Orientum Review: ORT and ORTP Ponzi points OneCoin clone

![]() Orientum operate in the cryptocurrency MLM niche. The company is based out Thailand and headed up by Chairperson Natchaphan Sonsirinun.

Orientum operate in the cryptocurrency MLM niche. The company is based out Thailand and headed up by Chairperson Natchaphan Sonsirinun.

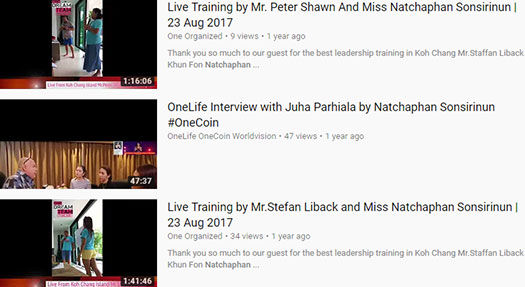

Prior to launching Orientum, Sonsirinun was a prominent promoter of the OneCoin Ponzi scheme.

Various OneCoin marketing videos on YouTube feature Sonsirinun working directly with several of the scam’s top earners:

OneCoin unofficially collapsed in early 2017. The company continues to limp along however affiliates have been unable to withdraw represented ROIs for 22 months and counting.

OneCoin unofficially collapsed in early 2017. The company continues to limp along however affiliates have been unable to withdraw represented ROIs for 22 months and counting.

OneCoin affiliates such as Sonsirinun(right) primarily generated large income via through referral commissions (convincing others to invest).

Whether Sonsirinun has MLM experience prior to scamming people through OneCoin is unclear.

Read on for a full review of the Orientum MLM opportunity.

Orientum Products

Orientum has no retailable products or services, with affiliates only able to market Orientum affiliate membership itself.

The Orientum Compensation Plan

Orientum market ORT and ORTP, speculative points that affiliates are able to invest in.

Referral commissions on ORTP investment is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Orientum cap payable unilevel team levels at three.

Referral commissions ORTP investment is paid out as follows across three unilevel team levels as follows:

- level 1 (personally recruited affiliates) – 12% referral commission in cryptocurrency and another 12% in ORTP points

- level 2 – 8% referral commission in cryptocurrency and another 8% in ORTP points

- level 3 6% referral commission in cryptocurrency and another 6% in ORTP points

Cryptocurrencies paid out by Orientum include bitcoin and bitcoin cash.

There is also a ten-level deep Matching Bonus, however specific details are not provided.

Joining Orientum

Orientum fail to provide affiliate membership costs on their website.

Presumably Orientum affiliate membership is free. Full participation in the Orientum MLM opportunity however requires an investment in ORT and/or ORTP points.

As with affiliate membership, Orientum fail to disclose the current internal value ORT and ORTP points are being sold to affiliates for.

Conclusion

The Orientum apple hasn’t fallen all that far from the OneCoin tree.

You’ve got points that affiliates are investing in, on nothing more than a bunch of pie in the sky promises.

In the case of Orientum, the company claims to be investing funds in a number of industries.

The unique appeal of the Orientum Platform is the fact that we guarantee a cryptocurrency that is backed by businesses involved in mega real estate developments, hospitality ventures, and other such tangible assets that are likely to maintain their value and appreciate over time.

Other than name-dropping a few location and companies however, Orientum fails to provide any actual evidence of doing what it says it’s doing.

Nor is Orientum registered with a securities regulator in any jurisdiction it operates in… because despite clearly offering a security through speculative ORT and ORTP points, Orientum claim they aren’t securities.

ORT Tokens are not securities.

The user acknowledges, understands, and agrees that ORT Coins are not securities and are not registered with any government entity as a security, and shall not be considered as such.

Furthermore, the user understands that investment funds allocated to various projects described in this document will not yield any dividends, earnings or direct profits to the user from those investments; they simply potentially contribute to the value and/or stability of the Orientum cryptocurrency.

Read that for what it is: confirmation Orientum aren’t registered to offer securities and thus operate illegally the world over.

As with OneCoin, the pseudo-compliance angle is downplaying ORT and ORTP investment.

The fact of the matter is however that the only reason anyone signs up to Orientum and invests is on the representation they’ll make a ton of money.

So how does that all work (in theory)?

Orientum runs an internal exchange for ORT and ORTP points.

