ByDzyne Review: A $428 smartwatch. Really?

ByDzyne operates in a number of MLM product and service niches.

ByDzyne operates in a number of MLM product and service niches.

The company fails to provide a corporate address on their website. ByDzyne’s Terms and Conditions however state that ‘all arbitration must occur in Vancouver, British Columbia, Canada‘.

That said, ByDzyne’s executives appear to based out of the US. I’m not sure what the connection to Canada is.

Another point of confusion is ByDzyne opting to hold their “Grand Opening Event” in Bangkok, Thailand.

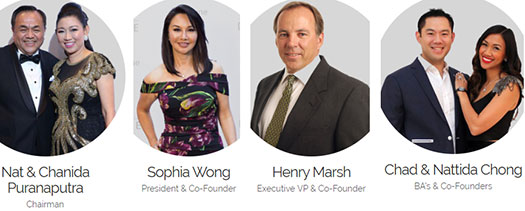

Listed as co-founders of ByDzyne are Nat and Chanida Puranaputra, Sophia Wong, Henry Marsh and Chad and Nattida Chong.

Nat and Chanida Puranaputra are best known for making an estimated $35 million in Organo Gold and World Global Network.

In 2016 the Chanida Puranaputra was appointed World Global Network’s Master Distributor.

After a series of hype promises regarding its products that World Global Network failed to deliver on, the company began to collapse around mid 2018.

Nat and Chanida Puranaputra bailed in October 2018.

To the best of my knowledge neither World Global Network or the Puranaputras have issued a definitive public statement clarifying the reason for their abrupt departure.

There is no mention of World Global Network in the Puranaputra’s ByDzyne corporate bio.

In late 2017 Chad and Nattida Chong were boasting they were earning $450,000 a month in World Global Network.

Nattida Chong is the daughter of the Puranaputras, and so seem to have followed them into ByDzyne.

Sophia Wong founded YOR Health with her brother back in 2008. I wasn’t able to pinpoint when or why she left the company.

Unlike the other ByDzyne executives, Henry Marsh doesn’t hide his MLM background. He’s openly cited as a co-founder and former Vice-President of Monavie.

Monavie was acquired by Jeunesse for an undisclosed sum in mid 2015.

In late 2017 Marsh re-emerged as an “Ambassador of Goodwill” and Board Director for Wealth Generators.

At the time of his appointment, Marsh is quoted as saying;

The most valuable skill I will bring to this company is to attract and attend to great leaders, which in turn will drive top line revenue.

This helped MonaVie and I believe it will do the same for Wealth Generators.

In 2018 the CFTC fined Wealth Generators $150,000 for operating illegally. When Marsh left the company is unclear.

Read on for a full review of the ByDzyne MLM opportunity. [Continue reading…]

MOBE trial date penciled in, Matt Lloyd expecting criminal charges?

A May 10th Case Management Report has revealed a proposed 2020 MOBE trial date.

A May 10th Case Management Report has revealed a proposed 2020 MOBE trial date.

Matt Lloyd McPhee’s response to production of evidence also suggests he might be anticipating criminal charges. [Continue reading…]

FTC seeks to hold Alan Moore in contempt over missing $26,500

Digital Altitude CTO Alan Moore reached a proposed settlement with the FTC in September 2018.

Digital Altitude CTO Alan Moore reached a proposed settlement with the FTC in September 2018.

As part of the settlement, it was agreed Moore would transfer $46,300 to the FTC.

Following a court order to unfreeze the funds, Moore represented to the FTC that the funds had been placed in escrow with his attorney.

This was reflected in the proposed settlement itself:

Settling Defendant is ordered to pay to the Commission Forty-Six Thousand, Three Hundred Dollars ($46,300.00), which, as Settling Defendant stipulates, his undersigned counsel holds in escrow for no purpose other than payment to the Commission.

In February 2019 Moore’s proposed settlement was approved by the FTC’s Commissioners.

The settlement was thus entered into as a final order on March 4th.

Despite agreeing to the settlement however, to date Moore has failed to uphold his side of it. [Continue reading…]

Vexa Global Review: Crypto ATM, exchange & trading Ponzi scheme

![]() Vexa Global provides no information on its website about who owns or runs the business.

Vexa Global provides no information on its website about who owns or runs the business.

The company’s website does have an “about us” section, but it appears to be filled with baloney.

On July 16, 2015 – Ernest Bogdanov founded Global Partner LLC. Uses his own experience gained during his professional career.

The company specializes in providing financial analysis and creating analytical tools for the forex market.

In 2016, the company entered to a new blockchain technology sector.

As we all know this was a breakthrough year for all crypto enthusiasts. Ernest and his analytic team exactly know when to enter the market and take big profits of it.

Ernst Bogdanov’s digital footprint consists of a Facebook profile featuring an obvious stock photo.

There is no content published to the account, suggesting it was purchased.

In an attempt to feign legitimacy, Vexa Global provides supposed incorporation documents for “Global Partner LLC”. This is an actual incorporation.

Putting aside there is no verifiable link between Global Partner LLC and Vexa Global, the registered agent for the incorporation is Valis Group Inc.

The supplied address for Valis Group Inc. is a virtual office. Further research reveals Valis Group provides Delaware incorporation services.

In an April 26th news update, Vexa Global wrote;

At the moment, our company is waiting for a license issued by the government in Estonia to manage the cryptocurrency market and the ATM network in the world!

In a post published to the official Vexa Global Facebook profile less than 24 hours ago, the company invited

all interested leaders who want to be with us in Tallinn, please contact our support.

What should be obvious is that Ernest Bogdanov doesn’t exist, and Vexa Global has no operations in the US.

Whoever is running Vexa Global is likely based out of Estonia or a neighboring country.

