To promote DagCoin, Igor Alberts slams Ponzi he earned millions in

Last weekend Igor Alberts fronted a DagCoin recruitment event in Tallinn, Estonia.

Last weekend Igor Alberts fronted a DagCoin recruitment event in Tallinn, Estonia.

His marketing strategy?

Slamming the collapsed Ponzi scheme he stole millions of dollars through.

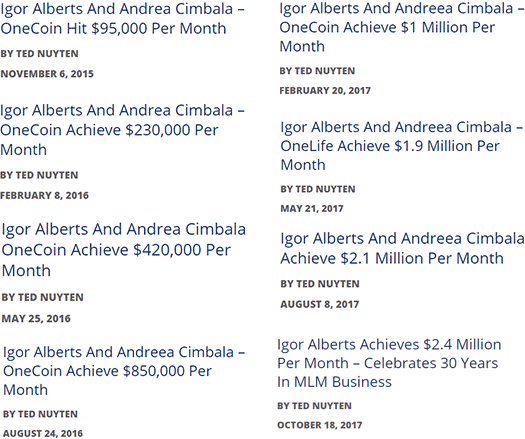

Despite BusinessForHome diligently celebrating Alberts purportedly still earning $2.4 million a month through the OneCoin as at December 31st, 2017, sometime over the past two weeks Alberts ditched OneCoin for DagCoin.

Despite BusinessForHome diligently celebrating Alberts purportedly still earning $2.4 million a month through the OneCoin as at December 31st, 2017, sometime over the past two weeks Alberts ditched OneCoin for DagCoin.

For those unfamiliar with the business, DagCoin is essentially a OneCoin clone with respect to its MLM offering.

DagCoin was launched by a former top European OneCoin investor after the company indefinitely suspended ROI withdrawals last January.

After a rambling introduction from fellow former OneCoin scammer Kari Wahlroos, Alberts scrambles onto stage in one of his trademark clownish jumpsuits.

After a rambling introduction from fellow former OneCoin scammer Kari Wahlroos, Alberts scrambles onto stage in one of his trademark clownish jumpsuits.

His first point of business?

Addressing the painfully obvious elephant in the room:

[3:33] Being here today, being here this weekend is uh… it’s it’s exciting, and it’s a little bit weird as well.

You understand that?

Shortly ago we had a belief that we were basically changing the world, and we find out about an inconvenient truth.

And when you find out that you are doing something that is …

Alberts mic conveniently cuts out briefly at this point. When it kicks back in he doesn’t finish the thought.

Instead Alberts falls back on familiar territory, a folksy retelling of his history with MLM dating back thirty years.

Around a quarter of an hour later, Alberts revisits OneCoin.

[52:16] And then actually came an opportunity by where they talked about the future of payments.

Where they talked about changing the world. Making on this world a more honest and better place.

And actually that idea grabbed me.

And I started so much to believe in that idea, that I forgot to see the reality. That’s what actually happened.

[53:02] I was talking about my vision and how we change the world and how we do it, but I didn’t look carefully enough at the facts.

Till half a year ago I found out that my vision was correct, my mission was correct, what I wanted to achieve was correct… but I did it with the wrong vehicle.

I needed a plane or rocket for what I wanted (to do) and I was riding a bicycle.

Alberts goes on to compare OneCoin’s business model to the Titanic.

[53:44] Instead of the future of payments, I get more and more the idea that I was part of the next version of the Wizard of Lies.

[54:00] And then comes the point that you find out that what you think you can achieve is completely impossible, because you will never arrive in New York because you are on the Titanic.

The Titanic took a route that seems to be shorter but was impossible to go.

And the Titanic ended up between the icebergs. And the captain of the ship, they let it go on.

Even when it became the most dangerous period (of the trip), the captain of the ship went to sleep.

And that is actually what happened to Andrea and me in the company where we came from.

And then, at a certain moment we saw that the ship could not continue.

Yes it could continue but the icebergs were closing on. Worse off, the ship had already hit the icebergs and it was taking water.

Just so we’re clear, Alberts’ is equating the captain of the Titanic with Ruja Ignatova, founder and owner of OneCoin.

So when we found that out we searched for the captain of the ship, but the captain of the ship was completely gone. No captain anymore!

