Antoun Toubia’s Swedish Trust Ponzi reboot isn’t going so well…

After United Capital Investments (later UCI Global) collapsed in 2020, owner Antoun Toubia returned with The Swedish Trust in 2021.

After United Capital Investments (later UCI Global) collapsed in 2020, owner Antoun Toubia returned with The Swedish Trust in 2021.

As reported by BehindMLM reader Hester in March 2021;

This company still making promises with no return.

UCI name now changed to Swedish Trust.

There are 4 pools of money going on for 2 years, nothing has been payed out and still people are paying UCI money.. WTF?

I had a brief look into The Swedish Trust, noted there wasn’t anything MLM related and moved on.

It’s since emerged that The Swedish Trust is in fact a continuation of the investment fraud started with UCI Global.

As of late 2021 Toubia (right) is believed to be sitting on millions of euros invested between UCI Global and The Swedish Trust.

Following a collapse on or around mid 2021, Toubia resurfed in late 2021 to smooth things over with investors.

The following it taken from a The Swedish Trust Zoom call held last October.

Toubia opened up the call by claiming he was sick and that surgery was the reason he disappeared.

I’m not the guy you know before the operation, before we stop the Zoom call(s) anymore.

I have gone through surgery and that changed my life so much.

Toubia goes on to blame the collapse of The Swedish Trust on COVID-19 and “family issues”. He claims things got so bad one of his team members contemplated committing suicide.

I’m not really 100% on what happened. Supposedly Toubia dumped a bunch of investor funds to some guy going by Christian Fortune (aka Chris Fortune).

I’m not sure this person actually exists.

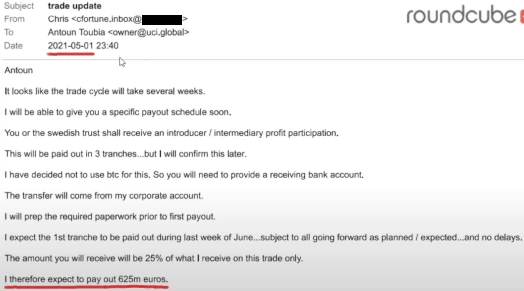

Anyway, Fortune was tasked with generating returns through trading. Citing an alleged email between himself and Christian, Toubia represents Fortune’s trading activity generated some €625 million euros to be “paid out”.

This was May 2021 and to date the payout hasn’t happened.

As you know, we have been struggling with receiving the money from the person that we invested into. Which is, his name is Christian Fortune.

He was my partner for over ten years. We have done many projects together.

Anyway for unknown reason(s), at least until this moment, we don’t know why Christian Fortune (is) still holding up to the money.

Evidently fine with writing off the loss, Toubia claims he’s moved on.

I am here today to open a new page with everyone and to put the stones which will build a new fundament and will build a better business for us. For everyone, for you especially.

And to correct all the mistakes that we have done in the past.

I take full responsibility of course, of everything that happened and all the delays. Because it was my decision to trust specific people.

We are not here to discuss this. I am here to assure you that your investment, your profit from the pools … they are protected. They are guaranteed to happen. I’m going to make that happen.

It doesn’t matter if I got scammed. If I got cheated. If I got lied to, it doesn’t matter. I’m putting that all behind.

And today, I’m going to show you our new strategy. Our plan.

Toubia goes on to “take full responsibility” by blaming the Swedish government for The Swedish Trust’s collapse;

There was some rumors that uh, that I am not saying the truth and I created some bull- y’know some story that “Yeah I cannot register you”.

I have no intention not to register you as limited partners in Sweden. I have very good intention to make you full partners with the Swedish Trust and I still have this intention.

But unfortunately the Swedish government is not ready … to register more than forty limited partners in a trust company in Sweden.

So I found a solution…

That solution?

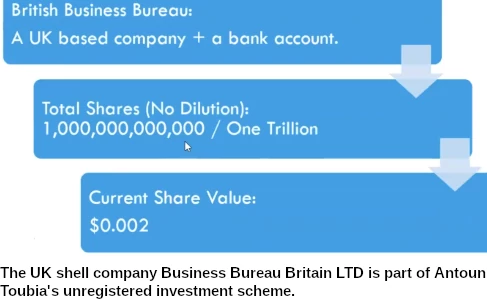

Creating a UK shell company called British Business Bureau. Business Bureau Britain LTD was incorporated on February 17th, 2022.

Toubia is listed as the sole Director of the company, through a virtual office address in London. Toubia’s stated country of residence is Georgia.

UK shell company incorporation is readily associated with fraud and is effectively unregulated.

To that end Toubia incorporated Business Bureau Britain LTD with a $2 billion USD statement of capital.

Obviously that’s based on baloney but, like I said, the basic UK is unregulated. You can input any Mickey Mouse data and the UK government will happily rubber-stamp it.

