Hyperverse trots out James Lockett to lie about securities fraud

![]() Hyperverse is little more than a broken website. Affiliates are still logging into the HyperFund backoffice.

Hyperverse is little more than a broken website. Affiliates are still logging into the HyperFund backoffice.

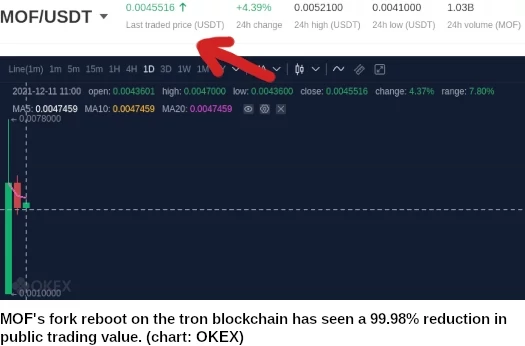

MOF has transitioned over to the tron blockchain, allowing Ryan Xu and Sam Lee to expand 100 million MOF tokens to 100 billion.

This has seen MOF’s public trading value plummet from ~$2 to less than half a cent.

Hyperverse affiliates are panicking. Instead of explaining what went wrong, Hyperverse has trotted out serial Ponzi promoter James Lockett to lie about securities fraud and compliance.

Lockett’s appearance in a post-launch official compliance video suggests Ronae Jull might have been shelved.

The first thirty minutes of Lockett’s Hyperverse presentation is marketing and compliance fluff BehindMLM has already debunked.

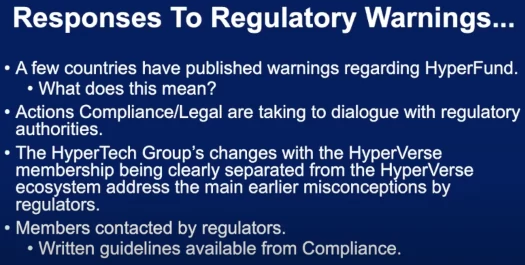

At [29:50] the following slide pops up:

Lockett (right) then proceeds to try and explain away HyperFund’s regulatory problems, namely securities fraud.

Lockett (right) then proceeds to try and explain away HyperFund’s regulatory problems, namely securities fraud.

[29:52] Now we did want to update you on the HyperGroup response to regulatory [sic].

There are a few countries that have published warning regarding the HyperFund. None so far about the Hyperverse.

BehindMLM has documented HyperFund securities fraud warnings and investigations from the UK, India, New Zealand, Guernsey, Germany and Bermuda.

Update 11th December 2021 – The UK added Hyperverse to their HyperFund securities fraud notice on December 10th. /end update

[30:08] That means that they have questions. In most cases these warnings or investigations were started because of member’s publishing or saying the wrong thing in an incorrect way, or in a non-compliant way or both.

And so warnings have come up. People have misunderstood things.

While regulatory investigations might be triggered via promotion, the warnings and investigations pertain to HyperFund and now Hyperverse’s fraudulent business model.

To be clear: None of the regulatory securities fraud notices or investigations cited above pertain to promotion of HyperFund. They are all directed at HyperFund and its executives – as a direct result of the company’s business model.

Claiming financial regulators have “misunderstood” securities fraud is Ponzi pseudo-compliance at its finest.

[30:30] So compliance and legal have been reaching out to these regulatory agencies. There’s just a handful of them, so it’s not a massive trend like some people in the press would like you to believe.

Diminishing securities fraud is also pseudo-compliance. Securities law doesn’t differ much between country to country.

Any country with a financial regulator regulates securities. And that requires registration with financial regulators and filed audited reports.

The reason for this is to establish verifiable external revenue generation, to prove that newly invested funds aren’t being used to pay returns.

Any MLM company that doesn’t register with financial regulators, and instead opts to commit securities fraud and operate illegally, does so because it’s a Ponzi scheme.

HyperFund and now Hyperverse is one such company.

[30:46] We are in dialogue with each and every regulatory authority that has raised a question.

In fact we were in touch with one regulator the day after (Hyperverse’s) launch.

So on Monday morning, the 6th of December, we were in touch with one regulator, who was absolutely delighted with the new changes.

