Swiss Mine Review: Ducatus Ponzi points OneCoin clone

![]() There is no information on the Swiss Mine website indicating who owns or runs the business.

There is no information on the Swiss Mine website indicating who owns or runs the business.

The Swiss Mine website domain (“swissmine.club”) was privately registered on December 5th, 2016.

The Swiss Mine compensation plan states that Swiss Mine is ‘registered in Singapore with its Branch office in Switzerland‘. Other than Singapore UEN registration number 201635218K, no further information is provided.

Further research reveals the provided UEN corresponds with Ducatus Swiss PTE LTD. Ducatus Swiss was incorporated in Singapore on December 30th, 2016.

The address used to incorporate Ducatus Swiss belongs to Luther Services.

We provide fast and efficient service for the formation and registration of a company or other legal entity in Singapore.

As such it appears Ducatus Swiss PTE LTD exists in Singapore in name only.

Corporate filings by Ducatus Swiss reveals Knut Unger and Ronny Andreas Tome as named Directors of the company.

Tome is listed as the sole shareholder of Ducatus Swiss. Knut Unger works for Luther Services.

According to the Ducatus Swiss incorporation documents, Tome is based out of Bali, Indonesia. This is likely where Swiss Mine is actually being run out of.

According to the Ducatus Swiss incorporation documents, Tome is based out of Bali, Indonesia. This is likely where Swiss Mine is actually being run out of.

Tome (right) doesn’t have an MLM history but does appear to have experience with cryptocurrency, specifically bitcoin.

In 2014 Tome sold an Indonesian villa to an anonymous buyer in Texas for $600,000 worth of bitcoin, the largest recorded bitcoin transaction at the time.

Tome is also co-owner of delMango Villa Estate hotel in Bali.

Why Ronny Tome does not acknowledge ownership of Swiss Mine on the company website is unclear.

The Swiss Mine Product Line

Swiss Mine has no retailable products or services, with affiliates only able to market Swiss Mine affiliate membership itself.

Swiss Mine has no retailable products or services, with affiliates only able to market Swiss Mine affiliate membership itself.

Once signed up, Swiss Mine affiliates invest Euro in exchange for tokens. These tokens can be converted into Ducatus points.

Ducatus points are not publicly tradeable and can only be exchanged for cash via Swiss Mine’s internal DucatusX exchange.

The Swiss Mine Compensation Plan

The Swiss Mine compensation plan sees affiliates invest in Ducatus points. Commissions are paid when they recruit others who do the same.

Swiss Mine affiliates can also earn money by converting Ducatus points into cash via an internal exchange. The company also runs a 1% a month ROI investment scheme.

Swiss Mine Affiliate Ranks

There are fourteen affiliate ranks within the Swiss Mine compensation plan.

Along with their respective qualification criteria they are as follows:

- Affiliate – sign up and invest €50 to €25,000 EUR

- Iron – have a downline generating at least 1000 GV a month and recruit at least two affiliates who have invested at least €50 EUR each

- Aluminium – have a downline generating at least 3000 GV a month and have at least one Iron ranked downline affiliate

- Zinc – have a downline generating at least 8000 GV a month and have at least two Iron ranked downline affiliates

- Nickel – have a downline generating at least 21,000 GV a month and have at least one Aluminum and one Iron ranked downline affiliates

- Copper – have a downline generating at least 55,000 GV a month and have at least one Zinc, one Aluminium and one Iron ranked downline affiliate

- Bronze – have a downline generating at least 144,000 GV a month and have at least one Nickel and two Aluminium ranked downline affiliates

- Silver – have a downline generating at least 377,000 GV a month and have at least one copper and two Zinc ranked downline affiliates

- Gold – have a downline generating at least 987,000 GV a month and have at least one Bronze and two Copper ranked downline affiliates

- Platinum – have a downline generating at least 2,584,000 GV a month and have at least one Silver, one Bronze and two Copper ranked downline affiliates (or personally recruit 5 Bronze ranked affiliates)

