HyperFund Review: HyperTech now a Ponzi shitcoin factory

I became aware of HyperFund following a securities fraud warning issued by the UK’s FCA.

I became aware of HyperFund following a securities fraud warning issued by the UK’s FCA.

HyperFund is the latest launch by Ryan Xu’s company HyperTech.

HyperTech represents it operates from Hong Kong. Whether Xu is based in Hong Kong or elsewhere is unclear.

On LinkedIn Xu represents he is in Melbourne, Australia.

On LinkedIn Xu represents he is in Melbourne, Australia.

BehindMLM first became aware of Xu and HyperTech through our Jan 2020 HyperCapital review.

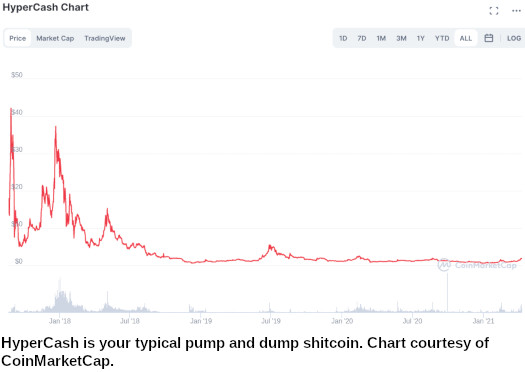

HyperCapital was a Ponzi scheme launched to resurrect HyperCash (formerly HCash), a failed shitcoin Xu launched a few years earlier.

HyperCapital failed to have any impact on HyperCash’s public trading value:

HyperCapital was eventually abandoned and today its website is defunct.

HyperFund was announced in mid 2020. It is essentially Xu and HyperTech’s migration to DeFi.

Which is to say we can likely expect more the same crypto investment related fraud.

Read on for a full review of HyperFund’s MLM opportunity.

HyperFund’s Products

HyperFund has no retailable products or services, with affiliates only able to market HyperFund affiliate membership itself.

HyperFund’s Compensation Plan

HyperFund refer to their MLM opportunity and compensation pan as “HyperCommunity”.

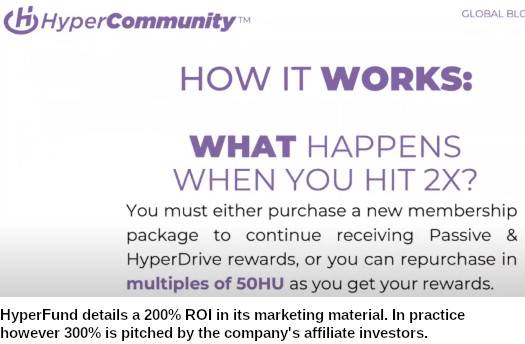

HyperFund affiliates invest tether (USDT) into HU, an internal token, on the promise of a 300% ROI.

HU investment tiers are 300, 500 and 1000.

Apparently the regular return is 200% but there seems to be a perpetual 300% limited time offer.

The 300% cap is calculated based off a daily return plus earned commissions (detailed below).

HyperFund pays returns daily in HU. Withdrawals to actual money are made through an internal exchange (HyperPay).

Note that once 300% has been realized, reinvestment is required to continue earning. HyperFund reinvestment is made in 50 HU increments.

Also note that 20% of commissions paid out (excludes daily returns), must be reinvested into various tokens HyperFund is promoting).

Residual Commissions

HyperFund pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

HyperFund caps payable unilevel team levels at twenty.

Referral commissions are paid as a percentage of daily HU earnings paid across these twenty levels as follows:

- level 1 (personally recruited affiliates) – 20%

- level 2 – 15%

- level 3 – 10%

- levels 4 to 6 – 5%

- levels 7 to 15 – 2%

- levels 16 to 20 – 1%

Note that each unilevel team level requires a recruited affiliate with an active investment to qualify.

E.g. you need to recruit and maintain one affiliate investor to earn commissions on level 1.

You need to recruit and maintain four affiliate investors to earn commissions on levels 1 to 4 etc.

VIP Reward

The VIP Reward allows HyperFund affiliates earn on HU earned by unilevel team affiliates outside of their strongest leg.

The strongest leg is calculated and based on daily HU generated across all unilevel team legs.

There are seven ranks within the VIP Reward:

- Expert – build a downline receiving 50,000 HU a day outside of your strongest unilevel team leg

- Pro – build a downline receiving 100,000 HU a day outside of your strongest unilevel team leg

- 1 Star – build a downline receiving 250,000 HU a day outside of your strongest unilevel team leg

- 2 Star – build a downline receiving 500,000 HU a day outside of your strongest unilevel team leg

- 3 Star – build a downline receiving 1,000,000 HU a day outside of your strongest unilevel team leg

- 4 Star – build a downline receiving 3,000,000 HU a day outside of your strongest unilevel team leg

- 5 Star – build a downline receiving 5,000,000 HU a day outside of your strongest unilevel team leg

Corresponding VIP Rewards paid out based on the above rank qualifications are as follows:

- Experts receive a 0.5% VIP Reward rate

- Pros receive 1% VIP Reward rate

- 1 Stars receive a 3% VIP Reward rate

- 2 Stars receive a 6% VIP Reward rate

- 3 Stars receive a 9% VIP Reward rate

- 4 Stars receive a 12% VIP Reward rate

- 5 Stars receive a 15% VIP Reward rate

Again these percentages are paid on all unilevel team legs (full depth), excluding the strongest leg.

There is also a coded component to the VIP Reward. This means that 15% is paid on all HU generated across each affiliate’s unilevel team.

In the event an HyperFund affiliate isn’t 5 Star ranked and receiving the full 15% paid out, the difference between their VIP Reward rate and 15% is paid to their upline (the affiliate who recruited them).

E.g. a 2 Star receives a 6% VIP Reward rate, leaving up to 9% left to be paid out to their upline.

How much is paid out depends on the upline affiliate’s rank.

If the personally recruited affiliate is at the same rank as the upline, the upline receives a 1% VIP Reward rate.

If the personally recruited affiliate isn’t VIP Reward qualified, the upline receives the full 15% volume on that affiliate’s unilevel team HU volume.

Global Reward

HyperFund puts the HU equivalent of 4% of company-wide investment into the Global Reward pool.

The Global Reward pool is split into four smaller pools.

Along with their qualification criteria, they are as follows:

- 2% Global Reward pool – generate 2 million in HU investment outside of your strongest unilevel team leg

- 1% Global Reward pool – generate 4 million in HU investment outside of your strongest unilevel team leg

- 0.5% Global Reward pool – generate 6 million in HU investment outside of your strongest unilevel team leg

- 0.5% Global Reward pool – generate 10 million in HU investment outside of your strongest unilevel team leg

Qualification appears to be accumulative. The Global Reward pool is paid out monthly.

Joining HyperFund

HyperFund affiliate membership is tied to an initial 300, 500 or 1000 HU investment package.

HyperFund solicits investment in USDT, meaning the above amounts are roughly equivalent to $300, $500 and $1000.

Conclusion

Having failed to resuscitate HyperCash, Ryan Xu has turned HyperTech into a full-blown Ponzi shitcoin factory.

This is being done behind the ruse of DeFi, because that’s the current trendy model for MLM crypto shitfuckery.

HyperFund is a 300% ROI Ponzi scheme combined with pyramid recruitment.

Affiliates sign up and invest USDT. They then receive a return and commissions in HU points, capped at 300%.

HyperFund’s commissions are tied to affiliate investor recruitment, slapping pyramid fraud on top of Ponzi investment fraud.

Notably, HyperFund’s compensation plan is a 1:1 clone of HyperCapital’s. The only difference is instead of paying HyperCash, HU Ponzi points have been created.

HU points are worthless outside of HyperFund. They cost the company nothing to generate, meaning commissions and returns can be “paid out” regardless of whether actual money can be withdrawn.

The other difference between HyperCapital and HyperFund is the shitcoin factory element.

HyperFund withholds 20% of paid commissions for mandatory shitcoin investment.

These shitcoins are created by HyperFund anytime they feel like pushing a new scam.

The first HyperFund shitcoin launch is HyperDAO (HDAO).

HyperDAO aims to establish a complete DeFi (Decentralised Finance) ecosystem, providing clients with a decentralised financial infrastructure.

Under the ruse of DeFi, HDAO is just an excuse to stop affiliates withdrawing 20% of earned commissions.