New changes you say? Go onnnnnnn…

[31:08] So the changes made by HyperTech Group with the Hyperverse membership clearly being separated from the Hyperverse ecosystem; that addresses a lot of the earlier misconceptions that regulators have.

Sorry, what?

Regulators have a problem with HyperFund and Hyperverse because its a Ponzi scheme offering 300% returns.

From a regulatory standpoint regulation begins with identifying an investment contract and, once identified, establishing whether a company offering securities is appropriately registered and filing audited financial reports.

If not, that company is committing securities fraud and operating illegally.

The US uses the Howey Test to establish an investment contract.

An investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

In HyperFund and Hyperverse, affiliates invest in a common enterprise (HyperFund and Hyperverse), with a “reasonable expectation of profits (an advertised 300% ROI), to be derived from the efforts of others (HyperFund and Hyperverse manages the ROI payout).

It doesn’t matter what silly names you come up with to mask an investment contract (“memberships”, “daily rewards” etc.), if it fits the Howey Test then it’s an investment contract as per US securities law.

Materially, there is no difference to the definition of an investment contact outside of the US.

Every financial regulator has a similar variation of the Howey Test. The only difference in the US is it was made a public written definition as a result of a Supreme Court case.

This is why, when an MLM Ponzi scheme gets big enough to attract regulatory attention, you’ll see similarly worded securities fraud warnings issued across multiple jurisdictions.

That’s all that really needs to be said when it comes to Hyperverse compliance.

But because James Lockett goes onto blatantly lie about securities regulation, we’ll continue to record Lockett’s lies.

[31:23] The (Hyperverse) membership is an unregulated membership.

And the ecosystem is a mix of unregulated and different types of regulated services.

And as long as we keep them separate, the membership can fly around the world without regulation, and be legal and proper in all those countries.

I’ve already addressed this “renaming” pseudo-compliance above. What I will do here is challenge anyone in Hyperverse to demonstrate where in the Howey Test or Securities and Exchange Act, it states

- securities fraud is legal if you call it a membership; and

- Ponzi schemes are legal if you separate them from membership.

That challenge is extended to Hyperverse investors outside of the US. By all means provide evidence of relevant securities legislation in any country that legalizes securities fraud when conducted through a “separate membership”.

Obviously, for reasons we’ll get into later, James Lockett knows he’s lying through his teeth.

It’s no secret that a large percentage of HyperFund/Hyperverse affiliate investors are keeping up to date with developments on BehindMLM.

Because BehindMLM is one of the largest MLM resources, that extends beyond HyperFund/Hyperverse’s affiliates.

And so Lockett’s next task is, rather then addressing the reality of securities fraud that destroys Hyperverse’s pseudo-compliance above (because he can’t without giving the game away), to “attack the messenger” so to speak.

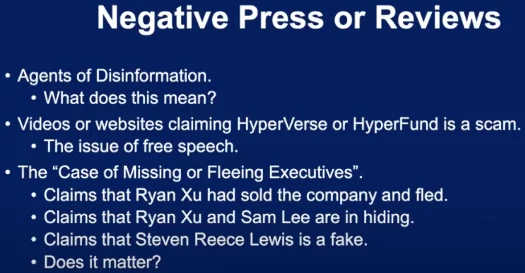

[33:03] So we have agents of disinformation. There are two or three major blogs that are just attack animals and they intentionally spread misinformation to draw traffic to their site.

And for them everything is a scam. And it’s not just Hyperverse or HyperFund, pretty much everything except what they’re doing is supposedly a scam.

For reference, in the twelve years I’ve been running BehindMLM I’ve never promoted anything on it.

As to “everything is a scam”, I go into every review with a neutral mindset. Research into a company creates the structure, direction and tone of each review, as it should be.

[34:02] So if you pay attention to all this garbage, and that’s what this stuff is, then you’re giving it more credit then it’s due.

And the problem is, if many of us, y’know when we see a blog article that… let’s go through these examples.

We recently had claims that Ryan Xu or Sam Lee had sold the company and fled, or they’re in hiding, or the company is shut down and now it’s relaunching, or they ran out of money and now they’re a Ponzi scheme – all this is fake. And we all know it.

We also had new claims that Steven Reece Lewis, our new CEO, we’ve seen several videos from him, that he’s a fake person.

