Worldwide Solutionz face regulatory heat, suspend payouts

One of the aspects of running a Ponzi scheme is that if it catches on, you’re bound to eventually run into finance regulations.

One of the aspects of running a Ponzi scheme is that if it catches on, you’re bound to eventually run into finance regulations.

While the trend of late has been to get into bed with increasingly shifty rogue Asian merchants (Hong Kong is a favourite), the lack of security surrounding such partnerships still causes many an admin to stop and think.

One such company going through this right now is Worldwide Solutionz.

When the 90 days is over, the original $25 pops back up in your account balance. Did you notice what just happened?

Your $25 became $40 while you were working on … Oh that’s right, you don’t have to do anything at all to earn this or make it happen.

Just purchase, relax, enjoy, rinse and repeat.

With a business model like that, it’s easy to see why Worldwide Solutionz might be having problems finding a payment processor willing to take on the risk.

One need only look at TelexFree’s banking woes to see just how difficult it can be to secure ewallet services for a sizable Ponzi.

In a recent email sent out to affiliates, Worldwide Solutionz explain their own banking and ewallet problems: [Continue reading…]

Achieve Community Review: $50 straight-line cycler

The Achieve Community launched earlier in July 2014 and are based out of the US state of Michigan.

The Achieve Community launched earlier in July 2014 and are based out of the US state of Michigan.

Listed as co-founders of Achieve Community on their website are Troy Barnes and Kristi Johnson (right).

Listed as co-founders of Achieve Community on their website are Troy Barnes and Kristi Johnson (right).

On his Facebook profile, Barnes credits himself as a “Bronze” in Skinny Body Care (weight loss). Prior to that Barnes was marketing Empower Network (2-up cash gifting).

This was around 2011, with Barnes more recently (late 2013) promoting Tan Banners (4 tier 2-up recruitment scheme).

Kristi Johnson meanwhile, prior to the launch of the Achieve Community, was involved in Quanta ($25-$495 cash gifting).

was involved in something called “We The People Downline Club” mid last year.

It appears to be a downline builder for various recruitment driven schemes.

As above, the promotional material I saw featuring Kristi Johnson’s name boasted of the creation of 600 affiliates in an Xplocial downline ($29-$100 cash gifting).

Earlier in the year Johnson used We The People Downline Club to push “Pro Matrix Plus”, a $25 matrix-cycler pyramid scheme.

We the People Downline Club is joining Pro Matrix Plus as a group right now.

Join the downline for free and then Pro Matrix Plus for a one time fee of $25.00 and no monthly costs! You will need a Secure Trust Pay account and the fees for that and using it to fund your Pro Matrix Plus membership are usually about $6.00, so your total cost to join up are $31.00.

That’s all you ever pay and the payouts for Pro Matrix Plus grow from $25.00 for your first cycle all the way to one million dollars! You can stay in Pro Matrix Plus forever for that one fee, and continue to cycle.

Then We the People Downline Club builds your downline for you with everyone else in the group, moving you through Pro Matrix Plus. It is a 2×2 matrix, so once you have your two people and they have their two your matrix is full and you cycle.

Going back even further, Johnson was involved with Level 9 App ($7.95 a month + $2 qualifier to earn recruitment commissions).

In going through both Barnes and Johnson’s MLM histories, I definitely was feeling the “shiny new thing” vibe.

Now, with the launch of Achieve Community, it seems both Barnes and Johnson have decided to run their own company instead of joining countless others.

Read on for a full review of the Achieve Community MLM business opportunity. [Continue reading…]

RevShareMatrix Review: AdHitsMatrix admin strikes again

![]() There is no information on the RevShareMatrix website indicating who owns or runs the business.

There is no information on the RevShareMatrix website indicating who owns or runs the business.

The RevShareMatrix website domain (“revsharematrix.com”) was registered on the 27th of August 2014. The registration lists a “Farrow Williams” as the domain owner, along with an address in Warrington, UK.

Further research reveals multiple businesses operate out of this address, indicating that the owner of RevShareMatrix is simply renting a virtual mailbox.

The footer of the RevShareMatrix website reveals some curious links, pointing to “CyclerAds”:

CyclerAds launched about a month ago on September 25th and saw affiliates purchase $30 revenue-sharing and matrix cycler positions.

