Swiss Valorem Bank Review: “Certificates” securities fraud

Swiss Valorem Bank launched in mid May. The company is a rebranding of GSPartners.

Swiss Valorem Bank launched in mid May. The company is a rebranding of GSPartners.

GSPartners is owned and operated by Josip Heit.

Originally from Croatia, Heit is believed to hold a German passport.

GSPartners was launched back in 2021 following the collapse of Karatbars International’s KBC cryptocurrency Ponzi scheme.

Karatbars International was owned and operated by Harald Seiz. Seiz partnered with Heit and his Gold Standard Bank circa 2017-2018.

Heit’s partnership with Seiz eventually led to Karatbars International lunching KaratGold Coin (KBC) in mid 2019.

The launch was a disaster, with KBC dumping 62% within a few days.

Sitting on funds they’d milked investors out of, Seiz and Heit laid low for most of 2019 and 2020.

Sometime in early 2020 “Gold Standard” was launched, and along with it yet another token reboot. This time it was G999.

After Gold Standard’s launch, Harald Seiz and Josip Heit had a falling out. This led to Heit leaving Karatbars International and launching GSPartners in late 2020.

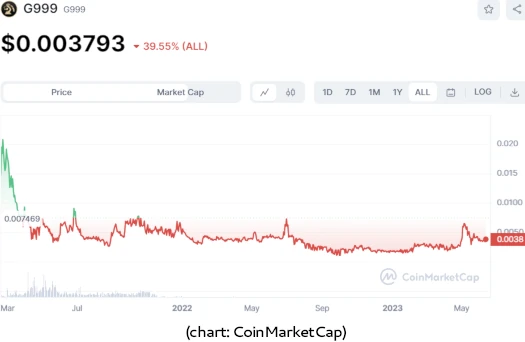

The original iteration of GSPartners was a simple MLM crypto investment scheme built around G999 token (the same token launched under Karatbars earlier in 2020).

G999 wasn’t worth anything within GSPartners. The token was dumped on public exchanges in February 2021.

Early GSPartners investors were quick to cash out, prompting the inevitable Ponzi coin dump. G999 never recovered.

Since GSPartners’ original G999 investment scheme, Heit has launched numerous failed iterations;

- J One – failed Dubai real-estate scheme built around short-lived JONE token (June 2021)

- XLT – JONE token replacement for real-estate and Lydian World metaverse grift (July 2021)

- Lydian Lions – NFT grift (January 2022)

- LYS token – created around the time the Lydian Lions NFT grift launched, was artificially pumped to $1800 in early 2022 – now $3.23

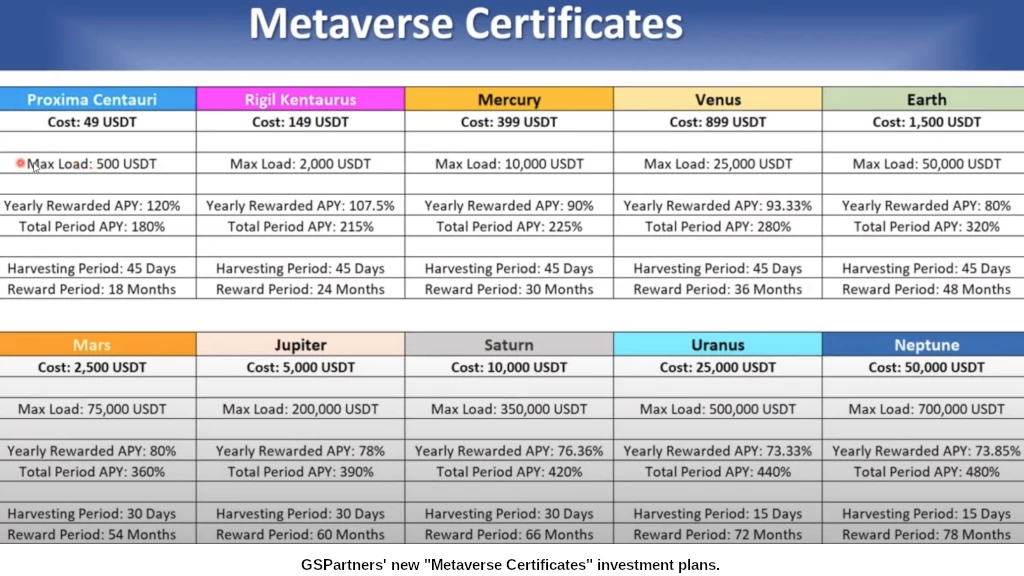

In May 2022 GSPartners launched its current “metaverse certificates” investment scheme. This coincided with the launch of GEUR, yet another token.

