OmegaPro funds seized by UK authorities (OneCoin?)

![]() OmegaPro funds have been seized by UK authorities.

OmegaPro funds have been seized by UK authorities.

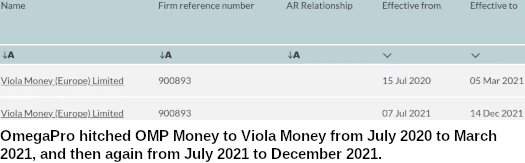

The regulatory action occurred through OMP Money, a UK shell company set up by OmegaPro to access banking channels.

OMP Money was in turn tied to Viola Money, which was shut down by UK authorities last December.

The background on these latest developments is a bit complicated so I’ll start at the beginning.

OmegaPro is a simple 200% ROI Ponzi scheme.

In order to access traditional banking channels, OmegaPro incorporated the UK shell company OMP Money in April 2020.

OmegaPro co-founder Andreas Szakacs pitched OMP Money as “a bank”. He presented it as an integral part of OmegaPro’s regulatory compliance;

The most important thing I want you to do is to go to the FCA register.

At the FCA register you can search for OMP Money and see that we are regulated by the FCA.

This would be something unique I would say for our industry and I’m so happy to finally announce this.

OMP Money accessed banking channels through Viola Money, another UK shell company.

OMP Money first ran into regulatory problems in June 2021, wherein the FCA deregistered the company.

OMP Money would remain deregistered until December 2021, wherein it was briefly reinstated before being deregistered again.

Viola Money was set up as V-Wallet (Europe) in July 2015. In May 2019 the company was renamed Viola Money (Europe).

Viola Money registered with the FCA a few months after the name change in November 2018.

Viola Money provided clients with access to GBP and EUR payment processor services, as well as banking and prepaid debit card services.

Viola Money conducted banking services through ClearBank (UK) and LHV Bank (Estonia)

As reported by Interpath;

On 22 October 2021, ClearBank notified both Viola Money and the FCA that it had decided to terminate its agreement for the provision of banking services to the Company with immediate effect.

The reasons given by ClearBank included that following a review of the Company’s activity they had noted:

-Unusual payment requests;

-Financial crime typologies; and

-An inability for the Company to adequately and effectively monitor transactions.

LHV Bank followed suit and gave Viola Money 60 days notice it was terminating their agreement on October 29th.

The FCA initiated action against Viola Money on November 2nd.

On November 25th, LHV Bank terminated Viola Money’s banking agreement “with immediate effect”.

The FCA deregistered Viola Money on December 14th.

Two Interpath employees would later be appointed Joint Special Administrators (Receiver equivalent).

In a February 9th fifty-six page report, Interplay disclosed;

The records of the Company are inaccurate and incomplete – for example, the Company does not appear to have previously performed a customer funds reconciliation and customer account balances per the Company records significantly differ to the actual balances held at financial institutions.

It is currently uncertain whether we will be able to make a distribution to customers.

This reflects that the customer funds are largely not currently controlled by the JSAs

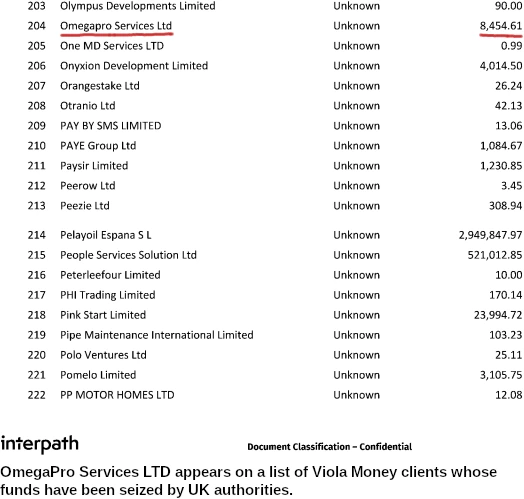

A list accompanying the report reveals €8454 EUR belonging to “OmegaPro Services Ltd” has been seized.

OmegaPro Services Ltd is yet another UK shell company tied to OmegaPro.

