iX Global sued for $49 million in fraud by SEC

iX Global, its CEO and several promoters have been sued for securities fraud by the SEC.

iX Global, its CEO and several promoters have been sued for securities fraud by the SEC.

Between iX Global and its Debt Box ruse, the SEC’s July 26th filed Complaint names eighteen defendants.

iX Global launched in 2020 and is headed up by US national Joe Martinez.

iX Global launched in 2020 and is headed up by US national Joe Martinez.

Prior to launching IX Global, Martinez was a promoter of Investview’s fraudulent Kuvera Global investment scheme. iX Global’s top promoters and earners are also former Kuvera Global promoters.

Investview rebranded Kuvera Global as iGenius after the CFTC filed fraud charges in 2018.

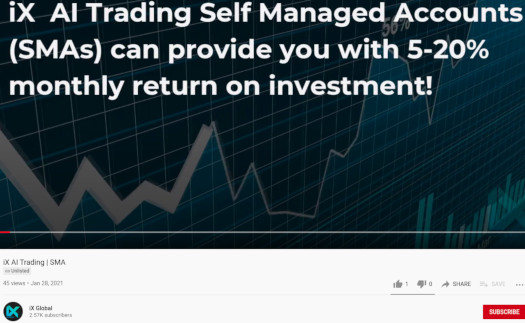

iX Global’s original business model combined a personal development platform and an AI trading bot investment scheme.

At least two other MLM companies were fed into iX Global since its launch.

In 2021 Richard Smith dumped what was left of his failed R Network MLM company into iX Global.

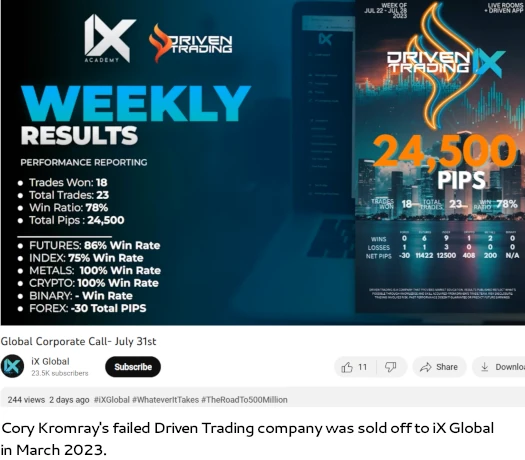

In March 2023 Cory Kromray did the same with Driven Trading.

Neither Smith or Kromray are named defendants in the SEC’s iX Global lawsuit.

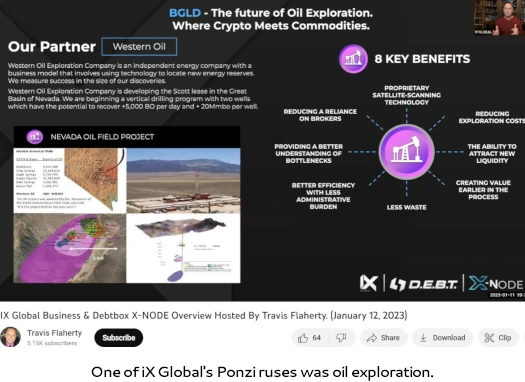

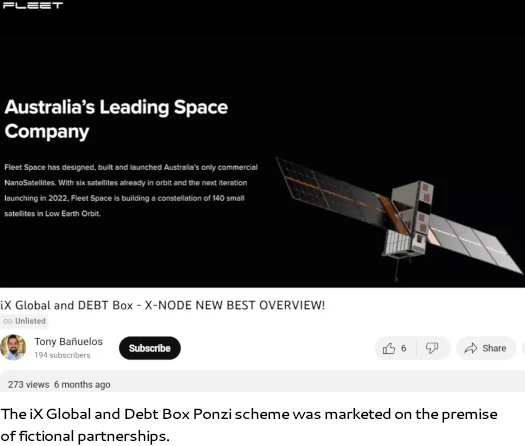

In 2022 iX Global partnered up with Debt Box. This partnership saw iX Global investors invest in “x-node” positions.

