HyperFund appoints Compliance Officer to bury securities fraud

A marketing video reveals the appointment of Helen Hope as HyperFund’s Compliance Officer.

A marketing video reveals the appointment of Helen Hope as HyperFund’s Compliance Officer.

As opposed to registering HyperFund with the SEC and providing audited financial reports, Hope’s job is to bury evidence of securities fraud.

Hope’s appointment was made public in a Q&A video hosted by HyperFund investor Albert ‘Alby’ Koster (right).

Hope’s appointment was made public in a Q&A video hosted by HyperFund investor Albert ‘Alby’ Koster (right).

Early on in the video Koster discloses that he “normally avoids compliance”. This is because Koster, in his own right, is a long-term serial scammer.

Koster, a resident of Australia, first appeared on BehindMLM as a promoter of the Dubli pyramid scheme.

Koster was also a Karatbars promoter.

Karatbars was a pyramid scheme turned failed crypto Ponzi scheme.

Koster appears to have gotten involved with HyperFund after Karatbars’ collapse last year. Koster is part of the “Team Final Destination” downline.

Koster was recruited into HyperFund under Dean Hines (right), another Australian scammer dating back to Dubli.

Koster was recruited into HyperFund under Dean Hines (right), another Australian scammer dating back to Dubli.

Koster introduces Hope Hill as someone who has

[1:55] worked in compliance for more than a decade. And she was brought on board by HyperFund to tackle the challenging compliance issues that the project is facing.

I tried to look up Hill’s employment history and came up blank. She doesn’t appear to have a digital footprint of professional history available.

Koster goes on to reveal Hill is a US affiliate “building HyperFund” herself. That seems to be her only connection to the company.

Later in the video Hill states she’s been involved in a number of companies that can’t operate in the US.

[16:46] I’ve been in network marketing for over thirty years. Okay?

I have been very successful and have lost hugely. Like you mentioned, a lot of us are jaded and I was introduced to HyperFund before it even launched and I just couldn’t. I couldn’t.

I didn’t have one speck of emotional energy left to look at one more opportunity. I just couldn’t.

Sounds like Hill was burnt out on fraudulent schemes. At least temporarily.

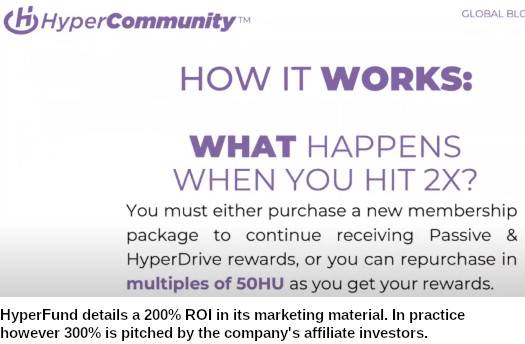

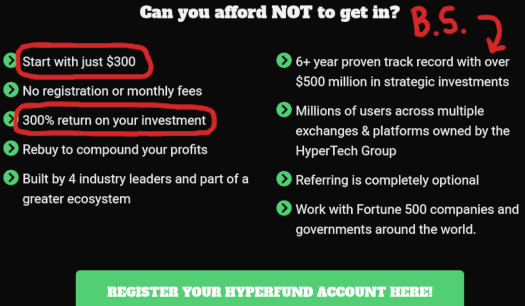

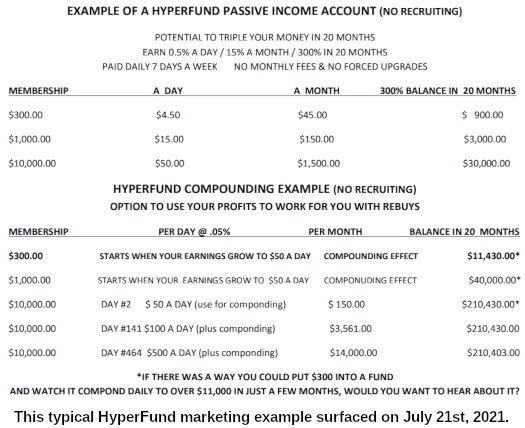

HyperFund’s compliance elephant in the room is that it’s a passive investment opportunity, primarily being promoted to and soliciting investment from US residents.

At the time of publication HyperFund has an Alexa rank of 12,427, placing it among the largest MLM Ponzi schemes today.