OmegaPro Services Ltd was incorporated in May 2019 and operates out of a Cardiff PO Box. Per Anders Kagestedt, purportedly a Swedish national, is listed as the sole Director.

Upon Viola Money running into regulatory problems, the stooges put in charge bailed.

Again from Interpath’s report;

The shareholders of Viola Money are Stephen John Davies (90.5%) and David Barclay (9.5%).

David Barclay and Mary-Ann Townsend are directors of the Company and are also the persons responsible for the management of its electronic money.

On or around 8 December 2021, Mr Barclay, the CEO and director of the Company, is understood to have resigned with immediate effect.

We have written to both David Barclay and Mary-Ann Townsend as the directors of the Company as reported on Companies House to request they complete and return a Statement of Affairs.

David Barclay has advised he resigned as a director of the Company on 8 December 2021 and no longer has access to the material required to complete a Statement of Affairs in any meaningful way.

Mary Ann Townsend advised that she is not aware of the information requested within the Statement of Affairs as her role was primarily the Money Laundering Regulations Officer for the Company.

As such we have not received a Statement of Affairs to date.

Stephen John Davies, Viola Money’s majority shareholder, doesn’t appear to exist. If Interplay’s correspondence with Barclay and Townsend was in writing, I’d proffer they don’t exist either.

UK incorporation and fraud have been synonymous for decades.

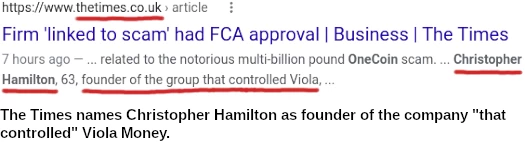

Who was actually running Viola Money (which was obviously part of a larger money laundering syndicate), brings us to an interesting Feb 22nd article from the Times.

Unfortunately the article is paywalled – but its introduction was enough to catch my attention.

A self-styled “fintech” payments business was authorised by the City regulator while its founder was subject to a money laundering investigation related to the notorious multibillion-pound OneCoin scam.

A new report from administrators has revealed that “almost all” the funds controlled by the business are subject to freezing orders from HM Revenue & Customs or police forces.

Now I’ve searched high and low for a “new report” from Interpath, and the latest I could find was the Feb 9th report cited above.

If there’s a new report it’s not on their website.

Unfortunately The Times don’t disclose how they’re tying Viola Money to OneCoin. OneCoin isn’t mentioned anywhere in Interpath’s February 9th report.

Nonetheless my own research led me to the tail-end of a discussion on Viola Money’s shutdown – referencing a February 2021 UK court case.

Unfortunately this article from Court News UK is also behind a paywall.

But like The Times’ article, we glean interesting information from what is available.

A money launderer rinsed over £75 million from a scam based on a worthless cryptocurrency called ‘OneCoin,’ a court heard.

Christopher Hamilton, 62, is said to have laundered up to US Dollars 105m from the American scheme in which investors were promised fantastic rates of risk free profit.

But the OneCoin was worthless and Hamilton was arrested at his home in Cowbridge, near Bridgend in south Wales in April 2016.

I’ve never heard of Christopher Hamilton. Nor is his 2016 OneCoin money laundering arrest in the UK referenced anywhere on BehindMLM.

What on Earth is going on here?

Based on what is publicly available, I can’t answer that. But bear with me because the rabbit hole gets even deeper…

In April 2019 Dominic Welsh, some schmuck in the UK, was prosecuted over a bungled blackmail attempt.

WalesOnline thankfully provides us with a freely accessible article;

An ex-marine blackmailed a “petrified” company director at his family home about an alleged $32m debt, a court heard.

Cardiff Crown Court heard Dominic Welsh placed his alleged victim’s family under surveillance and threatened violence in an attempt to recover money his employers believed they were owed.

The “victim” is none other than Christopher Hamilton, identified as “a director for more than a dozen companies in the UK and abroad.”

Prosecutor Christopher Rees said: “It is particularly chilling that the defendant was also tracking Mr Hamilton’s wife and daughter and even daughter’s boyfriend as part of the plot to demand money from him.”

The court heard a message was found on Welsh’s phone from June 7, 2017, saying: “On the debt we are just about ready to make our move.

