American Dream Nutrition Review 2.0: Autoship still a problem

BehindMLM published our initial American Dream Nutrition review all the way back in 2012.

BehindMLM published our initial American Dream Nutrition review all the way back in 2012.

About a week ago a reader suggested we revisit the company for an updated review, so let’s get into it. [Continue reading…]

22USD Club Review: $1 a pop pyramid scheme

![]() 22USD Club provides no information on their website about who owns or runs the business.

22USD Club provides no information on their website about who owns or runs the business.

The 22USD Club website domain (“22usd.club”) was privately registered on May 9th, 2018.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Banners App Review: FutureNet Ponzi wants access to your phone

Banners App provides no information on their website about who owns or runs the business.

Banners App provides no information on their website about who owns or runs the business.

The Banners App website domain (“bannersapp.com”) was registered on July 3rd, 2018.

Rafal Szymanski is listed as the owner, through an address in Lviv, Ukraine.

On Facebook Szymanski (right) credits himself as co-founder and CEO of Banners App.

On Facebook Szymanski (right) credits himself as co-founder and CEO of Banners App.

He is also heavily involved in the FutureNet, serving as “Chairman of the foundation council at FutureNet Foundation”.

FutureNet launched four years ago as a six-tier matrix Ponzi cycler.

In 2016 the company launched FutureAdPro, an adcredit Ponzi scheme.

In line with what much of the MLM underbelly was doing, in early 2017 news of a FutureNet altcoin surfaced.

Up until June 2018, FuturoCoin operated as internally traded Ponzi points within FutureNet.

Public trading began on or around June 8th at around $14.

Last month FutureAdPro collapsed, prompting FutureNet to only pay ROIs in pre-generated FuturoCoin.

The FutureAdPro FuturoCoin exit-scam has pumped the value of FuturoCoin from just under $6 to its current value of $12.

Banners App appears to have been launched in the wake of FutureAdPro’s collapse.

Read on for a full review of the Banners App MLM opportunity. [Continue reading…]

Infinity2Global criminal trial delayed

Richard and Angela Maike, Doyce Barnes, Richard Anzalone, Faraday Hosseinipour, Dennis Dvorin and Jason Syn were scheduled to face trial on January 7th, 2019.

Richard and Angela Maike, Doyce Barnes, Richard Anzalone, Faraday Hosseinipour, Dennis Dvorin and Jason Syn were scheduled to face trial on January 7th, 2019.

Following ongoing discovery issues and attorney substitution, that court date has now been vacated. [Continue reading…]

The Berlin Group Review: Recycle Bot Telegram Ponzi scheme

The Berlin Group operate in the MLM cryptocurrency niche and appear to be based out of Australia.

The Berlin Group operate in the MLM cryptocurrency niche and appear to be based out of Australia.

Two corporate addresses for The Berlin Group are provided on their website.

The first is in Brisbane and belongs to Servcorp, a virtual office provider.

The second address is an apartment in Melbourne. The connection between the Melbourne apartment and The Berlin Group, if any, is unclear.

Heading up the Berlin Group is Director and CEO, Joachim Pydde (right).

Heading up the Berlin Group is Director and CEO, Joachim Pydde (right).

According to Pydde’s Berlin Group corporate bio, prior to the current MLM offering he was selling coffee to supermarkets.

The current Berlin Group MLM offering appears to be spearheaded by Laurie Suarez.

Cited as The Berlin Group’s Executive Operations Manager, Suarez has a “solid foundation in crypto” and

was seconded by the Berlin Group to implement a capital raising Bot to facilitate in the inception of the various projects the company has on the table.

Suarez’s “crypto foundation” is not specified, nor was I able to tie him or Joachim Pydde to any other MLM companies.

What I did learn however is that Suarez, better known as Lorenzo David Suarez and Laurence Suarez, is a “convicted fraudster“.

Peter Ohanyan, cited as The Berlin Group’s Chief Marketing Officer, was promoting 3T Networks earlier this year (March’ish).