As estimated by Alexa, 43% of that website traffic originates from the US.

HyperFund isn’t registered with the SEC, potentially putting it in the crosshairs of the world’s most active securities regulator.

Hope Hill’s approach to compliance is the routine “deny our investment scheme is an investment scheme”.

[7:02] There’s two potential regulatory bodies that oversee entities like HyperFund.

One would be, here in the United States, it would be the SEC. And there are similar regulatory bodies everywhere in the world.

One of those “similar regulatory bodies” is the UK’s FCA, who issued a HyperFund securities fraud warning back in April.

[7:20] That would be for an investment product, mmkay?

If we were offering deposit accounts with interest, if we were offering bonds, or any investment product at all, then HyperFund would have to be registered to offer a financial product.

Anyone that shared it, um, would need to be registered as a financial advisor, or investment advisor or something like that.

Obviously we are not and so we don’t qualify to be regulated by entities like the SEC.

As someone who’s reviewed HyperFund’s business model, I can categorically state an “investment product” is exactly what HyperFund has.

Affiliates sign up, invest in HU points, park those points with HyperFund to receive a passive return (paid in HU points), and then cash out HU points – withdrawing subsequently invested funds.

You can add whatever hoops to jump through and crypto jargon terms to it – that’s HyperFund’s business model.

When Hope comes across content marketing HyperFund for what it is, a passive investment scheme, she “reaches out” to “remove the negative”.

[6:50] This is the best way to present what we have here, so we are in compliance with the laws that govern what HyperFund is.

In effect this is meaningless pseudo-compliance, burying HyperFund’s securities fraud as opposed to addressing it.

Most MLM Ponzi schemes sued by the SEC has exhibited some form of this behavior (Zeek Rewards, TelexFree, BitConnect etc.).

Typically compliance concerns appear towards the end of a larger Ponzi schemes.

The idea is to create the illusion of a Ponzi scheme trying to rein in fraud. Time and time again we’ve seen pseudo-compliance efforts don’t work.

If anything they provide regulators with more ammunition for use in their lawsuits (masking fraudulent activity is fraud in and of itself).

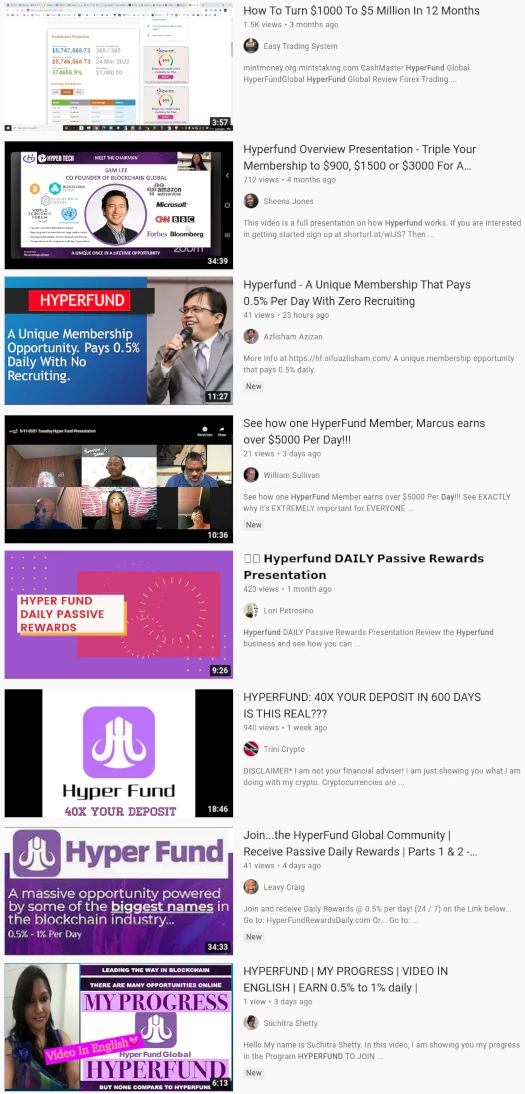

Emphasizing HyperFund’s pseudo-compliance efforts is Hope Hill’s claim she has “a spreadsheet of about ten thousand and growing websites, social media, YouTube videos”.

These are supposedly examples of HyperFund being promoted as an investment opportunity.

