Dubli Review: Recruitment and e-commerce

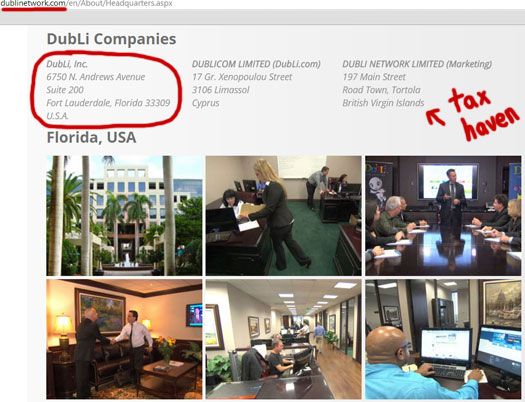

Dubli operates in the e-commerce MLM niche, with the company claiming to have a corporate headquarters office in Cyprus.

An address in the US state of Florida is provided on Dubli’s website, presumably to plant the seed that the company has a US presence. Further research however reveals that this is just virtual office space provided by Regus (starting at $109 a month).

It’s noted that the images used by Dubli to represent their purported Florida office look nothing like images of the actual office space provided by Regus:

What the story is there I’m not sure.

Heading up Dubli is CEO Michael Hansen (right).

Heading up Dubli is CEO Michael Hansen (right).

As per Hansen’s Dubli corporate bio,

In 1996, he commenced his entrepreneurial career by developing a successful chain of Mexican themed franchise restaurants which he sold in 1999 to pursue a career in the Network Marketing industry where he achieved the highest position in two US-based network marketing companies, in telecommunications and financial services.

I did see a Michael Hansen pegged to a few MLM opportunities but, due to language-barriers, am not sure if it is the same person. In any event, Hansen went on to launch Dubli in 2003 and has been running the company ever since.

As for Dubli, I first wrote about them all the way back in 2010 – when the company was mostly focused on online penny auctions.

BehindMLM reviews were a bit different back then, so you’ll have to excuse the deviation from the standard most of you are used to today.

I never got around to properly reviewing Dubli’s compensation plan then, as momentum for the company petered out shortly after the initial buzz.

As I recall though, the basic gist of it revolved around the selling of “Dubli Credits”, which were then used in the company’s auctions.

Over the next four years Dubli persisted with their model, occasionally fluttering in and out of the MLM industry’s consciousness.

During this time the company underwent more than a few relaunches in an attempt to get their auction business off the ground, but it wasn’t until 2012 that things began to take off.

As explained in Dubli’s annual report, filed August 2014:

During fiscal 2012, the auctions program generated an increasing number of transactions during the first three quarters and then grew significantly in the fourth quarter.

The fourth quarter growth is attributable to significant discount bonus feature added to each auction by the Company, a promotional device designed to build web site traffic and increased sales of goods and other products.

During 2012, Dubli sold a total of $2.09 billion in auction credits. Quarter 4 alone saw a 1330% increase in auction revenue, $1.9 billion up from $143,000 the previous quarter.

The problem?

Business Associates affiliated with our network marketing company purchased 96.0% of all DubLi Credits sold in fiscal year 2012.

Retail activity was insignificant.

With Dubli affiliates purchasing credits came commission liabilities, which, despite selling $2 billion worth of credits in 2012, saw Dubli abandon their auctions in 2013:

Although the addition of a random bonus discount that varied from 50% to 90% per auction increased transaction volume significantly which resulted in an increase in gross revenue recorded during the fourth quarter of fiscal year 2012, the profit margin on a majority of the transactions were negatively impacted and less than the expectation as desired by the Company.

Consequently, after conducting an evaluation of the auctions program, we decided to discontinue this part of our business model during 2013 and to focus our resources on potentially more profitable programs for our e-commerce platform.

Dubli’s e-commerce model as its known today was launched March 2013 (it existed previously in different forms, but failed to generate significant revenue):

After we discontinued the auctions program in fiscal 2013, we modified our business model to focus on… selling Premium and V.I.P. Member Package subscriptions to online customers.

That said, it’s only these last few months that the company has gained any traction. As evidenced by recent review requests and a recent schmooze event held out in Dubai, Dubli are now again trying to enter the US market.

I believe this is the first serious attempt to re-establish themselves in the US since the company ditched their penny auctions last year.

Read on for a full review of the Dubli MLM business opportunity.

The Dubli Product Line

Dubli owns an e-commerce platform, which provides access to third-party affiliate deals.

The company offers free customer access to the platform, with customers able to receive a “cashback” on purchases made.

In addition to free customer membership, two paid subscriptions exist offering a higher percentage cashback:

- Premium ($4.95 a month) – regular cashback + 4%

- VIP ($99 annually) – regular cashback + 6%

The Dubli Network Compensation Plan

The Dubli compensation plan pays out on the shopping activities of customers and recruitment efforts of affiliates.

Dubli Affiliate Membership Ranks

There are six affiliate membership ranks within the Dubli compensation plan.

Along with their respective qualification criteria, they are as follows:

- Team Member – starting affiliate rank

- Team Leader – recruit and maintain at least three affiliates or pay between $2475 to $12,000

- Team Coordinator – recruit and maintain at least three Team Leader ranked affiliates

- Sales Director – recruit and maintain at least three Team Coordinator ranked affiliates

- Vice President – recruit and maintain at least five Sales Director ranked affiliate legs

- Senior Vice President – recruit and maintain at least five Vice President ranked affiliate legs

Customer Commissions

If a Dubli affiliate signs up customers, they earn 25% of the subscription fee paid by Premium and VIP customers.

A 25% commission is also payable on any commissionable revenue generated by these customers.

Commissionable revenue is generated when customers purchase through Dubli’s shopping portal and third-party merchants pay Dubli a commission.

Note that any new customers referred by existing Dubli customers (not affiliates), are tracked to the affiliate who introduced the referring customer. This includes any commissions payable on their subscription fees and shopping activity.

Shopping activity by a personally recruited affiliate’s customers is also commissionable, payable according to a Dubli affiliate’s membership rank:

- Team Member – 5%

- Team Leader – 10%

- Team Coordinator – 15%

- Sales Director – 20%

- Vice President – 25%

- Senior Vice President – 27.5%

Recruitment Commissions

Dubli pay out commissions directly on the recruitment of new affiliates.

Recruitment commissions are paid out as a percentage of membership fees paid by newly recruited affiliates.

- Business License – $495

- Team Leader Accelerator – $2475

- Platinum Team Leader Accelerator – $6000

- Elite Team Leader Accelerator – $12,000

How much of a percentage is paid out is determined by how many affiliates a Dubli affiliate and their downline have recruited:

- Team Member – 5%

- Team Leader – 10%

- Team Coordinator – 15%

- Sales Director – 20%

- Vice President – 25%

- Senior Vice President – 27.5%

At the upper tier of the Dubli compensation plan, a Senior Vice President is paid $2750 for each Elite Team Leader Accelerator affiliate they recruit.

A further bonus commission is payable if an affiliate recruits groups of three affiliates within a rolling thirty day period:

- recruit three Business License affiliates = $300 per group of three

- recruit three Team Leader, Platinum Team Leader or Elite Team Leader Accelerator affiliates = $1500 per group of three

Coded Bonus (recruitment and customer commissions)

The recruitment of a new Dubli affiliate always generates a 27.5% commission, paid out of their sign-up fees.

When a Senior Vice President recruits a new affiliate, they are paid the full 27.5%. At all the other ranks, only a percentage of this 27.5% is paid out (see above in “recruitment commissions”).

When this happens, the remaining percentage is paid out via a coded bonus.

Eg. If a Team Coordinator recruits a new affiliate, they are paid 15% of the recruited affiliate’s membership fees.

12.5% remains to be paid out (27.5 – 15), so the system searches the affiliate’s immediate upline for a higher ranked affiliate.

In this example, let’s say the affiliate’s immediate upline was a Vice President. Their percentage payout is 25%, however 15% has already been paid out, so they are paid 10%.

