AdverWorldwide Review: $79 matrix positions

There is no information on the AdverWorldwide website indicating who owns or runs the business. The company does provide a corporate address on all website pages, pointing to an address in the US state of Delaware.

The address provided, “2915 Ogletown Road, #1930 Newark, DE 19713 U.S.A”, appears to be a private residence, despite the presence of an office suite number:

The AdverWorldwide website domain (“adverworldwide.com”) was registered on the 13th of May 2013, however the domain registration is set to private.

A “business presentation” available on the AdverWorldwide website names a Sill Sanders as the CEO of the company:

This corresponds with the “Sanders Sill” name provided for the “AdverWorldwide” YouTube account, used to upload AdverWorldwide marketing videos.

The Twitter account “@AdverWorldwide” also uses the same name.

Outside of AdverWorldwide I was unable to find any further information on Sill Sanders.

Read on for a full review of the AdverWorldwide MLM business opportunity. [Continue reading…]

Changes Worldwide Review: $25,000 revenue sharing

There is no information on the Changes Worldwide website indicating who owns or runs the business. On the Changes Worldwide Facebook page a corporate address in the US state of Florida is provided, indicating this is where the company is based.

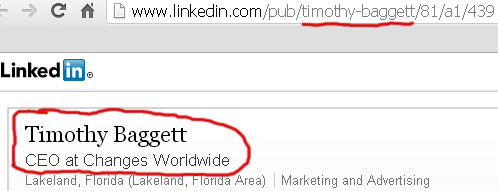

The Changes Worldwide website domain (“changesworldwide.net”) was registered on the 12th of September 2013 and lists a “Timothy Baggett” as the owner. On his LinkedIn profile, Baggett credits himself as the CEO of Changes Worldwide:

On his blog called “The Turn-Key System”, Baggett provides a brief history of his MLM experience:

My name is Tim and I am A MLM junkie. It seems like I have tried every MLM program from this planet (and some beyond) every time absolutely sure that I was on to something big.

I would join. jump in with both feet and try to get everybody and their grandma to join the “NEXT BIG THING.”

Yea, I was that guy that everyone ran from at family reunions (weddings, banquets, sporting events, funerals….ect) and what was so bad is my enthusiasm attracted people to my business opportunity the first 3 or 4 times but after the 17th, well you get the picture.

Circa 2010 Baggett was an affiliate with Lightyear Wireless, regularly appearing in the company’s top ten “sales performers” lists.

When Baggett left Lightyear Wireless is unclear, but he published an article on IBOSocial back in March of this year titled “10 Reasons I Joined Bids That Give”.

Bids That Give (now BTG180) is modelled on the Zeek Rewards Ponzi points compensation plan. In addition to the standard affiliate-funded revenue sharing and penny auction platform combination, Bids That Give added a charity element to the business model.

In his article Baggett writes

With BTG there are no selling or recruiting requirements, we are not a pyramid.

Of additional note is the involvement of Wayne Caraway, who credits himself as Changes Worldwide’s Chief Operating Officer on his Facebook profile:

Caraway was also previously involved in Bids That Give, and in a blog post titled “Bids that give review (why I chose BTG)” shares his experience with the company:

It came as a shock to a lot of people when I decided to give up traditional network marketing and join a new business.

I’m not bragging but many different reps from many different companies had been trying to recruit me for a long time with no success, the one thing that seemed to be common knowledge was, Wayne wouldn’t move.

So why did I decide to jump ship?

It’s really quite simple……… The Money!

Though I had done well, recruited quite a few reps and was happy with the paycheck, I got introduced to a concept that totally changed my way of thinking.

Private revenue sharing and daily pay!

You get rewarded or paid for recruiting others into the business…I can make money two ways with BTG by recruiting a ton of reps which I think is smart and all affiliates should be doing it. Or I can just recruit two, purchase some wholesale bids and take part in the daily payout,

Some have compared Bids that give to Zeek rewards and have concerns that the FTC will close Bids that give down.

Lets talk about that for a minute. yes Zeek turned out to be an illegal business but…BTG has made the necessary changes to the comp plan to not only make it stronger but to make it legal. Everything has been submitted to the FTC.

The reason I got involved in the home based business arena wasn’t for the products or perks, it was for the money. So to reiterate why I chose to join BTG…….ITS THE MONEY!!!!

Whether or not Baggett and Caraway are still actively involved in Bids That Give is unclear.