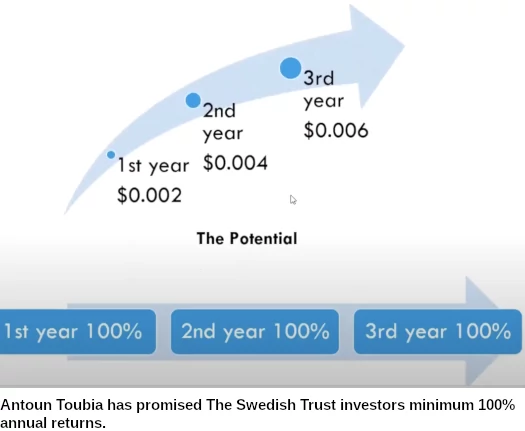

Based on this entirely fictional statement of capital, Toubia intends to set his fraudulent investment scheme up is by issuing Business Bureau Britain shares:

So it is less than one cent per share in the company. So imagine how many shares you will be having for your investment, profit and whatever.

Of course I’m not asking you to put any money in. We’re just converting your X amount of money that we already owe you into the shares.

This is clearly a securities offering:

The potential of these shares to grow… it is very big potential and we expect a minimum growth of 100% every year. This is the worst case scenario.

Naturally neither Business Bureau Britain or Toubia are registered with the FCA.

So where’s all the money going to come from?

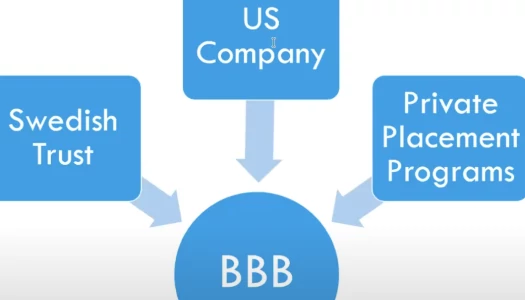

The same non-existent ventures Toubia trotted out when he launched The Swedish Trust.

Interestingly enough there’s now a US component woven into the fraudulent investment scheme:

We created a US company. This is… I cannot provide you details of the US company yet, because this is the early stage.

The US company is already registered. At the moment we are just waiting for the EIN number. It will take twenty to thirty days to have that number ready.

After that we have been promised by our law company in the United States, guaranteed, that we will get a bank account for that company.

Now, why we created a US company?

This company, by the maximum middle of January will be ready with a full bank account. After that we are going to the SEC, Security Exchange Commission. We are going to file an application with them to allow us to raise money from the US market.

I don’t have a company name but Toubia does mention it’s a Wyoming incorporation.

I ran a search through the SEC’s Edgar database for Antoun Toubia. Nothing came up.

In any event a lot more needs to be done before Toubia could legally solicit investment for The Swedish Trust in the US. For starters that entity, the UK shell company and Toubia himself would need to register with the SEC.

Setting up a shell company by itself isn’t sufficient.

Next Toubia would need to file audited financial reports, specifically detailing his investment opportunity and business operations (plans to generate external revenue).

Money is going to flow into the company. There’s no question about that.

Of course lots of people will take the offer and say, “OK Anton, you owe me… I invested $500, you owe me what, $50,000? Give it to me”.

Here’s your share, thank you bye bye.

Seeing as Toubia hasn’t bothered register his investment scheme in the UK with the FCA, it’s unlikely this will be followed through in the US.

Failure to do this constitutes securities fraud.

Toubia claims he was offering investors refunds but that is off the table as of October 2021.

So now we have a company with trapped investors who, to date, are waiting on promised returns to materialize.

Exactly how much Toubia pocketed between United Capital Investments, UCI Global and The Swedish Trust is unclear.

What should be clear is, as we enter the sixth year since the original United Capital Investments website domain was registered, is that the only person who’s made any money here in Antoun Toubia.

BehindMLM’s interest in Toubia’s current investment fraud extends as far as there are UCI Global victims in The Swedish Trust. We’ll keep an eye out for any updates.

Update 29th September 2023 – Antoun Toubia is still defrauding Swedish Trust victims.

In a Telegram message sent out on September 18th, Toubia solicited Swedish Trust victims on

an exclusive investment opportunity that promises to double your money within just 38 days, with an additional 5 days for processing.

This opportunity comes with a guaranteed return, and we’re inviting you to participate with a minimum investment of 2,000 USDT (TRC20).

Neither Swedish Trust or Toubia are registered to offer securities in any jurisdiction.

The person who made this review/accusations really has no idea of what is going on…. Violating the legal disclaimer by posting this information here will lead to lawsuit.

I urge BehindMLM to remove this article immediately. As an investor in a legal Swedish company i will personally file a complaint against BehindMLM to post this information if removal has not taken place in 72 hours.

Can confirm, won’t be removing anything.

Imagine trying to hold a third-party to your silly Ponzi disclaimer. Mary Kay, albeit not a Ponzi scheme, tried that last week. Didn’t work out too well for them.

Scammers who commit securities fraud (“legal Swedish company”, lulz), and have a long list of disgruntled victims behind them don’t file lawsuits. Last thing they want is the DOJ/SEC snooping around.

(Ozedit: derails and butthurt removed)

The Swedish Trust is legal. There is no need to place such untruthful misinformation.

Name one jurisdiction The Swedish Trust solicits investment in, has registered with financial regulators in and has filed audited reports in.

I’ll wait…

We are not allowed to share this info although it’s there.

