HyperFund confirms executives fleeing to Dubai

On October 6th HyperFund released a new “community FAQ”.

On October 6th HyperFund released a new “community FAQ”.

Of note is confirmation that the company’s executives are fleeing to Dubai.

HyperFund currently doesn’t provide a corporate address on its website.

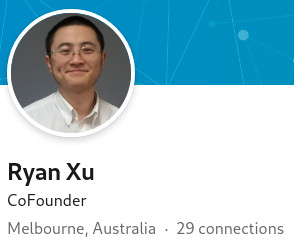

The Ponzi scheme is run by Ryan Xu (aka Zijing Xu), under the “HyperTech” umbrella.

The Ponzi scheme is run by Ryan Xu (aka Zijing Xu), under the “HyperTech” umbrella.

Xu, who refers to himself as “one of China’s four Bitcoin Kings”, has ties to Australia and south-east Asia.

Since investment into HyperFund took off earlier this year, Xu hasn’t been seen in public.

Based on a marketing video from around April, showing Xu in Dubai with top HyperFund promoters Kalpesh Patel and Rodney Burton, we assumed Xu had relocated there.

In HyperFund’s latest FAQ the company all but confirms this:

Where are the Hyperfund offices located?

Hyperfund is relocating offices to Dubai.

This isn’t a co-incidence. Due to lack of active regulation, Dubai has emerged as a hotbed of MLM related financial fraud.

Armed with residential visas and living off ill-gotten gains, MLM Ponzi scammers in Dubai prey on victims at arm’s reach from authorities.

Kalpesh Patel and Rodney Burton being prime examples of this in action.

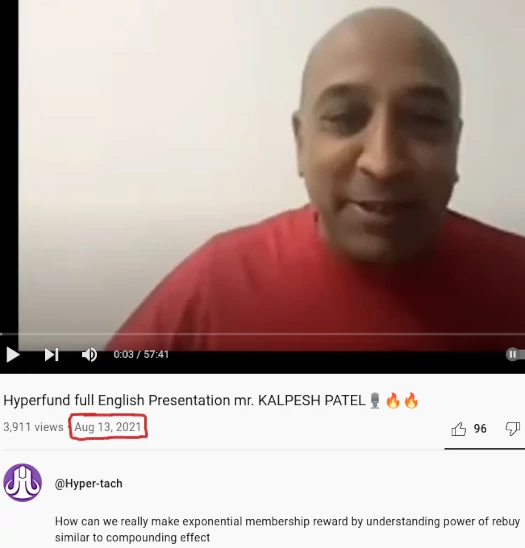

Kalpesh, a UK citizen, targets his MLM Ponzi promotion at a Hindi speaking audience in the UK and India:

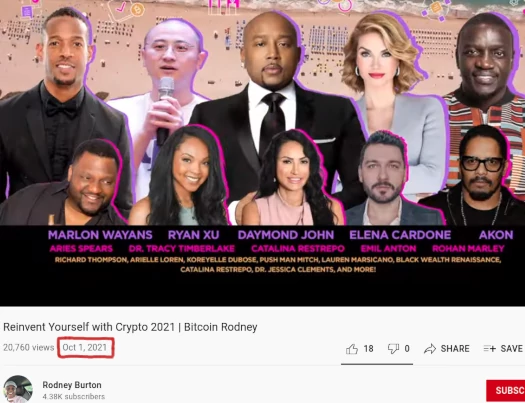

Burton, a US citizen, promotes MLM Ponzi schemes from Dubai to English-speakers back home.

To that end Burton, as “Bitcoin Rodney”, is promoting a cryptocurrency fraud event in Miami next month:

As above, HyperFund’s Ryan Xu appears in Burton’s promo for the event. In a separate video Xu confirms he will be attending Burton’s event as a “keynote speaker”.

Other interesting tidbits from HyperFund’s October FAQ include;

Was KPMG involved with setting up the HyperFund Rewards plan, and are they currently auditing the Rewards?

