MoBrabus Ponzi scheme collapses, model is “fundamentally flawed”

Things aren’t going well for MoBrabus.

Things aren’t going well for MoBrabus.

In a video uploaded on September 4th, admin Pearse Donnelly acknowledges that alot of MoBrabus affiliates are “concerned” and “pissed off”.

[0:06] There’s no point in beating around the bush. Alot of you are fed up, annoyed (and) frustrated at how things have turned out with MoBrabus.

MoBrabus is an adcredit Ponzi scheme launched in early 2015. MoBrabus affiliates invested $5 in Ad Packs on the promise of a $6 ROI, paid out of subsequently invested funds. [Continue reading…]

MMM Zimbabwe slash withdrawal exchange, reopen frozen accounts

In an effort to stave off an inevitable collapse, MMM Global’s Zimbabwe chapter froze investor withdrawals a few weeks ago.

In an effort to stave off an inevitable collapse, MMM Global’s Zimbabwe chapter froze investor withdrawals a few weeks ago.

Deposits were still permitted, with the intention being to collect money without withdrawals draining the system and unfreeze existing accounts on September 15th.

That plan has now been cancelled, with MMM Global Zimbabwe prematurely unfreezing investor withdrawals.

Things are going so well in the System that there is no need in Mavro freezing any more.

There is however a catch… [Continue reading…]

Warrants and collection of evidence against Merrill was constitutional

![]() Unavailable at the time the order denying James Merrill’s supression motions was published, Judge Hillman’s accompanying memorandum has since surfaced.

Unavailable at the time the order denying James Merrill’s supression motions was published, Judge Hillman’s accompanying memorandum has since surfaced.

In the memorandum the reasoning behind Judge Hillman’s decision is explained. In great detail too I might add, with the memorandum coming in at a whopping twenty-five pages. [Continue reading…]

Paysera terminate Kairos Planet processing, warn customers

Over the past month or so Kairos Technologies has been coming up with excuse after excuse regarding non-payment to affiliates.

Over the past month or so Kairos Technologies has been coming up with excuse after excuse regarding non-payment to affiliates.

In addition to “technical problems”, “hackers” and “malicious users”, Kairos Planet also lost ePayments as a payment processor last month.

ePayments were promptly replaced by Paysera, a small Lithuanian payment processor.

Over the last 24 hours Paysera sent out a warning email to newly created accounts. Citing “independent research”, Paysera claim Kairos Technologies is an “illegal financial scheme (pyramid)”. [Continue reading…]

Penny Pays Review: Social network spam & recruitment

There is no information on the Penny Pays website indicating who owns or runs the business.

There is no information on the Penny Pays website indicating who owns or runs the business.

The Penny Pays website domain (“pennypays.com”) was registered on the 26th of July, 2016. Michael Dodd of MD Operations Corporation is listed as the owner, with a residential address in the US state of Tennessee also provided.

Michael Dodd (right) first appeared on BehindMLM as the owner of Penny Matrix back in 2012.

Michael Dodd (right) first appeared on BehindMLM as the owner of Penny Matrix back in 2012.

Penny Matrix was a $7 a month pyramid scheme attached to an ebook library.

In 2015 Dodd resurfaced with GoBig7, another $7 a month pyramid scheme that switched out ebooks for advertising.

Alexa statistics show a steady decline in traffic to the GoBig7 website from late 2015. This has likely prompted the launch of Penny Pays.

Read on for a full review of the Penny Pays MLM opportunity. [Continue reading…]

Nigerian SEC warns against MMM Global investment

Nigeria has a Securities and Exchange Commission? Who knew?

Nigeria has a Securities and Exchange Commission? Who knew?

Following the collapse of MMM Global, local chapters of the Ponzi scheme have been sweeping across Africa.

The South African and Zimbabwean chapters have already collapsed, however Nigeria is still chugging along.

In an effort to combat an “aggressive online media campaign” promoting the scam, the Nigerian SEC has issued a warning against MMM Global investment. [Continue reading…]

Eden Life Club Review: Daily Ponzi ROIs, recruitment & e-points

![]() Eden Life Club operate in the cryptocurrency MLM niche and on their website claim to be headquartered out of Kuala Lumpur in Malaysia.

