Inside Nelo Life’s fraudulent trading scheme (ft. Ed Zimbardi)

Nelo Life has launched their securities and commodities fraud offering as LifeElevate (also referred to as Nelo Trade).

Nelo Life has launched their securities and commodities fraud offering as LifeElevate (also referred to as Nelo Trade).

BehindMLM first reported on Nelo Life adding securities and commodities fraud to its MLM offering back in March.

Today we dive deeper, following a rabbit hole that leads us to serial fraudster and wanted fugitive Ed Zimbardi.

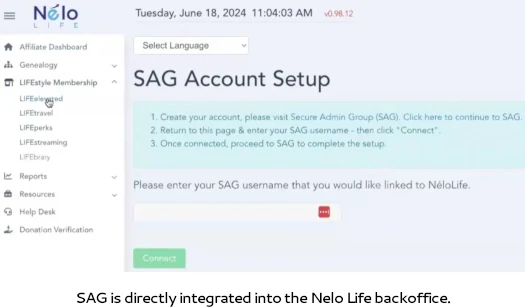

Instead of hosting LifeElevated themselves, Nelo Life requires affiliates to sign up for a Secure Admin Group account.

Once signed up with a Secure Admin Group account, Nelo Life affiliates “link” their MLM account to their SAG account in the Nelo Life backoffice.

On its website Secure Admin Group, or “SAG” for short, pitches itself as

the first Decentralized Auditable Resource Tracker which serves as an autonomous and anonymous bridge to connect exchanges, real world projects, liquidity pools, developers and participants in a unique, highly sophisticated ecosystem.

Fundamentally, Secure Admin Group functions as the TPA or third-party-administrator using its proprietary technology to track performance of Trade Scripts in Forex, Commodities, Cryptocurrency and other markets.

Secure Admin Group is built entirely around the USDC stablecoin ecosystem, which is the most stable and trusted stablecoin that undergoes monthly third-party audits to ensure it has sufficient liquidity in reserves.

No audits are provided to consumers on SAG’s website. SAG’s website proper doesn’t even disclose who owns or runs the company.

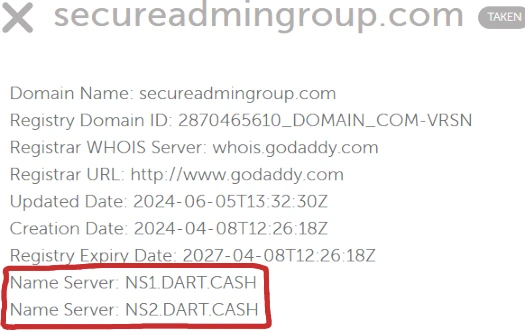

SAG operates from the domain “secureadmingroup.com”. The domain was only recently registered on April 8th, 2024.

Interestingly, Secure Admin Group’s domain uses name-servers belonging to Dart Cash:

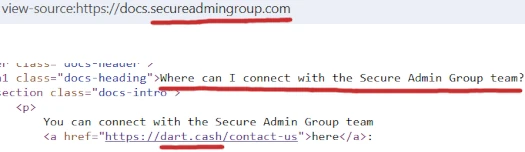

This coincides with Secure Admin Group directing anyone who wishes to contact them to Dart’s website:

On its website, Dart pitches itself as

the first Decentralized Auditable Resource Tracker which serves as an autonomous and anonymous bridge to connect exchanges, real world projects, liquidity pools, developers and participants in a unique, highly sophisticated ecosystem.

Fundamentally, DART functions as the TPA or third-party-administrator using its proprietary technology to track performance of Trade Scripts in Forex, Commodities, Cryptocurrency and other markets.

DART is built entirely around the USDC stablecoin ecosystem, which is the most stable and trusted stablecoin that undergoes monthly third-party audits to ensure it has sufficient liquidity in reserves.

Essentially, SAG and Dart are clones of each other. I’m not sure how both SAG and Dart can be “the first decentralized auditable resource tracker”, but I digress.