Read on for a full review of the Changes Worldwide MLM business opportunity. [Continue reading…]

Ads Davao Review: $2 adpack investment scheme

There is no information on the Ads Davao website indicating who owns or runs the business.

The Ads Davao website domain (“adsdavao.com”) was registered on the 19th of August 2013, listing a “Enrico Villanueva” as the domain owner. An address in the Philippine province of Devao del sur is also provided.

I wasn’t able to find any additional information on Enrico Villanueva on the MLM side of things. Given that Enrico Villaneuva is also the name of a well-known Filipino professional basketball player, I’m treating the use of the name as suspect.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Liberty Reserve founder guilty of money laundering

Since it was founded in 2006, Liberty Reserve was a widely used ewallet payment processor for a multitude of MLM companies. On their website, the payment processor professed it was

Since it was founded in 2006, Liberty Reserve was a widely used ewallet payment processor for a multitude of MLM companies. On their website, the payment processor professed it was

the oldest, safest and most popular payment processor … serving millions all around a world.

And indeed Liberty Reserve was just that, until it was shutdown back in May for money laundering.

In a joint operation between Costa Rican, Spanish and US authorities across no less than 17 countries, the company was shutdown following an investigation that revealed money was being pumped into the processor to be laundered.

Liberty Reserve is alleged to have been used to launder more than $6 billion in criminal proceeds during its history.

In the aftermath of the shutdown Liberty Reserve’s co-founders and operators were apprehended and now face criminal charges.

The first of those cases to be resolved is that of Liberty Reserve co-founder, Vladmir Kats, who plead guilty to ‘money laundering and operating an unlicensed money transmitting business‘ on Thursday.

“Vladimir Kats, by his own admission, helped to create and operate an anonymous digital currency system that provided cybercriminals and others with the means to launder criminal proceeds on an unprecedented scale,” said Acting Assistant Attorney General Mythili Raman.

“As a co-founder and operator of Liberty Reserve, Vladimir Kats served as a global banker for criminals, giving them an anonymous, online forum to hide the proceeds of their illegal and dangerous activities,” said U.S. Attorney Preet Bharara.

“With his guilty plea today, we take a significant step toward punishing those responsible for creating and running this international den of cybercrime.”

The case and charges against Kats’ co-defendants, namely the other co-founders and operators of Liberty Reserve, are still pending.

Interestingly enough a few weeks ago now I received an unsolicited email from payment processor International Payout Systems (i-Payout), defending their taking on the MLM company TelexFree as a client. [Continue reading…]

Ocean Ave vs Visalus: Espionage, hacking & threats

Coercion, entrapment, extortion, blackmail, espionage, hacking, personal threats, racketeering, corruption… not the sort of stuff one would usually associate with the MLM industry but rather it’s what you typically might see in an action packed spy movie.

Yet in the battle between Ocean Avenue and Visualus, all of the above have taken front and centre stage – in what is easily the most alarming MLM showdown I’ve written about yet.

The bad blood between Ocean Avenue and Visalus revolves, not surprisingly, around the leaving of affiliates from Visalus to go join Ocean Avenue. This in itself is nothing new with plenty of MLM affiliates and companies locking horns over the years whenever the issue comes up.

What is most startling about Ocean Avenue’s case against Visalus though is the levels Visalus sunk to in the war they waged. [Continue reading…]

Chinese protesters demand Hong Kong MLM regulation

Barring and unforeseen last minute entrants, 2013 will undoubtedly go down as a the year the MLM industry’s underbelly ruthlessly targeted both China and South America.

Whereas efforts by South American regulators over the past few months have finally begun to stem the tide of thinly veiled Ponzi schemes masquerading as legitimate MLM companies, over in China, specifically Hong Kong, things have been comparatively quiet.

In the face of several Hong Kong based schemes that are increasing in both exposure and scope, Chinese citizens who feel cheated by one particular company have taken to the streets. [Continue reading…]

EOW arrest state kingpin in ongoing Speak Asia case

Despite the assertion that Indian regulatory agencies are sitting on their hands as the December deadline to file a chargesheet in the Speak Asia Ponzi fraud case approaches, evidence that their investigations are still very much open continues to surface.

Following the granting of anticipatory bail just over a week ago to Speak Asia panelist and public spokesperson Aman Azad (alias Vivek Sharma), it was unclear how the authorities were going to proceed in the case.

At the time I opined;

Sounds like they’ve already gotten what they need then.