Combining a Ponzi scheme with a pyramid scheme cycler, CyclerAds appears to have collapsed shortly after launch.

Although the error is no longer visible on the CyclerAds website, the scheme’s initial launch gave away that the same owner of AdHitsMatrix was behind it:

AdHitsMatrix launched about two weeks prior to CyclerAds on September 10th. Similar to CyclerAds, AdHitsMatrix offered affiliates $20 revenue-sharing and matrix positions.

On or about September 22nd (3 days prior to CyclerAds launching) AdHitsMatrix stopped paying affiliates and collapsed. Anyone who had purchased positions with the company lost their money.

Now it appears the same admin is hoping to try his or her luck for a third time with RevShareMatrix.

Read on for a full review of the RevShareMatrix MLM business opportunity. [Continue reading…]

ProList Review: $9.95 recruitment, paid up 50 levels

![]() There is no information on the ProList website indicating who owns or runs the business.

There is no information on the ProList website indicating who owns or runs the business.

The ProList website domain (“prolist.bz”) was registered in January 2011 and lists a Daniel Dion of “GenSoft” (Genius Softwares) as the owner. An address in the Canadian province of Quebec is also provided.

Possibly due to language barriers, I was unable to track an MLM history for Dion either as an affiliate or in corporate.

Read on for a full review of the ProList MLM business opportunity. [Continue reading…]

Clicking Network Review: MLM soft. company goes Ponzi

There is no information on the Clicking Network indicating who owns or runs the business.

There is no information on the Clicking Network indicating who owns or runs the business.

The Clicking Network website domain (“clickingnetwork.co.uk”) was registered on the 16th of October 2014. Listed as the registered owner of the domain is “Nothing Inc”, indicating the information used to register the domain is false.

If one brings up a 404 error on the Clicking Network website, the following message is displayed:

Keskin Tech is an Indian company based out Delhi, India.

At “Keskin Tech” we offer complete MLM Software,network marketing software, referral Marketing Software, affiliate marketing software, software for many plans( RD FD, Career Plan, Binary, Board, Matrix, Level, Unilevel, Repurchase), where our clients are benefited to have all reciprocal solutions under a single umbrella in India.

There’s no information on the Keskin Tech website indicating who runs the company, however their domain registration lists a Tahir Zafar as the owner.

Researching the “frpcanada” directory in the 404 error image above, led me to the domain “frpcanada.co.in”:

As you can see, the content on the FRPCanada domain matches that of Clicking Network:

The domain registration for “frpcanada.co.in” lists a Shoeb Ansari as the owner. Further research reveals Ansari is credited as a Director of Keskin Tech.

As such, it would appear Keskin Tech themselves are behind Clicking Network. Why this information is not presented on the Clicking Network website is a mystery.

Read on for a full review of the Clicking Network MLM business opportunity. [Continue reading…]

Genesis Global Network Review: Addwallet Ponzi rebooted

Genesis Global Network review launched earlier this year and list a corporate address in Belize (a known tax-haven) on their website.

Genesis Global Network review launched earlier this year and list a corporate address in Belize (a known tax-haven) on their website.

Genesis is a legal corporation registered in Belize and is a closely held private company.

Research reveals multiple businesses operating out of this address, indicating that Genesis Global Network use virtual office space. Other than registration, it would appear Genesis Global Network do not have an actual physical presence in Belize.

Identified as Chief Visionary Officer on Genesis Global Network’s website is Donald Bernardin. Affiliate marketing for Genesis Global Network suggests Bernardin created the company with Brandon Bradshaw.

Back in 2013 Brandon Bradshaw fronted the Ponzi AddWallet as Vice-President. Loius Cordero was named CEO in Ecuador, however this was evidently a puppet position that formed part of a larger plan to elude US regulatory attention.

Why would AddWallet feel they need to hide from US regulators?

AddWallet was based on Zeek Rewards, an $850 million Ponzi scheme shutdown by the SEC in mid-2012.

A reload scheme that sought to cajole disenfranchised Zeek Rewards investors into a stripped down reload scam, AddWallet got rid of Zeek’s penny auction facade and had affiliates invest up to $5000 directly in Ponzi points.