You sign up as a gullible Orientum investor, and Orientum sells you pre-generated ORT and/or ORTP points – at whatever internal value they’ve assigned the points at the time.

More people invest and Orientum adjusts the internal value of ORT and ORTP points respectively.

To cash out your ROI, you put in a withdrawal request and Orientum will “exchange” your points for subsequently invested funds at the new rate.

The MLM cryptocurrency exit-scam is initiated when Orientum stop paying out withdrawal requests (as OneCoin did in early 2017).

What then happens is a race to the bottom, wherein desperate Orientum affiliates try to offload their points to each other.

Owing to management and insiders having already offloaded prior to announcing they’re turning off the tap, the value of ORT and ORTP crashes.

It is custom these days for MLM cryptocurrency companies to launch an altcoin at some point and get it traded on a few dodgy exchanges, so watch out for that at some point.

In true OneCoin fashion, Orientum are running their fraudulent investment scheme through a separate website, Bergman and Gold.

All new ORT package purchases will be immediately displayed in ORT wallets located in the Bergman & Gold Associate System Back Office.

Bergman and Gold is run by persons unknown and represents itself as being a Georgian corporation (the country, not the state).

In reality Bergman and Gold is just a shell company that doesn’t exist beyond having a website that accepts login credentials of Orientum affiliates.

The company serves no purpose other than to create the illusion Orientum itself isn’t soliciting investment from its affiliates (“We didn’t take your money, Bergman and Gold did!”).

The Bergman and Gold website domain (“bergmangold.com”) uses the name-servers of the “thecrypto-club.com” domain.

The Crypto Club website is nothing more than a list of twenty-three ICOs.

The altcoins listed have nothing to do with Orientum, but do suggest The Crypto Club might have had a hand in developing and/or launching ORT and ORTP.

Or it could just be another shell company tied to Orientum, who knows.

The Crypto Club website domain was privately registered on June 6th.

The Orientum website is hosted out of Singapore, however both Bergman and Gold and The Crypto Club are hosted in Thailand.

Like with OneCoin, trying to dissect how Orientum launders invested funds is merely academic.

The Ponzi lies within Orientum’s business model, and will collapse when new investment dries up.

A friend of mine tipped me about this scam in July. Back then the domain of Orientum was supposed to expire already during September.

Apparently the company has recently set its sights a bit further to the future: whois.com/whois/orientum.io

Also Navid Tavakoli-Toussy has been involved in OneCoin. You can find some references from Google connecting him to OneCoin.

So far Orientum doesn’t seem to be a big hit. There hasn’t been much traffic to the website and for example YouTube videos promoting Orientum don’t seem to attract much viewers.

Yeah, thankfully none of the “me too” OneCoin clones started by former investors seem to be taking off.

They claim that they are turning plastic waste into diesel.

youtu.be/sTACfGcJz2M

That’s not impossible.

If that would be possible, this company would quickly become a billion dollar company

Every MLM cryptocurrency company has some bullshit “see we’re legit!” hook.

Yet none of them register their securities offering with regulators and front up evidence to back their claims.

Much easier to publish YouTube videos for the gullible idiots who fall for it over and over again.

if it were that possible/easy/profitable, recycling companies would have started doing it long ago.

Yeah but those companies didn’t have blockchain. Y’know, that thing you just throw plastic into and out comes diesel.

I keep a few blockchains around my house just to throw old Coke bottles and what not in. AND I DON’T EVEN DRIVE A DIESEL CAR!

(I’m saving the diesel to power my lambo rocket to the moon, which I’m currently building through another blockchain I keep under my bed)

Winning!

Did you see this shocking video?: (Ozedit: video 404 as of March 2020)

i still dont know if this plastic to diesel technology is real or not. but if they actually have that, then this what they talk about might work.

Orientum Plus claims to be partners with a company that is converting plastic waste into fuel with an environmentally friendly process. They say they are doing it already. Can anyone confirm this???

There’s nothing shocking about stock footage strung together with “inspirational freeware music.mp3” and a fivver voiceover.

You’re here asking about it, which means even after trying to research it Orientum hasn’t provided you with enough information to verify.

We came to the same conclusion.

If Orientium was already turning plastic into black gold they wouldn’t be trying to steal your money through pointless MLM altcoins.

