Auvoria Prime Review: Eaconomy securities fraud reboot

![]() Auvoria Prime is the third attempt to sell use of a non-profitable trading bot to gullible victims.

Auvoria Prime is the third attempt to sell use of a non-profitable trading bot to gullible victims.

The scheme started as SilverStar Live, which ended in a $75,000 CFTC fraud settlement.

Co-owners Hassan Mahmoud and Candace Ross-Mahmoud then rebooted the scheme as Eaconomy.

Last month Eaconomy collapsed, amid bickering between the scammers running the show.

Auvoria Prime surfaced shortly after Eaconomy’s collapse, headed up by Chief Network Officer Sal Leto.

Auvoria Prime’s launch prompted a lawsuit from Eaconomy, filed in California on March 23rd.

Sal Leto (right) was Eaconomy’s Vice President of Operations.

Sal Leto (right) was Eaconomy’s Vice President of Operations.

Prior to Eaconomy, Leto is best known for spearheading attempts to market the OneCoin Ponzi scheme in the US.

When that failed Leto switched to iPro Network. iPro Network was recently sued by the SEC for being a $26 million dollar pyramid scheme.

Here’s a run down of the rest of Aurovria Prime’s executives:

- Joshua Phair is Auvoria Prime’s Chief Financial Officer, brought on as an Eaconomy consultant in July 2019

- Bill Wynne is Auvoria Prime’s Chief Technology Officer, formerly Eaconomy’s Chief Technology Officer

- Vanessa Leto (aka Rosario Lopez) is Auvoria Prime’s Corporate Director, she’s Sal Leto’s wife and evidently partner in crime

Another name that stood out to me was Mariska van de Langenberg, hilariously credited as Auvoria Prime’s Director of Compliance.

Van de Langenberg is another Eaconomy recruit. We first came across Van de Langenberg as CEO of 5 Star Signals back in 2015.

5 Star Signals, a pyramid scheme masquerading as an MLM trading opportunity, was issued a securities fraud non-compliance fine by the Netherland’s AMF.

In July 2016 5 Star Signals collapsed, amidst claims of $180,000 in commissions being stolen. Total investor losses remain unknown.

Yeah, some of the folks behind Auvoria Prime have been at this for a while.

Read on for a full review of Auvoria Prime’s MLM opportunity.

Auvoria Prime’s Products

Auvoria Prime sells access to automated returns and trading signals.

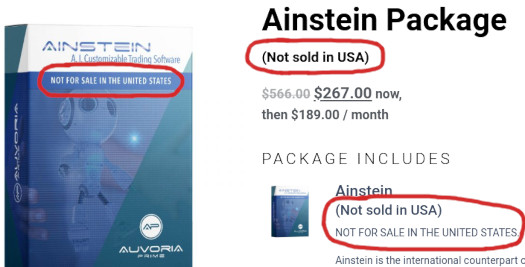

- Ainstein Package – $267 for access to an automated passive returns platform, then $189 a month

- Alexander Package – $267 for access to trading signals

Bundled with each package is a “virtual assistant” mobile app and “forex education program”.

Additional stand-alone products include:

- Airis – signals based on forex chart analysis for $39 a month

- Hailey – “A.I. trend scalping trade software”, marked “coming soon” on Auvoria Prime’s website but listed for $129 in the compensation plan

Auvoria Prime’s Compensation Plan

Auvoria Prime affiliates are forced to maintain an Ainstein and/or Alexander subscription.

Commissions are paid when they sell subscriptions to retail customers and/or recruited affiliates.

Commission Qualification

To qualify for MLM commissions, each Auvoria Prime affiliate must

- maintain their own Ainstein or Alexander package subscription

- sell three packages to retail customers and/or recruited affiliates (three active packages must be maintained)

Retail and Recruitment Commissions

Auvoria Prime pays retail and recruitment commissions on the sale of Ainstein and Alexander packages to retail customers and recruited affiliates respectively.

- sale of an Ainstein or Alexander package = $40 commission

- sale of Airis doesn’t generate a commission

- sale of Hailey = $20 commission

Momentum Builder Bonus

The Momentum Builder Bonus rewards Auvoria Prime affiliates for new sales activity each week.