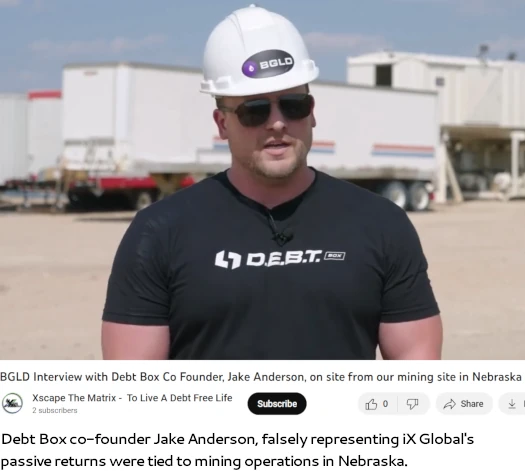

X-node positions purportedly generated passive revenue for iX Global investors through crypto mining and various ruses.

Defendants have represented that the value of each crypto asset is tied to profits generated by various underlying businesses performing, inter alia, gold mining, oil drilling, satellite scanning, beverage sales, and other so-called “commodity projects.”

The SEC alleges iX Global’s x-node positions were an “unregistered fraudulent offering”.

The SEC’s July 26th Complaint, filed in Utah, names eighteen defendants:

- Digital Licensing Inc (dba Debt Box) – Wyoming registered company

- Western Oil Exploration Company – Nevada registered company, owned by James Franklin

- iX Global – MLM company offering fraudulent investment contracts

- B&B Investment Group (dba Core 1 Crypto) – Utah registered company, owned by Benjamin Daniels and Mark Schuler

- BW Holdings LLC (dba The Fair Project) – Utah registered company, owned by Alton Parker, Benjamin Daniels and Mark Schuler

- Jason R. Anderson – co-owner Debt Box, Utah resident

- Jacob S. Anderson – co-owner Debt Box, Utah resident

- Schad E. Brannon – co-owner and President of Debt Box, California resident

- Roydon B. Nelson – co-owner, Director and Treasurer of Debt Box, Utah resident

- James E. Franklin – founder and President of Western Oil Exploration Company, also sued by the SEC twice for fraud in the past

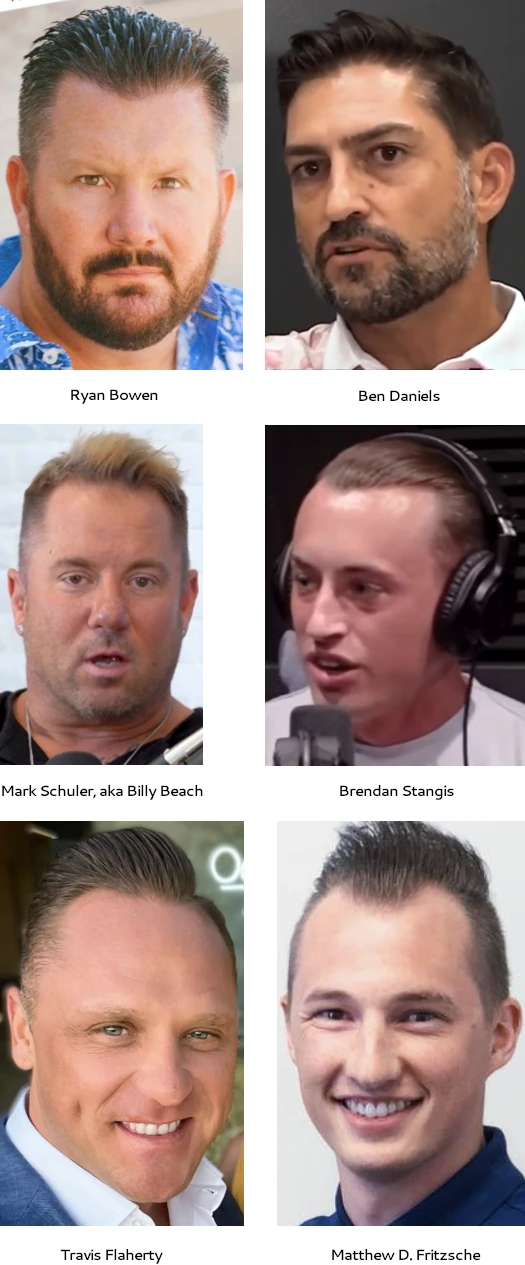

- Ryan Bowen – promoter of Debt Box, Utah resident

- Joseph Anthony Martinez – founder and CEO of iX Global, Utah resident

- Benjamin Frank Daniels – iX Global promoter and top earner, Utah resident

- Mark W. Schuler (aka Billy Beach) – iX Global promoter and top earner, Utah resident

