HyperOne: Fourth HyperTech crypto Ponzi hoax [updated]

I wasn’t sure if HyperOne was a joke at first.

I wasn’t sure if HyperOne was a joke at first.

Update 17th May 2022 – Turns out my spidey sense was dead on, HyperOne doesn’t appear to have anything to do with HyperTech, HyperFund or Hyperverse.

Kalpesh Patel has confirmed he has nothing to do with HyperOne in a recently published social media video.

I’ll leave this review up as a record of what HyperOne was pitching. /end update

The first video uploaded to HyperOne’s official Youtube channel is an old 2018 blockchain bro video featuring Sam Lee.

Lee, along with Ryan Xu, are HyperTech’s co-founders. They’re on the run from liquidators in Australia and are believed to be hiding out in Dubai.

You probably won’t hear much of Xu and Lee, if at all, in HyperOne’s marketing.

Instead we have two of the few people left promoting Hyperverse, Kalpesh Patel…

…and his sidekick Keith Williams:

There are some other names in HyperOne’s marketing but I wasn’t able to confirm involvement so I’ll leave them out for now.

Like Lee and Xu, Kalpesh Patel fled to Dubai to cement his Ponzi legacy.

Patel travels back to the UK from time to time to visit family. The UK is almost as lax as Dubai when it comes to MLM securities fraud regulation.

Keith Williams joins Patel on his Hyper* Ponzi webinars. Williams’ LinkedIn profile places him in the UK.

The other top earner in recent Hyper* Ponzis is Rodney Burton, a US citizen.

As far as I can tell he’s cashed out and isn’t coming back. Burton now spends his time walking around Dubai in his pajamas:

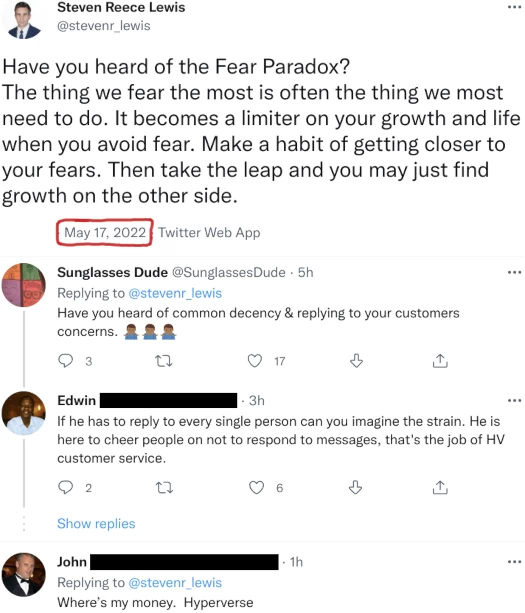

Hyperverse saw Xu and Lee hire an actor to play CEO Steven Reece Lewis.

Lewis is nowhere to be seen with HyperOne. He appears to have been paid off but the content bot is still posting social media cringe on his Twitter account:

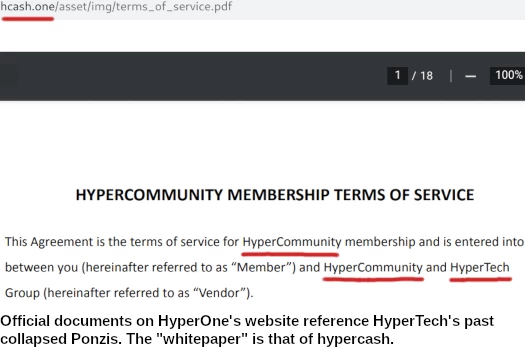

HyperOne’s website domain (“hcash.one”), was registered on April 26th, 2022. “Hyper One” is listed as the owner, through the Cayman Island. All other domain ownership details are redacted.

As to HyperTech, it’s a Ponzi factory created by Sam Lee and Ryan Xu.

First we had HyperCapital, then HyperFund, then Hyperverse (short-lived) and now HyperOne.

All MLM crypto Ponzi schemes and, except for HyperOne, all have collapsed.

So with mounting losses and executives in hiding, what’s HyperOne’s marketing schtick?

