Genios Club Review: DAI MLM crypto Ponzi cycler

Genios Club fails to provide ownership or executive information on its website.

Genios Club fails to provide ownership or executive information on its website.

Genios Club has two known website domains:

- geniosclub.net (already abandoned) – privately registered on November 3rd, 2022

- geniosclub.team – privately registered on August 13th, 2023

“Genios” is Spanish for “genius”. This tracks with SimilarWeb reporting, as of October 2023, 93% of Genios Club’s website traffic originating from Spanish speaking Colombia.

Spain is the only other notable source of Genios Club website traffic, making up the remaining 7%.

Although not guaranteed, it’s highly likely Genios Club is being run by someone in or with ties to Colombia (or at the very least a Spanish speaking country).

One name we can definitively attach to Genios Club is Wilson Acero.

Acero fronts Genios Club marketing and, according to his FaceBook profile, is from Bogota, Colombia.

Prior to Genios Club, Acero was promoting Generation Zoe (cycler Ponzi, 2021), Forsage (another cycler Ponzi, 2020) and Vida Divina (2018).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

7 Generation Zoe money launderers arrested in Argentina

Authorities in Rosario, a city in Argentina, have charged seven Generation Zoe money launderers.

Authorities in Rosario, a city in Argentina, have charged seven Generation Zoe money launderers.

Following four arrests last year, this brings the total number of Generation Zoe suspects charged in Rosario to eleven. [Continue reading…]

Alex Reinhardt trying to reboot collapsed Ponzi as Ultima

![]() Serial Ponzi scammer Alex Reinhardt is trying to reboot his collapsed Ultima Ponzi scheme.

Serial Ponzi scammer Alex Reinhardt is trying to reboot his collapsed Ultima Ponzi scheme.

Reinhardt latest ruse sees him pitch a new Ultima “smart blockchain”. [Continue reading…]

Fundsz securities fraud warning from Ontario, Canada

Fundsz has received a securities fraud warning from Ontario, Canada.

Fundsz has received a securities fraud warning from Ontario, Canada.

As per the Ontario Securities Commissions November 6th warning, Fundsz [Continue reading…]

Mike Sims lies about CFTC fraud charges, deceives victims

![]() In undated video footage that appears to be directed to OmegaPro victims, Michael Shannon Simms, has bizarrely denied the CFTC has filed fraud charges against him.

In undated video footage that appears to be directed to OmegaPro victims, Michael Shannon Simms, has bizarrely denied the CFTC has filed fraud charges against him.

Sims, aka Mike Sims, is also appealing to OmegaPro victims to send him potentially incriminating evidence. [Continue reading…]

Jeremie Sowerby facing indictments for “other fraud schemes”

Serial MLM crypto scammer Jeremie Sowerby is facing multiple pending indictments.

Serial MLM crypto scammer Jeremie Sowerby is facing multiple pending indictments.

The disclosure was made by the DOJ in a recent motion arguing for Sowerby’s ongoing detention, following his arrest on September 19th. [Continue reading…]

Paul Chalmers fronts My Wealth Club, NextGen Academy reboot

Following on from the collapse of NextGen Academy earlier this year, My Wealth Club has emerged as an official reboot. [Continue reading…]

Following on from the collapse of NextGen Academy earlier this year, My Wealth Club has emerged as an official reboot. [Continue reading…]

Fabulous Global Venture Review: Not so fabulous lies

Fabulous Global Venture fails to provide verifiable ownership or executive information on its website.

Fabulous Global Venture fails to provide verifiable ownership or executive information on its website.

A Fabulous Global Venture “Board of Directors” is presented, featuring people who have nothing to do with the company.

Fabulous Global Venture’s website domain (“fabulousglobalventure.io”), was privately registered on July 12th, 2023.

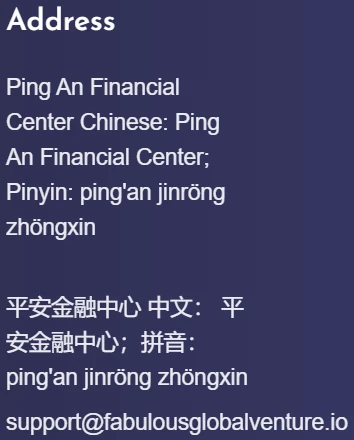

In the footer of Fabulous Global Venture’s website we find details for “Ping An”:

Ping An is a Chinese conglomerate based out of Shenzen. Worth ~$136 billion as of March 2021, Ping An is the world’s largest insurer.

Needless to say, there is no evidence Ping An has anything to do with Fabulous Global Venture.

Instead, we likely have Chinese scammers operating out of Vietnam.

SimilarWeb tracked just ~350 visits to Fabulous Global Venture’s website for September 2023. 100% of these visits originated from Vietnam.

350 monthly website visits tells us Fabulous Global Venture hasn’t taken off since July. The figure is so low that most of those visits are likely to be admin related.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

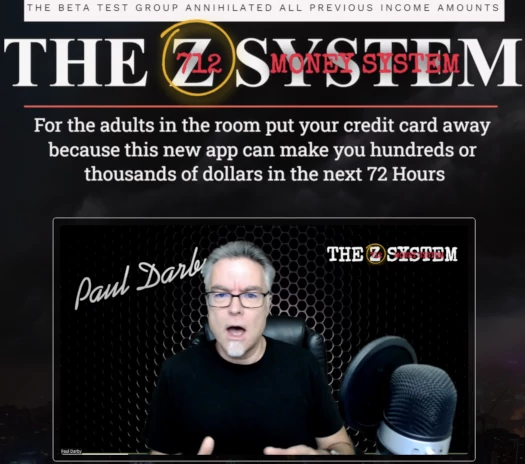

The Shiny Ball Syndrome Review: Paul Darby discovers AI

The Shiny Ball Syndrome’s website presents a marketing video and signup form front and center.

The Shiny Ball Syndrome’s website presents a marketing video and signup form front and center.

No ownership or executive information is provided. Nor do any of the provided links suggest this information is provided.

If we click through to The Shiny Ball Syndrome’s “commission fees” link, we find references to “Paul Darby, Inc.”

BehindMLM first covered Paul Darby in 2013, as owner of the YouGetPaidFast gifting scheme. Back then Darby was launching various scams under Unimax Services branding.

After YouGetPaidFast collapsed, Darby continued promoting third-party scams to his victims.

Darby’s next MLM venture was Z System, launched in mid 2022. Z System was an email marketing tool attached to a pyramid scheme.

Darby’s YouTube channel reveals he stopped promoting Z System in late 2022. Other than that, Darby has used his YouTube channel to market various “new” marketing systems under various names.

The latest is some AI grift, through which Darby pitches a 2000% ROI in less than two months:

Marketing for The Shiny Ball Syndrome began about two months ago.

Read on for a full review of The Shiny Ball Syndrome’s MLM opportunity. [Continue reading…]

Kristijan Krstic arrested in Georgia, extradited to the US

![]() Wanted fugitive Kristijan Krstic was arrested on February 2023 in Batumi, Georgia.

Wanted fugitive Kristijan Krstic was arrested on February 2023 in Batumi, Georgia.

Krstic’s arrest followed a request for extradition from the US who, unknown to us, had learned of Krstic’s whereabouts. [Continue reading…]