GSPartners collapses, GSPro reboot after fraud warnings

GSPartners has collapsed.

GSPartners has collapsed.

In an attempt to get ahead of multiple regulatory fraud warnings from the US, Canada, South Africa and Australia, the Ponzi scheme has rebranded as GSPro.

GSPartners’ website and that of Swiss Valorem Bank were disabled approximately 24 hours ago. This happened without prior warning or communication to GSPartners investors.

If we look at WHOIS records for both domains, we see GSPartners’ DNS entries were last modified on December 15th. Swiss Valorem Bank’s on December 4th.

GSPartners’ and Swiss Valorem Bank’s websites being disabled on December 15th also coincided with a KYC deadline, implemented a few weeks ago to cut off US investors from their funds.

What remains unclear is whether disabling of the GSPartners and Swiss Valorem Bank domain was voluntary.

Certainly the lack of communication beforehand suggests something happened behind the scenes at the registrar level.

GSPartners’ and Swiss Valorem Bank’s website domains were registered with GoDaddy and 101Domain respectively. Both companies are based out of the US (101Domain also has a corporate office in Ireland).

GSPro is operating from the domain “gspro.network”, registered through TLD Registrar Solutions on December 4th, 2023.

TLD Registrar Solutions is based out of the UK, a jurisdiction that hasn’t issued fraud warnings against GSPartners.

A visit to GSPro reveals an announcement informing investors “GSPartners platform platform is not accessible to its registered members anymore!”

GSPartners, along with related entities and individuals (collectively, “The Companies”), have been served with cease-and-desist orders and other legal process by the U.S. states of Alabama, Arizona, Arkansas, California, Florida, Kentucky, New Hampshire, Texas, Washington, and Wisconsin. The Companies are committed to our clients and are reviewing the filings.

At this time, however, The Companies are not doing business in Alabama, Arizona, Arkansas, California, Florida, Kentucky, New Hampshire, Texas, Washington, and Wisconsin.

Nor are we offering any services to, engaging in any transactions with, or accepting any Funds from residents of those U.S. states.

Taken at face value, it seems GSPartners investors in these states have lost access to invested funds.

Provided they’ve supplied personal credentials to organized crime interests in eastern Europe, the rest of GSPartners’ investors can purportedly carry on through GSPro.

In order to make sure all KYCed customers or members registered with GSPartners Platform are able to access their deposits or products held within GSPartners platfrom are pleased to go to GSPRO.network “platform” with their original credentials in able to allocate their deposits, products, withdrawals. [sic]

Taken at face value the above sentence makes no sense. What I think GSPartners is trying to say is that it’s business as usual through GSPro.

Well sort of. Now the GSPartners Ponzi scheme is hidden behind an eDuCaTiOn PlAtFoRm.

Established in 2023, GSPRO operates as a dynamic education and digital marketing platform.

This is of course pseudo-compliance. GSPartners has been running a ~5% a week Ponzi scheme for the better part of a year and a half.

Nobody signed up for education, that in any event didn’t exist until today anyway.

Still, that’s the new ruse GSPartners is going with;

GSPro is not a financial services provider or bank, and the entity does not provide any account opening possibilities.

Requests for account openings will be rejected and/or not responded to.

Tellingly, there’s no mention of GSPartners’ 5% a week MetaCertificates Ponzi scheme on its website. There’s also no mention of owner Josip Heit or any of the company’s other executives.

With US regulators naming all of GSPartners’ previous shell companies (triggering financial blacklists), GSPro has been set up through new shell companies.

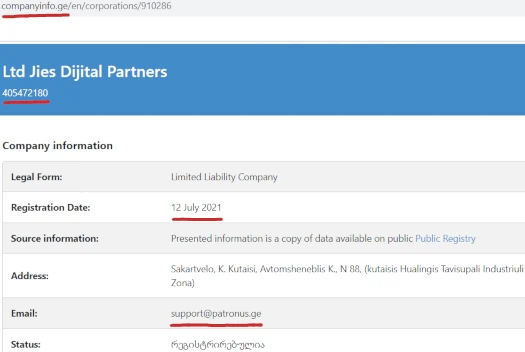

GSPro’s website footer states it is “operated by GS Digital Partners LLC”. GSPro’s Privacy Policy reveals GS Digital Partners LLC is a Georgian shell company.