Read on for a full review of HyperOne’s MLM opportunity.

HyperOne’s Products

HyperOne has no retailable products or services.

Affiliates are only able to market HyperOne affiliate membership itself.

HyperOne’s Compensation Plan

HyperOne affiliates purchase hyperone or hyperunit tokens from the company with tether (USDT).

Once acquired, hyperone tokens are invested back with the company (staking).

- invest 100 HU and receive 50 cents in HOT tokens for 400 days

- invest 300 HU and receive $1 in HOT tokens and 57 cents in HU tokens for 400 days

- invest 1500 HU and receive $4 in HOT tokens and $4.56 in HU tokens for 400 days

- invest 3100 HU and receive $8 in HOT tokens and $10.27 in HU tokens for 400 days

- invest 6300 HU and receive $16 in HOT tokens and $24.04 in HU tokens for 400 days

- invest 12,700 HU and receive $32 in HOT tokens and $53.78 in HU tokens for 400 days

Both HU and HOT are represented as having $1:1 token parity.

The MLM side of HyperOne pays commissions on recruitment of affiliates and their investments.

Referral Commissions (hyperone token investment)

HyperOne pays a referral commission when personally recruited affiliates invest tether for hyperone tokens.

Hyperone referral commission specifics are not provided.

Referral Commissions (ROI)

HyperOne pays a referral commission on daily returns paid to downline affiliates.

Referral commissions are tracked via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

HyperOne cap referral commissions at twelve unilevel team levels.

Specific referral commission rates are not provided.

Residual Commissions

HyperOne pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Residual commissions are calculated through “Hyper Rewards Points” (HRP). This appears to be an internal point system, likely a percentage of actual funds invested.

Residual commissions are paid at 10% of HRP generated on the weaker binary team side (presumed weekly).

Achiever Bonus

HyperOne sets aside 10% of weekly company-wide investment volume.

This is shared equally among HyperOne’s “top achievers” each week.

Joining HyperOne

HyperOne affiliate membership is tied to a $100 or more initial investment in USDT.

HyperOne Conclusion

HyperOne is a rehash of your basic MLM crypto Ponzi scheme.

Invest in hyperone tokens, recruit others who do the same, cash out their money. You’ve got staking and the MLM comp plan for specifics, but that’s the gist of it.

Hyperone token itself is a BEP-20 shit token. These cost little to nothing and can be set up in around five minutes. They’re the default for zero effort Ponzi schemes.

So what makes HyperOne different to the Hyper* Ponzis that came before it?

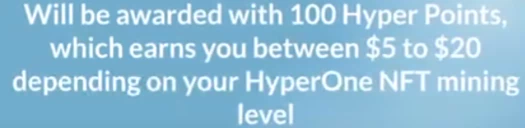

Aside from Xu and Lee hiding, HyperOne marks HyperTech jumping on the NFT fraud bandwagon… roughly about a year and a half too late.

The NFT scam fad has come and gone. What’s left are bottom-of-the-barrel grifters and it is that environment HyperOne hopes to populate.

HyperOne hamfisting NFTs into its thrice collapsed shit token Ponzi model is some rubbish about mining them through recruitment.

Something something get worthless HyperOne NFT. Something something use worthless HyperOne NFT to cash out other people’s money. It’s part of the Ponzi scheme so however they’re integrated the core function of withdrawing more than you invested, of other people’s money, remains intact.

The elephant in the room is what HyperOne does with HyperFund and Hyperverse bagholders.

If they’re grandfathered in, HyperOne is DOA. An MLM Ponzi scheme weighed down with two generations of bagholding victims is going to burn through new sucker investment rapidly.

If HyperFund and Hyperverse victims are shirked, the backlash is going to make it impossible to market HyperOne to new suckers.

That’s especially true, seeing as the last thing HyperFund did was tout 400% ROIs before entirely pulling the plug on withdrawals.