What happened to the captain?

Nobody knows. Till today nobody knows where is the captain.

And we tried to find the officers of the ship but there were no officers. No CEO, no CTO, no nothing.

And of course we were shocked, because we were so much in this hyper bubble – and then comes that moment that you feel like shit.

That you say, “No, it cannot be! Cannot be!”

We have 337,000 people in our team and we leaded them all, we lifted them all on this giant ship the Titanic. And we sailed into nothing.

[1:13:01] Yes, it was wrong. I leaded all of you the wrong way, ladies and gentlemen.

I made possibly the biggest mistake of my life.

Alberts claims his bodyguard and house-minder, both of which he cites as “best friends”, took out loans against their houses, on Alberts’ advice, to invest in OneCoin.

Alberts gave this advice, knowing full well OneCoin wasn’t what it was projecting itself to be.

Alberts gave this advice, knowing full well OneCoin wasn’t what it was projecting itself to be.

[1:05:20] Like me, (OneCoin investors) have no clue what they’re talking about.

Somebody said this is the blockchain so I write it down.

Then (a friend) started to explain to me about portfolios. And wow, then I talked to another guy who knows that too. And explained it too.

And then, after three years in this industry, two weeks ago for the first time I understand what is the blockchain.

And then they said, “Do you think the other company has that?”

I said, “For sure not. That’s not what they have. No, no.”

He said, “You need a lot of technicians to build that”.

I said, “There’s no technicians, they just have it (a blockchain)”.

He said, “No, we have over fifty, fifty-six, fifty-seven people. They are working on the technique”.

I said, “No. The other company has not even fifty people for them.”

He said, “Yeah but it’s a multi-national”.

“Yeah but it’s a network marketing company, you don’t need all these.”

He said, “Do you, did you ever met the Chief Technical Officer?”

(I said,) “They don’t need that. They don’t have that.”

Can you see how you can be in a bubble? How 3.3 million people can be in a bubble?

“Do they have a CMO?”

I said, “No, they don’t have a CMO. They fired almost everybody that they had.”

(He said,) “Did they ever have somebody like that?”

“No, they don’t need. It’s a network marketing organization. They don’t need them.”

(He said,) “Did you ever saw a department where people were working?”

Yes I was in the offices. There were ladies counting the money.

There were a lot of ladies counting the money, because in Bulgaria came in every day, millions and millions – so there were girls counting the money. That’s important.

So they (OneCoin) have a lot of people, counting the money.

(He said,) “Yeah but do they have people who try to call them, for customer support?

But that never worked out, because we figured out they have only one girl for the entire world.

Alberts appeals for sympathy by sharing his own alleged personal OneCoin losses.

[56:18] I have young children. I have eleven children.

Most of them, eight of them, are younger than fifteen years old.

My children put their savings money into (OneCoin) accounts so they would get coins.

Because their father told them, me, that it would be very good.

Because I believed, and now I find out that that belief was based on actually nothing.

Alberts laments that “after thirty years in the industry, that the last thing I did is a catastrophe”.

[1:08:57] I am the number one income earner in the world.

Till today, because last week we still received the money.

Not that we did something with it, it’s still on the account… but we received it.

Tomorrow is Monday. I think the moment that office opens, they are going to erase all my five hundred plus positions.

Okay and I own approximately eighty-six million coins. I think tommorow ten o’clock … I think we own zero any more.

At this point I have to call time-out.

After buttering up his audience with a lengthy story of entrepreneurial struggle, Alberts retelling of his time at OneCoin paints him as a victim.

This is complete and utter nonsense.

Onecoin didn’t become a scam over night, it was a calculated launch modeled on an already collapsed Ponzi scheme from day 1.

Alberts signed on with OneCoin shortly after Kari Wahlroos jumped on board in late 2015.

Over the next two years OneCoin’s Ponzi points business model didn’t change once. Alberts relentlessly recruited investors into OneCoin and ultimately profited handsomely from their financial misery.

Eventually Alberts efforts would lead Ted Nuyten to reward him with a top MLM income earner position on BusinessForHome.

The reality of OneCoin’s demise however is that there was no “awakening from the Titanic” as Alberts portrays. All that happened was Ignatova and her backers disappeared with invested funds, as was planned all along.