- Titanium – have a downline generating at least 6,765,000 GV a month and have at least one Bronze and two Copper ranked downline affiliates (or personally recruit at least 8 Bronze ranked affiliates)

- DC Senator – have a downline generating at least 17,711,000 GV a month and have at least one Platinum, two Gold and 3 Silver ranked downline affiliates (or personally recruit at least 10 Silver ranked affiliates)

- DC Centurion – have a downline generating at least 28,658,000 GV a month and have at least one Titanium, two Platinum and five Gold ranked downline affiliates (or personally recruit at least 13 Gold ranked affiliates)

- DC Emperor – have a downline generating at least 75,025,000 GV a month and have at least one DC Senator, two Titanium, five Platinum and five Gold ranked downline affiliates (or personally recruit at least 18 Gold ranked affiliates)

Commission Payout Percentages

Commissions paid out to Swiss Mine affiliates are not straight cash withdrawals.

The company forces affiliates to spend commission payouts as follows:

- recruitment and binary commissions and Matching Bonus – 55% cash withdrawal, 34% mandatory reinvestment, 8% mandatory spend through merchant network and 3% donated to charity

- recruitment bonus (€400 and €13000 EUR) – 89% mandatory reinvestment, 8% mandatory spend through merchant network and 3% donated to charity

- Car Bonus, Worldwide Revenue Pool and Ruler Share Pool – 89% cash withdrawal, 8% mandatory spend through merchant network and 3% donated to charity

- Rank Achievement Bonus – 55% cash withdrawal, 34% mandatory reinvestment, 8% mandatory spend through merchant network and 3% donated to charity

Recruitment Commissions

Swiss Mine affiliates earn a recruitment commission when they recruit a new Swiss Mine affiliate.

How much of a recruitment commission is paid out is determined by how much a newly recruited Swiss Mine affiliate invests:

- an investment of up to €4999 EUR pays a 13% commission

- an investment of €5000 EUR or more pays an 18% commission

A bonus €400 EUR is paid out if a Swiss Mine affiliate’s downline invests 5000 GV within the affiliate’s first thirty days (max 70% from any one recruitment leg).

If the downline invests 10,000 GV (within the same thirty days), the bonus is increased to €1300 EUR.

Residual Commissions

Residual commissions in Swiss Mine are paid out via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting each of these two positions into another two positions each.

Subsequent levels of the binary team are generated as required, with there being no restriction on how deep a binary team can grow.

Positions in the binary team are filled via direct and indirect recruitment of new Swiss Mine affiliates.

New investment volume is tracked on both sides of the binary, with affiliates paid a percentage of matched volume.

How much of a percentage is paid out is determined by how much a Swiss Mine affiliate’s binary team has cumulatively invested:

- 1000 GV = 2%

- 3000 GV = 4%

- 8000 GV = 6%

- 21,000 GV = 8%

- 34,000 GV = 10%

- 89,000 GV = 12%

- 233,000 GV = 14%

- 377,000 GV = 16%

- 610,000 GV = 17%

- 987,000 GV = 18%

- 1,597,000 GV = 19%

- 4,181,000 GV = 20%

- 101,946,000 GV = 21%

Note that to qualify for residual commissions, a Swiss Mine affiliate must invest at least €50 EUR and recruit two affiliates who do the same.

Matching Bonus

Swiss Mine’s Matching Bonus is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Swiss Mine cap payable unilevel levels at thirteen.