Attached to HyperFund are a bunch of HyperX branded smoke and mirrors companies:

- HyperPay

- HyperFin

- HyperBC

- HPX

- HyperMining

- HyperTalk

- HyperNews

- HyperMall

- HyperShow

Similar bullshit will presumably be set up for HDAO and any other yet-to-be released shitcoins.

This is typical of HyperTech, with the company’s marketing tying at least 150 shell companies to Ryan Xu.

If you’re wondering why I haven’t gone into any of the above HyperX branded companies, it’s because they have nothing to do with HyperFund’s MLM opportunity.

The HyperX companies are smoke and mirrors to put on HyperFund marketing slides.

Outside of HyperPay, HyperTech’s internal exchange, the HyperX companies either don’t exist or aren’t being used by anyone.

Finally there’s also the issue of HyperFund being engaged in securities fraud.

HyperTech acknowledge they are offering an passive investment opportunity through HyperFund. This constitutes a securities offering.

At the time of publication Alexa ranks the US as the top source of traffic to HyperFund’s website (52%).

Neither HyperTech, HyperFund, Ryan Xu or any of the plethora of associated shell companies are registered with the SEC.

This means that Xu and his Hyper companies are committing securities fraud in the US. Promotion of unregistered securities by US residents is also illegal.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve HyperFund of ROI revenue, eventually leaving them unable to pay HyperPay withdrawal requests.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

In the case of HyperFund, this will manifest itself by way of HyperFund affiliates being left holding worthless HU points.

To see this in action one need look no further than HyperTech’s HyperCash bagholders.

Thanks for this. I was just sent this from a friend:

hypergroup.io/overview/ (Referral link has been removed.)

In the videos and the web-site, it says: To get access to our community, contact the person who referred you to this amazing opportunity for a step-by step setup guide!

I also looked up Collinstar Capital which has a partially filled out Wix web-site (collinstar.wixsite.com/ )and an incomplete self-hosted site: collinstar.com/ No real blog or portfolio or clients.

I was interested in this originally as I thought I could get into a pre-IPO crypto investment. It wasn’t until the second video when I realized it was a Ponzi scheme.

Thank you for the detailed reviews and information your site provide. Your investment of time is remarkable and highly appreciated by Consumers who are approached with financial investment opportunities.

We are all responsible for our own due diligence and even more responsible to protect our personal and professional relationships when approached to “help spread the word” aka recruit.

Thanks again as this review is very relative and filled with additional links for individuals to continue their own due diligence.

I’ve been involved with hyperfund for 7 months now and I haven’t had a problem.

Withdrawals don’t have to be through HyperPay. HU is equivalent to USD so how can you say HU is worthless. You convert HU to MOF inside hyperfund and withdraw MOF to an exchange.

Maybe try speaking to the people who are actually involved and withdrawing a decent weekly income from this system before labelling it a scam.

HyperFund’s website domain was registered on 2020-06-16. So you’re another “I got in early and stole money” Ponzi apologist.

Because it is. Ponzi shitcoins are worthless outside of the Ponzi scams they were created in.

This differentiates them from USD. It doesn’t matter what your backoffice says.

It all happens inside HyperFund, which is HyperPay.

Why? Getting input from the tiny percentage of Ponzi scammers who steal money from the majority of investors is terrible due-diligence methodology.

Where my HyperCash bagholders at?

You don’t “make” money with the rewards. It takes 200 days for them to simply give you back your initial investment (oh right, it’s “not an investment, it’s a membership”…lol).

Every time you rebuy, you get more “memberships” under the guise of accelerated rewards, when all you’re actually doing is giving Ryan Xu a longer runway to come up with his exit strategy where he runs off with all your money.

Before you start touting your daily rewards, consider that you can’t ever get your initial investment back if you’re rebuying over and over.

Nobody cares if you make $50 a day on this if you put in $100,000 and you don’t have a cent of it in the bank.

You’re simply using the “rewards” to funnel more of your own money into the pyramid….

What’s this all about?

If people getting the memberships are happy what’s wrong?

(Ozedit: derails removed)

The problem is HyperFund is a Ponzi scheme.

Whether people are happy losing money in a Ponzi scheme (they aren’t), is neither here nor there.

I’m confused!

Are you telling me your name is Ryan Xu (Ozedit: no)

Read the review. This isn’t daycare for morons.

Hyperfund is legitimate. They have partnered with some of the largest corporations in Asia to invest.

I insist you do your research. Ryan Xu has an excellent reputation & is a real entrepreneur.

I demand the author of this article retract their statements. The statements are a mere conjecture and shows the author’s ignorance and stupidity. Just an article to create fear mongering and hate. I despise articles such as these.

I have emailed HyperFund on this website. I hope for a cease and desist to be put in place.

Anytime i see the word “membership” I’m instantly turned off.

This isn’t even MLM. The very definition of a pyramid scheme is the transfer of money without a specific good or service attached to it.

They are selling a promise of future money.

HyperFund is a Ponzi scheme because of its business model. Legitimacy via association isn’t a thing.

Facts are facts. Sorry for your loss.

(Ozedit: derails removed)

1. even if they did it first like that to get it launched

2. it is still legit, rules still have to be made around crypto, and then of course they will ADJUST again untill all is settled

3. if this is a ponzi, how do you know then. (Ozedit: more derails removed)

Ponzi schemes aren’t “legit”, they are illegal fraudulent scams.

Running a Ponzi scheme through cryptocurrency is not a get out of jail pass.

How do I know HyperFund is a Ponzi? Read the review.

Btw.. Hyperfund is NOT an MLM. Many misread the concept. It shouldn’t even be on this website: behindmlm.

(Ozedit: derail waffle removed)

MLM comp plan = MLM company

Graham Laurie AKA Cash Master is pushing this ponzi scheme heavily.

youtube.com/watch?v=MJqs9MXmj28 –

It would seem that HyperFund has now reached South Africa’s shores and to no surprise, everyone that hot scammed in Mirror Trading International are flooding to HyperFund because “it’s the complete opposite of MTI”.

I’d like to point something out here for the HyperFund maniacs. HyperFund (or Ryan Xu) states that they are either involved in Digital X or “majority shareholders if I’m understanding the first picture correctly.

Go and look on Digital X’s website under their contact us tab and see what they have to say about HyperFund. Or better yet, let me make it easier for you: digitalx.com/contact

Fun fact for when you want to invest in anything. Do your research on both the people that are involved in it as well as the companies that are claimed to be a part of it and not just the “business model”.

You can sugar coat any business model to make it sound legit.

Good review OZ. As per usual you are on the ball.

Alexa has the US, Canada and India as HyperFund’s top sources of traffic.

Guess that’s dried up and, once the well to do South Africans are on board, HyperFund has entered the pillaging low-hanging fruit in third world countries phase.

That is unfortunately correct. And South Africans have, in the past, proven to be ideal targets for any Ponzi Scheme.

Also, apart from the “organizations” started by Ryan Xu, I have yet to find a link between HyperFund and any of the other companies they claim to be involved in such as Ruden Blockchain and Generics Technologies.

Also haven’t been able to find any substantial news or literature on Ryan Xu or HyperFund apart from sites that are clearly paid propoganda. Some of the sites are even the same sites that were pumping MTI.

I could only really come across one news article that seems legit but that comes from a questionable source.

It seems like most of HyperFunds info is focused on Youtube videos. And Youtube videos have become a very commonly used form of self-marketing by scammers and get-rich-quick prophets.

You’d think that if this company was “so innovating” there would be a more formal and legitimate paper trail of them?

I’d feel offended were I a South African,but you aren’t wrong sadly haha

A friend (South African) provided information to me of the Hyperfund investment as legitimate based on due diligence provided by Hypertech and other bogus videos reassuring investors.

Unfortunately, my friend was also scammed under the MTI disaster.

So, it seems like there will always be a target audience that refuses to address the obvious when greed and/or get-rich-quick schemes are so enticing.

Hay guys, muh Ponzi scheme is legitimate cuz muh Ponzi scheme sez so.

What could go wrong?

Any thoughts?

luckscout.com/downloads/HyperTech_Due_Diligence_2021.pdf

Sure: marketing isn’t due-diligence.

HyperFund et al primarily solicit investment from US residents. They aren’t registered with the SEC and this is a major compliance problem.

