Park Lane Review: Affordable fashion jewelry since 1955

Park Lane operate in the jewelry MLM niche and have been around since 1955.

Park Lane operate in the jewelry MLM niche and have been around since 1955.

So the story goes;

In 1955, the company’s co-founders, Arthur and Shirley LeVin, started their business based on the philosophy of sharing and caring.

Today, the second generation of LeVins, inspired by the values and success of the first five decades, has taken the company to greater heights with the same sense of commitment, pride, passion and heart.

Park Lane today operates out of Illinois, the same state the company was founded in.

Park Lane today operates out of Illinois, the same state the company was founded in.

While there are “field executives” featured on the Park Lane website, curiously there’s no detailed information about any of the LeVins.

With a bit of Googling I was able to ascertain Park Lane’s CEO is Scott LeVin.

Unfortunately Arthur LeVin passed away in 2013. I wasn’t able to confirm Shirley’s death so I believe she’s still alive, albeit not actively involved in the running of Park Lane (due to her age likely for some time).

Being the son of Park Lane’s founders, Scott LeVin continues the family business. I believe some of the LeVin’s grandchildren are also involved although I’m unsure in what capacity.

A Park Lane marketing video cites Scott LeVin as a co-owner of the company. Siblings Arthur and Mark LeVin are also cited as a Park Lane co-owners.

A Park Lane marketing video cites Scott LeVin as a co-owner of the company. Siblings Arthur and Mark LeVin are also cited as a Park Lane co-owners.

On the legal front Park Lane has a pretty clean bill of health. There are a few infighting lawsuits but nothing major.

One of the LeVin’s sons, Ryan LeVin, was involved in a hit and run back in 2011. A followup article in 2015 suggests he has made significant life changes after the experience.

To be clear, this is not directly tied to Park Lane. I am however including it as in the 2011 article Ryan is cited as “the heir to a jewellery empire”.

Read on for a full review of the Park Lane MLM opportunity. [Continue reading…]

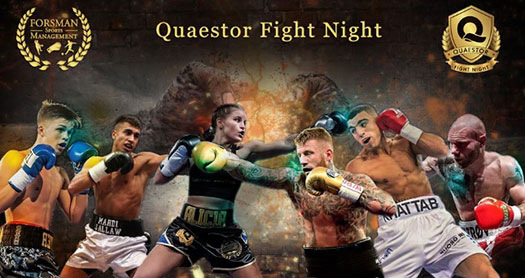

Quaestor Solutions tries to pair shitcoin with boxing, awkwardly fails

In an attempt to create usability for Quaestor coins, back in February Quaestor Solutions owner Svend Rasmussen came up with “Quaestor Fight Night”.

Earlier this month Rasmussen’s plans came crashing down, following public revelation his partner is a convicted serial rapist and fraudster.

Awk-ward! [Continue reading…]

BitXUp Review: Bitcoin pass-up gifting scheme

![]() BitXUp provides no information on its website about who owns or runs the business.

BitXUp provides no information on its website about who owns or runs the business.

The BitXUp website domain (“bitxup.com”) was registered on February 1st, 2019.

Mohammed Shoaib (right), who also goes by Muhammed, is listed as the BitXUp domain owner through an address in Karachi, Pakistan.

Mohammed Shoaib (right), who also goes by Muhammed, is listed as the BitXUp domain owner through an address in Karachi, Pakistan.

As far as I can tell, BitXUp is Shoaib’s first MLM launch.

Read on for a full review of the BitXUp MLM opportunity. [Continue reading…]

One World Network Review: B-Epic sister opp with forced autoship

![]() One World Network operates in the wight loss MLM niche. The company fails to provide a corporate address on their website.

One World Network operates in the wight loss MLM niche. The company fails to provide a corporate address on their website.

Heading up One World Network is founder and CEO, Eric Caprarese.

Caprarese (right) first appeared on BehindMLM’s radar in 2013, as co-founder and CEO of Brain Abundance.

Caprarese (right) first appeared on BehindMLM’s radar in 2013, as co-founder and CEO of Brain Abundance.

Brain Abundance had fizzled out by 2016. Caprarese resurfaced as President and CEO of B-Epic later that same year.

In our Brain Abundance and B-Epic prelaunch review, we noted both company’s distinct lack of retail focus.

A reader asked up to revisit B-Epic in mid 2018, prompting publication of an updated review.

Since our prelaunch review, B-Epic had deteriorated into a pay to play pyramid scheme.

Retail sales were possible, but handled through separate websites that had little to no traffic to them.

Thus it is believed the vast majority of B-Epic sales were by affiliates.