GEUR is cashed out 1:1 against the euro, but isn’t publicly tradeable and doesn’t exist outside of GSPartners.

Over the next 12 months GSPartners received regulatory fraud warnings from multiple jurisdictions:

- the Central Bank of the Comoros issued a GSB Gold Standard Bank LTD fraud warning in June 2022

- the Alberta Securities Commission in Canada issued respective GSTrade and G999 securities fraud warnings in March 2023

- Autorite des Marches Financiers (Quebec, Canada) issued a GSPartners securities fraud warning in March 2023

- the owner of GSPartners’ former financial services provider was arrested in May 2023

- the Alberta Securities Commission issued a GSPartners securities fraud warning in May 2023

As the regulatory fraud warnings began to pile up, GSPartners rebranded itself as Swiss Valorem Bank in mid May, 2023.

Post rebranding, British Columbia and Saskatchewan have both issued GSPartners and Swiss Valorem Bank securities fraud warnings.

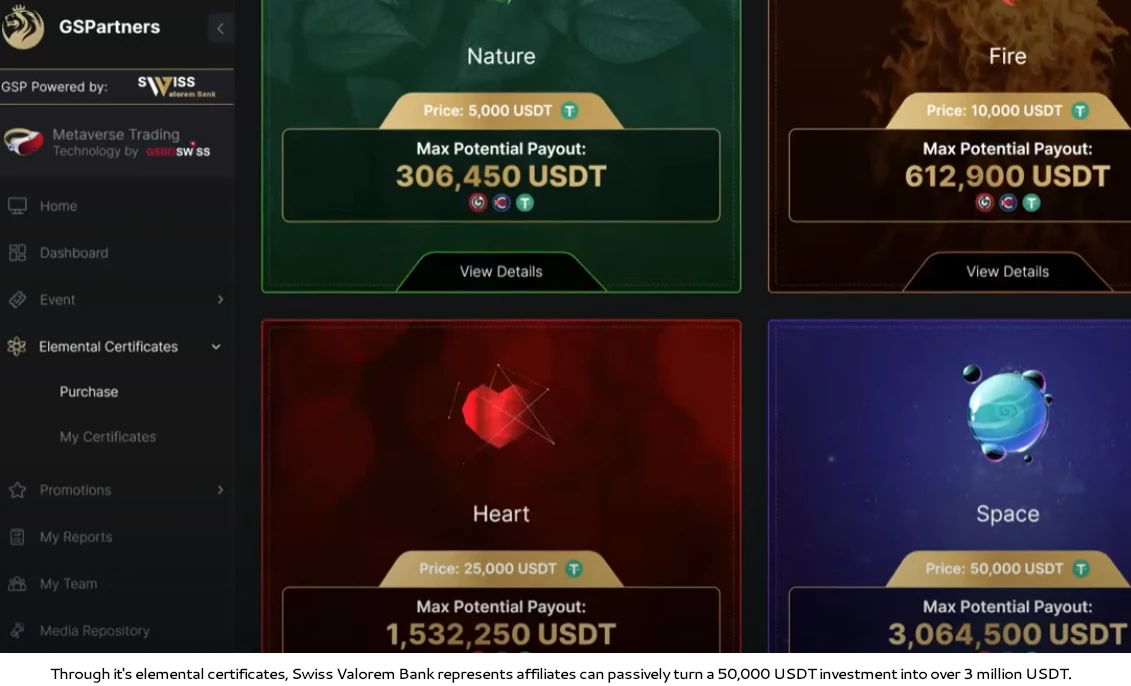

Since the metaverse certificates launch in mid 2022, GSPartners has launched two additional iterations. The third, “elemental certificates”, coincided with the Swiss Valorem Bank rebranding.