“We are gonna hit about four targets at once. A couple we are gonna just slap around and threaten their families but the other two we will put it on them heavily.”

In his evidence Welsh said he was paid $10,000 a month for his work and was due to earn a $30,000 bonus if he helped his clients to “recover” the money.

Who was Dominic Welsh, the alleged blackmailer, working for?

Prosecutors allege American businessman Gilbert Armentar and his associate William Morro hired Welsh to recover funds they believed they were owed.

That’s Gilbert Armenta, OneCoin founder Ruja Ignatova’s secret lover.

Armenta (right) was indicted and arrested in the US in 2017.

Armenta (right) was indicted and arrested in the US in 2017.

Armenta pled guilty to five counts of fraud, and is currently awaiting sentencing.

William Morrow is believed to be a pseudonym used by Segun Onibalusi.

Onibalusi, a Nigerian national, appears to be an accomplice working with/for Armenta.

Dominic Welsh was acquitted in April 2019.

Curiously, I was unable to determine the outcome of Christopher Hamilton’s OneCoin money laundering case.

What I can confirm is Christopher Hamilton also appears to be The Times’ link between Viola Money and OneCoin.

Whether UK authorities are still investigating Viola Money, and whether any of that will lead to action against OmegaPro, is unclear.

OMP Money markets payment processor services on its still active website.

OMP Money has decided to make a custody account service available to all its users which is now as easy as a checking account.

Secure your money with us, now!

Who OMP Money and OmegaPro are now providing these services through is not disclosed.

OmegaPro is run by co-founders co-owners Andreas Szakacs (Sweden), Mike Sims (US) and Dilawar Singh (Germany).

Szakacs, Sims and Singh run OmegaPro from Dubai, the MLM scam capital of the world.

Thus far OmegaPro has attracted regulatory attention in Colombia, Spain, France, Peru, Belgium and Chile.

Update 24th February 2022 – In addition to being a pseudonym used by Segun Onibalusi, William Morro is also an actual person working with Armenta.

Armenta and Morrow appear to have been laundering money for years. Whether Morrow is a person of interest to US authorities is unclear.

Update 26th June 2022 – Extradition proceedings in the UK have shed some light on Christopher Hamilton’s OneCoin money laundering case.

OMP money Director published OMP money accounts for a dormant company. (21st February 2022)

With a Cash in bank of 1500 £

find-and-update.company-information.service.gov.uk/company/12577980/filing-history

How can we get the interpath document with the list of company with seized funds ?

Further connection to Wales. Ruja Ignatova, Bulgarian national appointed Director of FIERCE UK Limited in Wales and registered Director role at Companies House on 14th December 2021.

find-and-update.company-information.service.gov.uk/company/08971719/officers

@Jen McAdam

That was a false alarm. You can find more here from comment #13:

https://behindmlm.com/companies/onecoin/bulgarian-onecoin-doco-deception-queen-out-nov-2022/#comment-449598

How does this freezing of funds affect their ability to pay people?

Here: ia-insolv.com/case+INTERPATH+PLC18C5249.html

Then “Joint Special Administrator’s Proposals”. One of the other documents is a near-copy too but slightly different IIRC.

The amount frozen wasn’t much, it’s more the regulatory action itself creating issues.

The wildcard is Dubai. OmegaPro had Sheik’s rock up to their event. They might have set up UAE accounts to continue laundering funds through.

Dubai’s banks don’t give a crap about fraud so that’ll go on till regulators elsewhere take action.

I saw this one, but I can’t find the document with the list of seize accounts. is the link in the same page ?

Yeah, you have to clink “Joint Special Administrator’s Proposals”. There’s a slight delay then it opens the doc in a new window.

The Sheik there was not a “that big” figure, and according the inside information, his is a client.

Dubai banks are more careful these days.

Even ruja from OneCoin got her Dubai bank account frozen (Mashrek bank). She had trouble to find other bank that can open an account for her or for Onecoin. She even tries in Kuwait without success.

Omegapro seems not to be registered in Dubai (or else in UAE). They might be in trouble faster than we think.

Until I see regulation, Dubai and any company based there is open to fraud.