From a “chaos” whitepaper hosted on Dart’s website, we learn both companies were set up to

allow direct Peer-to-Peer transactions that do not require a complex (and corrupt) banking system in between.

In other words, SAG and Dart were created to help criminals avoid banking and financial regulation.

Attached to Dart is an obligatory crypto Ponzi scheme, run through their inhouse CHAOS shit token.

Since token holders can receive rewards in CHAOS equivalent, they can compound their holdings rapidly.

The ‘new’ CHAOS released as rewards has a higher value than the previous CHAOS holdings that were released at a lower

valuation. This mechanism results in significant rewards for early adopters.

As to why the need for SAG, if I had to guess it’s because Dart and its CHAOS Ponzi scheme have collapsed. As of May 2024, SimilarWeb tracked just ~2400 monthly visits to Dart’s website.

Another possibility is wanting to set up new money laundering channels through SAG. Dart has been around since 2022 and could already be on financial blacklists.

SAG’s and Dart’s hiding behind decentralization is a ruse, as obviously neither company set itself up. SAG and Dart were created and are owned and operated by someone.

To that end SAG and Dart share common ownership, however only three executives are disclosed.

Our team is comprised to 10+ participants from the DeFi Community. The project is structured like a DAO (Decentralized Autonomous Organization) but more importantly, is created to function independent of a central team.

The bridge and liquidity in the platform are made up of multiple exchanges to offset risks and the need of a single team.

Notable team members include Mr. Akis Kourouzides who has over 20 years of experience in Major International Banking, AML regulations and Internal Procedures; Demetris Papadopoulos who is an accomplished media consultant and a thought leader in digital marketing and entrepreneurship; Vasileous P who has 15+ years experience in military, ecommerce, and blockchain projects.

Akis Kourouzides is a resident of Cyprus (red flag) and claims to be a “professional banker”. There is no mention of either SAG or Dart on Kourouzides’ LinkedIn profile.

Demetris Papadopoulos calls himself “DPapa” and, although he’s from Cyprus, has been a resident of Greece since 2002. On his marketing website Papadopoulos claims to be living a “flip flop life”.

SAG’s and Dart’s “core team”, as they’re referred to, make “most decisions” within both companies.

I’m not 100% sure but I believe “Vasileous P” refers to Vasileios Pasparas, a middle-aged crypto bro with a marketing background from Greece.

The previously cited CHAOS whitepaper provides some more names, and also suggests the tech side of SAG and Dart is handled by Indians.

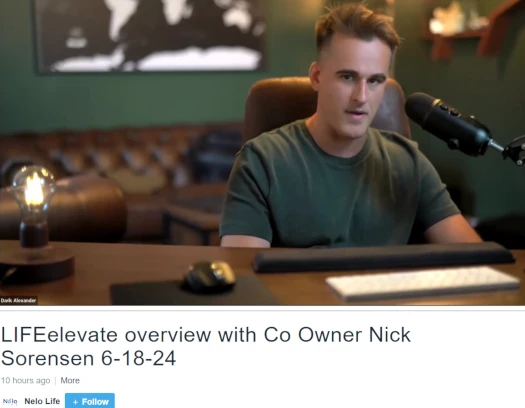

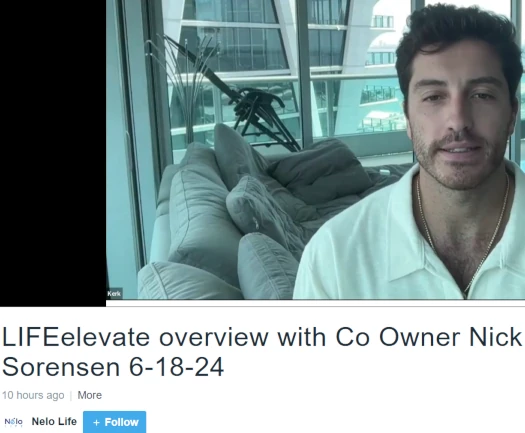

Whatever financial agreements exist between Nelo Life and SAG aren’t disclosed to potential investors. Instead, Nelo Life has Darik Alexander and Cameron Kerkar front LifeElevated.