I did come across a feud that suggested Vexa Global might be a spinoff of the Exp Asset Ponzi scheme.

According to an April 13th official Exp Asset Facebook post, Vexa Global is run by Piotr Badynski.

According to an April 13th official Exp Asset Facebook post, Vexa Global is run by Piotr Badynski.

In the post Exp Asset owner Patryk Krupinski claims Badynski tried to blackmail him.

Krupinski claims he verified this, by cross-referencing the blackmail email address against the Exp Asset affiliate database.

The Exp Asset account with a matching email lists Badynski of Vexa Global as the owner.

Krupinski also credits Badynski as owner of the collapsed CryptoTek Ponzi scheme. According to Exp Asset Badynski is based out Poland and the Ukraine, which fits our estimated admin profile.

Keep in mind this is one Ponzi scheme seemingly calling out a competitor, so make of it what you will.

I personally wasn’t able to verify Badyinski is the owner of Vexa Global. I’ve included the above in the absence of information revealing an alternative Vexa Global owner.

Update 21st August 2019 – A paper trail has revealed Vexa Global is likely owned by Polish serial scammer Pawel Wojnicz. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

One Hundred K Club Review: 4×7 matrix pyramid scheme

One Hundred K Club fails to provide any information about who owns or runs the business on their website.

One Hundred K Club fails to provide any information about who owns or runs the business on their website.

The One Hundred K Club website domain (“onehundredk.club”) was privately registered on December 26th, 2018.

If you visit the One Hundred K Club website without an affiliate referral code, you are automatically referred under “admin2”.

The provided messenger link for the “admin2” account belongs to Lynn Hamilton.

I was able to reproduce this for “admin” so it seems Hamilton (right) has more than one admin account.

I was able to reproduce this for “admin” so it seems Hamilton (right) has more than one admin account.

On Facebook Lynn Hamilton manages the official One Hundred K Club group.

Perusal of Hamilton’s YouTube channel reveals promotion of USI-Tech, BitConnect, Global Unity Club, Phoenix Power Rising, Traffic Monsoon, Lead Lightning, vStream TV and National Wealth Center.

Read on for a full review of the One Hundred K Club MLM opportunity. [Continue reading…]

KZ1 Review: eXfuze rebrands with slimmer product offering

KZ1 began as eXfuze, an nutritional supplement MLM company founded in 2008.

KZ1 began as eXfuze, an nutritional supplement MLM company founded in 2008.

BehindMLM reviewed eXfuze way back in 2013. At the time the company was headed up by co-founder and CEO, Rick Cotton.

At some point Rick Cotton’s brother Don took over as CEO. He held the position until December 2016, at which time health issues saw him step down.

A joint decision between Cotton and the eXfuze Board of Directors saw Robert Kelly appointed CEO.

On October 2017 eXfuze changed its name to KZ1. I was unable to find a reason for the name-change.

At the time of Don Cotton stepping down, Kelley (right) had been with eXfuze for seven years. Cotton credited Kelley with “leading (eXfuze’s) largest market in Japan”.

At the time of Don Cotton stepping down, Kelley (right) had been with eXfuze for seven years. Cotton credited Kelley with “leading (eXfuze’s) largest market in Japan”.

According to Cotton, Kelley

is a former COO of Apple Japan (a $2 Billion-dollar business) and the CEO of two companies.

I did try to ascertain whether those two companies were MLM related but came up blank.

Read on for a full review of the KZ1 MLM opportunity. [Continue reading…]

Monspace Ponzi scammers arrested and charged in Malaysia

![]() Admins of the Monspace Ponzi scheme have been arrested in Malaysia.

Admins of the Monspace Ponzi scheme have been arrested in Malaysia.

CEO Lai Chai Shuang (Jessy Lai), Wong Tat Foong and Chai Ling Mooi plead not guilty to charges relating to fraud. [Continue reading…]

5Linx’s Jason Guck sentenced to seven months prison for fraud

![]() Following a brief sentencing delay, Jason Guck has been sentenced to seven months in prison.

Following a brief sentencing delay, Jason Guck has been sentenced to seven months in prison.

Guck is the third 5Linx owner to be sentenced on charges stemming from wire and tax fraud. [Continue reading…]

Kuvera Global launches new unregistered securities, SEC still asleep

![]() MLM cryptocurrency companies and securities fraud practically go hand in hand.

MLM cryptocurrency companies and securities fraud practically go hand in hand.

It is easily the biggest regulatory threat facing the industry and, for that reason, you’ll see me emphasizing it in a lot of our reviews.

Most of the time the companies in question aren’t registered with the SEC and, because of that, I cut the regulator some slack.

They can’t keep track of everything and investigations take time. A lot more time when the companies are operating through offshore shell entities and puppet overseas management.

But when a US based company that’s registered with the SEC flaunts and continues to flaunt securities law, has been fined once and continues to operate illegally, I have no words.

How is this happening? [Continue reading…]

OneCoin victim class-action lawsuit filed in New York

A proposed class-action lawsuit has been filed against OneCoin in New York.

A proposed class-action lawsuit has been filed against OneCoin in New York.

The opening introduction of the complaint quotes Manhattan U.S. Attorney Geoffrey S. Berman, and pretty much says it all;

[They] created a multi-billion-dollar “cryptocurrency” company based completely on lies and deceit.

They promised big returns and minimal risk, but … this business was a pyramid scheme based on smoke and mirrors more than zeroes and ones.

Investors were victimized while the defendants got rich.

OneCoin investor Christine Grablis is named as plaintiff in the case.

Named defendants are OneCoin, Ruja Ignatova, Konstantin Ignatov, Sebastian Greenwood and Mark Scott. [Continue reading…]