Why did GSPartners stop weekly ROIs & restrict withdrawals?

Earlier this week it became apparent that GSPartners is on the road to collapse.

Earlier this week it became apparent that GSPartners is on the road to collapse.

This started with the disabling of weekly returns on Monday, swiftly followed up by a 50% withdrawal fee on Tuesday.

Officially, GSPartners has fed investors baloney about a “downturn in the markets”. The actual reason for the collapse is far simpler.

The Achilles’ heel of GSPartners trading representations is that there’s no proof of trading taking place, or trading revenue being used to pay withdrawals.

This is a legal requirement that can only be satisfied via registration with financial regulators and periodic filing of audited financial reports.

GSPartners isn’t registered with financial regulators. Nor has it filed any audited financial reports, for what should be obvious reasons by now.

With that in mind, as posted in GSPartners’ official private FaceBook group, here’s the trading ruse they’re going with;

With that in mind, as posted in GSPartners’ official private FaceBook group, here’s the trading ruse they’re going with;

If you have followed the markets over the past 45 days you would have seen market drops across multiple sectors.

Some of the trades took massive drops, whilst others have grown profitably.

Some of the negative trades reached margin call limits on accounts, triggering the need to top up the accounts or close those trades.

Upon advice the decision was made to top up accounts, and wait for the losing trades to reverse direction. This action was taken.

However over an extended period of analysis, it was decided that the losing trends would not reverse soon, and the decision was made to close those trades, without a second “top up”, whilst continuing on with the profitable trades.

Your accounts will be updated to show the loss your account has felt, whilst calculating any compound amounts which you may have done, which lessened the loss for you.

Even if you buy into GSPartners’ ruse, which you absolutely shouldn’t, there are a few points of contention to consider:

- what’s to stop this happening again (in a few months)?

- given returns paid to investors who weren’t withdrawing were also purportedly derived via trading, how come their balances didn’t change?

- GSPartners’ marketing pitch was up to 5% a week, guaranteed. The pitch never factored in losses and consumers were not advised of the possibility of having to reinvest to continue to receive the weekly passive ROI.

In the complete absence of verifiable evidence GSPartners is and has been paying withdrawals with trading revenue, obviously their ruse is fiction.

So what’s actually happening?

Signs of GSPartners’ collapse have been building up in the background, if you’ve been paying attention.

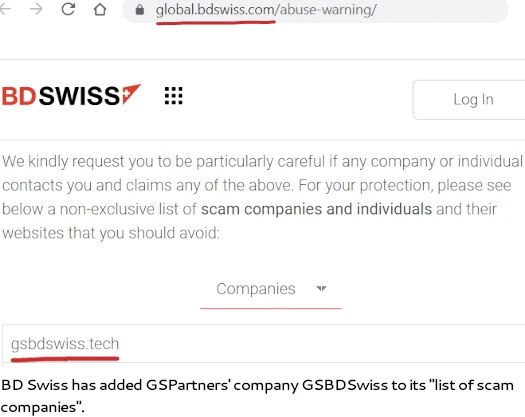

When it launched its certificates investment scheme in May 2022, GSPartners originally represented BDSwiss was trading on its behalf.

This ruse fell apart when BDSwiss publicly confirmed it had nothing to do with GSPartners in January 2023.

GSPartners swept this under the rug by pretending they meant Skygroup Group. That led to the creation of the shell entity GSBDSwiss.

BDSwiss’ response to GSBDSwiss was to issue a GSPartners and GSBDSwiss scam company abuse warning.

Regulatory problems for GSPartners began earlier this year with rolling securities fraud warnings out of Canada:

- GSPartners, GSTrade, GSB Gold Standard Bank & fifty-two associated website domains from Quebec’s AMF on March 9th

- GSTrade from the Alberta Securities Commission on March 15th

- G999 from the Alberta Securities Commission on March 15th

- GSPartners from the Alberta Securities Commission on May 19th

- GSPartners and Swiss Valorem Bank from the British Columbia Securities Commission on May 30th

- GSPartners from Saskatchewan’s Financial and Consumer Affairs Authority on June 1st

- GSPartners and Swiss Valorem Bank from the Ontario Securities Commission on July 25th

Swiss Valorem Bank rebranding was an attempt to get in front of the warnings. While GSPartners’ website still keeps up the charade, the rebranding was otherwise abandoned after Canadian authorities included Swiss Valorem Bank in their warnings.

Upon launching its certificates investment scheme last year, GSPartners primarily solicited investment from US and Canadian residents.

The Canadian regulatory fraud warnings and assumption that US authorities aren’t far behind dampened those recruitment efforts.

GSPartners, caught off guard by Canada and wary of a US regulatory investigation, began to focus recruitment efforts elsewhere.

In June 2023 GSPartners ratcheted up recruitment efforts in first India and then Hong Kong.

Notably, GSPartners founder Josip Heit was a no-show at either event.

The Canadian securities fraud warnings saw Josip Heit isolate himself in the perceived safety of Dubai.

The last time Heit set foot outside of Dubai for GSPartners marketing was back in March, for events held in Seychelles and South Africa.