GSPRO, as mentioned at gspro.network (domain/platform), is a trade name of GS Digital Partners LLC incorporated in the Republic of Georgia with Business Identification Number 405472180.

If we punch that BIN into Georgia’s CompanyInfo website, we get information on “Ltd Jies Dijital Partners”.

Luka Beruashvili is listed as GS Digital Partners LLC’s director. We have not seen this name in connection with GSPartners before.

The provided GS Digital Partners LLC email address corresponds with the Georgian law firm Patronus Legal.

GSPro’s privacy policy is also at odds with its website pseudo-compliance.

GSPro’s website footer states “GSPro is not a financial services provider”.

GSPro’s Privacy Policy states GS Digital Partners, who “operate GSPro”,

it is entitled to provide various services to members outside the Republic of Georgia according to the Free Zone Financial License and Annex issued by the Hualing Free Industrial Zone with License Number: 0110/473.

These services include Financial Services and Consulting, Cryptocurrency and Blockchain-related activities, e-wallet and Payment Processing Services, Professional Trustee Services to store and safeguard third party funds, Electronic Money Issuing, and Automated Signal Trading (including high-frequency trading in FX and cryptocurrencies in real time) engaging with cryptocurrency services, included but not limited to operating cryptocurrency exchanges, cryptocurrency trading, and operating of cryptocurrency wallet and storage services for digital assets.

I guess when you’ve been covering up lies with more lies for this long, consistency is difficult.

Oh and, not willing to take any chances with local authorities, GSPro doesn’t appear available to local Georgian residents (go figure).

GSPro’s “General Terms and Conditions” reveals another Georgian shell company, GSB Digital Partners LLC.

GSPRO … is a trade name of GSB Digital Partners LLC incorporated in the Republic of Georgia with Business Identification Number 405472180.

This is the same BIN provided for GS Digital Partners LLC. Again, consistency.

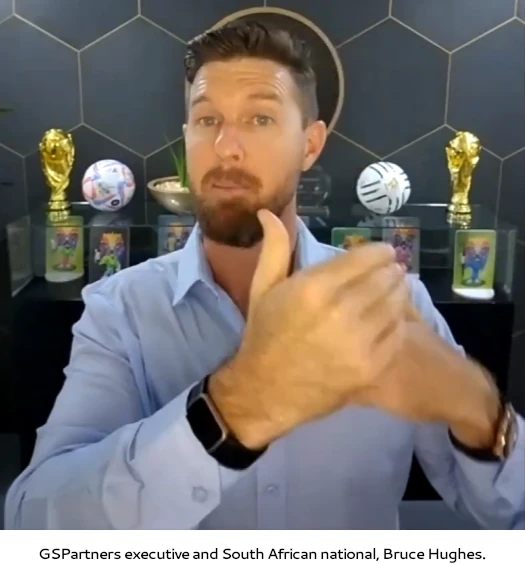

To the best of my knowledge GSPartners corporate, namely owner Josip Heit, CEO Dirk Zahlmann and Corporate Trainer Bruce Hughes, have not publicly addressed the GSPro rebranding.

Perhaps Hughes is still rehearsing his hand gestures.

In any event, it’s clear Heit and the gang have engaged lawyers in their bid to evade US securities law (Canada, South Africa and Australia seem to be ignored).

Looking forward, it’s unclear how much longer GSPartners will be able to keep its ~5% a week MetaCertificates Ponzi scheme afloat.

For November 2023, SimilarWeb tracked a 20% reduction in GSPartners website traffic. Outside of Canada and South Africa, traffic dropped as much as 51% in some countries.

Of course for anyone familiar with a Ponzi scheme slow-collapsing, the warning signs are already there. Withdrawal problems, regulatory fraud warnings, a KYC deadline, company rebranding – these are all typical of a Ponzi scheme circling the drain.

And when that does inevitably happen…

GSPro does not take any liability for any trading losses, financial risks, or, in general, any other investment risks that may occur by using the GSPro software and API solutions.

Disputes are subject to the laws of GSPRO’s registered office. GSPRO does not participate in dispute resolution proceedings.

On the regulatory front nothing has changed. GSPartners still operates illegally in every country it solicits investment in.

