Corex Coin Review: COREX points ICO lending Ponzi scheme

Corex Coin provide no information on their website about who owns or runs the company.

Corex Coin provide no information on their website about who owns or runs the company.

The Corex Coin website domain (“corexcoin.io”) was privately registered on February 9th, 2018.

At the time of publication Alexa estimate India as the largest source of traffic to the Corex Coin website.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Bitcoiin promotion continues in secret following fraud cease and desist

![]() Bitcoiin received a securities fraud cease and desist from New Jersey on March 7th.

Bitcoiin received a securities fraud cease and desist from New Jersey on March 7th.

If the company is legitimate, they have the option of challenging the notice and registering the with the SEC.

Doing so would require Bitcoiin to provide the public with important information pertaining to the company and its B2G altcoin.

So uh, that’s what they did… right?

Nah, this is MLM crypto baby. [Continue reading…]

Likium Review: LKM points ICO lending Ponzi scheme

![]() Likium provide no information on their website about who owns or runs the business.

Likium provide no information on their website about who owns or runs the business.

The Likium website domain (“likium.io”) was privately registered on December 12th, 2017.

At the time of publication Alexa cite Nigeria as the top source of traffic to the Likium website.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Malta Private Review: 144% ROI in 12 days “transactions” Ponzi scheme

![]() Malta Private provide no information on their website about who owns or runs the business.

Malta Private provide no information on their website about who owns or runs the business.

The Malta Private website domain (“maltaprivate.com”) was privately registered on May 15th, 2017.

Malta Private claim to be incorporated in the UK and provide an incorporation number on their website.

This number corresponds with Malta Private Invest Company, which was incorporated in the UK on October 17th, 2017.

UK incorporation is dirt cheap and for the most part unregulated. It is a favorite for scammers looking to incorporate dodgy companies.

It is far more likely that whoever is running Malta Private is doing so out of Europe.

Supporting this is Russian and English offered as languages on the Malta Private website.

Alexa also estimate that Russia (15) and the Ukraine (4) are the two top sources of traffic to the Malta Private website.

Needless to say, despite the name, Malta Private doesn’t appear to have any connection to Malta itself.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Coin Active Review: “Major investments” = 160% ROI every 21 days?

Coin Active provide no information on their website about who owns or runs the business.

Coin Active provide no information on their website about who owns or runs the business.

The Coin Active website domain (“coin-active.com”) was privately registered on January 16th, 2018.

Coin Active provide an incorporation certificate on their website, which corresponds with “Coin Active LTD”.

Coin Active LTD was incorporated in the UK on November 20th, 2017.

The address used to incorporate Coin Active LTD belongs to the famous Harrods, London department store.

Stefan Wiggins is listed as the sole Director of Coin Active LTD, through a separate residential address in London.

No information exists outside of the incorporation linking Wiggins to Coin Active, suggesting he likely doesn’t exist.

UK incorporation is dirt cheap and for the most part unregulated. It is a favorite for scammers looking to incorporate dodgy companies.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Bonestopco Review: Five-tier crypto mining and trading Ponzi scheme

Bonestopco provide no information on their website about who owns or runs the business.

Bonestopco provide no information on their website about who owns or runs the business.

The Bonestopco website domain (“bonestopco.com”) was privately registered on January 21st, 2018.

A corporate address in Hampshire, England is provided on the Bonestopco website.

Further research however reveals this address actually belongs to Ocean Village.

On their website Ocean Village market virtual office packages. As such it appears Bonestopco exists in the UK in name only.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Genesis Mining banned from operating in South Carolina, ramifications?

Genesis Mining, a Hong Kong company, claim to be ‘the largest cloud bitcoin mining company‘.

Genesis Mining, a Hong Kong company, claim to be ‘the largest cloud bitcoin mining company‘.

A marketing pitch on the Genesis Mining website claims the company has “over 1,000,000” investors.

It’s super simple – Your mining rigs are already set up and running.

As soon as you’ve set-up your account you can start to earn your first coins from our bitcoin cloud mining service!

Through a mining partnership with Swiss Gold Global, on March 9th Genesis Mining was ordered to immediately cease and desist offering unregistered securities in South Carolina.

What does this mean for the company as a whole? [Continue reading…]

Swiss Gold Global securities cease and desist issued in South Carolina

Swiss Gold Global initially launched in mid 2016 as a $50 a month “premium education program“.

Swiss Gold Global initially launched in mid 2016 as a $50 a month “premium education program“.

When that flopped, the company rebooted itself as a bitcoin mining ROI opportunity a few months later.

That business model has now caught the attention of US regulators, promoting South Carolina to issue a cease and desist against Swiss Gold Global on March 9th. [Continue reading…]

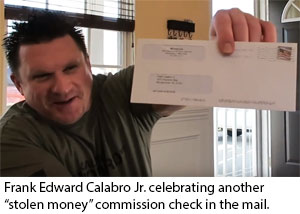

Frank Calabro Jr. serial scammer cease & desist issued in Nth Carolina

Frank Edward Calabro Jr. has a history of scamming people dating back to Zeek Rewards and beyond.

Frank Edward Calabro Jr. has a history of scamming people dating back to Zeek Rewards and beyond.

Since Zeek Rewards was shut down by the SEC in 2012, Calabro Jr. has promoted train wreck after train wreck of collapsed scams – profiting handsomely along the way.

It seems the law has finally caught up with Calabro Jr., following a securities fraud cease and desist issued by North Carolina. [Continue reading…]

StemTech Chapter 11 bankruptcy now a Chapter 7 liquidation

When BehindMLM neutrally reported on StemTech’s Chapter 11 bankruptcy last year, affiliates were quick to hurl abuse.

When BehindMLM neutrally reported on StemTech’s Chapter 11 bankruptcy last year, affiliates were quick to hurl abuse.

A reader by the name of “Mike M” demanded we

stop this madness. This company just filed Chapter 11 Reorganization like thousands of other companies do each year.

The purpose is to reorganize the debt of the parent company.

The operating subsidiaries aren’t affected at all and the global business isn’t affected at all.

Another reader, going by the name “Jen” , claimed we were publishing

fake news, another industry rag that should be sued for libel.

The “suppliers” referenced by “Oz” are clearly no longer suppliers and the chapter 11 filing restructures and discharges the debt (ie. no lawsuits).

The legitimate quality suppliers the company wishes to retain will continue to partner with Stemtech.

It will effect the global business for sure, in a POSITIVE way, so rent a clue please.

A year later, StemTech’s “positive” Chapter 11 bankruptcy is now a Chapter 7 liquidation. [Continue reading…]