SEC file “illegal pyramid scheme” case against TelexFree

![]() Hot on the heels of the Massachusetts Securities Division alleging TelexFree to be a $1 billion dollar Ponzi scheme, now comes a new complaint from the SEC.

Hot on the heels of the Massachusetts Securities Division alleging TelexFree to be a $1 billion dollar Ponzi scheme, now comes a new complaint from the SEC.

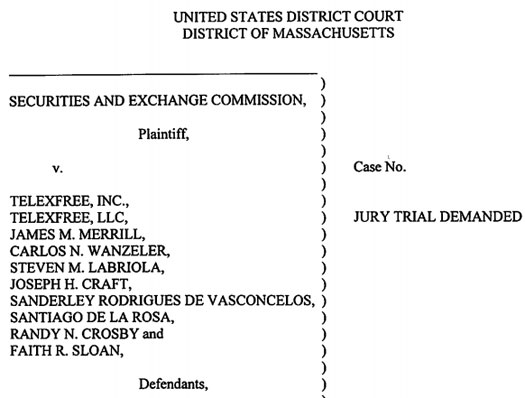

Filed on the 15th of April in a Massachusetts District Court, the SEC have named eight defendants in the case, and have grouped them into three distinct categories:

- The company – TelexFree

- Four principals (owners and employees) – James Merril, Carlos Wanzeler, Steve Labriola and Joseph Craft

- Four primary promoters – Faith Sloan, Randy Crosby, Santiago de la Rosa and Sann Rodrigues

Noticeably absent from the list is Carlos Costa, the third owner (principal) of TelexFree.

Much of the complaint echoes the earlier Securities Division complaint, however the SEC are a little more specific on numbers:

Since at least November 2012, TelexFree and its principals, Merrill, Wanzeler, Labriola and Craft, acting through promoters such as Rodrigues de V ancelos, De La Rosa, Crosby and Sloan, have raised more than $300 million, largely from the Brazilian and Dominican immigrant communities in Massachusetts and twenty other states, through a fraudulent and unregistered offering of securities.

The problem the SEC have with TelexFree is of course again the AdCentral investment scheme:

The securities take the form of “memberships” that promise substantial returns – 200% per year or more – for becoming promoters of the business.

TelexFree promises to pay promoters for:

(a) placing duplicative TelexFree ads on internet sites -a process which, by itself, generates no revenue; and

(b) recruiting other investors who pay the membership fees that constitute the lion’s share of monies taken in by TelexFree.

As has been reported here on BehindMLM for nearly two years, the VOIP component of TelexFree is and always has been just smoke and mirrors.

What’s more, the SEC reveal that the money TelexFree took in from VOIP sales (purchased by affiliates), constitutes just 1.3% of the AdCentral ROI liability the company has amassed:

Despite the misleading appearance of having a legitimate VoiP business, the defendants are actually operating an elaborate pyramid scheme. Documents available to date indicate that its VoiP sales revenues – approximately $1.3 million – have generated barely 1% of the nearly $1.1 billion needed to honor its promises to promoters for placing internet ads.

Note that the Securities Division figures were slightly different, with the SEC’s $1.1 billion figure pretty much on par with my $1.14 billion estimate made last week.

And here is the crux of the matter, spelled out for all and sundry:

As a result, in classic pyramid fashion, TelexFree is paying its older investors, not with revenue raised from the sale of its VoiP product, but with money received from newer investors.

End of story.

Well, actually that’s just the surface. While affiliates have been calling for calm and swallowing the bullshit TelexFree have been feeding them through official channels, here’s what’s really been going on behind the scenes:

TelexFree has been a money-making machine for the defendants. The company’s financial records indicate that, since mid-November 2013, TelexFree has transferred approximately $30 million to be transferred from TelexFree operating accounts to themselves and to affiliated companies in the past few months to accounts owned and controlled by TelexFree or the individual defendants.

Tens of millions of additional investor funds received by TelexFree are presently unaccounted for.

$30 million dollars of affiliate investor money has been transferred to TelexFree’s top dogs alone these last few months, and tens of millions of dollars are currently MIA (might I suggest checking with the Brazilian IRS?).

