Cirrus Networks Review: Juuva’s Gnodi crypto fraud

Cirrus Networks fails to provide ownership or executive information on its website.

Cirrus Networks fails to provide ownership or executive information on its website.

Cirrus Network’s website domain (“cirrusnetworks.io”), was privately registered on July 18th, 2024.

In Cirrus Networks’ compensation documentation, we find reference to “Gnodi”;

The Cirrus Networks Cloud-9 Compensation Plan is crafted to recognize and reward the efforts of our Affiliates and Associates in empowering individuals to embrace the Gnodi Decentralized Ecosystem.

Further research reveals Juuva pitching itself as “a marketing arm of the Gnodi Blockchain”:

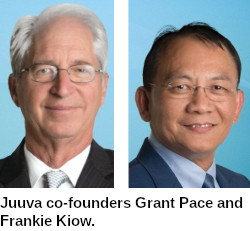

Juuva is a dietary supplement MLM company run by co-founders Grant Pace and Frankie Kiow.

Juuva is a dietary supplement MLM company run by co-founders Grant Pace and Frankie Kiow.

In BehindMLM’s 2020 Juuva review, we found kooky products combined with a recruitment focused compensation plan.

Juuva’s Grant Pace is at the center of Juuva’s Gnodi marketing:

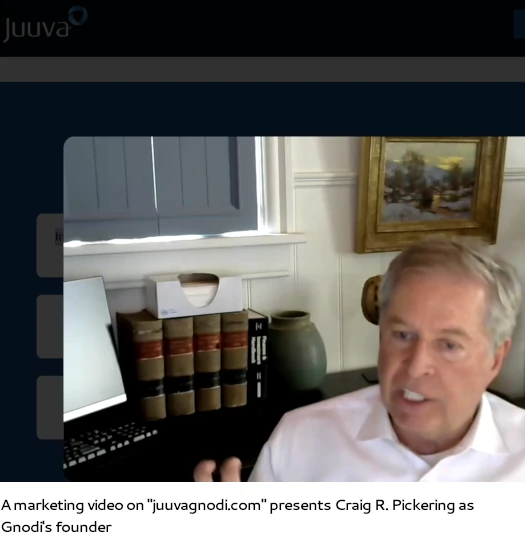

Juuva’s Gnodi marketing website is hosted on the domain “juuvagnodi.com”, privately registered on February 14th, 2025.

On Juuva’s Gnodi marketing website we find a video titled, “Interview – Founding Visionary of the Gnodi Blockchain”.

In the video Craig R. Pickering is presented as Gnodi’s founder:

This tracks with Pickering filing a US trademark application for Gnodi in October 2024:

With this information I was able to confirm Pickering is also the CEO of Cirrus Networks:

Pickering is best known in the MLM industry for defrauding consumers through iMall in the 1990s.

Pickering and business partner Mark R. Comer settled iMall fraud allegations brought by the FTC in April 1999.

Internet commerce site iMall and two former principals have agreed to pay $4 million to settle Federal Trade Commission charges that they made false earnings claims for Internet-based businesses they promoted and that they violated the Franchise Rule.

Craig R. Pickering and Mark R. Comer, two past presidents of iMall, also would be barred for life from selling any Internet or pay-per-call business opportunity; barred for 10 years from selling franchises; required to post a $500,000 bond before selling certain types of business opportunities; and barred from violating the Franchise Rule.

iMall will pay $750,000 and Pickering and Comer will pay a total of $3.25 million in consumer redress.

iMall would be permanently barred from violations of the Franchise Rule and from misrepresenting material facts about any business opportunity it promotes.

The iMall Opportunity Program offered investors the opportunity to become “consultants” and make money selling webpages on the iMall site.

The Internet Yellow Pages (IYP) program offered investors the opportunity to make money selling advertising space on the IYP website contained within the iMall site.

Typically, the seminar presentations claimed that for a $2,995 fee and as little as five to 10 hours investment a week, iMall consultants could make between $2,000 and $20,000 a month.

Potential IYP investors were told that for a $2,000 investment and a five to 10 hour commitment a month, they could earn between $2,000 and $5,000.

According to the FTC, the earnings claims were false and misleading in violation of federal laws.