2.5% of the 27.5% total commission still remains to be paid out, so the system then continues to search higher for a Senior Vice President ranked affiliate to pay the last 2.5% out to.

Note that in the above example, if the immediate upline was a Senior Vice President ranked affiliate, they would have been paid 12.5% (27.5 – 15). Given that the whole 27.5% has been paid out, the system would not need to search any higher.

Note that the coded bonus also applies to customer commissions, with 27.5% always paid out on recruited affiliate’s customer shopping activity (see “customer commissions” above).

Production Bonus

The Production Bonus is yet another recruitment commission, paying out $500 per ten affiliates recruited into an affiliates downline.

Affiliates are only counted towards the Production Bonus quota if there are no equally ranked affiliates between the affiliate qualifying and where the newly recruited affiliate is placed in their downline.

Note that only Team Coordinator or higher ranked affiliates can qualify for the Production Bonus.

Partner Program Certification

Dubli’s Partner Program involves third-party companies white-labeling their e-commerce platform and signing up their existing customers to it.

Details on this are sketchy. What I was able to ascertain is that a Dubli affiliate needs to purchase a Team Leader Accelerator package or higher to participate.

I’ve seen commissions of up to 30% mentioned on activity generated by Dubli Partners, but no specific breakdowns.

Golf & Beach Resort Promotion

If a Dubli affiliate achieves the rank of Senior Vice President within 30 months of joining Dubli, the company will award them with the title to a house built on property Dubli purportedly owns in the Cayman Islands.

Joining Dubli

Affiliate membership to Dubli is available at three price-points:

- Business License (basic affiliate membership) – $594 ($99 + $495)

- Team Leader Accelerator – $2475

- Platinum Leader Accelerator – $6000

- Elite Leader Accelerator – $12,000

Note that all affiliates are required to pay an additional $99 monthly fee after their first month.

Apart from the “team leader” packages auto-promoting an affiliate to the Team Leader rank and increasing their commission percentage payout, the only other difference between the packages is what’s bundled with them.

- Business License – 10 annual or 100 monthly trial VIP customer subscription vouchers

- Team Leader Accelerator – 30 annual and 200 monthly trial VIP customer subscription vouchers and Partner Program Certification

- Platinum Leader Accelerator – 30 annual and 200 monthly trial VIP customer subscription vouchers, Partner Program Certification and Partner Registration Voucher (includes first year monthly fees)

- Elite Leader Accelerator – 30 annual and 200 monthly trial VIP customer subscription vouchers, Partner Program Certification, 3 Partner Registration Vouchers (includes first year monthly fees)

Note that with the customer subscription vouchers, a 99 cent fee must be paid to activate them.

Conclusion

The first problem with Dubli is that it has no readily identifiable products or services.

The e-commerce platform belongs to the company, with only Partners who pay to rebrand and deploy it. As far as the MLM side of the business goes, all that’s on offer is access to third-party discounts.

To establish whether any of these offers were exclusive, I randomly picked three third-party merchants in the Dubli Mall and had a look at how Dubli has affiliated with them.

Pet Doors offers a 5.2% cashback, with Dubli affiliated with them through “Affiliate Traction”:

As per their website,

AffiliateTraction, with offices in Santa Cruz California, is the largest multi-national affiliate marketing agency in the world.

We provide all-inclusive affiliate program management and promotional services for global brands and retailers.

Next I looked up “2modern.com”:

The “tqlkg” domain link redirected me to the website of Converstant, who bill themselves

the world’s largest affiliate network, we have a commanding presence in every major product category. Over 50 percent of the affiliate advertisers on the web choose to work with us.

The third company I checked was “bikini.com”. At first I couldn’t see anything in the source-code that openly revealed a third-party, but then I noticed conspicuous HTML comments under the “verifications” section of the code:

Present on all Dubli Mall listings, what you’re looking at there is a collection of affiliate referral codes for the various network Dubli are involved in. If no direct URL for an affiliate network is used, then one of those codes triggers a referral cookie and tracks the sale.

I didn’t look any further than that, but it’s apparent that most, if not all, of the merchants Dubli offer access through their portal is via third-party affiliate programs.

This I later confirmed by going over

As such, a typical purchase through the platform would look something like this:

- merchant makes a sale

- third-party affiliate network collects their fee

- Dubli paid their affiliate commission

- Dubli affiliates paid a percentage of commission Dubli receive

This is additionally confirmed in a 10K filing, also from August of this year:

DubLi offers our own online “DubLi Shopping Mall” that allows customers to search and shop for products offered by various online stores. DubLi is not the supplier of these products.

We provide links to products sold in numerous merchants’ online stores based on the customer’s searches and earn a commission on the purchases made by the customers that we refer.

For all customer purchases that are completed with the respective online store (known as merchant partner in the affiliate network) which sold the product, the Company receives a set percentage based on the completed customer purchase (transaction share) or a flat dollar amount for each transaction that is directed from a DubLi Shopping Mall or Shopping Mall.

Albeit on a much larger scale, this is akin to me signing up as an Amazon affiliate, getting customers to purchase through my link and then offering whatever Amazon pay me as “cashback” to my customers.

Further analysis of Dubli’s Premium and VIP customer subscriptions though is where things start get murky.

One constant I noticed in Dubli affiliate marketing is that the coded bonus paid out on affiliate purchases (up to 27.5% of whatever Dubli is paid), is roughly the amount Free affiliates receive.

As such, I believe the cashback amounts Free members of Dubli receive is roughly the amount Dubli are paid by the affiliate networks they’ve enrolled themselves in.

This begs the question where does the extra 4% and 6% offered to Premium and VIP customers come from?

Taken from Dubli’s FAQ:

Per the Terms and Conditions of both the Premium and V.I.P. Memberships, you are only eligible to receive your annual Cashback after you have subscribed to the membership for 12 consecutive months.

The obvious answer is the $4.95 a month and $99 annual fee these customers are charged.

But if so, then a potential revenue liability exists if a customer acquires more cashback in the 4-6% bonus amounts then what they pay Dubli year on year.

Dubli could be hedging their bets that enough of their Premium and VIP customers aren’t going exceed the amount they pay the company in bonus cashback, but that’s a pretty dangerous gamble to wage your entire business on.

The bonus percentages obviously aren’t coming from the merchant network (see mention of “fixed percentages” and “flat dollar amounts” received from Dubli above).

And if it’s not coming from customer subscriptions, then that leaves affiliates – which is unlikely seeing as Dubli force them to purchase a VIP subscription and pay $99 a month for commission eligibility.

These monthly fees however could be redirected to cover bonus cashback percentage liabilities from the customer network.

With free customer membership still receiving the default cashback amount and not being required to put in any money of their own, I still think Dubli are making these additional cashback amounts up from the fees charged Premium and VIP members.

Possible evidence of this strategy is available with the mention of a loan taken out (from Dubli’s CEO no less) in August:

As previously reported in the Form 10-K for the fiscal year ended September 30, 2012 of DubLi, Inc. (the “Company”), on August 11, 2014, the Company entered into a revolving loan agreement with Michael Hansen, the Company’s President and Chief Executive Officer, who is also the controlling stockholder.

The unsecured promissory note (the “Note”) is for a maximum of $3 million which may be drawn as needed by the Company.

Interest is calculated at 6% per annum from the date of the amount drawn and all principal and interest is due and payable in full on December 31, 2015.

On August 27, 2014, the Company entered into an amendment and restatement of the revolving loan agreement with Michael Hansen (the “Amended Note”) whereby the maximum amount available under the loan agreement was increased by $2 million, for an aggregate amount of up to $5 million.

All the other existing terms of the Note remained unchanged in the Amended Note.

As of August 28, 2014, the Company’s borrowings under the Amended Note totaled $1.5 million.

That loan is barely a month and a half old and it’s already been extended beyond its original agree amount, and half of the initial amount has already been borrowed (and presumably spent).

And I have to mention that I found it rather odd that the CEO of Dubli is making loans (which attract interest) to the company himself. Something about that just doesn’t sit right with me.

