Liberty Reserve founder guilty of money laundering

Since it was founded in 2006, Liberty Reserve was a widely used ewallet payment processor for a multitude of MLM companies. On their website, the payment processor professed it was

Since it was founded in 2006, Liberty Reserve was a widely used ewallet payment processor for a multitude of MLM companies. On their website, the payment processor professed it was

the oldest, safest and most popular payment processor … serving millions all around a world.

And indeed Liberty Reserve was just that, until it was shutdown back in May for money laundering.

In a joint operation between Costa Rican, Spanish and US authorities across no less than 17 countries, the company was shutdown following an investigation that revealed money was being pumped into the processor to be laundered.

Liberty Reserve is alleged to have been used to launder more than $6 billion in criminal proceeds during its history.

In the aftermath of the shutdown Liberty Reserve’s co-founders and operators were apprehended and now face criminal charges.

The first of those cases to be resolved is that of Liberty Reserve co-founder, Vladmir Kats, who plead guilty to ‘money laundering and operating an unlicensed money transmitting business‘ on Thursday.

“Vladimir Kats, by his own admission, helped to create and operate an anonymous digital currency system that provided cybercriminals and others with the means to launder criminal proceeds on an unprecedented scale,” said Acting Assistant Attorney General Mythili Raman.

“As a co-founder and operator of Liberty Reserve, Vladimir Kats served as a global banker for criminals, giving them an anonymous, online forum to hide the proceeds of their illegal and dangerous activities,” said U.S. Attorney Preet Bharara.

“With his guilty plea today, we take a significant step toward punishing those responsible for creating and running this international den of cybercrime.”

The case and charges against Kats’ co-defendants, namely the other co-founders and operators of Liberty Reserve, are still pending.

Interestingly enough a few weeks ago now I received an unsolicited email from payment processor International Payout Systems (i-Payout), defending their taking on the MLM company TelexFree as a client.

i-Payout’s announcement came on the back of fellow ewallet provider Global Payroll Gateway dumping TelexFree just a few short months after establishing payment processing services for them.

Whilst no official reason has to date been published explaining why Global Payroll Gateway (GPG) suddenly dropped their support of TelexFree, on their website the payment processor advise they

use “government insured trust accounts” and “work with” Visa.

GPG maintains strict accordance with the USA Patriot act and a wide variety of other international financial regulatory and banking regulations.

GPG is very careful to follow all international regulations and laws concerning Anti-Money Laundering, Identity Protection and Payroll in general.

After months of investigations by Brazilian authorities and the denial of fourteen appeals, TelexFree are currently facing pyramid scheme charges in Brazil. Public Prosecutors from the Brazilian state of Acre have previously announced that in addition to TelexFree being a pyramid scheme, charges of money laundering and embezzlement are also pending.

Public Prosecutors in Acre have already submitted over 40,000 pages of evidence against TelexFree to Judge Thais Borges, who after reviewing the evidence will then decide what happens next in the case.

Despite using the same business model globally however, that being the depositing of money by affiliates on the promise of a $20 a week ROI for 52 weeks (paid out of newly deposited money), i-Payout insist that TelexFree is ‘compliant with all US laws‘.

Seemingly, despite TelexFree being owned and operated by the same three owners globally, i-Payout believe they’re able to wash their hands of any wrongdoing by claiming to

reiterate that i-payout™ has never worked with the TelexFree organization in Brazil and has never offered any of its services to TelexFree in Brazil.

In the aftermath of the granting of an injunction that prohibited TelexFree in Brazil from signing up new investors or paying out ROIs, affiliates of the company began marketing workarounds, advising their downlines and new prospective affiliate investors to sign up using US accounts.

The transferring of funds of Brazilian affiliates into US-based accounts aside, if the charges in Brazil stick, with TelexFree’s Brazilian operations owned by the same people, it also stands to reason i-Payout’s systems would have seen some Brazilian funds passed through it.

When I pointed all of this out to i-Payout in response to the emails they sent me, they just brushed it off:

Thank you for getting back to us. We appreciate and respect your opinions. As we have stated before, we would love to be a resource for you in relation to any and all factual information as it relates to i-payout.

Feel free to reach out to us with any further questions regarding i-payout.

As it stands, i-Payout’s approach to TelexFree appears to be “bury our heads in the sand and hope for the best”.

Now granted being shutdown in the US following a join investigation by ‘the Secret Service, the Internal Revenue Service-Criminal Investigation and the U.S. Immigration and Customs Enforcement’s Homeland Security Investigations, with assistance from the Secret Service’s New York Electronic Crimes Task Force‘, as Liberty Reserve was just a few months ago might be on the extreme end of the money laundering scale, there’s still considerations to be taken into account if things don’t come to that.

NxPay is a payment processor who provided ewallet services to Zeek Rewards. Following the shutdown of Zeek Rewards by the SEC, which revealed it to be a $600M Ponzi scheme, here’s what happened to NxPay:

In addition to their business tanking, hundreds if not thousands of NxPay’s customer accounts were frozen as regulators waded through the aftermath of months of NxPay also turning a blind eye to their clients’ business model.

