GetEasy miss investment bank launch deadline for 2nd time

As laughable as a Ponzi scheme opening up its own investment bank might seem, that’s currently what’s being sold to GetEasy investors.

As laughable as a Ponzi scheme opening up its own investment bank might seem, that’s currently what’s being sold to GetEasy investors.

Following a warning issued by the Bank of Portugal last November, and the announcement of a police investigation the month prior, GetEasy has struggled to pay out the ROIs it promised investors.

The scheme has all but ground to a halt. In the interim, several announcements from companies GetEasy feigned partnership with revealed there to be no such partnerships at all.

And this has now culminated in GetEasy dropping the facade, telling investors that they will be shortly launching an investment bank. [Continue reading…]

Achieve Community blame woes on economy & “the system”

Typically when a Ponzi scheme hits regulatory problems the admins usually shut it down and disappear.

Typically when a Ponzi scheme hits regulatory problems the admins usually shut it down and disappear.

Every once in a while though an admin comes along and believes they’ve truly re-invented the wheel.

Achieve Community owner Kristi Johnson is one of those admins.

With the stress of coming up with new excuses each week to keep her investors happy likely taking its toll, Johnson’s latest update is riddled with a barrage of Ponzi rhetoric. [Continue reading…]

ProAdShares Review: $2 150% ROI micro-Ponzi

Listed as the admin of ProAdShares at the end of the company’s website FAQ is “Nagy”.

Listed as the admin of ProAdShares at the end of the company’s website FAQ is “Nagy”.

Further research reveals ProAdShares affiliates identifying a “Nagy Mohamed” as the name that appears on their commission receipts.

Why Mohamed doesn’t provide his full name on the ProAdShares website is unclear.

Adding an additional layer of confusion is the fact that ProAdShares website domain is registered to “Ahmed Masoud” with a different email address.

The domain registration details for Masoud suggest he is based out Saudi Arabia.

One domain registered using the same address that appears on ProAdShares commission receipts is “kashosoft.com”, some sort of classifieds forum in Arabic.

Mohamed Nagy meanwhile is the name of a well-known Egyptian footballer, with the name appearing in conjunction with ProAdShares unlikely to be a co-incidence.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Grocery Rewards Network Review: $150 recruitment scheme

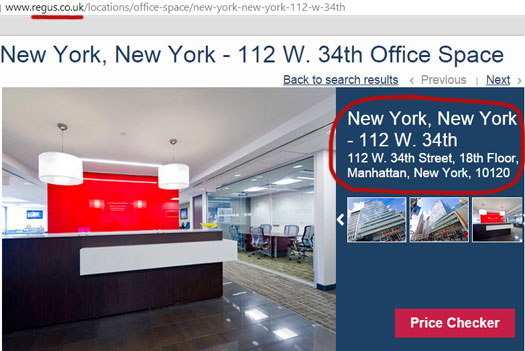

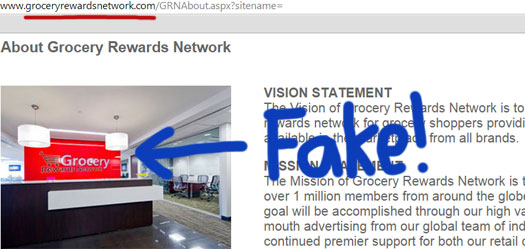

Grocery Rewards Network launched in December 2014 and provide a contact address in the US state of New York on their website.

Grocery Rewards Network launched in December 2014 and provide a contact address in the US state of New York on their website.

Further research reveals this address to be virtual office space rented from Regus:

Grocery Rewards Network would appear to exist in New York in name only.

Identified as the President of the company on the Grocery Rewards website is “Stephen G. Barr”.

Stephen G. Barr has a Harvard education background and is well experienced in the start up world.

He has sat on nearly 50 company boards and is one of the top 3% angel list investors.

This matches the information provided on Barr’s Facebook profile, where he identifies himself as being from New York but currently residing in California.

Given this, it’s likely that Grocery Rewards Network itself is in actuality being run out of California too.

Despite an extensive social media presence, I was unable to put together an MLM history for Barr.

Read on for a full review of the Grocery Rewards Network MLM business opportunity. [Continue reading…]

Total Takeover Review: Two-tier recruitment commissions

Identified as a trio of “business partners” in a Total Takeover prelaunch marketing video are Dave Lear, Wallace Nuanez and Val Smyth.

Identified as a trio of “business partners” in a Total Takeover prelaunch marketing video are Dave Lear, Wallace Nuanez and Val Smyth.

Total Takeover is currently in prelaunch (accepting free affiliate signups), with an advertised launch date of January 26th.

Dave Lear and Wallace Nuanez (sometimes credited as “Wallace Nunez”) appear to have a long MLM history together.

The pair first popped up on my radar as part-owners of Tazew.

Tazew launched in mid 2013, paying affiliates to recruit new affiliates against an irrelevant mobile marketing tools backdrop.

The Tazew website is still up today, but the scheme appears to have stalled shortly after launch.

A quick Google search reveals Lear and Nuanez, either together or individually, have been involved in VidaCup (coffee), Empower Network (cash gifting hiding behind free WordPress blogging platform), Brain Abundance (brain pills), RE247365 (short-lived recruitment scheme riddled with fraud), Liberty Health Net (matrix-based recruitment), Sisel (random assortment of products) , Pure Leverage (recruitment orientated blogging platform) , Organo Gold (coffee), EPX Body (weight loss) , Uneeqlee (text messaging ads + recruitment), Javita (coffee), FGXpress (pay to play + autoship) , VappNet (failed gaming app), Seacret (dead sea salts + autoship) and Stiforp (recruitment).