KPMG has never been involved with HyperFund, and do not currently audit HyperFund Rewards.

This appears to stem from a claim made by HyperFund, in response to BehindMLM’s original HyperFund review (April 2021).

ASIC and KPMG work hand in hand to regularly audit financial companies and second of all, regardless of the misleading presentations made my non compliant sources, this is a membership that pays rewards very much like airline miles or credit card points.

Naturally neither ASIC or KPMG have anything to do with HyperFund. But that didn’t stop “HyperTech Group Corporate Team” from namedropping.

Whether KPMG got in contact with HyperFund and told them to stop it is unclear.

I can’t think of why else HyperFund would put this in their FAQ.

In any event, what with regulators in several jurisdictions issuing securities fraud warnings, HyperFund has no doubt found it more difficult to feign association with regulators and auditors.

Is Hyperfund registered as a company? Is it regulated?

Hyperfund is a customer acquisition project under the umbrella of the Hypertech Group of companies.

Because it is not an investment and does not offer any financial products, it does not qualify for oversight by investment regulatory agencies.

This is just a straight-up lie. HyperFund is a passive investment scheme.

MLM companies offering passive investment schemes constitutes securities offering, very much requiring them to register with financial regulators.

You can see the result of HyperFund not operating legally by way of securities fraud notices issued in the UK, New Zealand and Guernsey.

It’s likely we’ll see more HyperFund securities fraud notices issued over the following months.

This next one is a combination of two FAQ questions.

The mental gymnastics on display doesn’t really need an explanation;

The mental gymnastics on display doesn’t really need an explanation;

Is it possible to receive more than three times my membership purchased value?

It is not. Each membership expires once three times its purchased value has been reached.

The “added” percentages achieved by referring new members is not a commission, but simply an acceleration of a member’s own earned Rewards.

How do I earn commissions?

There are no commissions paid in Hyperfund.

Too funny fellas. I’m sure with that cleared up regulators will surely drop any active HyperFund investigations.

My account at xxxxxx exchange said they won’t allow me to send USDT to HYperfund. What can I do?

Choose a different exchange.

Gee, I wonder why crypto exchanges might be blocking transfers to HyperFund?

I have extra USDT in my Deposit account. How do I get that sent back to me?

Unused USDT held in your Deposit account will not be refunded.

It can’t be refunded because the second you invest, HyperFund use that USDT to pay referral commissions and ROI withdrawals.

Finally towards the end of the FAQ, HyperFund drops a hint at its exit-scam of choice:

Do I need a passport to sign up for a Hyperfund account?

Hyperfund does not require a passport to register a new account.

If there is later an allegation of fraud or other wrongdoing, Hyperfund may require additional KYC in order to verify identity and resolve any issues.

A Ponzi scheme running out of money would certainly be an “issue”. Stay tuned…

Update 12th April 2022 – This article originally featured a link to one of Kalpesh Patel’s Hindi targeted HyperFund marketing videos.

As at the time of this update, Kalpesh has deleted the video. As a result I’ve disabled the previously accessible link.

Update 24th July 2022 – The deletion of evidence continues. This article originally included a link to the April video featuring Ryan Xu in Dubai.

That video has now been marked private. As such I’ve disabled the previously accessible link.

Hang on! Isn’t Elena Cardone married to Grant Cardone?

Gimme a sec. Putting together a third article on Burton’s event.

US celebs + HyperFund Ponzi scheme + serial scammers + Florida. Yeah, this isn’t going to end well.

One and the same.

They obviously needed somebody familiar with robbing people while “teaching them to become rich” other than Xu.

If someone simply bothered to do a Google search before they joined, and saw securities fraud warnings from over a dozen countries, that would be enough for anyone with just half a brain to avoid joining!

Apparently there are still a number of brain-less people with zero common sense still joining! Just proves Barnum’s adage still holds true in the 21st century-there’s a sucker born every minute.

If someone joins after doing a Google search and reading all the securities fraud warnings, they deserve to lose their money. It’s a good thing stupidity isn’t a crime!