- Travis A. Flaherty – iX Global promoter and top earner, Arizona resident

- Alton O. Parker – Debt Box promoter, Utah resident

- Brendan J. Stangis – Debt Box promoter, Michigan resident

- Matthew D. Fritzsche – Debt Box promoter, Utah resident

An additional ten relief defendants are also named:

- Archer Drilling LLC – Wyoming registered company, owned by James Franklin and recipient of $1.6 million in investor funds

- Business Funding Solutions LLC – Utah registered company, owned by Jason Anderson and recepient of $11.9 million in investor funds

- Blox Lending LLC – Utah registered company, owned by Jason Anderson, owned by Jason Anderson and recipient of $4.7 million in investor funds

- Calmfritz Holdings LLC – Utah registered company, owned by Matthew Fritzsche and recipient of $12.7 million in investor funds

- Calmes & Co Inc – Utah registered corporation and recipient of $300,000 in investor funds

- Flaherty Enterprises LLC – Arizona registered company, owned by Travis Flaherty and recipient of $260,000 in investor funds

- IX Ventures FZCO – Abu Dhabi shell company, owned by Jason Anderson and Jacob Anderson and recipient of $1.3 million in investor funds

- Purdy Oil LLC – Nebraska registered company, owned by James Franklin and recipient of $2.6 million in investor funds

- The Gold Collective LLC – Utah registered company, owned by Roydon Nelson and recipient of $3.9 million in investor funds

- UIU Holdings LLC – Delaware registered company, owned by Jason Anderson and recipient of $200 million in investor funds

The SEC backdates IX Global’s alleged fraudulent conduct to “at least March 2021”. For reference, BehindMLM reviewed and correctly identified iX Global’s fraud in February 2021.

Not surprisingly, iX Global’s Debt Box x-nodes were bogus. Tokens attached to the investment scheme were of the BEP-20 variety, which iX Global created on demand as needed.

The eleven digital asset tokens purportedly being “mined” by the node software licenses cannot be mined and never were mined.

Each of the eleven DEBT Box tokens is a BEP-20 token created on the Binance Blockchain (“BNB Chain”), which—as here—allows a user to instantly create a specified number of tokens.

Each of the eleven categories of DEBT Box crypto assets were generated instantaneously by DEBT Box at the outset of the tokens’ creation; the tokens were never generated through “mining” conducted by, or validated through, a “node” or “node license.”

As to the ruses iX Global claimed provided value to their x-node shit tokens, the SEC claims they were “a sham”.

The “real projects” and “real assets” Defendants tout as supporting the value of these tokens are a sham.

Defendants have made numerous representations regarding the underlying businesses purportedly propping up the tokens’ value, and those representations are false: the businesses simply did not and do not have the capabilities or revenues Defendants repeatedly represented to investors.

One example was Lazy Magnolia.

Beginning in or around December 2022 and continuing to present, in promotional videos and social media posts, DEBT Box and the members of the DEBT Council have claimed that Lazy Magnolia secured “multi-million-dollar” bottling contracts, including with retailers such as “7-11, Aldis, Food Lion, Sam’s Club and more” that are currently generating over “12 million dollars a month in revenue.”

As recently as January 15, 2023, Jason Anderson, Jake Anderson, Brannon, Nelson, and Bowen continued to claim that its bottling partners are generating millions in monthly revenue, and that DEBT Box’s share of these would be proportionally allocated amongst BEV token holders.

At no point did Lazy Magnolia or any other purported DEBT Box partner have contracts with “7-11, Aldis, Food Lion, Sam’s Club,” or any other bottling distributors or retailers.

Nor has Lazy Magnolia generated over “12 million dollars a month in revenue” at any point during the relevant time period. Indeed,

Lazy Magnolia’s net income in 2022 was only about $100,000.

Another example, Fleet Space Technologies, is cited by the SEC as a definitive example of iX Global and Debt Box concealing fraud.

DEBT Box claimed that it had increased the effectiveness of its “proprietary” technology through a partnership with an Australian mining exploration company named Fleet Space Technologies (“Fleet Space”).

At no point did DEBT Box have a partnership with Fleet Space or access to its technology and products.

Nor has Fleet Space ever surveyed or otherwise provided services in connection with oil wells owned by Western Oil or DEBT Box.

Indeed, in or around January 31, 2023, Fleet Space sent an email to Brannon demanding that Brannon and DEBT Box cease using Fleet Space’s promotional materials.