^^ That’s what actual due-diligence looks like.

Clicked expecting Due Diligence, Instead get met with YOOTOOB LINKS.

For the uninformed,like this lovely pug,Due diligence means actually reviewing Legal and Financial compliance, a la Registrations and Audits.

Not

YOOTOOB and “news”.

Anybody remember Stefan He Quin?

abc.net.au/news/2021-02-05/australian-stefan-he-qin-guilty-90m-cryptocurrency-scam/13126456

He was on CNBC 3 years ago as a revolutionary Crypto Hedge Fund manager – turned out it was just a ponzi.

Unfortunately this is the age we live in where geniuses think due diligence is looking at Youtube.

I agree with most of it, and I think there are many really shady links. Like collinstar.com : It’s like a shell website ( “Premier”/”Premier”/”Premier” links in the header, they’re all empty), and lower there are “stats” : “33”, “33”, and “33” with a loading image?)

Then if you click on “View all”, it shows “QTUM 1”, “QTUM 1”, and … yeah, “QTUM 1”, 6 times actually.

Anyway, I just wanted to say something else, which doesn’t change the essence of the post, but I think that HyperCapital IS HyperFund (or vice versa), meaning that people that were in HyperCapital still kept their funds when it rebranded to HyperFund.

Maybe to “hide their tracks” or whatever … but I think they should either NOT be in a different page, or specify that?

Jut a thought…

Yeah obviously the same people, same company etc.

I included a link to HyperCapital in the review, I thought it was obvious enough?

Yeah I’m just saying that it’s not “another project”, it’s the same one.

And we don’t know that HyperCapital didn’t “collapse” yet, we don’t know 100% that they will leave with your money “again” (because they technically never did).

I mean I’m not defending them, it’s just slightly inaccurate, but I guess it doesn’t really matter at this point..

HyperCapital –> HyperCash. With HyperFund that’s been abandoned for HU.

That’s why I made the distinction. It is the same scam but there was a collapse to record between HyperCapital and HyperFund.

With crypto being crypto you can of course just reboot script and port over your victim’s losses, but the collapse of HyperCapital/HC happened nonetheless.

I am confused….the contents here are on both the sides….Yes n No….what to do friends…please explain the truth in simple words…

I am still on the fence… have a legitimate, experienced online partner who is involved and promoting this opp… we will see. Thank you for you input.

@Carl

Just so we’re clear, your partner is a legitimate experienced scammer. There is no legitimacy in promotion of Ponzi schemes.

Also math is math, time isn’t a factor.

@vikram

Sure:

1. invest in Ponzi schemes like HyperFund = sorry for your loss

2. not investing in Ponzi schemes like HyperFund = no sorry for your loss

That’s as simple as it gets.

No, you don’t. You have an experienced scammer.

In you articles it seems its good, and its a scam. Leaning more to scam than a good deal. please explain “WHY WOULD YOU INVEST IN THIS”.

ThankYou

Marty Sarner

Same reason anyone invests in a Ponzi scheme, to steal money from people who join after you.

I’m glad I did my own due diligence and came across this article. “If it’s too good to be true, it’s probably is false”.

The low hanging fruit SA will be scammed once again because of poverty-stricken communities and wanting to “get rich faster”.

The parallels between hyper fund & bitconnect are making me laugh. And we all know how Bitconnect turned out 🙂

Except this time, hyper fund provides some nice marketing materials and calls it “due diligence”.

And the weird gas lighting with the leadership, claiming them as some pioneers in the crypto field that everyone has heard of, except whoever is getting suckered..

And also, bitconnect had corporate addresses. And “well known” leadership…

And the mob that relentlessly defends the scheme, telling you how much they are making. Draws to people’s natural greed for a quick & easy profit.

In your experience how long does a ponzi scheme lasts?

According to Yahoo Finance, HyperFund only launched in June 2020. Compare that to the “many” that claim being in this for years.

finance.yahoo.com/news/hypertech-group-announces-launch-hyperfund-080000378.html

iz legit bro im currently on my yatch drinking margaritas out of my diamond encrusted shoey.

actually it’s just a crusty shoe and yatch might actually be shopping cart that I in anger pushed into the yarra river and am now having a difficult time trying to retrieve.

HCASH 4 LIFE BABY! YOU SHOULD BE HERE!

wait shit that’s the wrong MLM.. I’m still hopeful i will get back my earnings from that one.

covid killed my world-dentures! evil virus I was so close to almost earning back the first month subscription too. Only took 14 months.

@Mario

Ponzi schemes last until there’s no more money left to steal.

@behindMLM Thank you! It is truly appreciated getting realistic feedback in a sea of hype!

Unfortunately I’ve already invested a modest amount (.. for me anyway). But I want invest another dime and I will not lure any of my friends and/or family to the scam. But I will snatch my money out at the first opportunity.

Thanks again, your logic and fact checking convinced me. Should’ve done my due diligence more thoroughly up front.

Glad to hear our research was useful. Take the due-diligence experience as a lesson learnt.

@Mario Bernie Madoff lasted over 20 years… biggest ponzi in history … fooled bankers, lawyers, investment fund managers, etc … to the tune of $65 BILLION before it came crashing down during the 2008 market crash.

Then people have had to pay back their gains… so far to the tune of $12 BILLION! And still more is being collected 13 years later…

Thanks for the info, I’m glad I’ve done my due diligence and some research.

I’ve invested a small amount into this fund but it would not kill me if it was lost.

The important information, I was going to invest a large sum of money but my research halted all of that nonsense.

If this company (opportunity) is taking money in USD but NOT paying commissions in USD, AND DOES’T ALLOW participants (so-called members) to withdraw money in USD, how are folks saying that they are drawing a daily, weekly, or monthly income from this program?

From what I understand, even with the 300.500,1000 membership fee that allegedly accrues daily, doesn’t that automatically get converted to HU’s? Can you pay buy anything at a Walmart, gas station, or fast food restaurant with HU’s?

I’m trying to figure out how ANYBODY makes “real or actual” money by investing in this besides the company that collects the initial fees?

I’m not seeing where the investor makes “actual money?” Getting these HU’s doesn’t seem to be “actual” money (USD).

What if I want to withdraw my money before a year or don’t want to reinvest? This crap is confusing…..

bEcAuSe NuMbErS oN a ScReEn = ReAl MoNeY

HU is where the music stops. When recruitment inevitably slows that’s when there’s nobody left to offload your HU bags onto.

What if this research result is a scare tactic, What if hyperfund is what it says?

Do you have 100% proof that your allegations are true ?

Why would you fear research revealing HyperFund is committing securities fraud because it’s a Ponzi scheme?

Talk about crypto bro mental gymnastics.

Sure:

1. Call up your local financial regulator and ask them if HyperFund is registered to offer securities.

2. Ask HyperFund for legally required audited financial reports dating back prior to HyperCapital’s collapse.

Sorry for your loss.

Here’s the thing you need to consider:

If they wanted to silence critics,and be allowed to offer services worldwide they’d simply get audited and register with the financial regulators,very simple to prove that they are doing what they are saying they are.

Instead – they choose to operate illegally and ignore being banned in multiple countries.

Not sure if I have ever heard of a legitimate business refusing to be registered and audited properly. Ask yourself why?

Simple answer – they won’t prove it because they can’t. And until they do it’s safe to assume they are lying about everything.

So why not just put a little bit of money in to find out your self ?

Why support a Ponzi scammers with even a “little bit of money”?

Anyone can “find out” HyperFund is a committing securities fraud and running a Ponzi scheme by going over its business model.

Find out what? Are they magically going to become legal after you put money in?

It’s an illegal scam, why would any sane honest person throw money at it?

Brandon – for the same reason you should not advise someone to put their hand in the fire just a little bit and see if it burns!

What an insanely stupid comment. By putting money in a ponzi scheme, you are encouraging the scammers, not to mention probably funding other criminal acts they may be involved in.

Why is my latest post not being add to the thread? I have tried at least a couple of times.

Because multiple copy+paste = spam. You posted your checklist once. No need to spam it everywhere.

There are several youtubers claiming to make 3 or 4 figures each day from Hyperfund.

They signed up early and referred others to this company.

I guess these people might have to pay that money back, if Hyperfund is found guilty of securities fraud?

I apologize… that was not my intention. My only intention is to help protect people from this scam.