Hyperfund seem to be having a big push to enroll new bagholders at the moment.

They are hosting a webinar tomorrow (13/10/21) at 8pm BST to do just that, and they have the Miami event coming up too.

Perhaps with all the withdrawal requests and frozen accounts, they need to get more revenue coming in.

I received an email from an affiliate today, who withdrew his initial investment in early September, but has now decided to re-invest the same amount.

Some people are definitely being suckered in by the marketing.

I can tolerate and find discussion around actual topics are interested. However, this site are so many asumptions and errors.

Peoples accounts are not frozen because of lack of funds to aprove withdrawl. You are talking investments and withdraw as members would get money.

All members konvert their HU (Hyper Unit) to their own token MOF. How come MOF only Rise in price on exchanges, even though all members are rewarded daily and can convert and withdraw, whenenver they have 50 HU?

Finally, please take alot who owns MOF. Ref, coinmarketcap (check MOF). I sense alot of Greed!

Ponzi schemes start to freeze accounts for one reason and one reason only.

There’s a reason you never see frozen accounts when a Ponzi scheme starts or recruitment is up.

Because people invest in Ponzi shitcoin = number go up.

Ryan Xu owns MOF. Duh.

That and stupidity. Welcome to every MLM Ponzi scheme ever.

Yup, you got caught in marketing and hype. Welcome future victim.

Wait, so you admit that it’s an investment and not just a membership?

Do you realize that you just admitted that Hyperfund does unregulated investments? The other phrase for that is “Securities fraud”.

You’re very correct, there is a lot of greed here. And you’re contributing to it.

HyperFund warning today from Germany’s BaFin.

bafin.de/SharedDocs/Veroeffentlichungen/DE/Verbrauchermitteilung/unerlaubte/2021/meldung_211219_thehyperfund.html

Thanks for the heads up!

”Concerned Citizen” -pls read my post again.

You guys really are experts in this field. Cant even read, lol I said ”YOU are talking like its an investment and that you withdraw money”.

That is not what you said. You said, and I quote:

You did not say “YOU are talking like its an investment and that you withdraw money.” So who can’t read?

This coming from a person who cannot spell the word convert…..

Ok so I didn’t understand your sentence, I can admit that.

Now regarding this statement from you. I want you to go and re-read it carefully. Think very carefully about what you said here.

And then read the following:

“Invest”, according to the Merriam-Webster dictionary is as follows:

Now, with this definition in mind, please explain what you use Hyperfund for.

What I would also like to hear from you is how Hyperfund generates funds to offer (I guess I can’t say “pay” cause it’s not an investment right) you a return (oops guess I can’t say return either) um, I mean, rewards.

I mean, considering you know more about legal financial structures than the financial regulators of first world countries…….

And if you say “I don’t care how it works, as long as I’m making money.”, then you deserve to be hunted down by all the people that you have cost money in this mickey mouse operation you think is called “financial freedom”.

But hey, I mean if that’s too much of an ask, we can always continue addressing incorrect use of diction and sentence construction. You seem to be an expert in that……..

Worthless website. A lot of speculation and name calling without ANY proof being offered. (Ozedit: dummy spit removed)

1. You can verify HyperFund isn’t registered to offer securities in any jurisdiction.

2. You can verify HyperFund’s executives have fled to Dubai.

3. Sorry for your loss.

RE: Tad bit more info on Molecular Future (MOF) Price Chart (and other data):

Over the past ~2yrs price has ranged between ~$0.03 to $1.92 and everywhere in between.

Daily Trading Volume over the past 6 months is (allegedly) between ~$5M to $20M (with today being the first time it’s traded under $5M daily)

But, this is what I found most interesting:

Total Supply: 100,000,000

Foundation Wallet: 23,259,471

Team Wallet: 15,000,000

The Total Circulating Supply and (therefore, also) the Market Capitalization is “unknown.”