I remember looking one of the Sheiks up, he was attached to the ruling royal family. That gives you access.

I’m not saying with certainty OmegaPro has UAE banking connections. It’s just a possibility now that OMP Money is DOA in jurisdictions that give a crap about regulation.

yes this is true. Dubai is a place for fraud.

Being attached with Royal Family can open doors, but can also close them all in an instant.

Running after bank that can clean your money is costly. (from 10% to 20% depending of the popularity of the business to clean).

I am forever hoping that regulators somewhere focus as much attention on these details as you do, OZ

I am not holding my breath, but remain optimistic.

SD

No. William Charles Morro is Armenta’s key associate. I’ve written about him many times before here.

Armenta and Morro are like Batman & Robin of OneCoin money laundering. They have destroyed many banks and payment companies together for criminals like Ruja. 😉

Here is Morro’s bio:

https://behindmlm.com/companies/onecoin/onecoin-fraud-sars-featured-in-fincen-files-leak/#comment-429136

He has participated in many of Armenta’s schemes and companies — also ones with Mark Scott’s involvement:

https://behindmlm.com/companies/onecoin/onecoin-fraud-sars-featured-in-fincen-files-leak/#comment-429105

https://behindmlm.com/companies/onecoin/onecoins-mark-scott-disbarred-in-new-york/#comment-430400

Theey seemed to have had Georgia-UK money laundering scheme with Wirecard associated Simon Dowson, which explain the mystery of the faked letter that ended up as a court exhibit at Mark Scott’s trial:

https://behindmlm.com/companies/onecoin/onecoin-digs-up-veska-ignatova-to-headline-legend-event/#comment-429636

What’s going on with Morro with regards to the SDNY court cases is one the key questions. Corporate filings from past years indicate he has been at large. I think pretty slim chances that he hasn’t been targeted by the Feds, so possibly a co-operator, Morro would be perfect witness in Mark Scott re-trial in an unlikely case there will be one.

@Semjon

Doh! I must have just ran a search on posts and not comments. I’ll make a note of your coverage in the article, thanks.

@shipdit

I have a lot to keep track of and miss things sometimes (see above). The real MVPs when it comes to OneCoin are Semjon, WBF and Melanie.

@oz:

looking at Interpath document showing viola money client’s seized accounts, We can see that most of the companies were created in 2020 (or dormant if created prior to 2020).

Their account reports prior to 2020 were close to 0 £, and became close to a million £ within a couple of months (settled when Viola money entered Ito special administration).

These companies have no web site, or dummy web sites.

All of this is really looking like a big money laundry, and big numbers came at the same time that OMP Money came in the picture. (or it is an unfortunate coincidence ?).

The company activity listed in Interpath document were close to Zero prior to OMP Money arrival. I don’t believe in Coincidences.

Omegapro has a lot of cash flow to “clean”, and it is more discrete to dispatch the clean money through various small companies.

But for Viola money it was a significant cash flow increases to absorb in a couple of months.

This caught the attention of their Banks ClearBank (UK) and LHV Bank (Estonia).

The companies bellow are picked up randomly from the list, showing significant cash at the date of the special administration of Viola money.

Other low cash companies account from the list could have been drained prior to the special administration.

Able Limited: UK company created 2016 (dormant)

find-and-update.company-information.service.gov.uk/company/02479287/filing-history

Dummy website able-consulting.co.uk

Dormant account from 2016 to March 2021

Cash in Bank march 2021: £1.00

Amount seized Dec 2021: £488,055.27

CALLKEY SYSTEMS LIMITED

Cyprus Company established in 2018

dnb.com/business-directory/company-profiles.callkey_systems_limited.006b54d19e43f6011e9bd2d5d8eb878c.html

Dummy website : casinoempire.com

annual business figure $75,532

Amount Seized Dec 2021 £1,037,197.82

CAPITAL MANAGEMENT GROUP LTD

Uk Company created 14 Oct 2021

Dummy website capitalmanagement.biz

Smart Fintech Agent Limited

find-and-update.company-information.service.gov.uk/company/12951094

Account deposit Oct 2021: £39,000

Amount seized Dec 2021: £714,668.65

SMART FINTECH LIMITED

Company created 28 May 2020

find-and-update.company-information.service.gov.uk/company/12630047

no website.