It is this third elemental certificates iteration that we’re reviewing today.

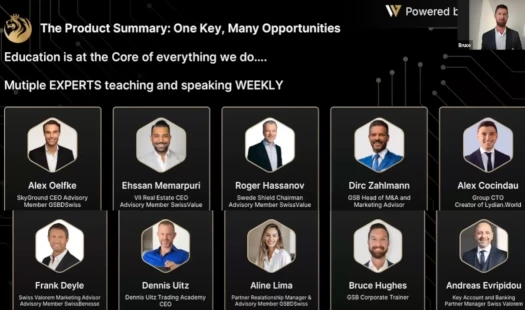

In addition to Josip Heit, Swiss Valorem Bank lists the following individuals as insiders:

- Alex Oelfke – Skyground CEO advisory, member GSBDSwiss

- Ehssan Memarpuri – VII Real Estate CEO, advisory member SwissValue

- Roger Hassanov – Swede Shield Chairman, advisory member SwissValue

- Dirc Zahlmann – GSB Head of M&A and marketing advisor

- Alex Cocindau – Group CTO, creator of Lydian World

- Frank Deyle – Swiss Valorem Marketing Advisor, advisory member SwissBenesse

- Dennis Uitz – Dennis Uitz Trading Academy CEO

- Aline Lima – Partner Relationship Manager, advisory member GSBDSwiss

- Bruce Hughes – GSB Corporate Trainer

- Andreas Evripidou – Key Account and Banking Partner Manager Swiss Valorem

It should be noted that Josip Heit relocated from Germany to Dubai shortly after GSPartners’ launch.

Although it’s tied to the German shell company GSB Gold Standard Corporation AG, GSPartners is run out of Dubai.

This isn’t a coincidence. Dubai is the MLM crime capital of the world.

Other shell companies listed on Swiss Valorem Bank’s website include:

- GSB Gold Standard Bank LTD (fake Mwali shell company)

- Swiss Valorem Bank LTD (Kazakhstan)

- IBBP Pay Services LTD (Kazakhstan) and

- CoinX24 AG (Switzerland)

With respect to Swiss Valorem Bank being operated from Dubai, BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Swiss Valorem Bank, read on for a full review.

Swiss Valorem Bank’s Products

Swiss Valorem Bank has no retailable products or services.

Affiliates are only able to market Swiss Valorem Bank affiliate membership itself.

Swiss Valorem Bank’s Compensation Plan

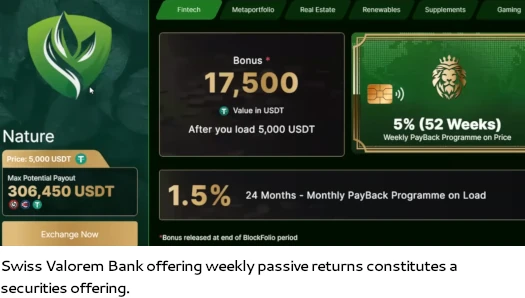

Swiss Valorem Bank affiliates invest tether (USDT) in what the company refers to as “elemental certificates”.

- Terra 100 USDT

- Light – 250 USDT

- Water – 1000 USDT

- Wind – 2500 USDT

- Nature – 5000 USDT

- Fire – 10,000 USDT

- Heart – 25,000 USDT

- Space – 50,000 USDT

- Prana – 100,000 USDT

This is done on the promise of a passive return, with six available themed tiers to choose from:

- fintech – 5% a week for 52 weeks plus bonus 3500 USDT

- metaportfolio – 2.5% a week for 52 weeks plus bonus 2000 USDT

- real estate – 3.5% a week for 52 weeks plus bonus 3000 USDT at end of 52 weeks

- renewables – 4% a week for 52 weeks plus bonus 4000 USDT at end of 52 weeks

- supplements – 5% a week for 52 weeks plus bonus 4000 USDT at end of 52 weeks (note reinvestment required every 3 months)

- gaming – 4% a week for 52 weeks plus bonus 4000 USDT at end of 52 weeks (note reinvestment required every 3 months)

Note that returns are paid out in GEUR, a token that is worthless outside of Swiss Valorem Bank.