In an effort to immediately put a stop to TelexFree’s shenanigans, the IRS are asking for a preliminary injunction.

The Commission seeks emergency equitable relief, including a temporary restraining order and preliminary injunction, to:

(a) prohibit the defendants from continuing to violate the relevant provisions of the federal securities laws;

(b) freeze the defendants’ and the relief defendants’ assets;

(c) require the defendants and relief defendants to repatriate all proceeds of the fraud that are now located abroad;

(d) require the defendants and relief defendants to submit an accounting of investor funds and other assets in their possession; (e) prevent the defendants and relief defendants from destroying relevant documents; and

(f) authorize the Commission to undertake expedited discovery.

The Commission also seeks:

(a) a permanent injunction prohibiting the defendants from further violations of the relevant provisions of the federal securities laws;

(b) disgorgement of the defendants’ and relief defendants’ ill-gotten gains, plus pre-judgment interest; and

(c) civil penalties due to the egregious nature of the defendants’ violations

In a nutshell, the sought injunction would immediately cease any and all of TelexFree business operations, and make it illegal for the company and it’s top earners to try and hide and/or continue to spend the money they made.

And to think it was only a week ago that Sloan was boasting on Facebook about buying a new house for her parents:

Ruhroh! I hope they saved some of the cardboard boxes they moved with…

Much of the background of TelexFree’s owners is identical to what the Securities Division has provided, but there is some new information regarding Joseph Craft and the top Ponzi pimps:

Joseph Craft – Joseph H. Craft, age 50, lives in Boonville, Indiana He is a Certified Public Accountant with offices in Indiana and Kentucky.

He is the chief financial officer of TelexFree, Inc. and TelexFree, LLC and prepares the company’s financial statements. He has been the chief financial officer of other multi-level marketing companies.

Sann Rodrigues – Sanderley Rodrigues de Vasconcelos, age 42, previously lived in Revere, Massachusetts, and now lives in Davenport, Florida He is one of the most successful promoters of TelexFree, especially among the Brazilian community in Massachusetts and elsewhere.

He has appeared in TelexFree promotional videos that have been posted on the internet (he posted at least one himself), and he publicly claims to be the first U.S. promoter to become a millionaire.He is the owner of WWW Global Business Inc., a Massachusetts corporation that he founded in February 2013.

In 2007, he settled charges brought by the Commission for operating a fraudulent pyramid scheme known as Universo FoneClub Corporation. He was permanently enjoined from violating Section lO(b) of the Exchange Act and Rule lOb-S, and Sections S(a), S(c) and 17(a) of the Securities Acts. He was also ordered to pay approximately $1.8 million of disgorgement.

Santiago De La Rosa – Santiago De La Rosa, age 42, lives in Lynn, Massachusetts. He is one of the most successful promoters of TelexFree, especially among the Dominican community in Massachusetts and elsewhere.

He has appeared in TelexFree promotional videos that have been posted on the internet. He is the owner of Magica Media Corp., a Massachusetts corporation that he founded in March 2013.

Randy Crosby – Randy N. Crosby, age 51, lives in Alpharetta, Georgia. He is one of the most successful promoters of TelexFree and has appeared in TelexFree promotional videos that have been posted on the internet. He has also promoted TelexFree through a website called “everybodygetspaidweekly.biz”.

Faith Sloan – Faith R. Sloan, age 51, lives in Chicago, Illinois. She is one of the most successful promoters of TelexFree and has appeared in promotional videos for TelexFree that have been posted on the internet.

She has also promoted TelexFree through a website called “telexfreepower.com”.

Unfortunately no specifics on how much money these pimps made is provided, however I expect the figures will definitely come out in the wash at a later date.

What is provided are figures on some of the attempts to launder money through various TelexFree shill corporations.

The Commission has not yet been able to obtain a complete set of statements from the defendants’ banks, brokerage firms, and credit card payment processing services.