The Matching Bonus is paid out on residual commissions paid out to affiliates on these levels as follows:

- level 1 (personally recruited affiliates) – 3%

- level 2 – 5%

- level 3 – 8%

- level 4 – 13%

- level 5 – 21%

- level 6 – 13%

- level 7 – 8%

- level 8 – 5%

- level 9 – 3%

- level 10 – 2%

- levels 11 to 13 – 1%

Rank Achievement Bonus

Swiss Mine pay affiliates a Rank Achievement Bonus as they qualify for higher ranks:

- Iron – €50 EUR

- Aluminium – €100 EUR

- Zinc – €200 EUR

- Nickel – €500 EUR

- Copper – €1000 EUR

- Bronze – €3000 EUR

- Silver – €8000 EUR

- Gold – €20,000 EUR

- Platinum – €50,000 EUR

- Titanium – €100,000 EUR

- DC Senator – €250,000 EUR

- DC Centurion – €500,000 EUR

- DC Emperor – €1,000,000 EUR

Car Bonus

Bronze ranked Swiss Mine affiliates qualify for a monthly Car Bonus.

The exact amount allocated to the Car Bonus is not provided in the Swiss Mine compensation plan.

Worldwide Revenue Pool

Silver or higher ranked Swiss Mine affiliates qualify for shares in a Worldwide Revenue Pool.

The Worldwide Revenue Pool is made up of 1% of Swiss Mine’s company-wide investment volume.

- Silver affiliates receive one share

- Gold affiliates receive two shares

- Platinum affiliates receive three shares

- Titanium affiliates receive five shares

- DC Senator affiliates receive eight shares

- DC Centurion affiliates receive thirteen shares

- DC Emperor affiliates receive twenty-one shares

The Worldwide Revenue Pool is paid out twice a year.

Ruler Share Pool

DC Senator and higher ranked Swiss Mine affiliates qualify for a share in a Ruler Share Pool.

The Ruler Share Pool is made up of an undisclosed percentage of company-wide investment volume and is paid out quarterly.

Ducatus ROI

When a Swiss Mine affiliate invests they receive tokens. These tokens can be converted into Ducatus points.

Through an internal exchange and value per Ducatus point set by Swiss Mine, affiliates can convert Ducatus points into cash to withdraw.

DucatusX

Through DucatusX, Swiss Mine offer a fixed ROI of 1% a month on €1000 to €500,000 EUR.

Invested monies are locked for a period of 8 months and can only be extended for a maximum of 2 additional periods.

Joining Swiss Mine

Swiss Mine affiliate membership costs €30 EUR plus investment in one of the following nine packages:

- Apprentice – €50 EUR

- Miner – €250 EUR

- Builder – €1000 EUR

- Trader – €2500 EUR

- Executive – €5000 EUR

- Viceroy – €10,000 EUR

- Patron – €15,000 EUR

- Magnate – €25,000 EUR

The primary difference between the packages is income potential through the Swiss Mine compensation plan.

Conclusion

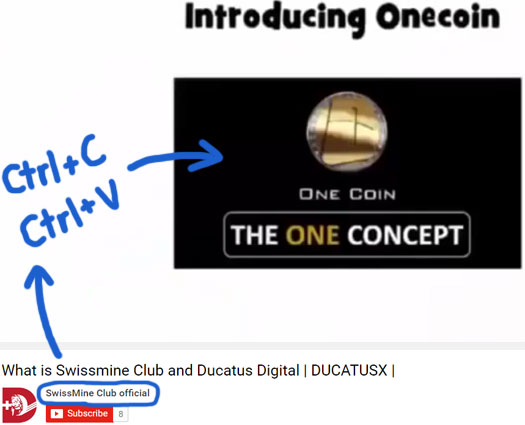

If Swiss Mine reminds you of the OneCoin Ponzi scheme, it’s because Swiss Mine has literally cloned OneCoin’s Ponzi points business model.

Nowhere is Ronny Tome’s inspiration for Swiss Coin more evident than in the presence of OneCoin marketing material on the official Swiss Mine YouTube channel:

The MLM cryptocurrency Ponzi points model sees a company launch points affiliates can invest into. The points themselves are worthless outside of the business opportunity.

Prospective affiliates are told the points will go public at some point and primarily market themselves via fear of loss (“Missed bitcoin? Don’t miss our coin too!”).

With respect to Swiss Mine’s Ducatus Ponzi points, the company states that they will pre-mine 7.7 billion of them.

