Satoshi Square Table Review: Sam Lee resurrects HyperFund

Satoshi Square Table operates in the MLM cryptocurrency niche.

Satoshi Square Table operates in the MLM cryptocurrency niche.

Satoshi Stable’s website domain (“satoshistable.com”), was privately registered on December 6th, 2024.

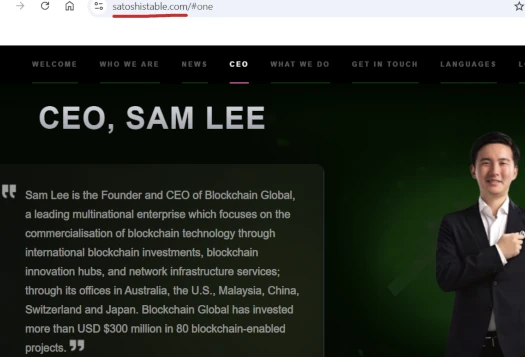

Serial fraudster Sam Lee is cited as Satoshi Square Table’s CEO.

Xue Samuel Lee is a wanted fugitive hiding in Dubai.

With partner-in-crime Ryan Xu, Lee launched HyperCash, HyperCapital, HyperFund and Hyperverse – all Ponzi schemes in which the majority of investors lost money.

After those Hyper* Ponzi schemes came HyperNation and HyperOne, although Lee’s direct involvement in those follow-ups is less clear.

Lee spent most of 2022 hiding in his Dubai apartment. Originally from Australia, Lee fled to the MLM crime capital of the world in 2021 as HyperFund took off.

In late 2022 Lee reemerged with StableDAO. Aimed at victims of Lee’s previous scams, StableDAO pitched an 11% a month return.

StableDAO also served as a scam incubator platform, through which Lee has launched StableOpinion and VidiLook.

StableOpinion failed to gain any significant traction. VidiLook did but collapsed on April 21st.

Fresh off VidiLook’s collapse We Are All Satoshi launched, marking Lee’s third StableDAO spinoff. We Are All Satoshi collapsed in September 2023.

In January 2024 Lee and two conspirators were indicted on HyperFund related fraud charges. The SEC filed parallel civil fraud charges against Lee that same month.

In October 2024 Lee was detained in Dubai on an Interpol arrest warrant. Lee was released in December 2024 and, as at time of publication, remains a fugitive wanted by US authorities.

Read on for a full review of Satoshi Square Table’s MLM opportunity.

Satoshi Square Table’s Products

Satoshi Square Table has no retailable products or services.

Affiliates are only able to market Satoshi Square Table affiliate membership itself.

Satoshi Square Table’s Compensation Plan

Satoshi Square affiliates invest molecular future (MOF) or tether (USDT) into “Hyper Wealth Packages”.

The cost of a Hyper Wealth Package isn’t disclosed but one package corresponds with 1000 Hyper Units (HU).

This is done on the promise of a 15% to 30% per month passive returns, paid out in HU.

Note that returns are capped at 3000 HU (3000%), after which new investment is required to continue earning.

20% of Satoshi Square Table earned MLM commissions must be reinvested. Satoshi Square Table also charges a 10% fee on all withdrawals.

The MLM side of Satoshi Square Table contributes to the 300% ROI cap and pays out as follows:

Satoshi Square Table Affiliate Ranks

There are four ranks within Satoshi Square Table’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- 1 Star – generate 1,000,000 HU in downline investment volume

- 2 Star – generate 3,000,000 HU in downline investment volume

- 3 Star – generate 5,000,000 HU in downline investment volume

- 4 Star – generate 10,000,000 HU in downline investment volume

Note that HU generated from the strongest recruitment leg is excluded for the purpose of rank qualification.

ROI Match

Satoshi Square Table pays out a ROI Match through a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Satoshi Square Table caps the ROI Match at twenty unilevel team levels.