This is how Ponzi schemes work. There’s nothing to be surprised or shocked about.

It’s a bitter pill that OneCoin investors are going to have to come to terms with when the latest October 8th “we’re going to go public” deadline comes and goes.

With over two decades experience in MLM, you think Igor Alberts didn’t recognize what OneCoin was when he signed on?

Alberts saw an opportunity to make money recruiting, and that’s exactly what he did.

Now the people he directly stole from are expected to cough up even more money and follow him once again into DagCoin.

Same “future of money” Ponzi scam, different paint job.

For his part and other than lamenting over his own alleged losses and tainted legacy, Alberts shows no remorse for his victims.

For his part and other than lamenting over his own alleged losses and tainted legacy, Alberts shows no remorse for his victims.

[57:58] Is (OneCoin) a scam? Possibly. Maybe.

Maybe they are able to mange but I don’t believe in it anymore because it has too many things.

Again, OneCoin hasn’t changed since it launched in late 2014.

Alberts was content promoting OneCoin for one and a half years. He only decided to start asking questions in late 2017, after affiliate recruitment (and his income) tanked.

[58:12] Whatever I asked (about OneCoin) I could not find an answer.

And that was exactly the moment that Kari said to me, “Igor, are you sure that you are doing well?”

I said, “Kari, honestly I don’t know. I think I made… I think I’m in the wrong way”.

And then he explained (to) me something that is called DagCoin.

And so here we are again. DagCoin has been limping along in OneCoin’s shadow since it popped up in mid 2017.

It is now being promoted by Igor Alberts and a large percentage of former OneCoin affiliates (none of whom apparently have any shame), as a vehicle to recover OneCoin losses through.

This is based on nothing more than them getting in early, as opposed to being the people they hope to steal from who join later throughout 2018.

What’s particularly shameful is each and every one of these people know what it’s like to lose money in a Ponzi scheme.

Yet we now have a sea of OneCoin victims who have no qualms about positioning themselves to profit off the financial ruin of those they convince to invest in DagCoin.

Just like that, those scammed turn into scammers themselves.

While it’s easy to see DagCoin as another attempt at cryptocurrency after OneCoin, the truth of the matter is it’s not cryptocurrency Alberts and those like him are attracted to.

[58:35] The first (thing I did), I asked a friend of mine.

I said, “Do you know about DagCoin?

Do you know what he said to me?

I’ll be honest with you, he said, “I have no clue but “dag” means shitty wool from sheep”.

So, I said, “Kari, why is this name?”

He said, “Igor it’s not that it’s DHG”. [sic]

Direct… oh I get into trouble… (someone prompts him offstage) Acyclic Graph. You see how technic I am?

To further drive home a point, after two years of promoting OneCoin investment cryptocurrency education, this is Alberts’ level of cryptocurrency literacy;

[1:04:32] And the Chris asked me about the blockchain.

“Do you know what is a blockchain?, he wondered.

I said, “Maaaan, comeon blockchain. What is that bullshit?”

What Igor Alberts is attracted to is the prospect of easy money, by convincing others to invest in flawed financial dreams.

That’s how Alberts made millions in OneCoin, and again how he hopes to replicate financial success in DagCoin.

The sooner those who blindly follow “leaders” from one scam to another realize this, the better off financially they’ll be.

Update 30th March 2020 – Since publication of this article, the YouTube video referenced in it has been set to private.

Igor really is the King of MLM. Go to minute 1:27:19 to watch him “sitting on his throne” Now, there’s a class act – – or should I say “clown act”?

After this scene – his next comment is” “WE all face the same shit”.

The complaints from investors have been limited up until this point because they were being told the Public Offering would take place and they would all be rich.

But now, almost all of the Top BS’ers have left and the reality is there for all to see. Those tokens are worthless and the so-called “haters” were right all along.

Ken Labine called anyone trying to warn his investors “haters” Looks like Ken has some “splaining” to do. He was last seen licking massive amounts of egg off his face.

IN this video Igor flushes that BS (OneCoin value) down the drain once and forever.

Igor – it will be interesting to see how you respond when “the shit hits the fan”

Will you finally take responsibility for all the pain, financial loss, heartache, divorces, destruction you caused for others?

