. That distinction was really for Littleman, since he was quoting law that specifically mentioned “Pyramid” schemes.

@Littleman – OK you got it. I guess you can tell me where I pulled the quote…now we’re just arguing and your missing my point – You win!

An existing member of MTI approached me to join them.

The scary thing for me was when she mentioned to me that MTI is expecting a market crash in about six months time from now and they have taken ample of insurance on their bitcoin trading account in order to make provision for this. She said that MTI will do a reset after that.

We spoke telephonically and afterwards she sent me youtube videos and PDF documents on whatsapp for starters to do my homework.

The fact that she mentioned something like that to me in a way as it was business as usual, put me off completely and I decided to google everything for myself instead of engaging in any kind of material she sent me.

This is how I came accross your information. I thought to share it. Scary business…

Hi, just wanted to leave this message to say great work Oz and keep fighting the good fight. I do a lot of work on Cameroonian advanced-fee fraud websites and deal with fake reviews left by fraudsters all of the time in my own directory. This thread is absolutely swimming in them.

Some additional information on this cowboy:

Steynberg has previously faked a “hack” attack on one of his previous schemes to cash-out. There was of course no proof of this but it was a convenient excuse to pull the plug (see link 2).

Just two examples of Steynberg’s criminal activities:

cointelegraph.com/news/major-bitcoin-miner-disappears-along-with-millions-of-dollars-worth-of-bitcoin

nationaldebtadvisors.co.za/nda-blog/suspected-pyramid-scheme-kipi-investments-hacked/

I consult with SAPS on matters of fraud. Unfortunately the policing of financial fraud isn’t given the same level of consideration as bank robbers and other violent crimes which ZA is rife with. It pretty much allows this guy to have a free reign.

Thanks for the support Mark. I’ve cottoned on that financial fraud isn’t a priority in SA.

Good work, Oz. It’s not so much that it isn’t a priority, there is just so much of it.

WRT, these particular fraudsters, read this: mybroadband.co.za/forum/threads/mirror-trading-international.1064664/

A lot of good research including wallet addresses etc particularly later in that thread.

I will be very surprised if they are still around next year, some founder members already buying houses close to R12 million.

Monthly payments on a house like this would be about 80k per month. This company will bypass the tulip and bitcoin growth if it lasts longer than 5 years.

This growth is from a super dooper trading bot LOL. Big companies that have been in the around for many years don’t seem to have this magic software.

Just wondering how much cash is flowing out and how much us flowing in. No financial Statements ….

Reply to Student remark below :

“PS. My grandfather always told me to never believe anything you hear and only half of what you see. So if MTI is a Ponzi scheme, well done Mr. Johann for fooling me and 60 000+ others.”

So Student, tell us.. have you seen these 60K people or have just just heard about them? Have you seen your returns….or is this just numbers on a computer screen…?

Maybe you will only see half your money, if you lucky!

Hey Oz –

A question for you, because I don’t know enough to know what I don’t know.

My Assumptions for the Question:

1. MTI is telling the truth

2. MTI is holding deposited BTC in a trade account with a third party

3. The third party is trading BTC in forex and depositing funds back to MTI’s wallet