Thank you for confirming The Swedish Trust isn’t registered to offer securities in any jurisdiction.

Sorry for your loss.

I have to wondere if Antoun Toubia and Ash Mufareh are related. Same M.O. and same BS promises of great things to come with zero results.

Same mindset of cult followers. Makes you wonder which one was first with this idea and which one is the copycat.

But if the reivew is not taken down in 72 hours or a lawsuit will be filed….PRICELESS!

Ponzi pimping 101 mantra. Come on Pnnzi pimps, at least try to be original. Oh wait, being original is not in the Ponzi pimp playbook.

At least Investorxxx didn’t claim a lawsuit for “criminal defamation” would be filed if you didn’t Oz. Dodged a bullet there! ROFLOL!

toubia, assisted by his right hand ‘man’ erik mollink, is a Big time Fraudster & Scammer!!

$US11M+ has been contributed by Investors into this Sham operation!

Sweden do not legally recognise trusts in the way toubia is promoting this Sham operation!

Investors entered this Sham opportunity on Agreement toubia would pay out in cash. Without getting Investors approval, toubia illegally changed proposed payout to intially his Shit crypto coins then shares in his Shit company! Only winner from this arrangement is toubia! He will receive Investors cash payouts for himself, giving them worthless company shares where he is the only potential buyer!

toubia has no ability to deliver investment returns as he claims! Late last year, showed Investors email from 2 ex business partners he claimed were going to arrange the next trade. 1 of those ex partners seperately confirmed they ended their involvement in those sorts of trades 2.5+ years ago! Also, as those ex partners haven’t been in contact with him for 2.5+ years, toubia doctored the 2021 email date shown to Investors!

toubia had another fraudulent scheme mid 2021, when he sold company profit share ‘partnerships’ to Investors. Some of them paid up to $US100k for their partnership. As stated above, toubia has no ability to trade as he claims. No trade means no company income/profit which means Investors will not receive any return on their partnerships in the forseeable future!!

British entity isn’t required – toubia has no idea what he’s doing!

Above investment allocation is bullshit!

Last December, Fortune invited him to reveal the truth of this Sham operation via Court/legal channels. Being a serial liar, toubia declined thar invitation – truth will not be on toubia’s side!

toubia is threatening to Investors he will close down his operation because of this bad publicity. toubia has low iq & ‘wings it’ on a daily basis ie. without any long term planning skills, all his businesses have been failures! toubia takes next to no responsibility for his business failures – always blames others!

About half of the investors ‘woke up’ months ago that toubia is full of shit. Unfortunately, the other half still believe in his rubbish claims – they continue to be ‘strung along’ by this con!

toubia (and maybe mollink) should be in prison for multiple frauds!!

Thank you for confirming you (and your alter ego “investorXXX”) are full of s*it.

Such a funny game often played by scammers: “We have important info to persuade public audience about our legality (success, profits made, whatever…)… but for obvious (sic!) reasons, we cannot/will not share it with public.”

Great!

As Bank of Georgia globally recorded toubia as a suspected money launderer in January 2020, his Australian & Georgian bank accounts were immediately closed & he has been unsuccessful since with opening a new account in any Country!!

Because of his global record, toubia can’t even open a most basic/elementary account in any lowest rated bank. toubia even confirmed to Investors he was investigated in 2020 for laundering billions!

toubia’s claim his entity is legal in & regulated in Sweden, while technically correct, is a ‘joke’.

Sweden is the easiest country to register a business – like toubia, person does not even have to visit the country for the registration. Sweden’s application process was limited to only sending toubia an anti-money laundering document to sign & checking he has no criminal record in the country – from then on, there is no regulation by Sweden of toubia’s entity!

toubia could charge 27% transaction fee and every Swedish regulator would respond “Nothing we can do for you, we have no regulation jurisdiction here” to all Investors’ complaints!

Sweden do not care about the business applicant’s criminal record outside of their country. Assuming bernie madoff had no Swedish criminal record, he could have successfully registered a business in the country while he was in US prison for his ponzi scheme!

Sweden has no interest in toubia’s confession he was recently investigated for laundering billions.

toubia’s British entity isn’t required. He claims it is because Sweden require all Investors to sign their anti-money laundering document and cap the number of people allowed in their limited partnerships.

toubia’s ‘solution’ is to get the British entity’s director to sign the document on the Investors’ behalf. Sweden’s Ministry of Finance has confirmed toubia’s Investors ‘signing’ claim isn’t true and their limited partnerships have no persons number cap!!

So, toubia’s British entity is yet another of his delay tactics &/or yet another confirmation he has no idea what is doing!!

Above investment allocation is bullshit. The only ‘asset’ in toubia’s business is the Investors contributions he hasn’t spent on his lifestyle yet!

mollink & toubia operated another fraudulent scheme by requesting 1,000 Investors to pay $2.5k each by March 15 2021 to cover costs of a non-existent independent ‘account registration’ company.

toubia claimed he contracted this company to upload Investors accounts into his entity. In reality, this contractor never existed – mollink uploaded Investors accounts!

toubia illegally claimed Investors who did not make the $2.5k payments by March 15 forfeited their trading profits & would merely receive a refund of their contribution after trade matures.

