Double Cash Review: $5 in, $10 ROI out Ponzi scheme

There is no information on the Double Cash website indicating who owns or runs the company.

The Double Cash website domain (“doublecash.info”) was privately registered on December 25th, 2016.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Global Dynamic Review: Centauri Coin Ponzi investment scheme

The Global Dynamic website identifies Lucas Cobham as CEO of the company.

The Global Dynamic website identifies Lucas Cobham as CEO of the company.

No information on Cobham is provided, casting doubt on whether he exists.

A virtual office address in Singapore is also provided, further casting doubt on who is actually running the company.

The Global Dynamic website domain (“gd-line.com”) was privately registered on May 3rd, 2016.

The spelling of certain words on the Global Dynamic website (eg. “ReQualifikation”), suggest it was put together by someone of European descent.

Alexa currently estimate that Austria (43%), Germany (39.2%) and Switzerland (7.4%) account for ~90% of traffic to the Global Dynamic website.

Whoever is actually running Global Dynamic is probably based out of either Germany or Austria.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

MMM Nigeria wipes 2016 ROI liability, restarts Ponzi

When a Ponzi scheme finds itself unable to meet its ROI obligations, a less popular option going forward is to just simply wipe the slate clean.

When a Ponzi scheme finds itself unable to meet its ROI obligations, a less popular option going forward is to just simply wipe the slate clean.

A minority of early investors keep what they stole, everybody else loses money.

In an attempt to generate new investment into the scheme, MMM Nigeria has wiped the 2016 ROI balance of its affiliates. [Continue reading…]

Skinny Body Care’s Legacy Matrix encouraging autoship recruitment?

I last reviewed Skinny Body Care late last year. One of the key-concerns identified was ‘the pushing of products onto affiliates as a commission qualifier.‘

I last reviewed Skinny Body Care late last year. One of the key-concerns identified was ‘the pushing of products onto affiliates as a commission qualifier.‘

After signing up, a Skinny Body Care affiliate are strongly encouraged to purchase products to qualify for commissions.

While there is nothing inherently problematic about affiliates purchasing products, to do so to qualify for commissions encourages chain-recruitment.

That is you sign up as a new Skinny Body Care affiliate, purchase products to qualify for commissions and get paid when you recruit new affiliates who do the same.

In this scenario the products become irrelevant and the income opportunity itself becomes what is actually being marketed and sold.

One Skinny Body Care affiliate even went so far as to claim most affiliates are on autoship to “protect their income“.

In light of the recent Vemma and Herbalife busts, which identified affiliate purchases as a primary source of revenue indicative of pyramid fraud, one would think MLM companies across the board would be doing everything they can to encourage retail sales.

Not Skinny Body Care. They’ve doubled down on their affiliate autoship recruitment model and introduced a “Legacy Matrix”. [Continue reading…]

2by2 Matrix Club Review: 2×2 matrix bitcoin cash gifting

![]() There is no information on the 2by2 Matrix Club website indicating who owns or runs the business.

There is no information on the 2by2 Matrix Club website indicating who owns or runs the business.

The 2by2 Matrix Club website domain (“2by2matrix.club”) was privately registered on January 30th, 2017.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

William Apostelos pleads guilty to wire fraud (Genesis Acquisitions)

Rather than argue a fruitless case in court and lose anyway, today William Apostelos plead guilty to mail and wire fraud.

Rather than argue a fruitless case in court and lose anyway, today William Apostelos plead guilty to mail and wire fraud.

Apostelos was indicted back in October of 2015 on thirteen counts of wire fraud. Part of Apostelos’ $75 million dollar Ponzi empire included Genesis Acquisitions, reviewed by BehindMLM in October, 2014. [Continue reading…]

Cycle BTC Review: $1 in, $3 out micro Ponzi cycler

![]() There is no information on the Cycle BTC website indicating who owns or runs the business.

There is no information on the Cycle BTC website indicating who owns or runs the business.

The Cycle BTC website domain (“cyclebtc.com”) was privately registered on November 8th, 2016.

Alexa estimate that Nigeria (28%), Pakistan (23%) and the Philippines (17%) are currently the largest sources of traffic to the Cycle BTC website.

