NewAge’s bankruptcy preceded by sabotage and extortion

NewAge’s bankruptcy just got a whole lot more interesting.

NewAge’s bankruptcy just got a whole lot more interesting.

Having secured NewAge through a Purchase Asset Agreement back in August, John R. Wadsworth’s first order of business is suing the company’s former executives.

Update 19th October 2022 – Clarification on the above sentence; while Wadsworth did sign a NewAge purchase agreement back in August, the agreement was only approved on October 17th.

The lawsuit against the former executives was initiated by Lawrence Perkins, NewAge’s Chief Restructuring Officer. /end update

Breach of contract, sabotage for self-gain and extortion. A peek into the downfall of an MLM company that once boasted $500 million in annual sales.

Named Defendants in NewAge’s October 7th lawsuit are:

- Frederick “Fred” Cooper – former NewAge director, co-majority Ariix shareholder prior to merging with NewAge and Kwikclick board of director and CEO

- Mark Wilson – NewAge President, co-majority shareholder prior to merging with NewAge

- Brent Willis – NewAge CEO

- Kwikclick – Delaware corporation

For reference, NewAge acquired Ariix back in 2020.

Described as a “brazen scheme”, NewAge’s lawsuit accuses the Defendants of failing to protect Ariix’s assets post-acquisition. Ariix also had major liabilities that weren’t disclosed.

This is alleged to have been in violation of the terms of NewAge’s acquisition agreement.

Generally speaking, Fred Cooper (right) comes off as a bit of a tyrant in the Complaint;

While Cooper has no executive role within the NewAge enterprise, legacy employees of Ariix continued to perceive Cooper as having the authority to dictate business decisions within the company.

This perception was reinforced by Cooper’s frequent presence in the corporate office, and his falsely holding himself out as the Chairman of the Board at his frequent speaking engagements with Brand Partners beyond the typical role of a corporate director. On information and belief, Cooper charged his expenses for the appearances to NewAge.

Although Cooper lacked any management authority, NewAge employees perceived his role as being a “co-CEO” of NewAge along with Brent Willis.

The Defendant’s’ failure to protect Ariix’s assets is rooted in giving

a complete copy of Ariix’s ICONN software to its former employee, Wenhan Zhang, to use at Kwikclick.

ICONN was Ariix proprietary software, owned by Ariix and developed by Ariix personnel at Ariix’s expense.

In or around June 2020, Ariix terminated Zhang, who until that time was Ariix’s Chief Information Officer. After his termination by Ariix, Zhang started a new position as Chief Information Officer of Kwikclick.

However, even after his supposed termination as an employee of Ariix, Zhang continued to draw his salary from Ariix.

On information and belief, Cooper directed Ariix to continue to pay Zhang’s salary in order to benefit Cooper’s new company, Kwikclick.

Cooper instructed Ariix’s software development team in China to devote a significant amount of time and attention to development of Kwikclick software.

Cooper did this solely for the benefit of his new company, Kwikclick.

On information and belief, after the merger with NewAge, Cooper instructed Tyler Jones, formerly of Ariix and after the merger NewAge’s Vice President, Legal, to draft and backdate a sham agreement between Ariix and Kwikclick regarding the ICONN source code.

The sham agreement was not disclosed to NewAge before NewAge acquired Ariix.

At one point NewAge was purportedly incurring a $200,000 month expense to code for Kwikclick.

When NewAge employees questioned whether a license agreement with Kwikclick was warranted, Cooper directly threatened and intimidated the NewAge employees who spoke out against his plan.

One NewAge executive thought Kwikclick

was a scam designed to gather information regarding NewAge’s Brand Partners and use that data to build a new, competing MLM..

Nonetheless, in late 2021 and without Board approval, NewAge entered into a software licensing agreement with Kwikclick.

The License Agreement was executed by Willis for NewAge, and Cooper for Kwikclick.

Willis and Cooper knew that Willis had no authority to cause NewAge to enter into the License Agreement because the NewAge board of directors had explicitly retained the authority to approve the deal itself and had not provided its approval.

Furthermore, KwikClick’s software was purportedly only 5% different to that of NewAge’s existing software.

The terms of the License Agreement are not standard. They are highly favorable to Kwikclick and detrimental to NewAge.

The License Agreement provided that NewAge would pay Kwikclick a licensing fee of $50,000 per month for the duration of the License Agreement.