Orientum was started by OneCoin scammers. Never forget.

looks like ex Onecoin scammers Liback and Ricketts are on board.

youtube.com/user/StaffanLiback/videos

Ricketts’ deal with Aulives must have gone wrong ??

Kari Boy in next dagcoin is just another shit clone Of OneCoin where ya the mighty blubber ??

I see all the hate for the Onecoin scam transferring over to the Orientum project. Easy to draw them together if one doesn’t care to look deeper into either organization.

Someone above mentioned “if they could turn plastic into diesel everyone would do it, another said, “they would be a billion dollar company already”.

You are both correct. But you haven’t looked further. The tech to do this kind of chemical conversion has been around since 2005, so nothing new there.

However Sepco, the company in Thailand that ORTP has an agreement with to fund 50 plants is completely independent of any MLM or Orgnanization. (Ozedit: Snip, see below.)

The author of this article as a common man can pack a bag and head to bangkok to investigate for himself. This is going to launch globally, 50 plants, then 100, then 300, then 1000. And then yes like the men said a billion dollar company.

Do your own researcb and if you can afford to, head to Thailand and see it all for your self. Inspect the blockchain, Corp compliance, a 3rd party wallet, Sepco’s plants, cypto exchanges, the products and services offered.

Inspect it all. You will be glad you did. Cheers.

Well of course it’s easy, both OneCoin and Orientium are blatant Ponzi schemes.

“Looking deeper” into both companies, as we’ve done in our OneCoin and Orientum reviews, only confirms this.

I was going to ask you for evidence of this agreement but then I realized Orientum’s Sepco Industries is a crock of shit.

Oreintum’s Sepco Industries didn’t exist until a few months ago. The company’s website domain (“sepcoindustries.com”) was registered in August 2018. Promotion of the company only began three months ago (YouTube).

The actual Sepco Industries was founded in 2011 and operates from “sepco-ogi.com”.

Orientum has only recently set up its own Sepco Industries knock-off website in an attempt to dupe gullible morons. Sounds like it’s working.

Or not. The Orientum website currently has an Alexa rank of over 5 million.

Feel free to provide third-party audited accounting showing Sepco Industries funds are being used to pay Orientum investors. Failing which you’re welcome to admit you’re just regurgitating Ponzi pageantry.

Consider the Orientum Ponzi scheme thoroughly inspected. Cheers and sorry for your loss.

And I will build a moon rocket. And then 50 rockets, then 100, then 300, then 1000. And then we’ll have regular earth-moon commuting.

If you don’t believe me, pack your bags and head to Antarctica so you can see yourself where my lunar base is being built!

No proof of business even taking place, just promises. And meanwhile in the real world: Orientum takes your money and gives you points that are supposed to have a high value in the future.

For this huge billion dollar business they did not take ordinary loan from the bank but instead they gather money through MLM setup because…

Well, because scammer logic!

Actually it is possible but not with PET and PVC plastic. They claim this is the main source of plastic for further processing.

I think this is well planned – to use and present noble aim as a coverage of ponzi scheme and cryptocurrency.

Than why any one try to stop that?

Pyrolyses is possible – austrians OMV (big oil company) began to develop 2011 with a process, build the prototyp 2018 and say it will last again serveral years to earn money out of this R&D… several other big companies argue in the same direction – and a small company (founded in 2018) in thailand now solve all these problems?

Possible but better you not believe it – by the way a big company in thailand (b.grimm – german roots) should not know as a mixed company and also working in the field of energyproducing, what happening in the energysector in Thailand??? beware !!!

Hello guys, does there anyone can give me a website about the real sepco company has nothing or deal with ortp and mlm currency or something else to prove this.

Cause someone in my around is doing this play here, so i need strong evidence to against him before the crowd. Thank you a lot,lol.

It’s a scam and big bullshit anyway. There is no real sepco company.

If whoever is trying to recruit you into Orientum hasn’t provided evidence of this, don’t you already have your answer?

Ok,but they give me some photo of sepco industries. It really looks real…. ,so what about those photos.

So I’ve got this really big statue to sell, the Statue of Liberty. Perhaps you’ve heard of it?

If you want proof I’ve got it just head onto Google and run an image search. Plenty of results come up.

No doubt the photos they’ve sent you are real. What you’re missing is a link between bullshit recycling operations in Thailand and the money used to pay affiliates returns when they cash out.

That’d require registration with financial regulators and audited accounting, which you’re not going to get from Orientum scammers.