As about 500 of the Investors are non-account paying, in theory, this fraudulent scheme will result in toubia retaining for himself $300+M trading profits of those Investors!!

toubia also claimed part of his deal with the account registration company was they would secure a bank account for him and, if they failed to do so, would refund the $2.5k fees.

A year later, no bank account has been secured and no refunds even mentioned again – let alone processed – by toubia! By giving the impression Investors had nothing to lose, toubia made up this claim at the time to Scam these fees from the Investors!

toubia has regularly violated international investments law! Investors entered this Sham opportunity on agreement toubia would pay out in cash – very simple.

After the investments commenced & supposedly matured, toubia changed this agreement a number of times – as outlined above – without the Investors’ approval! Investors contractually entered this investment on agreement payouts will be in liquid cash – not very non-liquid crypto or shares of toubia’s own company!

By uploading Investors as limited partners, toubia has effectively destroyed the swedish trust!! This type of bank trading is supposed to be an exclusive one-to-one relationship i.e. one wealthy business/person makes a deposit to the Bank’s Trading Desk who return, upon maturity, trading profits to same business/person.

By uploading all Investors into his entity, toubia is highlighting to potential Bank Trading Desks his business is a crowdfunded undesirable many-to-one relationship!! No Bank Trading Desk will do business with the swedish trust!

toubia claimed to Investors his 2 ex business partners are going to provide a $US25m marketing budget to his business. 1 of those ex partners seperately confirmed his claim is not true.

From the 2 hours & 9 minutes mark of youtube.com/watch?v=R1lyZyXeHks , toubia shows an email from his 2 ex business partners claiming they will facilitate pool 5. 1 of those ex partners seperately confirmed they ended their involvement in those sorts of trades 2.5+ years ago!

Also, as those ex partners haven’t been in contact with him for 2.5+ years, toubia doctored the 2021 email date shown to Investors! If you are interested in seeing the proof, email me at truthteller4u2day@gmail.com

So, toubia collecting about $US100k for pool 5 from Investors – when he knows he has no ability to invest them as he claims – is another of his frauds!

‘Awake’ Investors need to lodge complaints against toubia with the Authorities &/or Police in their Country 🙂

As the above video description states “What happened to all the millions of dollars? Where did the money go? Was there a real investment? Who is responsible? What happened to investors money?”

Each Investor should not be thinking along the lines of “I only put $900 into this scheme – move on, no big deal I lost it”! Every awake Investor should be thinking “toubia received $US11m, 12m, 13m… from this scheme.

If I do nothing/just move on, I’m encouraging toubia to repeat this Scam with a new bunch of Victims at a later date”.

Do the right thing – contribute to toubia (and maybe mollink) being imprisoned for multiple frauds 🙂 🙂

By the way the swedish trust is a registered and regulated entity in sweden, anyone can find the information publicly online on swedish government website (ozedit: derails removed)

i am not a supporter of toubia or whatever, but i do my own research. And what i read here is nonsense. DR.Toubia has delivered many projects before and anyone can find that info online, its not a crime to fail 4 out of 10. (Ozedit: derails removed)

Why is the blockheads that claim to have dOnE tHeIr OwN rEsEaRcH know bugger all about securities regulation?

THe Swedish Trust isn’t registered to offer securities in Sweden or anywhere else on the planet.

Cool. That doesn’t legalize running Ponzi schemes since United Capital Investments.

Yeah obviously :rolleyes:

“the swedish trust is registered in sweden” only means toubia does not have criminal record in sweden! If he has criminal record in any other country, sweden do not care!

“the swedish trust is regulated entity in sweden” is not true – read above!

“DR.Toubia has delivered many projects before and anyone can find that info online”, be our guest to show just 1 of toubia’s previous successful businesses – many people have searched online for such & found nothing!

(toubia’s claim he has phd in finance is yet another of his lies!)

It is a crime to commit fraud, as toubia has done several times in his latest Sham – read above! Simple research enquiries to experts, like Sweden’s Ministry of Finance, confirm his frauds & lies!

Everyone knows that a trust does not need any registration to sell securities, as The Swedish Trust is a licensed and regulated company in Sweden.

it does create Trust Deeds and do wealth management which is very legal, anyone claiming other than that, does not know anything about a swedish trust company.

When you attack or defame anyone, be realistic and full of facts, not just write something that is not related.

Creating trust deeds is not a securitu nor does need any registration, most of countries even legalize a trust vocally, as there is no need to even document it.

Registered with who? Even if The Swedish Trust was registered with Finansinspektionen and filing audited financial reports (they aren’t), that only applies to Sweden.

Quite obviously the Swedish Trust has no ties to Sweden beyond a shell company and isn’t actively soliciting investment there.

Please, if you have no understanding of what securities offering is and securities regulation itself, sit down.

I don’t mind explaining things to people but…

That just makes you look stupid.

“the swedish trust is regulated company in sweden” is not true – read above!

To see written Finansinspektionen confirmation, email me at (removed)

Sweden do not legally recognise trusts in the way toubia is promoting this Sham operation!