But you do know the definition of spam, right? Spam is NOT just multiple copy+paste. (Ozedit: derail removed)

Depends on where regulators strike.

Typically it’s only the US that goes after promoters. Other countries might issue warnings and/or cease and desists but that’s as far as it goes.

Mate I don’t want to get into an argument about what spam is or isn’t.

Posting the same comment across multiple articles = spam.

Why are you obsessing on the strict definition of spam? There is such a thing as slang, you know.

I mean, when I hear someone referred to as a dickhead, I don’t think there is an actual penis growing out of the guy’s neck. Not anymore, anyway.

It was on only 2 threads (including this one)… a far stretch to = spam, by any definition… nevertheless…

Then would you consider this compromise? Allow the post on this thread instead of the other older one? Since this one is more current, it would be more fitting here than there.

BTW, do you really find a comment like what Amos_N_Andy posted to be more useful to the conversation than what I posted?

I thought your motive was to help protect people?

Let’s not get caught up on “definitions”…

@Simon most likely just like many are still doing 13 years after the Madoff ponzi of 2008 (see earlier comment about this), and just like 2 of the ones I got fooled into are still being collected from the same era.

So, before getting involved with ANY scheme, be sure to prove that money coming out is actually coming from real business that has real profits that is actually linked to the money…

Follow the money trail with objective verifiable proof, not based on assumptions that was filled in by people’s minds or pretty pictures, logos and names on some promotion material.

If you cannot, then you have to ask yourself on what you are making a decision? Hype? (get the pun?!)

I have first hand experience because I was heavily involved in promoting some (losing 6 figures in the process). I learned the hard way how to tell good vs fake/bad due diligence… don’t make the same mistake.

Arguing semantics with the guy that presses the approve/decline button usually ends with the latter.

Leave it be and contribute or don’t,either way scammers gonna keep scamming.

…says the commenter who wrote several paragraphs sissecting the meaning of a one-syllable word.

The reason Oz didn’t delete my comment is because it wasn’t a copy-paste of an earlier comment. I’ve made the same point in multiple comments here, but I write fresh copy each time and try to keep it semi-original.

Oz has deleted my comments before–heck, he may delete this one–but I don’t get all butt-hurt when he does. Lighten up, Francis.

@smayer97 I was initially attracted to Hyperfund, because they say that the 0.5% daily interest comes from other businesses they are involved in, rather than new recruits.

However, as you say, I have yet to see objective proof of this, and it seems implausible that they could afford to pay thousands of people at such a high rate of interest. Also, I don’t trust the people behind the company.

Perhaps the people who got in early and managed to refer others will walk away with a nice profit, but it seems far too risky to me. There are just too many red flags for my liking.

1. posting the same thing across two articles/reviews is spam. If you want to republish here I’m fine with that. I’ve removed the other comment.

2. BehindMLM is first and foremost an information resource. That attracts people are here for different reasons but BehindMLM itself isn’t an activism platform.

Hi

I recently put some money into hyperfund (what I could afford to lose) and just wanted to see where it takes me.

Withdrawing is very simple and you can have your funds in your bank account within 20 minutes. Of course I’m being cautious and I’m trying to do as much research as I can and that’s why I stumbled across this site.

I just wanted to show you this link I was sent regarding Ryan Xu and him being registered with the SEC. Let me know what you think.

Once you understand how vast this is it gets fun If you ever wandered.. Ryan Xu is as great as Big as he is … think no more

Our Founder is now featured on the USA SEC website THIS IS HUGE WHY as you have be to clean as a whistle to be on a Listed Company:

prnewswire.com/news-releases/code-chain-new-continent-limited-announces-appointment-of-well-known-blockchain-investor-martian-zijing-ryan-xu-as-chief-strategy-officer-and-director-301264707.html

sec.report/Document/0001213900-21-020812/

We are in THE BIGGEST CRYPTO BLOCKCHAIN NETWORKING COMPANY EVER ⭐️⭐️⭐️⭐️

1. Getting appointed to some random blockchain bro company has nothing to do with HyperFund and Xu committing securities fraud because HyperFund is a Ponzi scheme.

2. There is no regulatory approval process for an SEC registered company appointing staff.

3. Ryan Xu’s name appearing as an new appointee in a company that has nothing to do with HyperCapital or HyperFund is meaningless.

If anything, Xu’s name appearing on unrelated SEC filings only emphasizes his securities fraud through HyperFund.

And you’ve still got a way to go before you reach the heights of OneCoin, BitConnect or BitClub Network.

Has Xu made friends with the Russian mafia and UAE sheikhs yet? That’ll be when you know HyperFund has really made it.

So the SEC has no problem getting involved with allegedly dodgy individuals? (Ozedit: derails removed)

The SEC hasn’t “gotten involved” in anything. You have a poor understanding of SEC filings.

If you want to rant and rave about the shortcomings of the SEC, do it somewhere else.

Before you go though, the least you could do is acknowledge HyperFund and Ryan Xu are committing securities fraud.

Latest video from Kalpesh Patel

youtube.com/watch?v=uNh3jFK_rn0

This all

Seems like you had a bad experience with some MLM… From my research this isn’t a MLM.

You say this is a Ponzi … show us it’s a Ponzi. It’s merely all your opinion. DeFi has nothing to do with the SEC.

would VISA put their name to a business model that’s a Ponzi? I think not.

I can’t find anything that says this is a Ponzi except your opinion. If you’re so sure and investigative, why haven’t you got inside the platform.

A new crypto bro has entered the chat… *groan*

Whether they have or haven’t, HyperFund is still a Ponzi scheme.

MLM comp plan = MLM company. Conclusion: You’re shit at research.

I did. Read the review.

Nobody said it did. MLM + passive investment scheme = securities offering.

Securities must be registered with the SEC and every financial regulator in every jurisdiction HyperFund solicits investment in.

VISA didn’t put their name to anything to do with HyperFund. Not withstanding legitimacy via association isn’t a thing.

This review is based on facts. Keep your opinions to yourself, thanks.

For the same reason I haven’t done any number of things that have nothing to do with HyperFund being a Ponzi scheme.

Sorry spilt some milk laughing.

Back to the show!

Congrats, you’ve confirmed that you are bad at adulting and should go back to school till you learn how

1) money works,

2) research works,

3) MLMs work (or don’t really work to do anything except make the majority of people poorer)

4) how Ponzis work

5) and how crime works in general.

PS. regarding VISA, here’s a secret you might not have known:

They couldn’t give a flying rat’s ass, all you need to be able to offer to become a payment processor is a SLA of % card transactions succeeding, and pay the associated fees.

They don’t care if you are legal or registered or audited – much like future ponzi victims like you.

Not that Hyperfail is a payment processor though, they are likely just renting a whitelabel solution like GSPartners does with their “GOLD CARD”.

Step 1: incorporate shell company with unassuming name in dodgy jurisdiction.

Step 2: use shell company to get VISA cards through dodgy merchant.

Step 3: wHy WoUlD vIsA pUt ThEiR nAmE oN oUr PoNzI sChEmE?

This has been going on since the start of scams.

If i’m reading these Youtube clips right looks like their VISA processor is a bank in Laos known as JDB.

For Mastercard or Unionpay it’s using a Lithuanian bank called Paytend.

TOTES NOT DODGY BROS lol.

Those would be your dodgy jurisdictions.

The Laos and Lithuanian banks will have some bullshit shell company (XYZ Corp. etc.), registered in some bullshit jurisdiction on the books.

Here is some more dogdiness:

Attempted filings of HyperFund with SEC (notice 1st “attempt” was archived):

sec.report/Document/0001811781-20-000001/

and

sec.gov/Archives/edgar/data/1852463/000185246321000002/xslFormDX01/primary_doc.xml

and

formds.com/issuers/hyperfund-investments-llc

more searching: duckduckgo.com/?t=ffcm&q=HyperFund+Investments+LLC&ia=web

Note: note exactly same registered names and different addresses… California vs Florida. Shows NO revenue or any financial details. Shows both registered under Vishal Harpalani as Director/Executor/Partner, etc. Whoever he is.

see linkedin.com/in/harpalani/

Other related info about Vishal Harpalani: cryptonews.com/news/xrp-falls-victim-to-several-elaborate-schemes-3216.htm

Lol, trying to pas off HyperFund as an exempt securities offering (it isn’t), through a Californian shell company registered to some fall guy schmuck.

