Nelo Life adds securities fraud trading to MLM opp

Nelo Life has held a marketing webinar. Retail has been addressed but the company has also revealed securities and commodities fraud.

Nelo Life has held a marketing webinar. Retail has been addressed but the company has also revealed securities and commodities fraud.

Before we get into that, as suspected, the “O” in Nelo is the name of the fourth co-founder.

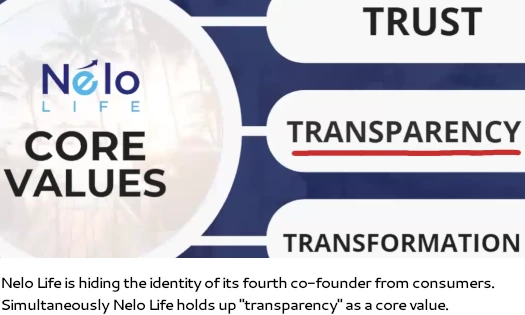

For reasons that aren’t clear, Nelo Life is hiding the name of its fourth co-founder from consumers.

On the cited webinar, held on Thursday evening, Eric Allen referred to Nelo Life’s fourth co-founder as the “Big O” and “tech unicorn”.

A BehindMLM reader claims Nelo Life’s fourth co-founder is Orkan Arat. I wasn’t able to personally verify.

The retail side of Nelo Life comes in at $59 a month. This provides access to Nelo Life’s travel booking platform and streaming shop. I believe access to the nutritional supplements is an additional $20 (a month?).

Speaking of which, Nelo Life has ten white labeled nutritional supplements:

Update 30th March 2024 – A reader wrote in to advise Nelo Life’s supplements are white labeled from Life Converted.

This led me down a rabbit hole which might explain why Orkan Arat is not publicly named as Nelo Life’s fourth co-founder. /end update

Next we get to Nelo Life’s trading platform. This isn’t offered to US residents, which is an automatic red flag. We’ll get into why later.

Nelo Life’s trading platform is marketed as “investment trading”:

Nelo Life pitches passive returns based on “proprietary algorithmic technology and trader oversights”.

In place of legally required audited financial reports filed with regulators, Nelo Life offers up marketing that cites a 57.8% ROI for 2024.

No source for this data is provided.

Under US law Nelo Life’s trading opportunity clearly constitutes an investment contract under the Howey Test.

Nelo Life affiliates are pooling funds under the control of a trading bot, on the expectation of passive returns.

The identification of an investment contract constitutes a securities offering and requires Nelo Life to register with the SEC. If the bot is trading forex or commodities (including cryptocurrency), Nelo Life also needs to register with the CFTC.

Nelo Life’s attempt to circumvent US law by only defrauding consumers outside of the US is moot, as Nelo Life and its co-founders are all based in the US.

As per the Securities and Exchange Act, it is illegal to sell unregistered securities. It doesn’t matter who US residents are selling unregistered securities to, the act itself is illegal.

With respect to Nelo Life’s affiliates, under the Securities and Exchange Act it is also illegal to promote unregistered securities. This makes promotion of Nelo Life’s trading platform by any US resident a violation.

Violating the Securities and Exchange Act constitutes securities fraud. Commodities fraud takes place by way of Nelo Life again not being registered with the CFTC.

To simply things, a US MLM company and its US resident promoters commiting securities fraud and commodities fraud against non-US residents is still fraud.

Furthermore, Nelo Life promoters should ask themselves why Nelo Life is excluding US residents.

A passive returns trading bot isn’t illegal per-say under US securities and commodities law. All a company has to do is register with the SEC and CFTC and file periodic audited financial reports.

This is crucial, as it allows both regulators and consumers to verify the company is doing what it claims to be – generating passive returns via trading in this instance.

The only reason a US-based MLM company representing it is engaged in legitimate trading would fail to register with the SEC and CFTC is if it isn’t doing what it claims to be.

This is again a major red flag with Nelo Life that should not be ignored.

I won’t get into the VPN nonsense that usually accompanies this type of “US excluded *winkwink*” pseudo-compliance, as Nelo Life hasn’t begun active enrolment into its trading platform yet.

At the moment Nelo Life is focusing on recruitment, namely scooping up as many disenfranchised TranzactCard/FinMore promoters as they can – all of whom are US residents.

With respect to pyramid scheme concerns, this now occurs if the majority of $59 a month and $20 a month subscribers are also affiliate promoters.

Historically MLM discount travel companies have struggled to generate significant retail sales revenue.

The “pay a fee for access to discounted supplements” is a copy+paste of LiveGood, which has failed to retain a retail market in any country it has spread to.

Based on this, BehindMLM’s initial pyramid scheme concerns about Nelo Life remain.

Update 19th June 2024 – Nelo Life’s “Life Elevated” trading scheme can be traced back to serial fraudster and wanted fugitive Ed Zimbardi.

Seems kind of crazy to name your company NeloLife when there has been a Neolife for years, product is also nutritional supplements. Might get a bit confusing.

I think this guy promotes everything Behind MLM exposes. Now, he’s promoting NELO.

youtube.com/@troyrejda/featured

So I just saw on fb that randy Schroeder is.now pushing the nelo life!

How in the world do these guys get away with scamming people again and again over and over without going to jail!

A d how in the world to these brainwashed mlm people keep following them and joining them….

Unconfirmed: Apparently Orkan Arat is contractually attached to another MLM at the moment, hence the hiding of his involvement as a Nelo Life co-founder.

Speaks to Nelo Life being a cash grab for what’s left of FinMore, as opposed the company being set up and launched properly.

Hilarious. This concept has been done before many times and has failed every time. Once a scammer, always a scammer I suppose.

Ken Russo is flogging Nelo Life to his Onpassive downline. Grifters gotta keep on grifting, including poaching from other grifters whose scams are on the ropes.