However, the information available to date, from bank records and other financial records as well as from statements made by various defendants, indicates that Merrill and Wanzeler, who had sole authority to transfer TelexFree corporate funds until the bankruptcy filing, have caused more than $30 million to be transferred from TelexFree operating accounts to themselves and to affiliated companies in the past few months:

TelexFree Financial, Inc. (“TelexFree Financial”) is a Florida corporation with its principal place of business in Coconut Creek, Florida. It was incorporated by Craft on December 26,2013. Its officers and directors are Wanzeler and Merrill, and Wanzeler is its registered agent.

On December 30 and December 31,2013, it received wire transfers totaling $4,105,000 from TelexFree, Inc. and TelexFree, LLC.

On April 14, 2014, TelexFree Financial filed for bankruptcy protection in Nevada under Chapter 11.

TelexElectric, LLLP (“TelexElectric”) is a Nevada limited partnership with its principal place of business in Las Vegas, Nevada. It was formed on December 2, 2013. Its general partners are Wanzeler and Merrill.

Financial statements prepared by Craft indicate that TelexFree made a $2,022,329 “loan” to TelexElectric.

Telex Mobile Holdings, Inc. (“Telex Mobile,) is a Nevada corporation with its principal place of business in Las Vegas, Nevada. It was incorporated on November 26,2013. Its officers are Wanzeler and Merrill.

Financial statements prepared by Craft indicate that TelexFree made a $500,870 “loan, to Telex Mobile.

Joseph Craft would appear to behind this diversification of stolen funds strategy, and I suspect is likely the primary reason he’s been named in the complaint.

Much of the SEC’s complaint focuses on the fallacy of “posting ads to get paid”, citing many YouTube videos, statements from the named four Ponzi pimps and reasons why the ads were “ineffective” (primarily because they generated no revenue).

The sheer volume of virtually identical advertisements for TelexFree’s VoiP service rendered them largely meaningless, especially because anyone who used “telexfree” as an internet search term would be led to the company’s own website.

In early April 2014, one website, Adpost.com, contained more than 33,000 ads for TelexFree, while another, ClassifiedsGiant.com, contained more than 25,000 ads posted just since February I, 2014.

Called out in the complaint, are also numerous TelexFree lies affiliates (and us here at BehindMLM) have been fed over the past two years:

TelexFree and its promoters made numerous false public statements about the company, its founders, and its business:

a. The TelexFree website, in a section entitled “Founder”, states that Merrill received a B.A. in Economics from Westfield State University. The statement is false. Merrill dropped out of Westfield State after only two years.

b. The “Founder” section of the TelexFree website includes a photo of Merrill standing in front of a large three-story building, with the caption “Mr. Merrill in front of the headquarters of Telexfree in the USA.” At least two versions of the marketing presentation on the company website contained a photo of Merrill and a photo of the same building with the caption “The Company HS: United States.”

The use of the building photo is misleading.

TelexFree, Inc. does not own or occupy the entire building. In fact, it originally shared a single suite (consisting of a receptionist, conference rooms, and cubicles) with 28 other companies.

Only in December 2013 did it move into its own suite, which occupies a portion of the first floor. TelexFree, LLC has no physical office at all, just a mailing address in Nevada.

On March 21, 2014, TelexFree issued a press release with the following quote from Merrill: “We have been in VOIP telecommunications for more than a decade.”

The statement is false.

As noted above, Common Cents was founded in 2002, and its business was marketing “10-10” long-distance plans for WorldxChange – not VoiP technology.

The public portion of the TelexFree website contains a picture of a Best Western hotel and a banner reading “Hotel Best Western Opportunity.” The TelexFree. “back office” website includes an icon with the logo of Best Western Hotels that is entitled “Best Western, Telexfree Tijuca”.

At least one version of the marketing presentation on the company’s website included descriptions of Best Western’s activities in the United State and South

America. Crosby stated in his April 2013 video, “This company has a joint venture with Best Western.”The representation and other suggestions that TelexFree has a business relationship with Best Western is false. Ympactus Comercial Ltda. (“Ympactus”), a Brazilian corporation controlled by Wanzeler and Costa, has a promotional agreement with a Brazilian company that is partnering with Best Western on a new hotel. TelexFree has no relationship at all with Best Western.