Capital £100.00

Amount seized Dec 2021: £298,843.05

CCA Services UK Limited Limited

Company created 8 Jan 2020

find-and-update.company-information.service.gov.uk/company/SC650890

No website

Capital £1.00

Amount seized Dec 2021: £855,734.42

Snowy Pay Limited

Company created 18 Jul 2019

find-and-update.company-information.service.gov.uk/company/12109641/more

Dummy website: snowy-pay.com

Capital £100.00

Amount seized Dec 2021: £1,153,445.50

Wallter UAB

HongKong Company created 10 Jul 2020

no website

hkcorporationsearch.com/companies/2959435

Amount seized Dec 2021: £1,569,816.39

Can’t confirm all those companies belong to Omega Pro. Pretty obvious Viola Money was only created to launder funds through though.

This is true, it can’t be proven that any of these account belongs to Omegapro.

And they don’t.

This is the money laundry principle. to compartmentalize the accounts, and not link any of them with the company you clean the money for.

When you look at Viola money public accounts since July 2015, their results are showing dormant to very low turnover from 2015 until 2020.

From 2019 to end 2020, Viola turnover and cash in bank was multiplied by 10

From 2020 to end 2021 viola cash in bank was multiplied by 10 !

It looks like Viola money was waiting for Omegapro.

Viola cash activity matches with Omegapro activity and growth.

Cash at bank dec 2021. 29,251,565.16 £

Turnover 30 sept 2020 : 1,208,634 £

Profit 114,707 £

Cash at bank 3,126,076 £

Turnover 30 sept 2019: 102,385 £

Profit 0,00 £

cash at bank 297,479 £

Turnover 30 sept 2018: N/A £

Profit 0,00 £

cash at bank 342,488 £

Cash at bank 30 sept 2017 100,00£

Declared Dormant company.

Cash at bank 30 sept 2016 100,00£

Declared Dormant company.

Like all forums and comments posted there are some factual points which are correct but most of the time 2+2=5 through guess work lack of knowledge and in some cases shear invention.

My role In this I was one of the investigators that helped put Viola into Special Administration having worked with in conjunction with the FCA enforcement team.

Duke some of your comments are factually incorrect certainly Walltor UAB and Snowy Pay legal teams will I am sure take offence to your comments as it was these 2 companies that forced the FCA’s hand into closing down Viola after finding their money had been stolen from their LHV and Transactive accounts.

For your information Walltor and Snowy Pay are 2 representatives out of 5 that have been appointed to the creditors committee that are responsible for helping the Administrators try and get some monies back for the creditors.

The article in the Times by James Hurley is convoluted with a mix of old news with comments from Interpath which have come from the creditors report and not directly form anyone there.

Again the press needed a story so created one with artistic license. However when the truth comes out this story is not even close to what has happened and the players involved.

Once published the FCA and the Payments Service Regulator will be held accountable to a level negligence unheard of.

Their failure in this matter to provide oversight and to regulate Viola Money to prevent what has happened is the worst I have ever seem. This case will cause massive changes I hope in the Law and the way fintech companies are allowed to be run.

Approx 30m!!! of clients money has been stolen not seized Duke by various means. There several main areas where fraud and misappropriation has taken place.

Omegapro and OMP Money is clearly a scam. they have used Viola Money, Avencia Digital and Script Asset management to launder funds through.

David Barclay and Anand are part of the key players in the UK and it was David Barclay that signed OMP Money of as an emd agent of Viola Money thereby creating a legitimate cover story for Omegapro’s story they had a UK Bank.

Thats one area of the Viola. The next issue is the real ownership of Viola Money.

Viola Money on paper was owned by Stephen John Davies 91% and 9% David Matthew Barclay. However the real owner was Mark Walter Cooling from Newark a current Bankrupt and convicted criminal with partner Mike Fields from Chesterfield/Dubai a known supplier of class A drugs.

Stephan John Davies is nothing more than a mobile Tyre fitter and was the main front for Cooling and Fields operation.