To see written Swedish Ministry of Finance confirmation, email me at (removed)

When you try to defend fraudsters & scammers, be full of facts by researching Swedish Authorities first!!

If you want to share correspondence suggest editing out sensitive info and uploading as image somewhere.

The twists and turns of scammers.

Dr? Antoun Toubia lays all the scamming on the shoulders of the illusive Christine Fortune and others.

In a statement posted by Dr? Antoun Toubia on his twitter page 11th May 2022, he claims he was and is the victim of multiple frauds, including PPP and that his name and business is being slandered. WOW…no swearing please…

The twitter link takes you to Antoun Toubia medium.com

Having seen how Toubia reacted to BehindMLM correctly identifying United Capital Investments as a Ponzi scheme (publishing a load of baloney on Medium), I’m not inclined to take anything from Toubia’s Medium account at face value.

I don’t know Christian Fortune. He might have handed Toubia a shovel but he dug himself into the Ponzi hole he now finds himself in.

This is just the “a bigger boy did it and ran away” exit scam. Closely related to the “hackers!” exit scam.

As with “hackers!” it gives the scammer a false shared victim status with the scammer’s victims.

Plus it gives them a pretext to milk them for more money in a recovery fraud, to “sue the bigger boy”.

If he only exists in Toubia’s blog posts, Christian Fortune should be considered imaginary until proven otherwise.

I mean, “Christian Fortune”? Might as well have called him “Rich Virtue” or “Niceguy Loadsamoney”.

After putting the thumbs up on someone offering condolences to Nadine who passed away, I was accused of being the Truth Teller and removed from Discord.

I am so disgusted with the whole show that I have deleted everything to do with it from my computer.

May the ST and it’s CEO rot in hell the dirty piece of dogs dropping, I wipe you all from my boots like the dirt that you are. Not a fan now.

Maltusian,

toubia is well into his ‘shared victim status with the scammer’s victims…pretext to milk them for more money in a recovery’ fraud!

– last 1 december, christian fortune invited toubia to confront him in court/legally. Because he doesn’t want the truth revealed to Investors, toubia wimped out.

So, I offered to confront fortune on Investors’ behalf – constantly throughout December, tried to get very simple answers from him to do so.

As always does, he responded in riddles/would not give straight answers. After a full month of trying, he never provided the very simple answers to be able to confront fortune!

That nobody has confronted fortune is 100% toubia’s fault As toubia doesn’t want the truth revealed to Investors, he will try to talk a big game but never follow through.

– a few months ago, claimed he had an amazing “guaranteed” trade opportunity with the Central Bank of Lebanon. toubia went silent on this Scam, when a few Investors kicked back “Why would we want to invest in such a huge risk economy? Practically guaranteed to lose our money!!”

– of course without any proof, claims has raised $3.5M of the required $5M for another trade. Claims he has $100M+ investors “lining up” to be in his next trade.

Trying to Scam the required $1.5M from ‘mom & dad’ Investors! Refuses to answer why his $100M+ investors will not fund the mere $1.5M shortfall to get the trade started – because these wealthy investors do not exist!

toubia has had at least 3 other ‘recovery’ Scams in the last 6 months! It’s a challenge to keep up with him, when toubia spends about 4 hours a day inventing BS!

Stephen,

Congratulations on seeing the truth about hard core narcissist toubia who has Scammed $US15M+ through this scheme!! May he eventually rot in prison for several years.

You can recognize deep narcissists by the following behavior patterns: When they are challenged, they have no defense – nothing internal to soothe them or validate their worth.

They react with great rage, thirsting for vengeance, full of a sense of righteousness – this is the only way they know how to assuage their insecurities.

They will position themselves as the wounded victim, confusing others & even drawing sympathy.

They are prickly & oversensitive – almost everything is taken personally.

They can become paranoid, having perceived enemies in all directions to point to. They see others as instruments for their attention & validation – their desire is to control them.

toubia to a t.

Note to anyone from the Swedish Trust who comes here to read the dark side, I write in my own name, not the Truth Teller as I was accused of being, What Antoun did to me was despicable and showed me that he is a man of no character and no depth.

A thumbs up emoji to acknowledge someone offering condolences. I won’t apologize for that, not to this creepy man who has stolen everyone’s money and not to anyone.

I am totally disgusted in his behavior and his willingness to abandon me after I had given him so much money and so much support. He is a true scammer…beware.

100% BSer toubia has some new claims:

– a “serious investor” has committed to invest the outstanding $1.5M of the required $5M for another trade. As always, con toubia is not providing any proof!

– “this will be followed with an investment of 50 million a few weeks later”. Serial liar toubia forgot he previously claimed has $100M+ investors “lining up” to be in his next trade – just 3 weeks after that claim, they have now disappeared!

– “before Christmas, the trade will start to profit 10 million a month – increasing by 2 million per month”. As always, fraudster toubia is not providing any proof!

Of course, toubia is using this fake good news for another of his feed-the-greed scams – last chance to invest in his business’ shares! “After 2 weeks, we will close the doors & share price will increase 100 times at least”! This creep knows it’s totally irresponsible to make such a share price increase fantasy claim, when he has delivered 0 in the last 3 years!