However, if they can do another or a few more big price pumps, they could rug-pull all coin holders by dumping ‘the Lion’s share,’ 38.26%, of the total supply (which could, hypothetically, be over half of the current circulating supply)!

This in addition to a 404 Server Not Found or frozen-numbers-on-a-screen scenario.

Source: coingecko.com/en/coins/molecular-future

Game Over.

insolvencynotices.com.au/noticeSummary/blockchain-global-ltd-4

afr.com/companies/financial-services/court-freezes-8-75m-in-crypto-collapse-case-20211007-p58y53

afr.com/companies/financial-services/failed-crypto-company-collapses-owing-21m-20211103-p595n3

I’m not following why people think a shell company in Australia means HyperFund is kaput?

HyperFund’s source of revenue is new investment. It won’t collapse until that runs out or it’s shut down (lol Dubai).

Some crypto bro shell company in Australia going bankrupt, even if it’s owned by a HyperFund executive, doesn’t change that.

To be honest I haven’t got a problem with people making money. You sign up and add a few members you can make your initial investment back quite quick.

I think most people know it’s a scam deep down.

It’s the constant lies about what a great opportunity it is and all the self help nonsense that goes with it that makes me sick. These people have no conscience.

Majority of pyramid members lose out,so you don’t have an issue with that as long as you make back what you put in?

People need to take responsibility for their actions. Only put in what they can afford to lose.

Create awareness for these people so they don’t get greedy but what you can’t stop this beast. It’s massive.

Bullshit. No one should be contributing to a scam operation, whether or not it’s money they can afford to lose. Helping fund scammers gives them the tools they need to hurt others.

@A: you have shown yourself to be a dirtbag of a human being. Please crawl back under your rock where you belong.

I don’t have a problem with people making money either, but I do have a problem when they call it making money when they are stealing money from others.

This is what this Ponzi is all about…stealing people’s money under the guise you are making money.

Cut the crap. You are a Ponzi pimp and you know it is stealing but you don’t care as long as you get yours.

Not buying your lame attempt at being altruistic and fake people should only put in what they can afford to lose BS.

You are part of a criminal enterprise. You are not making money you are stealing it. Own up to it.

People do need to take responsibility… for scamming others and for not doing due diligence.

Your general indifference to to the predatory nature is gross.

At least you’re being honest that you –

1) don’t care who loses as long as you win.

2) don’t care that it’s fraud/theft again as long as you win.

Dirtbag,

Very harsh comments. I joined up and did ask people to join but told them straight up I think it’s probably a scam.

But they have rebuys so potential to make some money before it goes kaput. Anybody that asks me about it I tell them i think it’s a scam.

Yes I’m a scumbag hypocrite but there’s a small chance I might make a little bit of money during the same time you lot are bitching and moaning about Ponzi schemes yet can do nothing about it.

I have details of every single one of the reward scheme pushers. Can I or you do anything with that? Nah, didn’t think so.

For the record I got convinced it was legit when I put my money in to it. Only after further research I realised it’s a scam. So I was quite foolish myself.

I will be pulling my money out as soon as it’s possible.

@ A

Karma is a real thing. Enjoy.

Mof has spiked today. Hyperfund members are celebrating….

All I got from that is it’s stolen money but not my problem so i’m going to take what I can.

You earned that dirtbag title x2.

I got conned and put my money in. The least I can do is get it out. Don’t get why the hate. I’m a victim here.

The only way to get more out of a Ponzi than you put in is to steal from others.

You say you are a victim of the scam and also state you wish to scam others by stealing their money.

It is impossible to earn or make money in a Ponzi, any so called profits is purely money stolen from others.

If you know its a Ponzi and still want to make money from it, you are nothing but a thief.

Then maybe it’s not a Ponzi scheme because many people are putting money in and getting x3 out without getting a single person on board.

Yes I told people about it but I also said it could be a scam so do some research.

After I looked in to further I was convinced it was so don’t ask people to join anymore. Should I just leave my money in there?