The “Founder” section of the TelexFree website states, “Being well versed in one of the new technologies in the era (V oiP), in 2002 he [Merrill] decided to found TelexFree, Inc. to serve this market.”

On August I, 2013, Wanzeler told a gathering of TelexFree promoters, “We have a company since 1995. It’s a VoiP product company.”

The statements are false, for several reasons. First, Common Cents – not TelexFree – was founded in 2002. Second, Wanzeler, Merrill and Labriola- not just Merrill-incorporated Common Cents. Third, the business of Common Cents was marketing “10-10” long-distance access plans for WorldxChange- not VoiP technology.

Quite an exhaustive list there, and an insight into just how much smoke and mirrors BS Ponzi kings will blow up your ass if you let them.

Meanwhile it turns out the recent compensation plan changes debacle, was initiated shortly after TelexFree was gutted in Brazil (June 2013):

In its bankruptcy filings on April14, 2014, however, TelexFree claims that after the Brazilan enforcement action against Ympactus, it began planning to restructure its compensation program- planning which resulted in the changes announced on March 9, 2014.

If I may, having blogged through the recent comp plan changes and ensuing mass-confusion, if that’s what ten months planning resulted in – my god these guys are hopeless.

Or perhaps they were just too busy counting the money that was coming in:

Based on the information available to date, it is clear that TelexFree’s VoiP revenue has been only a small fraction of the money it promised to pay to AdCentral promoters.

Credit card transactions from August 2012 to March 2014 indicate that TelexFree received slightly more than $1.3 million from the sale of approximately 26,300 VoiP contracts. During the same period, TelexFree received more than $302 million from approximately 48,000 AdCentral promoters and 202,000 AdCentral Family promoters.

Through the sale of those one-year contracts, TelexFree promised to pay more than $1.1 billion to the promoters who placed the required internet ads.

In other words, the receipts from selling VoiP packages covered barely 1% of TelexFree’s obligations to pay promoters who placed ads.

The disparity between TelexFree’s VoiP revenues and its AdCentral obligations was actually worse than that, because the $1.1 billion of estimated obligations does not include the commissions and incentives that TelexFree promised to pay to promoters under the additional programs described above.

In short, TelexFree was operating a classic pyramid. Because revenues from VoiP sales were so small, TelexFree was forced to use money from newer investors to make its payments to older investors.

TelexFree management’s cut of the affiliate investor funds?

Bank statements show that Merrill received $3,136,200 on December 26 and December 27,2013.

Bank statements show that Wanzeler received $4,317,800 on December 26 and December 27,2013.

Bank statements show that two companies controlled by Craft received more than $2,010,000 between November 19,2013 and March 14, 2014.

Federal wire transfer records show that Wanzeler wired $3.5 million to the Oversea-Chinese Banking Corporation in Singapore on January 2, 2014.

In addition, a bank has infonned the Commission that TelexFree, LLC sent $10,389,000 to an entity known as TelexFree Dominicana, SRL on April3, 2013.

Also, on April 11 Gust before TelexFree filed for bankruptcy), Merrill and the wife of Wanzeler obtained cashier’s checks in the total amount of$25,552,402. The checks are payable to TelexFree, LLC.

TelexFree’s 2013 profit and loss statement recorded a net-income of $36 million. No wonder TelexFree filed for bankruptcy, Merril and Wanzeler’s wife withdrew whatever was left in March!

Also the mention of a Chinese bank is news to me. That TelexFree were using Chinese banking channels to transfer funds out of the scheme only shows the extent to which they were willing to secure their ill-gotten funds.

On April14, 2014, defendants TelexFree, Inc. and TelexFree, LLC and relief defendant TelexFree Financial Inc. filed for bankruptcy in Nevada under Chapter 11.

The three companies claimed to have liabilities of as much as $600 million but assets of no more than $120 million. The companies stated that, in the five weeks after the March 9 rule change, promoters submitted claims for $174 million, primarily for AdCentral ad placements.