Rebranding GSPartners as GSPro and using different shell companies in different jurisdictions doesn’t negate existing fraud warnings.

Pending any further updates on GSPartners’ GSPro rebranding, we’ll keep you posted.

Footnote: For reference, here are all of GSPartners’ regulatory fraud warnings so far:

- Texas described GSPartners as “various fraudulent investment schemes that are threatening immediate and irreparable harm”

- Washington described GSPartners’ MLM business as “fraudulent activity”

- Alabama claims GSPartners was “evading Alabama laws and making guarantees that are unrealistic”

- California described GSPartners as a “fraudulent crypto investment scheme”

- Kentucky asserted GSPartners “acted as an unregistered issuer of unregistered securities through its publicly available websites”

- Wisconsin described GSPartners as a “global fraud scheme”

- Arkansas claimed GSPartners is “perpetrating numerous fraudulent investment schemes that are threatening immediate and irreparable harm to investors”

- New Hampshire accused GSPartners of “fraud and deception”

- Arizona determined GSPartners’ threat to “public welfare requires immediate action” and

- Florida’s undercover investigation into GSPartners revealed “unlawful activities“

- Mississippi described GSPartners’ Ponzi scheme as the “offering and selling fraudulent (of) certificates tied to digital assets”

- Quebec issued 52 GSPartners website securities fraud warnings on March 9th

- Alberta issued three GSPartners securities fraud warnings (G999, GSTrade and GSPartners) on May 19th

- British Columbia issued a GSPartners & Swiss Valorem Bank securities fraud warning on May 30th

- Saskatchewan issued a GSPartners securities fraud warning on June 1st

- Ontario issued a GSPartners and Swiss Valorem Bank securities fraud warning on July 25th

- Australia issued a GSPartners securities fraud warning on November 15th

- South Africa issued a GSPartners securities fraud warning on November 22nd

Update 20th December 2023 – GSPro has announced it is terminating all US GSPartners investor accounts.

Is the esteemed Eric Worre associated with this clown show?

GSPro, GoPro… *things that make you go hmmm*

Andrew Eaton must be rubbing his grubby paws together in anticipation of stealing more money from pensioners, and the desperate!

No doubt already thought of the lies he will tell the cult.

I guess all top promotors will be enjoying their festive season with their I’ll gotten gains.

I wonder if buying your family expensive gifts for Christmas takes away the guilt that it was bought with stolen money.

At last!!!!! Yes this coincides perfectly with the KyC deadline. Must be an amazing koinkidink.

Partners who wish to continue to benefit and recover losses, MUST continue scamming, their friends, work colleagues and church friends.

So was behind MLM wrong in calling this scam out? Where are the partners. Will you guys come out and care to share your version of this story?

I wonder what spin will Michael Dalcoe put on this?

Unironically they are paywalling and just stepping even deeper into the pay-to-play illegalities by locking all products and info behind referral and mandatory subscriptions.

It’s like their lawyers got their degrees from a Gumball machine 🙂

The social pages are going to ground HARD.

Not forgetting SA scammer schalk van der merwe demanding another $33 by 11pm SA time Monday 18th, if victims are to be allowed to stay on his ponzi Nordic group chat. Hysterical.

Although the desperate ones from karatbar days will fall for it again, if there’s the slightest chance they will be getting a $ back towards their brainless cult’s crystal ball collection.

You have to give it to them – they’re masters at making it all up, as they go along.

I think it is excellent that this reboot is showing the victims that so many US states are now blocked… If you’re in any other state, you must be wondering when it is going to hurt your position.

Also, I agree with ^ that it is a nice bonus it happened right after the KYC deadline. And then being confronted with hours of downtime the next day, seeing the reality of C&D orders blocking users, and being asked to pay for the privilege of access to the “back-office”…

Unfortunately, the desperate and believers will continue to be scammed; but I do hope that it is a wake-up call to many.

Ok, I sprayed my phone with tea when I got to the picture of the esteemed Mr. Heit…

I follow the Telegram group for G999 and there are people on there who have invested their life savings into this. What a horrible mess they have got themselves into.

I hope justice will be served at some point, but I am not holding my breath…

So I log into the new web site and see no trace of the certificates I have previously purchased. (Olympus and Elemental) My KYC is up to date so that isn’t the issue.

