Possible BehindMLM downtime (Faith Sloan bogus DMCA)

We’ve received a bogus DMCA takedown notice from Faith Sloan. She’s obviously not happy about our reporting of her SEC Ponzi case, misrepresenting her financial situation to US regulators and her involvement in subsequent questionable schemes.

We’ve received a bogus DMCA takedown notice from Faith Sloan. She’s obviously not happy about our reporting of her SEC Ponzi case, misrepresenting her financial situation to US regulators and her involvement in subsequent questionable schemes.

Naturally intending to file a counter-notification (not the first bogus DMCA we’ve dealt with), as Sloan’s clearly failed to take into account fair use as required by law.

Should be straight-forward enough to sort out but access to the site might be restricted a few days while our hosts do their thing.

Copy of the bogus DMCA complaint below for reference: [Continue reading…]

FDA warns Young Living & doTerra for false product claims

The FDA recently sent letters to both Young Living and doTerra, warning them that they had observed instances of their products being

promoted for conditions that cause them to be drugs under section 201(g)(1)(B) of the Federal Food, Drug, and Cosmetic Act (the Act) [21 U.S.C. § 321(g)(1)(B)], because they are intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease.

Young Living and doTerra are competing MLM companies that operate in the essential oils niche.

As one might expect, the FDA found the products being inappropriately marketed on affiliate websites. They also however found both companies to be pushing the disease angle in their inhouse marketing too. [Continue reading…]

Dubli Review: Recruitment and e-commerce

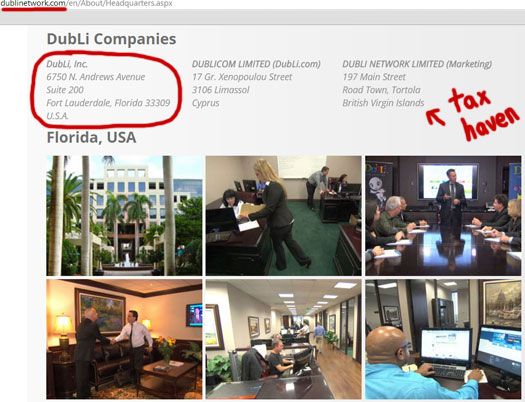

Dubli operates in the e-commerce MLM niche, with the company claiming to have a corporate headquarters office in Cyprus.

An address in the US state of Florida is provided on Dubli’s website, presumably to plant the seed that the company has a US presence. Further research however reveals that this is just virtual office space provided by Regus (starting at $109 a month).

It’s noted that the images used by Dubli to represent their purported Florida office look nothing like images of the actual office space provided by Regus:

What the story is there I’m not sure.

Heading up Dubli is CEO Michael Hansen (right).

Heading up Dubli is CEO Michael Hansen (right).

As per Hansen’s Dubli corporate bio,

In 1996, he commenced his entrepreneurial career by developing a successful chain of Mexican themed franchise restaurants which he sold in 1999 to pursue a career in the Network Marketing industry where he achieved the highest position in two US-based network marketing companies, in telecommunications and financial services.

I did see a Michael Hansen pegged to a few MLM opportunities but, due to language-barriers, am not sure if it is the same person. In any event, Hansen went on to launch Dubli in 2003 and has been running the company ever since.

As for Dubli, I first wrote about them all the way back in 2010 – when the company was mostly focused on online penny auctions.

BehindMLM reviews were a bit different back then, so you’ll have to excuse the deviation from the standard most of you are used to today.

I never got around to properly reviewing Dubli’s compensation plan then, as momentum for the company petered out shortly after the initial buzz.

As I recall though, the basic gist of it revolved around the selling of “Dubli Credits”, which were then used in the company’s auctions.

Over the next four years Dubli persisted with their model, occasionally fluttering in and out of the MLM industry’s consciousness.

During this time the company underwent more than a few relaunches in an attempt to get their auction business off the ground, but it wasn’t until 2012 that things began to take off.

As explained in Dubli’s annual report, filed August 2014:

During fiscal 2012, the auctions program generated an increasing number of transactions during the first three quarters and then grew significantly in the fourth quarter.

The fourth quarter growth is attributable to significant discount bonus feature added to each auction by the Company, a promotional device designed to build web site traffic and increased sales of goods and other products.

During 2012, Dubli sold a total of $2.09 billion in auction credits. Quarter 4 alone saw a 1330% increase in auction revenue, $1.9 billion up from $143,000 the previous quarter.