The companies also stated that revenues under the new March 9 compensation plan – which requires AdCentral promoters to sell VoiP products in order to get paid – have been so disappointing that the companies cannot meet their obligations.

Confirming that VoiP sales have not generated enough revenue to honor their promises to AdCentral promoters, the companies seek authority to reject all existing AdCentral contracts.

The whereabouts and/or disposition of much of the more than $300 million of investor funds raised by TelexFree is unknown.

Did TelexFree launder $300 million? If so, holy crap. You can bet none of the named defendants are going anywhere until the matter is settled.

In closing out their complaint, the SEC have asked the court to

enter a preliminary injunction, order freezing assets, and order for other equitable relief in the form submitted with the Commission’s motion for such relief.

Civil penalties and the ‘requirement that defendants to disgorge their ill-gotten gains and losses avoided, plus pre-judged interest, with said monies to be distributed in accordance with a plan of distribution to be ordered by the Court‘.

A “plan of distribution” will no doubt be music to the ears of many affiliate investors, who are only now coming to terms with the amount of money lost in Telexfree.

Footnote: The complete SEC complaint can be read in its entirety over at the SEC website.

It´s a nice start but they need to go after the top 30 promoters list, they are the main source of all this scheme and should be criminal charge for there illicit profits.

Well well well, I am running out of popcorn.

They made money using pyramide sheme, time to flip over this pyramide so innocent promoters will recover something. Interesting to see how much more lyers will face justice.

Boston strong.

Finally! Yeah!! Game over TelexFree!

Source:

http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370541520559#.U1Alvle53lY

http://www.sec.gov/litigation/complaints/2014/comp-pr2014-79.pdf

I’m running out of coffee! I think I’ve been awake for 30 something hours now…

And the whole world has to answer right now

Just to tell you once again

Who’s bad?

LOL!!!

I’ve had Warren G’s “Regulators” stuck in my head these last few days myself :).

OZ, please post the link to the formal complaint. thx

nevermind. just saw it above

I am not gona blame you Oz. Things are going to be interesting now.

Some of them will now post some videos saying that the SEC is just joking and that there is no charge at all.

Let see what Faith will say about here name listed on the SEC charge, will she post it on here website as breaking news?

At least the SEC froze the funds before they were diverted.

Great job Oz. Without efforts made by you and others, many more people would enter in this sinking ship.

Wow. It was expected of course. As for Carlos Costa I expect he will have his day in court at his own country of Brazil.

Thanks OZ.

The longest movie I have ever watched and it’s only halfway. Cant wait for the cinema version in 5 years time.

I’m really curious of how the outcome of US investigations will affect Brazil’s ones.

I bet CC will pull the “Wait a sec! Ympactus is NOT Telexfree! See, we do no even have a contract with them!” card.

From a person who lies about the most obvious things, you can expected anything.

Maybe Scorcesse could make it happen. Leo Dicaprio could get a Oscar this time.

As Faith Sloan mentions on her FB page…

She thinks all of this is funny. How cute.

….named “O lobo de Wall Street.”

Oh my!!! What will be Sloan’s fate?

Just curious, but is filing for bankruptcy just one last time out of the question?

I am so happy to see the pimp, Faith Sloan, on the defendant list. It is about time the feds took her out! Next are Ken Russo, David Sherman, etc and the likes (I hope).

In this case, the bankruptcy stuff would become totally useless, right?

With the “Chapter 11” thing, they seek to pay their friends AND ALSO continue operating.

I was guaranteed my investment from Julio Silva Top Team in Malden, MA.

Now when I called him he gave me an attorneys number to call.

Mr. Julio Silva was had several videos and pictured of Samn Rodrigues stating how brilliant Mr. Silva was! One as recent as last week. While (Samn) driving his Ferrari. Funny now all those videos are gone!!!

Many TelexFree supporters are using the same old excuses now, such as:

I think kschang needs to write something up on the common scam justifications such as “don’t risk money you can’t afford to lose”… similar to kschang’s fallacies article which I enjoyed a lot.

Ok, article is complete. I’m off to get some shuteye.

