Notorious MoneyMakerGroup forum domain redirects to HYIP site

In August 2017 two of the most prominent websites used to promote scams were taken offline within minutes of each other.

In August 2017 two of the most prominent websites used to promote scams were taken offline within minutes of each other.

The MoneyMakerGroup and TalkGold forums, owned by brothers Edward and Brian Krassenstein, were used to promote fraudulent investment and pyramid schemes for over a decade.

The websites eventually caught the attention of the authorities, which lead to the Krassenstein brothers being the subject of a DOJ forfeiture complaint filed mid last year.

In their complaint, the DOJ referred to MoneyMakerGroup and TalkGold as ‘discussion forums in which HYIP operators advertise and promote their fraud schemes to potential victims‘.

For those unfamiliar with the term, “HYIP” stands for “high yield investment program. The term is synonymous with Ponzi schemes.

And a good percentage of the Ponzi schemes advertised on MoneyMakerGroup and TalkGold were of the MLM variety. [Continue reading…]

FTC sues Redwood Scientific Technologies over consumer fraud

![]() The question of why Redwood Scientific Technologies stalled on providing the FTC with requested documents for over a year has been answered:

The question of why Redwood Scientific Technologies stalled on providing the FTC with requested documents for over a year has been answered:

Redwood knew a regulatory lawsuit would follow.

In hindsight I can’t say I blame them really. Turns out consumer fraud is just the tip of the Redwood iceberg…

Prepare to be disgusted. [Continue reading…]

Payza & Patel bros served cease & desist in New York (updates)

New York isn’t too happy with Feroz Patel’s efforts to keep Payza afloat.

New York isn’t too happy with Feroz Patel’s efforts to keep Payza afloat.

On October 24th the New York State Department of Financial Services issued Payza, founders Firoz and Ferhan Patel and associated companies MH Pillars, OboPay and MH Pillars with a cease and desist. [Continue reading…]

Redwood Scientific Technologies satisfies FTC’s CID

![]() Although their position appeared particularly precarious at times, Redwood Scientific Technologies has finally satisfied the FTC’s Civil Investigation Demand. [Continue reading…]

Although their position appeared particularly precarious at times, Redwood Scientific Technologies has finally satisfied the FTC’s Civil Investigation Demand. [Continue reading…]

FirstCoin Club collapses, investor alleges $245 million in fraud

![]() FirstCoin Club was an MLM crypto Ponzi scheme launched mid 2017.

FirstCoin Club was an MLM crypto Ponzi scheme launched mid 2017.

FirstCoin Club affiliates invested real money for worthless FRST, an altcoin launched by the company.

A monthly ROI in FRST was paid out, which affiliates could realize by selling their FRST to new gullible bagholders.

Despite all Ponzi schemes inevitably collapsing, a disturbing number of investors still feign surprise when they do.

When FirstCoin Club collapsed, one such investor was Mohammed Kibria. [Continue reading…]

Charles Scoville pleads guilty to attempted child sexual abuse

On top of the Traffic Monsoon Ponzi civil case, Charles Scoville was arrested and criminally charged back in June.

On top of the Traffic Monsoon Ponzi civil case, Charles Scoville was arrested and criminally charged back in June.

Scoville’s criminal case stems from alleged child sexual abuse in 2007. Specifics of the case are unknown and have not been made public.

In any event rather than defend the charge, Scoville has pleaded guilty to one count of attempted aggravated sexual abuse of a child. [Continue reading…]

Skyway Capital regulatory warnings issued in Greece & Germany

Regulatory notices concerning Skyway Capital have been published by regulators in Germany and Greece. [Continue reading…]

Regulatory notices concerning Skyway Capital have been published by regulators in Germany and Greece. [Continue reading…]

BitherCash Review: BEC Ponzi points Bitconnect lending clone

![]() BitherCash operates in the MLM cryptocurrency niche and appears to be operated out of Dubai.

BitherCash operates in the MLM cryptocurrency niche and appears to be operated out of Dubai.

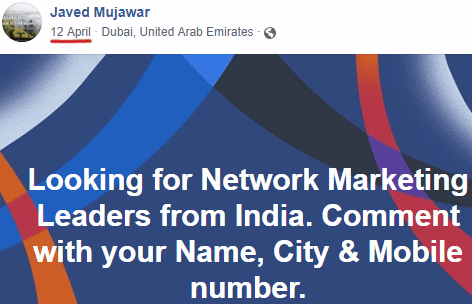

Heading up BitherCash is Founder and Chairperson, Javed Mujawar.

Prior to launching BitherCash, Mujawar (right) promoted the Global Donation Community and OneCoin Ponzi schemes.

At the time of publication Alexa estimate Pakistan makes up just under half of all BitherCash website traffic (49%).

Although recruitment there seems to have since cooled, initially Mujawar was targeting investors in India:

According to his Facebook profile, Mujawar is originally from Pune in the Indian state of Maharashtra.

Read on for a full review of the BitherCash MLM opportunity. [Continue reading…]

SEC sues Eric J. Dalius over Saivian Ponzi fraud ($165+ million)

Three years.

Three years.

If you’re wondering how long it might take the SEC to catch up with your multi-million dollar MLM Ponzi scheme… three years.

Eric J. Dalius launched the Saivian Ponzi scheme in 2015.

Likely due to his past indictment and conviction for wire and mail fraud, for the first year of Saivian’s operation Dalius hid in the background.

John Sheehan, who had no actual control over Saivian or management involvement, was presented to investors as the company’s President.

Without explanation, Dalius came out of the shadows to replace Sheehan as Saivian’s President in October 2016.

Despite mostly flopping in the US, Saivian picked up steam in China.

In mid 2017 Chinese authorities cracked down on Saivian and made several arrests.

Dalius and other key Saivian executives escaped arrest as they only traveled to China to promote the company.

After the Chinese crackdown Dalius stayed put in the US.

Having lost its primary source of new investment, in October 2017 Saivian officially collapsed.

Having extracted tens of millions of dollars from gullible Chinese investors, life was good for Dalius.

In an extraordinary showing of his new-found wealth, Dalius used stolen Saivian investor funds to purchase a $16.5 million dollar mansion in Miami earlier this year.

On October 3rd the law finally caught up with Dalius, following the filing of a civil complaint by the SEC. [Continue reading…]

7K Metals Review 2.0: Coin of the month autoship pseudo-compliance

BehindMLM’s initial 7K Metals review was published back in 2016.

BehindMLM’s initial 7K Metals review was published back in 2016.

Based on 7K Metals’ compensation plan, we expressed strong concern regarding the autoship recruitment nature of the business.

For those unfamiliar with the concept, autoship recruitment in MLM is where you have affiliates signed up for autoship, which qualifies them to earn commissions.

Said commissions are then primarily paid on recruitment of affiliates, who also sign up for autoship. They then recruit affiliates who sign up for autoship and so on and so forth.

To be clear, there’s nothing wrong with autoship in and of itself. When autoship recruitment is the primary source of revenue for an MLM company however, that’s indicative of a pyramid scheme.

A few weeks ago Robert Olson began commenting on our review.

Among other things, Olson claimed;

All of the information you started out with for your expose on 7KMETALS is outdated.

Retail is definitely available. That is the main reason I looked into them more extensively.

Having not looked into 7K Metals for two years, I queued 7K Metals up for a review update.

Today we go over what’s changed at 7K Metals since our initial December 2016 review.

Spoiler Alert: Retail is still not possible within 7K Metals’ compensation plan. [Continue reading…]