Goldy Capital Review: 3% a day Boris CEO Ponzi scheme

![]() Goldy Capital has a bit of a branding problem. The company markets itself as Goldy Capital but its website is branded based on the company’s domain “goldy.cc”.

Goldy Capital has a bit of a branding problem. The company markets itself as Goldy Capital but its website is branded based on the company’s domain “goldy.cc”.

I’ve gone with Goldy Capital, as that’s what how the company refers to itself in its marketing material.

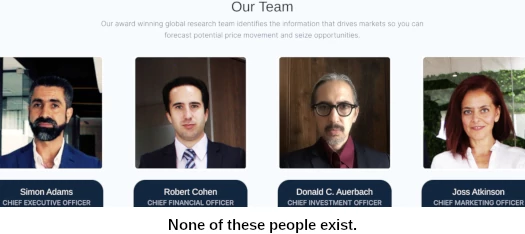

Goldy Capital provides no verifiable information about who owns or runs the company on its website.

A series of actors with Anglo-Saxon names are featured, however none of these people actually exist.

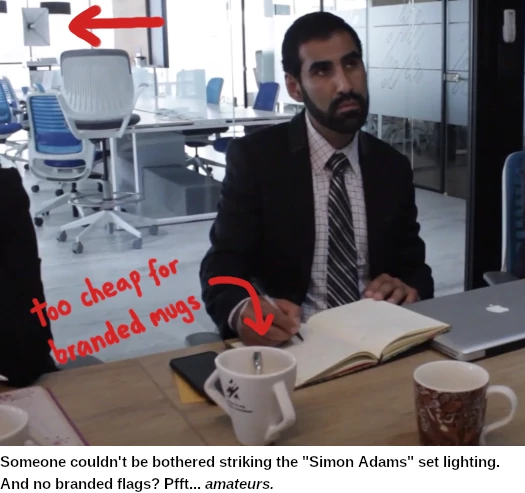

In the one marketing video hosted on Goldy Capital’s official YouTube channel, the actor playing Simon Adams is dubbed over.

This is typically done by scammers to mask non-native English speaking actors’ actual voices.

The video itself is your typical Boris CEO production with a rented office and branded props.

Of note are other actors in the video appearing as executives on Goldy Capital’s website.

Several shots of the actors show them introducing themselves, but the audio has been replaced by the Simon Adams dub.

Evidently Goldy Capital’s owner(s) couldn’t be bothered springing for additional voiceovers.

In an attempt to appear legitimate, Goldy Capital provides a UK incorporation certificate for Goldy Capital INT LTD.

An MLM company operating or claiming to operate out of the UK is a red flag.

UK incorporation is dirt cheap and effectively unregulated. On top of that the FCA, the UK’s top financial regulator, do not actively regulate MLM related securities fraud.

As a result the UK is a favored jurisdiction for scammers looking to incorporate, operate and promote fraudulent companies.

For the purpose of MLM due-diligence, incorporation in the UK or registration with the FCA is meaningless.

Boris CEO schemes are typically the work of Ukrainian/Russian scammers. That said, Alexa ranks India as the sole source of traffic to Goldy Capital’s website (100%). Goldy Capital’s official FaceBook page is also adminned from India.

Together traffic and the FaceBook page confirm whoever is running Goldy Capital is based out of India.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Eyal Avramovich fronts angry Mining City investors in webinar

It’s not hard. “Recruitment slowed down. We ran out of money and unless you go out and lure new suckers in, we can’t pay you.”

It’s not hard. “Recruitment slowed down. We ran out of money and unless you go out and lure new suckers in, we can’t pay you.”

Despite dragging Mining City through multiple exit-scams, owner Eyal Avramovich refuses to admit his Ponzi scheme has collapsed.

Investors continue to be left hanging, with future withdrawals the ever perpetually dangled carrot.

A few weeks back Avramovich held a webinar to address the collapsed state of Mining City.