Faith Sloan FB: “Don’t Cry For Me, Argentina….”

So I was checking Faith Sloan’s website and, as expected, she was fiercly dismissive and defensive, while at the same time pimping out her new scampportunity – Changes Worldwide.

What struck me though was one of the comments where there was what appears to be a scam to help you recover lost money from the TelexFree scam:

I went to the above website which cites actual examples of people who have recovered money from TelexFree. I requested additional information using a fake alias – First Name Ima Last Name Sucker – but I haven’t receive anything yet…

People can be so fucked up sometime.

Can anyone translate this?

Good night Oz…..

Well he sonds like Labriola in his last video. Talks and talks and manages to say nothing new realy.

Basically he still hoping the judge will go telexfree way. But does not sound convinced. He then shifts blame to media for SEC intervention. He says that like in Brazil they will not be able to prove it’s a ponzi.

Also complaind at beguining of video that some media channel said he could not be found anyware. His not running, and he has nothing to do with the SEC raid. Not his problem. Hum???

Anyway could watch all the BS so I found the a great theme tune for the movie:

Was in the phone conference this afternoon… many people still believe in TF being a legitimate business. Many defended the fact the Steve Labriola was not available as promised once again, to speak to the audience.

There are some real die-hard fans and it’s incredible to the level of naïve some can achieve.

Guessing IRS has been in haste to search all the money tunneling and officially charge TF; making this a an official crime; thus, having some of the administration named above to have a warrant for their arrest.

Any theories as to why Carlos Costa was not named as a defendent on the SEC document. He was listed on the Massachusetts Securities document as a Respondent.

Also, I haven’t heard any updates on what happened with the expedited bankruptcy hearing that TelexFree was granted in Nevada today at 1:30? Was it cancelled? Are there any further documents?

Watching this unravel live in front of my eyes is oddly exciting for me

Ditto Oz… Goodnight and thank you for this wonderful and informative site!

It says: “hell no, I’m not selling my yatch and beautiful house to pay you guys back. I’m innocent. Fuck you all suckers. I’ll now go bang my hot wife and partner in crime. Peace. TelexFree Forever.”

Stick a fork in it… another ponzi scheme is done.

@ Jimmy

Typical of scam netwinners. Mr. Yang comparing chances at casinos with a ponzi scam is just ridiculous. What he doesn’t realize is, at casinos, you either win or lose and, with ponzi scams, you either lose (your investment) or lose (with clawbacks). What an idiot.

They can run but they cannot hide.

Will be realy intersting if one can publish names of all those suckers who took advantage of all those hard working people, most of them used their life saving.

something like: telexfreeripoff.com

what do you guys think?

anyone knows about the results on the telexfree court hearing today in nevada? i want to know if anyone got handcuffed already??????

In business, when things don’t turn out the way it should be…Please don’t blame anyone! Blame yourself if you have to blame somebody.

No one is pointing a gun at you to do business with TelexFREE in the first place. You made your decision. In business, we win some and we lose some just like taking your chance at the casino.

Carlos Costa complained about Brazilian media talking bullshit about him. Said some lies about how the world is against Telexfree due a misunderstood and how God is great and will guide their people to the promisse land (not joking, he said that).

He didn’t talk about his wife, about how TF was trying to evade some cash or why only 30 people in the debt.

ckeck this out

During raid, TelexFree executive tried to leave with $38 million.

http://www.bostonglobe.com/business/2014/04/17/sec-freezes-assets-telexfree-and-eight-people-affiliated-with-company-alleged-fraud/fZwPyvFkLJD6nDy9BKaHiK/story.html

BOSTON STRONG

New audience 02/05 ?

but this whore of faith dont wil lgo in the jail? but in america for ponzi dont put these criminals in the jail?

this is very bad , they rub money at the peoples and then are also free.

Faith Sloan “News”:

So they were stealing until bitter end as true thieves.

It is more of jailhouse love with rough sex and night and fist pounding during the day.