Selling Auvoria Prime products to retail customers or recruited affiliates generates sales volume (PV).

- Ainstein and Alexander packages generate 140 PV

- Hailey generates 70 PV

- whether Airis generates PV towards the Momentum Builder Bonus is not clarified

A minimum of 420 PV from new customer/affiliate activity for the week is required to qualify for the Momentum Builder Bonus.

Note that exact sales volume amounts for each Auvoria Prime product is not provided.

At the end of the week Auvoria Prime tallies up each affiliate’s new activity sales volume.

Based on generated PV, the following shares are allocated:

- 420 PV = 1 share

- 840 PV = 2 shares

- 1120 PV = 3 shares

- 1260 PV = 4 shares

- 1400 PV = 5 shares

The shares correspond to a bonus pool, made up of an undisclosed percentage of Auvoria Prime’s sales revenue.

Residual Commissions

Auvoria Prime pay weekly residual commissions based on rank.

There are eleven ranks within Auvoria Prime’s compensation plan.

Along with their weekly respective qualification criteria, they are as follows:

- Active Affiliate – generate and maintain 140 GV a month (31 days)

- Visionary – generate and maintain 560 PV a month

- Visionary 600 – recruit and maintain four affiliates and generate 13 Qualifying Group Points (min 4 points in four unilevel team legs)

- Visionary 1500 – maintain four personally recruited affiliates and generate 35 Qualifying Group Points

- Icon 3000 – recruit and maintain five affiliates and generate 90 Qualifying Group Points

- Icon 5000 – recruit and maintain six affiliates and generate 250 Qualifying Group Points

- Icon 10,000 – maintain six personally recruited affiliates and generate 500 Qualifying Group Points

- Auvorian 25K – recruit and maintain seven affiliates and generate 1250 Qualifying Group Points

- Auvorian 50K – recruit and maintain eight affiliates and generate 2500 Qualifying Group Points

- Auvorian 100K – recruit and maintain nine affiliates and generate 5000 Qualifying Group Points

- Auvorian Legend – recruit and maintain ten affiliates and generate 15,000 Qualifying Group Points

If you’re wondering what “Qualifying Group Points” are, I don’t know either. Auvorian Prime does not define them in their compensation plan, and they’re only mentioned in the rank qualification criteria.

My guess is Qualifying Group Points are some reduction of GV (sales volume), into a simpler point value.

Qualifying Group Points exclude an affiliate’s own purchase and appear to only count that of personally referred retail customers and recruited affiliates.

In the qualification criteria above, it is assumed recruited affiliates are commission qualified.

Note that required Qualifying Group Points from Visionary 1500 are capped at 40% from any one unilevel team leg.

A unilevel team is a compensation structure wherein those you recruit/refer are placed directly under you on level 1:

Those they recruit are placed on your level 2 and so on and so forth.

Based on the above rank qualification criteria, weekly residual commissions paid out are as follows:

- Visionary – $40

- Visionary 600 – $150

- Visionary 1500 – $375

- Icon 3000 – $750

- Icon 5000 – $1250

- Icon 10,000 – $2500

- Auvorian 25K – $6250

- Auvorian 50K – $12,500

- Auvorian 100K – $25,000

- Auvorian Legend – $62,500

Joining Auvoria Prime

Auvoria Prime affiliate membership is tied to the purchase of Ainstein or Alexander.

- Ainstein affiliate package – $299 and then $199 a month

- Alexander affiliate package – $299 and then $199 a month

Retail customers can also upgrade for $30 and then $19 a month (on top of their Ainstein or Alexander package fees.

Conclusion

In addition to the fraud riddled past of Auvoria Prime’s management, the glaring red flag with their offering is US exclusion:

Any time an MLM company excludes the US from a legal product or service, it’s a good sign they’re up to no good.

In this instance, Auvoria Prime playing coy with US regulators can be traced back to SilverStar Live’s CFTC fine.

SilverStar Live was fined because it

acted as commodity trading advisors (“CTAs”) without being registered with the Commission as such, by exercising discretionary trading authority over the forex trading accounts of U.S. customers who were not eligible contract participants (“ECPs”).

To be clear, if a company registers with the CFTC and provides it and the public with legally required disclosures, there’s nothing illegal about trading on behalf of US customers.