Despite his 10/12/14… million monthly profits claim & about 200 broken promises over last 3 years, shameless toubia has the cheek to charge investors an $80 admin fee from 1 September!

“Not paying the fee on time will automatically place your investment account in inactive zone & a $20 daily penalty will be added” – wtf! Scammer toubia never misses an opportunity to have money flowing to him, with no money ever flowing back to Investors!

In summary; these developments are merely fraudster & scammer toubia – as he regularly does – tangling out some fake good news to pacify his few believers, before starting with his delay excuses in September ie cue up blaming impact of covid yet again!!

Clever scheme to get a monthly recurring admin income from people that are frightened silly to lose contact with their already lost investment.

Toubia obviously has zero income from his multi million pound scams and running out of personal scammed booty.

Those that do not pay up will be abandoned, which will please him. No responsibility for those that lose the faith.

He has done this over and over again. It is his exit strategy over a period of time. He knows it works as he has used it so many times.

If anyone has the clout and knowlege they need to file for an investigation of fraud now, in his country of residence in Georgia.

The Antoubia Toubia zoom call featured in this forum was removed by youtube following a copyright objection made sometime ago.

The claim was inniated by, name provided by youtube, Jetson Fifita.

email address given by youtube (Ozedit: email removed)

I contacted this email address and recieved no response. I since discovered that “we grow bitcoin” is also/was a big scam.

Draw your own conclusions. These are the facts.

If I can reupload the zoom call with some editing or not, I will, open for any advice on the matter.

Why just wait that Antoun get it done?

The money goes nowhere, and you will anyway not see it again if the company does not have any succes in there projects.

Yes, we all waiting a long time. Yes, some of them even died for it.

And yes, it’s wrong of Antoun to be angry about Truth Teller.

But still, you could make a less noise that damage the company only.

Solution we need, not more crap of people that want to slam around because there not see their promise money on time.

I’m assuming you still in Discord?

If you don’t believe Antoun, why you still paid for the Limited Partnership anyway?

So you believe still in a happy end?

But you just release your dissatisfaction like the rest of it?

The reason why Antoun is frustrated and kick people out is mostly because of you.

So if someone needed to blame to get kicked, then it’s only you.

Beside of it, you and everyone know in the beginning that investment is a risk. That will be always the case, whatever you do.

If you not invested in Antoun, you would invest it different way.

Sure Antoun could do it better, but what i can see he make progress. Maybe small but there is progress.

Let’s see what end August will bring.

Get what done? You invested in a Ponzi scheme and your money is gone.

All the copium in the world won’t get fictional things done. Sorry for your loss.

Well actually I’m in long before there was even ST.

But if everyone see it like a ponzi in a world where everyone get screw up, well i hope there will be much more projects of it.

Than i would even profit even more from it, and you will be still having a empty pocket. Seems to be very far.

Beside of it, i would be one of the first that would get the profit anyway. Than the rest will follow.

So don’t be sorry for my loss I never got?

waiting on a smile on the next big Ponzi, so I would even profit more!

Well that was a whole lot of unintelligible copium waffle. Sorry for your loss.

*finger hovers over spam-bin button*

Push it!

Pu-u-sh it!

Pu-u-u-u-sh it!

Latest scamming rubbish from toubia includes:

That’s not how real law works – toubia changed investment’s terms & conditions after it started without Investors’ approval.

“There is a Swedish Trust account yearly fee to be paid to keep the account maintained and serviced accordingly. Our fee is well considered”. No logic in $20 daily late payment fee on just $80 annual fee .

“we are now in Fund Raising stage, where we need $2.5 million, to acquire our full banking license in Europe” – next scam.

“Right after that, we will be able to issue the ATM cards” – that he charged Investors for months ago”. Clown, who has no idea what he’s doing, never said months ago banking license (which will take ages…) was first required to issue cards – he said $400 fee was to cover charge of somebody else issuing cards

“I advise everyone to convert their pool 5 investment into bbb shares, for best financial outcome” – he has probably already gambled away the $100k+ Investors sent him for pool 5

“I hold PHD in business administration & financial management from best UK universities” – F**K off you do, I thought “Charisma University” was joke until googled it – does exist in Turks & Caicos Islands No way this numbnut has PhD.

“that gives me the qualification to give you such an advice” – surely there’s code of ethnics financial advisers shouldn’t recommend their own companies to their own clients or, at very least, ensure their clients first get independent financial advise input – “What are ethnics?” says toubia.

Sounds like a combination of advanced fee, recovery and stalling scamming.

TL;DR: “Here’s some carrots to stall for some more time, now keep paying me fees or I cut you off.”

No new recruits, no new money to steal. Sounds like a mess that’ll drag on as long as investors play along.

For a class action against the fraudsters (Ozedit: link removed, see below)

Of interest, declan o’sullivan has disappeared from theswedishtrust.com/about/

BehindMLM doesn’t get involved in civil victim recovery efforts.

I’m not asking BehindMLM to get involved in civil victim recovery efforts. I’m trying to utilize this threat to get like-minded Investors to band together for a common cause (BehindMLM will support in principle) – seeing justice served on the fraudsters mollink & toubia.