In summary:

-Starts addressing some Brazilian newspaper complaints about the inability to reach him; claims newspaper is not serious in his coverage;

-States there’s an hearing today with a judge to start deciding the fate of Telexfree, assuring there will be no problem ’cause they are all clean;

-States that since they were taxed and payed Social Security in Brazil, they are not fraud nor criminals; the same will happen in the USA;

-States his company in Brazil is not the same as Telexfree, but they help each other since they share the same philosophy;

-States that independently of today outcome at the hearing they will fight for justice by all means;

-Repeats himself and talks about God a lot;

-(we are innocent, there is no way to proof what not exists, all this is an absurdity, etc.)

-Ask affiliates to get down on their knees and pray to God for justice for Telexfree in today’s hearing;

(Nothing new, and quite painful to hear actually, this guy is disgusting)

New audience 02/05/2014

John yes it’s be scheduled for May 2nd

@Naz

The SEC have been working with Brazilian authorities, I’m guessing it was strategic (Costa will get nailed in Brazil in due time).

As I understand it Costa doesn’t leave Brazil so probably best to leave local regulators to nail him.

That said the Masachusetts Securities Division have named him as a defendant so he’ll have to answer for that I guess.

5 from 9 point were accepted by judges, only 4 will remaind till monday, this may represente telexfree 1 – 0 SEC

BRAVO OZ and everyone for exposing these major serial criminals, many of whom pretend to be followers of GOD but do not care who gets hurt in the process of their serial criminal activities.

The law needs to put a stop at all these so called legit mlm business. Hopefully the law will make an example of these shameless people and throw their asses in the slammer for a long time!

In regards to that tax hearing today, I’m reading that TelexFree has been ordered to pay $20 something million in Tax (with assets frozen?) and that the next hearing has been set for May 2nd.

Treating it as unconfirmed for now.

Be wary of anyone suggesting that the business will restart or that this somehow signals the return of money to affiliates.

For starters there is no money, Joe Craft tried to make a run with the last of it when the office got raided. $300 million has also been stashed away somewhere.

And then there’s the issue that TelexFree have asked for all liabilities owed to their affiliates be declared null and void. You’re kidding yourself if you think the continuation of bankruptcy proceedings is any sort of victory.

TelexFree’s owners are just trying to wrangle free under the protection of bankruptcty, with success (as unlikely as that sounds in light of recent events), only benefiting them.

One only need read the SEC complaint to see that even as Labriola whispered sweet nothings to affiliates and called for calm, that management were busy transferring large sums of money to themselves.

Here’s a sample of the desperation currently flying around:

This guy has been running around telling everyone TelexFree will restart business the last few days.

One can only wonder how many thousands he’s got tied up in the company to warrant such a warped take on the situation. And even then, it’s one thing to keep this kinda crap to yourself and hold on to it, but to disseminate it on a public platform? No shame.

Here in Brazil, many associates are spreading fake news, saying the judge has accepted the bankruptcy of Telexfree and the company and voip (which many never used/know how to use/understand how it works) will be back after 02/05, so apparently they are in denial mode.

meanwhile in a city nearby telexfree headquarter a high level pimp got biten almost to death today.

he didnt even bother call police, he knew it was a unhappy afilliates. someone else alredy moved out of town ive heard too today.

This is great news. Hopefully they can charge everyone at the top, leaders and team builders, and make them repay profits into a victim pool.

Let justice be swift.

1. Lack of personal jurisdiction.

2. Carlos Costa wasn’t DIRECTLY involved in TelexFree USA, he ran the Brazilian part only. And he’s already defending that part in Brazil.

Carlos Costa was listed as one of the owners of TelexFree Inc. / TelexFree LLC in early 2013, but they made some changes to the ownership after the shutdown in June 2013, probably to protect CC from being prosecuted for something.

3. Massachusetts Ceurities has identified it as a Ponzi scheme, with Carlos Costa as one of the owners while the scheme was active. SEC has identified it as a pyramid scheme, and will look for active organizers rather than for owners.

local news:

What sort of criminal charges could be laid to the USA promoters of this scam?

Class action lawsuit = give away 25-30% of the monies recovered to a lawyer, without getting anything of interest in return.