Swiss Valorem Bank represents GEUR is pegged to the euro. It is convertible for actual cryptocurrency within the Swiss Valorem Bank backoffice.

In addition to initial investment amounts, Swiss Valorem Bank affiliates can invest additional tether in each of the six investment tiers offered:

- fintech – 1.5% a month paid on additional investment for 24 months

- metaportfolio – variable return paid every quarter for 18 months

- real estate – 1.5% a month paid on additional investment for 36 months

- renewables – 1.5% a month paid on additional investment for 30 months

- supplements – doesn’t appear to be any bonus ROI

- gaming – doesn’t appear to be any bonus ROI

Additional investment appears to be capped at the cost of a certificate.

E.g. each tier of a Water certificate costs 1000 USDT (6000 USDT max across six tiers). This means that 1000 USDT can be additionally invested at each tier.

The MLM side of Swiss Valorem Bank pays on recruitment of affiliate investors.

Swiss Valorem Bank Affiliate Ranks

There are ten affiliate ranks within Swiss Valorem Bank’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Affiliate – sign up as a Swiss Valorem Bank affiliate and invest

- Director – recruit three affiliates and generate 9999 USDT in downline investment volume (no more than 3999.6 USDT from any one recruitment leg)

- Regional Director – maintain three personally recruited affiliates and generate 29,999 USDT in downline investment (no more than 11,999.6 USDT from any one recruitment leg)

- National Director – maintain three personally recruited affiliates and generate 59,999 USDT In downline investment (no more than 23,999.6 USDT from any one recruitment leg)

- Executive – recruit six affiliates and generate 99,999 USDT in downline investment (no more than 39,999.6 USDT from any one recruitment leg)

- Continental Executive – maintain six personally recruited affiliates and generate 299,999 USDT in downline investment (no more than 119,999.6 USDT from any one recruitment leg)

- International Executive – maintain six personally recruited affiliates and generate 599,999 USDT in downline investment (no more than 239,999.6 USDT from any one recruitment leg)

- Ambassador – recruit nine affiliates and generate 999,999 USDT in downline investment (no more than 399,999.6 USDT from any one recruitment leg)

- Global Ambassador – maintain nine personally recruited affiliates and generate 2,999,999 USDT in downline investment (no more than 1,199,999.6 USDT from any one recruitment leg)

- Crown Ambassador – maintain nine personally recruited affiliates and generate 2,399,999.6 USDT in downline investment (no more than 2,399,999.6 USDT from any one recruitment leg)

Note that to count towards rank qualification, recruited affiliates must have an active investment.

Referral Commissions

Swiss Valorem Bank affiliates earn a 15% commission on investment by personally recruited affiliates.

Residual Commissions

Swiss Valorem Bank pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Swiss Valorem Bank caps payable unilevel team levels at nine.

Residual commissions are paid as a percentage of tether invested across these nine levels as follows:

- Directors earn 18% on level 1 (personally recruited affiliates)

- Regional Directors earn 18% on level 1 and 4% on level 2

- National Directors earn 18% on level 1, 4% on level 2 and 3% on level 3

- Executives earn 18% on level 1, 4% on level 2, 3% on level 3 and 2% on level 4

- Continental Executives earn 18% on level 1, 4% on level 2, 3% on level 3 and 2% on levels 4 and 5

- International Executives earn 18% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 and 5 and 3% on level 6

- Ambassadors earn 18% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 and 5, 3% on level 6 and 4% on level 7

- Global Ambassadors earn 18% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 and 5, 3% on level 6 and 4% on levels 7 and 8

- Crown Ambassadors earn 18% on level 1, 4% on level 2, 3% on level 3, 2% on levels 4 and 5, 3% on level 6, 4% on levels 7 and 8 and 6% on level 9

Accelerator Pool

Swiss Valorem Bank takes an unspecified percentage of company-wide investment and uses it to fund the Accelerator Pool.

