GSPartners rebrands as Swiss Valorem Bank after fraud warnings

GSPartners has rebranded as Swiss Valorem Bank.

GSPartners has rebranded as Swiss Valorem Bank.

The move follows several GSPartners related securities fraud warnings from financial regulators.

Swiss Valorem Bank is set up through Swiss Valorem Bank LTD and IBBP Pay Services LTD, both shell companies recently registered in Kazakhstan.

CoinX24 AG is also listed on Swiss Valorem Bank as a shell company registered in Switzerland.

There is no mention of GSPartners or owner Josip Heit on Swiss Valorem Bank’s website, although the rebrand operates from the same “gspartners.global” domain.

GSPartners is run by Josip Heit out of Dubai. Originally from Croatia, Heit is believed to hold a German passport.

Neither GSPartners or any off its associated shell companies have a physical presence in Kazakhstan.

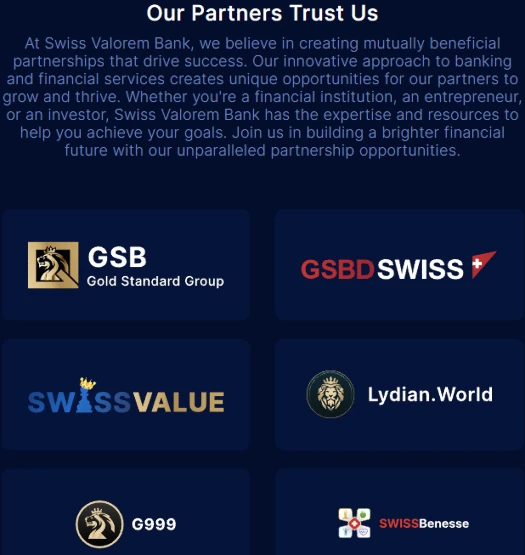

Other branding on Swiss Valorem Bank’s website includes GSB Gold Standard Group, GSBDSwiss, Swiss Value, Lydian World, G999 and SwissBenesse.