Financial losses of HyperTech’s existing victims also make HyperOne’s promises of riches ring thunderously hollow.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve HyperOne of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

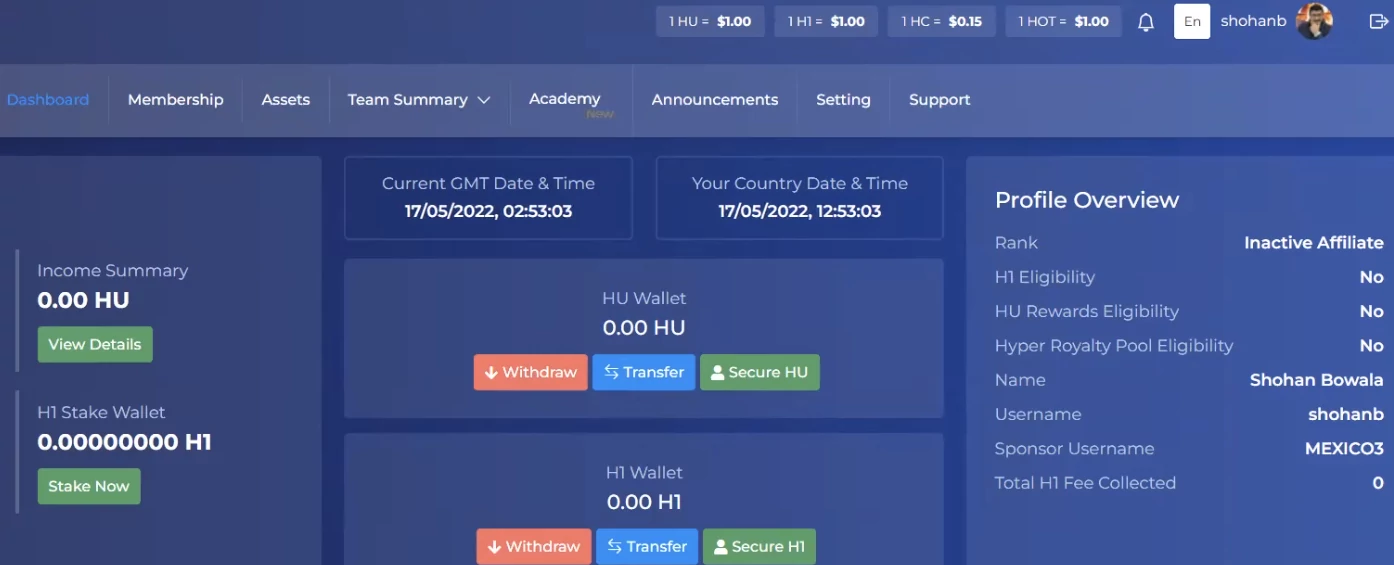

Update 17th May 2022 – Serial Ponzi promoter Shohan Bowala, a resident of Australia, has shared his HyperOne backoffice (click to enlarge):

From this screenshot we can see Hyperverse’s HU internal Ponzi points are part of HyperOne. “H1” appears to be a new internal Ponzi points system.

It is unclear whether HyperFund/Hyperverse HU bagholders will be able to import their HU into HyperOne.

For more informations about the newest bullshit check out this:

hcash.one

(Telegram link removed)

The worthless “HyperOne” Coin was developed a few days before….

bscscan.com/token/0xB15E296636CD8C447f0d2564ce4d7dFE4A72A910

Article updated with Kalpesh Patel denial.

It’s amazing they are able to convince anyone to “invest” in this with the trail of scams they have left behind, all while maintaining the brand name.

the dude in the white shirt is the same dude who was hanging out with craig grant promoting bitconnect.

https://behindmlm.com/wp-content/uploads/2022/05/rodney-burton-pajamas-dubai.webp

cant withdraw now. Only had a bit left to get my initial money out so could have been worse. I was very naive. what makes me sick though is I have messaged the same people that hounded me to join and get other people on board for help and they just dismiss it. I hate these people with a passion. I wish there was a way to get even with them.

Unable to make it as a scamlord on his own, Greg Perdriel has latched onto Rodney Burton’s teet. At least while it suits him.

I have now heard that Keith William has cancer now.

Anyone heard about this to confirm?