Even between the two of them, given the sheer number of opportunities Nuanez and Lear have been involved in I’d readily classify them as “opportunity jumpers”.

Val Smyth on the other hand hails from The Legends Network. Bob Bremner is officially credited as the founder and CEO of the company, however multiple readers (some affiliates of the company) claim that the company is infact owned by Val Smyth (see comments section of our Legends Network review).

Prior to that Smyth launched a series of marketing tools orientated opportunities, each utilizing 1-up style (pass-up) compensation plans.

Now, Smyth Nuanez and Lear have gotten together to launch Total Takeover (not to be confused with The Total Takeover, a collapsed $50 a month cash gifting scheme launched in 2013).

Read on for a full review of the Total Takeover MLM business opportunity. [Continue reading…]

$669,000 in default judgements against Canadian net-winners

Last November saw the Receiver file a clawback lawsuit against twenty-five Canadian Zeek Rewards investors.

Last November saw the Receiver file a clawback lawsuit against twenty-five Canadian Zeek Rewards investors.

Some have replied to the litigation filed against them, but a number of net-winners chose to simply ignore the proceedings against them.

Allowing sufficient time for a reply to be filed to pass, this resulted in the Receiver filing for default judgement against eight of the investors in late December.

In orders filed yesterday, the Court Clerk granting the motions for a total of $669,368. [Continue reading…]

Union Cycler Review: $2.50 a position 200% ROI micro Ponzi

![]() There is no information on the Union Cycler website indicating who owns or runs the business.

There is no information on the Union Cycler website indicating who owns or runs the business.

The Union Cycler website domain (“unioncycler.com”) was registered on the 10th of December 2014. Shannon Walker is listed as the domain owner, with an address in Manchester, UK is also provided.

I only just reviewed CashFlowClicking a few days ago, which also listed Shannon Walker as an admin with a different UK address.

I concluded in my CashFlowClicking review that Shannon Walker as presented as the owner of CashFlowClicking likely doesn’t exist. CashFlowClicking has all the hallmarks of being run by Indian scammers.

Union Cycler would appear to be no different, with Alexa estimating that the two countries traffic wise to the domain are Russia (16.2%) and India (14%).

Furthermore, CashFlowClicking images are being hosted on the Union Cycler website:

This is obviously not a co-incidence, with the owners of CashFlowClicking simply recycling their Ponzi script to launch Union Cycler with.

Who actually runs Union Cycler remains a mystery… but it’s a safe bet that it’s not Shannon Walker.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Achieve Community in crisis. No processor, not compliant.

Despite previously claiming that their “new Payout Processor is Global Cash Card”, news today that Achieve Community is once again without a payment processor.

Despite previously claiming that their “new Payout Processor is Global Cash Card”, news today that Achieve Community is once again without a payment processor.

When exactly Kristi Johnson was made aware GCC would not be working with Achieve is unclear. Today’s announcement however appears to have been prompted by an Achieve affiliate publishing an email they received from GCC. [Continue reading…]

CashFlowClicking Review: $10 “cashtap” investment positions

There is no information on the CashFlowClicking website indicating who owns or runs the business.

There is no information on the CashFlowClicking website indicating who owns or runs the business.

The CashFlowClicking website domain (“cashflowclicking.com”) was registered on the 25th of November 2014. Shannon Walker is listed as the domain owner, with an address provided in Nottinghamshire in the UK.

Typically a generic anglo-saxxon sounding name and UK address suggests CashFlowClicking is being run by Indians. In this particular instance however I’m not 100% sure, as Alexa estimates that 17.8% of the domain’s website traffic originates out of the US. The UK is second with an estimated 9.2%.

A Facebook account exists for Shannon Walker, having been created only recently on the 19th of September 2014. Whoever operates the account uses it to comment on the official CashFlowClicking Facebook page.

Putting all of this together it’s likely that “Shannon Walker”, as created for the CashFlowClicking domain registration, doesn’t exist.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

IFC Group clarify GetEasy’s investment bank plans

IFC Group (International Finance Corporation Ltd.), not to be confused with legitimate companies bearing the same name, is an Israel-based partner in the global GetEasy Ponzi scheme.

IFC Group (International Finance Corporation Ltd.), not to be confused with legitimate companies bearing the same name, is an Israel-based partner in the global GetEasy Ponzi scheme.

Instrumental in the laundering of money through GetEasy’s business operations and seemingly in control of the flow of new investor funds to existing investors, IFC is headed up by Michael Herzog.

On his LinkedIn profile, Herzog (right) describes himself as someone perfectly suited to orchestrate a Ponzi scheme primarily targeting Europe and South America.

On his LinkedIn profile, Herzog (right) describes himself as someone perfectly suited to orchestrate a Ponzi scheme primarily targeting Europe and South America.

Dr. Michael Herzog, PhD, MD founder and chairman of International Finance Group, International Finance Bank and other companies, brings more than twenty years of experience in the management of global equity, fixed-income and derivatives portfolios to the firm.

Since early 1997, he has worked on several investment banking transactions to finance debt reduction for several countries as well as infrastructure projects throughout Latin America as well as satellite and telecommunications projects.

Following on from GetEasy CEO Tiago Fontoura’s video announcements yesterday, Herzog has today issued a press-release further clarifying GetEasy’s global Ponzi investment bank plans. [Continue reading…]