When someone asked Igor what he thought about the lives he had ruined, he was said to have replied, “Frankly, I don’t give a shit”.

the wizard of life -> should be ‘The Wizard Of Lies’ (Bernie Madoff ponzi movie).

Thanks, the accent was hard to transcribe at times.

On a side note, for anyone who watched the whole thing, anyone find the irony in Alberts repeatedly rubbishing Bulgaria and its people (the insinuation they are all thieves is there), whilst at the same time preaching tolerance and acceptance of all people, “no matter where you come from”.

I get the praise lavished on Estaonia (always pander to you hosts), but surely those in attendance caught a very distinct prejudice toward Bulgaria in the same breath?

The ending of the video should make any reasonable person cringe.

You have to love Youtube – the truth lasts forever if you bother to look.

Here’s Igor explaining how he got into OneCoin back in Dec 2016: youtube.com/watch?v=3BE8Srpqcxo

Check out Minute 1:15 – Igor was 50% right. And, minute 2:02 “made a shitload of money”

This video was published on Dec 19, 2016. Bitcoin was selling at around $450 at the time. If one of Igor’s investors had invested $10,000 into Bitcoin instead of his ponzi scheme, it would be worth over $300,000 today vs the value of OneCoin (zero).

Wow – they even tried to warn their victums – minute 10:02 “be ready because we will get you – these guys here are sharks”.

o the prose and the storytelling! sooo vivid! is alberts a closet hollywood writer? 🙂

uh, props to the women who are the mothers of igor alberts children. imagine reproducing with this disgusting clown. like ugh.

bloody mean^^, i know. but igor alberts is so deserving!

is alberts saying onecoin sold packages to children too? is alberts admitting he stole from his own children? what a deplorable disgusting clown!

well, disgusting as it is, this is a well planned exit strategy executed in cahoots with the paid ponzi promoter ted nuyten of business for home:

– announce kari wahlroos has joined dagcoin

– announce onecoin has crashed and leaders have defected

– [coming soon] – coverage of igor alberts joining dagcoin

– [coming soon] – heavy coverage of dagcoin through 2018

…and the pimping continues unabated folks, bring out the popcorn and watch the ‘dagcoin ponzi show’, in case you missed the onecoin show and like re-runs.

tomorrow kari wahlroos will be in london promoting dagcoin. but where’s the venue?

seems the venue in london is secret-secret and can only be shared via private messaging on FB:

FB, a few hours ago:

now, why would ‘university education’ about cryptocurrency involving the latest crypto tech need to be secret?

too many scammed onecoin victims in london kariboy? don’t want anyone gate crashing your new scam party kariboy?

I made a twenty minute video of Igor’s OneCoin comments: youtu.be/LqjWOnMaMyA

have seen the 20 minute video which confirms all the fears and rubbish. Igor apparently knew that OneCoin was false about 6 months ago but continued to promote it with his scam wife until the end of the year.

remember Lisbon where she was extolling the benefits of the product that had no substance -yes she did mean it literally!

Kari similarly lied through his teeth. Kari is now promoting the new Dagcoin scam. arrests arrest arrests!!!

LOL. OneCon sponsored LMP2 car crashes during 6 Hours of Buriram (Asian Le Mans Series) and causes Full Course Yellow.

Symbolic.

NOLINK://youtu.be/d6Jg9LOYhsA?t=6623

500+ positions, lol.

Again, beating a dead horse, but how brain dead do people have to be to not see how buying multiple “education” packages illustrates how much OC was never about education.

Igor Alberts is a scammer who obviously knows how to maximize his pyramid and ponzi earnings through stacking.

Is this Igor’s first rodeo? If not, let’s not give him any credit. The reality is:

Successful MLMers aka “leaders”, or MLM promoters, know it’s a scam from the day they join.

Are those 3 piece pyjamas?

These scam-artists are amazing: Igor has lured in what according to himself sums up as millions of investor money and at no point has he asked where the money was going?

Well let’s – for the sake of argument – assume so. Now Igor is saying it was all a fraud. Is he asking for a compensation? Building a lawsuit? Asking for the investors to join forces to get this to court?

NO!!! He wants you to invest to his NEW ruse (which – coincidentally – is almost identical to the previous one)!