From memory the EOW didn’t bother responding to 383 either until the cronies got sand in their vaginas about it. And even then it turned out to be a complete waste of time.

I’m guessing today’s showing was probably more out obligation than anything. Six months without interrogation indicates they’ve moved up the Manoj Kumar foodchain.

And with the revelation of three new arrests in the case, sounds like I wasn’t too far off the mark. [Continue reading…]

Craddock to reveal “really good” rev-sharing opp

Whether pegged to penny auctions, third-party travel affiliate deals, advertising credits, ebook libraries, health and nutrition products, casinos or what have you, for the most part the MLM “revenue-sharing” niche is dead.

Bar a few offshore companies based out of Hong Kong still taking affiliate investments, every other revenue-sharing based MLM company has either collapsed, stalled or voluntarily shut themselves down.

The reason for this of course is the SEC shutdown of Zeek Rewards, which pretty much cemented that the offering of revenue-sharing points in exchange for money, regardless of how it was described, boiled down to nothing more than a Ponzi scheme.

Under the MLM revenue-sharing model affiliates pump money into the scheme under a variety of guises, with affiliates who have previously deposited money into the scheme receiving a share of this money, typically by way of a daily payout (ROI).

Retail is usually attached to the model, however if affiliates are able to fund themselves is a negligible source of revenue, regardless of the product or service the opportunity attaches itself to.

On the rare few occasions a company has prevented affiliates from funding their own points, we’ve seen a general lack of interest from the industry and subsequent stalling (lack of revenue to pay out to those that participate) or outright failures (a previous incarnation of Bidify that was quickly dropped comes to mind).

Despite all of this however there are those that would have you believe the model is still viable.

The catch?

Secret patents that will provide ‘the right combination of legal and excitement‘, and also protect ‘protect the hard work, legal dollars and teams that have invested so much‘ into the model. [Continue reading…]

KingUni Review: $100 to $1999 mobile gaming?

There is no information on the KingUni website indicating who owns or runs the business, with the company only disclosing that it’s a

joint-venture with investors from China, South Korea, and the United States.

A corporate address is provided on the KingUni website, indicating that the company is registered in the US state of Nevada.

Interestingly enough the address provided (“3131 Las Vegas Blvd. South, Las Vegas, NV”), is that of the Wynn Las Vegas and Encore Hotel. No mention of KingUni is made anywhere on the Wynn Resort website, nor do they list any leasable office space (virtual or otherwise), so why KingUni are using their address on their website is a mystery.

Two additional corporate addresses are provided on the KingUni website, one in Shenzen China and the other Seoul Korea.

Both addresses however are marked “coming soon”.

The KingUni website domain (“kingunimobile.com”) was registered on the 23rd of August 2013, and lists a “Lee Jong Jin” as the domain owner.

I wasn’t able to find any further information on Lee Jong Jin, other than he or she appears to be based out Korea. The email address used to register the KingUni Mobile domain is a Korean-language domain, with the KingUni Mobile website itself being hosted out of Korea.

With the information that is currently known, Lee Jong Jin’s relationship and/or position within KingUni is unclear.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Lawyers Barnett & Linn ok’ed WCM777 profit points?

On their website legal firm Barnett & Linn list one of their practice areas as ‘SEC Compliance‘.

William Barnett and Roger Linn have each been representing business clients for over 30 years. Together they bring a wealth of experience and extensive knowledge to achieve efficient and practical solutions to their clients.

Barnett & Linn specialising in SEC compliance and the fact that they are based out of California, are likely the primary reasons WCM777 founder Xu Ming approached the firm for legal consultation.

Turns out Ming himself wasn’t sure if WCM777’s “Profit Points” compensation plan component would be seen as an unregistered security by the SEC.

In addition to offering affiliates a 100 day passive ROI on investments of up to $1999 and recruit commissions for bringing new investors into the scheme, WCM777 also offered affiliates what they called “Profit Points”.

Taken from the BehindMLM WCM777 review:

Profit Points are issued with each membership position purchase, with WCM777 claiming that the points ‘will be turned into stock when WCM goes public on NASDAQ‘.

In addition to points generated on the purchase of membership positions, 20% of all WCM777 affiliate’s earnings are held by the company “to purchase profit points” with.

Despite appearing to have “unregistered security” written all over it (points awarded on the expectation of future profit via the company going public), when approached for legal advice Barnett & Linn thought otherwise. [Continue reading…]