Naturally it went down like a ton of bricks. [Continue reading…]

Monarch Review: United token Ponzi from serial crypto scammer

Monarch’s homepage is rather vague:

Monarch’s homepage is rather vague:

Monarch is totally free to join and allows you to start earning weekly income without any downside.

Further down the page we get a little more information:

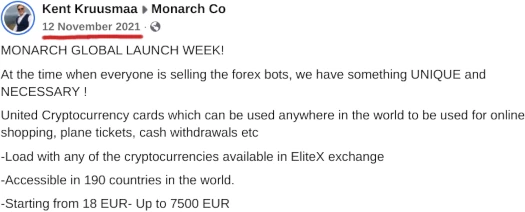

Monarch OÜ was founded in 2020 October by Kent Kruusmaa in Estonia.

Company Monarch is an official distributor of United Crypto cards and all of the United Solutions ecosystem products now and in the future.

Ken Kruusmaa describes himself as a “crypto expert & investor”.

As per Kruusma’s LinkedIn profile, he started off his professional career in 2011 as CEO of cleaning company.

In 2015 he joined the Wellstar pyramid scheme. After Wellstar Kruusmaa migrated to cryptocurrency fraud with the notorious OneCoin Ponzi scheme.

Kruusmaa was part of the Igor Alberts downline that migrated to DagCoin after OneCoin collapsed in early 2017.

Through the DagCoin Ponzi and its attached Success Factory marketing arm, Kruusmaa was clocked earning €140,000 EUR a month.

That didn’t last and later that year Kruusmaa signed on as Head of Marketing at United Token.

Today Kruusmaa is cited as founder and CEO of United Token on the company’s website.

The founder of the United is Kent Kruusmaa from Estonia.

By today Kent is the Founder/Co-founder of EliteX Exchange, Ex Utility Token, Ucube Crowdfunding platform, Monarch and U-land marketplace.

Ucube and U-land I’ve never heard of but I personally made note of EliteX last November;

Wanted to make a note of a Ponzi scheme being run through Erik Nurm’s Coinswap Space scam platform.

EliteX Exchange is being run by Kent Kruusmaa, a former OneCoin and DagCoin Ponzi scammer.

Usual crypto shitcoin bullshit: invest in ex token and get 250% staking or 240% if you “farm” with CoinSwap Space’s own css shit token.

Referral commissions aren’t MLM, you get 5 USDT per affiliate investor you recruit.

Eirk Nurm is one of the scammers behind the TronCase Ponzi scheme. After TronCase collapsed he went on to launch his CoinSwap Space blockchain bro factory.