James “Cal” Cunningham tried to attract local NC victims to an “I have a plan” lawsuit few days after Zeek’s shutdown. His plan was probably to get a piece of the cake, because he probably knew he wouldn’t be able to get any results for his clients.

Another lawyer tried something similar in Louisiana. The case has been stayed most of the time, but has been allowed to appeal the stay to a higher court. The lawsuit was based on “Security Act 1933”, arguments that most likely will fail in court. Sale of securities can’t be BOTH fraudulent and legitimate at the same time.

I was going to try translating this…guy’s “stament” but about 2 minutes in the video I got naushes and almost puke!

Can’t imagine the pain you went through watching that video till the end!

Is it any worse than “Comical Ali”, i.e. Baghdad Bob?

TelexFREE’s version of Robert Craddock.

We all know these people were crooks and this is not the first time that Julio Silva and Marcio Pinheiro were stopped for fraud. They were both highly involved with National Lending a mortgage company that made a ton of fraudulent document and again put the brazilian community in a deep hole.

Congradulation PASTOR Julio, you are a great leader!

Yes that is true the person who fled is Luizinho. He owns a store in Framingham. Big big telex promoter. Not the first time he had problems with this sort of thing.

S*** I was not aware the they both were behind the National Lending Fraud. Now a friend informed me that I didn’t recognize Julio Silva was because he was over 400 lbs back then!!!

What can I do ? I lose all my money in the Telexfree, anyone can help me to withdraw my invest?

You wait for authorities to do their job, and you may get SOMETHING back. Not close to all of it, just some, like 25%. Be lucky if you get 50% or more. And I mean what you put in, not what you *think* you “earned”.

Many crooks will claim they have special access… if you pay them. They are out to scam you again. This is called “reload scam”. Do not be victimized AGAIN.

Thanks Chang,

I’m in China, and I invest TelexFree at March 6, 2014 for 3 packages of Family ADcentral thru my friend’s introduction. I want to know where can I register or report for my losses in case of get something back, like 1/4 of my invest?

Thanks to God, I get not even 1 cent from Telexfree.

Just to be clear, y’all (I mean you Oz and Chang) were the first to break the story on Zeek Rewards. Same is true for TelexFree, right? Just want to give you the proper credit y’all deserve 🙂

Hey guys. Keep us posted on developments. Im wondering how the investors from miles away from USA will get justice.

Curious to know opiao of you what will be the decision of the judge on the Telexfree at the SEC’s website says that more judges and ponzi seems undecided?

We don’t know yet, the case is still too fresh. I posted SOME information in the “TelexFree Rwanda” thread about previous Ponzi shutdowns (Zeek Rewards, 2012), but I also pointed out some differences.

behindmlm.com/companies/telexfree/rwandan-telexfree-affiliates-mull-legal-action/

Currently the focus should be on WHERE people can find information and WHAT they can find there.

The top four Ponzi pimp defendants in this case might be looking at having to pay back triple of what they stole:

http://www.forbes.com/sites/jordanmaglich/2012/10/23/ponzi-scheme-victims-may-owe-triple-damages-for-usury-in-clawback-lawsuits-a-new-tool-in-ponzi-scheme-litigation/

Quick read over…..not an easy article…have to get my college law dictionaries out and dust off for this one to pass an opinion…lol

The bottom line is …if they don’t have the money to pay up do they do the time? Or are they forever having to pay 20% of their future paychecks from washing floors or working at Lowes (local big corp hardware store)to pay back?

Either way..they get to wear some kind of goofy jump suit

The SEC is only able to bring “civil” or “administrative” action against the defendants and it cannot impose anything but financial penalties.

It can, however, ask the court to order an asset freeze and disgorgement of any or all profits plus penalties.

Criminal charges will probably follow in due course.

The use of civil proceedings ensures the fraud is stopped dead in its’ tracks, meaning there can be no more victims and the assets are protected, giving investigators and prosecutors time to thoroughly complete their work, before preferring criminal charges.

IOW, ensuring when the DoJ nails the criminals to the wall, they will stay nailed.