“A deceptive claim is a deceptive claim, whether it’s on the Internet or in your local newspaper,” said Jodie Bernstein, Director of the FTC’s Bureau of Consumer Protection.

“This case sends two important messages: Marketers, back up your earnings claims. It’s the law. Consumers, don’t buy a pig in a poke. Check out business opportunities to make sure they’re everything they claim to be.”

We learn more about Pickering in a 2021 KwikClick SEC filing;

Craig Pickering is an affiliate of the Company through indirect ownership of 16,668,035 shares of our common stock which constitutes 14.38% of our outstanding stock.

For at least the past 20 years, Mr. Pickering is a self-employed angel investor and business consultant.

For several years between 2012 and 2018, Mr. Pickering served as the Company’s CEO.

Mr. Pickering served on the Company’s board of directors until June 10, 2020 when he resigned from the board in connection with the Company’s acquisition of KwikClick, LLC. Mr. Pickering was closely involved with the acquisition of KwikClick, LLC.

Mr. Pickering was closely involved in the founding of Ariix International in 2011.

Ariix was a dietary supplement company that was sold to NewAge Beverages in 2020.

NewAge filed for Chapter 11 bankruptcy in September 2022. KwikClick was at the center of sabotage and extortion allegations by NewAge’s then Chief Restructuring Officer.

Pickering wasn’t a named defendant in legal proceedings initiated against NewAge executives in 2023.

In addition to Pickering, other Cirrus Networks executives include Bob Steed (CMO), Craig Smith (COO), Dewey Mackay (CFO), Cat Bonhar (Advisory Board, Compliance) and David Hunt (Advisory Board, Legal).

In 2019 a BehindMLM reader tied Craig Pickering to Ormeus Global founder John Barksdale.

I wasn’t able to verify a direct connection between Pickering, Barksdale and Ormeus Global, so I wasn’t going to mention it.

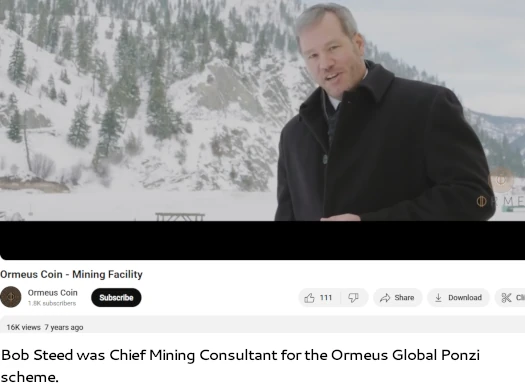

Bob Steed, Cirrus Networks’ CMO, however was Ormeus Global’s Chief Mining Consultant:

Ormeus Global was a $124 million plus MLM crypto Ponzi built around Ormeus Coin (ORME).

Barksdale was indicted on Ormeus Global fraud charges in March 2022. The SEC filed civil Ormeus Global fraud charges against Barksdale the same month.

As of May 2025, Barksdale remains a wanted fugitive hiding out in Dubai.

Prior to US authorities going after Barksdale, Bob Steed’s name came up in a report to Thai police in 2019. The report led to Barksdale’s detainment and subsequent fleeing to Dubai.

This is from the description of a Cirrus Networks marketing video;

Mr. Pickering, Bob Steed and a few partners put together one of the largest bitcoin mining operations in the world.

We know Steed was heavily involved in the marketing side of Ormeus Global. How deep Pickering was involved has not been publicly disclosed.

If a BehindMLM reader brought up Pickering’s Ormeus Global involvement in 2019 however, it appears the information is out there.