(Ozedit: link removed, last warning)

No, we won’t.

So the following website claims areN’t really true!!

The website has No interest in usefully assisting in Slightest justice being served!!

The website’s Only interest is to Moan – which changes Very little in the Real world! – often with Inaccurate information.

‘Thanks’ for being of No assistance, Totally unwilling to Even assist like-minded Investors to band together for seeing justice served on fraudsters 🙁 🙁

I don’t know how you got “we’re here to be used as a class-action fishing expedition” from what you quoted. I also don’t particularly care.

Your failure to comprehend basic English is a “you” problem.

BehindMLM has never gotten involved in civil recovery. By the time it gets to hOw Do I gEt My MoNeY bAcK?, we can’t help you. That’s not what BehindMLM is here for.

I have no interest in vetting potential civil recovery efforts. And I’m not about to open our readership up to recovery scammers.

If you want to file a class-action against Toubia, do so. Send me the filed court document and I’ll cover, as we do any MLM related litigation.

If you want to use BehindMLM’s readership to fish for a potential class-action, GTFO.

Policing babies that got fooled by simple scams is not a review site’s job

If you can’t be arsed to do proper research that’s a “you” problem

Yeah no “often” is overstating,and Oz corrects when provided verified info,usually pretty on the mark

Start a website,Facebook,Telegram group. Trying to hijack a site that you claim publishes “inaccurate” information seems to be counterintuitive?

Seems more like crybaby victim victimizing himself further

‘Thanks’ for confirming you don’t particularly care (Ozedit: You’re welcome, goodbye.)

I have never cared about individual finances of people losing money to scams after the fact.

It’s not like I haven’t been open about this. “Sorry for your loss” and I get on with my day.

I don’t have any interest in it. That’s not what BehindMLM is here for.

Anyway I think we’re done here.

Hope you allow this OZ.

I will comment to Truth Teller from a personal experience I had many years with the SEC in the US.

I gave evidence in a global scam that involved huge amounts of money. There were many scam products being sold and being reported, the US justices became involved when the scammers pushed their luck into securities, such as pension funds.

Two fraudsters were arrested, and accounts seized. Many years hence, both defendants are serving heavy sentances, monies seized were divided amongst the victims by the court. Arrest warrants for twenty others are still active, they fled the US.

Only way anyone would ever get their money back from Antoun Toubia is to file a complaint of fraud in Sweden, against the swedish trust and a fraud complaint to the Georgian authorities, Antoun Toubias country of residence, Georgia. UK authorities are useless, dont bother.

You would need to provide all your evidences in both Countries, stating fraud committed and laws broken.

Takes a lot effort and time. If successful, authorities will take action as described above.

I am not giving any kind of legal advice, just my personal experience.

@Max, I am a UK citizen, I filed in the UK I got nothing, as you say totally disappointed here.

I decided to travel to Georgia with my wife and hired a lawyer last year, but there was nothing I could do, as the lawyer couldn’t find anything illegal about what Antoun did, crypto is not a regulated business, and no evidence also about fraud, as no supporting documents could be found, and regarding Pool 3, 90% paid to MACTX and have agreements with those Australian Girls who disappeared.

if anyone has a chance they need to prosecute the Australian girls first. also we checked in Nevis where UCI global was registered, you need to put a security deposit of 30k USD to file a lawsuit against an entity there.

Anyway, we have lost 8k, we spent another 3k on travel and lawyers and got nothing, so a total 11k loss.

Now we just moved forward and put everything behind us. Hopefully next time, we listen to OZ before we reach that stage and become a cry baby.

An unfortunate expensive lesson.

Jeff Ladd, Max & Others:

Investors need to lodge a complaint with their Country’s Police, requesting it be referred to Euro/Interpol – because those responsible for the disappearance of the Investors’ $15+M contributions live in various Countries.

Antoun Toubia – Georgia

Christian Fortune – England

Declan O’Sullivan – Ireland (as ex Managing Director, he has some responsibility)

Erik Mollick – Netherlands

Marianne Thomas (MACTX) – Australia

Marnie Pascoe (MACTX) – Australia

Investors can also lodge a complaint against MACTX with ASIC (Australian Securities & Investments Commission) – asic.gov.au/

ASIC accept complaints from International, not just Australian, citizens.

For assistance/to coordinate our efforts, (Ozedit: removed)

Here’s to Euro/Interpol sorting out these worms for the Investors $15+M disappearance!!

Toubia’s latest announcement is literally a list of 9 ideas to enrich himself!!

He is even going to charge each Investor $25 for each updates zoom call they attend! Calls that are full of his lies.

Claims “We are working on CoinCrowd Network, the only censorship-free social media network in the world, it will be launched in October”. Using Google for just 1 second shows there are already 10+ such networks!

Any truth long ago left this con’s life!!!

Ah Judy,

I remember you were always so positive for Antoun as was I. He phoned me and I apologized for all my swearing above but to be honest I could never trust him again after what he did to me.

I have logged a complaint with certain authorities, not to get back the money I lost but just so that they can start to collect data on him and eventually catch him and the others and stop them ripping people off.

