Ad Pack Pro Review: Adcredit Ponzi with heavy pseudo-compliance

Marketing material for Ad Pack Pro suggests the company launched in mid 2015. The Ad Pack Pro website domain however (“adpackpro-international.com”), was only registered earlier this year in March.

Marketing material for Ad Pack Pro suggests the company launched in mid 2015. The Ad Pack Pro website domain however (“adpackpro-international.com”), was only registered earlier this year in March.

A corporate address in Switzerland is provided on the Ad Pack Pro website. Further research reveals a number of businesses using the same address, suggesting it is rented virtual office space.

Peter Müller (right) is cited as CEO of Ad Pack Pro, which itself is owned by parent company OneVision Holding.

Peter Müller (right) is cited as CEO of Ad Pack Pro, which itself is owned by parent company OneVision Holding.

Many creative and intelligend [sic] people with a common vision – that is the OneVision Holding AG.

The basic idea of the founders to combine the Know-How of several experts from different sectors, as well as their networks, to create a [sic] innovative Online Company, arose in May, 2015.

Possibly due to language-barriers, I was unable to put together an MLM history on Peter Müller.

Infact outside of Ad Pack Pro, there doesn’t appear to be any information on Peter Müller online. This could again be due to language-barriers but I’m flagging it as suspicious nonetheless.

Read on for a full review of the Ad Pack Pro MLM opportunity. [Continue reading…]

Engofor Review: Three package investment fraud

Engofor initially launched as “Cryptocoins Invest” back in June.

Engofor initially launched as “Cryptocoins Invest” back in June.

The company hosting the Cryptocoins Invest website appears to have since terminated the site with it today showing an “account suspended” message.

Rather than acknowledge this, those running Cryptocoins Invest have trotted out a sob story involving hackers:

To our dismay we realized that the hackers have caused more damage to the CCI network than we initially thought.

They succeeded to manipulate the system that there are now quite a number of accounts at another final balance than expected.

This, both positively and negatively. It has proved impossible to recover the data.

How much money has so far been lost is unclear. A relaunch as Engofor was announced last month which, as I understand it, is pretty much the same business model.

A corporate address in the Netherlands is provided on the Engofor website. No information about who owns or runs the company is provided.

Further research reveals Diego van der Veen (owner), Wendy van Dijk and David Vink as co-CEOs of the company.

Further research reveals Diego van der Veen (owner), Wendy van Dijk and David Vink as co-CEOs of the company.

These do appear to be actual people, however due to language-barriers I was unable to put together an MLM history on any of them.

Update 28th December 2016 – The Engofor website now credits Diego van der Veen as “Founding Director” of the company. Wendy van Dijk is credited as “Financial Support”.

Generic corporate bios for both on the Engofor website don’t actually reveal anything about their MLM history. /end update

Read on for a full review of the Engofor MLM opportunity. [Continue reading…]

Colombian regulator warns Wealth Generators is a pyramid scheme

Wealth Generators launched in 2013 and are based out of Utah in the US.

Wealth Generators launched in 2013 and are based out of Utah in the US.

The company operates in the financial services MLM niche, with a specific focus on stock market trading.

Recently the Wealth Generators has caught the attention of Colombia’s Superintendencia Financiera regulatory body, who claim it’s a pyramid scheme. [Continue reading…]

Karatbars International banned in Canada, pyramid scammers fined

Karatbars International are one of the pioneers of the gold recruitment MLM business model.

Karatbars International are one of the pioneers of the gold recruitment MLM business model.

Under the guise of purchasing gold, Karatbars’ business model sees affiliates pay a fee and are then paid to recruit others who pay a fee.

In 2014 Canadian regulator Autorité des marchés financiers (AMF) issued a warning against Karatbars.

The warning was reinforced with legal action, which has been playing out over these past two years. [Continue reading…]

USFIA trial back on for January 10th?

Following a scathing summary judgement decision that saw USFIA labelled a Ponzi scheme and Steve Chen the scammer who operated it, the SEC’s case against USFIA seemed all but over.

Following a scathing summary judgement decision that saw USFIA labelled a Ponzi scheme and Steve Chen the scammer who operated it, the SEC’s case against USFIA seemed all but over.

Despite effectively losing the case, Steve Chen is still fighting it out to the bitter end. [Continue reading…]

The Advert Platform Review: My Advertising Pays’ third Ponzi reboot

My Advertising Pays was initially launched in 2013 by Mike Deese.

My Advertising Pays was initially launched in 2013 by Mike Deese.

The premise was simple enough, invest $50 and receive a $55 ROI. Wash, rinse and repeat.

Unfortunately the only verifiable source of revenue entering My Advertising Pays was affiliate investment, making it a Ponzi scheme.