Seeing as that’s what HyperFund is, these examples aren’t hard to find.

Having dismissed the need for HyperFund to register its passive investment opportunity with the SEC, Hope turns to the FTC.

[8:03] What does govern what HyperFund does, is regulatory agencies like the Federal Trade Commission, mmkay?

They look at what we have here with HyperFund and put it in the category of network marketing companies.

Now there are vast differences between HyperFund and almost every other network marketing company that’s ever been in existence.

However, legally, we are under the umbrella of network marketing companies. So therefore we have to comply with their rules.

“Their rules” would see the FTC classifying HyperFund as a pyramid scheme.

As per HyperFund’s business model, nothing is being marketed or sold to retail customers. Everyone in HyperFund is an affiliate investor feeding the Ponzi scheme.

Rather than address this, Hope Hill offers up a remarkably incriminating diversion;

[8:36] When you look at the Service Agreement, that document … was drafted by the founders and their legal counsel, along with sitting down with a couple of attorneys from the Federal Trade Commission in the US, and legal counsel for regulatory agencies in two other jurisdictions.

Regardless of what’s in HyperFund’s Service Agreement, I can categorically state no FTC attorney helped them draft it. US regulators do not approve companies or help them set up compliance.

[9:09] They sat down and they drafted this document, that would make the HyperFund rewards plan absolutely legal in every jurisdiction in the world.

Implying, or outright stating it as Hope does here, that US regulators signed off on a business is a major regulatory no-no.

The main reason for this is because scammers who imply cooperation or approval with regulators, then dupe consumers into participating in fraudulent schemes based on these representations.

Well if the SEC and FTC signed off on Hyperfund, I guess it must be legit!

And of course that’s exactly what Albert Koster does next.

[11:27] Probably the first thing everybody does when we present the HyperFund opportunity, is they do their Google search and they come back with all the scam reports.

And it’s so lovely to hear that these things actually happened on the ground. That, as you said, attorneys for the HyperFund or the HyperTech group get together with the FTC, they sit down, and they draft out that Service Agreement.

That’s a real thing. You’re the real deal. This is not something that has just been set up with smoke and mirrors.

Indeed.

Update 1st August 2021 – “Hope Hill” doesn’t have a digital footprint is because it is indeed an alias.

Earlier today BehindMLM outed Hill as Ronae Jull. As far as we can tell, Jull doesn’t have a history in MLM compliance as claimed.

Update 29th May 2022 – Turns out Ronae Jull is a convicted felon.

In 1998 Jull was indicted on multiple counts of fraud related to… wait for it, running a Ponzi scheme.

Favorite part:

Except she literally just confirmed that’s “what this is”. Invest a shit ton into HyperFund, recruit a shit ton of victims under you and make $100,000 this year.

Y’know, like any MLM Ponzi scheme.

Anyone got intel on Hope Hill? I’ve never heard of her and she appears to be small fish.

Seems to be well-versed in Ponzi pseudo-compliance. I’d be very surprised if she doesn’t have a few scams under her belt.

Also hearing Ryan Xu has fled to Dubai (because of course he has).

MLM + Dubai = scam.

Surely it would be a simple matter to contact the FTC to confirm whether any of their attorneys helped to draft the service agreement?

If they didn’t, then I’m sure the FTC would be interested to know about this video.

I love it when scammers can’t keep their story straight. They claim they created their company from the get-go to be “absolutely legal,” with the help of a couple of pretend attorneys from the FTC, but now they need

Sure, makes sense.

I also love how they describe their cookie-cutter, we’ve-all-seen-it-a-thousand-times-before, shit-token pyramid/Ponzi scheme as having “vast differences [against] almost every other network marketing company that’s ever been in existence.” Uh-huh.

[Oz, “reign in” slipped into this article, I’m afraid. I saw the same typo in an NPR article the other day, so you’re in good company.]

Argh that one’s such an easy mistake to make. Thanks for catching it.

I was coerced and conned into giving my inheritance to Alby Koster, he had spent years grooming my family – I haven’t seen the money and Alby refuses to reply my correspondence.

It’s broken me. I’m disabled and find it hard to get a job and I live in absolute poverty.

There is no justice. My husband got me to make a bank cheque and he handed it over. He then divorced me.

It’s so wrong. There should be justice.