Are they seriously requiring a paid membership just to view and collect on previously purchased securities or are they discontinuing the older series as a rug pull.

I see where I can purchase the new success series certificates… The plot thickens…

I’m tempted to purchase a membership just so I can verify that the older certs still exist. I can tell they are hyper paranoid of anyone sharing any information.

I think they are requiring everyone to be a member as you will have more skin in the game and less likely to leak info as they seem to be holding these people hostage that are in really deep.

Apparently there is a corporate call tomorrow where they will discuss the “NEW ERA”…… In other words,” Piss down your back and tell you it’s raining!”

Don’t throw good money after bad…

They should return you what you’re owned, without you needing to pay to see your account. That is an obvious scam.

File a complaint with local, state, federal or national authorities; reference the existing C&D orders when doing so, making clear that since 16 November 2023 the GSPartners (and all related entities) had ample time to respond, rectify or compensate you.

They didn’t and now you need to pay to see the status? That is just another scam. It might also be account harvesting, you might be phished… It should be clear that you’re a victim now. Sorry for your loss.

Do check if any of the C&D orders provides you any cover (when you’re a citizen of such state, or your “upline” was from such state); as that may provide some leverage.

Don’t hold your breath though, most likely there is little change you get your money back. Sorry for your loss.

Ol’ Brucey’s got his hand gestures sorted then. Brilliant.

Next corporate call linked here for anyone wanting to join – facebook.com/photo/?fbid=747033720780961&set=a.583622077122127

The typo “platfrom” in the warning message on this GSPro.network reboot is just typical for fraudsters, make your reboot look like a phishing site…

The meeting ID is not valid. Funny way to hold a Zoom.

I guess ol’ Brucey couldn’t decide on which hand gestures to use after all. 🙁

Zoom update call just taken place! All of the G999 holders are told to be patient and wait until September 2024!

I got this link from a Telegram group of screen recordings of todays’ (Dec 18,2023) meeting. They are in 5 minute chunks due to some limitations, but anyone can watch here.

drive.google.com/drive/u/0/folders/1MiLgPzEWaSAWxtjrDtwh1SGjUe9gwRhI

@Jacob S

Thanks for that. My takeaways:

–> Hughes: these products are ending (2024 rugpull/exit-scam)

–> Heit: lying about “regulations are changing”. Securities law with respect to investment opportunities in the US hasn’t changed since 1933.

Nor has there been any substantial securities law updates in Canada, South Africa or Australia.

If you’re offering securities and and aren’t registered, you’re committing securities fraud. This is the long-standing foundation of securities law in every country with a financial regulator.

Heit looking like he hasn’t slept in weeks. Loved the cigarette smoke wafting up.

I have read in numerous comments that Bruce Hughes was a minister in a church in SA and allegedly lost the church”s money before joining Andrew Eaton and co in all their scams (Lifestyle Galaxy, Karatbars, GSPartners …).

Does anybody know what the name of the church is and how he (allegedly) lost their money?

Frank – Olive Tree Church (Salt Rock campus). From what I gather, it seems like he got them to invest in Karatbars – someone may have more information on what happened there.

This was sometime in 2016/2017. I understand that he started after being introduced into it by Andrew Eaton.

blockleaders.io/leaders/bruce-hughes-on-the-renaissance-of-freedom-through-blockchain

Last church mentioned online was Olive Tree Church in Durban.

For clarification, after re-reading your question – I believe it was congregants money that was lost and not the church’s.

As of today, lydian world public telegram channel has been cleaned up from anyone who is not a member and has been made private, as well as cleaning all the FB groups, so only active members can partake further in the ponzi. So no chance of any screen captures from outsiders.

We rely on insiders now to share any valuable information. i was able to record the last corporate update, the majority at least, igot in quite late.

Seriously. schalk is so desparate righ now on his chosen career path.

And “poof!” even that LW heavily patrolled Telegram channel is taken off the internets. It was a beacon of transparency while it lasted, deleting every “negative” message entering the chat.

Now please “poof!” the LW site itself as well, why pay for developers and administrators maintaining it… Oh, they are paid in crypto on the “back-office” and will receive their Christmas bonus in equally valid vouchers.