The problem?

Business Associates affiliated with our network marketing company purchased 96.0% of all DubLi Credits sold in fiscal year 2012.

Retail activity was insignificant.

With Dubli affiliates purchasing credits came commission liabilities, which, despite selling $2 billion worth of credits in 2012, saw Dubli abandon their auctions in 2013:

Although the addition of a random bonus discount that varied from 50% to 90% per auction increased transaction volume significantly which resulted in an increase in gross revenue recorded during the fourth quarter of fiscal year 2012, the profit margin on a majority of the transactions were negatively impacted and less than the expectation as desired by the Company.

Consequently, after conducting an evaluation of the auctions program, we decided to discontinue this part of our business model during 2013 and to focus our resources on potentially more profitable programs for our e-commerce platform.

Dubli’s e-commerce model as its known today was launched March 2013 (it existed previously in different forms, but failed to generate significant revenue):

After we discontinued the auctions program in fiscal 2013, we modified our business model to focus on… selling Premium and V.I.P. Member Package subscriptions to online customers.

That said, it’s only these last few months that the company has gained any traction. As evidenced by recent review requests and a recent schmooze event held out in Dubai, Dubli are now again trying to enter the US market.

I believe this is the first serious attempt to re-establish themselves in the US since the company ditched their penny auctions last year.

Read on for a full review of the Dubli MLM business opportunity. [Continue reading…]

BitCoin Cycler Review: Todd Hirsch tries bitcoin

BitCoin Cycler is currently in prelaunch, with the company claiming to be headquartered out of Davao City in the Philippines.

BitCoin Cycler is currently in prelaunch, with the company claiming to be headquartered out of Davao City in the Philippines.

Heading up BitCoin Cycler is Todd Hirsch, who is identified as CEO of the company in its marketing material:

Hirsch (right) has a long history of releasing recruitment-driven matrix scams. His last venture was Rocket Cash Cylcler v2 (stylised as RCCv2), which launched back in February.

Hirsch (right) has a long history of releasing recruitment-driven matrix scams. His last venture was Rocket Cash Cylcler v2 (stylised as RCCv2), which launched back in February.

Alexa statistics reveal that RCCv2 flopped, which when coupled with the recruitment requirements required to keep the scheme afloat, means that it’s likely collapsed some time ago.

Prior to RCCv2 Hirsch launched Rocket Cash Cycler in mid 2013 as a silent owner. Also recruitment dependent, RCCv2 launched when RCCv1 began to collapse.

Rocket Cash Cycler itself was a reboot of Hirsch’s prior matrix scheme, Cloud 2×2.

Going back even further, Hirsch was then involved in the Ponzi schemes Zeek Rewards and Bidify. I’ve previously covered Hirsch’s earlier MLM history in BehindMLM’s cloud2x2 review:

Todd Hirsch was a member of the recently stopped $600 million Ponzi scheme Zeek Rewards and is also a self-described “top earner” member of Bidify.

Hirsch currently claims to be the “#4 top earning” affiliate in Bidify.

Bidify, a penny auction (Bidsson) attached to an MLM business opportunity had a similar Ponzi points compensation plan to Zeek, which was immediately changed following SEC action against Zeek Rewards.

Hirsch recently claimed in a video that he was involved in promoting Zeek Rewards and recruiting new investors knowing full well it was a Ponzi scheme.

Hirsch also recently claimed on Troy Dooly’s MLMHelpdesk that he is a member of the suspected Ponzi investment scheme, ‘Banners Broker’.

Describing himself as a “program jumper” on his blog, Hirsch claims he’s ‘in about seven different programs at this time and (that he’s) joined and been apart of maybe over 50+ programs since (he) started in online marketing in early 2010.‘

Mike Lavoie, named as the CEO of Skycoinlabs in BitCoin Cycler marketing materials is a longtime partner of Hirsch’s. In their marketing efforts, Cloud 2×2 affiliates named Lavoie as co-founder of the scheme with Hirsch.

Only a few months ago, Lavoie (right) launched GoldAdMatrix. Similar to Hirsch’s matrix scams, Lavoie’s GoldAdMatrix had affiliates buy-in for between $2 to $567 and required constant recruitment to maintain commission payouts.

Only a few months ago, Lavoie (right) launched GoldAdMatrix. Similar to Hirsch’s matrix scams, Lavoie’s GoldAdMatrix had affiliates buy-in for between $2 to $567 and required constant recruitment to maintain commission payouts.