Rather than register with the CFTC and operate legally however, Auvoria Prime have opted for pseudo-compliance.

I say this because it’s glaringly obvious that the majority of Auvoria Prime’s executives, including Sal Leto, are based out of the US.

Leaving the US for a moment, it’s worth pointing out that unlicensed auto trading is also illegal in every country where trading markets are regulated.

Which is pretty much every country with an established economy.

Auvoria Prime’s idiotically named Ainstein service also constitutes a securities offering. Again not illegal in the US and elsewhere in the world, provided you register with financial regulators.

Something Auvoria Prime is loathe to do.

Ban the US (*winkwink VPN nudgenudge*), and roll the dice on international regulators not bothering to come after us… until it’s too late for our investors.

Registering with financial regulators would require Auvoria Prime to make full disclosures about their bot, including who coded it and past results.

That’s not going to happen for what should be obvious reasons.

One thing we can reveal is Eaconomy’s lawsuit against Auvoria Prime suggests their virtual assistant app is provided by VisiKard.

Eaconomy lumps VisiKard, Maurice Katz and Bolt Capital (a shell company registered in Nevis), as developers of what was supposed to be their own virtual assistant app.

EACONOMY had been working closely with VisiKard, Inc. Defendats KATZ and BOLT to develop its software to allow its products to be compliant with the laws of the United States.

This software modification included an App which was to be provided to EACONOMY’S product customers.

When accessed, this App would allow the customer to make certain discretionary commands.

EACONOMY had paid $25,000 to KATZ and approximately $165,000 to BOLT for the App and such software improvements.

However, when the developed software and App were provided to EACONOMY it did not work.

On information and belief, BOLT, VisiKard, and KATZ have provided the fully functioning software and App to AUVORIA PRIME and intentionally provided defective and faulty software to EACONOMY as part of the conspiracy to steal company assets and to destroy EACONOMY.

Maurice Katz worked with Sal Leto to promote the OneCoin Ponzi scheme across the US.

VisiKard is run by CEO Kenneth O. Lipscomb. Katz isn’t mentioned on VisiKard’s website so I’m not sure what the connection there is.

A common link between SilverStar Live and Eaconomy is that recruitment took precedent over the trading results.

Despite two collapses, nobody heard a peep from retail customers losing access to the bots.

Looking at Auvoria Prime, it’s pretty obvious the only people paying for subscriptions are going to be Eaconomy affiliates and whoever they can convince to sign up.

As I write this Alexa cites Libya (38%), the US (18%) and Singapore (15%) as top sources of traffic to Auvoria Prime’s website.

Put simply: the money is in recruitment. Auvoria Prime is the same pyramid scheme wrapped in securities fraud that SilverStar Live and Eaconomy were.

If someone trying to recruit you into Auvoria Prime can’t provide evidence of having registered with financial regulators in your country, run.

And if you’re in the US, know that it’s still illegal to promote unregistered securities to non-US residents.

Footnote: I’ve gone over Eaconomy’s complaint against Auvoria Prime.

It pretty much repeats what has already been disclosed in the Eaconomy collapse announcement, so I won’t be publishing a separate article.

That said we will be tracking the lawsuit going forward.

At the time of publication, none of the named defendants have responded to Eaconomy’s filed March 23rd lawsuit.

Update 17th December 2020 – Eaconomy has dropped its lawsuit against Auvoria Prime.

Such a bullshit. Who do you trust more, a Hassan and Candice who telling lies or people like Chriz Nickel who are in Forbes magazine and topleaders of Auvoria Prime? Auvoria Prime started cause Hassan and Candice didnt made changes like online banking and many other problems. So there were 2 options:

-We stay and have all problems cause nobody can change cause the 2 stupid CEOs.

or

-We go and change every problem and make everything easier and much better for everyone. (Btw the software works way better and has many new upgrades already!!!)

So dont post hate about the best company if you havent seen your own results and of thousands of others!! 🙂

Auvoria Prime, a company run by US residents, is committing securities fraud. Who gives a fuck if somebody appeared in Forbes?