I have stopped looking at anything from him now and although it was a big loss, 6 months down the track I am happy to be rid of the whole thing from my life.

Hi Stephen,

Which Authorities did you lodge a complaint?

If same ones I have, will give me a reason to “I know you have complaints about him from others!” prompt them (I won’t mention your name without your prior approval)

If different ones to I have, will give me ideas as to which other Authorities to lodge my complaint.

Cheers

(Ozedit: removed) this is the lawyer for the Georgian police man I spoke to. He used an English speaking lawyer to take my statement.

They can only monitor but will build a case as other come on board. There is no way of getting the money back.

Shame, I felt like a member of a family for a while there. One little kick in the teeth and I just lost all trust. I am not angry, bitter or twisted. I just want these free oaders off the internet.

I know Antoun reads this post so I guess he will move back to Lebanon.

Hi Stephen,

Brilliant, thanks.

Antoun has just supposedly moved back to Lebanon. Claimed family members were killed in car accident and he has to manage their olive oil business, lol. More than likely, the worm is still in Georgia!

Thanks again for the contact. As Toubia does read this post, not saying here what I’m going to do now. Let the bastard continue to live his worthless life, looking over his shoulder every 4 minutes.

Cheers

Sorry the email was removed, if you want it let me know – it is (Ozedit: removed)

Do not post random emails on here. Thanks.

Shame – no way to contact her really. I will go away – I don’t really want any part of this site and stuff it deals with. Cheers.

Never thought it would, but it did…….

will comment to Truth Teller from a personal experience I had many years with the SEC in the US.

I gave evidence in a global scam that involved huge amounts of money. There were many scam products being sold and being reported, the US justices became involved when the scammers pushed their luck into securities, such as pension funds……

sometimes it happens…. received a cheque this morning from the US State Justice Dept, a percentage of my loss to the scammers. Court case trial was in 2016. the sammers received long prison terms, with all assets and property ceased.

Swedish Trust Zoom Call 10 12 21

This is now for public viewing again, the call only features Antoun Toubia giving his explanation of how he was scammed and what his intentions are to move forward with his following.

Video taken down again by youtube. Antoun Toubia filed a copyright complaint.

toubia’s conveyor belt of scams continue with streamable.com/lwqka7

master key bank will never be reality because fraudster toubia will never get banking license.

toubia can try to hide behind shell companies – like gitex ltd he registered mid last year – but banking regulators keep digging at the businesses ownerships until they identify the real people at the end of the line.

Of course, even though fraudster toubia knows master key bank will never be reality, he’s still selling founders positions – to fund his lifestyle!

Of course, like all of toubia’s scams, those founder purchases will be non-refundable! Add them to list of monies flowing to him with nothing in return for last 3 years – bank of georgia accounts, british business bureau shares, limited partnerships, pools 1-4 contributions, netz & swede coins

master key bank is fraudster toubia’s third way of scamming from same one set of profits!!! His first scam – limited partnerships – was all he needed to share 100% of profits!! H

owever, once he had spent those scam proceeds, launched second scam – british business bureau. As bbb does not make any extra profits, only winner is fraudster toubia by selling shares!

Once he had spent those scam proceeds, launched third scam – master key bank. As mkb will not make any extra profits, only winner again is toubia by selling founder positions!

Fraudster toubia sold Investors all the profit pie with limited partnerships. Then, he took back half the pie Free of charge & sold it Again to investors. Now, he’s taking back a third of the pie Free of charge & selling it Again to investors

Some investors are So Dumb – Even though he’s produced Zero in last 3 years, Still sending $ to pathological liar toubia!!! These people are a financial danger to themselves

Article updated to note Toubia is still pushing fraudulent investment schemes through Swedish Trust.

It is always hard to realize that we have been scammed. Anton is a Master Scammer, one day he too will find his patch of earth to meld into.

We all need to move on and advise all investors to steer clear of this monkey mother mucker…

Any updates on this?

Nothing substantial. Toubia is still releasing “Mike G Deal” style updates to string investors along.

Well doctor antoun is offering Swedish Citizenship for $35,000 guaranteed apparently by passing all the crooks out there…

Search youtube Antoun Toubia updates..

Link is if allowed: youtu.be/AQlVzV_G4H4

Max, …specifically targeting Indian & Pakistani people!

$US35k investment requires people to purchase toubia’s shit crypto at 50+ times greater than its current market value!

toubia needs authorisation – even though he’s implying he’s an indirect residency process facilitator – (which I doubt he has) of Swedish Migration Agency to promote this supposed service.

As he claims it’s limited to 500 people, if it’s fully legit service, hard to believe Swedish Authorities have given him provisional authorisation i.e. “We’ll process up to 500 applicants from you – if quality of people is good, you can proceed – if quality is poor, we’ll be terminating our authorisation”.

Surely, Swedish Authorities don’t ‘gamble’ with residency in this manner!

In summary, Yet Another toubia Scam!

toubia has recently opened a restaurant, with money Stolen from his bank trading Investors!

toubia isN’t a doctor – BS claims to have phd in finance, LOL – does have a phd as a Con Scammer!