Other than Dewey Mackay being tied to Ariix, I didn’t find anything of particular interest with the rest of Cirrus Networks’ executives.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Cirrus Networks’ Products

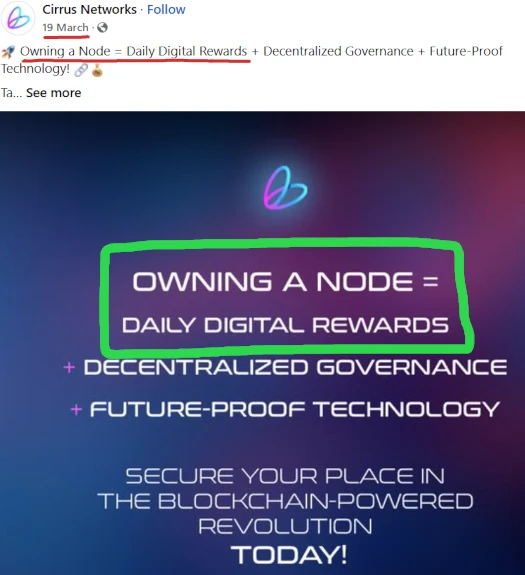

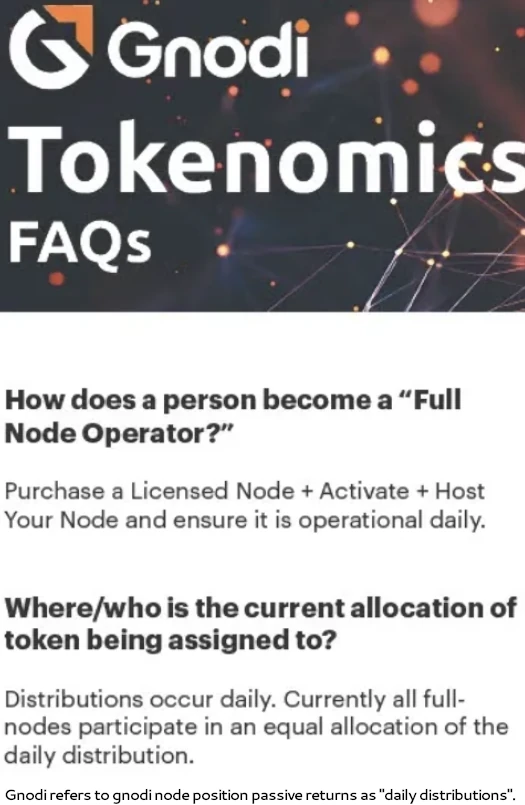

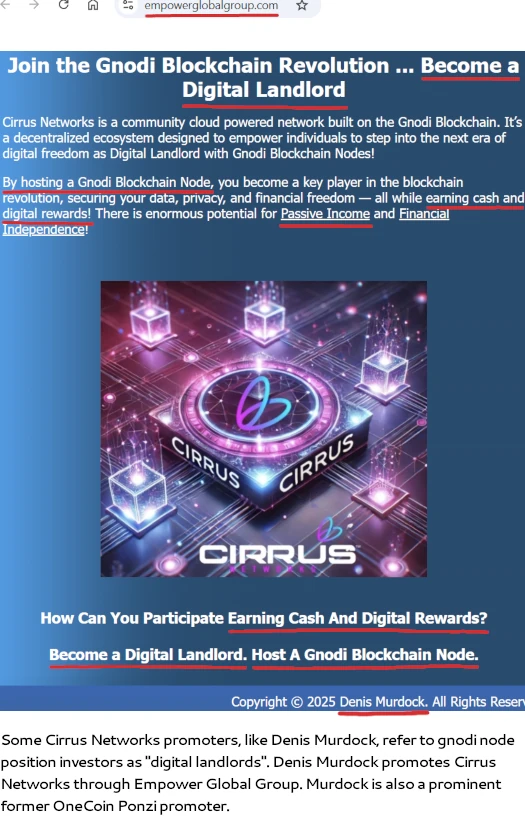

Cirrus Networks sells $1150 “gnodi node” investment positions.

Juuva allows retail investors to spend up to $230,000 in one transaction on two hundred gnodi node positions:

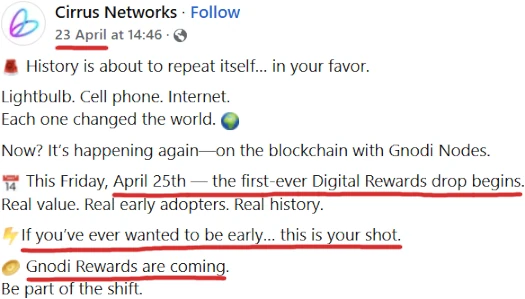

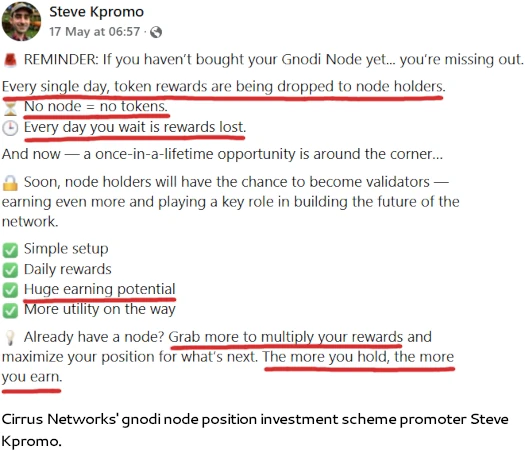

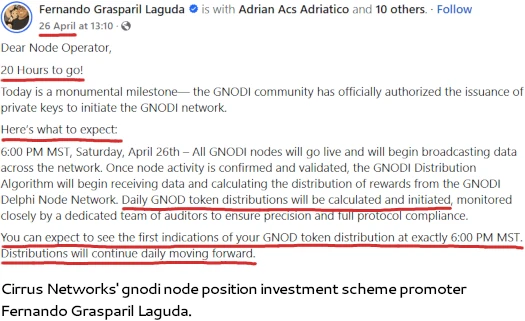

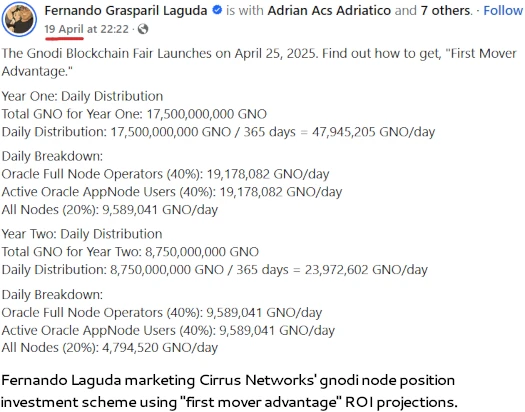

Retail customer investors and Cirrus Network/Juuva promoters invest in gnodi node positions on the promise of passive returns (referred to internally as “digital rewards” or “distributions”), paid out daily in GNO tokens.

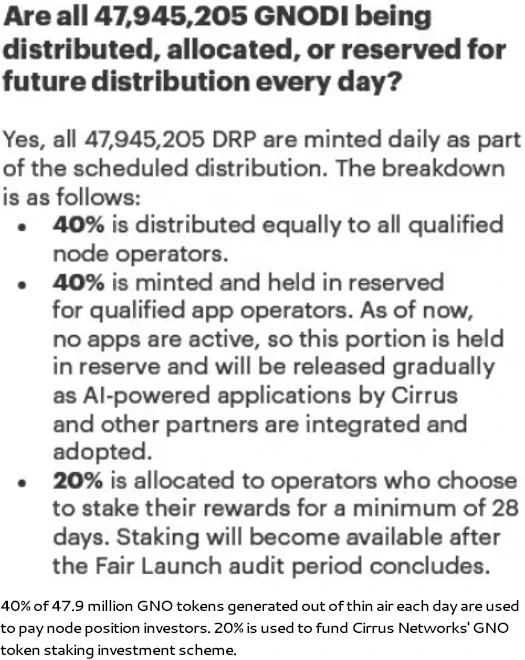

Cirrus Networks’ marketing represents 40% of 47.9 million gnodi tokens are paid to gnodi node position investors daily:

GNO token holders, whether directly invested into or acquired through the gnodi node position investment scheme, are also able to participate in a staking investment scheme.

In a staking investment scheme, GNO tokens would be parked with Cirrus Networks. This is done on the promise of passive returns, again paid out in GNO tokens.

Be it gnodi node investment position returns or staking returns, GNO tokens are worthless outside of Cirrus Networks and must be cashed out internally.

Cirrus Networks’ Compensation Plan

Cirrus Networks’ “Cloud9” compensation plan pays out on gnodi node investment by retail customer investors and Cirrus Networks and Juuva affiliate promoters.

Cirrus Networks’ Affiliate Ranks

There are twelve affiliate ranks within Cirrus Networks’ compensation plan.