Yellow news this site is a fraud , just because you know the company’s ranks doesn’t mean you know their customers who are 100% successful using their services.

i have not seen a single person who reported Auvoria Prime by fraud. Why don’t you ask Avery single customer.

If you criticize a company you are criticizing real true leadership.

This is just a Paid Ad for sure By those who are afraid about technology. You can fight anything But can’t fight with tendency.

^^ I think that’s all the scam cliche defenses? Did he miss any?

Whether Auvoria Prime’s customers affiliates are successful or not is irrelevant. The company is committing securities fraud.

By the time people report being scammed it’s too late. Just like Silverstar Live and Eaconomy.

If you want to follow scamming leaders have at it. You sound like a perfect mark.

I am using one of theirs product and have amazing results trading on live account. I am 100% satisfied with wath I get for my money.

All their products are aweful. I tried during the trial phase and blew 2 demo accounts … The US version is useless at best, a complete fraud more likely.

Those comments defending the product are likely affiliates or from the company itself.

People don’t believe this mlm bullshit. They are trying to take your hard earned money and leave with it.

It is such bullshit and crap. What a waste of human potential.

So if one company or person doesn’t get it right on one or 2 tries, that means everything a person does or company does afterwards won’t work either? Is that your logic?

#2 You said Eaconomy had a app that was in compliance with the CFTC but didn’t work “this App would allow the customer to make certain discretionary commands”. So why is it that Auvoria has the same app but improved it but now somehow it is NOT COMPLIANT?

#3 If I understand it correctly the reason why one is not available in the USA is because it’s not compatible with the CFTC rules.

That shows them doing what the law requires. Am I wrong about that? Please don’t curse in your response. I want to still have respect for you and your platform.

Nope. My logic is Auvoria Prime is committing securities fraud based on its business model.

No I didn’t. Read the conclusion of our Eaconomy review.

Pseudo-compliance restricting US IP addresses doesn’t change the fact Auvoria Prime is a US company run by US residents committing securities fraud.

Targeting victims outside of the US doesn’t justify securities fraud (ref: Traffic Monsoon).

@Outside:

Do not be fooled when they say things like, “I made some mistakes last time, but now I’ve learned how to do it right.” They have to say something to explain away their track record of scheme collapses.

These people are scammers. They’ve run multiple scams in the past, and now they’re working another one. Same scam, different tune.

You should trust Oz’s track record; he knows how to analyze a business model and pierce through the marketing hype. But with due respect to Oz’s skills, this one is an easy call to make.

It is clearly a scam, and not a particularly well-disguised one. The payout model means the only measurable source of income is going to come from affiliates; that is the very definition of a pyramid scheme.

They are pretending to block sales to the US for one reason only: they’ll be able to run the scam longer if the US regulators aren’t investigating them.

These are not honest business people trying to build a thriving company. They are con artists running another con. Stay away.

Hello, I am a current customer of Auvoria Prime & my results have been wonderful.

This article is most likely a paid advertisement. Do not believe everything you read. Results show.

hEy GuYs, IgNoRe ThE fAcTs CuZ i’M gEtTiNg PaId!

Irrespective of whether you’re getting paid, Auvoria Prime is committing securities fraud.

You have to wonder if everything was above board, why Auvoria Prime would opt to operate illegally.

“a paid advertisement” for what, Kate? Do you see any competing MLM being touted here? Do you see any investment system at all touted here?

Of course not; Oz doesn’t give financial advice so he can remain unbiased.

You are biased by your own admission, so if you can make no substantive contributions, please do not bother.

Hey guys. In my opinion it is pretty interesting what you wrote. Are there any information about where the quotations come from?

I think it is very important to show other people the source of these information? And I would like to get good proved information I can spread.

In violation of securities law, Auvoria Prime don’t disclose information about their service.

Hi OZ

Sai Leto is maybe not a saint but neither is he criminal. My personal opinion-he is OK guy.

Eaconomy disapeared, ok thats a fact. AP just get rid of a rotten apples. But what about their customers/affiliates. What about their invested money. I had a close look in some of accounts started by august/september last year till now and imagine, they are all making/earning money.

Bloody hell how is it possible, company vanished and customers are ok is,nt that telling something about Leto.