By all means go out and get a loan from a bank or what not… but the CEO loaning the company he works for? Yeah, might be legal but definitely doesn’t feel kosher.

As to the loan itself, I only brought it up as a possible revenue source to make up liabilities that arise out of Premium and VIP customers receiving “too much” cashback.

Dubli themselves have no inventory or shipping costs, so other than affiliate commissions what else could be costing them so much so quickly?

In any event, why is any of this relevant?

Well, if they’re hedging their bets on enough customers not making enough cashback to match the fees they pay, this is hardly sustainable in the long-term.

This might explain the need for the MLM side of the business, as one would think Dubli’s e-commerce network should have been taken off by now.

Unfortunately analysis of Dubli’s compensation plan takes things from murky to toxic.

Continuing analysis of the customer subscriptions, the inherent danger Dubli faces is that, in bundling so many subscription vouchers with paid affiliate memberships, there won’t be a significant amount of customers purchasing subscriptions.

Dubli already experienced this back in 2012 when they incentivized affiliates purchasing credits, and although that resulted in a revenue explosion, ultimately commission liabilities (not to mention regulatory liabilities) saw the company pull the plug on the auctions.

With affiliates being given plenty of customer subscription vouchers to splash around, are we going to see a repeat performance?

How Dubli is marketed needs to be paid attention to here, because it’s quite reasonable for the company to claim this latest launch has resulted in thousands of new customer subscriptions going forward.

Who paid for the subscriptions however is ultimately what will count. If most, if not all, of the customer subscriptions Dubli holds were paid for by affiliates, we’re probably going to see a similar scenario to that of Zhunrize.

Zhunrize, another MLM e-commerce platform company, was shut down earlier this week by the SEC.

Like Dubli, Zhunrize also charged affiliates thousands of dollars to participate, however upon investigation by the SEC it was revealed that

substantially all of its revenue has comes from the sale of memberships (referred to as stores) and the corresponding monthly internet hosting fees associated with operating those stores, rather than the sale of products.

If thousands of Dubli affiliates spending at least $594 each to join the company dwarfs whatever Dubli received from its affiliate networks and any fees from retail customers buying memberships, then compliance wise the company has a big problem.

And that’s only one of the significant compliance challenges facing the company.

The other is the blatant recruitment-driven pyramid scheme Dubli have embedded into their compensation plan.

Pay $594 to participate as an affiliate, recruit new affiliates and get paid.

At no point in the Dubli compensation plan (which co-incidentally is not provided openly anywhere on the company’s website), is there any customer requirement pegged to either the amount of customers an affiliate must sign-up, or how much they spend (cumulatively) in the e-commerce platform.

As such, it’s entirely possible for a Dubli affiliate to totally ignore the e-commerce platform and just treat Dubli as a chain-recruitment pyramid scheme.

As I mentioned in the compensation plan analysis of this review, at the top-tier a Dubli affiliate is paid $2750 for each Elite Leader Accelerator affiliate they recruit ($12,000).

Compounding this is the fact that affiliates are wholly encouraged to solely focus on affiliate recruitment, as every affiliate membership rank (which increases an affiliates commission percentage payout), is tied to direct and indirect recruitment.

Nowhere in Dubli’s compensation plan, other than 5% direct commissions at the base-level, are affiliates encouraged to acquire and maintain non-affiliate e-commerce customers.

Under this scenario, one could swap out the e-commerce network because it fails to have any relevance to your typical Dubli affiliate’s focus – other than serving to kill time in marketing presentations.

The e-commerce platform very much feels like the hook here, with the actual guts of Dubli’s compensation plan revolving around affiliate recruitment and compensating affiliates who recruit the most.

The recruitment commissions paid out on affiliate membership fees alone should be enough to trigger a regulatory investigation. Let alone analysis of the e-commerce platform and whether or not it’s actually functioning as advertised.

All in all I’d highly recommend prospective affiliate inquire as to how many paid members (that is members who paid for subscriptions themselves without the use of a voucher), a prospective upline has.

Then weigh that amount against the affiliate VIP subscriptions they have and any non-affiliate subscriptions that originated via the use of a voucher (the upline paid for).

If you don’t see significant non-affiliate funds being generated through the e-commerce platform, then there’s a good chance most of the money being generated is being raised purely on the affiliate recruitment side of things.

And if that’s the case, avoid at all costs.

Dubli is a publicly traded company who are required to make regular filings with the SEC, they’re only going to get away with this for so long before it catches up with them.

I’ll finish up with an appropriate quote from Dubli’s August 10-K filing:

Our network marketing program is subject to a number of federal and state regulations administered by the Federal Trade Commission and various state agencies in the United States, as well as, regulations on direct selling in foreign markets administered by foreign agencies.

We are subject to the risk that, in one or more markets, our network marketing program could be found not to be in compliance with applicable law or regulations.

Regulations applicable to network marketing organizations generally are directed at preventing fraudulent or deceptive schemes, often referred to as “pyramid” or “chain sales” schemes, by ensuring that product sales ultimately are made to consumers and that advancement within an organization is based on sales of the organization’s products rather than investments in the organization or other non-retail sales-related criteria.

The recent flurry of affiliate activity and the likely millions subsequently paid out in commissions isn’t likely to go unnoticed.

Update 27th September 2014 – Regarding the cashback frequency, it’s been brought to my attention that VIP members are paid cashback monthly with a 60 day delay.

Premium members are paid cashback annually but only if they pay $4.95 for 12 consecutive months.

I’ve been waiting for this – thanks so much for your review and analysis. What do you think about some of the names behind the MLM side – ie, Matt Trainer, etc.?

The videos and a personal contact mention you do not at all *have* to recruit customers yourself – in fact, the model at the moment is about completing “tasks” and then getting credit in their “rotator” mechanism to receive random customer commissions that way (rotator starting payment in a few weeks – apparently).

As there’s no detail beyond person-made YouTube videos (look for Team WUKAR), I’m guessing there’s zero guarantee of payment behind that mechanism, and the only payments they’re legally tied to are the DIRECT customer and affiliate referrals?

Couldn’t care less.

Although if they’re behind the comp plan, it’s a pretty piss-poor reflection of their standing in the industry.

A customer rotator? So what, they’re going to turn this into a passive opportunity ala Zeek Rewards?

Sign up, pay fee, dump VIP accounts on company-supplied customer accounts… profit.

Zeek was only shutdown 2 years ago, cmon!

If they’re focusing on affiliate recruitment, customer activity is neither here nor there. Commission generation is tied to affiliates signing up and paying their fees (upfront and $99 monthly).

They can use their vouchers as toilet paper and still collect the upfront and monthly residual commission from recruited affiliates in their downline.

Thanks, this has been really helpful. They’re trying to hook prevously non-MLM people with the spin of you don’t need to recruit any business affiliates OR even direct customers if you don’t want – you can solely just complete tasks for credit in the customer commission rotator and earn money just through some back-end SEO/video task work.

It smellt a bit fishy to me, mostly because there’s no written guarantee, and could easily take your $594 (or $2574), and claim ‘technical difficulties’ to never fulfill the rotator scheme!

That side has not promised big money, and they are quite clear that the big money is in the affiliate/MLM side, but by opinion the appeal to people who would normally not touch MLM with a barge pole, it’s either going to be really good or really bad!! (no prizes for guessing which side you guys predict)

I would be extremely weary of affiliates in a publicly traded MLM company, who are required to file regular reports and declarations with the SEC, that are openly selling customers to their downlines and marketing said company as a passive income opportunity.

Let’s just say Rod Cook are less than thrilled with these folks. There’s news item that DubLi’s head bailed out a scammer from jail, so it’s suspect that the scammer is a highly placed affiliate.

There is a guy out there by the name of Dustin Mitchell, that just got out of jail and is calling himself a vice president of international business developement at Dubli (or something of the sort). Could this be the guy that got bailed out?

http://www.examiner.com/article/dustin-mitchell-secrets-divulged-man-not-who-he-claims-to-be

He is also saying on his facebook page to come see him speak at the Amway conference in Australia with Dexter Yeager.