Does it matter?

Well it’s the sticks and stones idea. But it doesn’t really matter what they say. We know what the truth is.

Again, anyone who’s been following BehindMLM’s coverage, in particular the Blockchain Global fallout of late, can attest that only the facts have been reported as they’ve been made public.

Ryan Xu and Sam Lee have fled to Dubai. Ryan Xu and Sam Lee are in hiding from Blockchain Global liquidators after the company collapsed, generating $48.9 million AUD in losses.

Steven Reece Lewis has no verifiable digital footprint. He is a Boris CEO actor plucked from obscurity.

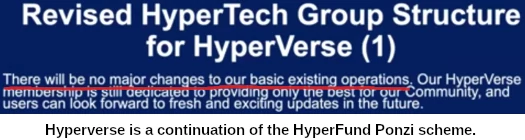

And Hyperverse is a reboot of HyperFund. Same Ponzi scheme, new coat of paint.

Pretending there’s some alternative truth to these actual events playing out sees Lockett gaslighting Hyperverse investors.

This is less behavior found in a legitimate business, and more in line with what you’d see in a cult.

What makes James Lockett’s denial of facts and gaslighting all the more egregious, is this is far from his first Ponzi rodeo.

And the playbook is exactly the same.

Lockett cemented his scamming legacy with USI-Tech. USI-Tech launched in 2016 as a forex trading Ponzi scheme.

That collapsed a year later, prompting USI-Tech to relaunch as a 150% ROI MLM crypto Ponzi scheme.

Lockett was a prominent promoter of USI-Tech through his YouTube channel “Global Turbo Team”.

Following a series of regulatory securities fraud warnings (I don’t think I need to point out the obvious pattern here), USI-Tech collapsed in early 2018.

Like Hyperverse, USI-Tech’s executives fled to Dubai.

Up until USI-Tech’s collapse, Lockett sputtered the same pseudo-compliance and “don’t listen to the facts” denials he’s now regurgitating for Hyperverse.

BehindMLM documented USI-Tech, as we’re doing with HyperFund and Hyperverse, from launch to collapse across fifty-one articles.

After USI-Tech Lockett deleted all his denial and promotional videos from Global Turbo Team.

He continued to use Global Turbo Team to promote various smaller MLM Ponzi schemes.

As the collapses began to mount, so did the backlash from Lockett’s victims. This eventually lead to Lockett spitting the dummy and deleting his YouTube channel.

Lockett resorted to promoting scams through Telegram, where he felt he could maintain a much tighter grip on his victims.

BehindMLM documented Lockett’s “eat shit” moment, noting he officially abandoned USI-Tech in April 2018.

Fortunately, Lockett’s USI-Tech scamming was immortalized in videos hosted on “The Ponzi Show” YouTube channel.

In early 2020 Lockett had a crack at My Daily Choice. Evidently that didn’t work out and so he returned to MLM crypto Ponzi scamming.

Now he’s weaseled his way into HyperFund compliance and here we are. The same bullshit, three and a half years later.

When he’s not promoting Ponzi schemes and lying about securities fraud, Lockett doubles as an “international lawyer and manager” through Lockett International.

Lockett is based out of the US. Neither he, HyperTech, HyperFund, Hyperverse or any of its executives are registered with the SEC.

At time of publication Alexa estimates the US is the largest source of traffic to Hyperverse’s website (29%).

Update 16th July 2022 – This article originally included a link to James Lockett’s Hyperverse presentation.

As at the time of this update, YouTube advises “the YouTube account associated with this video has been terminated.” As such I’ve disabled the previously accessible link.

The hyperfund warning from the UK has an new update containing the thehyperverse.net now.

fca.org.uk/news/warnings/hyperfund

Lol! Lemme finish this review and I’ll do a quick writeup.

Keep up the good work. Unfortunately I think this Ponzi scheme is going to continue for quite some time yet as Hyperverse.

I’ve been in contact with the FCA re: hyperverse, I’ve passed over some of their new documentation promoting it…..tick tock.

Doubt they will do anything with it.

When I spoke to them they hinted that an investigation is ongoing and that they are keen for more info if I had any, which, of course I gave them.

Article updated to note James Lockett’s Hyperverse YouTube presentation is no longer available.