Bonvera Review: Nutritional supplements with third-party merchants

Bonvera launched in February 2016 and operates in the health and nutrition MLM niche.

Bonvera launched in February 2016 and operates in the health and nutrition MLM niche.

While Bonvera discloses it’s headquartered in Kansas, the company fails to provide executive details on its website.

There is a “Our Leaders” link, however when clicked visitors are redirected to a “leader’s thoughts” blog.

Posts on the blog are authored by Bob Dickie. Further research reveals Bob Dickie goes by Robert Dickie on his social media profiles.

On his LinkedIn profile, Dickie (right) cites himself as co-founder and CEO of Bonvera.

On his LinkedIn profile, Dickie (right) cites himself as co-founder and CEO of Bonvera.

Dickie’s provided location is Knoxville, Tennessee, which didn’t make much sense considering Bonvera’s website states it’s headquartered in Kansas.

The answer is in Dickie’s LinkedIn profile, which states;

the company went through an ownership and leadership change in 2018 and relocated to Knoxville, Tennessee.

Dickie appears to have been appointed CEO of Bonvera on or around May 2018.

Prior to Bonvera Dickie was President of Crown Financial Ministries.

Crown, founded in 1976, is a global NGO focused on personal-finance policy and education that has taught or equipped more than 50 million people in more than 104 nations.

As far as I can tell, Dickie has no prior MLM executive experience.

Update 14th January 2019 – Scott Johnson has written in to inform us that Robert Dickie has a non-executive MLM history with Amway.

Robert Dickey has plenty of MLM experience. He headed up the tool scam company owned by Orrin Woodward while he was in Amway (Quixtar at the time), and Dickey’s father was the official Woodward organization preacher who eventually had a falling out with Woodward.

Dickey was forced to disclose some individuals who made disparaging remarks against Amway in a landmark free speech lawsuit when Woodward broke from Amway in 2007.

/end update

Read on for a full review of the Bonvera MLM opportunity. [Continue reading…]

Dish Network given 45 days to serve Pshehalouk, default withdrawn

After failing to respond to a lawsuit filed against TVizion and owner Ferras Jim Pshehalouk in April 2018, Dish Network filed for an entry of default in July.

After failing to respond to a lawsuit filed against TVizion and owner Ferras Jim Pshehalouk in April 2018, Dish Network filed for an entry of default in July.

The court clerk entered default on July 23rd. Subsequently Dish network filed for default judgment on November 12th.

On December 13th however, it was ruled that Pshehalouk had been incorrectly served. This meant that default judgment would not apply to him. [Continue reading…]

Court orders FTC to proceed in MOBE case without lawyers (???)

Trump’s government shutdown has wreaked havoc on scheduling for active FTC lawsuits.

Trump’s government shutdown has wreaked havoc on scheduling for active FTC lawsuits.

One such lawsuit is FTC vs. MOBE, in which a Judge has bizarrely ordered the FTC to continue trying without lawyers. [Continue reading…]

Crowdfunding Guaranteed Review: 300% ROI five-tier cycler

Crowdfunding Guaranteed provides no information on their website about who owns or runs the business.

Crowdfunding Guaranteed provides no information on their website about who owns or runs the business.

The Crowdfunding Guaranteed website domain was privately registered on September 29th, 2015.

Despite the age of the domain, Alexa traffic estimates show interest in Crowdfunding Guaranteed beginning early December 2018.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

[Continue reading…]

Jeunesse RICO settlement receives final approval, appeal filed

Despite it appearing to be a bum deal for Jeunesse victims, the RICO lawsuit settlement has received final approval.

Despite it appearing to be a bum deal for Jeunesse victims, the RICO lawsuit settlement has received final approval.

On January 9th a court order granting the settlement found it to be ‘fair, reasonable, adequate, and in the best interests of the Settlement Class Members‘.

Under the terms of the settlement, Jeunesse will pay $2.5 million to victims. Just under half of that amount is expected to go toward legal fees.

The original RICO lawsuit filed against Jeunesse alleged affiliate losses running into hundreds of millions of dollars. [Continue reading…]

3pexcel Review: Discount card cycler pyramid scheme

3pexcel provides no information on their website about who owns or runs the business.

3pexcel provides no information on their website about who owns or runs the business.

The 3pexcel website domain (“3pexcel.com”) was privately registered on July 24th, 2017.

The footer of the 3pexcel website advises the company is ‘a member of Xeap Group Inc.‘

Xeap Group is incorporated in California in the US.

Upon visiting the 3pexcel website for the first time visitors are required to choose a country. Nigeria is provided at the top of the list and is separated from the other choices. A corporate address in Port Harcourt, Nigeria is also provided on the 3pexcel website.

Both suggest 3pexcel is being operated from Nigeria itself. As far as I can tell Xeap Group is nothing more than an offshore shell company.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Wakaya Perfection overturn arbitration order in Youngevity lawsuit

The beef between Wakaya Perfection and Youngevity dates back to 2016.

The beef between Wakaya Perfection and Youngevity dates back to 2016.

Our reporting initially covered Youngevity’s lawsuit in California, which alleged Wakaya Perfection was founded on stealing business from Youngevity.