The Accelerator Pool is broken down into smaller rank-specific pools, which are paid out monthly to rank-qualified affiliates:

- Directors receive a share in 20% of the Accelerator Pool

- Regional Directors receive a share in 16% of the Accelerator Pool

- National Directors receive a share in 16% of the Accelerator Pool

- Executives receive a share in 9% of the Accelerator Pool

- Continental Executives receive a share in 9% of the Accelerator Pool

- International Executives receive a share in 9% of the Accelerator Pool

- Ambassadors receive a share in 7% of the Accelerator Pool

- Global Ambassadors receive a share in 7% of the Accelerator Pool

- Crown Ambassadors receive a share in 7% of the Accelerator Pool

BlockStar Pool

Swiss Valorem Bank takes 4% of company-wide investment and places it into the BlockStar Pool.

There are three ranks within the BlockStar Pool:

- Rising Blockstar – generate 3000 USDT of downline investment within 30 days of signing up as an affiliate

- Blockstar – generate 9999 USDT in monthly downline investment volume

- Blockstar Supreme – generate 29,999 USDT in monthly downline investment volume

Note that Rising Blockstar has a limited qualification period. Blockstar and Blockstar Supreme have monthly recurring qualification criteria.

The Blockstar Pool is paid out based on shares, which correspond to the three available ranks:

- Rising Blockstar – one share in the BlockStar Pool for a month and one permanent Blockstar Pool share

- Blockstar – two shares in the Blockstar Pool for a month (increased to three shares if affiliate qualified as a Rising Blockstar)

- Blockstar Supreme – four shares in the Blockstar Pool for a month (increased to five shares if affiliate qualified as a Rising Blockstar)

If a Swiss Valorem Bank affiliate qualifies for the Blockstar Pool (any rank), they also receive a 25% match on BlockStar Pool earnings by personally recruited affiliates.

Infinity Pool Bonus

Swiss Valorem Bank pays a monthly Infinity Pool Bonus to Directors and higher:

- Directors receive a 1000 USDT a month Infinity Pool Bonus

- Regional Directors receive a 1500 USDT a month Infinity Pool Bonus

- National Directors receive a 2300 USDT a month Infinity Pool Bonus

- Executives receive a 6000 USDT a month Infinity Pool Bonus

- Continental Executives receive a 9000 USDT a month Infinity Pool Bonus

- International Executives receive a 15,000 USDT a month Infinity Pool Bonus

- Ambassadors receive a 20,000 USDT a month Infinity Pool Bonus

- Global Ambassadors receive a 40,000 USDT a month Infinity Pool Bonus

- qualify at Crown Ambassador and receive 90,000 USDT

Joining Swiss Valorem Bank

Swiss Valorem Bank affiliate membership is 33 USDT a month.

Full participation in the attached income opportunity requires a minimum 100 USDT investment.

Swiss Valorem Bank solicits investment in tether and USDT equivalents of bitcoin, ethereum,

Swiss Valorem Bank Conclusion

There isn’t much to Swiss Valorem Bank as an MLM opportunity. Affiliates invest in certificates on the promise of a passive return.

With nothing marketed or sold to retail customers the MLM side of Swiss Valorem Bank operates as a pyramid scheme.

What is worth noting is Swiss Valorem Bank’s “elemental certificates” are the third (fourth?) iteration of the same investment scheme.