Alexander and Kerkar, who claim to be business partners for twelve years, appeared on a June 18th Nelo Life webinar to pitch potential LifeElevated investors.

Alexander describes LifeElevated as a “game of investing, a game of compound interest”.

[13:58] Little bit of advice … one, absolutely no question get started as soon as you possibly can with this.

[14:30] Two, if you want to be able to make more money, if you want to be able to create more residual income, then I would highly recommend building a massive organization in Nelo (Life).

The reason why is because if you can build a large organization in this business and get a lot of people involved, you’re check’s going to be bigger than if you had only ten people involved. If you had ten thousand people it’s a bigger check.

Why is that important?

It’s important because if you have a ten thousand person team and you have that bigger check, well how quickly could you reinvest your money into systems like ours, for example, that can give you that compound interest? Where you can not only be earning from Nelo but you can also be earning from your investments?

Now what’s the benefit of that?

When you earn from your investments, that’s just purely passive right? That’s a very beautiful passive income.

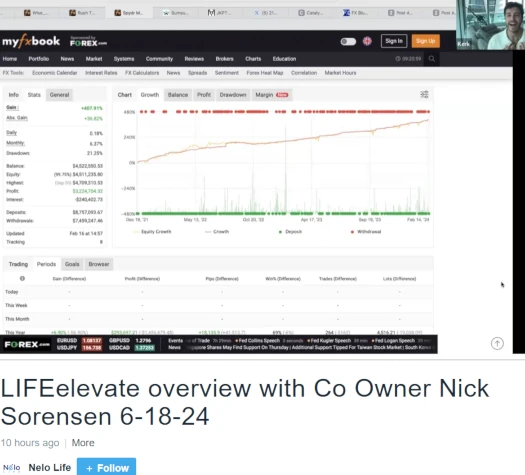

Cameron Kerkar pitches Nelo Life investors on the basis of a claimed returns over the past year.

[18:31] Nick am I able to share, would you like me to share my screen and kinda give a little bit of an expectation… basically returns from last year?

So we’ve been running this account I’m pulling up, we’ve been running this for coming up on thirty months now.

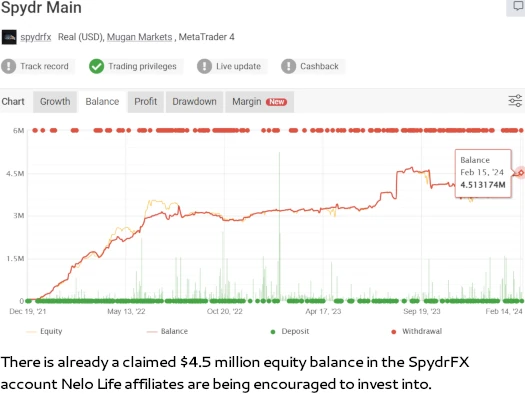

Kerkar brings up a MyFxBook report. I want to stress that MyFxBook reports are both easily faked and not a substitute for audited financial reports filed with regulators (legal requirement).

[20:14] The very first month that we started trading was back in December of 2021.

If you guys had the luxury of us being in your network at the time … you would be up over 400% return on your capital since day one.

[21:43] Darik and I, if we were doing this call a couple of years ago with you guys, the backdrop would have been much different, y’know Darik wouldn’t be speaking about the compounding and speaking about what he’s done for his family, the way we have, because we haven’t been able to tap into the compounding effect of what these types of returns [generate].

No they’re not huge returns every month. This is where it gets scary is when you talk about five years down the road. And right now we’re just over two and a half years in.

So as we continue to do these numbers, whether it’s 2%, whether it’s 3%, whether it’s 5% in a month, this is consistently compounding over time.

[24:58] The biggest hedge funds, the biggest funds in the world, they’re doing 30% in a year, 40% a year, 50% a year and what are they giving their clients? 12%. 15%, right?