David Barclay was brought in as the Banking knowledge and was clearly involved in helping move the money around. Interestingly Mary Ann Townend is the Brother of Christopher John Hamilton wanted by the US for the Onecoin scam.

Again how did the FCA not pick up on this.

Michelle Hodges head of Payments at Viola is the sister of Mark Cooling the defacto owner of Viola Money.

I have shared this information most of which is in the public domain. However as there are a number of serious high level inquiries by UK and EU Police forces which I know once restrictions are lifted it will put Viola Money Scam/Crimes up there as the worse EMI theft/Money Laundering for Drugs and VAT in UK history.

People have the right to know the truth but at the same time there are people innocently involved and do not deserve reputation damage therefore Mr Moderator I will fact check because I dont want the responsible persons getting away.

The FCA and the Payments Service Regulator must be held accountable for this loss they had several opportunities to close this down and they failed.

Clearly lessons after the Wirecard theft were not learnt or were just ignored. Me I feel the later was the case as they were told in April May last year of client funds being co mingled.

How do you know Hamilton is wanted by US authorities?

Also do you know why there’s no outcome for Hamilton’s UK OneCoin laundering case?

Apoligies Mary Ann Townsend is his sister. I think there is sufficient information in the public domain about this without me commenting further in relation to the issue with onecoin.

As for his UK case I cannot comment as I believe there are reporting restrictions in place and not only that it is separate from what our investigating remit was.

I’d never heard of Christopher John Hamilton till I published this article. Doesn’t seem like anyone else had either.

There’s plenty of information available on OneCoin but not Christopher John Hamilton and OneCoin specifically.

Can you at least confirm the UK money laundering case is ongoing and that’s why there’s no outcome available?

I cannot comment on that.

Thanks.

@David Cope.

Good you are joining with some more details about all of this.

The shame is that Omegapro is still Scamming lot of people that are left alone because of missing information, or slow investigations.

Do you know how Omegapro is doing their money laundry now?

@ David Cope

When you are referring to Walltor UAB bankis it Wallter UAB described in the article bellow ? :

Bank of Lithuania imposed a fine of €280 thousand on Wallter UAB

lb.lt/en/news/bank-of-lithuania-imposed-a-fine-of-eu280-thousand-on-wallter-uab

My account is block since 1 year… can’t access and withdraw my BTC. Support don’t even answer me 😀

I had 0.09 btc, so I lost 0.27 BTC. I can say goodbye to my 0.09 btc starting funds.

@Nairod:

Are you in the US ? or Canada ? did Omegapro told you why our account is blocked ?

Recently Omegapro blocked the account of leaders because they were seen with the “competition” called Validus.

Omegapro seized all the money of the blocked accounts.

Yes lot of info from david cope is very very accurate. But missing few things about Christopher hamilton. Christopher was involved in onecoin scan with robert macdonald(anchester sleaford)

They launder money using company called mercury fx. But problem was they had lot of money to launder. So they opened a office in Hydrabad india. They invested 8 million in hydrabad. Ceo shahid tanveer and cto kumar pisipati(currently director in barclays) helped them launder money from one coin.

@David:

shahid tanveer ? the CEO of Viola Money india ?

linkedin.com/in/shahid-tanveer-3963a411/?originalSubdomain=in

And kumar pisipati from Barclays ?

linkedin.com/in/pisipati/?originalSubdomain=uk

According the recent communication from Omegapro, their trading is done by Barclays bank now. No more traders.

Is it a coincidence ?

Yes. Sahid tanveer is ceo in india.

Kumar pisipati

uk.linkedin.com/in/pisipati

Kumar made a deal with christopher hamilton. He will made him director in uk company that will help him get job in Barclays. He resigned after getting job.

Important thing is how easy it is to get a job in big financial institutions these days. They dont do any background checks at all.

find-and-update.company-information.service.gov.uk/company/12160774/filing-history

since Omegapro collapsed in nov 2022 and since we found out that part of the payment to Omegapro clients were coming from BTC wallets untouched since 2017, is there anything new with Viola money/ Oneocoin / omegapro ?