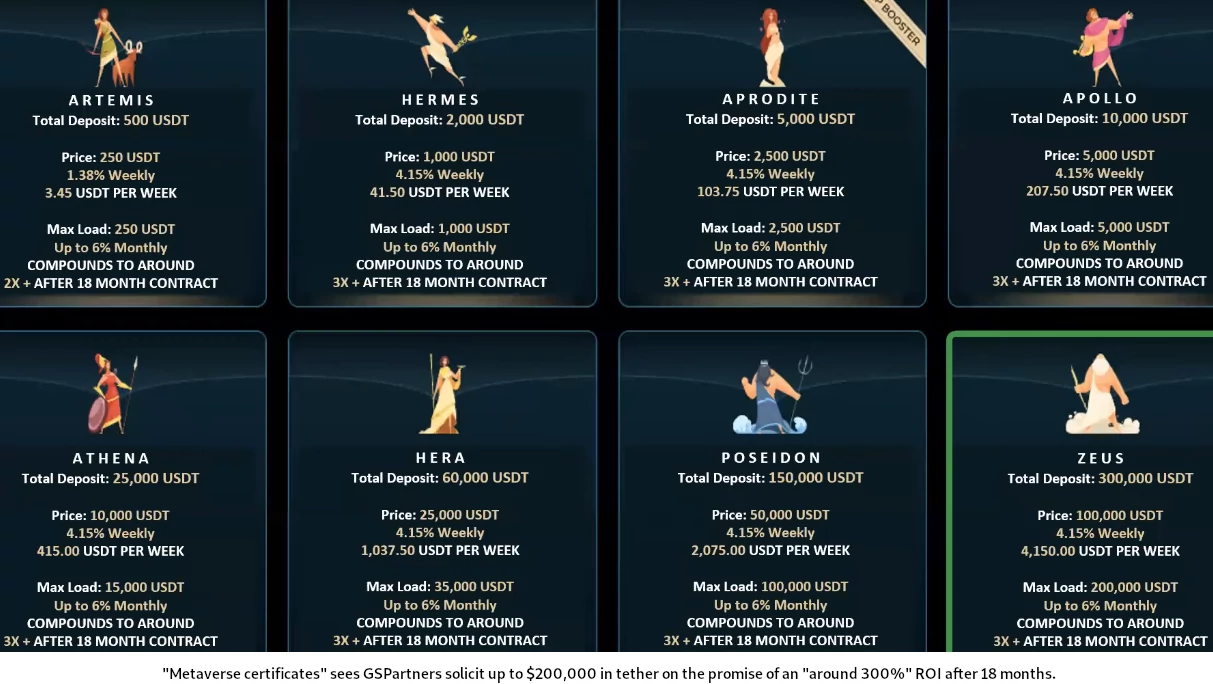

First we had “planet certificates” (also launched as metaverse certificates, click to enlarge below):

Then “olympus certificates” (click to enlarge again):

And now we have “elemental certificates” (click to enlarge again):

“Planet certificates” were also apparently launched but seem to have been mostly ignored. Still, I guess technically that makes “elemental certificates” the fourth certificate launch.

In any event, what you’ll notice between the certificate launches is the ROI and how much can be trapped in the certificates increases.

The top “prana” tier of “elemental certificates” tops out at 1.3 million USDT (100,000 USDT initial investment, 100,000 USDT *6 for the individual investment tiers and then 100,000 USDT *6 again for additional investment on each tier).

I’m pointing out the obvious here but the game plan is clearly to keep affiliates rolling over paid returns on the promise of ever-higher ROI rates.

Over time relaunching new certificates to trap money will hit a diminishing returns roadblock (accumulated GEUR being withdrawn will grow exponentially, inevitably outstripping new investment).

Swiss Valorem Bank and GSPartners before it do represent external revenue is generated via external sources (fintech, metaportfolio, real estate, renewables, supplements and gaming).

What’s missing are audited financial reports proving these claims. This is a legal requirement that Swiss Valorem Bank fails to satisfy with respect to consumers and financial regulators.

And that brings us to Swiss Valorem Bank committing securities fraud.

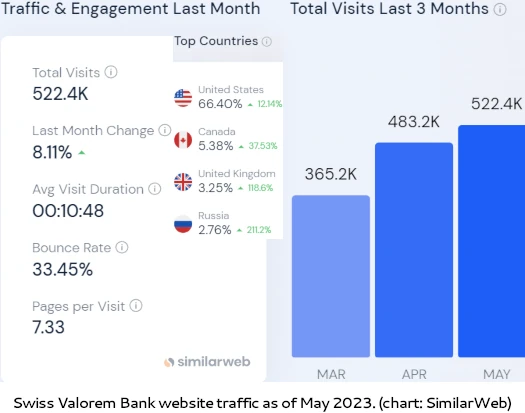

As tracked by SimilarWeb for May 2023, top sources of traffic to Swiss Valorem Bank’s website domain are the US (66%), Canada (5%), the UK (3%), Russia (3%) and Greece (3%).

We’ve already seen Canadian authorities make moves against Swiss Valorem Bank through issued securities fraud warnings.

In the US securities are regulated by the SEC. So far US authorities haven’t taken action against Swiss Valorem Bank or Josip Heit.

With just over half a million Swiss Valorem Bank website visits last month and the majority of that being US traffic, how long before we see action from the SEC, CFTC and/or DOJ remains to be seen.