The ROI Match is paid as a percentage of the daily HU return paid across these twenty levels as follows:

- level 1 (personally recruited affiliates) – 20% match

- level 2 – 15% match

- level 3 – 10% match

- levels 4 to 6 – 5% match

- levels 7 to 15 – 2% match

- levels 16 to 20 – 1% match

Note that unlocking unilevel team levels is tied to recruitment. Satoshi Square Table affiliates must recruit one affiliate investor to unlock level 1. Recruit two affiliate investors to unlock level 2 and so on and so forth.

VIP Reward

The VIP Reward is a percentage boost on the ROI Match:

- 1 Star ranked affiliates receive a bonus 5%

- 2 Star ranked affiliates receive a bonus 6%

- 3 Star ranked affiliates receive a bonus 7%

- 4 Star ranked affiliates receive a bonus 8%

Global Rewards

Satoshi Square Table takes 4% of company-wide investment and splits it into four smaller Global Rewards pools.

The Global Rewards pool are shared with ranked Satoshi Square Table each month:

- 1 Star ranked affiliates receive a share in a 1% Global Rewards pool

- 2 Star ranked affiliates receive a share in a 1% Global Rewards pool

- 3 Star ranked affiliates receive a share in a 1% Global Rewards pool

- 4 Star ranked affiliates receive a share in a 1% Global Rewards pool

Joining Satoshi Square Table

Satoshi Square Table affiliate membership is free.

Full participation in the attached income opportunity requires a minimum undisclosed investment into a Hyper Wealth Package.

Satoshi Square Table solicits investment in MOF tokens and USDT.

Satoshi Square Table Conclusion

There’s not much too Satoshi Square Table.

- hyper unit (HU) was the original shit token Lee’s HyperFund Ponzi scheme ran on

- molecular future (MOF) was one of the many shit tokens launched after HU collapsed in a bid to keep HyperFund going

Seeing as Lee’s company HyperTech Group owned HyperFund and HU, what we have here is recycling of a dead Ponzi token to launch yet another Ponzi.

Acceptance of MOF to invest demonstrates targeting of Lee’s HyperFund victims. All that’ll happen there is MOF bagholders will become HU bagholders.

Tether is available in a desperate attempt to solicit new investment, without which nobody in Satoshi Square Table can cash out.

And just in case there was any doubt Satoshi Square Table is yet another Sam Lee Ponzi scheme, this is from Satoshi Square Table’s own website;

Satoshi Group takes a thoughtful approach to innovation, studying the journeys of Hyper Capital, Trage, Novatech, WAAS, and Empirex—their successes and challenges alike.

- HyperCapital was the original HyperTech Group Ponzi scheme, its collapse prompted the launch of HyperFund

- TrageTech was an MLM crypto Ponzi that collapsed in December 2024

- NovaTech FX was an MLM crypto Ponzi that collapsed in February 2023 (SEC fraud lawsuit filed in February 2024)

- WAAS = We Are All Satoshi, an already collapsed Sam Lee MLM crypto Ponzi

- EmpiresX was an MLM crypto Ponzi that collapsed in October 2021 (owners indicted, SEC and CFTC fraud lawsuits filed in July 2022)

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Satoshi Square Table of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Hat tip to Danny de Hek for the heads up on this one:

dehek.com/general/ponzi-scheme-scamalerts/sam-lees-2025-plan-the-start-of-another-crypto-scam-or-the-end-of-the-road/

What got me is how ryan Xiu and lee were ware able to be elevated to such high positions that everyone was blind th the red flags.

they seemed so legit. Even rory , who was supposed to be an educated as well as dr michael, who were big promoters of this in sa, got duped.

I wonder how much rory and michael withdrew ? I know that dr michael put in R1m from coining it on another failed platform in sa which had to do with “coin auctions ” and stil dr Michael is in “disbelief” when people question ” where does the money come from ”

All because dr michael has an honorary doctorate in finance, doesnt mean he is qualified. He uses that title to hide behind what he is promoting and so does rory.

Xu and Lee never came off as legit. It was obvious fraud from day one.

The only people blind to the obvious were greed-stricken rubes. A lot of them sure but certainly not “everyone”.