I can promise you that Yeager has no clue who this crack pot is, let alone be willing to share a stage with him. He has had VERY little success in ANY of his network marketing deals yet claims (more so that the rest) that he is some highly successful, world renound, sought after, whatever.

Among other things he claims to be

This quote was from one of his profiles and I am quite sure its a complete fabrication. You be the judge.

He eludes to having his own legal team and talks about holding a variety of fictitious titles, degrees, relationships, experience etc.

Here is a quote from ONE of his facebook pages. “James Arthur Ray and Dustin Mitchell are planning their winter tour dates. Would you like us to come to your city?”

https://www.facebook.com/catalystlifecoaching/photos/a.419722408167215.1073741828.419708241501965/451964861609636/?type=1&theater

I can bet that J.A. Ray has no clue who this guy is.

Long story short its and endless list of complete BS. This person is a deeply disturbed and mentally deranged individual. His antics run far and wide.

If you look him up you will be taken down a path of VERY odd, creepy and disturbing behaviors that are coupled with more than just “false claims” but downright unsettling visions of grandeur. I can almost hear the voices in his head MYSELF when I read some of this stuff. ha ha..

Yes, THIS is exactly the kind of person Dubli likes to do business with. They are a perfect match.

Be careful if you post anything, he may get his “legal team” after you, ha ha.

I just saw someone over on Businessfor Home say that Dubli has a 400:1 Customer to distributor ratio,,, ha ha What a joke. Do those reps actually believe what they say? I have seen people say some dumb things but this one is hilarious.

Try searching for a product online and see if a Dubli site shows up offering that product.

Are they counting the number of Vouchers they give out at signup as customers? Where the HELL to they think they are coming up with that number? Those reps will be lucky to get 2 customers each for that crappy deal.

Even if they DID have that number of registered customers it still wouldnt matter because they wont and DONT use the program. TRUST me, Dubli is the LAST place a consumer is going to go for a deal.

Thank you for the report you hit on some good points here mostly some rif raf drama from the past. One thing though i will say after reviewing the compensation plan, i will have to correct you that Dubli does have customer requirements for affiliates.

Also, each affilate is required to acquire at least 1 new VIP customer per mo. (as in the monthly fee that you mentioned) from what i have read.

Other than that they seem to new in the states and id like to follow this company more to see how they continue to develop. ill report back more to you

The guy that was calling himself the Senior Vice President of Dubli just put a post on Business for Home that he was just “fired” from Dubli. I know the REAL reason he got fired but his delusion is kind of funny.

Now he is calling himself the President and CEO Publisher of Network Marketing Lifestyles Magazine.

@Frederick

Such as? I spent 5-6 hours researching and failed to come across any.

Paying $99 a month != acquiring a VIP customer.

Isn’t James Arthur Ray the guy who killed two people via his “sweat lodge” vision quests through negligence?

Not sure about that one K. Chang. It very well could be.

James Arthur Ray is the former Herbalife speaker who was sentenced to two years following the deaths of three participants in one of his nonsense sweat lodge frauds and is one of The Salty Droids’ least favourite scumbags.

@CommonSense totally not backing DubLi up, but they are *claiming* it’s going to go big with American consumers because they’re essentially recruiting their BAs to do SEO work to get the site viral. Though I don’t doubt most startups MLMs claim this!!

With the revenue streams on the consumer end, is it possible that the percentages they’re paying Free members are *less* than they receive, so the difference is pocketed as income and also used to help pay the difference in percentages to VIPs? Surely that’s the same model as legitimate cashback websites (Topcashback and Quidco in the UK are very successful and there’s no MLM side).

I am not a business nor MLM person & have only been digging into DubLi for a friend, but on the surface, it could ‘work’ simply because other websites have done identical in other markets. Unless of course they don’t care if it works, pull out all the money they possibly can before 12 months is up and leave thousands of “VIPs” without their enhanced cashback payments – which I get is what you watchdogs are predicting! What you want to bet the 25% BAs earn isn’t payable for 12 months either?!

I keep waivering back and forth on DubLi…sounds like there’s some shady people involved and in all likelihood will go tits up inside of 2 years, but seems there’s a *possibility* of a little money to be made if you only dip your toe, keep your head down, and get out quick. *shrug*

yes thats true , because the cash back side seems genuine . but the high membership cost and the commissions paid thereon, is the money making machine .the cashback income may be too piddly to count .

Fortune High Tech Marketing [FHTM] , also had a retail product side, with very small margins , the main earnings came from memberships and monthly fees paid to FHTM. on the surface FHTM appeared legit because of branded retail products, but the truth was those products were not generating sizeable income. FHTM , as we know was shut down.

dubli launched in india in april this year. i found some indian dubli team leaders on the net , and called them . it was sold to me as a recruitment scheme . invest around Rs20,000 and get other people to join .

they threw names like myntra jabong, make my trip , which are very popular online shopping portals . a quick search did not throw up any tie ups of these companies with dubli for cashback . so either it a lie, or it works some other way with these companies, which i am not aware of.

internet shopping is growing but has not yet come of age in india. it’s a little difficult to imagine a middle class person from a small city , going crazy shopping on jabong 🙂

Cashback programs in and of themselves can be successful for the retailers and affiliate with the right marketing and direct relationships with retailers. (ie E-bates)

BUT, If you are trying to make an MLM out of “cashback” alone, especially as a third party It will NOT work. PERIOD! There is NOT enough margin. This is NOT debateable in any fashion. Its just MATH.

Dubli is NOT a viable or practical selling system. In the scheme of things and compared to ligit companies, they move/produce virtually ZERO in dollar volume. Dubli is nothing more than a paid for recruiting, mass signup game.

Ask yourself this: How much sales by dollar volume has Dubli produced for the retailers? How much have end consumers actually spent through Dubli?

If you can even find that ACTUAL number (without it being something someone made up). Compare it to BILLIONS that the legitimate companies that Dubli and the rest of them are trying to copy.

Where is Dubli ranked in any of the retailers reports on who their top referers (affiliates) are? Compare that to the companies that consistantly rank in the top 10.

Trust me, you will not find Dubli on the list at all because the retailers have no idea who Dubli even is.

Regardless of concept, you are NOT going to compete in an e-commerece environment with a few computers and a handfull of people. It takes a HUGE backbone with HUNDREDS of employees, IT people, Marketing departments etc, to get the job done.

It takes MILLIONS of dollars in Server banks and infrastructure. Assembling a few affilaite links and recruiting a bunch of mlm’ers will NEVER cut it. Never has, never will.

Can a company start small and work their way up? YES, but NOT with a business model like Dubli. The pyramid will crash LONG before they build any meaningful equity or buying power into the company that would afford them the people, credibility and infrastructure they need.

You cant build a REAL company just on the money from signing up distributors and they CERTAINLY cant do it on some measly little 3rd party, affiliate comissions. It will NEVER happen the way they are currently setup. NEVER!

just got the dirt from a team leader in dubli :

dubli is in prelaunch in india and will formally launch end of the year .

this guy has a team of 250 people already , his cash back earning for the month of august was 15$ and ‘other income’ was 450$

out of 250 people only 5 people from his team shopped online in august

he was a sweet guy , feel bad ratting out , but this shows how the money flows.

I recently ran across an article that stated, on average, on-line spending is about $1700 a person per year.

Commissions on affiliate programs run from about 2 or 3% on the low end up to 8-10% on the high end (there are probably exceptions, of course).

Let’s say, on average, Dubli is getting 7% of that $1700 ($119)and pays 5% ($85) to the free customers. That leaves them with a profit of $34 per person a year.

And that original $1700 figure comes from shopping the entire internet not just limited to the stores that Dubli has on their site.

JUST for argument’s sake, Let’s say it doesn’t look viable because they haven’t started the intense SEO work to drive traffic – no idea how true, but apparently they do have some pretty decent SEO brains in their employ, and once things ramp up, it could start to drive a reasonable amount of traffic.

I do get what you’re saying, that it’s in no way a long term viable business.