The License Agreement also required NewAge to pay substantial commissions on sales of product by NewAge Brand Partners through the Kwikclick platform.

Moving onto disclosures, prior to acquisition Defendants told NewAge Ariix had $11 million in working capital.

Ariix actually had an $18 million debt liability.

One interesting tidbit is the exploration of Cooper, having profited from the company’s downfall, buying NewAge to avoid bankruptcy.

Discussions with Cooper ultimately broke down when he refused to sign an appropriate non-disclosure agreement and failed to provide proof of funds or agree to terms acceptable to the Special Committee of the Board of Directors overseeing the sale process.

What instead happened was Cooper began setting up Kwikclick as the unofficial successor to NewAge.

In 2022, Kwikclick’s shares began public trading. Defendants Cooper and Wilson began issuing shares in Kwikclick to NewAge executives and top Brand Partners and sales leaders around the world.

The NewAge board of directors were not given notice of these gifts.

On information and belief, Cooper arranged for the distribution of Kwikclick shares to NewAge executives and Brand Partners as a way to buy loyalty and to solicit the business of those executives and Brand Partners and to incentivize the executives and Brand Partners to promote the use of Kwikclick within the NewAge organization.

At an August 30, 2022 Founder’s Club special emergency meeting in Orlando, Florida, Defendant Wilson told the group of key Brand Partners that his noncompete agreement and the noncompete agreement of Cooper would expire in November 2022.

Wilson told the group that as of November 2022, he and Cooper would be “free agents.” Wilson told the group that the remainder of the group were also “free agents.”

These statements were meant to solicit NewAge’s top Brand Partners (members of the Founders Club) to compete with NewAge by working with a new venture formed by Cooper and Wilson in violation of the restrictive covenants applicable to Cooper and Wilson.

Cooper’s plan escalated throughout August 2022, with the demand that he and NewAge stock investors be “made whole” or else.

On or about August 31, 2022, Phil Lewis (the operations executive formerly of Ariix and now employed by NewAge) reported to John Wadsworth that he had spent ten hours with Cooper on August 30, 2022.

Lewis reported to Wadsworth that “the Ariix team is mobilizing,” and the “team” planned to “leave as a group” unless everyone who lost money on NewAge stock was made whole.

Lewis also told Wadsworth that if Wadsworth did not “make Fred [Cooper] an owner,” then Wadsworth would “lose the entire Ariix team.”

Lewis told Wadsworth that he should give up 30% of the NewAge business to Cooper or else Wadsworth would lose half of the business when Cooper left the company.

Tim Sales (right), cited as a “significant Brand Partner for NewAge”, was onboard with Cooper’s plan and personally threatened Wadsworth.

Tim Sales (right), cited as a “significant Brand Partner for NewAge”, was onboard with Cooper’s plan and personally threatened Wadsworth.

On or about September 2, 2022, Tim Sales, a significant Brand Partner for NewAge, told Wadsworth that “if you don’t make Fred an owner, or give Fred the Ariix business, everyone will leave, and you will lose half of your investment.”

Sales was an early Brand Partner for Ariix. Sales and his downline Brand Partners are responsible for a large volume of sales of NewAge products.

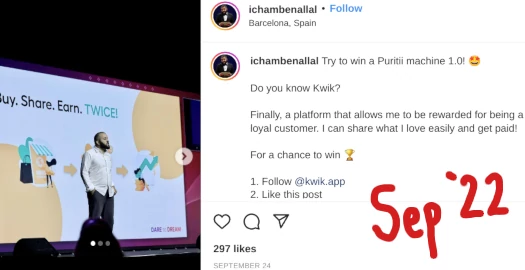

Ishim Benallal (aka Icham Benallal, right), NewAge’s General Manager in Europe, kicked things up a notch with outright extortion.

Ishim Benallal (aka Icham Benallal, right), NewAge’s General Manager in Europe, kicked things up a notch with outright extortion.

On September 16, 2022, Benallal told Wadsworth that all the European Brand Partners would leave NewAge if Cooper and Wilson were not made majority owners and controlling shareholders in the company that acquired NewAge’s assets through the bankruptcy process.

Benallal told Wadsworth he could destroy NewAge’s European business in three days if he wanted to.

In a presentation to NewAge’s European Brand Partners, Benallal exhorted them to “take out your phone now and sign up for Kwikclick; do it now!”