My dear Oz, in your report you did not mention two crucial moments and they are:

A- who is operating the investors money. Not Mr.Leto but officialy recognized broker with all his good faith and AI Ainstein/Alexander.

B- The most important item- investors have their money on disposal at any time, they can get it on their account without any consequences.

Hypotheticaly: AP goes bankrupt for any reason, what about their money? It is on a safe side with trader- yes or not. Yesssss

Your mantra is-they are breaking security laws… Only in US. To make a long story short- Show me the facts and the results, I beleive you heard that somewhere.

So far all that is teribly against you. Must not forget to mention disclaimer.

That is only my personal opinion.

All that with AP.

B-

Promoting Ponzi schemes (and now running them) is illegal. Criminals commit illegal acts.

If you ignore Leto’s past (you definitely shouldn’t), at the very least he’s still currently committing securities fraud through Auvoria Prime.

Securities fraud is a civil matter but the money laundering side of things ventures into criminal territory.

Doesn’t matter if Mickey Mouse is “operating the investors money”. The securities offering is made through Auvoria Prime. They need to be registered with the SEC and filing full disclosure.

Until they can’t. And also again, this has no bearing on securities fraud.

The US is important because that’s where Leto and the gang are operating from.

Auvoria Prime is also committing securities fraud outside of the US, in every country they haven’t registered with financial regulators. That’s all of them.

The facts have been laid out for you. Stop making excuses for scammers.

Lol.

Product works and Auvoria never has a access to clients money.

Get to know facts, Oz.

Lol. Neither of those have anything to do with Auvoria Prime committing securities fraud.

Get to know facts John.

Please show us some facts. Í’d like you to give some specific aspects of what Auvoria is doing which break US security laws. Then, some examples of specific non-US jurisdictions where those same things are quite legal.

Surely this cannot be difficult to do, since you must have already done your research on this. Otherwise you wouldn’t have made such a sweeping statement. I’d be happy with just a few examples of non-US countries, with verifiable links to their relevant legislation.

First:

Ainstein and Alexander are computer programs, or at least that’s the suggestion on the Auvoria site – just what it is you get when you buy them is completely unclear.

The description is so vague, they could well consist of nothing more than just giving access to some Auvoria-operated website, or to some non-HTML server, with god-knows-what software or human-operated system behind it.

But whatever they are specifically, they are just software, and thus by definition not capable of doing anything with money. Only legal entities (human beings or companies) can do that.

Second:

I have looked at the Auvoria site, and nowhere can I find any mention of any “broker” being involved in what they do.

So for the same countries for which you’ve provided us with the evidence that Auvoria is legal there, can you provide us with the names and contact information of the “officially recognized” brokers in those countries who are somehow associated with Auvoria?

And explain just what it is that they do in regards to investors’ money, and what their legal relationship is to (a) Auvoria, and (b) the buyer of Auvoria products?

Correct, Human beings or Companies can do that with money. Auvoria prime doesn’t do anything with our money. They give us the software, we control the software and take action on our own investment. We are human beings.

The fact that we use AI technology to assist us is a whole different (Ozedit: abuse removed). Therefore your first argument is bullshit and makes no sense.

Second, the brokers (Ozedit: abusive derails removed)

Also, Ainstein is registered and compliant in all countries outside of the US. Alexander is registered and complaint for people INSIDE of the US. They are a US based company because their main product is for US users (Ozedit: abuse removed).

They’re sooooo good they were able to tweak it and add features that are compliant with multiple countries and you’re just upset. Fuck outta here.

They do, through their software, if you’re outside of the US (or using a VPN *winkwinknudgenudge*).

Passive investment opportunity = securities offering. Auvoria Prime isn’t registered to offer securities in any jurisdiction.

Securities fraud = illegal. Scammers mad.

Feel free to provide one country Auvoria Prime has registered to offer securities in.

Show me where it says Auvoria Prime takes our money and invests it for us. That’s offering securities. (Ozedit: snip, see below)

Sure thing, from the Auvoria Prime website page for the Ainstein Package:

Non-manual input == automation == passive return == securities offering.

Maybe next time know your subject matter before mouthing off and carrying on like a homophobic pork chop.

If one uses the definition of “countries” as “member states of the UN”, there are 193 of those. So Auvoria has 192 of these registrations. I seem to be unable to find a list on their website. Perhaps you could provide us with a few examples.