My pet theory is I think the smaller tier early adopter BAs could probably make a bit of money in the beginning – nothing major, just a bit of extra cash in their pockets, but would be wise to cut and run fairly quickly as it will crash out within 1-2 years.

I could be wildly off, just a theory! Probably too optimistic for most, haha.

Allow me to correct an error in the review. I’m not a Dubli distributor on the MLM side, but I am a customer on the cashback side. Meaning, I recently paid $99 for the annual VIP membership to get increased cashback on purchases. Concerning when the cashback is normally paid, this is not correct:

That was actually their answer to this FAQ on their site, concerning canceled memberships:

Here’s the correct question and answer, from their FAQs:

So it’s approx. 60 days – not 12 months – when you’re eligible to recieve your cashback. Big difference, and quite reasonable. (I agree that 12 months under normal circumstances would be ridiculous.)

I’d also like to add that despite buying the annual VIP membership just a couple of weeks ago, I’m already up to over $120 in cashback as you can see here in this screenshot of my account (with more purchases planned):

http://screencast.com/t/EL9NcP0ncCmI

So speaking only as a customer of Dubli’s cashback program, I’m thrilled with what I’ve seen so far. The purchases are tracked and they typically appear within a couple of days.

I did purchase a washing machine from Best Buy a week ago that hasn’t appeared yet, but they say to allow up to 14 days for purchases to appear. I’ll be happy to report back once they’ve paid my $120 plus to my Payoneer debit card.

@Tissa

Thanks for clearing that up, but I’m still confused by the wording of “annual cashback”.

That wholly suggests that the cashback is paid annually.

There definitely seems to be conflicting information on the Dubli website about this. I’m not at all understanding what cancelled memberships have to do with 12 month eligibility periods.

(If somebody can better explain this to me I’ll update the review accordingly)

Any idea where the extra member cashback funds are coming from? Obviously not the third-party affiliate networks as they only pay Dubli a fixed amount (regular “cashback”).

That’s one of the major problems I see sustainability wise with Dubli’s business model (in addition to the recruitment commissions being paid out on the affiliate end, which you claim you’re not a part of so I won’t ask).

Cashback for Premium members is paid annually. Cashback for VIPs is paid monthly, as shown on their site:

http://www.screencast.com/t/fxpwtvhYpRu6

Perhaps that is creating the confusion.

You can ask 🙂 I’m not a Dubli affiliate/distributor, as I stated above.

So Premium customers pay monthly fees, but receive cashback annually.

Well, obviously that’s just there as a donkey option to create the illusion of choice then. Nobody in their right mind is signing up for annual cashback.

Again, thanks for the clarification.

If I may ask, you’re involved in the MLM industry – any reason you didn’t take up affiliate membership?

Agreed, that’s why I chose the VIP option.

Why would someone pay $99 to get the same cashback incentives that other companies give for free?

Oz, yes there is a flat % that retailers pay. Usually the affiliate would keep a portion and give the other portion to the consumer in the form of cashback. They CAN have tiers and allow the consumer to get more cashback. There is a little wiggle room there. This opens up far more questions than it answers though.

By having a VIP level, it generates less commissions for the company or sales force. Hence, the signup fee to help makeup for that.

Beyond that, as a company, you would have to hope that the consumer does not “use” the service to the point beyond breaking even. In fact, from a profitability per transaction standpoint, you would hope they dont use it at all as a VIP.

ALSO, since it greatly decreases group comissions per cashback transaction, income becomes dependent on signing up new customers. There is NOTHING residual about this pay structure. Its all churn and burn baby.

Sure, because in Dubli’s case, I think the product (cashback to customers) offers a much broader opportunity for me as an online marketer than the affiliate side.

By showing customers how they can save money on things they would buy anyway, I’m able to earn commissions without having to recruit or draw circles on a whiteboard. 🙂

Aren’t customers limited to a static $20 a pop on signing up VIP customers? Bit of a short-term opportunity no?

I would MUCH rather have a percentage of every transaction than a one shot $20

BUYing a discount makes no sense at all. And please don’t say buying clubs. They are NOT MLM.

She is definitely smart by not jumping into the business side. No one in their right mind would want to recruit to get paid. Especially if they have to do it on a mass scale and KEEP doing it.

Why do they have to? For example, let’s say you signed up for the cheapest $595 “team member” option.

Tissa has stated she is interested in recruiting customers – so as long as she’s happy to recruit enough to cover her intial fee, so long as her aspirations are fairly low, she could get in, get 25 customers and make $500 profit (=$1125 = $595 fee + $530 profit), plus more down the line from their purchases.

I think SO LONG as you didn’t stick around too long or get too greedy, you could use this launch hype quite well before the company crashed and burned from poor business model.

Perfectly legal, no?

Both approaches are equally valid.

Affiliate marketers usually go for the one-time commission from a sale. Network marketers prefer recurring commissions from one sale. Others like myself fall somewhere in-between.

Each model has its variables, and a lot depends on marketing strategy.

No. But even if it was, you really care that little about your credibility, integrity and ethics?

according to the dubli leader i spoke with yesterday , premium members get their regular cash back monthly , but the extra 4% is paid annually.

VIP members receive the full cashback on a monthly basis.

in india, the joining affiliate Business license is for approx 340$

i was told a guy who was on the board of coke , is on dubli’s board . is this true or hype?

and dubli being a listed company , is one of the highlights of selling the scheme.

tissa’s case shows how valuable the cashback program can be for regular high value shoppers.

if i were a travel agent making hundreds of hotel bookings for my clients , i could forward the hotel discounts to my clients and get cash back in my account for every booking .with a proper clientele a cash back MLM can definitely create value for its members.

Yeah but we’ve already established it’s not sustainable.

The money has to come from somewhere, and with only a fixed amount coming from the merchants (regular “cashback”), the bonus percentages are coming from affiliate/customer fees.

Those funds are already covering recruitment fees and what not so there’s only so much money to go around.

My theory is that this is why Dubli are borrowing from their CEO. They’re hedging their bets on attracting enough customers who don’t receive more cashback then they pay in fees.

Like I said in the review, that’s a dangerous gamble.

ha, i called up myntra customer care , they have NO cash back program at all . they have gift cards and coupons but no cash back .

Or you could do the same thing for FREE through other companies without having to spend $99 to $12,000 for the “privilege”

FYI. the affiliate commission on travel is not based on the total price of the package. If travelocity shows 3% cashback, they are paying 3% on THEIR profit, NOT the total package price. If its a $5000 trip you might get paid 3% on $200 of that $5000.

Moot point anyway.

One direct question from me …

Are you being paid anything EXTRA from Dubli, directly or indirectly, to use the card in a specific way, e.g. do you receive any additional payments other than the $20 recruitment commission and your own cash back?

The reason for the question is that it has always been difficult to find any “only customer, not an affiliate” for Dubli earlier. You fit directly in as a solution to that problem, as a “proof” for “We do actually have real customers”.

I’m not sure which card you mean. I use my usual Visa, MasterCard, or Amex etc. to shop at the merchants.

I’ve opted for Dubli to pay my cashback to my Payoneer debit card, which is a MasterCard that can be used like any other MasterCard.

I do not receive any additional payments from Dubli other than $20 referral fees and cash back from my own purchases.

I’m only a customer. I’m not participating in the affiliate program at all. I created my customer account at Dubli.com; I’ve never created an account at DubliNetwork.com (the affiliate side).

you have probably kept away from the affiliate side of the business to ‘keep your hands clean’.

but could you explain , that as a VIP customer WHERE is your extra bonus 6% cash back generated from ? this is not exactly a cashback , as the vendor is NOT paying it .it is more like a commission from dubli.

according to the law , from koscot thru burnlounge , the non negotiable condition for MLM , is that commissions have to be related/generated from ‘product sales’.

could you explain HOW your 6% bonus is connected to product sales?

She is gaming the system knowing perfectly well that her money are dirty.

The whole ebates system is nonsense. You save few percent of purchases at best, but enticed to spend much more than you need.

As I said earlier. The extra 6% CAN come from the money that the stores pay the affiliates. I am not saying it DOES in this case BUT there is wiggle room there.