Yeah, nothing dodgy about that.

Your review …. is your opinion. You have no actual proof this is a Ponzi.

(Ozedit: derails removed)

It’s not a MLM or Ponzi. I’ve seen how you get your HU into MOF on their crypto platform.

You’re missing so many facts to what’s what it’s mind boggling. (Ozedit: derails removed)

Literally not the case.

The only verifiable source of revenue entering HyperFund is new investment. Fact.

HyperFund is not registered with any financial regulator. Fact.

HyperFund is committing securities fraud. Fact.

MLM + securities fraud = Ponzi scheme. Fact.

Dismissing facts as opinion doesn’t make them any less facts.

MLM comp plan = MLM company.

MLM + securities fraud = Ponzi scheme.

Denying facts doesn’t make them any less facts.

Cool. Here’s a cookie. HyperFund is still a Ponzi scheme.

By you removing my comments is actually a joke.

(Ozedit: derails removed)

It’s DeFi …. it doesn’t have to register.

Are any cryptos registered?

Again, prove it’s a Ponzi.

Just because your wrote opinion doesn’t actually mean it’s a Ponzi. Show some real investigation into this.

Don’t edit … claiming “derail”.

It’s the only way to stop Ponzi shills such as yourself from going off the rails everytime they’re confronted with facts and get butthurt.

There is no exemption for DeFi in the Securities and Exchange Act. Securities are securities regardless of the vehicle they are offered through.

HyperFund isn’t committing securities fraud because it’s using cryptocurrency. It’s committing securities fraud because it’s offering a passive investment scheme.

MLM + passive investment scheme = securities offering.

All securities offerings must be registered with financial regulators.

Again, what vehicle the passive investment scheme is offered through is irrelevant.

You invest into HyperFund, you get worthless HU Ponzi points, you eventually put in a withdrawal request and cash out more than you invested.

HyperFund pays your withdrawal request with subsequent investment. That’s literally a Ponzi scheme.

Last time I’m saying this: Dismissing facts as opinions doesn’t make them any less facts.

If I see any more butthurt derails or “lIkE, tHaT’s JuSt yOuR oPiNiOn man!” bullshit I’m just hitting spam.

Wow, you’ve quite elegantly proven why many adults should not be allowed to make decisions for themselves, you disregard all facts and reality, and substitute them with some childlike worldview disconnected from reality – and highly illegal no less.

Clearly don’t even understand what “opinion” means, take your money and invest in an actual education kid.

WHAT??? Unicorns and Santa aren’t real?

NNNNNOOOOOOOOOOO…….. AAAAAAAAAAAHHHHHHHH!

Bingo, for interest sake. As you are a member of Hyperfund. Could you please explain how you are generating a return on your investment?

I mean, does Hyperfund provide you with a list of companies that they invest your capital in, in order to generate a return?

Do they trade your fiat into a crypto and then trade it on an exchange? If so, which exchange? Regardless of it being a centralized or decentralized exchange?

I’m asking this, cause you are being very hectic on research. So I’m asking you, do you know where HyperFund is utilizing your capital (and please be specific) in order to generate a daily return for you?

If you don’t know where and how they are generating an income for you then you are clearly being ignorant and whether this is or isn’t a Ponzi scheme.

If your only proof is that you are making money then we shouldn’t be locking up drug dealers as their business is generating an income (is this the logic you’re following?)

Again, just post a list of companies that your capital is invested in or exchanges (centralized or decentralized) your capital is traded in and it would be relatively easy to match the performance of those platforms with your daily returns.

If you cannot provide a returns generating source, then you should start asking yourself: “Where is my money actually going?”

As for your argument about it not having to be regulated, please refer to Behind MLM’s review on Mirror Trading International and go and have a look in the news about how that innovating, money generating establishment ended up.

Again, and I’m being serious here, please post a list of what is generating a return for you (like, in what is HyperFund investing your capital?)

Yup… like I said in post #66

“Follow the money trail with objective verifiable proof…”

Very true!!

I invested $1200 in February I’m getting back $300 per week and have withdrawn my original investment and its continuing to grow so if I make even $1 profit its still and profit and I have not marketed this to anyone else so please explain what your problem with this company really is?

Also a ponzi scheme doesn’t work if those below you can pass you by referring people themselves that would be a kind of upside down pyramid would it not?

HU is worthless. Sorry for your loss.

You seem confused about how Ponzis and pyramids work.

While both are similar in that they continuously need new investors to continue functioning, a key difference between Ponzi vs. pyramid schemes is the fact that while both involve attracting new investors, the participants in a Ponzi scheme do not typically have any active involvement in recruiting new investors, while the participants in a pyramid scheme must be actively involved in recruiting new investors to succeed.

So, while you yourself may not be recruiting for you to steal from others, any gains you make are in fact still stolen from other joiners in the Ponzi as they are necessary for the continuation thereof as Hyperfart has no audited financials to prove any actual income.

The fact that there is a secondary option to generate stolen gains from recruitment also makes it a Pyramid scheme.

Not sure where this upside-down-pyramid-claim comes from though, alcohol?

Lastly,to be blunt: STOLEN MONEY IS NOT PROFIT YOU SODDING SCAMMER.

Glenn:

Interesting choice of words.

Investments are regulated.

Does Hyperfund have a license to sell investments?

No.

Why not?

Because they are an illegal scam.

Drug dealers also make a profit. Does that mean we should be fine with their illegal activities? Profit does not ensure legality.

I’ll ask you the same question. How is HyperFund generating a return for you? And how are you verifying that it is actually accurate?

Also, in a Ponzi you don’t just steal from the people directly under you. You steal from the people that came in later than you, irrespective of them being part of your downline or not. Please do proper research on what a Ponzi and Pyramid scheme is. You cannot deny that something is a fish simply because you don’t know what a fish actually is.

I’m copying this forever now.

Haha. Glad I could provide.

This is actually a very short, concise and helpful way of summing up the argument. There are more applications of whether you should be a part of a project or not. You could ask yourself:

* If I am making money and not actively recruiting, am I doing anything bad – I guess the answer is yes as you may not be (knowingly or unknowingly) misleading your direct friends/family, but any member who joins the project at a later stage may be the one who ‘suffers losses’ if the well dries up.

Oz and AntiMLM I would be grateful if you share your opinions on the following:

In the Netflix series The Next Blockchain Episode 6 and in various presentations the owners / Xu and co. are deemed to have been a few of the bitcoin mining survavalists by insisting on continuing to mine bitcoin during the drop in vaue in 2014/2015 and reinforcing their belief in the blockchain business.

If we say that the owners really have an interest in creating a DeFi system to promote transparency and blockchain technology, and them stating that they have a desire to recruit 30 million people as loyal members, allegedly giving people a chance to be a take part in an IPO, yada-yada-yada and them being allegedly wizards at generating growth and finances (in the presentations the give the example of the owners aquiring the BW mining company and raising its value from 100 million to 20 billion in 4 years) and we assume that they do know how to reinvest the crypto in such a way that they have a higher than 100% return within 6 months ( as a Hyperfund member can get their money back in 200 days)….

is it possible to make a claim/argument that they really could have a ‘higher’ vision of being at the forefront of DeFi and blockchain promotion and trying to normalise this by having loyal and trusting members (and incentivising them as such by being part of their membership/rewards)….

or do you believe that the motives are unmistakeably a hit and run Ponzi scheme?

I totally get your research on this project not being regulated which obv. doesn’t reflect good on the project. I am mostly wondering on your interpretation on the vision of the owners.

I’ve been taught to look at a few things:

– vision of the company (I am asking you mostly about this)

– who are the people behind it (they are promoted as bockchain gurus, not sure how to verify this, but doing more research)

– what experience they have (you score this as a fail – Hcash)

– is there longterm service/product/benefit (you score this as a fail)

Thanks for your input!

I don’t have a problem with any of this. To do it legally though you have to register with financial regulators and provide regulators, investors and the public with periodic audited financial reports.

HyperFund hasn’t registered with financial regulators or provided audited financial reports. Why? Because it’s a simple Ponzi scheme.

Don’t diminish it. Choosing to operate illegally and in violation of securities law the world over is proof HyperFund is a Ponzi scheme.

The vision is to steal money. This is the same vision of every Ponzi scammer.

