Avon fined $135 million for bribing Chinese officials

Shedding light on what the MLM industry gets up to in China, comes news today that Avon has plead guilty to conspiring to violate the Foreign Corrupt Practices Act (FCPA) and the Securities Exchange Act.

Shedding light on what the MLM industry gets up to in China, comes news today that Avon has plead guilty to conspiring to violate the Foreign Corrupt Practices Act (FCPA) and the Securities Exchange Act.

Two separate cases were filed by US regulators, one by the SEC and another the result of joint-investigation by the US Attorney’s Office, the Department of Justice and the FBI. [Continue reading…]

Millionaire Earner: “Herbalife not based on customer purchases”

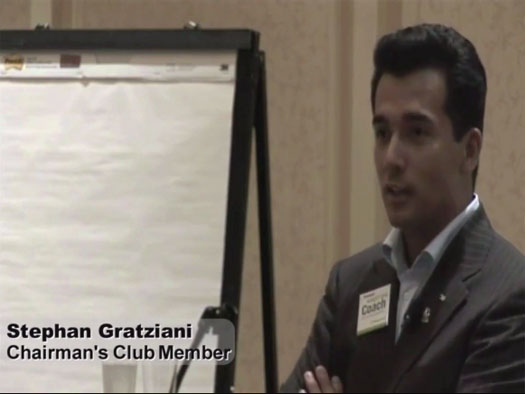

In what looks like a hotel conference room, Stephan Gratziani delivers a training presentation to a crowd of a hundred or so Herbalife affiliates.

In what looks like a hotel conference room, Stephan Gratziani delivers a training presentation to a crowd of a hundred or so Herbalife affiliates.

The Herbalife business model at this point in time is not based on customers purchasing, it’s based on distributors purchasing volume.

Several Herbalife executive managers are in the audience, including then Vice-President Mike McKee, Senior Vice-Presidents Rob Levy and Bruce Peters, and Board Member Leslie Stanford.

Yet nobody makes a move to interrupt Gratziani. Instead, with Herbalife executives sitting in the audience, he continues…

That is the Herbalife business model, that is the way it works.

Gratziani’s frank assessment of Herbalife’s business model was made during a three-hour long closed-door training presentation. The presentation was given back in 2005, the same year Gratziani made $1.75 million as a Herbalife affiliate.

Needless to say nobody knows better how Gratziani made his money that year. And from the sounds of it, it had nothing to do with the selling of Herbalife products to retail customers. [Continue reading…]

PCI collected $9.7 million from Zeek, claim to be victims

The ongoing battle between the Zeek Rewards Receivership and Plastic Cash International (PCI) has seen the Receivership demand the company return an outstanding $8.9 million in fees collected from Rex Venture Group (Zeek’s parent company).

The ongoing battle between the Zeek Rewards Receivership and Plastic Cash International (PCI) has seen the Receivership demand the company return an outstanding $8.9 million in fees collected from Rex Venture Group (Zeek’s parent company).

Plastic Cash International provided Rex Venture Group with access to payment processor services, permitting them to continue defrauding investors to the tune of $850 million dollars.

Yet despite this relationship, PCI’s involvement in Zeek was only discovered after PCI had the gall to demand lodge a claim with the Receiver in mid-2013.

In addition to the $9.7 in fees they’d already collected, Plastic Cash have since demanded a further $14.9 million in stolen investor funds.

Initial contact between the Receivership and PCI saw the company attempt to hide its involvement with Rex Venture Group.

PCI conducted all business with Zeek through a bank account in the name of “SecureNet”, an unrelated direct payment processor.

Investigation by the Secret Service resulting in $812,433.96 seized from a PCI bank account.

At the time PCI failed to disclose that they held any additional RVG funds. It wasn’t until forensic accounting revealed that a further $8.9 million had been stashed in an account with the Los Angeles Firemen’s Credit Union, that the full of extent of PCI’s involvement with Zeek was uncovered.

While the Receivership was tracking down these funds, PCI withdrew the money. To date the whereabouts of the funds are unknown.

In the face of PCI refusing to cooperate, the Receiver recently filed a motion asking the court to order PCI to hand over the funds and hold PCI in contempt of court.

A 25 page response to the Receiver’s filing was filed by PCI yesterday. In it, Plastic Cash claim that, despite profiting to the tune of almost $10 million, they are “a victim” of Zeek Rewards.

Seriously? [Continue reading…]

Disner appeal denied, $2M dollar default judgement stands

In analyzing court filings by Ponzi investors, a common thread of assuming the judiciary and regulators involved in the case are complete morons can be observed.

In analyzing court filings by Ponzi investors, a common thread of assuming the judiciary and regulators involved in the case are complete morons can be observed.

Whether this stems from the bubble-world such investors live in, a carry-over from treating the everyone they encounter as gullible morons (critics of the schemes they invest in are also often treated with similar contempt), a simple lack of education – who knows. But it’s definitely there.

A recent example was Faith Sloan in the SEC’s TelexFree case. Named as a defendant in the SEC’s civil case, which alleges TelexFree to be a billion dollar Ponzi, Sloan was quick to cry poor in court filings.

Simultaneously, Sloan was also openly advertising her qualification for thousands of dollars in recruitment commissions on Facebook.

Today we take a look at another example, Zeek Rewards investor Todd Disner. [Continue reading…]

Merrill drops $4 million dollar defense bid, evidence withheld

![]()

A few days ago news broke that James Merrill and Carlos Wanzeler had been granted access to $400,000 in funds. Access was approved after the pair proved the funds were not related to TelexFree.