In or around January 31, 2023, Jason Anderson, Jake Anderson, Brannon, and Nelson learned that investors had contacted Fleet Space regarding the company’s purported partnership with DEBT Box.

Rather than disclosing to investors that DEBT Box never had a partnership with Fleet Space, DEBT Box announced in a February 10, 2023 message to investors that it had “terminated” its partnership with Fleet Space.

To conceal their prior misstatements about Fleet Space, Brannon and each of the members of the DEBT Council claimed that its relationship with Fleet Space was terminated due to “harassment” of Fleet Space by competitors and other third parties.

Since at least February 10, 2023, members of the DEBT Council have discouraged users from contacting companies to verify DEBT Box’s claims that those entities have partnered with DEBT Box.

Since February 10, 2023, Jason Anderson, Jake Anderson, Brannon, and Nelson have concealed the names of supposed business partnerships.

In response to questions from investors about these partnerships, the DEBT Council members have described their partnership agreements as “proprietary” and, at other times, have claimed that certain partners have requested DEBT Box keep the relationship confidential.

If we accept that neither iX Global or Debt Box were generating external revenue revenue to cover investor withdrawals, we’re left with a typical MLM shitcoin Ponzi scheme.

That in turn lends itself to iX Global and Debt Box executives and promoters

misappropriat(ing) the funds for their own personal gain—buying luxury vehicles and homes, taking lavish vacations, and showering themselves and their friends with cash.

In filing their Complaint, the SEC acknowledges that iX Global was gearing up to further defraud consumers with a new round of bogus investment contracts.

Defendants have recently announced they will be offering at least two new node software licenses backed by new, presumably illusory, businesses. In addition, certain defendants recently launched a spin-off offering, the FAIR Project, differing from DEBT Box only in name.

The SEC also notes that, presumably upon learning they were under investigation, iX Global and Debt Box executives and promoters initiated plans to flee to Dubai.