It is worthwhile reordering this list to avoid getting sucked into marketing spin at the expense of proper due-diligence:

1. if you identify a passive investment opportunity, check for registration with financial regulators and request audited financial reports. This is a *stop* condition, if it can’t be met the company you are researching is a scam.

2. use supplied audited financial reports and regulatory registration to verify people behind the company and their experience

3. “is there a longterm service/product/benefit”

4. vision of the company.

Also remember you are not buying stock in a company, via IPO or otherwise, that may go up based on demand for that same stock (that is what drives the price of stocks up…. nothing else).

Hyperfund is asking people to “invest” money with a guaranteed return. So, not only is there the need to determine if the business is legit, the question needs to be answered as to whether there are actually enough profits being made from that business to cover the payouts.

And even if HyperTech (and/or its subsidiaries) were producing sufficient profit, what is the evidence that shows that the payouts from HyperFund are coming from said business?

Those are a lot of ifs… and there has not been anything to support and validate any of the above. But there has been a lot to show the opposite.

This is legit the hyper pay card is backed by visa. I have a visa hyper paY card. It’s not a scam.

See #77. Visa has nothing to do with HyperFund. And legitimacy via association isn’t a thing.

*sees VISA logo,must be legit*

No

I reached out to the customer service of Hyperfund and asked them to respond to concerned citizen’s questions.

They sent this to me as a response. hypergroup.io/overview/

I have looked into the information but would appreciate it if OZ would also provide analysis of this information.

My response is I don’t see evidence of HyperFund registering with the SEC or any other financial regulator on that link. I also don’t see any audited financial reports.

Conclusion: HyperFund is committing securities fraud because it’s a Ponzi scheme.

HyperFund will never actually address this because it means admitting it’s a Ponzi scheme.

edit: Just saw the homemade “compliance approved” badge at the footer of the page. LOL!

So no relevant audited financials,and basic ASIC registration which only starts caring about financials after what,2 years,and then it’ll still be years likely before ASIC bothers to deregister

Also for a “Australian Private Company” registration,they aren’t registered for any taxes in Australia – oddly?

Note that they only give links to financials for 2 irrelevant orgs,of which one’s been running just shy of 600 million USD loss for years,and the other one’s income is under 80mill. Seems like the pinnacle of financial success these guys 10/10

1. They offer a ‘membership’ this is a common way of skirting regulations or incases unjust laws or over regulation through language or labels. The crypto along with the hemp industry is (Ozedit: derails removed)

2. You dont need to recruit anyone to receive a MINIMUM OF 300% if you rebuy and compound the interest its much more. Aka $10k goss to $200k in 1.something years if you dont draw down throughout the term. I know of one that did that with 200k and compounded it…he has earnt more than us all put together in 2 years.

3. Doesnt have to be reinvested in other tokens that bs you just change it to USDT aka tether and convert straight back to cash or use the visa card to spend your HU tax free.

4. This is a inverted pyramid…a pyramid scheme seeks to recruit as many as possible where as this has a commission limit of 20 deep I’m assuming thats to ensure mrmbers can always be paid otherwise it would be unsustainable.

This is literally the opposite of a pyramid and speaks to the community building which make sense to go back to the SEC with 30m members.

A ponzy scheme infers that the funding is coming from the members….is anyone doubting that Xu owns ths 4th largest mining company in existence since 2004? The nature of crypto is ones true net worth is unknown but he is one of the big guys!

Xu has one blemish with those vietnamese peeps and hypertech failed. He still actually maintains that from what I undedstand.

We are not in the age of Ponzi and outdated paper fillings with ms dos…for me the only thing is Xu’s wealth is unquantifiable hence we cant be sure that he xan finance the expansion but if he is one of the biggest crypto guys we know he can finance the expansion to the target of 30m members and when he gets there….. crypto replaces currencies.

(Ozedit: derails removed)

You can call it whatever you want. You invest in HyperFund’s shitcoins and hope to withdraw funds of those who invest after you.

If you want to discuss hemp, Barclays, Julian Assange or any other topics that have nothing to do with HyperFund, do it somewhere else.

Ponzi schemes are illegal for good reason. They are fraudulent business models in which the majority of participants are guaranteed to lose money.

They are marketed on false pretenses, and one need only look at you and the last few commenters to see this in action.

Doesn’t matter. Someone has to recruit new victims or nobody can cash out.

Has no bearing on HyperFund being a Ponzi scheme.

Again, call it whatever you want. MLM + no retail = pyramid scheme.

Whether anyone doubts any of Xu’s claims is neither here nor there. The issue is no verifiable evidence of external funds being used to pay HyperFund withdrawals.

The only legally acceptable verifiable proof of external revenue would be audited financial reports. These don’t exist because HyperFund is a Ponzi scheme.

What blockchain bro bullshit Xu gets up outside of HyperFund is irrelevant to HyperFund being a Ponzi scheme.

*Attempting to* skirt regulations,thanks for confirming they need to evade laws

This was where you should’ve stopped,its absolutely financially impossible to give everybody 3x their money

Your upline being a proficient scammer doesn’t exactly disprove anything,quite the opposite – it proves exactly what the business model is

Nothing is tax free

Uh,you’re clearly very new to triangular shapes and how they relate to MLMs,and you were doing to well up to now,always so sad the lack of education shills demonstrate

What in the flying pork sausages will more victims mean to the SEC? Were you at any meetings with the SEC where they said “You don’t need to prove your audited finances,just play pokemon and collect them all (or 30 million idiots?)”

No proof of income,obviously it’s from the members till proven otherwise

Did Madoff not actually run a huge investment firm? Still turned out to be a scam,surprising how ponzi scammers don’t have to be poor people

It’s called doubling down

K

Amusing as it is seeing every one of you hyperturds come in copy-pasting the same excuses proving exactly why grown-ass-adults sometimes need to not be able to make decisions for themselves,you haven’t added anything remotely more convincing

Hi @Oz would like to contact you. I have more info on this. thnx

Contact button is on the top right of every page.

OZ,

In response to my inquiry you stated the you saw no evidence of Hyperfund registering with the SEC or any other regulator on the link provided.

However, minutes later AntiMLM states accurately that they have registered with ASIC. Is it a requirement for foreign companies to register with the SEC?

In fact on April 7, 2021 Zijing (Ryan) Xu did register with the SEC with another company:

sec.gov/Archives/edgar/data/1641398/000121390021020812/ea139260-8k_codechain.htm

I understand that it isn’t the same company but it does seem surprising that someone that is intentionally engaged in a Ponzi Scheme would act in this manner.

Reviewing the document I provided does appear to demonstrate that they are working with government agencies (Australia) and others. This may be part of the ploy but it seems strange to me.

I admit I am no expert on these matters but I am trying to get to the facts and the truth. I ultimately want to do no harm.

In spending time on the site I am also impressed with the amount of educational information that is covered in their Academy. Just saying.

Nownow,don’t try to warp what I posted.

The ASIC registrations are useless for a multitude of reasons,including the lack of enforcement,lack of verification,and their reactive nature,and also for irrelevant companies.

The SEC is somewhat more capable.

Go look up the few registrations that are there for Hyperfarts’s shell companies,they are for nondescript companies that have nothing to do with the ponzi business portion. It’s a common tactic to only publish financials for show,and hide the actual relevant bits in a shell-game.

Which is actually more damning,since it indicates they know how to register with a registrar and do financials,but choose not to for the relevant businesses.

Now enough with the nonsense,we both know your angle already.

ASIC registration is meaningless.

ASIC don’t actively regulate MLM securities fraud (scammers know this), and Australia is not a primary source of HyperFund investment.

Any MLM company offering a passive investment opp to US residents must register with the SEC.

Registering shell companies that have nothing to with HyperFund = meaningless.

It’s really simple: Either HyperFund and Ryan Xu are registered with the SEC or they aren’t.

If they aren’t they’re committing securities fraud and MLM + securities fraud = Ponzi scheme.

Don’t confuse registering in scam-friendly jurisdictions with “working with government agencies”.

Fact: HyperFund and Ryan Xu are not registered to offer securities in the US, their primary source of invesmtent.

Truth: MLM + securities fraud = Ponzi scheme.

Looking beyond this fact and truth is an attempt to legitimize fraud. Your due-diligence begins and ends with securities fraud and HyperFund being a Ponzi scheme.

With any buisness you need members. Its a movement of money to grow the business to advertise the buisness.