100% of DUCATUS coins will be pre-mined and securely stored by the company.

Over a period of 3 years, these coins will then periodically be released to the partners following a pre-determined schedule.

What this means in reality is that Swiss Mine will generate otherwise worthless points, which are pawned off to affiliates for actual money.

The usual promises of a merchant network and public launch are also evident:

The company will launch an internal trading platform by August 1st 2017. This platform will allow partners to sell their coins back to the company or directly to other partners.

Public trading of Ducatus coins is determined for January 1st 2020.

Despite withholding affiliate withdrawals to be spent in the currently non-existent Ducatus merchant network, how the company plans to overcome attracting legitimate third-party merchants to a Ponzi scheme is unclear.

As OneCoin will find have to come to terms with following the launch of their merchant network next month, real legitimate businesses can’t operate on Ponzi points.

As to the Ponzi aspect of the business, that lies within the DucatusX internal exchange.

Affiliates invest money in Swiss Mine in exchange for Ducatus points. Swiss Mine increase the value of Ducatus points and affiliates cash out a ROI through the DucatusX exchange.

This ROI is paid out of subsequently invested funds, making Swiss Mine a Ponzi scheme.

The MLM compensation plan is focused on paying Swiss Mine affiliates to recruit new affiliates, without which the scheme collapses.

Pay to play is also embedded into the compensation plan, with minimum investment amounts required to qualify for commissions (residual commissions and the matching bonus).

Putting all of it together, you have worthless Ponzi points attached to a pyramid scheme compensation plan.

Despite advertised plans to list Ducatus on public exchanges in 2020, the reality is the company will likely be bust long before then.

OneCoin began making it difficult for affiliates to place OneCoin ROI withdrawal requests in late 2015, just over a year after it launched. Last week the company prohibited affiliates from making ROI withdrawal requests altogether.

Reboot schemes are never as successful as the scams they modeled on, so it’s unlikely Swiss Mine will make it that long – let alone to 2020.

And even if it did, public cryptocurrency exchanges have already expressed zero interest in listing Ponzi points (it’s not like OneCoin didn’t try).

Furthermore what going public for a MLM cryptocurrency Ponzi points scheme really means is the artificial value of the points dropping to zero.

Outside of the business opportunity there’s no interest in the coin, which goes hand in hand with there being no legitimate use of the coin either.

As with all Ponzi schemes, once affiliate recruitment dies down Swiss Mine will collapse.

Although far too late to actually do anything about, for some affiliates only then will they realize the Ducatus points they hold aren’t worth what their backoffice valued them at.

Update 21st January 2018 – Swiss Mine has rebranded as Ducatus Network. All aspects of the business opportunity reviewed above are otherwise the same.

Update 10th June 2021 – Ducatus Network has been rebooted as Centurion Global.

“The exact amount allocated to the Car Bonus is not provided in the Swiss Coin compensation plan.”

I think you meant to say “Swiss Mine compensation plan”?

“Despite advertised plans to list Ducatus on public exchanges in 2010, the reality is the company will likely be bust long before then.”

Think you meant to say 2020.

Nice write up on this one.

Why are they forcing you to donate to charity and reinvest all your commissions earned?

Thanks for catching that Terrence.

The reinvest is easy, to keep funds trapped in the system (effectively less ROI paid out so stretches the reserve out).

If the charity is “give us money and we’ll forward it to charity” then they’re probably keeping that money in the reserve too.

I did. I caught myself typing Swiss Coin a few times writing the review. Guess that one slipped through!

Hi All (Ozedit: marketing spam removed)

Ducatus Coin is at pre market…so yes it is a gamble to buy untill it goes to market.

(Ozedit: more marketing spam removed)

Ducatus has real company offices all over the world already…. that anyone can walk into at anytime and talk and meet the staff there..

So the real rub here if you will is…WHY MLM Marketing? Well we are already in over 100 countys world wide.. so love it or hate it if used well and policed it is a great tool for getting Ducatus out to the market right..