Left hanging in the balance from last Tuesday’s hearing was $4 million Merrill had previously requested, with the outcome of his claim only now coming to light. [Continue reading…]

Zeek merchant delay efforts squashed

The two remaining high-profile disputes between merchants and the Zeek Receiver are NxPay and Preferred Merchants.

The two remaining high-profile disputes between merchants and the Zeek Receiver are NxPay and Preferred Merchants.

NxPay served as Zeek’s merchant payment processor and, after returning some of the stolen Ponzi funds in their possession, hold out that they are entitled to keep some $9 million.

After the staffer NxPay put in charge of negotiating with the Receiver agreed NxPay would likely have to return the money, they got rid of her and started to play hardball.

Similarly Preferred Merchants are holding onto $4.8 million in stolen funds, sourced from a Rex Venture Group trust fund.

After they were notified that the SEC had shut Zeek Rewards down, Preferred Merchants quietly transferred $4.8 million out of a Rex Venture Group trust account and hoped nobody would notice.

Forensic accounting of Rex Venture Group’s account undid them, and now Preferred Merchants are doing everything they can to delay the inevitable return of funds.

In the meantime, the Receiver had filed a Motion seeking to find Preferred Merchants and its owner, Jaymes Meyer, in contempt of court for not handing over requested documents related to the funds.

In two separate orders filed yesterday, Judge Mullen moved to squash both NxPay and Preferred Merchant’s dillydallying. [Continue reading…]

Lyconet Review: Unit commissions that don’t add up

I first took a peek at Lyconet earlier this year back in February.

I first took a peek at Lyconet earlier this year back in February.

Launched in response to ongoing criticism of Lyoness’ accounting unit investment scheme, the purpose behind Lyconet was to completely separate the affiliate side of the business from that of the MLM opportunity.

Unfortunately nothing much has materialized on Lyconet since my first look at it. Even today a visit to the Lyconet website is a complete waste of time.

There’s a login page and that’s it:

No compensation plan details, no information about Lyconet itself, what it’s all about. As it stands almost a year after Lyconet was announced, the Lyconet website is a complete and utter failure.

I’ve meanwhile been waiting patiently for a copy of the Lyconet compensation plan to materialize in order to formally review Lyoness’ new angle. A Polish copy surfaced a month or so back but, while it was translatable, we learnt that the compensation plan might differ from region to region.

Going to the effort to pull apart Lyconet’s compensation plan in the event of the US version being different didn’t seem like a good use of time.

Finally a copy of Lyconet’s US compensation plan was recently sent to me by a BehindMLM reader. It’s twenty-one pages in length and just as headache-inducing as Lyoness’ original compensation plan was.

Nonetheless, I’ve done my best to break it downa and see where Lyconet’s new direction differs from Lyoness’ previous compensation plan. [Continue reading…]

Xu used WCM777 Ponzi funds to buy mum a house

Last we checked in, the WCM777 Receiver’s Third Interim Report detailed that in February of 2014, $1 million in stolen Ponzi funds was transferred to Phil Ming Xu’s sister.

Last we checked in, the WCM777 Receiver’s Third Interim Report detailed that in February of 2014, $1 million in stolen Ponzi funds was transferred to Phil Ming Xu’s sister.

This was done under the guise of Xu’s company ToPacfic, who on paper were purchasing garments.

Trouble is, Xu transferred the million odd dollars back in February 2014. As of October his sister’s company, Mana Fashion, still had the garments in storage.

Despite paying for the goods, WCM777 had done nothing to acquire them.

Sound fishy? You bet.

The garments in question were purchased by Xu’s sister over 2011 to 2013. Despite initially not co-operating with the WCM777 Receiver, Xu’s sister eventually handed over the goods.

After acquiring them, the Receiver then promptly sold the garment collection to a wholesaler for $295,000. Money that will at a later date be eventually returned to WCM777 investors.

In the meantime, what of the $1 million Xu transferred to his sister? Where did that money go? [Continue reading…]

AdsWorker Review: $100 – $10,000 advertising investments

There is no information on the AdsWorker website indicating who owns or runs the business.

There is no information on the AdsWorker website indicating who owns or runs the business.

The AdsWorker website domain (“adsworker.com”) was registered on the 6th of September 2014, however the domain registration is set to private.

A marketing video uploaded to the YouTube account “Alice Breton” appears on the AdsWorker website.

This account was created on the 25th of November, and is likely not an actual person.

An address in Glasgow, Scotland is provided on the AdsWorker website. A Google search of the address reveals a ton of companies operating from it, suggesting that it is a rented mailing address.

It’s worth noting that Alexa currently estimates that 90.6% of all traffic to the AdsWorker domain originates out of the Dominican Republic, indicating that this is where the company is being operated from.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Liberty Reserve Tech Chief jailed for 5 years

In its heyday, Liberty Reserve was the darling of countless scams that populated the MLM underbelly. And that was only a fraction of the fraud they got up.

In its heyday, Liberty Reserve was the darling of countless scams that populated the MLM underbelly. And that was only a fraction of the fraud they got up.

The argument that the payment processor was simply trying to be the next Paypal was never going to hold up in court. Yet that’s the excuse that was trotted out at a sentencing hearing for Mark Marmilev.

Marmilev, Liberty Reserve’s Technology Chief, was sentenced yesterday in a New York District Court. [Continue reading…]