That would also provide an answer to the question that keeps bugging me: if, as keeps being repeated, Ainstein is just a piece of software, which doesn’t do anything with anyone’s money, and Auvoria as a company also doesn’t do anything with anyone’s money, then as what the hell are they ‘registered’, with which 192 official bodies?

It is certainly an extraordinary feat of both legal and software engineering: one and the same piece of software which is legal to sell in 192 countries, each with their different laws, but wholly illegal in just one. Unless you’re telling us they’re maintaining 192 quite different versions.

Auvoria Prime and their german distributers the “True Peak Army” (what a cringeworthy name) are a complete scam.

Pretty much every negative comment on here and everything mentioned above is true. Do NOT buy their products.

Oz, please stop spreading falsehoods and do your homework. Auvoria Prime does nothing with the each software user’s money.

With Ainstein, the user has full control of their own settings which they decide on and MANUALLY input and monitor. The software will NOT execute trades that the user has not authorized in their settings. It is NOT a passive return. So get your facts straight, please.

They do with investors outside of the US, which is a securities offering and requires SEC registration.

So get your facts straight, please.

I just started with their software but I have been also very sceptical about Auvoria Prime because I have read many critics. But I wanted to give it a try. Here are my expierence (after just 2 weeks):

software system works. I got 2% profit in both weeks. that doesnt mean of course, that this will last forever but its a good start. my money is managed by a broker, so Auvoria Prime has no direct access to my money.

What I do pay is the monthly fee of 267$ in the first month, next month 189$ and so on. Its quite much I must say but I am going to keep testing the software and if it still works, the money is worth it.

What I do not like is the networking part. Thats why I am still sceptical and totally undertand others who have second thoughts about Auvoria Prime.

Its kinda a snowball system which means, that only the higher-ups who started to recruit gain much money because of it and tell their recruits that they can do it also. Buts thats not true.

Its simply mathematical. If you recruit 6 persons and each of them also 6 persons and so on and so on….you already reach the whole population of the world on the 13th rank.

summary: software program works so far, but u definitely need help with all the settings by someone who has experience. the networking part is unnecessary.

So ignoring the pyramid recruitment, you need to invest at least $13,350 just to break even with fees (first month).

You should definitely not ignore the pyramid recruitment.

Look at it this way…Donald Trump had many lawsuits against him and he went bankrupt himself….yet he’s still the President of the United States.

The software works great, the FXBOOKS to back it up including my own as well as prove a great statement. Make sure you settings are on point and you’ll be profitable.

Your Donald Trump analogy has nothing to do with Sal Leto promoting multiple Ponzi schemes and now running his own.

So why not register with the SEC and run Auvoria Prime legally then? You know why. I know why. Sal Leto knows why.

OZ, you’re just absolutely right.

I’ve tried the tools and yes, there might be a chance to use them at a profit. However, due to the poor grid strategy, it seems very difficult to do this for a long time.

And if your looking at AUVORIA PRIME as a company… it’s definitly a scam. Monthly payments that are so high for an inferior robot almost call out that they are only used to maintain the pyramid.

Most robots cost about once as much as AUVORIA PRIME each month … what a miracle.

I have seen this company genuine and providing all legal servies and I would request this is the news against about auvoria prime totally crap.

and you guys should remove this who wrote this without knwoldge shoudl be in jail.

LOVE AUORIA PRIME and blessing opprotunint and junkies just wasting thier time on this kind of shits.

Yeah, there aint nothing legal about securities fraud chief.

Hey Oz,

All the software and products are certified and compliant to CFTC and SEC rules and regulations. I’ve done my research as well since I was skeptical.

It’s a good company and very customer oriented. If you want a user friendly EA for trading, this is a great company.

If you want to become an affiliate – it’s up to you. No ones forcing the affiliate portion of it which is nice.

Cheers!

Lol, certified by who? Securities fraud is very much not compliant with the Securities and Exchange Act.

Auvoria Prime RECEIVES NO investment capital to trade with or invest with on behalf of their customers. They receive 120$ a month for use of software that only the customers have control over to use at their disposal. Just like someone would do with Microsoft Word or Adobe.