Typically an affiliate commission will be 8%. 1/2 of that goes to the affiliate and 1/2 goes to the consumer. If they pay for an VIP membership then the customer can get a higher percentage BUT the “Dubli Rep” would get less towards their commission.

The question is: Does adding the 6% come out to MORE than the store is paying the affiliate? That would take some homework to figure out. Find out who their 3rd party affiliate bank is, (who ALSO takes a percentage) then, do the math from there. All stores typically pay different ammounts. They range from 2% to 12% with the average being somewhere around 8% the last time I checked.

Using Tissa’s list of things she purchased, I was able to find some percentages:

Lowe’s pays out 4% which puts Dubli in the hole for 2%

1800flowers pays 6% which makes it a wash for Dubli

I wasn’t able to find Hyatt Hotels but Marriott pays 3 %

Best Buy pays 5% on appliances (which Tissa said she bought one about a week ago).

Thanks for the revue, Tissa is a guy by the way

You can give this free cashback offer to 1 million people, and only less than 1% of them will use it SOMETIMES

Affiliates are making pennies on customers

Not one single person can show me proof that they are making a living just from bringing in customers

It’s a scheme that will get shut down soon

Yes, but those are standard affiliate commissions typically published on their sites.

Speaking as a long-time affiliate marketer, higher commissions are almost always negotiated behind the scenes based on volume and lead quality. I’ve experienced this personally, and there’s no doubt that companies can negotiate even higher percentages.

Take 1800Flowers for example. Indeed their site states 6% commissions to affiliates, but purchases via ZoolaRewards pay twice that, at 12% cashback:

http://www.screencast.com/t/WMFeEFGFaSw

How are they able to do that?

Membership in ZoolaRewards is completely free, so clearly they’re not taking from membership fees to pay cashbacks. Obviously they’ve negotiated a deal with 1800Flowers or some third-party aggregator based on volume.

A similar scenario is entirely possible with Dubli. I don’t think any of us are privy to what Dubli may or may not have negotiated with whomever.

All I’m really qualified to comment on is that I’m seeing Dubli’s cashback program working very well on the customer side.

I know of bloggers and youtubers that do make money off of affiliate programs (and ads) but I think it’s more in the area of “mad money” as opposed to being able to live off of it.

Plus they have large audiences and their blog and/or youtube channel focuses on a specific topic or closely related topics.

@Tissa

If so, then why the monthly, annual cashback wait? They’d be paying the excess all in one hit.

Additional transactions on their part means more processor fees. Makes no sense.

And they’re offering fixed percentage bonuses on all cashbacks. They can’t negotiate fixed bonuses with all the affiliate networks they’re participating in. The only other fixed source of revenue are membership fees (both customer and affiliate).

right. your example of 1800flowers and zoola proves that .we now have two scenarios:

1]if your 6% bonus is coming from affiliate member fees , then even at customer level, dubli is a pyramid scheme.

2]if dubli has negotiated high commissions from vendors , and your 6% bonus comes from that , then it raises a pertinent question: cashback which should have accrued to free members thru their shopping is being routed to paid members.

for instance , if zoola and dubli both have a 12% commission deal from flower1800 , then zoola members[all free] will each avail of the cashback EQUALLY. however in dubli free members may get less cashback to create a pool for your 6% bonus.

i am sure free dubli members are unaware that their shopping rewards are being stolen from them without their knowledge.

this is clearly a ‘deceptive and unfair trade practice’ under FTC Act 5 .

Federal Trade Commission Act , Section 5: Unfair or Deceptive Acts or Practices:

this would absolve the customer side of dubli from pyramiding or deception.the affiliate side however, would remain an out and out pyramid scheme.

Regardless a third party affiliate portal is not a viable mlm product

They are a 3rd party affiliate of linkshare and commision junction. The 60 days is the time it takes for linkshare or CJ to bill the merchant, collect the money then pay the affiliate(dubli).

You cannot sell for most of these companies without going through those affiliate managing companies. Dubli is just a 4th party with a active affiliate relationship with a 3rd party affiliate program managing company.

You can join linkshare for free and sell for walmart Best Buy and most other major big box retail and online businesses, and earn a commision of the sales you produce!

Where is the extra 6% cash back bonus of VIP members coming from????

Is it internal revenue (marketers joining)??

If a rich customer buys $10 million of stuff through the portal as a VIP member, then how would Dubli pay this person the cashback??? What about 5 rich people doing the same thing?? 50 people??

The 6% extra VIP cashback isn’t coming from the store like Walmart and Apple … I could be wrong …

That’s my guess.

Dubli themselves don’t disclose this information.

Speaking of ponzies. At 7:17 in a video you’ll hear Tony Rush admit hes made $150,000 and none of it came from the cash back from the tool bar.

He’s making money by enrolling hundreds of people for $2500 each. Thats illegal. Follow the money. You can bet the federal agencies are starting to.

If Rush’s backoffice is anything to go by, Dubli has nothing to do with e-commerce and everything to do with recruiting people who pay hundreds or thousands of dollars to qualify to earn when they recruit people who do the same.

This is just affiliate money being recycled from new recruits to those who do the most recruiting.

people worship Rush and will go all-in $12k just to get his attention to have a chat.

a lot of lives will be ruined by this company. all the people that say they can simply build a customer base without recruiting are heavily trying to recruit.

Looking at the video numbers, I’d be surprised if they were still around this time next year.

There’s the added disadvantage that, being a public company and already having had their hand slapped for something else, they are already on the radar with the feds.

FYI. the affiliate commission on travel is not based on the total price of the package.

If travelocity shows 3% cashback, they are paying 3% on THEIR profit, NOT the total package price.

If its a $5000 trip you might get paid 3% on $200 of that $5000.

I dont understand this part. If I booked a $5000 trip what would my rebate be?

It’s what happens when you yourself don’t offer any products and services other than affiliate membership.

Maybe I am mistaken, but isn’t Dubli paying a PERCENTAGE of whatever their PERCENTAGE from the merchant is?

Example:

1) Dubli affiliate makes a purchase thru Dubli portal for $100

2) Retailer pays Dubli a set percentage of the purchase price (for this example, let’s say 10%) which equals $10 for Dubli

3) Dubli pays their affiliate a set percentage of the Dubli percentage funds (let’s say 6%) for a cashback to the affiliate of 60 cents.

If this is how they have it structured, Dubli has $9.40 remaining that they can use for other means, or as profit.

If that’s the case then the shopping portal becomes even less attractive.

Cashback percentages are already low, a percentage of a <5% percentage is hardly worth it (nobody is paying Dubli 10% unless the merchant is pushing something shonky).

And it would only serve to increase the disparity between recruitment commissions and the cashback network.

Oz, then maybe Dubli is acting in a go-between capacity, the consumer is a pseudo-affiliate of the retailer, thus getting the full amount of the affiliate agreement with the retailer is.

It is all very confusing to me (obviously).

You have to take the free account as the baseline. That’s what Dubli receive from merchants.

That amount as a percentage of what is actually paid Dubli makes no sense, as it would put the network at a massive disadvantage (4% of typically 1-5% is nothing, even when hundreds of dollars are spent to purchase something).

The answer as to where the extra cashback comes from lies in Dubli bundling sample memberships (which cost them nothing to produce), with affiliate membership options that cost thousands of dollars.

That money doesn’t just disappear. Some of it is used to pay recruitment commissions and inevitably some of it is going to be recycled into cashback.

Dubli is a big convoluted mess, in part because they don’t explain dollar for dollar the mechanics behind the cashback. Writing the review was headache enough for me.

I obviously need to dig into it all further. I was considering joining, but I’ve had some doubts from the beginning.

As nothing is truly free, the income to pay the “Free” accounts is a total wash for Dubli to lead people to the paying customer side of the business.

They dress it up to make it attractive to buy in.

Not enough. Typical Amazon affiliateship pays a few percent. Even those “Cashback with every purchase” credit/debit cards pays like 1% or more, and you don’t have to pay a penny. Dubli talks a lot but in the end, it’s “pay us, and we promise to pay you back, really”

So the question is: do you understand the scheme well enough to trust their promise to hand over your money?