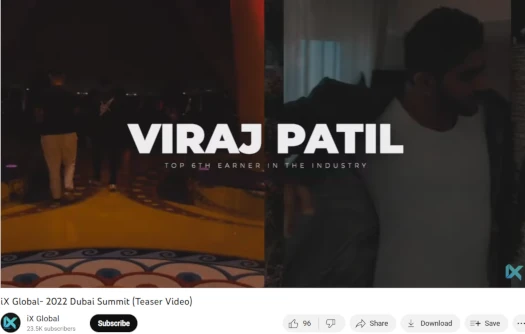

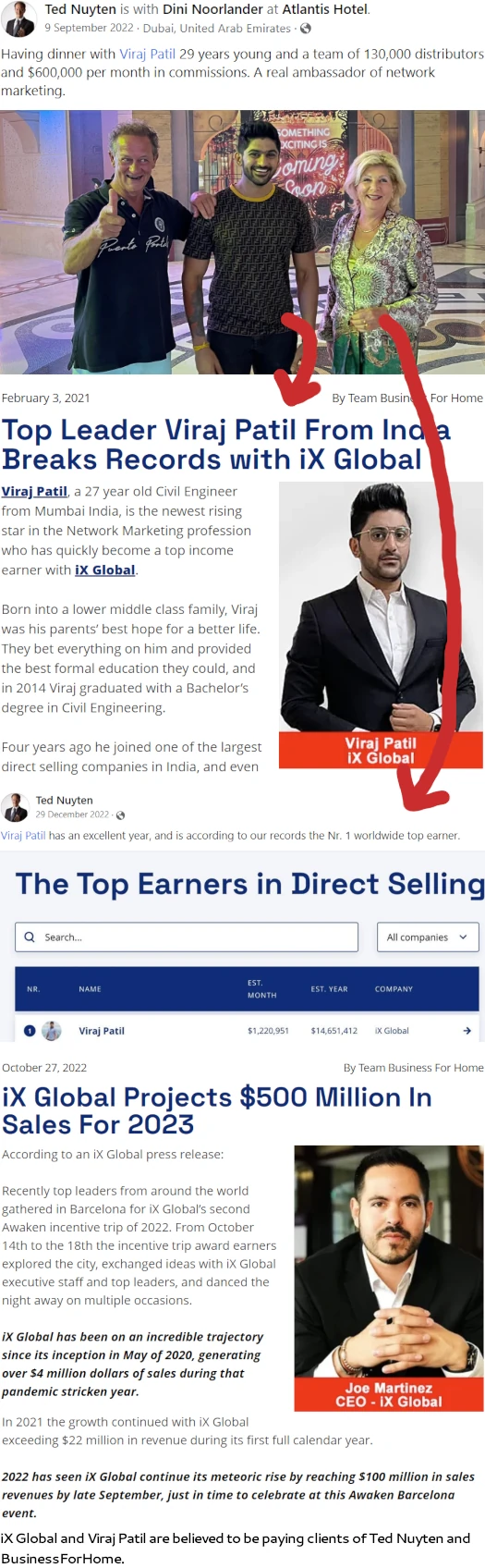

iX Global’s promotional efforts in the UAE and India are headed up by “top income earner” Viraj Patil.

In filing their July 26th Complaint, filed under seal, the SEC accuses the iX Global and Debt Box defendants of misappropriating at least $49 million through securities fraud.

The Commission brings this action to halt Defendant’s ongoing violations of the federal securities laws, prevent further harm to investors, and to seek disgorgement and civil penalties stemming from Defendants’ wrongdoing, among other remedies.

The same day the Complaint was filed, the SEC also sought a TRO against iX Global and Debt Box, as well as the appointment of a Receiver.

The TRO was granted on July 27th.

As per the terms of the granted TRO, the iX Global and Debt Box defendants are required to

- immediately cease any further fraudulent conduct and

- immediately cease and business related trading, purchase and/or sale of securities or funds (including cryptocurrency)

The defendants’ bank accounts and assets have also been frozen, including

- five Utah properties owned by Jason Anderson

- two Utah properties owned by Jacob Anderson

- two California properties owned by Schad Brannon

- four Utah properties owned by Roydon Nelson

- twenty Utah properties owned by Ryan Bowen

- one Utah property owned by Joseph Martinez

- five Utah properties owned by Benjamin Daniels

- three Utah properties owned by Mark Schuler

- four Arizona properties and one Utah property owned by Travis Flaherty

- one Utah property and two Wyoming properties owned by Alton Parker

- one Utah property owned by BW Holdings LLC

- two Utah properties owned by Matthew Fritzsche

- a 2022 Maserati Levante Base

- a 2021 Lamborghini Urus

- a 2018 Jeep Wrangler Unlimited Sahara

- a 2017 Ferrari California

- a 2017 Ferrari 488 Spider

- a 2020 Chevrolet Corvette Stingray

- a Toyota Sequoia SR5

- a 2021 Cadillac XT5 Sport

- a 2019 Toyota Tacoma Double Cab

- a 2016 Toyota Prius

- a 2003 Dodge Ram 3500

- a 1995 Dodge Ram 2500

- a 1994 Ford F150

- a 1991 Ford F150

- a 2014 Honda Accord EXL

- a 2022 Cadillac Escalade Sport

- a 2022 Lamborghini Urus

- a 2018 Polaris RZR XP

- a 2013 Ford F150 Supercrew

- a 2022 Chevrolet Corvette Stingray

- a 2022 Tesla Model X

- a 2018 Land Rover Range Rover Sport SVR

- a 2012 Toyota Tacoma

- a 2023 Mercedes Benz S Class

- a 2021 Cadillac Escalade ESV

- a 2015 Mercedes Benz S Class

- a 2005 Mercedes Benz E Class

- a 2018 Porsche 911 GT3

- a 2015 Porsche 911

- a 2017 Lexus RX 350

- a 2022 Ford F250 Super Duty

- a Can-Am Outlander Max XT 850 ATV

- a 2021 Porsche Taycan Cross Turismo and

- a 2020 Ford F150 Raptor

On July 28th, the court appointed a Debt Box and iX Global Temporary Receiver. This removes control of Debt Box and iX Global from their owners.

The granted TRO is in effect for 10 days, after which it will be renewed pending any opposition.

Looking forward, unless the iX Global and Debt Box Defendants are successful in overturning the TRO and Receivership (unlikely), the TRO will remain in place and a preliminary injunction will be granted at some point.

Outside of the US, Sailesh Pandey was arrested in India in late 2022.

Pandey was arrested on charges related to iX Global money laundering. Since Pandey’s arrest last October there have been no further updates on his case.

Whether criminal charges are pending against any of the iX Global and Debt Box Defendants is unknown.