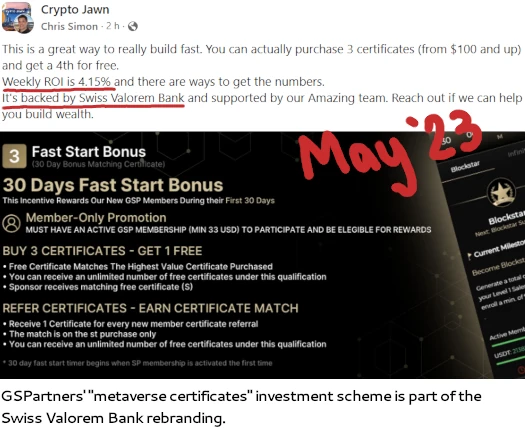

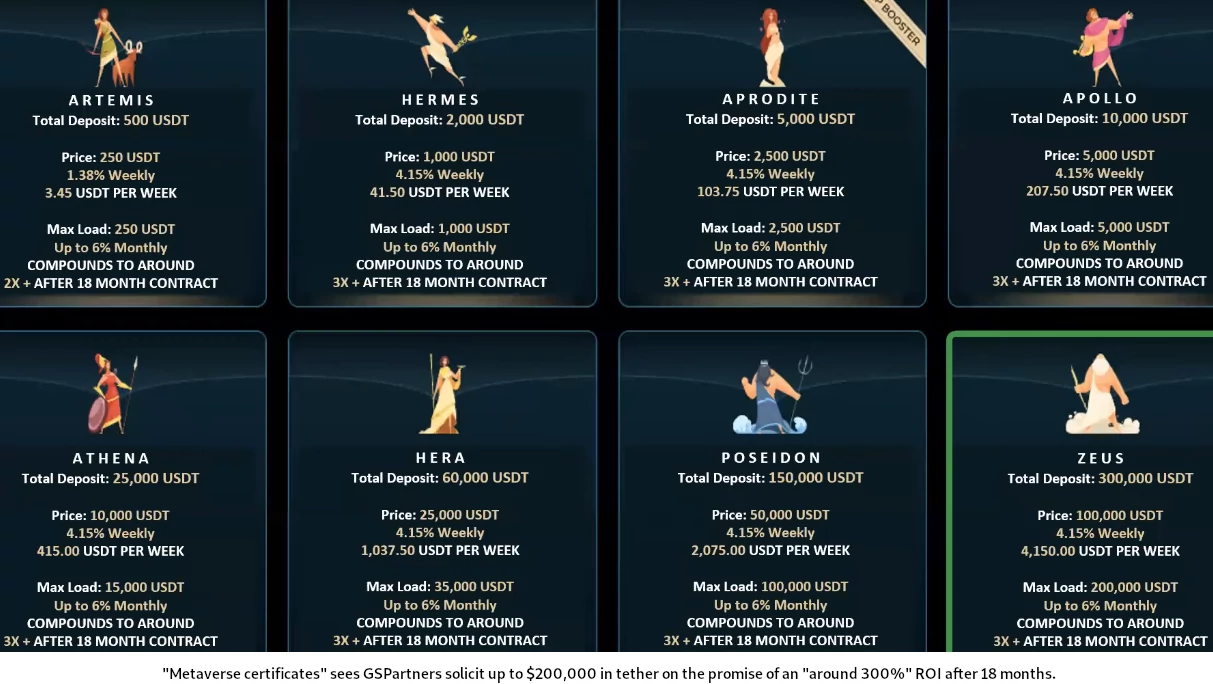

The new Swiss Valorem Bank website also fails to disclose GSPartners’ metaverse certificates investment scheme, through which investors are pitched a 300% passive ROI over 18 months (click below to enlarge).

Back in June 2022 the Central Bank of Comoros issued a GSB Gold Standard Bank LTD banking fraud warning.

More recently Canadian authorities have taken action against GSPartners.

On March 9th Quebec’s Autorite des Marches Financiers issued a GSPartners securities fraud warning.

The warning included a list of 52 domains associated with GSPartners and GSB Gold Standard Bank LTD, including the company’s website and GSTrade.

On March 15th the Alberta Securities Commission added GSTrade and G999 to its investment caution list, advising the companies “appear to be engaging” in securities fraud “or may be scams”.

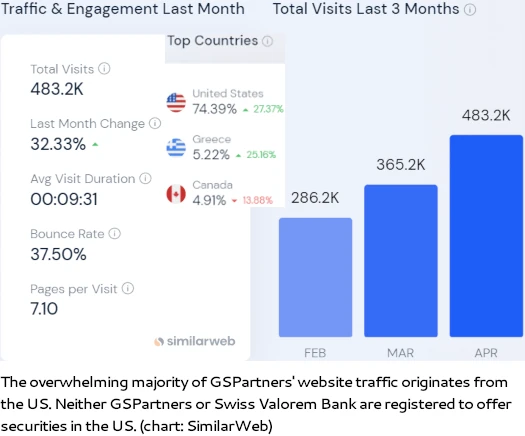

Neither GSPartners or Swis Valorem Bank itself are registered to offer securities in the jurisdictions they actively solicit investment in.

This includes the US, which makes up the bulk of GSPartners website traffic.

GSPartners’ website traffic data corresponds with the majority of GSPartners and Swiss Valorem Bank investors being US residents.

With respect to regulation of MLM companies committing securities fraud in the US, the SEC warns that

any investment in securities in the United states remains subject to the jurisdiction of the SEC.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure

investors into Ponzi and other schemes.Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

Pending further action by financial regulators or law enforcement, we’ll keep you posted.

Update 13th June 2023 – BehindMLM has published a stand-alone Swiss Valorem Bank review.

Somewhat ironically, Michael Dalcoe has been promoting the latest GSPartners “Metaverse Certificates” over the past few days on Youtube.

I am guessing Josip Heit forgot to tell his man in America about the name change!

Personnel changes in the Board of Directors of Coinx24 AG in February 2023:

Herbert Sterchi from Switzerland has resigned. He was replaced by Yevhen Shot from Ukraine residing in Switzerland.