It is highly likely that whoever is running Cycle BTC is based out of one or more of these three countries.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Excallit Review: Veros cryptocurrency pump & dump altcoin scheme

![]() On their website, Excallit claims to be a Delaware corporation established in July of 2012.

On their website, Excallit claims to be a Delaware corporation established in July of 2012.

This is questionable, as the Excallit website domain was only registered in May of 2014.

A Delaware address is listed on the Excallit website domain registration. The address however belongs to Delaware Registry LTD, who provide Delaware incorporation services.

As far as I can tell Excallit has no physical presence in the United States.

The Excallit website identifies Michael Juul (right) as CEO of the company.

The Excallit website identifies Michael Juul (right) as CEO of the company.

In 2001 Juul co-founded the GII Corp pyramid scheme. The same scammers behind GII Corp seem to have morphed into a gaming platform (T6 Poker) at some point.

To what extent, if any, Juul was involved in T6 Poker is unclear.

As per his Facebook profile, Juul is from Denmark but currently lives in Singapore. This is presumably from where Excallit is actually being operated from.

Excallit marketing material suggests the company is primarily pitched to a Chinese audience. A secondary market appears to be emerging in Romania.

Read on for a full review of the Excallit MLM opportunity. [Continue reading…]

$498 million default judgement awarded in Changes Trading case

Last year the CFTC filed a lawsuit against Changes Trading and co-owners Timothy Baggett and Kimball Parker.

Last year the CFTC filed a lawsuit against Changes Trading and co-owners Timothy Baggett and Kimball Parker.

Negotiations between Parker and the CFTC are ongoing but Baggett has thus far failed to make an appearance in the case.

In November the CFTC filed for an entry of default against Changes Trading and Baggett. This was granted in December.

On February 1st the CFTC filed a Motion for Default Judgement, which was granted the same day. [Continue reading…]

Centurion Network Review: Centurion Coin Ponzi points

There is no information on the Centurion Network website indicating who owns or runs the business. The website currently displays a timer, presumably counting down to the Centurion Network launch.

There is no information on the Centurion Network website indicating who owns or runs the business. The website currently displays a timer, presumably counting down to the Centurion Network launch.

The Centurion Network website domain (“centurionlab.org”) was privately registered on November 16th, 2016.

Further research reveals an associated Centurion Network charity named Centurion Foundation.

The “staff” page of the website appears to list people involved in Centurion Network, some of which have ties to the MLM underbelly.

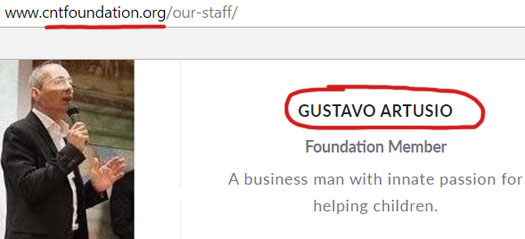

The first person listed is “Gustavo Artusio”.

This is a screenshot of Claudio Gustavo Artusio speaking at a My Advertising Pays event. The image is part of a profile image for a YouTube account bearing the name “Claudio e Claudia Artusio”:

Claudio Artusio (right) is from Italy and was an affiliate in the My Advertising Pays Ponzi scheme. My Advertising Pays collapsed late last year and has since been rebooted as The Advertising Platform.

Claudio Artusio (right) is from Italy and was an affiliate in the My Advertising Pays Ponzi scheme. My Advertising Pays collapsed late last year and has since been rebooted as The Advertising Platform.

Other individuals listed on the Centurion Foundation have a history in network marketing:

- Sunitkumar Patel (FGXpress)

- Pascal Federle (Sisel)

- Vincent Piscitello (Organo Gold)

- Gianvito Ricciardone (Sisel)

- Benedetto Cancemi (no specific company but lots of marketing coaching on his Facebook page)

- Fabrizio Di Silvio (Sisel)

- Nicole Ganier (Sisel, FGXpress)

The exact nature of professional relationship between those listed on the Centurion Foundation website with Centurion Network is unclear.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]