Wakaya Perfection filed their own lawsuit in Utah, over breach of contract and “tortious behavior”.

Wakaya Perfection’s lawsuit was subsequently moved to federal court, wherein Youngevity filed for dismissal.

In November 2017 the dismissal was granted, requiring Wakaya Perfection to settle the dispute via arbitration.

Wakaya Perfection filed an appeal, a decision on which was finally made last month. [Continue reading…]

Jason Guck’s sentencing delayed, 5Linx “a shell of its former self”

![]() Jason Guck is the last of the three 5Linx co-founders still awaiting sentencing.

Jason Guck is the last of the three 5Linx co-founders still awaiting sentencing.

Guck was supposed to be sentenced on December 19th, however that date came and went with no news.

Today I had Guck’s case flagged for an update. [Continue reading…]

ShareNode Review: Nasgo NSG and SNP token securities fraud

![]() ShareNode provides no information on their website about who owns or runs the business.

ShareNode provides no information on their website about who owns or runs the business.

The ShareNode website domain (“sharenode.com”) was first registered back in 2006.

The domain registration was last updated in August 2018. Stephen Chiang is listed as the owner, through a PO Box address in the US state of California.

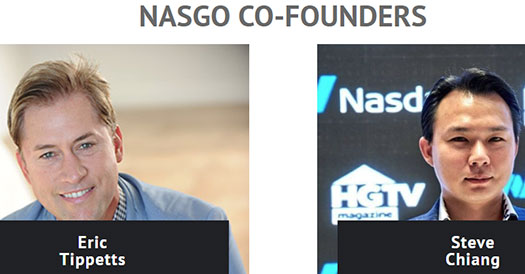

Further research reveals Chiang (who also goes by “Steve Chiang” and “Steve Jiang”) and Eric Tippetts cited as a co-founders of Nasgo.

On the ShareNode website the company advises it is “powered by Nasgo”.

A press-release dated October 3rd names James Hardy (right) as co-founder of ShareNode.

A press-release dated October 3rd names James Hardy (right) as co-founder of ShareNode.

Eric Tippets has been doing the rounds of the MLM training circuit for a number of years, primarily through his Rocket Recruitment app.

At least for a number of years, Nasgo appears to be Tippet’s first MLM venture as an executive.

Steve Chiang also appears to have a marketing background but is much more secretive about it.

This is from Chiang’s LinkedIn profile;

The first organization I created quickly became a 1000 member force using each others skill sets to succeed and create the template for future success.

That organization became the fastest growing organization in a US company and with those 1000 employees quickly became the #1 distributorship within a three month period.

Due to the generic nature of the name, I wasn’t able to specifically pin down Chiang’s MLM past.

James Hardy heads up eVantage Financial, some sort of insurance based income opportunity.

Alexa statistics for the eVantage Financial website suggest it has long-since collapsed.

Read on for a full review of the ShareNode MLM opportunity. [Continue reading…]

OnPassive Review: GoFounders four-tier matrix pyramid scheme

![]() OnPassive is currently being marketed via a “GoFounders” prelaunch website.

OnPassive is currently being marketed via a “GoFounders” prelaunch website.

Both the OnPassive and GoFounders website domains were privately registered in mid 2018.

The OnPassive website is currently a placeholder that claims “Only Qualified Founders Accepted in Prelaunch By Invitation Only”.

A video on the GoFounders prelaunch website presents Ash Mufareh as OnPassive’s founder.

On Facebook Mufareh (right) cites himself as CEO and founder of GFI Fusion, a marketing team within Global Domains International.

On Facebook Mufareh (right) cites himself as CEO and founder of GFI Fusion, a marketing team within Global Domains International.

Going further back (~2010), Mufareh launched AshMax, a recruitment-based matrix scheme.

These days Mufareh promotes various “passive income” scams to a closed-group of investors who follow him from one scheme to the next.

Two Ponzi schemes I was able to link Mufareh to include TelexFree and PayDiamond.

TelexFree was a a Ponzi scheme launched in 2012.

In a marketing video uploaded to YouTube in 2013, Mufareh downplayed TelexFree’s legal issues in Brazil.

As of now, TelexFree has made many mistakes, not one or two, many mistakes in Brazil…

…however past doesn’t mean the future. Brazil doesn’t mean the United States or the world.

Anyone who experienced what happened in Brazil (who had a position in TelexFree), they would definitely become more protected in the United States.

Because we know they (TelexFree) have a strong will to survive and stay in the market for a very long time. Years to come.

That said they (TelexFree) have to take extra measures to be protected in the United States as there is a very clear constitution and law that doesn’t change as frequent(ly), and to mention a solid law.

I can’t accuse anybody or any government of having some maybe gaps or, you know what I’m talking about. But this is a lot more reliable in terms of business in the United States.

TelexFree was shut down by the SEC in 2014. An investigation by a court-appointed Trustee has since revealed TelexFree investor losses in excess of $3 billion.

BehindMLM reviewed PayDiamond in early 2017 and, based on its business model, concluded it was a Ponzi scheme.

PayDiamond collapsed in mid 2018, shortly after which Ash Mufareh began setting up OnPassive.

Read on for a full review of the OnPassive MLM opportunity. [Continue reading…]