Alexa reveals some activity in Italy, but otherwise shortly after launch GoldAdMatrix appears to have flopped.

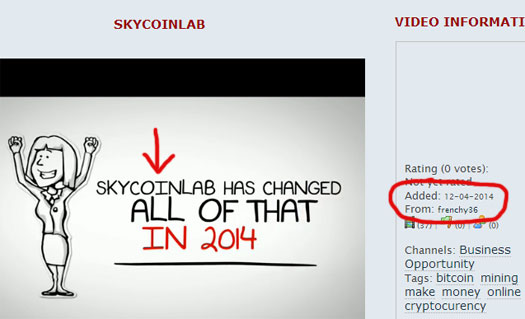

The mention of Sky Coin Labs in BitCoin Cycler’s marketing materials is interesting, as Lavoie (“frenchy36”) was seen promoting the scheme back in April:

Further research into Sky Coin Lab revealed it ‘accepts investments from affiliates on the promise of ROIs paid out via BitCoin‘ (taken from our GoldAdMatrix review).

What is a BitCoin Ponzi scheme doing partnering up with BitCoin Cycler?

Read on for a full review of the BitCoin Cycler MLM business opportunity. [Continue reading…]

iFreeX Prelaunch Review: The new TelexFree?

There is no information on the iFreeX website indicating who owns or runs the business.

There is no information on the iFreeX website indicating who owns or runs the business.

The iFreeX website domain (“ifreex.com”) was registered on the 10th of September 2014, however the domain registration is set to private.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Ads Reward Daily Review: $150 – $1100 ad credit Ponzi scheme

Ads Reward Daily claims to have ‘more than 45 employees around the world’, however no information about company ownership or management structure is provided on their website.

Ads Reward Daily claims to have ‘more than 45 employees around the world’, however no information about company ownership or management structure is provided on their website.

The Ads Reward Daily website domain (“adsrewarddaily.com”) is registered the generic sounding “Mike Drew”, with what appears to be a fake address in the US state of California.

A Certificate of Incorporation is provided on the company’s website, purportedly showing that Ads Reward Daily was registered in Belize, a known tax-haven, on August 28th.

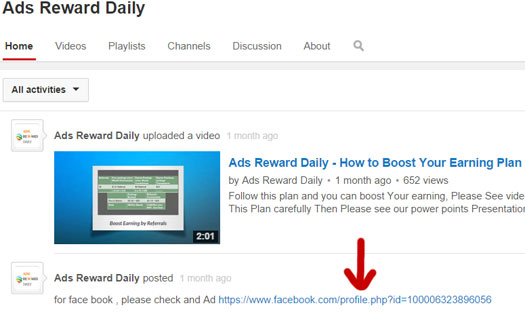

YouTube videos feature on the Ads Reward Daily website, which have been uploaded to the account “Ads Reward Daily”:

If one clicks the Facebook account linked by the official Ads Reward Daily YouTube channel, you are directed to the profile of Nicolás Lodeiro.

Lodeiro was advertising Ads Reward Daily on his Facebook profile from the start of August, well before the purported registration date in Belize. Lodeiro also claims on his Facebook profile that he has “worked at Ad Reward Daily”:

Given that his profile is linked from the official company YouTube channel, there’s a strong indication that he owns the company.

Additionally, Lodeiro lists himself as his Facebook location as Los Angeles, California. This matches the US state and city used in the Ads Reward Daily domain registration.

Why Lodeiro does not openly disclose his ownership of Ad Reward Daily on the company website is a mystery.

Read on for a full review of the Ads Reward Daily MLM business opportunity.

SEC shuts down Zhunrize, assets frozen

It’s the way in which Zhunrize pay out commissions to their affiliates which drags this opportunity into murky pyramid and potential Ponzi scheme territory.

Within the company themselves there’s no retail, as Zhunrize themselves only sell affiliate membership fees.

Put all of it together and, as an MLM business opportunity, Zhunrize leaves a lot to be desired.

–BehindMLM Zhunrize Review, December 2013

The SEC has shut down Zhunrize, revealing it to be a $105 million dollar Ponzi scheme in the process.

The SEC has shut down Zhunrize, revealing it to be a $105 million dollar Ponzi scheme in the process.

A civil injunction was filed in the Northern District court of Georgia against Zhunrize and CEO Jeff Pan. [Continue reading…]

Youngevity Review: 500+ products, compensation red flags

Youngevity launched in 1991 and are based out of the US state of California.