Along with their respective qualification criteria, they are as follows:

- Cloud 1 – sign up as a Cirrus Networks affiliate and generate 500 GV

- Cloud 2 – generate 1000 GV

- Cloud 3 – generate 2000 GV

- Cloud 4 – generate 4000 GV

- Cloud 5 – generate 10,000 GV (must have two 2500 GV recruitment legs)

- Cloud 6 – generate 20,000 GV (must have two 5000 GV recruitment legs)

- Cloud 7 – generate 40,000 GV (must have two 10,000 GV recruitment legs)

- Cloud 8 – generate 70,000 GV (must have two 17,500 GV recruitment legs)

- Cloud 9 – generate 130,000 GV (must have two 30,000 GV recruitment legs)

- Rainmaker 1 – generate 250,000 GV (must have two 75,000 GV recruitment legs)

- Rainmaker 2 – generate 400,000 GV (must have two 100,000 GV recruitment legs)

- Rainmaker 3 – generate 750,000 GV (must have three 100,000 GV recruitment legs)

GV stands for “Group Volume”. GV is gnodi node position investment volume by referred retail and recruited downline affiliate investors.

Referral Commissions

Cirrus Networks pays a 30% referral commission on gnodi node position investment by personally referred retail investors and recruited affiliates.

Residual Commissions

Cirrus Networks pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Cirrus Networks caps payable unilevel team levels at nine.

Residual commissions are paid as a percentage of gnodi node investment position revenue across these nine levels based on rank:

- Cloud 1 ranked affiliates earn 5% on level 1 (personally recruited affiliates)

- Cloud 2 ranked affiliates earn 5% on level 1 and 3% on level 2

- Cloud 3 ranked affiliates earn 5% on level 1, 3% on level 2 and 2% on level 3

- Cloud 4 ranked affiliates earn 5% on level 1, 3% on level 2 and 2% on levels 3 and 4

- Cloud 5 ranked affiliates earn 7% on level 1, 3% on level 2 and 2% on levels 3 to 5

- Cloud 6 ranked affiliates earn 7% on level 1, 5% on level 2, 3% on level 3 and 2% on levels 4 to 6

- Cloud 7 ranked affiliates earn 7% on level 1, 5% on level 2, 3% on levels 3 and 4 and 2% on levels 5 to 7

- Cloud 8 ranked affiliates earn 8% on level 1, 6% on level 2, 4% on level 3, 3% on level 4, 2% on levels 5 to 7 and 1% on level 8

- Cloud 9 ranked affiliates earn 8% on level 1, 6% on level 2, 4% on levels 3 and 4, 3% on level 5, 2% on levels 6 and 7 and 1% on levels 8 and 9

- Rainmaker 1 ranked affiliates earn 10% on level 1, 7% on level 2, 5% on levels 3 and 4, 4% on level 5, 3% on level 6, 2% on levels 7 and 8 and 1% on level 9

- Rainmaker 2 ranked affiliates earn 10% on level 1, 7% on level 2, 5% on levels 3 to 5, 4% on level 6, 3% on levels 7 and 8 and 2% on level 9

- Rainmaker 3 ranked affiliates earn 10% on level 1, 7% on level 2, 5% on levels 3 to 7 and 4% on levels 8 and 9

Matching Bonus

Cirrus Networks pays a Matching Bonus on unilevel team earnings down eight levels of recruitment:

- Cloud 5 ranked affiliates earn a 7% match on level 1

- Cloud 6 ranked affiliates earn a 7% match on level 1 and 5% on level 2

- Cloud 7 ranked affiliates earn a 7% match on level 1, 5% on level 2 and 3% on level 3

- Cloud 8 ranked affiliates earn an 8% match on level 1, 6% on level 2, 4% on level 3, 3% on level 4 and 2% on level 5

- Cloud 9 ranked affiliates earn an 8% match on level 1, 6% on level 2, 4% on levels 3 and 4, 3% on level 5 and 2% on levels 6 and 7

- Rainmaker 1 ranked affiliates earn a 10% match on level 1, 7% on level 2, 5% on levels 3 and 4, 4% on level 5, 3% on level 6 and 2% on level 7

- Rainmaker 2 ranked affiliates earn a 10% match on level 1, 7% on level 2, 5% on levels 3 to 5, 4% on level 6 and 3% on level 7

- Rainmaker 3 ranked affiliates earn a 10% match on level 1, 7% on level 2, 5% on levels 3 to 7 and 4% on level 8

Joining Cirrus Networks

Cirrus Networks affiliate membership is $47.95 annually. Note this fee is waived for the first year if a Cirrus Networks affiliate invest $1150 into a gnodi node position.