The CUSTOMER then chooses any broker THEY see fit to use and deposits THEIR investment capital into THEIR broker account. The customer and the customer alone are the only person who has access to their broker and investment capital.

Thus, having zero chance of a “Ponzi or pyramid scam” I suggest you google the definition of one. A scam would require a customer to give their investment capital to the company to invest for them and pay them out commissions on it. That is clearly not the case as I just explained above.

The customer then drags and drops the software onto THEIR trading platform to use as THEY please and adjust any risk settings they choose for them selves.

The software is just an algorithm-coded, specific strategy with a high success rate that the customer controls to increase their success in Forex trading.

The rules and regulations in the US state that a resident can not have an EA (Expert advisor/software) execute the actual trade. Thus, it sends a notification for the user to manually take the trade. The rest of the world is legally aloud to have the EA actually execute the trades for them.

That user does not need to manually approve any trade. That is the differences between the two and how they are compliant in the US and the rest of the world. Each of the 5 software they offer have the two options to make them compliant in whichever country the customer is in.

THERE IS ZERO CHANCE OF A SCAM! YOU AND YOU ALONE ARE THE ONLY ONES THAT HAVE ACCESS TO YOUR TRADING CAPITAL. THE SOFTWARE IS A TOOL FOR YOU TO USE TO TRADE YOUR OWN MONEY. AUVORIA PRIME RECIEVES NO INVESTMENT CAPITAL.

Get your facts straight before bashing a company you clearly don’t know how it operates or works.

And?

Auvoria Prime markets a passive investment opportunity.

MLM + passive investment opportunity = securities offering.

Auvoria Prime is not registered to offer securities.

Unregistered securities = illegal.

Auvoria Prime = illegal unregistered securities offering.

Get your facts straight before pseudo-compliance waffling on about laws you clearly have no idea about.

Securities fraud is most certainly not legal outside of the US.

As for getting scammed, all it takes it the bot owner (not disclosed, again securities fraud and a violation of the FTC Act), to change the code and steal your money through bogus trades.

Happened plenty of times before.

It’s official… did as I was told and my account blew up. All my money is gone.

Passive investment or the signals?

You must’ve not set up your settings correctly or you traded using a volatile week.

Auvoria Prime is not responsible with your account or settings. They do not suggest any settings.

My account does 20% a month consistently.

Hi there Oz,

Really interested in this review. You might have just saved me some money as my friend invited me to sign up to this.

Just out of interest, are you saying that the sale of any automated trading robot (just the software, for example an MT4 Expert Advisor) is a securities offering?

Keep up the good work!

Simon.

All I’ve ever said is:

MLM + passive investment opportunity = securities offering

unregistered securities = securities fraud

Marvelous!

Has Barron’s or the Wall Street Journal contacted you yet?

That is exactly eight times better than Warren Buffett, George Soros or Peter Lynch ever did, after all.

How’s your wife … uh … Morgan Fairchild?

Yeah. That’s the ticket!

SD

C’mon, shipdit, everybody knows Morgan Fairchild is married to little Tommy Flanagan.

It will all go down when people withdraw big amounts of money at one time.

As long as there are little amounts withdrawn there will be no harm done and it all looks good. But when people want to have the big bugs it’s going to be awful and painful.

That and the law will get the Ponzi schemes down.

Do you have a resource somewhere that points to the SEC, FTC, and CFTC codes, rules, or regulations?

Is there anything that points to who they register with, how they register, and what is required.

It would be very helpful for people who are writing auto-trading bots to sell or lease for people to use in their own brokerage accounts.

Maybe it depends on if their bot operates in the stock market, the futures market, the forex market, or the crypto exchange market as to who the register with, so let’s say forex, or crypto.

I know some people who are currently writing such a bot, and they probably don’t know what they don’t know about the regulations and requirements. You somehow do though. Could you post a link or a link to links?

Links to those rules would also be helpful for all the people looking to buy or lease one of these bots from a company for example to use and market the product, before they get in.

Securities in the US are regulated as per the Securities and Exchange Act.

You can read that or cliffnotes: MLM + passive investment opportunity = securities offering.

The Howey Test is probably also worth looking up. It’s used to determine an investment opportunity.

