TelexFree claim Homeland Security & SEC are lying

![]() When news broke that TelexFree’s Chief Financial Officer had been caught trying to escape with management’s retirement funds, the evidence the FBI presented in court was pretty conclusive.

When news broke that TelexFree’s Chief Financial Officer had been caught trying to escape with management’s retirement funds, the evidence the FBI presented in court was pretty conclusive.

Filed in a Massachusetts District Court on April 16th, Scott Stanley, an attorney with the SEC filed the declaration of John Soares, a special agent with the Department of Homeland Security.

Soares’ declaration details the attempted escape of Joseph Craft, aforementioned TelexFree CFO, and covers what went down when HSI and a number of other agencies raided TelexFree’s offices last week:

During the exercise of the search warrant, a Bristol County Deputy Sheriff encountered Joseph H. Craft, the Chief Financial Officer of TelexFree, entering an office and attempting to grab a laptop and bag.

Craft stated that he was a “consultant” helping TelexFree prepare for bankruptcy and that the laptop and bag were personal items.

The Deputy Sheriff told Craft he could not take the laptop and bag and that these items were subject to search.

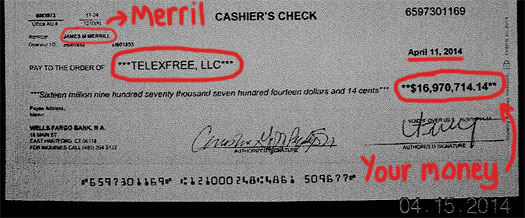

HSI agents searched the bag and identified ten Wells Fargo bank, N.A. cashier’s checks totaling $37,948,296.

Included in the court-filed declaration, viewable over at the Boston Globe, are photos of all the checks the agents found.

This declaration was filed in support of the SEC’s ex-parte emergency motion for a temporary restraining order (TRO) against TelexFree, which was granted the same day.

Now, in response to the filing, TelexFree are accusing the Department of Homeland Security, the SEC and a Bristol County Deputy Sheriff of lying. [Continue reading…]

TelexFree bankruptcy hearing continued on Monday

![]() I’m seeing a whole bunch of crazy information getting pushed out there by TelexFree affiliates about the next tax hearing date. Dates in late April and May are all over the place, and many are citing some list of nine things that are apparently to be discussed.

I’m seeing a whole bunch of crazy information getting pushed out there by TelexFree affiliates about the next tax hearing date. Dates in late April and May are all over the place, and many are citing some list of nine things that are apparently to be discussed.

Meanwhile in reality, a single Judge has signed the order for a continuance of the motion, to be held on Monday April 21st. That’s it, so take any additional information with a dumptruck full of salt (such as five judges voting on anything…etc). [Continue reading…]

SEC granted TRO against TelexFree, hearing set

![]() Turns out the SEC don’t trust TelexFree management at all. And after the revelation yesterday that Joseph Craft lied about his position in the company while trying to make off with $37.9 million dollars, who can blame them?

Turns out the SEC don’t trust TelexFree management at all. And after the revelation yesterday that Joseph Craft lied about his position in the company while trying to make off with $37.9 million dollars, who can blame them?

The SEC pyramid scheme complaint against TelexFree was originally filed on the 15th of April, meaning it was filed on the same date as the Massachusetts Securities Division Ponzi complaint (double-whammy).

The reason we didn’t hear about it until yesterday, is because it was filed “under seal”.

Why did that happen? [Continue reading…]

TelexFree exit strategy thwarted, millions recovered

![]() As agents from the FBI, Department of Homeland Security and Immigration and Customs Enforcement burst through the door of TelexFree’s Massachusetts head office, Joe Craft looked up from his laptop.

As agents from the FBI, Department of Homeland Security and Immigration and Customs Enforcement burst through the door of TelexFree’s Massachusetts head office, Joe Craft looked up from his laptop.

“They’re early”.

Craft had been running his laptop day and night in anticipation of a raid, deleting the mile-long paper trail that he hoped would throw regulators off the scent.

Realizing he was out of time, Craft slammed the laptop case shut and began scooping up the checks he’d written into the black sports bag he’d kept under his desk.