Without a gnodi node investment position, Cirrus Networks affiliate membership is $299.95 (and then presumably $47.95 annually).

Cirrus Networks charges fees and solicits investment in USD or tether (USDT).

Cirrus Networks Conclusion

Cirrus Networks is a simple two-tier MLM crypto Ponzi. The first tier is the gnodi node position investment scheme, the second the GNO token staking scheme.

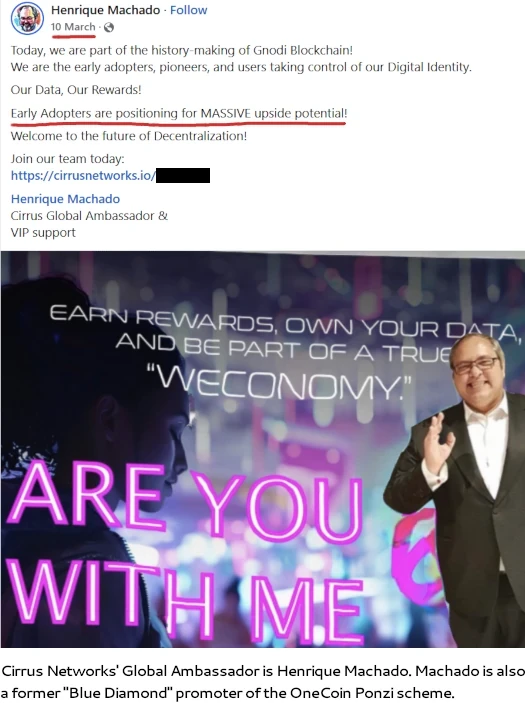

It appears things were pretty dead over at Juuva, prompting Grant Pace and Frankie Kiow to put the entire company at risk of criminal and civil fraud charges – something Craig Pickering is familiar with but, having come out Ormeus Global unscathed, evidently isn’t too fussed about.

Other third-party companies attached to Cirrus Networks include Tyga Bank (dba TygaPay), Vaultix Wallet and 1ClickHosting.

On the specifics of Cirrus Networks’ fraud, we have both wire fraud and securities fraud at play.

Securities regulation of MLM investment schemes in the use is rooted in establishing the existence of an investment contract using the Howey Test.

The U.S. Supreme Court’s Howey case and subsequent case law have found that an “investment contract” exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

In Cirrus Networks we have retail investors investing $1150 into gnodi node positions. Here Cirrus Networks satisfies the “common enterprise” prong.

The investment into gnodi node positions is made for no other reason than the expectation of passive profits.

I’ll provide plenty more examples throughout this conclusion but here’s Cirrus Networks soliciting investment on said expectation of passive profits:

The passive profits Cirrus Networks pays out are calculated and paid out by Cirrus Networks, satisfying “the efforts of other” Howey Test prong.

Despite representing to consumers that Cirrus Networks is a “fully registered business” and is “complaint from the USA”…

…a search of the SEC’s Edgar database reveals neither Cirrus Networks, Gnodi, Juuva or Craig Pickering is registered with the SEC.

Thus we have confirmed that Cirrus Networks’ gnodi node position investment scheme is an unregistered security.

Wire fraud comes into play by the transfer of money in and out of a fraudulent investment scheme. Specific transfers are typically cited in an indictment or SEC lawsuit.

The SEC warns consumers that securities fraud and Ponzi schemes go hand-in-hand.

Any investment in securities in the United states remains subject to the jurisdiction of the SEC.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes.

Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

We can further confirm this by way of there being no verifiable source of revenue entering Cirrus Networks, other than new investment.

Thus it follows when Cirrus Networks investors cash out, they are likely to be cashing out previously invested funds.