This was done under the guise of advertising credits, a commonly used front by online Ponzi schemes today.

AddWallet launched in early 2013 and by mid-year was showing signs of new affiliate funds drying up.

On a conference call held in late May, Brandon Bradshaw told his investors that if they weren’t happy with the diminishing returns, they should cut their losses and move on.

Around the same time, other AddWallet affiliates begged their fellow investors not to withdraw funds (as they were likely trying to withdraw themselves).

The next few months saw AddWallet continue to decline. The company desperately attempted to attract new investor funds with $2000 “founder packages”, however with affiliates reporting widespread lack of payments and disappearing Ponzi points, these attempts went nowhere.

In August, Bradshaw announced he was leaving AddWallet (and taking whatever funds he’d stolen from investors with him).

No official reason for Bradshaw’s departure was ever provided.

No official reason for Bradshaw’s departure was ever provided.

As mentioned earlier, both Bradshaw and Bernardin (right) are graduates of the Zeek Rewards Ponzi scheme.

As above, two “Donald Bernardins” appear on a published list of Zeek Rewards investors who made more than $1000 and, as of May 2014, have refused to negotiate the returning of funds they stole:

It would appear whatever money was left from the AddWallet collapse (the company completely fell apart when Bradshaw bailed), has now run out. And so Bradshaw and Bernardin are back with a new opportunity, Genesis Global Network.

Having likely burnt their bridges in the Dominican Republic, now we have Genesis Global Network registered in Belize.

Bradshaw is no stranger to deliberately orchestrating scams with a focus on evading US regulatory attention. In March of 2013 Bradshaw (a resident of Florida in the US) explained specifically why he’d registered AddWallet in the Dominican Republic:

[13:44] One of the first things that was wrong was that they (Zeek Rewards) were incorporated in the southern United States, they were incorporated in North Carolina and they were sitting ducks.

Y’know, once you have so much advertising people know you, you become global and they became a target.

So we saw all the way what happened here. So we incorporated in Ecuador.

Bradshaw didn’t see a problem with Zeek Rewards ripping off thousands of investors (a feat he would later repeat with AddWallet), it was that they made the “error” of registering their Ponzi scheme in the US.

Today, the sentiment behind Bradshaw’s 2013 comments are continued on via the Genesis Global Network website:

Genesis was started because we were flat out frustrated!

We were tired of being let down by companies after spending a lot of time, energy and money in them and watching our financial dreams become nightmares.

We still believe in this industry and rather than quitting, we decided to start Genesis to become a beacon of hope for people like us and for others around the globe.

Read on for a full review of the Genesis Global Network MLM business opportunity. [Continue reading…]

Infinite Leverage System Review: $4297 traffic generation

![]() Infinite Leverage System is operated by co-founders Chad Stalvey, Greg Chambers, and Doug Wellens.

Infinite Leverage System is operated by co-founders Chad Stalvey, Greg Chambers, and Doug Wellens.

Based out of the US state of Florida, the company is run under the Streamlined Marketing Systems, Inc. brand, which Stalvey, Chambers and Wellens launched in 2009.

The earliest record I could find of Stalvey’s involvement in the industry dates back to Liberty League International (personal development and recruitment).

A “Bill Marler”, posting over at the MLM.com forums, claims that Greg Chambers and Doug Wellens were involved in the Reverse Funnel System (used by Wealth Masters International in 2010).

According to Marler, prior to Reverse Funnel System Chambers and Wellens were responsible for Quicklister, a marketing platform used by Global Resorts Network (travel niche). This was in 2007 and marked the beginning of Stalvey, Chambers and Wellens working together.

In 2010 Stalvey, Chambers and Wellens were operating an earlier incarnation of Infinite Leverage System, which was attached to Bon Voyage 1000 (recruitment-based travel opportunity).

Bon Voyage 1000 (now Bon Voyage Elite) collapsed years ago, but I wasn’t able to find any MLM related activity by the trio since Marler’s 2010 forum posting.

Sometime recently they’ve relaunched Infinite Leverage System as a standalone company, which is what this review is based on.