Youngevity launched in 1991 and are based out of the US state of California.

The company operates in the health and wellness MLM niche, and is headed up by CEO Steve Wallach.

Wallach’s father, Joel D. Wallach is one of the co-founders of Youngevity.

A biomedical research pioneer, Dr. Joel D. Wallach spent more than 40 years in the field of Veterinary Medicine, observing and researching the effects of individual nutrients on animal health, before becoming a Naturopathic Physician in 1982.

Ma Lan is Youngevity’s other co-founder:

Dr. Lan received her medical degree from Beijing Medical University and her Master’s degree in Transplant Immunology from Zhon-Shan Medical University. She also has extensive training in Traditional Chinese Medicine.

As for Steve (right), his Youngevity corporate bio credits him with ‘nearly two decades of sales and network marketing experience‘.

As for Steve (right), his Youngevity corporate bio credits him with ‘nearly two decades of sales and network marketing experience‘.

In addition to his work over at Youngevity, Wallach was a co-founder of DrinkACT.

DrinkACT launched in late 2007 and marketed an energy drink under the “Vitalagy” brand.

In early 2013 DrinkACT was acquired by Youngevity. The two companies merged and the DrinkACT brand was dropped.

Acquisitions are a recurring theme over at Youngevity, with the company having acquired Javalution (2011), R-Garden (2011), Bellamora (2011), Financial Desitination Inc. (2011), Adaptogenix International (2011), Heritage Makers (2013), GOFoods Global (2013), Biometics (2013) and Good Herbs Inc. (2014).

In 2014 Youngevity also partially acquired Beyond Organic.

The company still operates as a stand-alone enterprise, however the affiliate-bases appear to have been merged:

Youngevity has entered into a definitive agreement to acquire certain assets and assume certain liabilities of Beyond Organic, Inc.

As a result of these business combinations, Youngevity distributors and customers will have access to Beyond Organic’s products and programs.

In turn, Beyond Organic distributors and customers will gain access to more than 500 high-quality, technologically advanced products offered by Youngevity.

Read on for a full review of the Youngevity MLM business opportunity. [Continue reading…]

OneCoin Review: 100-5000 EUR Ponzi point “cryptocurrency”

There is no information on the OneCoin website indicating who owns or runs the business.

There is no information on the OneCoin website indicating who owns or runs the business.

The OneCoin website does have an “about” section, however no information about the company’s ownership structure is revealed.

The company does state however that it

is headquartered in Europe with worldwide operations. We focus on core markets such as South East Asian countries, Europe, India and Africa.

Conspicuously absent is the US.

The OneCoin Terms and Conditions suggests that the company is based out of Bulgaria:

Onecoin follows strictly the regulations of the Electronic Commerce Act of the state of Bulgaria.

We are not in the business of selling your personal information to third parties. Where permitted by the provisions of applicable law, Onecoin may though share such information from time to time with the following third parties:

Any government agency or other appropriate governmental, police, or regulatory authority in state of Bulgaria or elsewhere in order to meet legal security and regulatory requirements.

The OneCoin website domain (“onecoin.eu”) was registered on June 23rd 2014, however the domain registration is set to private. OneCoin’s website itself is hosted out of Bulgaria.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Wanzeler seeks to delay TelexFree criminal investigation

![]() During the raid on TelexFree’s Massachusetts offices,

During the raid on TelexFree’s Massachusetts offices,

federal law enforcement seized various assets of TelexFree, including servers used by TelexFree, about 38 boxes of documents, and about two dozen computer drives.

The electronic data alone is believed to be over 400 terabytes of material.

As regulators continue to build their respective cases against TelexFree, the monumental task of sifting through the evidence faces potentially significant delays due to

all of the information seized from TelexFree first reviewed by a team of lawyers and paraprofessionals, whose duty would be to examine all of the documents and remove any materials that appear to be attorney-client privileged before the documents would be made available to the Governmental Authorities for use in Governmental Proceedings.

Seeking to speed up the investigation into TelexFree, Chapter 11 Trustee Stephen Darr recently approached the bankruptcy court with a request to waive TelexFree’s right to any attorney-client privilege.

The motion, if granted, would permit authorities to immediately begin sifting through the collected evidence and enable them to use anything they find to build their respective cases.

Opposing this motion is TelexFree co-owner, Carlos Wanzeler. [Continue reading…]