After reading this whole thread. I still dont know it wont work on the customer side not the recruiting side.

If Dubli is making a spread on all the sales no matter what the rebate is they are making money. Right?

Jeff

From my understanding, Dubli becomes an affiliate with X company which agrees to pay Dubli 5% (or whatever %). Dubli tells it’s free customers that it will pay them 3%. Mr.Customer buys $100 from X company. X company pays Dubli $5 and Dubli pays Mr. Customer $3 out of that. Dubli makes $2.

Enough free customers and/or purchases made by free customers and Dubli could make some money before expenses (web site, any staff, etc.) but they’re not going to rich off of it.

My example doesn’t include travel as somebody stated that travel items are done differently.

When you start adding in the different levels and payouts for bringing people in (as customers only), etc. that the numbers don’t start adding up.

The mlm/business side is just 100% ponzi.

I dont know whats so complicated. They “pre-purchase” 20 years worth of “autoships” then assign them to their moms, dads, aunts, uncles, Dogs, cats, and goldfish etc.

They pay the comissions on the “vouchers” before they are sold. Its a paid for recruiting game PERIOD! Nothing else matters beyond that.

I have been in a networking based e-commerce business for 6+ years. I know EXACTLY how this works. The way Dubli has their commissions structured they will need 10,000 reps in their pay line’s to make $5000 a month residual off of consumer “shopping”.

There is respectively NO residual income here. Its not freakin rocket science. Its really simple math. If anyone cant see that, they do NOT belong starting ANY type of business.

Thank you so much for writing this! My husband’s friends are losing their minds over anything and everything Dubli.

It’s like his facebook newsfeed has been taken over by Dubli, they don’t even post about their real lives anymore it’s all Dubli and Wukar and “we’re going to be millionaires drinking cocktails in Grand Cayman in 2 months.”

Oh and by the way DUBL is a pink sheets (Over The Counter) stock. To quote ehow…

Read more: ehow.com/info_8148945_pink-sheet-stocks.html

One of the Terms and conditions of Dubli !!!

It seems to be about “testimonials” and other types of marketing efforts. It means you won’t be compensated or asked for permission for that type of use. They won’t need to remove that type of material.

People can still complain about misleading information.

Which makes it worthless as a service (not obviously useful) and dangerously risky as an income opportunity, doesn’t it?

I am both a customer and a BA(buisness associate) with Dubli and i just read this whole tread. I have been with Dubli over a year now,and i will just give some of my inputs on all of this.

As a customer, me and my wife have received over 1200.00 dollars from cashback purchases. We are VIP members so, our $99.00 fee was recovered. It does take sometime useally over 60 days for the cashback to be available for transfer to your bank account or dubli mastercard.

I have had 6 transactions not process due to various reasons, but it was do to not following the correct way to activate the cashback.

As a premium or VIP you can get your cashback out at anytime after the 60 or so day for the processing. As free member you can only take it out once a year on your anniversary day.

So as a customer i am very satisfied so far. VIP’s can only be used as a personal account and can’t be used by a buisness. There is a buisness or corporate account that basically is the same as the free account.

Now on the buisness associate side, i still am working on this. I never joined Dubli to recruit people, i just never done this before and have no experience in mlm, but what got my attentions is the non-profit program that no one has mentioned so far.

So for any non-profit organization Dubli offer a free branded website that the non-profit can use to promote to their members and they will receive a 30% commission on all of their members annual cashback amounts.

So my idea was just to build a large customer side and if they do use it like we did i will get a % of that as a buisness associate.

Now as far as all the other comments i did not analyze that deep, and will probably pay for that lol.

(Ozedit: recruitment spam removed)

Unfortunately the customer cashback side of Dubli, at least as far as the bonus percentage goes, can’t exist without the recruitment side of the business (MLM).

Well it’s all there for you in the review. Additional cashback doesn’t just materialize out of thin air, it’s subsidized out of the ridiculous affiliate package fees charged.

Out of curiosity, which package did you come in at?

I came in at the TLC level. That included 10 VIP vouchers that i sold. It also allowed me to sign up Non-Profits.

Just one other note, it looks like some of the major retails like WalMart are naming Dubli as the number one affiliate producer. Not sure if this is important or not.

Team Leader Accelerator?

Why would someone who “never joined Dubli to recruit people” drop $2475 on affiliate membership?

What, for a replicated branded website for your non-profit? Cmon son.

Did any of the people you sold the VIP vouchers to sign on as affiliates?

None of my VIP have signed Business Associates if thats what you are asking and thats because i did not tell them anything about that side of Dubli.

They have renewed their VIP’s and i am getting commission on their cashback.

Also out of that 2475, i made back 1000 just by selling the 10 VIP’s that i got as part of the package and i also received 20 for every VIP for referring them as a customer and 25 for the annual commission that i get as a Business Associate so thats another 450.

So i paid 1000 to be able to sell to the non-profits. If you take the 1200 that i made as a customer using the VIP plus the 1000 for my VIP vouchers plus the 450.00 for the referral and commission i have made back my money and i am not counting my other commissions for cashback from my customers.

I am certainly not making any significant money this way but if the company sticks around i may be in a few years. Bottom line is i don’t feel like i am selling something to anyone. i am just showing them how to save money on something most people do, which is shop online.

Check out my website if you want to really find out how Dubli works. Let me be clear, i am not recruiting new buisness associates i am trying to build a customer side. This is what i was told i can do and make money and that why i did it.

Well if that’s the case then more power to you.

Like I said previously though, know that the additional VIP cashback is unsustainable without the supply of fees charged. If enough VIP members receive over $99 in annual cashback the system runs red.

At that point they can dip into affiliate package funds or continue to accumulate debt.

Oz you may be right and i will bring this up and check into it more in depth. The way it was explained to me was that Dubli negotiates with all of the merchants on the cashback it receives, then it pays its members a certain portion, then it keeps the rest.

Because of the volume that dubli is sending these merchants the merchants may increase the amount of cashback. So the idea is that even the extra VIP 6% is still being covered by the merchant cashback. Hope this helps.

6% flatrate across all merchants? Cashback is typically set by the merchants, not a third-party company.

And the volume argument is bust, as you can’t measure volume without signing up a merchant, which would require agreeing to a 6% uniform cashback.

Retail doesn’t work like that, the margins are already typically stretched thin per sale.

The fact that Dubli themselves don’t clarify this publicly indicates it’s the weak point of their cashback model.

I mean if they were able to keep 2% of cashback for non-VIP members, why bother having the MLM side of the business at all?

As per Tony Rush’s reveal video, there’s evidence of a disconnect with Dubli’s top MLM commission earning affiliates and cashback commissions. In that, those who are earning significant money in Dubli are certainly not earning it as a result of referring non-affiliate cashback customers.

Rush himself earnt some $150,000 or so in two months from memory, all from affiliate recruitment. Cashback was so negligible he didn’t even bother to show it.

Tony Rush did a wonderful job in showing how much of a pyramid scheme DubLi is with his reveal video. Well done Tony!

Seasoned MLM pros like Tony Rush see the opportunity to use Dubli to recruit and make quick money. He also already has team base that will do or follow his lead.

There’s another guy that made over 500k in 29 days, the fastest VP in Dubli history.

After doing my research in the MLM buisness the common elements i saw, was a bunch of guru’s promoting deceiving techniques like (open end questions, close end questions) an other sales type techniques to lure young or unsuspecting people to join their MLM.

Then they want you to build a team to do the same. This just did not sit right with me, so i dont really pay any attention to that side of the buisness.

Dubli did offer the other side the i mentioned before and i have not seen any other MLM out there that gave this option. I may be wrong but most MLM are product driven.

You should. Regulators will go after the company first, and only then might go after individual affiliates.

Good point OZ i will certainly keep that and all the info in this blog in mind. Thanks for all your good info. I guess if i dont recruit anyone i should be safe. Lol.

Firstly, apologies I haven’t included a photo as I could not work out how to do this. Secondly, I really just want to ask for clarification on DubLi being a ponzi scheme.