The only way for consumers to verify this isn’t happening would be through audited financial reports filed with the SEC.

Cirrus Networks isn’t registered with the SEC or filing said audited financial reports. I’ll leave it up to you to figure out why.

Someone attached to Cirrus Networks’ who definately knows why is David Hunt. This is again from the previously cited 2021 KwikClick SEC filing;

David Hunt serves a member of the board of directors. For at least the past 20 years, Mr. Hunt has been a business lawyer in private practice as a solo practitioner.

Mr. Hunt regularly serves as a business advisor and angel investor to developing companies.

Mr. Hunt has advised numerous developing companies in all stages of development and has been involved with hundreds of private offerings for enterprises ranging from start-ups to exchange traded companies.

Mr. Hunt has also been involved with a number of public securities offerings.

Despite his transaction focus, Mr. Hunt has continued to selectively litigate contract and securities related cases throughout his career.

He has worked on cases and represented parties in matters across the United States, including those before the Delaware Court of Chancery, U.S. Securities and Exchange Commission, the Public Company Accounting Oversight Board, and a number of state and Federal courts throughout the U.S.

For nearly a decade, Mr. Hunt was a regular participant in the Securities and Exchange Commission’s annual Government-Business Forum on Small Business Capital Formation in Washington, D.C.

If there’s one person in Cirrus Networks who should be unequivocally familiar with US securities laws and why lying about US regulatory compliance is a bad idea, it’s David Hunt. Yet, here we are.

Meanwhile for those still in denial about “node investment scheme” fraud, Cirrus Network’s gnodi node position investment is nothing new.

The SEC filed suit against iX Global and Debt Box for a near-identical node investment scheme in 2023.

The case was ultimately dismissed last year following procedural errors on the SEC’s part. The underlying securities fraud however remains unprosecuted.

Pending an expected follow-up lawsuit from the SEC and potential criminal charges, iX Global owner and wanted fugitive Joe Martinez shut iX Global down in June 2024.

Run by former iX Global promoters, Trusted Smart Chain is another example of MLM crypto node position investment fraud.

Having mostly flopped since launch, it remains to be seen whether Trusted Smart Chain attracts the attention of US regulators.

As with all MLM Ponzi schemes, once investor recruitment dries up so too will new investment.

This will starve Cirrus Networks of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Jeremy Jenkins usually pushes Richard Smith’s scams but neither Richard nor Peter Rancie have any current frauds to flog so Jeremy presumably has nothing better to do at this point than promote this piece of crap.

How unoriginal. There’s nothing about Cirrus Network that hasn’t already been done ten years ago yet they are still trying to trot this all out today.

Multiple hundreds of MLM crypto shitcoins have created each promising to be the next Bitcoin. To date each and every one of them has failed costing almost all investor’s their hard earned money.

Cirrus Network is just the next in a sad tired and far too long list of MLM crypto scams.

I came here researching the company after a friend raved about it. Needless to say, your in-depth research has just saved me the hassle of giving this further energy.

If it looks like a scam, and sounds like a scam then sure enough, it is a scam. Thank you.

Anybody know the connection between GNONDI / Cirrus and Parler / Optio?

I’ve seen some crossover, especially with Bryan Ferre listed as the “architect of the Gnodi Blockchain” but he’s CoChair at Parler/Founder of Optio Community?

I don’t think there’s any connection other than Bryan Ferre being involved.

Ferre seems to be a random crypto bro who sets up copy+paste (sorry, “forked”), blockchains. He did the same thing at Parler last year:

parler.com/blog-posts/parler-playtv-and-optio-join-forces-a-new-chapter-in-decentralization-and-creator-empowerment

Being a “layer 1 blockchain” in MLM circles has turned into a marketing ruse for “we copied (sorry, “forked”) someone else’s code and slapped our logo on it”.

Gotcha. Thanks.

From a tech perspective, I like Layer 1s and there is some good applications possible but these all seem the same and the big red flag for me is not being able to find their Layer 1’s Block Explorer – which shows transaction data on the blockchain – and I can’t find Optio or Gnodi’s Block Explorers anywhere.

Maybe, just maybe you can’t find it because it doesn’t exist.