Update 9th August 2023 – Another TRO filing was made by the court on August 7th.

This might reset the 10 day expiry date of the original order.

Defendants have been served as per the case docket but no news on a preliminary injunction hearing yet.

Update 31st August 2023 – Another TRO was entered against the Defendants on August 29th. This one expires after 14 days, on or around September 12th.

There have also been some asset freeze carveouts granted for “necessary and reasonable living expenses”.

Update 13th September 2023 – Another TRO was entered against the Defendants on September 12th.

A Status Conference has been scheduled for September 15th, after which hopefully we’ll have a more substantial update.

Update 30th September 2023 – A preliminary injunction has been scheduled for October 30th. The TRO and Temporary Receiver remain in place till then.

Update 7th October 2023 – An October 6th court order has dissolved the TRO and Temporary Recievership.

Q: What’s the difference between iX Global –> Debt Box and iGenius –> EndoTech?

A: Nothing.

Not everything is always as it seems.

Perhaps, but that has nothing to do with iX Global and Debt Box committing securuties fraud because they’re running a Ponzi scheme.

49 Million that must be only the tip of the Iceberg I guess!

Their top income earner made 15 Million and the top 10 another 15 million per year if you look at BFH.

Pretty sure Kromray not out of the woods as the investigation unfolds!!

Let’s hope the SEC will act accordingly with igenius then.

Dear SEC whom concern

This is Kunchi Yi(Kasey) from Korea.

Debtbox and Ix global opened the business in early March, 2023. And launched the debtbox 12 licenses so far and has sold the licenses to the Korean people though the Network method.

May 20th, 2023 Debtbox and Ix Global CEOs came to Korea and offically opened the Korean business.

After, all of leaders have been working hard to sell those licenses and spreading hugely in Korea.

We all strongly believed the Debtbox and Ix Global company.still, Noone trusts the Debtbox is scam.

Also, All Koreans are pennic and cannot accept the fact that this news is true.

And they closed 3days ago. but they said that the business will be opened in a week.

But I cannot trust both of them anymore.

What can we do? Korean people and leaders definitely need your help.

First of all, I’d like to know since SEC did asset frozen, so are we able to get back the investment? If does, when?

There is anyway to reopen the same business lawfully? Is this a stupid question?

Please let me know as soon as possible.

Sorry to hear about your situation. The reality is your money is gone, Debt Box and IX Global executives and promoters spent it on real-estate, cars and their friends and family.

What’s left in Debt Box has been frozen per a court order. At some point a preliminary injunction will be scheduled and that’ll give Debt Box and IX Global a chance to prove they weren’t lying about anything.

At a minimum though they were committing securities fraud. Before you invested you could have checked with the Korean Financial Services Commission to see if Debt Box was registered. You didn’t, and here we are.

The law firm Holland & Knight LLP has been appointed Temporary Receiver over DEBT Box. The receivership website is:

hklaw.com/en/general-pages/receiverships-and-class-actions/debtboxreceiver

I see the list of defendants and I noticed Cory Kromray isn’t on there.

He’s the scammer from Driven before it was “Acquired” by IX Global and he seemed to have operated Driven through IX Global as if he was still the CEO and promoted these fraudulent mining nodes as well.

I think it should be added to the SEC about his NFT rugpull that got them over $338,000 from an inside job where Antoine Sims was pre-selected as the winner of a car that one of the individuals on Driven Trading LLC already owned.

Kromray needs to be listed in this trial as he has gone quiet on his social media pages!

Brief case update added to article.

the top earner in ix Viraj Patil in a reel on Instagram published that SEC has done such a thing so that the debt token price dips and it can buy the tokens in a dip and make money once ix and the debt box is cleared of the allegations.

meanwhile the complaints of the victims are being investigated by various divisions of mumbai police.

I don’t usually speak for regulators but I can assure you the SEC doesn’t give a crap about the DEBT token price.

Viraj Patil is full of shit.

MLM Attorney Kevin Thompson recently posted the following on facebook:

Debtbox was taking the money and buying the tokens on the backend and inflating the values of non existent tokens.

The platform would give it some crazy conversion dollar amount to the value of the token- s0 by buying their own they manipulated it. super intentional what they were doing.

You have to sue Tony Yu, Kyungsook An ( 안경숙), and Maria Lee (이순남) to find out how much you lost.

They scammed tens of billions of won in Korea and made billions of won in income.