Eden Life Club operate in the cryptocurrency MLM niche and on their website claim to be headquartered out of Kuala Lumpur in Malaysia.

Curiously, Eden Life Club provide a corporate address in Hong Kong in the footer of their website. No explanation is provided.

Heading up Eden Life Club is CEO ReyHew Yik Choong (right).

Heading up Eden Life Club is CEO ReyHew Yik Choong (right).

Possibly due to language barriers, I was unable to put together an MLM history on Choong.

Read on for a full review of the Eden Life Club MLM opportunity. [Continue reading…]

Mr. Movie Time Box Review: $219 purpose-built piracy boxes

![]() There is no information on the Mr. Movie Time Box website indicating who owns or runs the business.

There is no information on the Mr. Movie Time Box website indicating who owns or runs the business.

The Mr. Movie Time Box website domain (“mrmovietimebox.com”) was registered on the 16th of July, 2016.

Douglas Saferite is listed as the owner, with a residential address in the US state of North Dakota also provided.

Whether Mr. Movie Time Box is actually run out of North Dakota is unclear. Two corporate addresses in Texas and California are provided on the Mr. Movie Time Box website.

The Mr. Movie Time Box Terms and Conditions state the company is ‘a division of D & G Marketing‘.

This Agreement shall be governed, construed, and enforced in accordance with the laws of the State of Texas, without regard to its conflict of laws rules.

Douglas Saferite (or his father) has a history of involvement with HYIP schemes dating back to 2005.

In 2012 Saferite was credited as the programmer for The Mobius Loop, a now defunct $10 a pop recruitment scheme.

Read on for a full review of the Mr. Movie Time Box MLM opportunity. [Continue reading…]

Pearse Donnelly (MoBrabus) threatens BehindMLM with “negative SEO”

Today’s slice of life in the MLM underbelly is brought to you by Pearse Donnelly.

Today’s slice of life in the MLM underbelly is brought to you by Pearse Donnelly.

Donnelly is the admin behind MoBrabus, an adpack Ponzi scheme launched early last year.

When MoBrabus began to slow down a few months ago, Traffic Powerline was announced.

Instead of adpacks, Traffic Powerline’s investments are attached to “traffic packs”. The flow of funds within Traffic Powerline however is the same: new affiliates invest and those funds are used to pay off existing investors.

Symptomatic of Traffic Powerline’s launch perhaps not going as well as envisioned, last night I received an email from Donnelly himself. [Continue reading…]

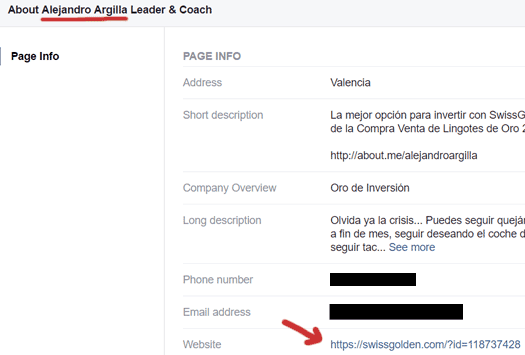

Eagle Aurum Team Review: Gold-based matrix cycler Ponzi

The Eagle Aurum website identifies Alejandro R. Argilla as CEO and President of the company.

The Eagle Aurum website identifies Alejandro R. Argilla as CEO and President of the company.

No corporate address is provided on the Eagle Aurum website, however the company appears to be based out of Spain.

Update October 5th 2016 – Eagle Aurum Team now provide an address in Valencia, Spain on their website. /end update

The Eagle Aurum website domain was registered on the 15th of June, 2016. Eagle Aurum Company is listed as the owner, with an address in Valencia, Spain also provided.

On Alejandro Argilla’s Facebook profile an affiliate link for SwissGolden appears:

Under the guise of selling gold, SwissGolden was a matrix Ponzi cycler launched in 2014.

Read on for a full review of the Eagle Aurum MLM opportunity. [Continue reading…]