This is what they’d rehearsed and early or not, it was going to work. It had to. [Continue reading…]

SEC file “illegal pyramid scheme” case against TelexFree

![]() Hot on the heels of the Massachusetts Securities Division alleging TelexFree to be a $1 billion dollar Ponzi scheme, now comes a new complaint from the SEC.

Hot on the heels of the Massachusetts Securities Division alleging TelexFree to be a $1 billion dollar Ponzi scheme, now comes a new complaint from the SEC.

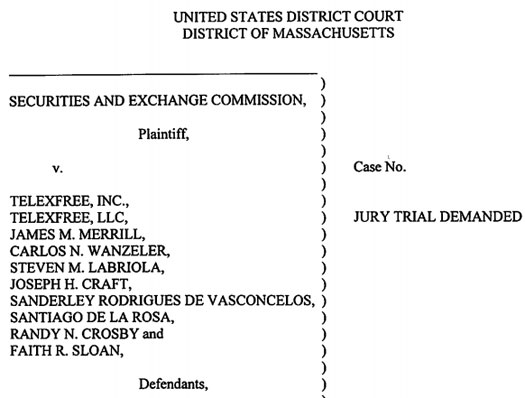

Filed on the 15th of April in a Massachusetts District Court, the SEC have named eight defendants in the case, and have grouped them into three distinct categories:

- The company – TelexFree

- Four principals (owners and employees) – James Merril, Carlos Wanzeler, Steve Labriola and Joseph Craft

- Four primary promoters – Faith Sloan, Randy Crosby, Santiago de la Rosa and Sann Rodrigues

Noticeably absent from the list is Carlos Costa, the third owner (principal) of TelexFree. [Continue reading…]

iPayout hint at TelexFree money laundering?

![]() Late yesterday we reported on iPayout disabling the ewallet services they were providing to TelexFree.

Late yesterday we reported on iPayout disabling the ewallet services they were providing to TelexFree.

Since then, some interesting developments have come to light. [Continue reading…]

Rwandan TelexFree affiliates mull legal action

![]() In contrast to US TelexFree affiliate leaders busying themselves censoring social media groups of factual information and demanding artificial positivism from those who invested under them, Rwandan Telexfree affiliate leaders are considering legal action against the company.

In contrast to US TelexFree affiliate leaders busying themselves censoring social media groups of factual information and demanding artificial positivism from those who invested under them, Rwandan Telexfree affiliate leaders are considering legal action against the company.

The news comes as yesterday Rwandan affiliates called on their government to intervene and recover losses incurred by Rwandan TelexFree affiliate investors. Estimates peg the total amount at stake is 44 billion RWF, or $65 million USD. [Continue reading…]

Will Smith used to promote Paymony?

In what is definitely one of the more bizarre attempts I’ve seen to legitimize an otherwise questionable opportunity, it would seem Paymony affiliates are trying to assert that Will Smith has joined the scheme.

In what is definitely one of the more bizarre attempts I’ve seen to legitimize an otherwise questionable opportunity, it would seem Paymony affiliates are trying to assert that Will Smith has joined the scheme.

Published on the “Unitel Association” website, the promo is titled “Will Smith in Paymony in mind and heart”, and features a photo of Will Smith with some unidentified men: [Continue reading…]

TelexFree top Ponzi pimp claims he’s a victim

![]() One of the more dangerous side-effects of making a lot of money in Ponzi schemes, is the blowback you get from your downline when the scheme inevitably collapses.

One of the more dangerous side-effects of making a lot of money in Ponzi schemes, is the blowback you get from your downline when the scheme inevitably collapses.

An old-hand at scamming people in such schemes, Sann Rodrigues, being TelexFree’s top Ponzi pimp, is arguably now in the most dangerous position of all.

His exit strategy?

“I’m a victim just like you guys!” [Continue reading…]

iPayout disable TelexFree ewallet services

![]() Just a brief update on this (working on some lengthier articles for later publication).

Just a brief update on this (working on some lengthier articles for later publication).

Earlier today TelexFree’s payment processor, iPayout, pulled the company’s ewallet services offline. [Continue reading…]