My Advertising Pays first collapsed in mid 2015. In an effort to keep the scam going, US investor ROIs were cancelled and Deese (right) relaunched in Europe.

My Advertising Pays first collapsed in mid 2015. In an effort to keep the scam going, US investor ROIs were cancelled and Deese (right) relaunched in Europe.

That lasted about a year, with My Advertising Pays again collapsing in mid 2016.

Another reboot was announced last month, however that appears to have already been scrapped.

A consistent theme with My Advertising Pays’ relaunched is the fact that most affiliates aren’t paid. This doesn’t seem to affect the top investors, who regularly boast about luxury purchases on social media:

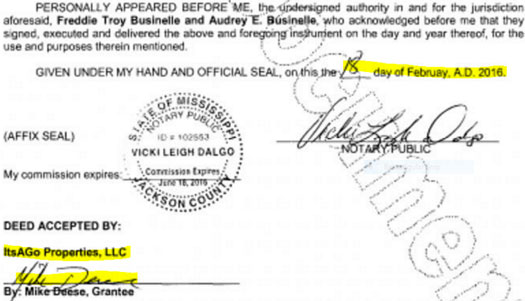

Mike Deese himself seems to be flush with cash, as evidenced by the purchase of a $600,000 home in Mississippi earlier this year:

Affiliates meanwhile are told My Advertising Pays can’t pay them because VX Gateway, their former payment processor, ran off with $60 million in invested funds.

A lawsuit has been filed to that effect and is still playing out in court.

Now under the name “The Advert Platform”, My Advertising Pays is gearing up to relaunch for a third time. [Continue reading…]

Internet Business Suite Review: $1 a day chain-recruitment pyramid

There is no information on the Internet Business Suite website indicating who owns or runs the business.

There is no information on the Internet Business Suite website indicating who owns or runs the business.

The Internet Business Suite website domain (“internetbusinesssuite.com”) was registered on the 2nd of January, 2016. Dustin Langley is listed as the owner, with an address in the US state of Tennessee also provided.

This matches up with Langley’s Twitter profile, which is linked off the Internet Business Suite website.

Dustin Langley (right) first appeared on BehindMLM’s radar as a possible admin of Residual Daily Profits, a recruitment driven matrix pyramid scheme launched mid 2012.

Dustin Langley (right) first appeared on BehindMLM’s radar as a possible admin of Residual Daily Profits, a recruitment driven matrix pyramid scheme launched mid 2012.

Residual Daily Profits appears to have morphed into WahVision, a Ponzi scheme launched that same year.

In 2014 Langley resurfaced with Banner Ads Daily, a 125% ROI Ponzi scheme.

Banner Ads Daily lasted less than a month before it collapsed.

Langley appears to have been running MLM underbelly scams since at least 2010 (10K 4 Christmas).

In addition to Residual Daily Profits, here’s a list of MLM underbelly schemes Dustin Langley has launched since then:

- Global Venture Club (chain-recruitment, 2011)

- Residual 500 (chain-recruitment, 2011)

- Long Term Residuals (subscription based cycler, 2012)

- AdProjectX (135% ROI Ponzi scheme, 2013)

- Fast Residuals (cycler recruitment, 2013)

- Earn Revolution (matrix-based pyramid scheme, 2014)

Read on for a full review of the Internet Business Suite MLM opportunity. [Continue reading…]

Bank of Hungary calls out OneCoin pyramid scheme

Another day, another European regulator warns about OneCoin without actually doing anything about it.

Another day, another European regulator warns about OneCoin without actually doing anything about it.

The latest regulatory warning against OneCoin is another from the Central Bank of Hungary.

An advisory on the risk of cryptocurrencies dated December 20th singles out OneCoin as a pyramid scheme. [Continue reading…]

ZID Ads Review: Ad Pack Ponzi investment scheme

There is no information on the ZID Ads website indicating who owns or runs the business.

There is no information on the ZID Ads website indicating who owns or runs the business.

The ZID Ads website domain (“zidads.com”) was privately registered on November 26th, 2016.

A Facebook account bearing the name “Ryan Walker” created the official ZID Ads Facebook Group on December 8th.

There is no content on the Ryan Walker account and it appears to be bogus.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Take Fund Review: Six-tier bitcoin cash gifting

There is no information on the Take Fund website indicating who owns or runs the business.

There is no information on the Take Fund website indicating who owns or runs the business.

The Take Fund website domain (“take.fund”) was privately registered on the 3rd of October, 2016.

Take Fund itself appears to have only launched in early December, with the official Take Fund Facebook page going live on December 12th.

Alexa currently estimate that Poland (36.5%) and Ireland (28.8%) are the top sources of traffic to the Take Fund website.

This suggests that whoever is running Take Fund is also likely based out of one of these two countries.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]