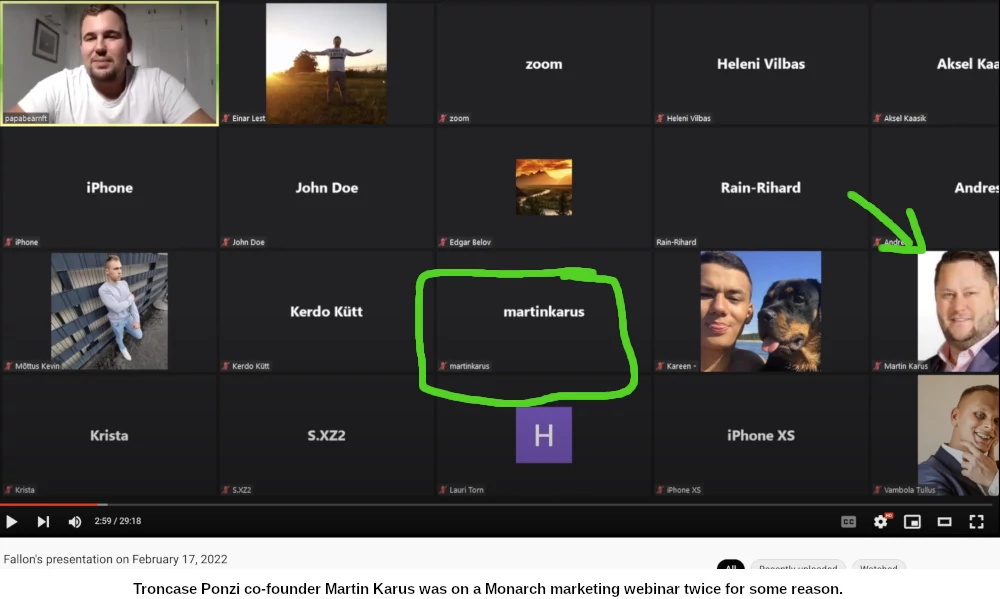

Erik Nurm’s Troncase partner in crime was Martin Karus. Karus popped up on a Monarch webinar hosted by promoter Fallon Neeme last month (click to enlarge):

Unofficially it appears the Troncase scammers Nurm and Karus are both working with Kruusmaa.

Kaaruusma is building his own crypto fraud factory through Nurm’s CoinSpace Space platform. The latest addition of which is Monarch.

Monarch was officially launched last November, around the time EliteX popped up:

Read on for a full review of Monarch’s MLM opportunity. [Continue reading…]

Antoun Toubia’s Swedish Trust Ponzi reboot isn’t going so well…

After United Capital Investments (later UCI Global) collapsed in 2020, owner Antoun Toubia returned with The Swedish Trust in 2021.

After United Capital Investments (later UCI Global) collapsed in 2020, owner Antoun Toubia returned with The Swedish Trust in 2021.

As reported by BehindMLM reader Hester in March 2021;

This company still making promises with no return.

UCI name now changed to Swedish Trust.

There are 4 pools of money going on for 2 years, nothing has been payed out and still people are paying UCI money.. WTF?

I had a brief look into The Swedish Trust, noted there wasn’t anything MLM related and moved on.

It’s since emerged that The Swedish Trust is in fact a continuation of the investment fraud started with UCI Global.

As of late 2021 Toubia (right) is believed to be sitting on millions of euros invested between UCI Global and The Swedish Trust.

Following a collapse on or around mid 2021, Toubia resurfed in late 2021 to smooth things over with investors.

The following it taken from a The Swedish Trust Zoom call held last October. [Continue reading…]

Crowd1 pays off Emerge Gaming for Miggster Ponzi partnership

![]() Crowd1 has “purchased” Miggster off Ponzi collaborator Emerge Gaming.

Crowd1 has “purchased” Miggster off Ponzi collaborator Emerge Gaming.

As per an agreement reached in early March, Nibiru e-Gaming AB will acquire Miggster for $5 million AUD (~$3.75 million USD). [Continue reading…]

IPCapital escalates exit-scam by firing themselves

![]() The scammers behind Intelligence Prime Capital have escalated their exit-scam… by firing themselves from the company. [Continue reading…]

The scammers behind Intelligence Prime Capital have escalated their exit-scam… by firing themselves from the company. [Continue reading…]

Crypto Crown Review: $550 crypto trading securities fraud

Crypto Crown provides no information on its website about who owns or runs the company.

Crypto Crown provides no information on its website about who owns or runs the company.

Crypto Crown’s website domain (“cryptocrown.vip”), was privately registered on December 20th, 2021.

As per Crypto Crown’s website Terms and Conditions, the company identifies itself as

Crypto Crown Inc. (the “Corporation”), a Canadian Corporation regulated by the Canada Business Corporations Act.

The corporate address provided belongs to a UPS store in Ontario.

A search for Crypto Crown Inc. does in fact reveal a registered Canadian incorporation.

Basic incorporation is typically meaningless for MLM due-diligence, but it does give us the names Eric and Stephanie Madsen.

Although it’s not linked from its website, Crypto Crown has an official YouTube channel.

On that channel you’ll find various corporate presentations, hosted by Crypto Crown co-owner Andrew Montague.

Montague introduces Crypto Crown’s other co-owner as someone else Madsen. I can’t quite make it out but it’s definitely not Eric or Stephanie (Jens Madsen?).