To reward the members with 3x leverage. The more people who get into Hyperfund the better it grows as a buisness. You have to start from somewhere.

The hyperfund group set it up in a way where it is not illegal. However the case may be.

There may be things you are not aware of that makes this legit.

The banks (Ozedit: snip, derails and whacky conspiracy theories removed)

Legitimate businesses don’t start with securities fraud. Ponzi schemes do.

Securities fraud and running Ponzi schemes is illegal the world over.

Feel free to share anything that would make securities fraud and running an MLM Ponzi scheme legal.

What “the banks” are or aren’t has nothing to do with HyperFund committing securities fraud because it’s a Ponzi scheme. Leave that crap on Facebook, thanks.

If it’s as good as they claim,they can be registered and sign up entire nations easily,everyone would be glad for the chance to clear the trillions of debt and stop working entirely

No need for MLM and to operate unaudited and unregistered

Unless

You guys must have a different agenda. Which is very sad!

What if they don’t have to register. What if there are details you are missing that makes it legal in the usa.

Don’t you think they can answer all your doubts. We do buisness together there is no one above anyone.

Don’t you think the proper people have looked into this and have found nothing wrong with it. (Ozedit: derails removed)

There is no “agenda”, only facts:

1. HyperFund is soliciting investment from US residents.

2. HyperFund is not registered with the SEC.

3. HyperFund is committing securities fraud.

4. MLM + securities fraud = Ponzi scheme.

There are no “missing details” that legitimizes securities fraud in the US or anywhere for that matter.

You are welcome to provide any relevant details you think legalize securities fraud and I’ll be happy to tear them apart.

Failing which, keep your whacky conspiracy theories to yourself. Last time I’m politely asking.

No idea who “proper people” are but whether they find nothing wrong with securities fraud and Ponzi schemes, that is neither here nor there.

Gonna quote the full waffle because people need to see the absolute crap you posted (unless Oz decides it’s not funny enough – fair game).

You are a deficient future victim.

(Ozedit: snip, see below)

Funny as some of them may be, the reason I’m hard on derails is if you engage then we all wind up talking about anything but HyperFund (or whatever scam someone is trying to deflect from).

Not useful and quickly becomes a nightmare to moderate.

Man I guess we will have to see won’t we. Just cause you think it’s fraud doesn’t mean it is.

I’m sure the proper people who are in charge of these things whoever they are! would shut Hyperfund down if it was so fraudulent but they haven’t. I wonder why!! (Ozedit: waffle removed)

Facts != thoughts.

Anyone can verify HyperFund is not registered with the SEC by running a search on the Edgar database.

MLM + securities fraud = Ponzi scheme. Again, no need for thoughts – just facts.

Same reason anyone runs a Ponzi scheme for, money. As long as dumbasses sign up to lose money Xu will keep HyperFund going.

Inevitable exit-scam/collapse happens when investment slows down and/or regulators start paying attention.

@Oz,WHAT A PAIN NEEDING TO RETYPE SOME OF THIS lol

They have to,it’s the law. What if you have to do what the law requires,like everybody else should?

There isn’t anything missing,except their audited financials and required registration

They haven’t answered,because they can’t answer,because it’s a scam

It’s a ponzi AND a MLM,there’s literally everybody that signed up before you above you

The proper people are those who are not involved with it,who can objectively review it as there is nothing to gain or lose for them in it’s continuation or its failing. IE not you or any other cultists,or hired guns of any kind. Regulators being the ideal ones,but in absence of regulators,BehindMLM does a sterling job

You knew what was going to happen when you quoted the derail!

(stupid email comment system, thinks it’s the boss of me!)

I was bored, and your edits make the guy seem less of a cultish whackadoodle 🙁

Also yay Email comment system, get to see before you can despamify (^.^)

Yes your thoughts which is ok to have.

Yes indeed if it’s the law that you have to be registered! You all are just people with some knowledge of the situation.

What I’m trying to get across why are you having a one track mind on the subject. Where is the hope? (Ozedit: derails removed)

Thank you for finally acknowledging HyperFund is committing securities fraud because it’s a Ponzi scheme.

Hope has no place in due-diligence. Only facts.

Now we see you!

We have hope.

Hope that you realize you need to get out before it inevitably collapses and hope that you haven’t recruited others into an obviously illegal enterprise

What we don’t have is Hope it’s not a scam, because that’s not hope, that’s wishful thinking and delusion.

You’re really arguing so hard that this is legit. But you don’t even know who the regulators are that need to investigate Hyperfund?

You haven’t done any due diligence have you? You’re more of the “Well I’m making money so I don’t care about how this works” type of people aren’t you?

So then humour me for a second and answer these TWO simple questions: “How is Hyperfund utilizing your provided funds in order to generate an income for you?” and “Have you seen proof of how they utilize your funds to generate an income?” (it should be noted that saying “the proof is me making money” isn’t proof good sir)

I mean, surely you know how your invested funds are being utilized?

And of course the other main question and point that keeps being raised here is “Is the income legit?” (no proof that it is but lots of proof it is isn’t).

And even if it were legit, the final question would is there any proof that there is enough profit being generated to cover all the IOUs and payouts? Of course, this question is moot if the income is not legit.

You should see some of the patronising shit the so called leaders come out with. I hope they get what’s coming to them one day.

What patronising shit?? Please explain what you mean?

At the end of the day everyone is entitled to their own opinion and trying to reason with someone who is stubborn and made up their mind is impossible. No matter how many “facts” are provided.

The problem is when scammers start pushing their opinions as facts, and dismiss actual facts as tHaT’s JuSt YoUr OpInIoN!

You can find multiple examples of HyperFund scammers (future victims) engaging in this by scrolling up. Wonder where they got it from?

Lack of independent thought, can only parrot what they hear.

From my point of view, (Ozedit: snip, see below)

Your point of view is irrelevant if you’re not going to address HyperFund committing securities fraud because it’s a Ponzi scheme.

Own the fact HyperFund is a scam and stop making excuses for financial fraud.

But what if we love ponzi’s Oz? What if we don’t give a flying fig about what you think Oz?

We just don’t care about what you have to say! Tough turds!

Aso, since when is the SEC the “sole arbiter” in determining what is legal or not?

We are not in the business of catering to establishment regulators, who are thieves and do not care about the little guy.

Here’s a cookie I guess? If you’re a self-confessed scammer hell bent on stealing money from people, obviously this review isn’t for you.

Can’t stop your potential victims from reading the facts though. Sorry for your loss.

At least this guy’s as honest as a thieving douche can be – at least about his intentions.

Part of the stellar “I don’t care if people lose everything as long as I make money” crew.

Ironic though he calls regulators thieves when he does the thing he seems to “despise”.

10/10 and a gold star for the dunce of the day.

This is a troll.

Hi guys

Someone I know (and trust) is making around 5k a month part time from this. I asked him more details and he sent me a zoom link for a Hypertech promo video call last week.

I was suspicious immediately, ‘pyramid scheme’ immediately popped to mind.

However, there were a number of testimonials of real people making money, its hard to fake video testimonials with so many people, and my friend is making money (I will ask to see withdrawals to his bank account just to be sure)

so

1) It seems many people are making money

The question is:

Is it legal?

Is it sustainable? (possibly is it ethical?)

MY RISK:

Firstly, if you can convert your money you earn, into real currency eg USD and withdraw to your bank account, my personal risk is significantly lowest.

Even if the whole thing eventually collapses, if you have taken eg half of your profits and regulary withdrawn each month, then you are protected.

(e.g If for example you have invested $1000 initially, but because of recruiting eg 20 members (ethical?) you now make 4k a month and you withdraw eg 50% of this and keep 50% in).. Even if company collapses 1 year later.

I invested 1k, got back 24k, had 24k still in there I lost as unfortunately company collapsed..

But overall, providing I can withdraw each month.. I’m in profit.

Personally I have a low risk and a financial profit.

I was able to convert shitcoins into real dollar currency each month and withdraw – which I believe it is possible to do.

Now, there is ethical issue, that the people I recruit may get fucked over and take a loss worst case.

The thing I dont understand is: FSA warns against Hyperfund

fca.org.uk/news/warnings/hyperfund

Hyperfund is not registered with SEC.

My question is, if Hyperfund is illegal and authorities know about them – why havent they shut them down? Why are these companies still operating?? Sure the FCA would have closed them down very easily?