I will take it out and the x3 that was sold to me. If that makes me a thief then so be it. Come and arrest me.

Also if I’m a thief what the hell are these thousands of people actively getting hundreds more to join?

Literally a ponzi.

I know you don’t want to hear it, but the moment you deposited you donated to those who withdrew before you. What’s there now on your dashboard isn’t yours.

And then you complain about being called a dirtbag and a thief. Not even JUST what you put in but MORE.

People with the same argumentative and cognitive ability to say it’s not their problem they will withdraw what they were promised.

See how that works?

As I said, you’re a dirtbag. You think warning people you’re hawking a scam makes what you’re doing OK?

Ponzi scams do not necessarily require you to sign up others directly (you’re confusing it with a pyramid scheme).

When you “invest” in a Ponzi, you do with the hope that those running the scheme steal enough from others to put you in the black. You are funding organized crime.

“BuT i MaDe MoNeY” is no excuse for scamming. Please, just go away.

So what you going to do about it? Fuck all. People like you are as bad as the scammers.

All you do is moan about stuff but haven’t got the balls to do anything about it. Weak people. At least you’ll go to heaven right?

There is a crypto conference in dubai in December. Hyperfund will be guest speakers including some of those mentioned on here.

One of them is also offering to reimburse costs for 300 members in HU. They will be looking to add a lot of members.

Maybe Amos n Andy you can use this info to help people? Nah you just give abuse to me on a website instead: No backbone and pathetic.

Ps respect to creator of this website and page for creating awareness.

There is nothing wrong with getting what you invested in this Ponzi out. What makes you a criminal is when you said you would get your initial investment out and the “3x you were sold,” as if you were entitled to the 3x.

That makes you a criminal, because the 3x is stealing and you know it.

As for the thousands of others you reference, it is real simple. They are all criminals. Glad I could clear that up for you since you seem to have a disconnect on what is and what isn’t a criminal.

But your comment “come arrest me” reminded me of a flea floating down the river on its back, with an erection, yelling “raise the drawbridge.” Someone has a guilty conscience and is doing everything they can to try to assuage they are not doing anything wrong.

Just because they are presenting at a crypto conference in Dubai does not make this Ponzi not a Ponzi.

They aren’t the first Ponzi to make e presentations at a crypto conference. The reason being they paid to be a presenter, like all the other presenters.

But I really loved the “I am a victim” claim. Too funny. One more thing, you do your DUE DILIGENCE BEFORE you join and invest, not AFTER.

@A

Just because you’re not recruiting your victims doesn’t mean you’re not stealing from them.

Ponzi schemes are a zero-sum equation. There’s no “maybe”.

So I should pull my money out and stop there? Ok that is what I’ll do. I don’t want to steal from anybody.

I’m staying on their communication channels though. I want to see how far they take this as much as they make me vomit with the shit they come out with congratulating each other.

I’m starting to wonder if the trip to Dubai is becoming close to rug pull as they are pushing it to lots of people with reimbursement in Jan. so 3k dollars all sent to KP by lots of people that travel to Dubai.

@ A

If you can pull out your initial investment, good luck to you. I kind of get the impression it’s already too late.

Now that you know what Hyperfund is, if you don’t walk away it is a judgement on your character.

By all means please stay in the communication channels, knowing what they’re doing is good for everyone. Up to you.

Only way I can’t pull it out is if I pull the plug in the next 2-3 months.

All My fund should be available to withdraw by that time. This is going on for a lot longer yet.

Said everyone in a Ponzi the day before it collapsed.

It is impossible to predict when a Ponzi will collapse, as it is completely random, same as stockmarket crashes, wars and any other mass social movement.

Sorry not sorry about your future loss.

@maltusim – stock price crash’s aren’t random. There are lots of warnings.

@strings of purls – doubt there will be any loss but if there is so be it. I put in money I was prepared to lose. Plus pulled in the next 45 days and then my money is gone. It just won’t happen.

I’ll keep you posted.

Elon musk tweets come without warning.