The management remains in the hands of Felix Honigwachs.

moneyhouse.ch/de/company/coinx24-ag-20755717601

Felix Honigwachs and Herbert Sterchi jointly managed the company GloBee International AG in Zug (Switzerland), which went bankrupt in September 2022 because no assets could be identified.

moneyhouse.ch/de/company/globee-international-ag-in-liquidation-20072263481

Felix Honigwachs on Twitter:

share-your-photo.com/ca82a2ce15

twitter.com/cryptocat_za

share-your-photo.com/93c8aed7f1

condecosoftware.com/blog/work-from-anywhere/

@Gertrude

Originally Swiss Valorem Bank was a separate page on the GSPartners website. Sometime (Wed/Thu) they replaced the GSPartners website entirely.

Not sure if that was the original plan but it might have caught promoters off-guard.

Bitexlive = IBBP Pay Services Kazakhstan Ltd.

Lion Filipovic is the director of IBBP as well as GSChain PLC, the listed company

Last update on BitexLive’s website is dated June 2022:

SimilarWeb tracks ~14,000 visits a month.

Conclusion: Repurposing a dead exchange on the cheap.

I’m assuming it’s not actually LEGIT to sell high yield investments and call yourself a “BANK”. That would be like me changing my name to “DOCTOR” and selling health supplements.

Yes, I’m DOCTOR LATHE. First name Doctor, Last name Lathe. Would you like to buy my vitamin?

Apparently they just had some event in Dubai that a bunch of North Americans flew over…. Apparently they missed the boat that this was a ponzi…

Most of those high enough to be travelling to Dubai followed Heit over from Karatbars International.

They know.

How stupid do you have to be not to recognise gspartners/Lydia world/heit/ g999 as a scam? Fools and their money are easily…….

Earp-jones, Andrew Eaton, etc etc- will all be me up in jail. Eventually.

These crooks are now desperately trying to steal from the Asian desperados now that they have milked what they can from SA and the US.

guess they have given up on the property tokens.

Josip Heit is apparently the first scammer in the world to own his own newspaper! Here is the imprint:

share-your-photo.com/bc742bc486

berlinertageszeitung.de/page/IMPRESSUM

In his own newspaper, Josip Heit of course advertises his scams like gsb.gold with this imprint:

share-your-photo.com/0cbcfc3d92

An article with this title appeared in this “newspaper” on July 14, 2021:

share-your-photo.com/030c92e4aa

berlinertageszeitung.de/boulevard/95711-bucharest-allegations-against-successful-businessman-alex-bodi-were-without-substance.html

Who is Alex Bodi? Gertrude Perkins wrote on August 30, 2022:

https://behindmlm.com/companies/gspartners/gspartners-abandons-youtube-harassment-lawsuit-in-us/#comment-457271

Croatia and Romania are just two Balkan countries with pronounced crime and corruption!

share-your-photo.com/532b264b48

youtube.com/watch?v=QzHiBzt5vn8

The man with the microphone in the middle is the managing director and editor-in-chief of the German magazine inside-wirtschaft.de (inside economy) Manuel Koch.

The website inside-wirtschaft.de never mentioned the serial fraudsters Josip Heit and Harald Seiz or Karatbars International. Or have articles with these names been deleted in the meantime? Was Manuel Koch paid for this “interview”?

Jacob Oana commented below this video:

It’s worth noting how they hop between names when it suits their agenda.

Here is a comprehensive writeup on when they were going by the moniker of Gold Standard Bank.

g-crypt.com/g999-scam-opportunity/

Going to be interesting how they will spin this latest name change.

Brendon Earp-Jones is rebranding in Cape Town: instagram.com/reel/Cvw5P8NK3Rg/?igshid=MmU2YjMzNjRlOQ==

Addition to comment #2

Ukrainian citizen Yevhen Shot is no longer a member of the Board of Directors of Coinx24 AG in Zug (Switzerland) as of September 26, 2023.

German Felix Honigwachs now leads the dubious company alone.

share-your-photo.com/e35d17e3b3

moneyhouse.ch/de/company/coinx24-ag-20755717601/

Addition to comments #2 and #15.

Yesterday, on March 21, 2024, Coinx24 AG in Zug (Switzerland) was renamed CEX DIGITAL MARKETS AG. The German Felix Honigwachs remains the CEO.

ibb.co/C128dkY

moneyhouse.ch/de/company/cex-digital-markets-ag-20755717601/