So here, you’re looking at the returns right there. Last year we did over 50% and gave our clients over 40% return.

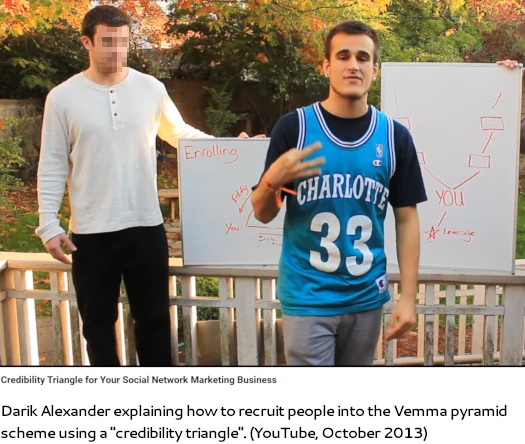

Alexander and Kerkar got involved in MLM through Vemma’s “Young People Revolution” marketing arm.

YPR, as it was known, specifically targeted college students and vulnerable young people.

The FTC shut Vemma down in 2015, revealing it to be a $200 million pyramid scheme.

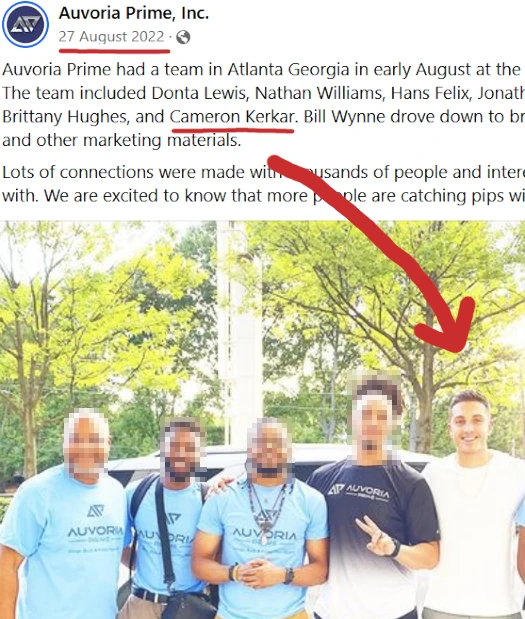

After Vemma the pair appear to have gotten into MLM trading schemes. In 2020 Alexander and Kerkar were named defendants in a legal dispute between Eaconomy and Auvoria Prime.

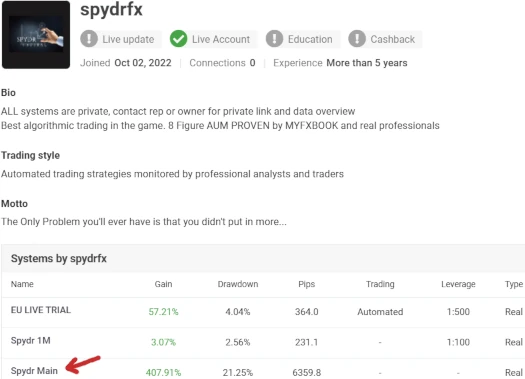

If we zoom in to Kerkar’s desktop as he presents the MyFXBook stats on the Nelo Life webinar, we can see the tab name is truncated to “Spydr M…”

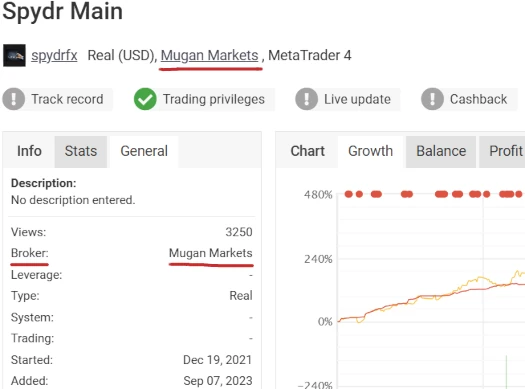

This corresponds to “Spydr Main”, an account attached to the MyFXBook account “spydrfx”.