The chinese ban on profit-based private education came without warning.

Evergrande making an interest payment or not is a surprise at this point.

You’re just showing more of that lack of fiduciary sense to try implying you can “See when it’s gonna fail”.

Stock market crashes are not predictable. Yes, there can be signs but nobody can time them.

What is absolutely predictable is that a ponzi will collapse.

Are you saying that you cannot presently withdraw your original investment or any funds?

Every stock market crash in history has taken the majority of investors by surprise.

Oh, it’s easy to point out the “signs” everyone missed before the crash, but only in hindsight.

Anyone claiming to be able to reliably predict stock market swings is running a scam.

@yo, you get small amount released each day. This increases based on referrals and rebuys. I can’t withdraw each day but there are fee’s associated to transfer it to their coin called MOF.

@antimlm, you cant pinpoint exact timing of market crash but there are always technical indicators that give warnings to get out or reduce holdings.

I’m not talking pull backs I’m talking proper crashes which take out 20% of the S&P. There has only been around 3 In the last decade or so and a lot of technical weakness built before this.

I have no experience of Ponzi scheme until this one but can’t see them pulling the plug when they guest speakers in a big crypto conference in December. This will go in to next year at least.

@amos n Andy – you’re an idiot.

This is what is posted on WhatsApp group whenever somebody gets a new rank.

I see a number of people are reporting withdrawal requests being cancelled.

Also no MOF withdrawals from platform from 26 Nov due to asset split and move to TRC20 network. Withdrawals to commence again in December, but no actual date.

Could this be the beginning of the end……..

Could be an attempt to prevent the inevitable December cash out.

As Ponzi schemes get bigger December becomes more dangerous for them.

A lot of people are cashing out what they can before the 26th though. They have said they expect deposit and withdrawal functionality to return Dec 3rd.

I don’t think there’s anything this. Will just mean less fees to withdraw.

If you can consistently predict when stock prices will crash, why are you messing around with little flea MLM scams when you could get rich in no time by shorting shares?

How clever you are. Why waste time calling me names when you could be making a killing in every stock market in the world?

Could be over…. according to a member of the Now What group they may be about to do a name change to Hyperverse and accounts said to be down…

I have money in this please keep me informed as you get more intel on this hyperfund organization.

Also if you know how to get out without loosing $$ let me know! I appreciate it ..thank you✌️♥️

FROM COMPLIANCE TODAY:-

This all but confirms the name-change is related to regulatory action.

Ponzi schemes only change their names for two reasons:

1. They collapse (HyperCapital –> HyperFund)

2. Regulators start sniffing around and/or banks get suspicious

Sure. The way to get out without losing $$ is to walk away and forget about the money. Then avoid any more get rich quick schemes.

Sever contact with whoever conned you into this and change your phone number, email or any other contact details that you used in relation to HyperFund: these are now on a suckers list.

This will stop you losing any money in recovery scams, pointless legal action, or further Ponzi schemes.

The money you put into HyperFund is already lost.

That comment from A a few weeks ago about how HyperFund has at least a few more months to run sure has aged well, hasn’t it?

What do you expect from someone who doesn’t know plurals from possessives?

Only a proper cunt would point to grammar mistakes to help their arguments. People are still withdrawing so I wouldn’t get too cocky yet.

It will collapse eventually then you Amos_N_Andy can continue to be a smug little worm. You’re as bad as them.

And you are still a Ponzi pimp trying to assuage your conscience knowing you are stealing money from others.

Only a proper Ponzi pimp would defend stealing from others. Sounds like someone has a guilty conscience. Sucks being you doesn’t it.

HyperPonzi has already collapsed…just saying…

Yeah yeah go cry in your pillow.

Only thieving douches knowingly join scams and withdraw as much as possible so run along guiltmonger, nobody cares how you make yourself sleep at night.

Yes it will. Because it is a scam. And you are a fucking asshole scammer.

Kalpesh Patel deleting HyperFund marketing videos. Ruhroh…