GSPartners launches Lydian Lions clipart NFTs

GSPartners’ latest ruse to get people interested in their Lydian World Ponzi ecosystem is a clipart NFT collection.

GSPartners’ latest ruse to get people interested in their Lydian World Ponzi ecosystem is a clipart NFT collection.

Named “Lydian Lion”, the collection is typical of low-effort NFT cash-grabs:

Such collections start off with a base template, which in this case is a depiction of a standing lion with a slight lean to the right.

Next you create a bunch of variable layers. These are typically accessories, facial expressions, hairstyles, facial features etc.

Input these into a bot, set the color pallete and congratulations, you just created an “exclusive” NFT collection.

If you’re particularly greedy, you can run the images through a mirror algorithm and create two “exclusive” NFT collections.

GSPartners’ Lydian Lions is one such “exclusive” collection. Even with in the lion NFT niche, there are a bunch of these low-effort scams competing.

Lydian Lion’s marketing hook is that it’s attached to GSPartners.

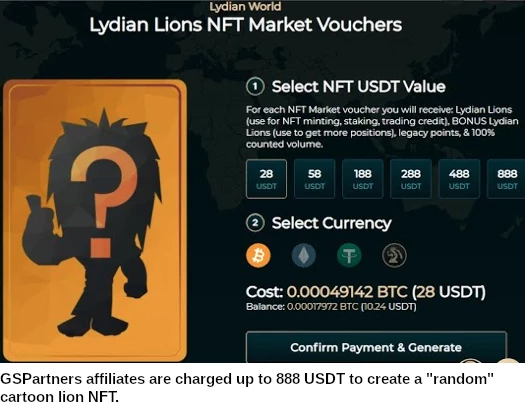

GSPartners affiliates hand over bitcoin, ethereum, tether or G999 to mint (create) a Lydian Lion NFT.

This is a fancy way of saying GSPartners affiliates pay owner Josip Heit cryptocurrency, or burn G999, in exchange for pre-generated clipart.

That “NFT” itself is a link to the pre-generated Lydian Lion clipart, presumably pointing to a copy of the clipart hosted on a GSPartners domain.

In addition to the clipart itself being practically worthless, when GSPartners eventually collapses and whatever domain the NFT link points to is disabled, the NFT itself becomes worthless.

That’s a future problem. Right now it’s just hype something something buy our NFTs please.

While there were some legitimate early ~March/April 2021 NFT sales, today “open” NFTs are used for money laundering. Not dissimilar to what happens in the tangible art world.

You create/obtain some random NFT, “sell” it to someone for an obscene amount of money and, at least on the surface, you appear to have participated in a legitimate transaction.

The other thing you’ll see is wash trading. That is NFT’s being traded in a coordinated manner to drive their price up.

Once an NFT has a suitably inflated transaction history, it’s then offloaded onto a gullible sap. Said sap hopes to sell the NFT to someone else for even more.

Depending on the current supply of gullible saps, this might happen. Or they’re left holding an otherwise worthless NFT (this is the typical outcome).

A variation of this scam sees insiders trade an NFT back and forth, and then sell it to someone at a “discount”. The play is otherwise the same.

With GSPartners all of this is of course possible. Due to the closed nature of the collection however (Lydian Lions are tied to GSPartners), manipulation is less likely.

This is bad news for GSPartners affiliates, who thus don’t even get the illusion of desirability.

Lydian Lions are being sold to GSPartners affiliates for between 28 to 888 USDT each (and equivalents in supported cryptocurrencies).

GSPartners marketing presentations that appeared in late November have urged affiliates to purchase Lydian Lions with G999.

This, the various presenters claim, will drive up G999 price because spent G999 is burned (taken out of circulation).

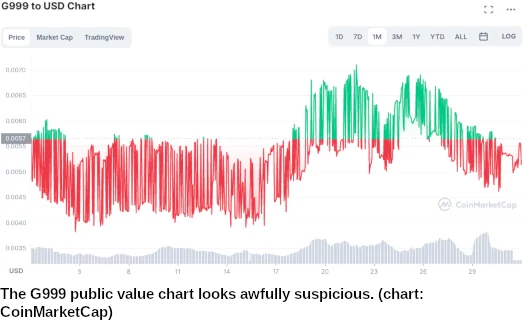

Over the past month that hasn’t really worked out:

It’s worth pointing out G999’s public value chart is anything but organic. G999’s value stays within an artificial specified range, up and down, up and down.

This is a good indication of manipulation.

In related news, GSPartners has recently introduced a monthly affiliate membership fee.

When BehindMLM reviewed GSPartners in February 2021, affiliate membership was $99 annually plus G999 investment.

Today GSPartners affiliate membership costs $33 a month, paid in USDT. Annually, this represents a 400% increase.