On social media we find Kerkar spruiking Spydr Capital, so it seems SpydrFX goes by at least two names.

If we open up the Spydr Main account ourselves we find, as of February 2024, there is $4.5 million in claimed equity investment.

We also find the account is attached to the broker Mugan Markets.

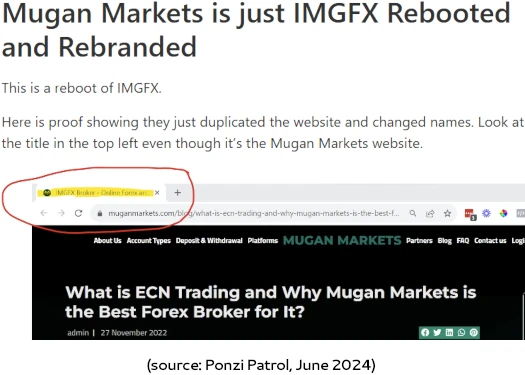

As already researched by Brandon Williams of Ponzi Patrol, Mugan Markets is the successor to IMGFX – both owned by Edward Anthony Zimbardi (aka Ed Zimbardi).

Mugan Markets is an offshore brokerage operated by Ed Zimbardi and his partners.

IMGFX was closed down and set up again under the Mugan Markets brand. The reason is that Ed Zimbardi used IMGFX to orchestrate multiple PAMM account scams.

People deposited money into IMGFX under the encouragement of Ed and his affiliates.

They were paid a percentage every month for some time, and when they wanted to withdraw all of their money, all of a sudden the “chief traders” lost all of the money. The money all disappeared.

The money didn’t disappear because of bad trades, however. It disappeared because there were no traders, Ed faked all of the trades, and the money was simply cashed out through a backdoor of IMGFX.

The SAME THING WILL HAPPEN WITH MUGAN MARKETS.

This plays into Cameron Kerkar referring to LifeElevated (NeloTrade, SAG, SpydrFX, Spydr Capital or whatever you want to call it), as a “marathon and not a sprint”.

[26:56] Whether we have a slow month or a break even month, you’ve really got to zoom out and take a look at this over a multi-year period. And build your strategy, build your plan of how you want to use this over a multi-year period.

I also want to point out that Kerkar was still promoting Auvoria Prime as of October 2022.

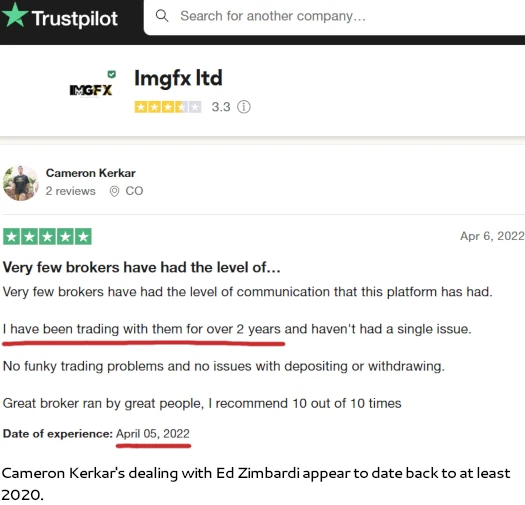

In April 2022 however, Kerkar left a TrustPilot review praising IMGFX.

From this we can see Kerkar’s business relationship with Zimbardi goes back to at least early 2022. This coincides with the Spydr Main account on MyFXBook appearing in December 2021.

Ed Zimbardi, a convicted felon, launched CryptoProgram in late 2022. The fraudulent investment scheme pitched consumers on a perpetual 25% monthly ROI.