You should report the fraud to the police as soon as possible to get your money back.

Thank you for your responding for my questions.

Above those three leaders began the ixglobal business in Korea. But I really don’t know them. They have been providing us zoom meeting 5times a week which helped us for the business.

You told me to report them to the Korean police as a scammer but I don’t have any evidence or clues that they have been deceiving Korean people.

I just like to know if DEBTBOX and IX Global lose to the SEC, Is there a chance to get back all investor’s money for Korean?

Sine the SEC froze their account and properties and cars, There will be enough money to cover to pay back for Korean investors.

Would you please help for Korean? Many people blame me also, and I have no idea why they’ve been running the business like that.

I definitely love CEOs and Companies. All of Korean people also love Debtbox and IX.

fantastic job as usual oz! there is a zoom call tomorrow Saturday- August 12th 10am USA MT by Joe Martinez – for those who drank the koolaid.

probably not much to say except fodder to delay, while he and his fellow grifters concoct their exit strategies.

URL for call: us06web.zoom.us/j/81911267970

wonder if oz or kevin might have an opinion as to whether criminal charges will be brought on, and on who? some of these guys appear to be serial sociopaths.

thanks again

1. Your money is gone.

2. The SEC’s Complaint is full of evidnence of securities fraud.

3. You can verify IX Global isn’t registered to offer securities in Korea as previously stated.

Nobody is going to hand you anything on a platter. You need to do the work on your end or nothing will happen in Korea.

Re. recovery, assuming this ends in a settlement or judgment against Debt Box and IX Global, the court-appointed Receiver will establish a claim portal for victims with distribution of recovered funds/assets.

This is realistically years down the track though.

Thanks. I wouldn’t put too much weight into Martinez running around trying to damage control. I assume at some point his lawyer(s) are going to tell him to stop potentially providing the SEC with additional evidence.

Will be paying attention to the court filings as that’s what matters at this point.

On criminal charges, logically you’d assume they’re coming but even if there’s a solid criminal case it’s ultimately up to the DOJ what cases they pursue.

MORE THAN USD 49 million. Joseph m said that only 10-12 % business is from the US guess which country suffered the most – india obviously.

Viraj Patil is finally married.

Martinez says that he feels that debt box is fair and honest the same way he said about tp global fx when he pedalled his forex automation for 115-180 USD per month to investors.

Article updated with latest from IX Global case docket.

There was an August 30th corporate call:

youtube.com/watch?v=JcNPYAM5qhk

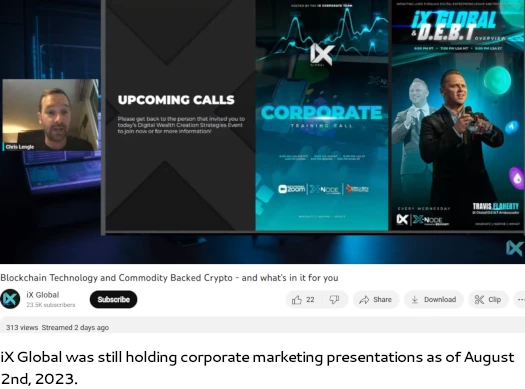

Even without Debtbox IX Global is still marketing securities.

@4:30 in the above linked video Joe Martinez rattles off IX’s success rates in Forex, Binary and Synthetic Options and iEX for investors in India. There’s even a new “K-Trading” opportunity for investors in Korea.

Crypto is strictly N/A

A few weeks back Martinez did a PR interview with Troy Dooly. He harped on the education and lifestyle improvement aspects of IX but he spoke nary a word about their ongoing investment opportunities.

@11:20 in the video Joe speaks of IX 2.0, comp plan tweaks, product pack adjustments, “becoming a better version of yourself” and such happy horse crap. All designed to keep people paying their monthlies and recruiting.

@15:40 Martinez speaks to the SEC lawsuit. He soft sells the sale of unlicensed securities after all, that is what he is being charged with. He reveals that in one month since the suit was lodged his legal bills are in the vicinity of $180-200K.

@17:30 “I want you guys to understand one thing, either we pay the lawyers, OK, or we pay the distributors. That is kinda where we’re at right now.”

Martinez promises a motion will be filled in the next week hoping the Judge will presumably lift the TRO against IX Global. Failing which Joe may well not be able to make payroll.