Whoever it is they speak later in the video and are male.

I wasn’t able to find anything on Andrew Montague with respect to Crypto Crown. This raises the question whether Andrew Montague is an alias too.

I also wasn’t able to find anything further on the Madsens. When combined with the UPS virtual address, this raises red flags in and of itself.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

GSPartners holding US Lydian World Ponzi event in Georgia

GSPartners has announced a US Ponzi promotional event.

GSPartners has announced a US Ponzi promotional event.

Josip Heit is scheduled to attend the April event, held in the hometown of GSPartners’ top US promoter. [Continue reading…]

IM Mastery Academy affiliate leaders arrested in Spain

![]() Eight IM Mastery Academy affiliates have been arrested in Spain.

Eight IM Mastery Academy affiliates have been arrested in Spain.

Spanish authorities have charged the affiliates for promoting a pyramid scheme. [Continue reading…]

BBC Global Review: BBC token 200% ROI Ponzi scheme

BBC Global provides no company ownership or executive information on its website.

BBC Global provides no company ownership or executive information on its website.

At time of publication a visit to BBC Global’s website reveals it’s “by invitation only”. The website itself is a marketing page limited to login and registration options.

BBC Global’s website domain (“mybbcglobal.io”), was privately registered on January 23rd, 2022.

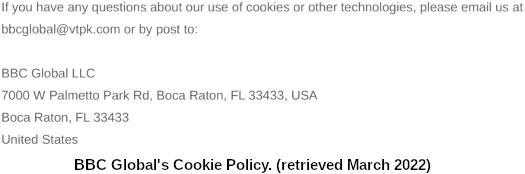

BBC Global’s website Cookie Policy provides us with the following information:

The Florida address belongs to a virtual office provider and by itself isn’t important. What’s of interest is the email address, specifically the domain.

“Vtkp.com” is registered with a Florida address. The registration was last updated in 2018 and appears to have had the same owner for some time.

As a website domain “vtkp.com” has been defunct for years. So who’s using for an email server?

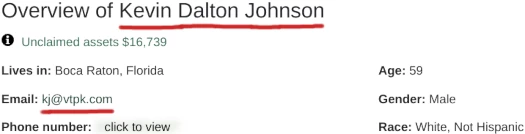

We get a full name from the Florida Residents Directory:

In 2019 Armen A. Temurian tied Kevin Dalton Johnson to Travelada. Travelada was a travel themed pyramid scheme with an attached TACP package investment opportunity.

Temurian was behind the collapsed Vista Network Ponzi scheme. He sued Dalton and other defendants in 2019 alleging, among other things, extortion.

Dalton and his fellow co-defendants counter-sued. Temurian’s lawsuit was voluntarily dismissed in 2020. The counter-claim lawsuit is still playing out.

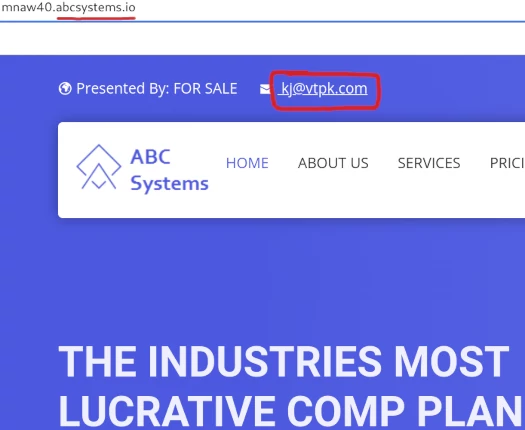

Temurian also tied Dalton to the ABC Systems Ponzi scheme in 2019.

I was able to independently verify this through Dalton’s “vtpk” email address:

Kevin Dalton Johnson is a resident of Florida. Virtual office addresses aside, it follows thus that BBC Global also operates out of Florida.

Alexa currently ranks India as the only notable source of traffic to BBC Global’s website (37%).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]