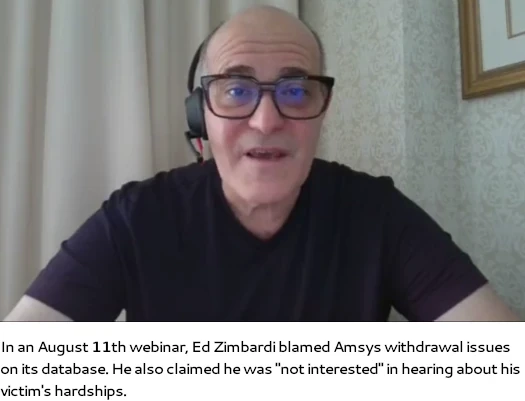

Following regulatory fraud warnings from British Columbia and California, Zimbardi collapsed CryptoProgram and rebooted it as Amsys in July 2023.

Amsys was short-lived and collapsed a few months later in August.

While Amsys was floundering, two additional regulatory fraud warnings were issued by Alberta and Georgia (the US state).

At some point during all of this Zimbardi, a Georgia resident, fled the US for Europe.

In March 2024, Zimbardi was arrested in the Netherlands on suspected money laundering charges.

Dutch authorities suspect Zimbardi assisted Corina de Jong with defrauding over 1400 consumers. Specifically, Zimbardi is alleged to have helped De Jong launder over €56 million EUR.

De Jong funnelled investor funds into Mugan Markets, a sham broker Zimbardi controlled.

US authorities were reported to be aware of the arrest and working closely with Dutch authorities as part of several ongoing US criminal and civil fraud investigations.

Despite being an obvious flight risk, Dutch authorities released Zimbardi only for him to flee again.

As of June 2024 Zimbardi’s whereabouts and status remain unknown. The tens of millions in stolen funds laundered through IMGFX and Mugan Markets remain unaccounted for.

What we can confirm is Zimbardi continues to defraud consumers, the latest scheme of which is now being offered to unsuspecting Nelo Life affiliates.

In addition to a potential open Dutch arrest warrant, Zimbardi is believed to also be wanted by US authorities.

Putting all of this together, we have:

- Nelo Life – Nick Sorensen (Texas), Eric Allen (Indiana), Larry Lane (California) & Orkan Arat (Louisiana) –>

- Secure Admin Group – Akis Kourouzides (Cyprus), Demetris Papadopoulos (Greece), Vasileios Pasparas (Greece) & Yusuf Ouda (?) –>

- Spydr Capital/SpydrFX – Darik Alexander (Florida) & Cameron Kerkar (Florida) –>

- Mugan Markets – Ed Zimbardi (US national, convicted felon and wanted fugitive)

Despite direct ties to the US and millions in equity investment claimed, none of the above entities and individuals are registered with the SEC or CFTC.

Update 14th November 2025 – Ponzi Patrol’s Mugan Markets research article has been deleted.

This article originally contained a link to the deleted article, which is now no longer available.

wonderful research! BRAVO!!! STEF

The word “Ecosystem” is obviously now MLM code language for “a group of brainwashed sheep.”

………..I’m not sure about all your content here Oz so, I will look forward to Randy Schroeder explaining/ clarifying things for us …………as part of his” honesty/transparency/full disclosure/ social impact ecosystem.”

Maybe some “Servant Leaders” could step up and show Oz the error of his ways?

Stellar and in-depth reporting. I saw Randy Schroeder also chatting about some new health product they’re calling their hero product for the US market.

It seems to be based on a product released almost 20 years ago. Stelomare (the “3-in-1” anti-aging product) seems to have a presence online since February 8 (with a beach scene in the background).

It seems this was established well before Finmore was even announced. So those early days of Eric promoting Finmore, albeit not a member of the corporate team allegedly, are suspicious.

Under your comments about Auvoria Prime, Inc., I believe the 2nd person from the right is Donta Lewis.

He was heavily embedded in TranzactCard and Finmore and did early presentations for/with Nelo Life. Makes sense as he talks about “the trading platform side of the business” with having “experience”.

The U.S. Government (FTC, etc.) is horribly ran and apparently overworked when I look at anti-mlm content creators/exposers while it seems they (our government) sits on their hands.

Meanwhile, people get sucked in to the tune of >90% of them losing money in EACH MLM PYRAMID scheme (business model). So amazingly sad.