Alexa traffic estimates for the B-Epic website show a sharp decline throughout 2019.

That said the B-Epic website is still functional. Eric Caprarese is still cited as company President and CEO.

Surprisingly, Russia is cited the top source of traffic to B-Epic’s website (30%).

Whether One World Network was launched in response to or is responsible for the decline in B-Epic website traffic is unclear.

Promotion of One World Network began in late September, 2018. B-Epic’s social media accounts were still live and updated as of March 22nd, 2019.

Read on for a full review of the One World Network MLM opportunity. [Continue reading…]

Skyway Capital continues investment fraud with tokens & CryptoUnits

The Skyway Capital Ponzi scheme might be running low on cash, prompting Skyway to announce both Skyway tokens and CryptoUnits.

The Skyway Capital Ponzi scheme might be running low on cash, prompting Skyway to announce both Skyway tokens and CryptoUnits.

Communication seems to be a problem at Skyway Ponzi HQ though, as both reload scams have been announced simultaneously.

This naturally caused confusion, prompting Skyway to issue clarification that they aren’t one and the same.

The launch of Skyway tokens is taking a backseat to CryptoUnits, which are supposedly good to go. [Continue reading…]

Traffic Monsoon claims tied to SCOTUS writ, clawbacks authorized

A case docket remark has tied approval of the claims process to Scoville’s intention to file a writ of certiorari with the Supreme Court. [Continue reading…]

A case docket remark has tied approval of the claims process to Scoville’s intention to file a writ of certiorari with the Supreme Court. [Continue reading…]

FutureNet scam warning issued in Poland, prosecutors investigating

Poland’s Office of Competition and Consumer Protection (UOKiK), has issued a pyramid scheme warning for FutureNet and associated companies. [Continue reading…]

Poland’s Office of Competition and Consumer Protection (UOKiK), has issued a pyramid scheme warning for FutureNet and associated companies. [Continue reading…]

Nui co-founder behind The Digital Vault and RevvCard?

As I was doing my research for our article yesterday on Nui’s arguably pointless CompChain, I came across a corporate blog post that piqued my interest.

As I was doing my research for our article yesterday on Nui’s arguably pointless CompChain, I came across a corporate blog post that piqued my interest.

Titled “ATTN: Important Clarifications for Nui Members”, here’s an update Nui pushed out to affiliates on March 11th;

The Digital Vault Is Not Associated with Nui

You may have heard talk about something called The Digital Vault. Some are alluding that Nui is part of the project.

We want to make it very clear that Nui is not associated in any way with the Digital Vault.

It has never been one of our initiatives, and therefore we have no insight, visibility, or influence on it.

Neither Nui corporate, nor Darren Olayan (CEO), Reid Tanaka (President), Jim Pare or Casey Combden (Keystone Leaders) are affiliated with or endorse the Digital Vault.

If members wish to share information personally about the Digital Vault, they must not use any Nui-affiliated channels.

Any posts on social media groups, pages, etc. that bear the Nui name or in any way imply that the Digital Vault is involved with Nui will be considered a compliance violation and subject to corporate action.

I’d previously seen Digital Vault referenced in passing, but this sounded like it warranted a closer look. [Continue reading…]

Nui launches CompChain with pyramid recruitment & COCO altcoin

Another day, another excuse to ram crypto buzzwords down the throats of the MLM community.

Another day, another excuse to ram crypto buzzwords down the throats of the MLM community.

Why Compchain?

Compchain is changing the scope of networking as we know it.

Built on immutable blockchain technology, Compchain allows you to lock in your network for life, and tap into new products and opportunities as they’re added to the platform.

The basic concept behind Nui’s CompChain is your downline is tracked on a blockchain, as opposed to a regular database.

For Nui affiliates there’s no discernible difference. CompChain is a unilevel team downline, same as any other MLM company.

But y’know… blockchain. [Continue reading…]

DFRF defendants ghost their attorneys, try to shirk SEC lawsuit

At a scheduling conference held on January 31st, the attorneys of DFRF Enterprises defendants Wanderley Dalman, Gaspar C. Jesus and Eduardo N. Da Silva, informed the court they ‘could not locate or communicate with their clients‘.

At a scheduling conference held on January 31st, the attorneys of DFRF Enterprises defendants Wanderley Dalman, Gaspar C. Jesus and Eduardo N. Da Silva, informed the court they ‘could not locate or communicate with their clients‘.

All three defendants have filed outstanding motions to dismiss, which the court gave until February 28th to either withdraw or renew.

On February 28th all three motions to dismiss were renewed, despite the attorneys admitting they still haven’t located or communicated with their clients. [Continue reading…]