Benallal also told Wadsworth that Cooper had given him 6 million shares of Kwikclick, so he would no longer need to work if he did not want to.

NewAge’s Complaint sums up the allegations above as being “made at the direction or urging of Cooper and Wilson and for their personal benefit.”

And this of course came at the expense of NewAge, which was effectively left rudderless heading into bankruptcy.

NewAge’s lawsuit accuses the Defendants of:

- tortious interference with contractual relations (Cooper, Wilson, Willis and Kwikclick)

- breach of fiduciary duty (Cooper, Wilson and Willis across three separate counts)

- breach of contract – merger agreement (Cooper and Wilson)

- fraud – merger agreement (Cooper and Wilson)

- fraud – license agreement (Cooper and Kwikclick)

- breach of contract – license agreement (Kwikclick)

- aiding and abetting a breach of fiduciary duty (Kwikclick)

- violation of the Defend Trade Secrets Act (Cooper, Wilson, Willis and Kwikclick)

- misappropriation of trade secrets (Cooper, Wilson, Willis and Kwikclick)

- breach of contract – covenant not to compete and not to solicit (Cooper)

- breach of contract – covenant not to compete (Cooper and Wilson)

- tortious interference with contractual relations (Cooper, Wilson, Willis and Kwikclick)

- conspiracy (Cooper, Wilson, Willis and Kwikclick)

- unjust enrichment (Cooper, Wilson, Willis and Kwikclick)

- imposition of constructive trust – fraud (Wilson, Willis and Kwikclick)

NewAge is also seeking a declaratory judgment as to ownership of Kwikclick’s software, alleging it owns the source-code.

Down from an all time high of $7, Kwikclick shares are currently trading at $2.

As alleged in NewAge’s Complaint;

Cooper still owns approximately 53.4% of the outstanding shares of Kwikclick.

Until approximately September 2022, Cooper acted as the CEO of Kwikclick.

In or around September 2022, Cooper resigned as CEO of Kwikclick.

Kwikclick’s former website domain now redirects to “kwik.com”, suggesting the company has rebranded.

The “kwik.com” private domain registration was last updated on June 30th, 2022. Kwik’s official FaceBook page was set up in October 2021.

As tracked by SimilarWeb, Kwik’s website traffic is a bit all over the place; 6,700 visits in July, 30,000 in August and 18,200 in September.

All of that traffic is split across France, Italy and Israel. This appears to be Icham Benallal at work:

Assuming Cooper, Wilson and Willis don’t wimp out with a settlement, this is shaping up to be a particularly interesting case to watch play out.

Update 5th June 2023 – The NewAge’s Chief Restructuring Officer’s lawsuit detailed above was dismissed on June 1st, 2023.

The dismissal appears to be procedural, in light of a new lawsuit filed by the NewAge Liquidator on May 31st.

The NewAge Liquidator’s lawsuit names additional Defendants but mostly pertains to the same allegations made by NewAge’s Chief Restructuring Officer.

To be continued…

What’s that saying? Oh yeah, “No honor among thieves.”

I hope they all spend a crap-ton on attorneys’ fees.

I don’t know if there’s a good reason to call Tim Sale’s comment a “threat”. What if it’s simply a fact and he’s warning him of the reality of the situation?

What makes Sales’ threat a threat is that he “and his downline Brand Partners are responsible for a large volume of sales of NewAge products.”

The implication behind “everyone will leave” is if you don’t do what Cooper wants, I will take my “downline and large volume of sales” over to Cooper (Kwikclick).

Being Ariix bros, Cooper and Sales were clearly in cahootz. I can’t say with certainty Sales did know the full extent of what was going on, but given his position and long history with Ariix he’s clearly close to Cooper.

Even if he didn’t know, it’s still a threat (for the reason stated above) and a poor judgment call he can’t take back.

I do draw the line at extortion though. That’s why I made the distinction between Sales’ threat and Benallal’s extortion.

I currently hold 60,000 shares of NewAge in a non qualified Schwab Account and 21,000 shares in the wife’s IRA account. I hold 4,000 shares of NewAge in my personal IRA Account.

I stand to loose over $160,000 due to a NewAge bankruptcy proceedings.

Article updated noting NewAge’s Chief Restructuring Officer’s lawsuit has been dismissed in favor of the new NewAge Liquidator’s lawsuit.