“It’s easier to give birth than raise the dead” said Kevin Thompson in a quote posted above. If I were an IX Global affiliate I’d follow that advice, stop throwing good money after bad and move on to greener pastures.

Thanks Glim. I’ll have a look through it tomorrow and report back.

As per the snapshots of filings of the IX/POCHEN in india shared on a telegram group – Viraj Patil got paid rs. 27 lacs + as a managing director of ix global in 2021.

Viraj Patil after which had resigned and joined tp global as a managing director.

tp global is still not paying the investors while Viraj Patil and Joseph martinez deny promoting it ever.

Got around to watching this update today. Stripped down “education” packages that nobody is interested in. No commissions, no apology or acknowledgement of securities fraud.

I’m not 100% on the returns provided at [4:30], sounded like signals as opposed to the automated trading they were offering? K-Trading also sounded like signals as opposed to automated returns.

Wouldn’t be too optimistic in getting the TRO lifted. Not when the case is this clearcut.

Article noting new TRO and Sep 15th. Status Conference.

Article updated with iX Global preliminary injunction date.

Did they just get the TRO rescinded? There are rumors out there that the SEC has to return all assets to Debt Box…. Whoa if true.

Looks like a motion to dissolve was granted on October 6th. On my list for an update today.

Oz, where is the proof for that?

Article up in a bit.

What the hell is going on here??? This idiot is going straight from TRO lockdown to trying to launch new programs? The SEC is going to straight up BANG these guys. He should be fleeing to Dubai.

Name me ONE serious person in MLM that signs up with an SEC target or stays with an SEC target – yup, nobody.

This company is done. – IX means NINE but it should mean FUBAR. Good luck throwing them lavish birthday parties at chuck e cheese dumb dumb!

oops

Thanks for the heads up!

What’s the matter, ever since TRO was lifted I don’t see any follow-up from OZ. Nothing to say?

We covered the TRO decision. Beyond that there hasn’t been anything to follow up on. I’m not running the case, the court is.

SEC cases can take years to sort out. When there’s something to update with I’ll update.

Can we expect an unbiased reply based on what the court decides? Also, do you think there could be some settlement in the future?

Whatever the outcome of the case is it’ll be reported. Don’t expect me to endorse securities fraud anytime soon though.

Typically MLM securities fraud cases brought by the SEC are settled. This comes down to the law being pretty clear-cut and going to court just resulting in higher penalties.

This is what the chief legal officer at Ripple posted today on X.

I’m not sure what that means.

From what I am reading from articles online (I haven’t paid to access the docket on pacer) the judge is saying that the SEC should be sanctioned for freezing DEBT BOX’s accounts on the claim that they were trying to transfer funds to overseas accounts, when there is no evidence to prove it.

The funny thing about it is that this is the first time DEBT BOX has been brought up in the crypto community in a mainstream way, and these publications are trying to make it seem as if the SEC is in the wrong, and that DEBT BOX is some legit company.

The headlines read “The judge calls to sanction the SEC over false and misleading claims.”

Take anything you read on crypto blogs with a grain of salt.

I last checked the docket on Nov 19th. Next check was scheduled for Dec 4th.

Had a look today anyway and on Nov 29th the court has ruled “the ex parte TRO was improvidently issued because even considering the Commission’s new evidence, it has not shown irreparable harm.”

In other words the court believes if the SEC prevails, monetary penalties and restitution will be paid (even if funds are laundered overseas apparently). So the TRO being dissolved stands.

This is an important statement from the court (Nov 30th):

Also on November 30th there’s an order for the SEC to show cause, pertaining to “several of the Commission’s representations supporting the TRO Application the court believed were false or misleading.”

The representations appear to pertain to Debt Box’s closure of bank accounts. I’d rather wait for the SEC’s response before publishing but given explaining this order and what specifically it pertains to is lengthy, I’ll put out an article covering it later today (it’s too long for a comment).

you don’t know anything about what’s going on and you’d better give an update that the SEC has made a big mistake here.

several lawyers have been fired from the SEC. BTW the SEC is not your friend but a bunch of clowns 😀

Hello random crypto bro #95186.

If you’d actually read the article you’d have seen BehindMLM has been covering the case updates. Nobody was fired, SEC attorneys who bungled the case resigned.

Same as would happen in any job really.

Meanwhile the underlying Debt Box and iX Global securities fraud has yet to play out in court. But uh yeah, back to the crypto fraud echo chamber I guess.