Even today, fourteen months after Zeek Rewards was shutdown NxPay’s problems persist. In a third quarter update by the Zeek Rewards Receivership, published just yesterday, Kenneth Bell wrote

During the third quarter, the Receiver continued to investigate the extent to which there are any recoverable funds from the Receivership Defendant’s former e-wallet vendors.

Specifically, the Receiver has been working with the USSS to investigate and secure additional Receivership Assets connected to NxPay and LST transactions from their accounts at Four Oaks Bank. These funds include $5.2 million in improper credit card chargebacks and fees paid out after the August 17, 2012, Freeze Order issued.

In addition, the Receiver Team has persisted in its efforts to recover approximately $10 million from Payza and to confirm whether SolidTrustPay holds any additional Receivership Assets.

Payza and SolidTrustPay are two additional ewallet providers who also turned a blind eye to Zeek Rewards’ Ponzi activities.

NxPay and the other e-wallet companies used payment processors and banks to complete transactions , and liability for improper payments on chargebacks after August 17, 2012 is still being determined by the Receiver.

Should the Receivership determine liability as per the above statement, it is important to note from a business perspective that it is the payment processor who will be held liable, not the customers they transferred the funds to (with that money likely being long gone in anycase).

But of course none of that concerns i-Payout, because they’ve conducted ‘complete due diligence on TelexFree‘ and decided the company is ‘compliant with all US laws‘.

With their largest affiliate investor source in Brazil blocked by court order, TelexFree have recently stepped up their global marketing efforts. Tomorrow the company has scheduled an “extravaganza” to be held in Florida, during which the TelexFree will reward existing affiliates, and hope to lure new investors on board with promises of a “glamorous gala dinner” and Mercedez Benz and Apple iPad and Macbook “prizes”.

Meanwhile TelexFree’s non-Brazilian affiliates (including those based out of the US), continue to bombard the internet with marketing spiels promising “guaranteed weekly income”, “everyone gets paid” and “weekly pay” – all uploaded within the past week:

Those last few listings are of particular note as it was only just over a week ago that the SEC published an investor alert, advising investors to

be wary if you are offered compensation in exchange for little work such as making payments, recruiting others, and placing advertisements.

The SEC advise that amongst other things, the promise of getting paid to post advertisements is ‘a hallmark of a pyramid scheme‘.

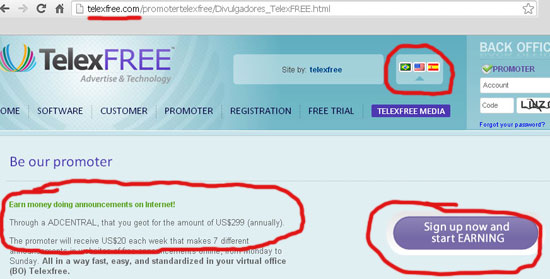

And let’s not forget, it was only a short while ago TelexFree themselves were marketing their investment scheme as such:

But again, none of that matters to i-Payout because they’ve conducted ‘complete due diligence on TelexFree‘ and decided the company is ‘compliant with all US laws‘.

I’ll finish up by leaving you with this statement from Acting Assistant Attorney General Mythili Raman, issued shortly after Vladmir Kats plead guilty to money laundering charges yesterday:

(Kats’) conviction reinforces what we said when Liberty Reserve was first brought down: banking systems that allow criminals to conduct illegal transactions anonymously will not be allowed to stand, and professional money launderers will be brought to justice.

Sounds heavy but hey, as long as ewallet payment processors continue to see no Ponzi, hear no Ponzi and speak no Ponzi, then there’s probably nothing to worry about…

According to the indictment, before being shut down by the government in May 2013, Liberty Reserve had more than one million users worldwide, including more than 200,000 users in the United States, who conducted approximately 55 million transactions through its system and allegedly laundered more than $6 billion in suspected proceeds of crimes, including credit card fraud, identity theft, investment fraud, computer hacking, child pornography, and narcotics trafficking.

…right?

The only reason I see for US authorities not investigating i-payout and TelexFree yet is simply because TelexFree is small in the US. Check Google Trends info on the term “TelexFree”:

http://www.google.com/trends/explore?q=telexfree#q=telexfree&geo=BR%2C%20DO%2C%20PT%2C%20US&date=today%2012-m&cmpt=geo

Currently, Dominican Republic is the country with most searches. Portugal and Brazil are tied in second. Unfortunately, searches in the US are negligible when compared to the peak reached in Brazil.

(By the way, TelexFree claims to work in the US for almost 10 years before reaching Brazil, and they say they’re ROCKING USA. Google Trends says the opposite.)

I hope one day TelexFree might reach 4 or 5 in that graph. Maybe it will be enough for SEC to investigate i-payout and shut down both.

Looks like Arthur Budovsky (creator of Liberty Reserve) is heading to the US to be prosecuted:

Love the psuedo-compliance BS. “But I sold my shares guv. I ‘ad nufink to do with all that fraud, ‘onest!”.

Feel free to appeal away, but it’s pretty obvious this guy’s going to wind up in a cell.

http://money.cnn.com/2014/02/21/news/liberty-reserve-budovsky/

Nailed.