Read on for a full review of the Infinite Leverage System MLM business opportunity. [Continue reading…]

Tsū Review: Social network with 90% revshare

Forward: Tsū stylize the “u” in their name but in an effort to keep things simple, hereafter I simply refer to the company as “Tsu” (pronounced “sue”). /end forward

Forward: Tsū stylize the “u” in their name but in an effort to keep things simple, hereafter I simply refer to the company as “Tsu” (pronounced “sue”). /end forward

There is no information on the Tsu website indicating who owns or runs the business.

The Tsu website domain (“tsu.co”) was first registered on July 21st 2010. The registration details were last updated on the 28th of January 2014, possibly indicating that this is when the current owner(s) took control of the domain.

Unfortunately the domain registration is set to private, so no details of ownership are disclosed.

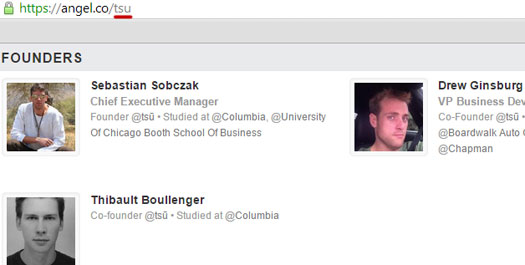

A listing on Angel List, an investor website, reveals the company founders to be Sebastian Sobczak (Chief Executive Manager), Drew Ginsburg (VP of Business Development) and Thibault Boullenger.

The listing cites Tsu as being based out of New York and if it’s to be believed, Tsu has had $8 million invested into it this year. Sobczak is the sole credited investor.

I wasn’t able to find an MLM history for either of Tsu’s co-founders, indicating that this is their first MLM venture either as an affiliate or as company owners.

Read on for a full review of the Tsu MLM business opportunity. [Continue reading…]

AlfaDesigner Review: Custom tailored menswear

There is no information on the AlfaDesigner website indicating who owns or runs the business.

There is no information on the AlfaDesigner website indicating who owns or runs the business.

The AlfaDesigner website domain (“alfadesigner.com”) was registered on the 25th of April 2014, however the domain registration is set to private.

Further research reveals AlfaDesigner market mens wear from Alfa Worldwide (wasn’t too hard to put that together). Alfa Worldwide was co-founded by Boris Kodjoe and operates from a different URL (“worldofalfa.com”) to that of AlfaDesigner.

There’s no information on the Alfa Worldwide website revealing who Kodjoe’s fellow co-founders are. The domain registration for Alfa Worldwide is also set to private.

The AlfaDesigner Terms and Conditions does shed some light on the relationship between the two companies but fails to go into any specifics.

Alfa Distribution & Marketing LLC. (hereafter referred to as “Alfa D&M”) is hired by Alfa Worldwide Ltd. (hereafter referred to as “Alfa”) to manage operations of Alfa’s network distribution structure.

Records reveal Alfa Distribution & Marketing LLC was registered in Delaware in 2011, but who owns and operates the company remains a mystery.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Paul Burks indicted for operating Zeek Rewards

After two and a half years of silence leaving many of us wondering what Paul Burks’ ultimate fate would be, news broke this morning that he has now been indicted.

After two and a half years of silence leaving many of us wondering what Paul Burks’ ultimate fate would be, news broke this morning that he has now been indicted.

Burks was indicted by a grand jury for the operation of Zeek Rewards, an $850M Ponzi scheme he operated between 2011 and 2012.

For those unaware of the grand-daddy of penny auction MLM scams, Zeek Rewards offered unregistered securities using the penny auction platform Zeekler as a front.

Burks (right) is collectively named in the indictment, along with those who helped run the scam, as co-conspirators.

Burks (right) is collectively named in the indictment, along with those who helped run the scam, as co-conspirators.

The co-conspirators falsely represented that Zeekler was generating massive profits from its penny auctions that the public could share in such profits through investment in Zeek Rewards.

In truth and fact, Zeekler’s purported profits were bogus and Zeek Rewards operated as a fraudulent Ponzi scheme whereby the co-conspirators used monies from later victim-investors to pay fraudulent returns to earlier victim-investors and to personally enrich themselves.

The indictment goes on to detail the fraud behind the pretending that Zeek Rewards’ ridiculous ROIs were pegged to the retail activities at Zeekler. [Continue reading…]