Jesus, how many shitty Karatbars offshoots are we going to see?

Yes, it is absolutely tragic what this team of deceivers have done… Many people lost lots of money and their retirement because they trusted in them.

But know this.,. “The Lord rewards everyone according to their works!” Nobody…gets away!

sos.ga.gov/search?division=Securities&board=&type=&query=GS+Partners

Thanks for the heads up!

Are we able to collect the money we spent and earning on all the certificates we bought? I’m unable to get into my account. Not happy at all.

Of course not. Welcome to the Ponzi end-game.

Next webinar is tomorrow (March 01st) at 3pm UK time

zoom.us/j/9674288810

Meeting ID: 9674288810

Passcode: 235446

They have a special product launch to share.

Also, when logging onto the website gspro.network, you are told that “You cannot purchase any financial products or conduct any form of financial investments, through this website.”

If you look at the video content you can see it is business as usual selling certificates.

youtube.com/live/AVcFo8eK-zY?si=ETtU6YXuLiYOjh8r&t=1959

I am a gspartner and my expiration date is June 30, 2024. If I wanted a refund what do I need to know to receive my refund. Thank you.

There are no refunds in Ponzi schemes. Sorry for your loss.

If you wanted to take action you should have filed a complaint with the SEC and/or CFTC months ago. It is of course never too late to take action.

If this is a scam why are they fighting the allegations in courts and your website? Scammers come in and grab the $$$ and vanish.

What do they hope to gain by spending their money fighting it. Easier to just pack up and run. I guess come September will have their investers either cashed up or broke.

If GSP do deliver to all their investers (Ozedit: snip, see below)

They’re not, they’re stalling for time. To date GSB has failed to provide evidence in any court that it hasn’t committed securities fraud.

A legitimate business would be able to provide evidence it has registered with financial regulators and filed audited financial reports. For some reason GSB seems unable to do this (can’t think why).

In Arizona GSB has requested a hearing, which is scheduled for September. Trying to get securities fraud legalized in the US is a fool’s errand but it’s investor funds they’re spending, so not like it’s costing Heit and co. anything personally.

Other than pointless squabbling with the Texas State Securities Board, GSB doesn’t appear to have requested a hearing in Texas. Or at least I haven’t seen any public confirmation of one.

As for the other dozen plus regulatory fraud warnings, these have gone unchallenged and are now permanent. Federal non-public investigations in the US are ongoing.

As for vanishing, running off to Dubai to hide is the modern equivalent of vanishing.

Fighting BehindMLM? Sounding like a new recruit, you probably missed the part where GSB’s subpoena petition was tossed for lack of evidence.

Deliver what? GSPartners is over. Other than a few dummies in South Africa and Australia being recruited into skeleton scams (what’s left of Billionico after the SA arrest and Auratus in AU), there’s nothing left.

Sorry for your loss.

If they had any evidence to prove their legitimacy they would give it to all the countries that have banned them,and give it to Oz. Oz would be the first one to apologize.

Instead… they spend people’s money to sue for “Defamation” and to Remove articles from Search results.

That’s a very roundabout way of proving your business is not a Fraud don’t you think?

I myself have challenged plenty of Ponzi morons to provide actual verifiable proof of legitimacy and i’d sink a million USD in their downline – nobody has bitten yet. Clearly they don’t want that easy money i’m offering.

Instead Heit starts new businesses, hides the evidence and have hundreds of people complaining to authorities and here that they can’t get their money back. So much for a transparent client-focused investment.

It is now November 2024. My certificate matured March 24. Can’t find my certificate anywhere. GSP Platform; GSPRO, GSPRO.Network not anywhere.

Sent an email to GSPRO.Network like they said in the conference calls and GSPRO emailed me back and said I have to contact the Third Party for that information and my refund, but they never gave me the Third Party information.

I guess I just lost my savings. I trusted someone I respected.

Sorry for your loss. Oz has been writing about GS Partners being a ponzi for a long time.

There is no denying it, these guys are busy setting up the next scam to buy into now that gspro has essentially failed.

I got a compliance violation email for talking about it on social media, now my account is being investigated and may be canceled. Defamation this, defamation that.. so sad.

You can apparently apply for a refund but who knows, fortunately didn’t invest too much money.

Know a few who went all in.. very sad.