SEC charges HyperFund’s Sam Lee & Brenda Chunga

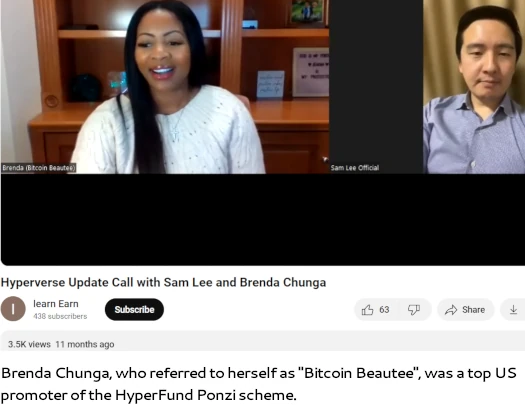

HyperFund co-founder Sam Lee and promoter Brenda Indah Chunga have been charged by the SEC.

HyperFund co-founder Sam Lee and promoter Brenda Indah Chunga have been charged by the SEC.

The SEC cites HyperFund as a ~$1.7 billion dollar Ponzi scheme. This tracks with BehindMLM’s HyperFund review, published back in 2021.

Lee, an Australian national who fled to Dubai in 2021, and Chunga, aka Bitcoin Beautee, have been charged with multiple violations of the Securities Act.

HyperFund operated under the banner of HyperTech, a company Lee co-founded with Ryan Xu (aka Zijing Xu).

Chunga, a US national residing in Maryland, was a top HyperFund promoter. The SEC cited Chunga as “arguably the face of [HyperFund’s] United States presence”.

Chunga eventually became one of only six “corporate” presenters for HyperFund, and one of only two in the U.S.

The ruse behind HyperFund’s Ponzi scheme was cryptocurrency mining.

As revealed in the SEC’s January 29th filed Complaint;

Lee was a co-founder of HyperTech Group, which claimed to be involved in “Large Scale Crypto Mining,” including bitcoin, that promoters asserted was a key revenue source for HyperFund.

However, Lee later admitted that HyperTech Group was not engaged in large-scale bitcoin mining.

HyperFund had no real source of revenue other than funds received from investors. HyperFund … was a pyramid and Ponzi scheme.

Ultimately, the scheme collapsed in 2022 when investors were no longer able to make withdrawals

As per US law, HyperFund’s passive returns investment scheme constituted a securities offering.

HyperFund’s membership packages were offered and sold as investment contracts, and therefore, securities under the federal securities laws, because investors made an investment of money in a common enterprise with a reasonable expectation of profits from the efforts of Defendants or third parties.

The membership packages were offered and sold without registration, and without qualifying for any exemption from registration.

The SEC doesn’t disclose how much Lee personally stole through HyperFund.

Chunga is accused of encouraging others to lose “at least $5 million” in HyperFund. She is also personally accused of stealing “over $3.7 million”.

[Chunga] used her earnings to fund extravagant personal expenses and help recruit others into the scheme by showing off the potential wealth to be earned through HyperFund.

Among other things, Chunga spent that money on a lavish birthday party that doubled as a HyperFund recruitment event, as well as expensive custom-made jewelry and clothing, a BMW, designer handbags, a $1.2 million home in Severna Park, Maryland, and a $1.1 million condominium in Dubai.

To encourage new recruits to sign up and lose money, Chunga falsely boasted she was stealing “over $5 million a year” through HyperFund.

Most of the money Chunga stole was through HyperFund’s Ponzi scheme. Some of it though was directly stolen from HyperFund victims Chunga recruited.

Chunga often accepted U.S. currency directly from investors who transferred funds to her personal bank account via check or wire.

Chunga charged these victims a 1% to 3% fee for accepting their money. These fees totalled $1.1 million alone.

While Ryan Xu is cited in the SEC’s Complaint as “Founder B”, charges against him are conspicuously absent.

Xu also appears to have dodged criminal charges, following Lee’s and Chunga’s respective HyperFund indictments.

One possibility is that Xu was just a frontman.

Lee was not only a co-founder of HyperFund, but he maintained control over HyperFund throughout its existence.

Either way, Xu hasn’t been seen in public since fleeing to Dubai. His current whereabouts and status remain unknown.

With respect to its civil fraud charges filed against Lee and Chunga, the SEC is seeking a permanent injunction, disgorgement of ill-gotten gains and a civil monetary penalty.

As per a January 29th press-release from the SEC, Chunga has already settled filed civil fraud charges against her.

Chunga agreed to settle the charges, to be permanently enjoined from future violations of the charged provisions and certain other activity, and to pay disgorgement and civil penalties in amounts to be determined by the court at a future date.

In her parallel criminal proceedings, Chunga also pled guilty to conspiracy to commit securities and wire fraud.

BehindMLM is tracking both criminal and civil HyperFund proceedings. Stay tuned for updates.

Update 16th February 2024 – Judgment was entered against Brenda Chunga on January 31st.

Disgorgement, prejudgment interest, a civil penalty and “other amounts due” will be determined at a later date, pending an SEC motion requesting determination.

When that SEC filing is made I’ll publish a separate article detailing the monetary side of Chunga’s settlement.

Update 12th November 2024 – Sam Lee has been detained in Dubai. This has allowed the SEC to effect service on Lee through a foreign process server.

SEC’s HyperFund case docket isn’t publicly available either. Expecting it and the criminal docket will become available over the next 24-48 hours.

CashFx was about the same size fraud. Here’s hoping Ron Pope and his gang of thieves get charged too.

Justin Halladay is sitting under their noses in Jacksonville Florida babbling on about Jesus. He needs prison time.

I’ve been taken for the ride too and lost all funds in hyperverse.

AT least people should be wiser now and not trust anyone with their money.

Article updated noting judgment has been entered against Chunga. Monetary penalties and disgorgement to come.

I lost 1000 only, but many their life savings.