Your opinions appreciated, because it seems there are people genuinely making money from this.

If your bar for “should I invest in scams” is “are people making money in this”, you’re going to continually lose money in scams.

Remember, it’s not that nobody makes money in MLM Ponzi schemes like HyperFund. The owner (Ryan Xu), and a small group of top recruiters and early investors make money.

This happens at the expense of everyone else.

It’s not hard to invest in a shitcoin Ponzi, get paid in said shitcoin and upload “LOOK MANG, ELEVENTY BILLION DOLLARS PROFIT!” videos to YouTube. This of course is not actual money.

“Making money” in a shitcoin Ponzi doesn’t happen until you cash out. And, like every Ponzi scheme, there’s only so much to cash out (see HyperCash collapse).

Math is math, the majority of investors lose money in Ponzi schemes. Getting in now you’re investing in an already collapsed Ponzi scheme, now laden with new bagholders from the reboot.

Do what you will, those are the facts. I don’t particularly care what you do either way.

Re. FCA, they are hopeless when it comes to enforcement. I only document the FCA’s securities fraud warnings as other regulators and banks take notice.

HyperFund’s largest investor source is the US. Can’t speak as to if or when US regulators will go after HyperFund.

Typically it’s years after the fact, by which time you and all the other investors who think they could beat math have already lost their money (BITCONNEEEEEEEEEEEECT!).

It screams pozni-pyramid because that’s what it is. The returns and payouts are so astronomical as to be logically unsustainable unless they own a moneyprinter and can end world-hunger and fossil-fuel dependency – but they prefer to run an unregistered MLM illegally instead.

It’s true plenty of people can make money,but I prefer my money clean and not stolen from others that will be losing everything one day to the eventual exit (or 2nd exit?).

Trust your ethical heart and avoid it or go with the greedgoblin and join.

Just a reminder about Bernie Madoff… Many people “made” BILLIONS over 20+ years of this ponzi scheme BUT since 2008 when it all collapsed, regulators have gone after and collected over $12BILLION so far from the $65BILLION that were lost.

And they are STILL going after those that “made” money and collecting money 13 years AFTER the collapse.

This is 100% legit. The company makes millions of dollars a day (Ozedit: snip, see below)

If you want to make financial claims about HyperFund back them up with legally required audited financial reports.

No reports? Thank you for confirming HyperFund is a Ponzi scheme.

The HU turns into mof which you convert into usdt. You buy bitcoin with usdt. You can either keep the bitcoin or cash the bitcoin.

Let’s say the company shuts down they guarantee you will get your rewards. (Ozedit: derails removed)

So you’ve seen the audited financials for the ponzi? Feel free to link them.

You aren’t converting shit without new bagholders to hold your bags. Just like any other shitcoin Ponzi scheme.

Lol. Ask the HyperCash bagholders how that worked out.

You’ve literally just pasted the marketing spiel.

Yeaaaah because a company that’s not audited or registered to provide services is toooootally above board and will definitely honor guarantees.

Are you in preschool or just intellectually challenged?

Of course you need new bagholders (Ozedit: snip, see below)

As previously stated, thank you for confirming HyperFund is a Ponzi scheme.

Seeing as you continue to make unverified financial claims about the company, I’m adding you to the spam-bin now. Best of luck with the scamming.

So I came across this, effectively saying Hyperfund are not registered with SEC, but the lady is say they do not need to been listed with SEC because it’s *not* an investment company. Instead they are listed with another American organisations.

What do you guys think of this? Legit?

(Ozedit: link removed, see below)

I had to add spaces so that the link can been seen. Hope that is ok. Is this lady legit? Thanks

I did enough research to say that hyperfund is a potential scam and is a ponzi scheme.. Even if I put my researches aside, let me say some normal facts.

1.There is no shortcut in life for success unless you’re stealing or doing fraud.

2.If they triple your money in 600 days and they are legit why billionares are working hard to make money?? They can just invest here and get their money tripled.

3. If this is real, why are people working?? they can just invest and invest for his family under him and that’s all. life is set.

This things won’t happen because it’s a ponzi scheme .. If this is true then the whole world is wrong, people’s hardwork, struggle for money is worthless.. Which is not possible..

I’m not stating facts like others because there are a lot to prove it a ponzi scheme. I’m just telling some truth as a human.

I appreciate the effort you guys put into researching these scammers.

My dad got sucked in a couple of months ago unfortunately and is being seriously stubborn about any shady stuff I try and warn him about (I feel the need to point out I’m not the most knowledgeable guy about regulations and scams so I can’t effectively debunk the whole operation).

I’ve tried leading with the securities fraud angle, letting him know that they’re offering a security as per the “Howey test” and therefore need to be registered. But he maintains that its not an investment but a “membership”.

Anyone got any advice on how to tackle that particular defense?

Appreciate it.

@Wairan

I’ve addressed HyperFund’s BS compliance video here – https://behindmlm.com/companies/hyperfund-appoints-compliance-officer-to-bury-securities-fraud/

@Towelrake

Ask your dad what he did when he signed up (deposited funds).

Followup with why he did it (to eventually withdraw more than he deposited).

Followup with what he’s doing to generate that return (nothing).

That’s an investment contract. Calling an investment a “membership” doesn’t make it any less of an investment in practice.

Nobody ever dodged a securities fraud lawsuit with “bUt It’S nOt An InVeStMeNt, It’S a MeMbErShIp!”

Unfortunately there’s not a lot you can do if your dad continues to lie to himself about the facts.

The genius about this whole thing is in the name … Hyper Fund. It is all about hype.

Hype it till there’s no more new money coming in then run.

@Towelrake

Almost all investment scams claim they are not investments and therefore not subject to regulation, registration, etc.

Of course they do, because they have no intention of doing anything (like registering their investment scheme) to get the attention of regulators.

The cover stories vary; in this one, they claim investors aren’t investors, they’re members. Bitcoin scams often say they don’t have to register their Bitcoin-based Ponzi scheme because Bitcoin is a commodity, not a security.

The articles on this site are littered with hundreds and hundreds of scammers, shills, and clueless victims parroting some bullshit reason why their obvious investment scheme is somehow not an investment (heck, a lot of them are on this very comment thread).

When the scheme inevitably collapses (and they ALL collapse eventually), they are either never heard from again or are begging for help because they got taken.

If you can convince your dad to visit this site and read about some of the other companies who ran similar scams and have since imploded, he may start to see the light for himself.

You never know; it’s worth a try. Tell him the stories make for entertaining reading (because they do!).

this post seems baseless and cosmetically presented in English only who have not been involved in the investment plan. And only says it is Ponzi or MLM type only.

The main point to understand is that (Ozedit: derails removed)

You don’t need to lose money in a Ponzi scheme to identify one.

Because that’s all HyperFund is. It’s an MLM Ponzi scheme.

HyperFund is a Ponzi scheme in which the majority of investors will lose money. Spare us the marketing spiel, not interested.

It seems so obvious when you lay it out like that lol.

Yea, I just hope it all comes crashing down sooner rather than later if I can’t convince him. I just saw your new post about their “compliance” garbage as well, you think that’s a sign things are unravelling?

Thanks again guys @Oz @Amos_N_Andy.

I don’t think the compliance video is a sign things are unravelling but launching the mining opp is.

Without knowing what’s left in the kitty though, trying to gauge when exactly a Ponzi will collapse though is a waste of time.

Does anyone know what Financial company Hope Hill work for in the US? Very little digital footprint.

She is not listed in FINRA, and they go back at least 10 years with their listing of brokers. Anything past that time frame has to be done by email request. Since we don’t know more than her name, that would be hard for them to find.

I also checked with CFTC through their broker listing with the NFA and she is not listed there either. So we know she is not listed with the SEC nor CFTC.

Odds are they lied about her being a registered broker. I know that comes as a total shock that they would lie about something like this, especially since this is a fully legal and legitimate company (cough, cough).

The only Hope Hill with a compliance job that I could find was the one with Impact Community Action in Ohio.

No idea if she is the same as the Hyperfund Hope Hill or not, however.

Hi Oz and AntimLm,

My brother here in London has put thankfully a small amount of 2k into this scam, through a so call friend in the pub that has also got a lot of other people involved. Thank you both for all the real factual information you guys have put up here.

Q if I report this guy to the FCA here in London will they close him down?