At some point Heit appears to have realized he needed a public GSPartners fall guy. German national Dirc Zahlmann was promoted to CEO in July 2023.

GSPartners’ recruitment efforts in India and Hong Kong both flopped.

In late September, Zahlmann and a contingent of top GSPartners promoters were sent to the Caribbean to drum up recruitment of new victims.

It was while these promotional events were going on, that GSPartners dropped its ROI and withdrawal fee updates in early October.

From the subsequent crisis meeting that were held, it appears nobody in the Caribbean was aware of the pending changes.

But why now?

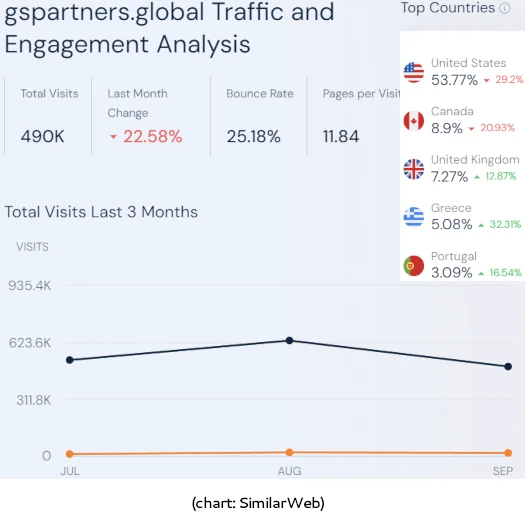

For the month of September 2023, SimilarWeb estimated GSPartners’ website traffic plummeted by 23%.

Hardest hit were the US (down 29% month on month) and Canada (down 21% month on month). Both countries were previously GSPartners’ largest source of new investors investor recruitment.

Evidently Canadian fraud warnings have taken hold, curtailing recruitment of new GSPartners victims in the US and Canada.

GSPartners is still active in the UK, Greece and Portugal, but this is nowhere near enough to cover GSPartners’ ever-growing “up to 5% a week” ROI liability.

For an MLM company that requires new investment to pay out withdrawals, a 23% drop in website traffic month on month is catastrophic. And so this last week played out the way it did.

The final thing to note is the timing of GSPartners’ ROI disabling and 50% withdrawal fee.

Next month marks the beginning of the holiday season, a time when Ponzi schemes bleed due to investors withdrawing to cover increased spending.

In previous years we’ve seen major MLM Ponzi schemes collapse around this same time.

In 2021 CashFX Group disabled withdrawals in November. In 2022 NovaTech FX started having withdrawals problems in October.

The timing of these events is not a coincidence. If GSPartners is already in trouble now, they know things are only going to get worse over the coming months.

So what happens now?

What we don’t know is how much in invested funds GSPartners has left. Mathematically speaking, clawing back ~27% of initially invested funds and cutting withdrawals by 50% buys them some time.

On the other side of that though is what’s left of GSPartners recruitment likely to completely collapse. That means the rate of new investment will plummet even further.

Unfortunately the exact moment a Ponzi scheme collapses is impossible to predict. CashFX Group never recovered. NovaTech FX managed to limp along till February 2023.

Hopefully investors who’ve woken up to the fact they’ve been ensnared in an endless loop of *EUR shitcoins and certificate releases, have or are at least thinking about filing complaints with the SEC and DOJ.

Anyone in GSPartners who publicly complains and is identified, is threatened with account termination and invested fund seizure.

Not much different to having your funds seized unless you pay a ~27% fee, but the threat seems to be working.

Looking forward, whatever happens next, BehindMLM will be here to cover it.

No Oz, you got it all wrong.

It’s those pesky YouTubers from South Africa whom they are suing for defamation and loss of income that caused this.

I wish you’d have told me that before I put this all together. Would have saved me a lot of time.

Some are still living in denial; that they “invested” in an illegal Ponzi scam being run by a serial crook in league with East European Mafia and organised criminals.

Wasn’t Gregory Perdriel in this deal too?

They have strong leaders, especially in South Africa. So they could kick this can down the road until next year, they even have an event coming up in Cape Town on the 18th of November.

Wonder if they’ve sold out before the start of the collapse. And I don’t think JH will spend any money to make an appearance.

South Africa was a thing back in the G999 days. These days South Africa isn’t even a top 5 source of GSPartners’ website traffic.

I don’t doubt scammers down there aren’t trying, but it doesn’t appear to be working.

does any know know whatever happened to to those Jone and June tokens ? Have those been abandoned too?

Everything was pretty much abandoned once the certificates launched in May 2022.

They tried to integrate Lydian World into the certificates but it’s nothing more than a glorified withdrawal off-ramp. The whole NFT and metaverse nonsense went nowhere.

Rico Cunningham mentioned above by Oz is the operator of goldbackers.info where Swiss Valorem Bank still is mentioned.

share-your-photo.com/cc93f2310e

A video on the same website with the note:

share-your-photo.com/4da86d94c1

goldbackers.info

Of course, the website does not contain an imprint or contact details, only a contact form. For me, this is a sure sign of fraud.