3T Networks was an illegal unregistered securities offering, combined with pyramid recruitment.

After 3T Networks collapsed Ohanyan started promoting GroceryBit, a failed cryptocurrency cashback scheme.

Read on for a full review of The Berlin Group MLM opportunity. [Continue reading…]

iComTech Review: 0.9% to 2.8% daily ROI bitcoin Ponzi scheme

![]() iComTech provides no information on their website about who owns or runs the business.

iComTech provides no information on their website about who owns or runs the business.

The iComTech website domain (“icomtech.io”) was privately registered on July 19th, 2018.

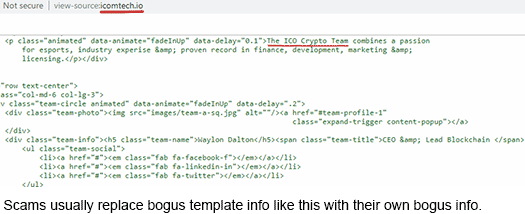

The website itself appears to be a cookie-cutter theme. Buried in the iComTech website source-code is reference to “The ICO Crypto Team”.

Various fictional executives are listed in the default theme. Typically an MLM cryptocurrency will create new names and new stock photos to fool people with.

iComTech didn’t bother and instead chose to just comment out fake management information so viewers don’t see it.

For those curious, the theme used is “Cryptico” from Ocean Themes ($59).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

24/7 Gains Review: Crypto mining and trading bitcoin Ponzi

![]() 24/7 Gains provides no information on their website about who owns or runs the business.

24/7 Gains provides no information on their website about who owns or runs the business.

The 24/7 Gains website domain (“247gains.co”) was privately registered on July 9th, 2018.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Westland Storage Ponzi caught out in private island lie

![]() In a recently updated roadmap, Westland Storage added the following to their 4Q 2018 timeline;

In a recently updated roadmap, Westland Storage added the following to their 4Q 2018 timeline;

Conference on the island of WestLand Storage. Speech of the main persons of the company.

We organize a conference on the island we bought. Our best clients get a free trip and our top executives give speeches at the conference.

In a blog post dated October 8th, Westland Storage claimed the update resulted in “many inquiries about his event”, prompting the company to “divulge some inside info and details.”

The WestLand Storage Conference will take place on our personal island in the Caribbean.

It’s the biggest event of the year which will feature the top executives in our company.

Accompanying the post is a photo of an island.

Just one problem though, as one eagle-eyed BehindMLM reader pointed out, it’s definitely not a private island owned by Westland Storage. [Continue reading…]

Thirteen Maxim Trader scammers sentenced to prison in Taiwan

Thirteen Maxim Trader Group executives and employees have been found guilty in a Taiwanese court on charges related to investment fraud. [Continue reading…]

Thirteen Maxim Trader Group executives and employees have been found guilty in a Taiwanese court on charges related to investment fraud. [Continue reading…]

Color Street Review: Can you compete with Walmart?

![]() Color Street operate in the personal care niche and are based out of New Jersey in the US.

Color Street operate in the personal care niche and are based out of New Jersey in the US.

Heading up Color Street is headed up by Founder and President, Fa Park.

So the story goes, Park’s business concept

So the story goes, Park’s business concept

began in 1984, when Fa Park was on a bus stuck in a traffic jam and saw a woman in a nearby cab trying to polish her nails.

He thought, “There has to be a better way!”

He bought some nail polish and started experimenting with it, starting by painting it on different types of paper.

After countless attempts, he finally created a process where although the top was dry, the bottom was still moist and could be adhered to the nail.

Mr. Park’s revolutionary vision, a 100% nail polish strip, was born!.

Fast forward decades with much hard work to perfect and patent his product, Mr. Park’s innovation has become a leader in the beauty industry.

Color Street launched in mid 2017. Park also owns the non-MLM companies Incoco and Coconut Nail Art, through which similar products to Color Street are marketed and sold.

Read on for a full review of the Color Street MLM opportunity. [Continue reading…]