No shame.

The blame shifting in the presentation was amazing.

Igor tells us his two best friends, one of whom is his bodyguard and his kids all lost money in OneCoin, he even admits that he was the person who sold them all on the scheme.

Does he accept responsibility for helping his friends and family get ripped off? Does he express regret for personally profiting at their expense? No, he presents himself as a sympathetic character in the narrative and any blame is pushed elsewhere.

None of this is in any way surprising, you can’t be a prolific serial scheme promoter if you have a conscience so instead of feeling remorse for his past (and future) victims he uses them as part of his sales pitch.

Just perusing the London onecoin mafia’s facebook posts, Zafar and co are still going strong. Blows my mind that these people are SO delusional.

Zafar is going for Crown Diamond. Looks like they are coming up with their own levels now and stealing money from people. Pure Insanity…

As others have remarked, its like taking an old pig, putting lipstick on it and calling it a new pig… A pig is still a pig.

What were these guys like Igor and Kari selling in OC being top leaders and feted around the world, when the very basis of what they were selling was fraud and had ZERO clue what a blockchain was or if OC did even have one which was obvious to most who had any background in crpyto.

Based on what Igor was saying, he was selling a dream which got millions to hand over their hard earned money.

And what is even more astonishing is other OC leaders are still going on and ignoring comments by former top level OC scammers.

In my opion: All (!) OneLife-OneCoin-“Leaders” worldwide are only greedy and smelly rats without character and honor! They also go over dead bodies for money.

Every “leader” should be imprisoned for 10 years – or 20 years – or 30 years. The more the better!

Today I saw in german television: Bernie Madoff can leave the prison 2139. Then the King of Ponzi is 201 years old… 🙂

Despite Igor’s claim that he now understands what a blockchain is, he’s a joke. He didn’t care in OC and he sure doesn’t care in Dagcoin.

Igor is a pathological liar. It makes no difference what the Ponzi de Jour he is in claims it is doing. All he cares about is how much and how fast he can earn from it, and get out before it collapses.

Bad for future recruitment. Everything wrong with OneCoin is the same in Dagcoin.

I do admit he is one big BS’er, and it is incredible that anyone believes a word he says. To do so means you have to suspend all reason, logic and common sense.

Kari is no different and neither as all of the other major promoters of OneCoin. They all are great BS’ers and pathological liars.

The day is coming when one of these major promoters is going to rip-off the wrong person(s) and the results are going to be disastrous.

It has happened before and I’m afraid with the large amounts of money they are stealing from people it is going to happen again and soon.

Igor is real scammer! He now try to get Panama and Surinam market in.

Check MIHAIL PETROVIC!! In Thailand! SCAMMERS!

I thought he was a Max Miller tribute act. I could imagine him saying “It’s all clever stuff, no rubbish!” as he cons the gullibles in his audience.

Karma is a bitch 😀

https://i.imgur.com/RrykCkB.jpg

Makes you wonder why we always get the greedy scumbags winning elections because let’s face it the elites analogy that the population of the world are stupid is not too far off the money.

You could just compare it to sheep led to the slaughter under a non-human being lacking any sort of remorse or morals yet the sheep still happily sit on the conveyor belt awaiting their demise.

Will these people wake up in time to see the eugenics system in operation? Unlikely if they insist on listening to these so-called leaders.

What’s saddest about this is the process to making some money in real crypto investment is not difficult and it doesn’t even require people to promote it but we still have the idiots looking for the quick fix to what can be described a a few months learning the markets.

Anyone reading Oz’ article and still thinking this shit is worth joining you are the ones who need to educate yourselves and stop funding the so-called leaders lifestyles.

Oh he will be leaving way before then for real!!

OneCon sponsored LMP2 car crash, corrected timestamp in hyperlink

NOLINK://youtu.be/d6Jg9LOYhsA?t=17389

Igor E. Alberts in action:

share-your-photo.com/img/2235a25b06.png

Leader? Slimy actor? Or only a ridiculous jumping jack? With Frank Ricketts (behind Igor) and Staffan Liback in Bangkok, December 2017.

The story about his kids’ money is just an attempt to victimize himself. Standard action from scammers playbook:

“see? I was robbed too! And my kids! My poor kids! I lost everything like you all did! Everything except the few millions* I managed to cash out of this!”