Securities fraud and MLM companies operating Ponzi schemes go hand in hand.

With respect to the US, the SEC states

any investment in securities in the United states remains subject to the jurisdiction of the SEC.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure

investors into Ponzi and other schemes.Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

As with all MLM Ponzi schemes, once Swiss Valorem Bank affiliate recruitment dries up so too will new investment.

This will starve Swiss Valorem Bank of ROI revenue, eventually prompting a collapse.

The math behind MLM Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

The clever ones will be pulling out as much as they can at this delicious ROI. fortunately for them, they have many celebrities’ and sportsman men and woman, and lawyers promoting the hell out of this thing, so its continuing much longer than a lot of schemes which would have collapsed by now.

One affiliate who offered to buy me a certificate was boasting about his 300k per month which he is earning. Strangely he is familiar with MTI and Karatbars and has several other businesses, including a well known and established printing company which has been running for almost 30yrs.

The greed must have gotton hold of him, but I will be sure to check back with him once withdrawals have been disabled.

I didnt ask him how much his initial investment was, but I am certain that it was profits earned from previous ponzis.

I’d like to keep abreast of what is happening with this MLM company. Thanks.

Please keep me informed on Swiss Valorem Bank.

I’m so grateful to see people who are smart enough to know what are they doing. This site and others are so helpful to beginners who don’t know what are they doing and just listen other people in that scheme give the “permission “ about passive income.

I’m not going to play gambling and be with this schemes. Much love and respect to all of you!

Now expansion to asian market.

Anybody how long the average lifecycle of a Ponzi is? As an example, Karatbars and MTI were both c.3 years and G999 coming up for 3 years now.

The monthly subscription charge of $33 is netting Josip Heit and his cronies c.$240m a year but surely that cannot even last!

Still cannot believe how stupid people are to pay $33 a month subscription fees. Then again I suppose 99% of them have no understanding of blockchain and chasing the snake oil.

There is no average, as it depends on how much is invested.

The current “certificates” iteration of GSPartners began in May 2022 so it’s coming up on just over a year. The first “300% over 18 months” early investor plans will be withdrawable at the end of 2022.

Convincing gullible investors to reinvest (compound) with ever-increasing weekly ROI rates has to be factored in too though.

I have $170k invested my son stole the account requested company put back in my name.

nothing yet for a month but I was pulling out $3200 a week we will see.

Was added to a community chat group recently promoting this rubbish. I kindly informed the lady that it’s a tried and tested ponzi scheme and they all follow the same script. They even use the same language in their offerings and plans.

Sadly she eventually turned on me when I kept pointing out the risk and evidence. It seems to be part of the psychological manipulation that they have you so invested in the hype and desire to recruit others (to make more money), that they will defend their pet scam no matter how much evidence or reason you send their way.

I want to be a good citizen and warn others, but alas most seem to be a lost cause and will have to learn the hard way. I just hate seeing people lose their hard-earned money and life savings.

Do you have a way of proving the fraud warnings?

The Canadian ones are on the respective Canadian provincial regulatory websites.

Each is linked in its respective BehindMLM Canadian fraud warning article.

The confirmed US regulatory investigations aren’t public.

Use search with “GSPartners” to find the different C&D (cease and desist) orders of some 11 states in the USA delivered to this scam in November/December 2023.

The domain registration of swissvalorembank.com from May 2, 2023:

share-your-photo.com/1622920f67 or

ibb.co/1JqJXXp

As the website is no longer accessible, here is the link to the WebArchive. The last save was on November 16, 2023.

web.archive.org/web/20231116214234/http://swissvalorembank.com/

I was in karatbars n GSParners.. Inactislly saw a return with Karatbats.. all was good until the into of those damn coins! Kcb n kbc.. then it went to ish!

Gs partners was totally different.. saw the money on my account.. NEVER able to get the debit card or get anything out of it.. at all!

So happy that none of my close friends got involved! Lost about $900.. pissed but lessen learned!

When g999 reached .003 in Aug 2023 I practically BEGGED several people to get their money out n help me get mine.. nobody wanted to get their s out or help me! We all lost! Greed! Sad