So I get the whole recruiting people and if your income is predominately from recruitment – then alarm bells. But how about doing tasks, earning credits and exchanging those credits for customers or business associates. You essentially have done work / provided a service and are paid for that work through customers and business associates. Still a ponzi?

Another question I have is – if it was a ponzi scheme, your posts date back to 2010, why has the authorities not done anything, surely they would have done something by now, its been 4 years +?

Really just looking for clarification as I consider all this.

Thanks in advance.

@Jill

You’re using the term Ponzi instead of pyramid, those two terms are not interchangeable and refer to different business models.

That doesn’t negate the recruitment side of the business.

You’d have to ask the authorities.

If I had to guess it’s because Dubli never went anywhere until they relaunched with recruitment-focused commissions. They were not even a blip on the radar until recently.

Now you’ve got affiliates posting $100,000+ in recruitment commission videos. How long do you think that’s going to go unnoticed?

What is the difference between ponzi and pyramid then please?

I can definitely see that these video’s that Tony Rush, Kristian Hoenicke, Tar’Lese Rideaux and the like are putting out there with all the money they are making just from recruiting is going to cause issues.

Are all countries subject to the same legalities regarding ponzi schemes?

Another way of describing a pyramid scheme is as an “endless chain recruiting scheme”

Once recruiting stops, as in, new recruits can’t be found, the scheme collapses.

Many modern ‘net based schemes are combinations of both ponzi and pyramid

@ jill somers

en.wikipedia.org/wiki/Ponzi_scheme

en.wikipedia.org/wiki/Pyramid_scheme

the difference is that ponzi schemes are not recruitment based , but are direct investments ; and pyramid schemes are recruitment driven with commissions for recruitment .

the similarity is that both are money transfer systems without any real ‘economic activity’ underlying them.

when they crash , most participants lose money .

and yes , they are illegal everywhere.

I have a relatively long blogpost where I deal with the differences and how each type can be disguised so the sheeple can’t tell them from real businesses.

amlmskeptic.blogspot.com/2012/06/mlm-basic-what-is-ponzi-scheme-and-what.html

Thanks guys – so all in all – your view is that DubLi is a pyramid scheme? And one should stay away from it as eventually the authorities will catch up with them?

It’s very likely a hybrid MLM / Ponzi / Pyramid scheme where you can BUY your way to higher ranks instead of via sales alone for greater rewards.

That in itself, is very reminiscent of Lyoness and why Lyoness is under investigation in Australia where ACCC (their FTC) already charged Lyoness with operating illegal money scheme.

By doing it half and half, they’ll confuse the sheeple who who keep looking at the legal half and put in money, while the “leaders” who paid in early for the top positions are reaping the rewards and encourage followers to go all in (i.e. join at the middle under them so they can benefit).

@Jill

Either that or it will organically collapse (stall).

There’s no sustainable retail activity taking place within the business.

So today I found out that DubLi have direct relationships with the retailers. I am told that they do not offer cashback via third parties or other affiliate programs. Do you think this is BS?

I know that they definitely have a direct relationship with Apple, because as you know Apple don’t normally offer discounts.

Keen to hear everyone’s thoughts on this. Apologies for all the questions – but I am exploring the customer side not the recruitment of associates side. So want to know absolutely everything and anything.

Told by who? Did you see any proof?

Does it make any difference? The primary part of the business will still be the recruitment of new participants.

If you’re looking at DubLi as an income opportunity, it will be that part of the business you will be joining. The only realistic way to make any income is to recruit minimum 3 additional participants, and to help them recruit minimum 3 additional participants, and so on and so forth in an endless chain of recruitment of new investors.

If you google “Dubli compensation plan”, you will find that the compensation plan has been relatively unchanged in the last 5 years or more. Only the front side of the business has changed = it has introduced new “next big thing on the internet” components one or two times per year.

The main part of the business has always been about the recruitment of new investors = people paying for “positions” disguised in different ways.

——– Pay directly for a position ——–

•Team Member – starting affiliate rank

•Team Leader – recruit and maintain at least three affiliates (or pay $2475)

•Team Coordinator – recruit and maintain at least three Team Leader ranked affiliates (or pay xxxx, I don’t remember the amount)

•Sales Director – recruit and maintain at least three Team Coordinator ranked affiliates (or pay $12,000)

———– Recruitment required ———

•Vice President – recruit and maintain at least five Sales Director ranked affiliate legs

•Senior Vice President – recruit and maintain at least five Vice President ranked affiliate legs.

please go through the official apple internet reseller list . neither is dubli inc and neither is medianetgroup [parent company of dubli] , on this list .

apple says:

salesresources.apple.com/sp/catalog/

If you’re primarily looking at the customer side of the business, I don’t really see any problems. I haven’t analysed that part of the business either.

Potential problem:

It’s relatively common to use a “customer side” of a business as a feeder program for the “opportunity side” of the business.

A feeder program will feed the main program with a stream of “prospective new participants” = people they actively can try to recruit into the main opportunity.

dubli inc seems very ‘gentleman corporate’ if you look at their board of directors .these are stalwart corporate folks with backgrounds ranging from microsoft to senior positions in publicly traded companies :

1] blas moros comes from microsoft

2] Lester Rosenkrantzis is a wall street veteran , including a 17 year tenure as CEO of Rosenkrantz, Lyon & Ross, Incorporated, a NYSE-member firm.

3] david sassnet’s experience encompasses more than 12 years with the auditing and consulting firm of Deloitte & Touché, LLP.

michael hansen the CEO is the founder of dubli inc , and his CV is not that strong .

what are the top three guys doing with dubli ?

Is the board actually doing anything? Or is Hansen just paying them to use their names (along with Dubli affiliates)?

@ jill somers

dubli is lying about ‘apple’ and its lying about ‘walmart’ too . in india they are lying about tie ups with retailers like myntra and flipcart . i called the companies and checked that no such tie ups are there.

if dubli has direct tie ups with apple and walmart and what not, there will be some proof , because these are things a company would celebrate , instead of hide.

Read more : ehow.com/how_5966899_become-online-retailer-walmart.html

They DO NOT have direct relationships. They DO NOT have the buying power or track record to negotiate with retailers. They dont even know what it takes to make that happen, let alone, do it.

It takes loads of clout, years of results, years of negotiations and a HEAVY corporate infrastrucre to make that happen. TRUST me, the retails have no clue who Dubli is. If they even attempted to make the approach to retailers, they would be laughed out of the building. Not that it even matters, because its just a paid for recruiting pyramid scheme, but, Whoever is saying “they have direct relationships” is flat out LYING to you. It is COMPLETE BS!

Why would you even CONSIDER working with some cheap, BS knockoff off recruiting deal? Dubli (and the rest of these dime a dozen “cashback” deals) are not doing anything but trying to copy a successful e-commerce and product brokerage company and they are doing a very, VERY poor job of it.

Innovation wins the race, NOT imitation. Dubli is pathetic at best.

For a supposedly “direct” relationship with Apple, they got a pretty shitty deal. Here are restrictions if you shop through a Dubli link:

“The iPhone 6 and iPhone 6 Plus are not eligible for Cashback. There will be no Cashback paid for purchasing the new iPad Air 2 and iPad mini 3. Cashback is not available on MacPro, Bose Products, Gift Cards, Shipping, iTunes, Gift Wrap and Apple One to One Membership.”

Like others have said – they have no direct relationship. They simply signed up for a bunch of affiliate programs and slapped them all on one website.

Let me shed some light on not just the “customer” or “retail” side, as I think a lot of good affiliate marketers have kind of exposed Dubli so far, ( how they can pay MORE cashback $$ to customers who pay DUBLI $99 etc etc), let me tell you whats going on the MLM side.

I am a member of Dubli/WUKAR who stopped promoting this immediately I begin seeing whats going on.

Matt Trainer who is “WUKAR” joined this directly under Dubli (some say that DUBLI even paid him big $$ to get this kickstarted in the US) and with the help of some big names in MLM begin promoting Dubli.