*(According to Bullshiforhome, as reported by himself.)

OLN letter:

mailchi.mp/f995f8b9dc3a/jxkey6m9c9-701169?e=a0e0b3336a

Igor and Andrea have issued their “official statement” on leaving OC in their FB page. Some of the comments are hilarious and spot on. Just surprised they weren’t deleted.

Check it out: NOLINK:facebook.com/wdreamsmaycome/videos/1334307820007619/

WARNING! Clown Suit alert when watching. Does he buy his 3-pice suits at a tent maker?

Sounds like they’re nuking criticism now.

igor and andrea playing^^ tagteam so beautifully.

here’s how i heard it:

– it was sweet little andrea who forced igor to join onecoin. he’s y’know, not a tech guy but just a ‘believer’.

– awww, the pretty little thing just made a stupid mistake, but she’s cho niiice she wanted to stand with onecoin till the end with ‘honor’ and ‘belief’.

– but then kari wahlroos sent nils grossberg and the CTO of dagcoin [named kris?] to igor’s house and he suddenly realized that cryptocurrency needs a ‘technical team’ to make it real! bam! he’d been blindfolded by andrea’s cute stupidity!

– so he had to force his sillybilly little wife to hear all about dagcoin, but she was ‘doing insubordination’ and not listening to him

– finally he did some mansplainin and she agreed to abandon onecoin for dagcoin because it’s the bestest tech ever and now she understands.

all throughout the video, andrea cimbala sits by igor like a well trained puppy wife, nodding and repeating his words and trying to look innocent because she’s not going to do any ‘insubordination’ no more.

and now, master igor has a manhandle on all this stuff, so y’all can all kindly join! sign here please!

they’re not getting a lot of love in the comments under this video announcement.

here’s some examples from poor pissed cheated affiliates in their downline:

don’t think igor and andrea give a damn about about these people^.

they’re going to go on a dagcoin rampage across the world in their color coded outfits.

protip: andrea dahling, if your’e going to design matching clothes for your husband, could you at least not dress him like a clown? is this a sign of passive ‘insubordination’ on your part and do you secretly revel in your husband running around dressed like a complete joker? 😉

The brother of his wife, Iulian Cimbala also in the front row, they rip you off with their BS fairytale presentations. Don’t get brainwashed by these clowns.

Wait. I just came back from the toilet, throwing up.

facebook.com/wdreamsmaycome/videos/1344745115630556/

We want to change the world. Hey Michael Jackson is back!

They will continue to do what they did. So they will continue to scam people and steal money.

They were not looking, you need to become the destined to be.

OMG can they please stop these idiots now in Dagcoin and put them in jail.

Now he knew already in Lisbon were he declared his faith in pubic. These people are believing their own lies just out of greed.

Paygety started unlimited selling and buying of DagCoins (DAG -> BTC) yesterday. The price was originally above 1 euro and has declined ever since. This morning it was at 0,65€ and now it is at 0,53€.

Considering Paygety is not an open exchange but more of a Forex/currency exchange service that defines prices by itself, it is quite fast decline.

The Paygety unlimited exchange has not gone as well as it was supposed to. The people who invested in Dagcoin bought their DAGs for the price of 1 euro/DAG.

Today they can exchange their DAGs back to euros in Paygety. The exchange happes by current rate of 0.175 euros for each DAG.

But wait – there is more! You can also BUY yourself some DAGs using euros! For that the price is 0.32 euro/DAG. The price would have to double for you to get even if you buy and sell.

This – ladies and gentlemen – is what happens when your Ponzicoin becomes publicly traded.

The fraud portal whatdreamsmaycome.eu of the former OneCoin fraudsters Igor E. Alberts and Andreea Cimbala can no longer be reached. I therefore quote the following article published on January 27, 2018.

Source: web.archive.org/web/20191214111255/http://whatdreamsmaycome.eu/fr/2018/01/27/why-we-have-taken-the-decision-to-leave-onelife/

share-your-photo.com/a51b052fc4

The video on YouTube.

youtube.com/watch?v=v11c5yTCSks

Funny detail.

The video had 736 views but only 6 likes.