HyperFund Review: HyperTech now a Ponzi shitcoin factory

I became aware of HyperFund following a securities fraud warning issued by the UK’s FCA.

I became aware of HyperFund following a securities fraud warning issued by the UK’s FCA.

HyperFund is the latest launch by Ryan Xu’s company HyperTech.

HyperTech represents it operates from Hong Kong. Whether Xu is based in Hong Kong or elsewhere is unclear.

On LinkedIn Xu represents he is in Melbourne, Australia.

On LinkedIn Xu represents he is in Melbourne, Australia.

BehindMLM first became aware of Xu and HyperTech through our Jan 2020 HyperCapital review.

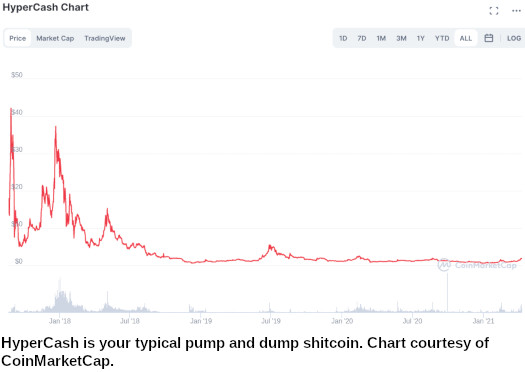

HyperCapital was a Ponzi scheme launched to resurrect HyperCash (formerly HCash), a failed shitcoin Xu launched a few years earlier.

HyperCapital failed to have any impact on HyperCash’s public trading value:

HyperCapital was eventually abandoned and today its website is defunct.

HyperFund was announced in mid 2020. It is essentially Xu and HyperTech’s migration to DeFi.

Which is to say we can likely expect more the same crypto investment related fraud.

Read on for a full review of HyperFund’s MLM opportunity. [Continue reading…]

HyperTech’s HyperFund cops securities fraud warning from UK

HyperFund has received a securities fraud warning from the UK’s Financial Conduct Authority.

HyperFund has received a securities fraud warning from the UK’s Financial Conduct Authority.

HyperFund is part of HyperTech, owned by Ryan Xu. [Continue reading…]

Success by Health affiliates denied motion to intervene

The bid by Success by Health affiliates to intervene in the FTC’s regulatory case has been denied.

The bid by Success by Health affiliates to intervene in the FTC’s regulatory case has been denied.

The denied second motion to intervene follows an earlier attempt, which was also denied. [Continue reading…]

CashFX Group securities fraud warning from New Zealand

CashFX Group has received a securities fraud warning from New Zealand’s Financial Markets Authority (FMA). [Continue reading…]

CashFX Group has received a securities fraud warning from New Zealand’s Financial Markets Authority (FMA). [Continue reading…]

Be Rules launched after Canadian fraud warning

Late last month I was engaged with a reader pretending retail customers had interest in Be’s apps.

Late last month I was engaged with a reader pretending retail customers had interest in Be’s apps.

At the time I noted Be had changed their website domain from “befactor.com” to “berules.com”.

Considering the Be reboot of Melius was not that old itself, I flagged this as a strange.

MLM companies don’t change their website domain on a whim.

For all my poking around though, I couldn’t figure out why Be abruptly changed their website domain.

Today that mystery was solved.

Back on December 2nd, Quebec’s Autorite Des Marches Financiers issued a fraud warning against BeFactor. [Continue reading…]

The Token Network Review: Another pointless DeFi scheme

![]() The Token Network operates in the cryptocurrency MLM niche. The company fails to provide a corporate address on its website.

The Token Network operates in the cryptocurrency MLM niche. The company fails to provide a corporate address on its website.

Heading up The Token Network is Project Manager Benjamin Kang:

According to Kang’s LinkedIn profile he’s based out of Germany. This is presumably where The Token Network is operated from.

Throughout most of the 2010s Kang participated in and promoted various poker tournaments.

In mid 2020 Kang appears to have decided he wanted to be a crypto bro. Cue The Token Network’s launch on or around October 2020.

As far as I can tell Kang has neither MLM or cryptocurrency executive experience prior to The Token Network.

Read on for a full review of The Token Network’s MLM opportunity. [Continue reading…]

Mining City drops mining facade, now offering “fixed returns”

Mining City has dropped its mining revenue facade. The company is now paying fixed returns on a schedule.

Mining City has dropped its mining revenue facade. The company is now paying fixed returns on a schedule.

Mining City’s fixed returns are being marketed as “payment plans”. [Continue reading…]

We Share Abundance abandons guaranteed WESA token value

Graham Frame has dropped the “guaranteed minimum value” for his WESA tokens.

Graham Frame has dropped the “guaranteed minimum value” for his WESA tokens.

Turns out manipulating the sell value for Ponzi tokens only works if there’s new investment rolling in.

What a shock. [Continue reading…]

Eaconomy rebooting through Beyond

![]() Company owner Hassan Mahmoud is gearing up to reboot his collapsed Eaconomy forex opp.

Company owner Hassan Mahmoud is gearing up to reboot his collapsed Eaconomy forex opp.

Rather than a straight reboot, Mahmoud has revealed he’s partnered Eaconomy with Beyond. [Continue reading…]

Bulavita sold off to Juuva?

Bulavita appears to have been sold off to Juuva.

Bulavita appears to have been sold off to Juuva.

Which is kind of strange, seeing as Bulavita itself is barely a year old. [Continue reading…]