I look forward to any comments on here…and am more than happy to answer them..

kind regards charlie and the Ductus teams

How is Swiss Mine using newly invested funds to pay out Ducatus point withdrawals not a Ponzi scheme?

How is Swiss Mine paying commissions on the recruitment of new affiliate investors across multiple levels not a pyramid scheme?

kthx.

Hi all… A little more background on Ducatus the facts.. (Ozedit: marketing spam removed)

You asked for questions, the least you can do is answer them. Piss off with the spam already.

Sorry for the long responce i went to the CEO for the answer

Swissmine is not an investment company. (Ozedit: Yeah, I’m going to stop you there.)

Your CEO is lying to you.

I invest money in Swiss Mine and get Ducatus Ponzi points.

Swiss Mine increases the value of Ducatus Ponzi points and I put in a withdrawal request.

Swiss Mine pay me a ROI with subsequently invested funds.

That’s an investment opportunity and more importantly, a Ponzi scheme.

With respect to recruitment commissions, Swiss Mine affiliates are paid when they recruit new affiliates who invest.

There’s no retail sales happening anywhere in the company, it’s all a closed-loop business model.

If your CEO wishes to challenge the above facts, that’s fine. But don’t waste my time with “we’re not xxx, cuz I said so” pseudo-compliance.

Hi Oz,

do you have an email address which i could contact you directly? i agree with what you have mentioned & i am interested to know more. in fact, i could share with you on what i have in mind on this scheme.

Contact button is on the top right of every page.

hi Oz. unable to contact you via the button. error msg: Not Acceptable!

An appropriate representation of the requested resource could not be found on this server. This error was generated by Mod_Security.

I just tested it now myself. Sent a message fine.

Sounds like you’re trying to send something (code?) that’s triggering the firewall.

hmm. ok let me try again. thanks!

The swissmine-scam changed their website from swissmine.club to network.ducatus.net – but the link “WHITE PAPER 2.0” is dead (404):

share-your-photo.com/img/f7767d589b.png

The :gerlachreport published their new service instructions and the cutthroat-management… 🙂

Don’t have first hand knowledge of their networking model but I’ve attended a few cryptocurrency seminars by Ducatus at their Ducatus Cafe and my experience was rather pleasant.

The people are nice and no one tried to recruit me to be part of the network – maybe if I expressed an interest, they will 😉

Everything looks legit to me tbh.

So uh, you have no idea about Swiss Mine’s business model but “everything looks legit”.

Rightio….

Uhm, why the snide remark? 😉

I said I have no first hand knowledge of their networking model but that doesn’t mean I don’t know how to do my own research based on facts on the ground.

I am commenting on Ducatus cryptocurrency business and from my experience, I don’t see anything shady.

They have a crypto, I bought their crypto (Ducatus coin) and I was able to use these coins to buy coffee (which btw, is very good esp the popcorn latte) and bagel at Ducatus Cafe.

From my own experience, everything was perfectly smooth and legit.

Chill 🙂 All points of view are welcome – it helps all your readers arrive at an informed conclusion.

Well y’know, except for Ducatus not being a cryptocurrency.

Ducatus is an centrally controlled points system, the value of which is internally manipulated by Swiss Mine.

Withdrawal requests on points are conducted through an internal exchange. Swiss Mine honor the requests by using subsequently invested funds to pay off existing investors.

You didn’t buy coffee with Ducatus, you transferred Ducatus to a Swiss Mine affiliate and they gave you a coffee.

By virtue of it being not publicly tradeable, Ducatus cannot be used as a cryptocurrency.

Those are the facts. Whether you think Ponzi points schemes are “smooth and legit” is neither here nor there.

NOLINK://share-your-photo.com/b5be8e4f0b

The German-language page ducatus.world is no longer available.

Aaaaaaand it’s gone.

It seems Ducatus company is back again. Airdrop campign is going on and its all around.

Alongside, the price of the centralized DUC coin has been stacked on crypto markets for 5 months already. Funny people.