If you’re doing forex then you also need to register with the CFTC.

Before anyone trots out the usual excuses for fraud; it doesn’t matter how your passive investment scheme is set up, it’s a security.

Thanks.

Will search for those to look those up.

I think a page of links to their rules and regulations and requirements would serve as a good measuring stick against which people could measure the legality of their trading bot or Ponzi investment opportunity.

Here is a list of questions I have – you touch on a lot.

In the case of a trading bot, let’s say one that trades in a person’s own futures, or forex account rather than a pool, I’ve seen automation sellers say it’s “self directed” because the customer has to “turn it on”.

It sounds like they are trying to be cleaver to avoid identifying it as “passive”. It gets confusing where the line is for the rules.

Also in the case of trading bots, again let’s say one that trades in a person’s own brokerage account, are their rules about how much trade history or performance history has to be disclosed by the bot seller, or how much performance history the seller is not allowed to disclose to the buyer to avoid being guilty of “enticement”?

Again I don’t know how people stay on the right side of the line.

Trading pools are another thing. Nobody usually knows what they are doing with the money and if they really have automated AI or humans, or no trading at all.

No matter what they say I just can’t believe them. But that said, US citizens are supposedly allowed to participate in PAMM accounts.

The same questions come up though. For example, how do the managers show if the broker hosted PAMM is real and how do customers know if the whole brokerage is a scam created just to host a fake Ponzi PAMM? What can regulations do to clear this up?

Then for business opportunities where there are referral commissions, what are the requirements on “sales” commissions. Are commissions as a percentage of the customer’s invested amount and earnings against the rules or not?

Are commissions on fixed price “monthly memberships, or subscriptions” for financial products like automated trading bots against the rules or not?

In more detail, how many affiliate levels of commissions are allowed if allowed, 1 level or more levels?

What regulatory agency or rules determine this for the financial products world?

The above comments are insightful.

I don’t want these questions tracing back to me, but I joined a crypto trading so called “AI-Bot” program that is not out yet as an affiliate.

Presently they won’t tell anyone how much it makes or give any numbers because (Ozedit: snip, see below)

With respect to MLM; MLM company + passive investment scheme = securities offering.

What about…

MLM company + passive investment scheme = securities offering.

But what if I…

MLM company + passive investment scheme = securities offering.

OK but how come…

MLM company + passive investment scheme = securities offering.

Can’t I just…

MLM company + passive investment scheme = securities offering. Period.

I don’t have any interest in non-MLM related securities offering as it falls outside the scope of BehindMLM.

If they’re generating a passive return for you it’s a securities offering.

If the company isn’t registered with the SEC and other financial regulators, it’s committing securities fraud.

MLM + securities fraud = scam.

I have been a part of Auvoria Prime, cuz we were forced to leave Eaconomy since Hasan Mahmoud was getting Eaconomy downhill. Nothing worked.

Since Auvoria Prime launch till now, 3.5 years everything evolved and this article above is complete bullshit. AP rents out its products on a monthly basis, it is trading technology or signals. So they are a technology provider.

and people I have seen have a 3-year track record of winning with those products in the market.

How can then AP scam their customer?

It is ridiculous to say that. AP doesn’t handle or touch their customers money. Any customer can choose any broker they want, deposit their money onto their account and plug in the tools to start trading.

IT CANNOT BE MORE LEGIT THAN THAT 🙂

I have used and use all their products and made money with each tool.

As for mentioning Sal Leto, Chriz Nickel – they are good guys and I know them personally, but they have no involvement with AP for the last 2.5 years already, so these articles are outdated and full of misleading information.

(Ozedit: spam removed)

This review is date-stamped and was accurate at time of publication. That doesn’t make it misleading or “complete bullshit”.

Clearly Auvoria Prime doesn’t have a 3 year track record. I went on their website and none of the products here are featured.

Also if you want to make financial representations, feel free to provide audited financial reports filed with the SEC. Your social media bullshit isn’t a substitute.

Failing which, best of luck with the securities fraud. In that sense Auvoria Prime hasn’t changed since 2020.

SimilarWeb tracked just ~12,000 visits to AuvoriaPrime’s website in August 2023. How’s that for a track record?