Oddly enough, GSPartners don’t accept G999 for affiliate membership fees.

*What is so special about elon moosk anyway? He put twitter and dogecoin up. Is not so hard. Josip can do same!*

“H’yello Twitter. Is me, Josip Heit! I like bratwurst and color six. Buy G999!”

“Josip you are genius. Let me log in to backoffice and… G999 price the same?! ALEX!”

“Sir?”

“Get me Meester Dorsey. Twitter broken and I need words.”

“Dorsey doesn’t work at-”

“I PUT TWITTER AND G999 STAY SAME. TWITTER IS BROKEN AND I NEED WORDS. NOW!”

“Josip, don’t be ridiculous. You think you are next Elon?”

“Well ye- hey, what is that? You bring coloring book?! Is Josip drawing time? BORIS! Where are my Josip crayons?!”

“Josip, this is my next plan. They’re called “EN EFF TEES.”

“Is not color book? But I want color story time. There’s nothing to do in Dubai.”

“These are just sketches. We will hire slaves to put on computer.”

“Ooooh cartoon lions! Rah-rwr. I am king of lions and this my jungle! Alex, do the noises…”

“We can sell these to people for a lot of money.”

“Boris, you play zebra! Josip is coming to eat y- we can what?”

“Money, Josip. We’re going to be rich again.”

“Such amazing art. Look at the… textures. The individual brush strokes. The way the light plays off the… what is that in the background?”

“I haven’t decided yet. We are still testing optimal design to trick people into handing over money.”

“I see. Wait, Alex! I have idea…”

“Yes?”

“Josip NFT.”

“I… um…”

“Elon Moosk and Bayzeus don’t have NFT. This could be Josip moment!”

“I’ll um, see what we can do.”

“You already say no to Josip space rocket. Dubai said my face too long for stupid Burj Khalifa. Alex, what is point steal all this money if I can’t have Josip moment?”

“It’s just that we need things to feed into the computer to mix and match. Like an umbrella, a moustache and so on. What would be combine with Josip NFT?”

“We could have one stack of money, two stacks of money, three stacks of money-”

“They need to be different.”

“Well yes. One crayon, two crayons… don’t I pay you to think idea?”

“I’ll run it past the devs.”

“This idea I like, Alex. Cartoon lions we sell big money to idiots. Fat-head Harald thinks Karatbars is coming back. Hah! We bury Karatbars with cartoons. Lions is just beginning.”

I thought this quote from a BBC news article was rather apt…

Former Christie’s auctioneer Charles Allsopp said the concept of buying NFTs made “no sense”.

“The idea of buying something which isn’t there is just strange,” he told the BBC.

“I think people who invest in it are slight mugs, but I hope they don’t lose their money.”

I literally have no idea whatsoever why anybody would purchase this low-quality, worthless clipart. But I also had no idea why anybody would buy G999 or KBC or KCB. I guess there truly is one born every minute!

Michael Dalcoe – The CEO (of absolutely nothing) is still promoting Gold Standard Partners as od December 2021, despite the fact it must be blindingly obvious that it is a scam. So Michael Dalcoe is as criminally responsible as Josip Heit.

Speaking of Josip Heit, he recently launched another crypto ponzi scam called Bitcoin POS. There is a picture on the Internet of Josip Heit at a Bitcoin POS event with his “brother for life” Alex Bodi.

Bitcoin POS? I don’t know whether to laugh or cringe. I tried to do both and broke my face.

Has Bitcoin POS been rebooted? When I punched it into Google I was getting October 2020 results.

Happy New Year Everyone! Except for The Fat Dwarf (Tony De Gouveia), Fester ( Andrew Eaton), Colgate (Brendon Earp-Jones), Goof Ball (Bruce Hughes) and The Godfather (Josip Heit).

Hope you all get eaten by a Lion!

Since you called out the odd G999 coin price behaviour it has headed south. Check price over past 30 days.

If you look at the 1M/3M chart, it looks like they turned off the wash trading bot on or around Dec 31st. Tried to start it up for a few days in early Jan but then gave up.

Consequently the up and down programmed spikes stopped and actual trading volume is revealed.

Of course G999’s value also tanks because outside of GSPartners, nobody cares.

Not recently afaik, they launched BitcoinPOS, Stellarfund and G999 together I believe (Event videos feature the various brands, they re-used some stock footage too between the events).

So BitcoinPOS went woosh. Stellarfund got seized by the Federales.

G999? The last surviving shitcoin income they have.

Hints of more shady activity in early Jan

twitter.com/GGGGGGOLDMAN/status/1478006594239713285?s=20

Stare at numbers on a screen for another 3 years

youtu.be/Q-Nsp98Xdd8?t=418